North America News

US Stocks Close at Record Highs as Traders Eye Fed Decision and Big Tech Earnings

U.S. equities surged to fresh record highs on Friday, capping a strong week driven by cooling inflation data, expectations of a Federal Reserve rate cut, and growing investor FOMO.

All three major indexes ended at all-time highs, supported by optimism that monetary easing will continue and strong tech sector momentum.

At the close:

- Dow Jones Industrial Average jumped 472.51 points (+1.01%) to 47,207.12

- S&P 500 gained 53.25 points (+0.79%) to 6,791.69

- Nasdaq Composite rose 263.07 points (+1.15%) to 23,204.87

Investor sentiment was lifted by Thursday’s softer-than-expected U.S. CPI report, which strengthened expectations of a 25-basis-point rate cut at the Fed’s meeting next week.

Chipmakers outperformed after Intel posted better-than-expected earnings late Thursday and IBM announced that it had successfully run a quantum computing error correction algorithm on AMD chips, sparking enthusiasm for broader semiconductor adoption.

Among tech heavyweights, Apple climbed 1.25%, Meta and Microsoft each added 0.59%, Amazon gained 1.41%, and Alphabet surged 2.70% ahead of their earnings next week.

Chip stocks extended the rally, with Nvidia up 2.25%, Broadcom advancing 2.86%, AMD soaring 7.65%, and Micron adding 5.96%.

The week ahead will bring a critical round of results from Big Tech — including Microsoft, Meta, Apple, Amazon, and Alphabet — alongside the Fed’s rate announcement, which could define market direction into year-end.

U.S. Michigan Consumer Sentiment Weakens in October

The University of Michigan’s consumer sentiment index slipped to 53.6 in October, below expectations for 55.0 and down from 55.0 in September.

The current conditions index dropped to 58.6 from 61.0, while expectations eased to 50.3 from 51.2.

Inflation expectations were mixed: 1-year expectations held steady at 4.6%, while 5-year expectations edged up to 3.9% from 3.7%. The report points to weaker consumer confidence amid persistent price concerns.

Global Manufacturing PMI Climbs to 52.2 in October, Services Strong

The S&P Global Flash Manufacturing PMI rose to 52.2 in October, topping expectations for 52.0, according to data released Friday. The prior month’s reading stood at 52.0.

The services index also improved, rising to 55.2 from 54.2 and exceeding the 53.5 forecast. The composite PMI climbed to 54.8, up from 53.9 in September, signaling stronger global business activity as both manufacturing and services sectors expand further into growth territory.

U.S. September CPI Rises 0.3%, Slightly Below Expectations

U.S. consumer prices increased by 0.3% in September, undershooting the 0.4% estimate, according to Labor Department data released Friday. The prior month’s figure was also 0.3%.

Core CPI, which strips out food and energy, climbed 0.2%, below forecasts for a 0.3% gain. On a yearly basis, headline inflation rose 3.0%, a touch under the 3.1% estimate and up from 2.9% in August — the highest level since May 2024.

Core CPI rose 3.0% year-on-year, compared to 3.1% expected and 3.1% previously. The unrounded monthly readings showed 0.23% for the core rate and 0.31% for the headline rate, versus 0.38% last month.

Markets continue to price in a 25 basis point rate cut at the Federal Reserve’s October meeting. By year-end, expectations now imply about 49 basis points of easing, up from 45 before the CPI release. The Fed is scheduled to announce its decision on Wednesday.

Social Security Cost-of-Living Adjustment Set at 2.8% for 2026

The Social Security Administration announced that benefits will increase 2.8% in 2026, reflecting the latest inflation data.

The adjustment, derived from September’s CPI figures, is slightly below the 3.0% year-over-year inflation rate recorded in the latest report. The smaller increase signals moderating inflation pressures but still marks a meaningful rise for retirees and beneficiaries.

U.S.-Canada Trade Talks Falter; Carney Signals Readiness to Resume

U.S. economic adviser Kevin Hassett said trade discussions with Canada are “not going well,” citing long-standing frustrations over progress and policy alignment.

Hassett added that there is “no evidence tariffs are causing inflation.”

Canadian Prime Minister Mark Carney responded that Ottawa “cannot control U.S. trade policy” but remains “ready when the U.S. is ready.” Carney said Canadian officials have made “lots of progress” and are also exploring “new partnerships, including with Asia.”

White House: Next Month’s Inflation Report Likely Delayed

The White House said it is unlikely that a Consumer Price Index (CPI) report will be published next month due to the ongoing federal government shutdown.

Officials indicated that key economic agencies remain closed, limiting the ability to compile and release major statistical data. Markets reacted positively, with equities trading higher on the session as investors interpreted the disruption as a potential catalyst for delayed policy tightening.

Trump Cancels Trade Talks With Canada Over Advertisement Dispute

Donald Trump declared that all trade negotiations with Canada are “terminated,” lashing out via his social media platform after taking issue with a Canadian advertisement.

The U.S. president’s announcement immediately reignited tensions between Washington and Ottawa, marking his latest public dispute with the Canadian government.

Canada’s Q3 GDP Faces Larger Revisions Amid U.S. Government Shutdown

Statistics Canada warned that third-quarter GDP data will be subject to larger-than-usual revisions, citing a lack of U.S. import figures due to the ongoing U.S. government shutdown.

The agency said the absence of complete import data will likely distort preliminary calculations and may result in significant adjustments once full data becomes available. The disruption has complicated the compilation of trade statistics, which are a major component of GDP measurement.

Ontario Premier Ford Says U.S. and Canada Must Stand United

Ontario Premier Doug Ford emphasized the enduring alliance between Canada and the United States, invoking the spirit of former President Ronald Reagan in a statement following renewed trade tensions.

“Canada and the U.S. are friends, neighbors, and allies,” Ford said, adding that “President Reagan knew we are stronger together.”

His remarks came after former U.S. President Donald Trump abruptly cancelled trade talks with Canada, claiming he was responding to a misleading advertisement that suggested Reagan opposed tariffs.

Canada Cuts Tariff-Free Vehicle Quotas for Stellantis, GM

Canada is slashing the number of U.S.-made vehicles General Motors and Stellantis can import duty-free, seeking to pressure both automakers into maintaining domestic production.

The government’s decision, reported by CBC, cuts GM’s annual remission quota by 24.2% and Stellantis’s by 50%. The move follows both companies’ plans to shift production out of Canada.

The tighter limits will increase costs for imported vehicles and are expected to drive new negotiations between Ottawa and the automakers. While consumers may face higher prices, Canada’s domestic auto industry is likely to see the decision as a supportive signal.

Commodities News

Gold Rebounds as Softer US CPI Strengthens Expectations for Fed Rate Cut

Gold edged higher on Friday, recovering from earlier losses as investors priced in an increased likelihood of a Federal Reserve rate cut following mildly softer U.S. inflation data.

