North America News

U.S. Stocks Advance as Quantum Computing Rally Lifts Tech Sector

Major U.S. equity benchmarks finished higher Thursday, led by gains in quantum computing stocks after a Wall Street Journal report said Washington is weighing increased investment in the sector.

Shares of D-Wave Quantum surged 13.78%, Rigetti Computing gained 9.82%, IonQ Inc. rose 7.07%, and Quantum Computing Inc. climbed 7.20%.

Index performance:

- Dow Jones Industrial Average: +144.20 points (+0.31%) to 46,734.61

- S&P 500: +39.04 points (+0.58%) to 6,738.44

- NASDAQ Composite: +201.40 points (+0.89%) to 22,941.80

Bond market snapshot:

- 2-year yield: 3.494% (+5.1 bps)

- 5-year yield: 3.612% (+5.9 bps)

- 10-year yield: 4.006% (+5.4 bps)

- 30-year yield: 4.587% (+4.8 bps)

Ford and Intel Report Earnings; Ford Cuts 2025 Outlook, Intel Beats

Ford Motor Co. (F) posted mixed third-quarter results after the close, topping earnings forecasts but trimming its full-year outlook.

- Adj. EPS: $0.45 (est. $0.36)

- Ford Pro revenue: $17.4B (est. $16.43B)

- Ford Pro EBIT: $1.99B

- Ford Blue revenue: $28B (est. $25.67B)

- Ford Blue EBIT: $1.54B (est. $1.28B)

- Model E revenue: $1.88B (est. $1.78B)

- Model E EBIT loss: $1.41B (est. loss $1.24B)

The automaker now expects FY adjusted EBIT of $6B–$6.5B, down from $6.5B–$7.5B, and adjusted free cash flow of $2B–$3B, versus prior guidance of $3.5B–$4.5B. Ford maintained its capital expenditure outlook near $9B.

The company also warned of a $1.5B–$2B EBIT impact in 2025 due to the Novelis plant fire.

Meanwhile, Intel Corp. (INTC) delivered a stronger-than-expected quarter as margins and data center sales improved.

- Adj. EPS: $0.23 (est. $0.012)

- Revenue: $13.65B, up 2.8% year over year

- Q4 revenue outlook: $12.88B–$13.8B

- Adj. operating margin: 11.2% (est. 3.07%)

- Adj. gross margin: 40% (est. 36.1%)

- Datacenter & AI revenue: $4.12B (est. $3.97B)

- Intel Foundry revenue: $4.24B (est. $4.51B)

Intel’s results highlight stabilizing demand in its data center segment and ongoing progress in its turnaround strategy.

U.S. Treasury Sells $26B in 5-Year TIPS at 1.182% High Yield

The U.S. Treasury sold $26 billion in 5-year Treasury Inflation-Protected Securities (TIPS) on Thursday at a high yield of 1.182%, slightly above the when-issued level of 1.17%.

The auction produced a 1.2-basis-point tail, compared with the six-month average of 0.8 bps.

The bid-to-cover ratio stood at 2.51x, stronger than the 2.40x average.

Investor breakdown:

- Direct bidders: 24.4% (vs. 18.9% avg)

- Indirect bidders: 62.1% (vs. 70.4% avg)

- Dealers: 13.5% (vs. 10.7% avg)

U.S. Existing Home Sales Match Forecasts at 4.06 Million in September

U.S. existing home sales for September were in line with expectations, coming in at an annual rate of 4.06 million versus 4.00 million in August. Sales rose 1.5% month over month, the fastest pace in seven months.

Inventory levels reached 1.55 million units, a 14% increase from a year earlier and the highest in five years, representing a 4.6-month supply.

The median home price climbed to $415,200, up 2.1% from September 2024, marking the 27th straight month of annual gains.

Regional breakdown:

- Northeast: Sales up 2.1% to 490,000; median price $500,300, up 4.1%.

- Midwest: Sales down 2.1% to 940,000; median price $320,800, up 4.7%.

- South: Sales up 1.6% to 1.86 million; median price $364,500, up 1.2%.