Spot gold rose 0.10% to $4,127 per ounce after dipping to a session low of $4,043, buoyed by expectations that the Fed will deliver a dovish signal at its October 28–29 policy meeting.

The September CPI report showed consumer prices rising 0.3% month-on-month, slightly below forecasts, while annual inflation came in at 3.0%, matching market expectations but easing fears of renewed price acceleration. According to the Prime Market Terminal, markets now assign a 96% probability to a rate cut next week.

Meanwhile, S&P Global’s flash PMI data pointed to modest improvement in U.S. business activity in October, even as University of Michigan consumer sentiment weakened further from preliminary readings.

Geopolitical developments added to bullion’s bid. The White House confirmed that President Trump and Chinese President Xi Jinping will meet next week in South Korea, ahead of the November 1 tariff deadline. Separately, Washington imposed new sanctions on Russia, targeting major oil firms Lukoil and Rosneft, further lifting demand for safe-haven assets.

Gold has rallied 55% year-to-date, supported by central bank purchases, ongoing geopolitical risks, and expectations of sustained monetary easing. Analysts say that if the Fed confirms its shift toward rate cuts, bullion could maintain support above the $4,100 level in the near term.

Baker Hughes Rig Count: U.S. +2, Canada +1

Baker Hughes reported Friday that the U.S. rig count increased by two to 550, marking a modest uptick in drilling activity.

Oil rigs rose by two to 420, while gas rigs held steady at 121 and miscellaneous rigs were unchanged at nine. Compared to last year’s total of 585, the count is down by 35 rigs, with oil rigs 60 lower, gas rigs up 20, and miscellaneous rigs up five.

The U.S. offshore rig count rose by four to 21, up five rigs year-on-year.

In Canada, the total rig count increased by one to 199, with oil rigs up two to 138, gas rigs steady at 61, and miscellaneous rigs down one to zero.

Year-over-year, the Canadian count is 17 lower than last year’s 216, with oil rigs down 12 and gas rigs down five.

Platinum Rebounds After Selloff, China Tax Shift in Focus – Commerzbank

Platinum prices have rebounded sharply, recovering most of their recent losses as traders reacted to Chinese tax changes and a correction in precious metals, according to Commerzbank analyst Carsten Fritsch.

Spot platinum traded around $1,610 per troy ounce on Friday, roughly $120 below last week’s 12½-year high.

Fritsch said platinum’s relative undervaluation to gold helped limit downside pressure, while China’s plan to abolish the 13% tax rebate on domestic and imported platinum starting November 1 has spurred import demand ahead of the deadline.

He added that demand may weaken after the tax takes effect, as China — which accounts for over 30% of global platinum consumption — faces higher costs on imports.

Copper Rally Extends as Supply Risks Mount – ING

Copper prices remain near record highs, supported by falling inventories, a weaker dollar, and rate-cut expectations, according to ING’s Ewa Manthey.

The metal has surged more than 20% year-to-date, even as global trade concerns linger. Manthey cited mounting supply disruptions, including Freeport-McMoRan’s force majeure at the Grasberg mine in Indonesia, which accounts for roughly 4% of global production.

Despite mixed near-term demand signals — particularly from China — the long-term outlook stays bullish, backed by structural demand from electrification, grid expansion, and data center growth.

Copper prices are expected to hold above $10,000 per metric ton, though Manthey said further gains would depend on renewed demand momentum from China, the world’s largest consumer.

Russian Oil Exports Remain High Despite Refinery Disruptions – Commerzbank

Russia’s seaborne crude exports remain elevated, even as domestic refinery capacity suffers from Ukrainian drone strikes, Commerzbank’s Carsten Fritsch reported.

Data compiled by Bloomberg show weekly exports at 3.7 million barrels per day, with the four-week average climbing to 3.82 million barrels, the highest since May 2023.

The refinery disruptions have led to lower domestic processing, freeing additional crude for export. Some production in Kazakhstan has also been curtailed due to the strikes but is expected to recover quickly. Fritsch noted that the temporary losses are unlikely to meaningfully affect OPEC+ output levels.

JPMorgan Predicts Gold Could Double by 2028

JPMorgan strategists said gold prices could rise by 110% over the next three years as investors increasingly replace bonds with bullion as a hedge against equity volatility.

The bank dismissed the recent sharp selloff — the largest in more than a decade — as a technical correction, not a fundamental shift. Analysts said a structural change in investor behavior has reduced the role of long-dated bonds, leaving gold as the preferred hedge.

If nonbank investors reallocate 2% of their portfolios from bonds to gold, JPMorgan calculates that prices would need to climb 110% to balance portfolios by 2028.

Brent Curve Reverts to Backwardation as Supply Risks Rise – Commerzbank

The Brent forward curve has steepened again after briefly flattening earlier this month, reflecting renewed supply concerns linked to U.S. sanctions on Russian exports, Commerzbank analysts Barbara Lambrecht and Carsten Fritsch reported.

For a short period, six-month Brent contracts traded above the front month — a temporary contango — before prices rebounded. The prompt contract now trades roughly $2 above the six-month future, nearly restoring the previous backwardation structure.

The analysts noted that the gasoil market also tightened, supported by reduced Russian diesel exports amid Ukrainian drone attacks on refineries. According to the IEA, Russia exported 720,000 barrels per day of gasoil in September, down from 800,000 in August and 840,000 in September 2024.

Tighter supply pushed the gasoil crack spread to $27 per barrel, lifting prices to around $700 per ton.

U.S. and India Near Deal to Scale Back Russian Oil Imports – Commerzbank

The U.S. and India are close to a deal that would gradually reduce Indian crude imports from Russia, according to Commerzbank’s Carsten Fritsch.

Citing IEA data, India imported 1.6 million barrels per day from Russia in September, but tanker-tracking data indicate volumes dropped below 1 million barrels per day in the first three weeks of October.

Recent U.S. sanctions on Russia’s two largest oil firms are expected to further curb flows to India. Fritsch said a reduction in Russian exports could tighten the global market, offsetting some of the current oversupply and supporting higher prices.

The potential for stronger prices would increase further if China were to cut Russian crude purchases. Reuters reported that Chinese state refiners have temporarily halted seaborne oil imports from Russia.

Goldman Sachs Reaffirms $4,900 Gold Forecast Despite 6% Pullback

Goldman Sachs reaffirmed its bullish outlook for gold, maintaining a $4,900-per-ounce target for 2026 despite the metal’s 6% drop this week.

Analyst Lina Thomas said the pullback is temporary and underpinned by continued central bank buying and expectations of Fed rate cuts. She added that major investors, including sovereign and pension funds, are increasing allocations to gold for diversification.

The reaffirmation is expected to steady market sentiment and encourage dip-buying after the recent correction.

Trump Administration May Back Strikes on Russian Energy, RBC Warns

RBC Capital Markets warned that the Trump administration could support Ukrainian attacks on Russian energy infrastructure, signaling an escalation in U.S. involvement in the conflict.

The bank cited conversations with senior officials suggesting growing urgency to weaken Moscow’s war financing, driven by U.S. military assessments that Russia could gain major ground within a year.

RBC said falling oil prices may provide a window for tougher sanctions or covert assistance to Ukraine’s strikes, but noted that OPEC’s reduced spare capacity leaves global markets highly exposed to any disruption.

Analysts said traders may soon start pricing in a higher geopolitical premium for crude as the risk of direct U.S.-backed attacks increases.

Lockheed Martin Secures Scandium Supply Option With Australia’s Sunrise Energy

Australia’s Sunrise Energy Metals has granted Lockheed Martin a five-year option to buy up to 15 tonnes of scandium oxide annually, securing a Western supply of the critical mineral largely dominated by China, Russia, and Ukraine.

The material will be sourced from Sunrise’s Syerston Project and represents roughly a quarter of its expected yearly output. Scandium is a key input for aerospace and defense alloys, and the U.S. defense contractor is already developing scandium-aluminum materials with Pentagon backing.

Europe News

European Stocks End Higher as Markets Log Weekly Gains

European equities closed broadly higher Friday, extending gains for the week as upbeat U.S. sentiment lifted global risk appetite.

The German DAX rose 0.13% on the day, finishing the week 1.72% higher. France’s CAC 40 ended flat but managed a 0.63% weekly advance. The UK’s FTSE 100 led regional gains, adding 0.70% on Friday and 3.11% for the week — its strongest performance in months.

Elsewhere, Spain’s Ibex 35 climbed 0.44%, bringing weekly gains to 1.67%, while Italy’s FTSE MIB edged up 0.25%, closing 1.74% higher on the week.

The positive tone followed sharp rallies on Wall Street, with major U.S. benchmarks on track for record closes as investors bet on easing inflation and potential rate cuts later this year.

Eurozone PMI Surprises to Upside as Services Drive Growth

Euro area business activity accelerated in October, led by strong gains in services, according to flash data from HCOB.

The services PMI rose to 52.6 from 51.3, topping the expected 51.1, while manufacturing hit 50.0, slightly above forecasts of 49.8. The composite index climbed to 52.2, up from 51.2.

The improvement reflects Germany’s strong performance, with resilient employment and cooling inflation helping stabilize sentiment. While price pressures continue to ease, the pace of moderation remains gradual, supporting the ECB’s decision to maintain its current policy stance.

HCOB notes that:

“France is increasingly becoming a drag on the eurozone economy. While the economic situation in Germany brightened significantly in October, the rate of contraction has accelerated for two months in a row in France. As a result, economic growth in the eurozone, even though accelerating a bit, has been much weaker than it otherwise could have been. Uncertainty about whether the current government under Sebastien Lecornu can remain in power for much longer in view of the disputes over the 2026 budget is causing unease and contributing significantly to the weak economic situation in France. As an important buyer of products and services from other eurozone countries, France’s weakness contributes to the fragility of the recovery in the rest of the eurozone.

Industry in the eurozone has been stagnating for practically six months. The marginal improvement in the headline PMI to 50 offers little hope of a turnaround. This is all the more true given that new orders have been similarly weak. In this environment, manufacturing companies have accelerated their workforce reductions in an effort to adapt to weaker demand conditions and become more efficient at the same time. Although companies have been able to pass through slightly higher prices to their customers, input prices have also risen somewhat, meaning that profit margins are unlikely to have increased significantly.

Inflation in the eurozone services sector remains moderate. The rate of inflation for sales prices has risen slightly, but remains close to the long-term average. Cost increases were slightly lower in October, so there is little danger from this side in the short term. The European Central Bank, which pays particular attention to inflation in the service sector, is likely to see this data as confirmation of its stance not to implement further interest rate cuts.”

German PMI Data Show Strong Start to Q4, Services Lead Expansion

Germany’s private-sector activity expanded at its fastest pace in over two years, fueled by strength in services and a modest rebound in manufacturing.

Flash HCOB data showed manufacturing PMI at 49.6 (vs. 49.5 expected) and services PMI at 54.5, well above the 51.0 forecast. The composite reading rose to 53.8, also beating expectations of 51.5.

The report cited rising new orders and growing backlogs, signaling a firm start to the final quarter as Europe’s largest economy continues to recover from last year’s slowdown.

Commenting on the flash PMI data, Dr. Cyrus de la Rubia, Chief Economist at Hamburg Commercial Bank, said:

“This is an unexpectedly good start to the final quarter. Activity in the service sector has increased significantly, and output in the manufacturing sector has risen for the eighth consecutive month. This means that the economy as a whole is also showing accelerated growth.

“It is encouraging to see that new orders in the manufacturing sector have risen again slightly after a dip in the previous month. New business in the service sector has even received a real boost. Basically, these are good conditions for growth in the fourth quarter. However, the fact that the outlook for the future is more cautious than in the previous month, both among service providers and in industry, shows that the economic situation remains fragile.

“The situation in the manufacturing sector remains difficult. Although companies in this sector once again produced more than in the previous month, they are continuing to cut jobs at an accelerated pace. Added to this are the current problems surrounding supply chain issues in connection with semiconductors, which are particularly needed in the automotive sector, but also in mechanical engineering. The accelerated reduction in stocks of inputs and slower supplier delivery times may be linked to these uncertainties.

“The situation in the service sector is brightening. This is evidenced by significantly more business activity than in the previous month and a higher volume of new business. In addition, after two months of staff reductions, companies have stepped up their hiring again. One factor weighing on the sector is that costs have risen at an accelerated pace for the third month in a row.

“Above-average wage increases are likely to continue to have an impact here, as they are enforceable despite the deterioration in the labour market situation in the economy as a whole. At least service providers are in a position to pass on some of the cost increases to their customers, as sales prices have also risen more sharply than in the previous month.”

French Business Activity Contracts Sharply as PMI Hits Eight-Month Low

France’s private-sector downturn deepened in October, with both manufacturing and services output slipping further into contraction territory, according to flash PMI data from HCOB.

The services PMI fell to 47.1 from 48.5, missing expectations for 48.7, while the manufacturing index edged up to 48.3 from 48.2. The composite PMI dropped to 46.8, an eight-month low.

Demand conditions remained subdued, continuing to weigh on output. Employment levels held up, and price pressures softened, offering some relief for the European Central Bank as it monitors inflation risks elsewhere in the bloc.