- West: Sales up 5.5% to 770,000; median price $619,100, up 0.4%.

Kansas City Fed Manufacturing Index Jumps to 15 in October

The Kansas City Federal Reserve’s October manufacturing index climbed sharply to 15, up from 4 in the previous month. The composite index also improved, rising to 6 from 4 in September. The data points to stronger factory activity across the Midwest region as production and new orders accelerated.

Freddie Mac: 30-Year Mortgage Rate Falls to 6.19%

Freddie Mac reported that the average 30-year fixed mortgage rate dropped to 6.19% for the week ending October 23, down from 6.27% the previous week. That marks the lowest level since early October.

The decline tracks the move in Treasury yields, with the 10-year note yield touching a low of 3.936% this week—its lowest since April 7—before rebounding to 4.001%. The year’s low for the 10-year stands at 3.86%.

U.S. Treasury Schedules 2-, 5-, and 7-Year Note Auctions Next Week

The U.S. Treasury Department announced its lineup of coupon auctions for the coming week. The agency will offer $69 billion in 2-year notes and $70 billion in 5-year notes on Monday, October 27, followed by a $44 billion auction of 7-year notes on Tuesday, October 28.

The shift from the usual Tuesday–Thursday schedule reflects adjustments made for the FOMC rate decision set for Wednesday.

White House Confirms Trump’s Meetings with Asian Leaders Next Week

The White House confirmed that President Donald Trump will meet with key Asian leaders during his upcoming trip to the region next week.

- Tuesday: Japan’s new Prime Minister Sanae Takaichi

- Wednesday: South Korea’s Prime Minister Kim Min-seok

- Thursday: China’s President Xi Jinping

The Xi meeting had been uncertain but is now officially on the president’s schedule. The trip comes amid escalating trade tensions between Washington and Beijing. The U.S. plans to raise tariffs on Chinese imports to 155% starting November 1, while China continues to restrict rare-earth exports and soybean imports.

According to the New York Times, the administration is also preparing a Section 301 investigation into China’s compliance with the 2020 trade deal, signaling potential for additional tariffs.

Super Micro Computer Forecasts $5B in Q1 Sales, Misses Estimates

Super Micro Computer Inc. (SMCI) said it expects first-quarter sales of about $5 billion, falling short of Wall Street’s $6.518 billion estimate.

The company reaffirmed its fiscal 2046 revenue outlook of at least $33 billion, maintaining a bullish long-term view despite the near-term shortfall.

SMCI shares were down roughly 7% in premarket trading on Thursday following the update, reflecting investor concern over slowing sales momentum after a strong run earlier this year.

Trump Proposes Higher Beef Import Quota from Argentina

President Donald Trump plans to raise the tariff-rate quota for Argentine beef to 80,000 metric tons, up from 20,000 tons currently, as part of a move aimed at lowering US beef prices.

The increase in import allowance is intended to ease pressure on American consumers facing elevated meat costs. The change, if implemented, would expand Argentina’s access to the US market significantly, potentially weighing on domestic producers while offering near-term price relief for households.

United Rentals Shares Sink on Margin Pressures Despite Solid Revenue

United Rentals shares plunged 7.7% in after-hours trading, falling to $925 from a $990 close, after the company reported weaker-than-expected margins.

Adjusted earnings came in at $11.70 per share versus expectations for $12.30. Revenue, however, beat forecasts at $4.23 billion versus $4.16 billion estimated, and the company raised its full-year sales outlook to $16.0–$16.2 billion from $15.8–$16.1 billion.

The company cited inflation and rising costs for the margin shortfall and lowered its free cash flow forecast to $2.1–$2.3 billion from $2.4–$2.6 billion.

CEO Matthew Flannery said he remains optimistic about growth prospects “within large projects and across key verticals,” signaling steady demand despite cost headwinds.

Canada’s Carney: Will Act to Protect Workers if U.S. Talks Stall

Canadian Prime Minister Mark Carney said his government is ready to take action to defend domestic workers if trade talks with the United States fail to progress. Speaking on Thursday, Carney emphasized that Canada “will not allow unfair access to our market” unless reciprocal access is granted by the U.S. He noted that while the discussions remain ongoing, Canada is prepared to respond if negotiations break down.