HCOB notes that:

“The subdued trend in France’s private sector persists. The Flash Composite PMI for October fell to 46.8, indicating a continued and stronger contraction in overall economic activity. Output in both manufacturing and services is declining, pointing to broad-based weakness. Our in-house HCOB nowcasting model predicts zero growth for the third quarter.

“While French firms maintain a fundamentally positive outlook, sentiment deteriorated. This is largely attributable to the weak global economic environment and domestic political uncertainty. The forward-looking index for business expectations has worsened further from an already low level, and the order situation remains lacklustre. Although Prime Minister Sébastien Lecornu gained short-term political leeway for budget negotiations by suspending the pension reform, the overall economic and political climate remains tense. This is likely to weigh on consumer spending and investment activity.

“Conditions in the manufacturing sector remain fragile. Declines in production and new orders suggest a prolonged period of weakness. In an effort to boost sales, manufacturers adjusted prices downwards, as output prices fell for the second consecutive month. However, it is worth noting that the sub-index for employment remains above the growth threshold in both sectors – a sign of underlying labour market resilience.”

French Consumer Confidence Climbs to Six-Month High

French consumer sentiment improved more than expected in October, with optimism rising to its highest level since April.

The INSEE index climbed to 90, beating forecasts for 87 and marking an upward revision of September’s figure to 88 from 87.

Confidence strengthened across most measures, with a notable drop in unemployment expectations — from 54 to 48 — the lowest reading since March. The improvement suggests households are feeling slightly more secure about job prospects as 2025 draws to a close.

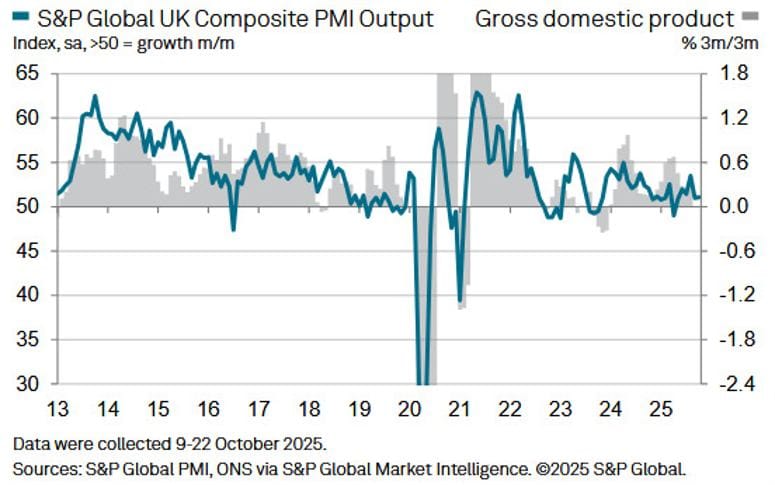

UK Private Sector Growth Picks Up in October as Inflation Pressures Ease

The UK economy showed modest improvement at the start of Q4, with business activity expanding at a faster pace and input cost inflation easing to an 11-month low, according to S&P Global’s flash PMI survey.

The services PMI came in at 51.1 (vs. 51.0 expected), up from 50.8 in September. The manufacturing index rose sharply to 49.6, well ahead of forecasts for 46.6 and up from 46.2. The composite PMI also printed at 51.1, compared with 50.6 expected.

The data indicate the fastest growth in private-sector output since early 2025, reinforcing expectations that the economy may avoid a deeper slowdown.

Chris Williamson, Chief Business Economist at S&P Global Market Intelligence:

“October’s flash UK PMI survey brings hope that September was a low point for the economy from which business conditions are starting to improve. Output has picked up, with a particularly welcome return to growth for manufacturing for the first time in over a year accompanied by an upturn in demand for services, notably among consumers. Business confidence has also brightened slightly, job losses have moderated, and inflationary pressures are coming back to levels consistent with the Bank of England’s 2% target.

“However, even with a helping hand from restarted production at JLR, the overall pace of growth signalled by the PMI remains consistent with only sluggish GDP growth of around 0.1%. And, while easing, jobs continue to be cut amid a backdrop of business confidence that remains subdued by historical standards. Goods exports also continue to fall at a worryingly steep rate, in part due to the global trade disruptions caused by US tariff policy.

“Companies are clearly treading cautiously in terms of spending, investment and hiring ahead of the upcoming Budget, the outcome of which has the potential to once again sway the business mood in the months ahead.”

UK Retail Sales Beat Forecasts, Offering BOE Breathing Room

UK retail sales posted a stronger-than-expected gain in September, suggesting consumer demand held up well through the end of Q3 despite weakness in some categories.

Data from the Office for National Statistics showed total sales rose 0.5% month-on-month, beating expectations for a 0.2% decline. August’s figure was revised up to +0.6%. On an annual basis, sales climbed 1.5%, well above forecasts for a 0.4% rise.

Excluding autos and fuel, retail sales increased 0.6% on the month and 2.3% year-on-year, both comfortably exceeding estimates.

While food and department store sales slipped 0.1% and 0.3% respectively, the headline gain was driven by stronger spending at other non-food outlets (+2.1%), household goods stores (+1.2%), and non-store retailers (+1.5%).

The robust showing may give the Bank of England some additional flexibility heading into year-end, easing concern about a sharper slowdown in household activity.

UK Consumer Confidence Climbs, But Budget Concerns Linger

UK consumer sentiment rose to its highest in 14 months in October, with GfK’s index improving to -17 from -19, beating expectations for -20.

Promotional events at major retailers boosted big-ticket spending, but optimism was tempered by growing concerns over personal finances ahead of next month’s budget.

Analysts warned that expected tax increases could limit household spending despite stronger headline confidence. Markets see the data as neutral to mildly negative for sterling, given persistent caution among consumers.

Aberdeen: December BoE Rate Cut Now More Likely

Aberdeen Asset Management said a surprise stall in UK inflation has increased the chances of a Bank of England rate cut in December.

The firm said the flat inflation reading and moderating wage growth indicate easing price pressures. While November action may still be premature, Aberdeen expects “significant easing” over the next year, beginning as soon as December.

The outlook drove a bullish response in gilts and UK equities, though sterling came under pressure as investors priced in earlier monetary easing.

Asia-Pacific & World News

PBOC Pledges to Deepen Yuan Reform, Maintain Stability

China’s central bank pledged to further refine the yuan’s exchange-rate formation mechanism while maintaining general currency stability, as it continues balancing monetary support with financial discipline.

The People’s Bank of China said it would “build a scientific and prudent monetary policy framework” that balances short- and long-term goals. It also reaffirmed plans to promote yuan internationalization and expand its use in trade.

The PBOC noted it would “calibrate the intensity, timing, and pace” of monetary adjustments to support stable economic growth, signaling a steady but flexible policy stance.

PBOC Adviser Calls for Fiscal Push to Repair Trade War Fallout

A senior adviser to China’s central bank said Beijing must rely on fiscal stimulus — not monetary easing — to repair the economic damage from the U.S. trade war.

Speaking at the Bund Summit, PBOC policy committee member Huang Yiping said household and corporate balance sheets remain weak despite solid exports, citing sluggish private investment and persistent unemployment.

Huang urged targeted fiscal support to stabilize the property market and lift household incomes, warning that subsidies have offered only “short-term relief.” He also noted limited room for further monetary easing, implying fiscal policy must take the lead.

Markets interpreted the remarks as confirmation that Beijing’s next policy moves will center on infrastructure and domestic demand rather than central bank action.

China State Planner to Roll Out Major Investment Projects

China’s National Development and Reform Commission said it will press ahead with a series of large-scale investment initiatives as part of efforts to reinforce the real economy.

The NDRC said strong domestic demand remains a strategic foundation for modernization, adding there is still “ample room” to expand internal consumption. The agency pledged to improve the structure of government spending, increase allocations toward people’s livelihoods, curb local protectionism, and direct over 5 trillion yuan into new urban infrastructure such as underground pipeline networks.

Beijing Officials Urge Faster Rollout of New Development Framework

China’s economic policymakers said the country’s growth remains on a solid foundation but warned that the global environment is “uncertain and unstable.”

The deputy head of the Communist Party’s Office of Financial and Economic Affairs Commission said Beijing must “move faster” to implement its new development paradigm to sustain long-term growth momentum.

IMF Flags Asia’s Growing Vulnerability to Stronger Dollar

The International Monetary Fund warned that Asia’s resilience could be tested if the U.S. dollar strengthens, raising borrowing costs for heavily indebted economies in the region.

IMF Asia-Pacific Director Krishna Srinivasan said low rates and a weak dollar have cushioned the impact of tariffs so far but cautioned those tailwinds may reverse. The IMF raised its 2025 Asia growth forecast to 4.5% but expects a slowdown to 4.1% in 2026.

The warning is likely to trigger caution across Asian markets, with currencies such as the won, baht, and rupiah seen at risk if U.S. rates rise. Equity markets could also face headwinds from higher corporate debt costs and moderating growth expectations.

China’s Policy Chief Sees GDP Hitting 140 Trillion Yuan in 2025

China’s top policy research official said the country’s gross domestic product is on track to reach 140 trillion yuan this year, while per-capita output is expected to climb above the global average.

The deputy head of the Communist Party’s Financial and Economic Affairs Commission said Beijing will continue advancing a growth model built on domestic demand and household consumption.

Separately, China’s Science and Technology Minister pledged to accelerate progress in artificial intelligence, focusing on breakthroughs in chip design, AI governance, and top-level planning. The minister said Beijing aims to make AI “an international public good.”

Xi Urges Focus on Breaking Through Core Technologies

President Xi Jinping said China must “strive to achieve breakthroughs in key core technologies” as part of a broader national strategy to integrate education, science, and talent development.

In remarks published by Xinhua, Xi said the country faces “strategic opportunities and challenges,” emphasizing the need for deeper coordination between science, innovation, and education to drive long-term competitiveness.

PBOC sets USD/ CNY mid-point today at 7.0928 (vs. estimate at 7.1192)

- PBOC CNY reference rate setting for the trading session ahead.

In Open market operations (OMOs) the PBOC inject 168bn yuan at an unchanged rate of 1.4%

Australia’s Manufacturing PMI Falls, Services Expand

Australia’s manufacturing sector slipped back into contraction in October, with the flash S&P Global PMI dropping to 49.7 from 51.4.

The services index, however, rose to 53.1 from 52.4, lifting the composite PMI slightly to 52.6. The data highlight ongoing divergence between the goods and services sectors as domestic demand stays resilient.

Japan prime minister Takaichi says will implement responsible proactive fiscal policy

- Remarks by Japan’s prime minister, Sanae Takaichi

- The foundation of our approach will be guided by the principle of ‘economy first, then fiscal policy’

- Will ensure fiscal sustainability and maintain market confidence by reducing the debt-to-GDP ratio

- Will swiftly compile economic measures and submit supplementary budget to parliament

Japan’s Factory Activity Shrinks to 19-Month Low

Japan’s manufacturing sector contracted in October at the fastest pace in nearly two years, with the flash S&P Global PMI dropping to 48.3 from 48.5.

Weak domestic demand led to a deeper slide in new orders, though export declines slowed and factory optimism improved. The services PMI also softened to 52.4 from 53.3, pulling the composite reading to 50.9 — its weakest in five months.

Analysts said inflation pressures remain elevated as input and output costs continue rising, driven by higher labor, fuel, and material prices alongside a weaker yen.

Japan Inflation Stays Firm at 2.9% in September

Japan’s headline consumer inflation held steady at 2.9% in September, matching forecasts and remaining above the Bank of Japan’s 2% target.

Core CPI, excluding fresh food, also rose 2.9%, while core-core CPI, excluding food and energy, came in at 3.0%. Service prices increased 1.4% year-on-year, while goods prices rose 4.2%, suggesting firms continue to pass on higher costs gradually.

Japan’s Rengo Union Seeks 5% Pay Hike to Outpace Inflation

Japan’s largest labor confederation, Rengo, will demand at least a 5% wage increase in 2026 spring negotiations, maintaining its aggressive stance to secure real wage growth and protect workers from inflation.

The policy includes a base-pay rise of 3% or higher, with unions at smaller firms encouraged to seek 6% or more to narrow the pay gap with large corporations. Rengo also aims to lift the national minimum hourly wage to 1,300 yen, up 50 yen from this year’s target.

The move follows record wage gains in 2025, when the average increase reached 5.25%. Analysts said the renewed push will pressure the Bank of Japan, potentially reinforcing inflation and heightening the likelihood of further rate hikes next year — a positive for the yen but a mixed signal for equities.

Japan finance minister: Ueda has emphasised importance of maintaining accommodative monetary policy

- Japan finmin Katayama:

- Important that the Bank of Japan’s monetary policy aligns with the government’s basic policy

- Necessary to maintain close communication between BoJ and government

- BOJ’s Ueda himself has emphasised importance of maintaining an accommodative monetary environment

- Based on this, I do not believe it is a situation that requires me to make any particular comment on BoJ policy

- spoke with Bessent for about 15 minutes on the phone

- Told Bessent she wants to tackle various issues

- Will meet Trump and Bessent next week

- Need to take various factors into account when asked possibility of raising financial income tax

- It’s not that the cabinet has decided against government’s target of achieving primary budget surplus

- Hopes the Bank of Japan will continue appropriate dialogue with markets

- Hope BOJ will continue appropriate dialogue with markets

- Hope that BOJ Ueda will communicate with markets appropriately to pass BOJ’s economic, price views and basic policy stance

- Will talk with US Treasury Secretary Bessent over phone

South Korea Ties U.S. Investment Bid to Tariff Negotiations

South Korea is seeking a large U.S. investment package, smaller than $350 billion, as part of its ongoing tariff negotiations with Washington, according to Industry Minister statements this week.