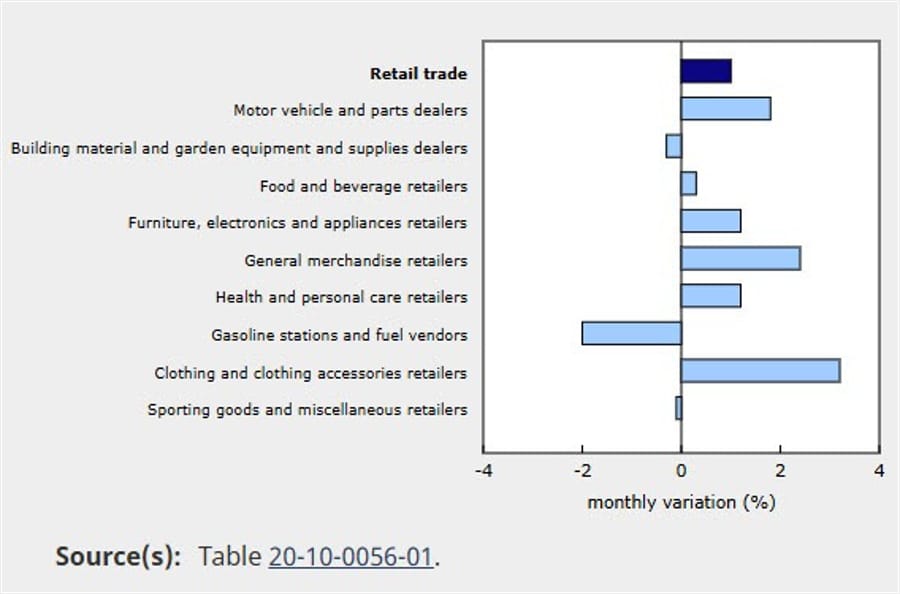

Canada Retail Sales Match Forecasts, Up 1% in August

Canadian retail sales rose 1.0% in August, matching forecasts and rebounding from a 0.8% decline in July.

Excluding autos, sales rose 0.7%, missing estimates for 1.3%. Gains were seen in six of nine sectors, led by motor vehicle and parts dealers (+1.8%), with new car dealers up 2.3%.

Sales fell at gasoline stations (-2.0%) and building materials stores (-0.3%). Regionally, Ontario posted a 1.2% gain, including a 2.4% rise in Toronto. Quebec rose 1.8%, while Nova Scotia dropped 0.5% amid weaker vehicle sales.

Analysts expect sales to slip 0.7% in September, reflecting uneven momentum in consumer spending.

Canada’s Carney Declares US Economic Integration “Over”

Prime Minister Mark Carney said Canada’s decades-long process of economic integration with the US has ended, calling the shift a “rupture, not a transition.”

In a pre-budget speech, Carney outlined plans to deliver “generational investments” aimed at strengthening national resilience and independence.

He pledged record defense spending, support for high-speed rail, and new “Buy Canadian” rules for steel and aluminum. The upcoming November 4 budget will emphasize “building, taking control, and winning,” he said.

Federal spending has risen 7% annually over the past decade, with projected deficits of C$50–C$100 billion—roughly half the US ratio relative to GDP.

Carney vowed to preserve key social programs, including national childcare and a permanent school food program, while cutting waste and boosting efficiency.

Commodities News

Gold Rebounds Above $4,100 After Testing Key $4,000 Level

Gold prices rebounded on Thursday after two consecutive sessions of steep declines, rising $50, or 1.21%, to $4,147.

The metal earlier hit a high of $4,149.86 and a low of $4,066.17.

Wednesday’s slide brought prices as low as $4,004, just above the major $4,000 psychological threshold. That level remains critical support, well above the 38.2% retracement mark at $3,955.77 from the late-July rally.

For sellers to regain control, gold would need a sustained break below $3,955.77. Until then, technical indicators suggest the broader uptrend remains intact, with buyers defending key support levels.