The minister linked the outcome of the talks to a fresh wave of American investment, framing the deal as a key step toward resolving bilateral trade disputes.

Markets view the linkage as a double-edged sword: a successful agreement could lift the won and support equities in the tech and auto sectors, while any breakdown may trigger sharp declines amid renewed tariff risk.

South Korea finance minister: Will act swiftly if needed to stabilize financial markets

- Will work to increase housing supply to stabilize property markets

- Closely monitoring financial markets

- Will act swiftly if needed to stabilize financial markets

- FX volatility seen continuing

- Will work to increase housing supply to stabilize property markets

Crypto Market Pulse

Ethereum Rebounds Above $4,000 as Softer CPI Reinforces Rate-Cut Bets

Ethereum (ETH) briefly climbed past $4,000 on Friday after a softer U.S. Consumer Price Index (CPI) print lifted risk sentiment and reinforced market expectations for further Federal Reserve rate cuts in 2025.

The September CPI report showed headline inflation up 3.0% year-on-year, below forecasts of 3.1%, while core CPI rose 0.2% month-on-month, also under expectations. Core inflation eased to 3.0% from 3.1% in August.

With the U.S. government shutdown delaying other economic releases, the CPI data will likely be the Fed’s key input heading into its October 29–30 meeting. Markets are now pricing in an 85% chance of two additional cuts before year-end, according to Kalshi prediction data.

The shift toward looser policy helped drive risk assets higher, pushing the S&P 500 to a record 6,806 on Friday. ETH open interest also ticked up to 11.75 million ETH, the highest since the October 10 crash, reflecting renewed investor appetite.

However, analysts note ETH remains constrained by resistance at the 50-day and 100-day exponential moving averages, with broader sentiment still cautious amid ongoing U.S.-China trade tensions.

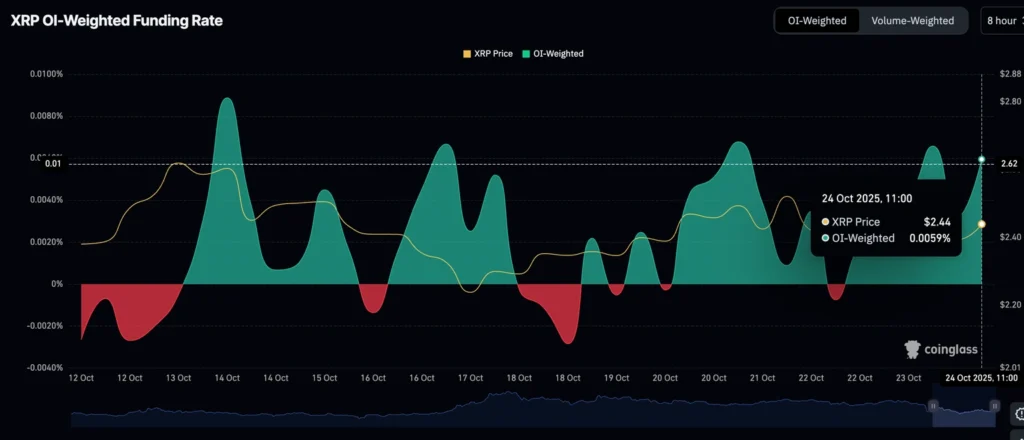

XRP Futures Volume Hits $27 Billion on CME Group as Bulls Regain Momentum

XRP extended gains on Friday, trading above $2.45 as traders positioned for a bullish weekly close above $2.50, supported by a rebound in retail demand and growing institutional interest in regulated futures.

The token moved in step with broader crypto markets following the release of U.S. CPI data, which showed annual inflation at 3.0%, slightly below expectations. Core CPI eased to 3.0% from 3.1% in August, fueling optimism that rate cuts remain on the table.

According to CME Group, total notional volume for XRP and micro XRP futures has reached nearly $27 billion just five months after launch. The derivatives giant introduced XRP futures in April, expanding its portfolio of regulated crypto products that already includes Bitcoin (BTC), Ethereum (ETH), and Solana (SOL).

Each standard XRP futures contract represents 50,000 XRP, while micro contracts cover 2,500 XRP. Both are cash-settled on CME Globex and benchmarked to the CME CF XRP-Dollar Reference Rate.

Market data show the OI-weighted funding rate climbed to 0.0059% Friday, up from 0.0032% midweek — signaling a rise in long positioning.

However, futures open interest remains subdued at $3.67 billion, down from $9 billion in early October, suggesting many traders remain cautious about the sustainability of XRP’s rally.

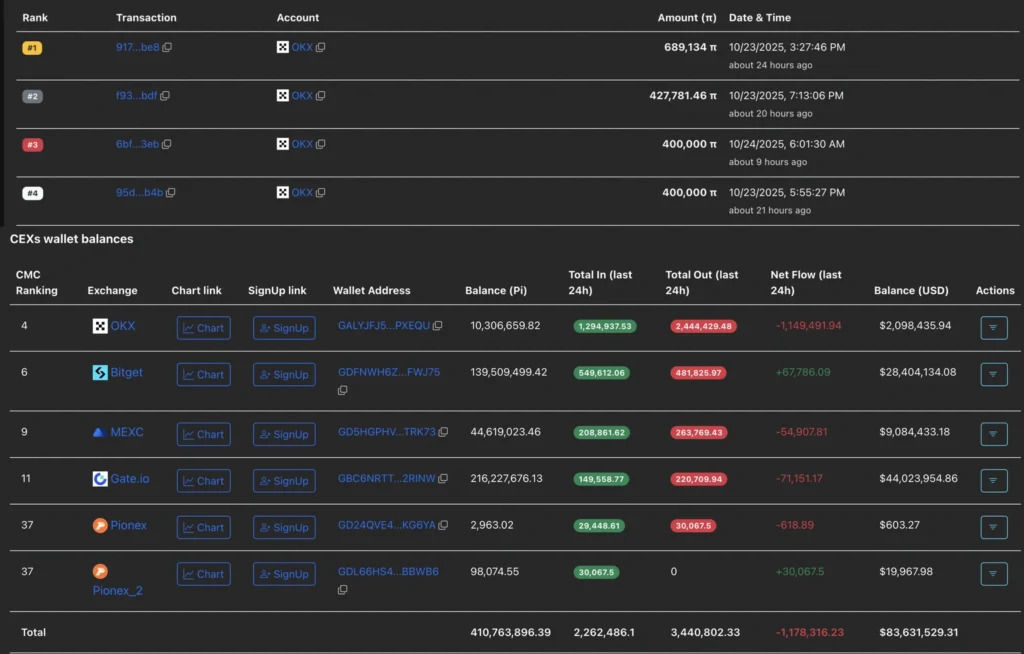

Pi Network Advances as Mainnet Migration Surges Past 2.7 Million Users

Pi Network (PI) consolidated near the 50-period EMA on Friday after breaking above a descending triangle formation, buoyed by accelerating mainnet migration and growing token demand.

The network confirmed that 2.70 million Pioneers — users who have passed Know Your Customer (KYC) checks — have successfully migrated to the mainnet, out of 3.36 million recently verified participants. The milestone coincided with a 3% jump in PI price on Thursday.

Pi Network said another 3 million users are currently in a tentative KYC stage, awaiting camera-based facial verification before completing migration. The expanding mainnet user base is expected to boost activity and adoption across the ecosystem.

On-chain data also point to rising demand. PiScan reported that over 1.17 million PI tokens were withdrawn from centralized exchange (CEX) wallets in the past 24 hours, led by large transfers exceeding 400,000 PI from OKX.

A sustained wave of outflows typically reduces available supply on exchanges, tightening liquidity and supporting price appreciation. The combination of growing user migration and CEX withdrawals underscores increasing confidence in the network’s transition to full mainnet operations.

Bitcoin, Ethereum, XRP Extend Gains on Retail Demand

Bitcoin (BTC) rose for a second straight day, trading above $111,000 on Friday amid renewed retail demand and improving market sentiment.

Ethereum (ETH) hovered above $3,900, while XRP climbed to around $2.45, buoyed by a MACD buy signal that improved its technical outlook.

Data from derivatives markets show Bitcoin open interest stabilizing at $69 billion, up from a post-liquidation low of $67.7 billion, following the October 10 deleveraging that wiped out $19 billion in crypto assets.

The rebound in open interest signals growing risk appetite among traders and steady inflows into the broader crypto market.

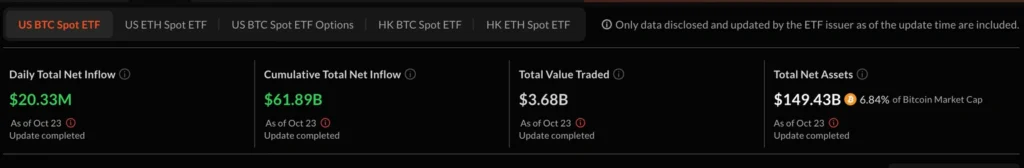

JPMorgan to Launch Bitcoin, Ethereum-Backed Loans for Institutions

JPMorgan Chase plans to roll out Bitcoin (BTC) and Ethereum (ETH)-collateralized loans for institutional clients by year-end, marking a significant expansion of its digital asset operations, according to Bloomberg.

The loans will use third-party custody providers for asset safekeeping. The move follows JPMorgan’s earlier step of accepting crypto ETFs as collateral for limited clients in June.

Since the approval of U.S. spot Bitcoin ETFs in January 2024, institutional participation has surged, with roughly $62 billion in net inflows and $149 billion in assets.

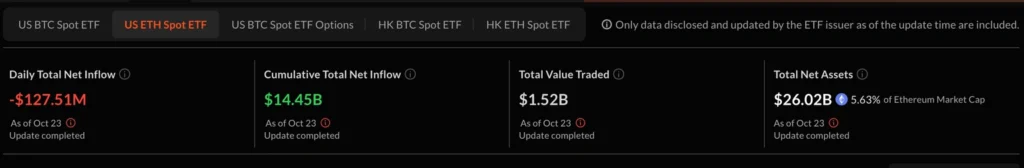

Ethereum ETFs have accumulated $26 billion, with $14.45 billion in inflows this year.

CEO Jamie Dimon, who once dismissed Bitcoin as a “hyped-up fraud,” has recently softened his tone, saying he supports clients’ right to invest. JPMorgan also plans to offer access to crypto trading via E*Trade in 2026.

Dogecoin Breaks $0.195 Resistance on Heavy Institutional Flows

Dogecoin (DOGE) surged 2.4% in Thursday’s session, climbing from $0.1911 to $0.1957 and breaking key resistance at $0.1953 amid rising institutional demand.

Trading volume jumped 68% above average to 483 million, signaling strong accumulation consistent with a Wyckoff accumulation phase.

DOGE established new short-term support around $0.1940, with price consolidating near $0.1955–$0.1960 by session end. Analysts said the pattern suggests institutional buying rather than profit-taking, with the setup resembling prior accumulation phases that preceded multi-week rallies in 2017 and 2021.

Traders are watching whether DOGE can hold above $0.194 and extend gains beyond $0.20, which could trigger further inflows. On-chain data show declining exchange reserves, reinforcing long-term bullish sentiment.

The Day’s Takeaway

North America

U.S. Stocks Close at Record Highs as Traders Eye Fed Decision and Big Tech Earnings

U.S. equities finished the week at record levels, driven by softer inflation, mounting expectations of a Federal Reserve rate cut next week, and tech-led momentum.

The Dow Jones Industrial Average climbed 472.51 points (+1.01%) to 47,207.12, the S&P 500 added 53.25 points (+0.79%) to 6,791.69, and the Nasdaq Composite advanced 263.07 points (+1.15%) to 23,204.87 — all marking fresh all-time highs.

Tech names extended gains ahead of next week’s earnings from Microsoft, Meta, Apple, Amazon, and Alphabet. Chipmakers outperformed after Intel’s strong results and IBM’s announcement of successful quantum error correction tests on AMD chips.

Among major movers: Apple +1.25%, Meta +0.59%, Microsoft +0.59%, Amazon +1.41%, Alphabet +2.70%, AMD +7.65%, Nvidia +2.25%, Broadcom +2.86%, and Micron +5.96%.

The rally capped a strong week fueled by FOMO buying and reinforced market conviction that monetary easing will continue into year-end.

U.S. Inflation Softens; Markets Cement Rate-Cut Bets

The U.S. CPI rose 0.3% in September, slightly below the 0.4% forecast, while core CPI climbed 0.2% versus the 0.3% estimate. Headline inflation increased 3.0% year-over-year, below the 3.1% consensus, the highest since May 2024.

Traders now price a 25-basis-point cut at next week’s Fed meeting, with roughly 49 basis points of easing expected by year-end. The Fed will announce its decision Wednesday.

Canada Warns of Q3 GDP Data Distortions Amid U.S. Shutdown

Statistics Canada flagged that third-quarter GDP will face “larger-than-usual revisions” due to missing U.S. import data from the ongoing federal government shutdown. The lack of updated trade figures could distort preliminary readings, with revisions expected once data gaps are filled.