Crude Oil Futures Settle 5.6% Higher at $61.79

Crude oil futures surged on Thursday, settling up $3.29 (+5.62%) at $61.79 a barrel after renewed U.S. sanctions on Russian oil producers stoked supply concerns. Prices traded between $59.64 and $62.40 during the session.

Technically, crude briefly broke above resistance between $61.45 and $61.94 before closing within that range, keeping it a key pivot zone heading into Friday’s session.

- Bullish outlook: A sustained move above $62.00 could open the door toward the 100-day moving average near $64.40.

- Bearish outlook: Support remains between $59.78 and $60.10. A drop below that band would negate the day’s gains and signal renewed selling pressure.

Kuwait Signals OPEC Ready to Reverse Cuts if Supply Tightens

Kuwait’s oil minister said OPEC stands ready to roll back production cuts if needed to prevent market shortages.

Crude prices eased slightly after the comments, with WTI last up $2.85 at $61.35 a barrel. Earlier, prices hit a session high of $62.12 and a low of $59.64.

On technical charts, WTI climbed above a prior resistance zone between $59.78 and $60.10, briefly touching the upper swing range near $61.94 before retreating to $61.45. A move below that level could trigger renewed selling momentum.

The minister’s statement adds nuance to OPEC’s current output discipline, suggesting the group is prepared to respond if Western sanctions or geopolitical tensions disrupt supply flows.

Gold Holds at $4,000 as Traders Eye US CPI

Gold steadied around the $4,000 mark after sliding nearly 9% this week amid easing US-China tensions.

The pullback began after upbeat comments from President Trump on trade talks spurred profit-taking in precious metals. Traders now await the US CPI report for fresh direction.

On charts, gold is finding support at a key trendline near $4,000. A break below could target $3,600, while resistance stands at $4,185.

Despite short-term volatility, falling real yields and a dovish Fed outlook keep the broader uptrend intact.

Oil Extends Rally on US, EU Sanctions Against Russia

Crude prices surged as fresh US and EU sanctions tightened pressure on Russia and its trading partners.

WTI rose 4% to $61.75, up nearly 8% on the week after hitting a five-month low Monday.

The EU unveiled its 19th sanctions package, targeting key Russian sectors and two Chinese refiners accused of helping Moscow skirt restrictions.

Combined with Washington’s move against Rosneft and Lukoil, the actions have fueled expectations of tighter global supply.

WTI Rises Above $60 as US Targets Russian Oil

Oil prices climbed as the US rolled out sanctions against Russia’s top energy producers. WTI crude rose $1.63 to $60.14 a barrel after President Trump announced measures against Lukoil and Rosneft, citing the need to “finally act” after months of restraint.

The Treasury said the sanctions could be expanded. Details on possible secondary sanctions for buyers or intermediaries remain unclear. The move followed Trump’s cancellation of a meeting with Putin. Traders viewed the step as a sign of tighter supply risk, sending crude higher from intraday lows near $57.50.

Oil Prices Rally as US, EU Tighten Sanctions on Russia

Oil markets extended gains Thursday after the US imposed new sanctions on Russian producers Rosneft and Lukoil, which together account for over 5 million barrels per day of output.

WTI crude rose roughly 2.8%, reclaiming the $60 per barrel mark, according to ING commodity strategists Ewa Manthey and Warren Patterson.

Analysts say the key question is whether these measures will meaningfully reduce Russian exports to major buyers such as China and India. Earlier sanctions this year on Gazprom Neft and Surgutneftegas had limited effect.

Meanwhile, the EU approved its 19th sanctions package against Moscow after Slovakia lifted its veto, targeting 117 vessels from Russia’s “shadow fleet,” two Chinese refineries, and introducing a ban on Russian LNG effective January 1, 2027.

ING notes that the tougher stance by Washington and Brussels marks a turning point in policy toward Moscow, increasing the likelihood of broader trade and energy restrictions if no progress is made on a Ukraine peace deal.