U.S.-Canada Trade Talks Stall; Carney Signals Openness to Resume

U.S. economic adviser Kevin Hassett said negotiations with Canada are “not going well,” citing continued policy misalignment. Canadian Prime Minister Mark Carney said Ottawa “remains ready when Washington is ready,” while also pursuing new partnerships in Asia.

Social Security COLA Set at 2.8% for 2026

The Social Security Administration confirmed a 2.8% cost-of-living adjustment (COLA) for 2026, tied to September’s CPI data. The increase trails the 3.0% annual inflation rate, signaling moderation but still providing meaningful support to beneficiaries.

White House: Next CPI Report Likely Delayed

The White House said next month’s CPI release will likely be postponed due to the shutdown. Markets viewed the disruption as dovish, with equities extending gains on expectations of delayed tightening.

U.S. Michigan Consumer Sentiment Weakens

The University of Michigan index dropped to 53.6 in October, below expectations for 55.0, as confidence slid amid sticky inflation concerns. One-year inflation expectations held at 4.6%, while five-year projections rose to 3.9%.

Commodities

Gold Rebounds as Softer CPI Data Boosts Rate-Cut Hopes

Gold recovered from early losses, rising 0.10% to $4,127 per ounce after touching $4,043, supported by expectations that the Fed will deliver a dovish signal at the October 28–29 meeting.

The softer CPI reinforced a 96% probability of a rate cut, according to Prime Market Terminal data.

Geopolitical tailwinds also supported bullion, as the White House confirmed a Trump–Xi meeting next week in South Korea, and new sanctions on Russian oil majors Lukoil and Rosneft heightened risk sentiment.

Gold has gained 55% year-to-date, underpinned by central bank demand, trade tensions, and expectations of continued policy easing.

Baker Hughes Rig Count: U.S. +2, Canada +1

Baker Hughes reported a modest increase in drilling activity. The U.S. rig count rose by two to 550, with oil rigs up to 420 and gas rigs steady at 121.

In Canada, rigs increased by one to 199, driven by oil drilling. Year-over-year, the U.S. total is down 35 rigs, while Canada is off 17.

Platinum Rebounds as China Tax Change Spurs Import Demand

Spot platinum rebounded to $1,610/oz, reversing most of its recent selloff. Analysts at Commerzbank said China’s plan to scrap a 13% tax rebate on platinum imports from November 1 has triggered pre-deadline buying.

China accounts for 30% of global platinum consumption, and higher import costs could weigh on demand after the tax shift.

Oil Market Tightens as Sanctions Hit Russian Supply

The Brent curve has returned to backwardation, with prompt contracts trading about $2 above six-month futures. Commerzbank said renewed supply risks linked to U.S. sanctions on Russian exports and reduced diesel output have tightened markets.

Russian gasoil exports fell to 720,000 bpd in September, from 800,000 bpd in August, as drone strikes disrupted refineries. The gasoil crack spread rose to $27/bbl, pushing prices near $700/ton.

Russia Maintains High Crude Exports Despite Strikes

Despite refinery outages, Russia’s seaborne crude exports held near 3.7 million bpd, with the four-week average at 3.82 million, the highest since May 2023, according to Bloomberg data. Reduced domestic refining freed additional barrels for export.

U.S., India Near Deal to Cut Russian Oil Imports

The U.S. and India are nearing an agreement to gradually scale back Indian crude purchases from Russia. India’s imports have fallen below 1 million bpd in October from 1.6 million bpd in September, according to IEA data.

Further curbs could tighten global supply, especially if China also limits Russian intake.

Copper Extends Rally on Supply Risks and Weak Dollar

Copper traded near record highs, up 20% year-to-date, lifted by low inventories and supply disruptions, including Freeport-McMoRan’s force majeure at the Grasberg mine in Indonesia.

ING’s Ewa Manthey said the long-term outlook remains bullish on electrification, data centers, and grid expansion, with prices expected to stay above $10,000/ton despite near-term demand uncertainty from China.

Europe

European Stocks Rise to End Week Higher

European markets finished broadly higher Friday, tracking U.S. gains. The DAX added 0.13%, up 1.72% for the week; CAC 40 ended flat but rose 0.63% weekly; FTSE 100 gained 0.70% Friday and 3.11% for the week — its strongest run in months.

Ibex 35 advanced 0.44%, and FTSE MIB rose 0.25%, both posting over 1.6% weekly gains.

Risk appetite improved as investors anticipated further rate cuts and stronger global growth data.

Asia

Global Manufacturing PMI Climbs to 52.2; Services Strengthen

The S&P Global Flash Manufacturing PMI rose to 52.2 in October from 52.0, exceeding expectations, while the Services PMI climbed to 55.2 from 54.2. The Composite PMI hit 54.8, reflecting stronger expansion across manufacturing and services.

The improvement underscores steady momentum in global demand and optimism about easing supply chain constraints.

Crypto

Bitcoin and Ethereum Extend Gains on Softer CPI, Retail Demand

Bitcoin (BTC) rose above $111,000, marking its second straight advance, while Ethereum (ETH) traded near $3,900. Renewed retail buying and stronger sentiment followed the softer U.S. CPI print.

Open interest in BTC stabilized around $69 billion, signaling improving risk appetite after the October 10 deleveraging.

Ethereum Briefly Tops $4,000 on Rate-Cut Bets

ETH crossed the $4,000 threshold Friday as investors priced in more Fed easing. Markets now assign an 85% chance of two additional cuts by year-end. ETH open interest climbed to 11.75 million ETH, the highest since early October.

XRP Futures Volume Surges on CME Group

XRP traded above $2.45, with CME Group reporting $27 billion in XRP futures notional volume just five months post-launch. Futures open interest remained at $3.67 billion, reflecting cautious optimism among traders.

JPMorgan to Offer Bitcoin, Ethereum-Backed Loans

JPMorgan will launch BTC and ETH-collateralized loans for institutional clients by year-end, expanding its digital asset operations. The bank will use third-party custodians for collateral management.

The move follows surging ETF inflows, with $62 billion into spot Bitcoin ETFs and $26 billion into Ethereum ETFs since approval.

Dogecoin Breaks $0.195 Resistance on Institutional Flows

DOGE climbed 2.4% to $0.1957, clearing key resistance amid heavy volume and signs of institutional accumulation. Analysts said holding above $0.194 could open the path toward $0.20 and beyond.

Pi Network Migration Crosses 2.7 Million Users

Pi Network (PI) continued consolidating near its 50-period EMA after surpassing 2.7 million mainnet migrations. On-chain data show rising exchange outflows, tightening supply and reinforcing bullish sentiment for the ecosystem’s transition to full mainnet operations.