US Treasury Expands Sanctions on Russian Oil Giants

The US Treasury has imposed new sanctions targeting Russian energy majors Lukoil and Rosneft as part of a broader effort to pressure Moscow into ending its war in Ukraine.

The Office of Foreign Assets Control (OFAC) designated multiple subsidiaries of both firms, stating that any entity owned 50% or more—directly or indirectly—by Rosneft or Lukoil will also be blocked, even if not specifically named.

President Donald Trump said he hopes the sanctions will push Russian President Vladimir Putin toward “reasonable” negotiations, noting that while his conversations with Putin have been “good,” they “never go anywhere.” Trump cancelled a planned meeting with the Russian leader, saying it “didn’t feel right” to proceed.

Europe News

European Stocks Close Higher; FTSE 100 Outperforms

Major European equity indices ended the session higher on Thursday, led by the UK’s FTSE 100, which advanced 0.67%.

Closing levels:

- DAX (Germany): +0.23%

- CAC 40 (France): +0.23%

- FTSE 100 (UK): +0.67%

- Ibex 35 (Spain): +0.07%

- FTSE MIB (Italy): +0.41%

Gains were broad-based, reflecting investor optimism ahead of next week’s U.S. Federal Reserve meeting and solid corporate earnings across Europe.

French Business Confidence Rises to Six-Month High

French business sentiment improved in October, with INSEE’s confidence index rising to 97 from 96, its best reading since April.

Manufacturing confidence jumped to 101 from 97, offsetting a decline in the services sector, which fell to 96 from 98. The employment indicator also rose to 96 from 93, matching July’s high.

The rebound suggests that industrial optimism is helping to counter service-sector softness as France heads into year-end.

UK Manufacturing Orders Sink to Post-Pandemic Lows

UK factory orders fell sharply in October, with the CBI’s total orders balance dropping to -38 from -27, the weakest since December 2024.

Manufacturing output expectations also slid to the lowest level since January, while quarterly data showed the biggest declines in domestic and export orders since mid-2020.

Export expectations over the next year fell to their weakest since April 2020, signaling continued strain across the sector.

BoE’s Dhingra: US Tariffs Will Weigh on Growth, Prices

Bank of England policymaker Swati Dhingra said rising US tariffs are likely to dampen global growth and inflation, reinforcing the case for a cautious policy approach.

Dhingra, one of the central bank’s most dovish members, argued that aggressive rate cuts remain risky given inflation’s persistence.

“Running expansionary policy into tariff-driven cost shocks isn’t sustainable,” she said, warning that premature easing could undermine price stability.

SNB Minutes: Inflation Risks Balanced, Policy Steady

The Swiss National Bank kept its policy stance unchanged at its September meeting, minutes showed.

Officials cited low financial market volatility and said the current policy mix remains appropriate.

The SNB warned that higher US tariffs could weigh on global trade and lift the franc, though the currency has remained stable against the euro.

Inflation risks stem mainly from exchange-rate swings, the bank said, while Switzerland’s economic outlook remains uncertain but resilient.

Asia-Pacific & World News

U.S. to Probe China’s Compliance with 2020 Trade Pact — NYT

The New York Times reports that the U.S. will launch a Section 301 investigation into China’s adherence to the 2020 Phase One trade deal, potentially escalating trade tensions ahead of Trump’s Oct. 30 meeting with Xi Jinping in South Korea.

Under the 2020 accord, China pledged to purchase an additional $200 billion in U.S. goods and services and enhance market access and intellectual property protections. Analysts note those commitments were never fully met.

The inquiry could pave the way for new tariffs, adding to existing duties already set to rise to 100% on November 1, up from 55% currently.

Australia’s NAB Business Conditions Improve in Q3

Australia’s business sentiment showed renewed strength in the third quarter, according to National Australia Bank’s quarterly survey.

Business conditions rose to +6 from +1, while confidence improved to +2 from 0.

The data mark a recovery from the post-pandemic low in May, returning to levels last seen in mid-2024. The quarterly survey tracks profitability, capacity use, costs, and forward orders, offering a detailed read on inflation and growth pressures.

Japan’s Largest Labor Union Seeks 5% Pay Rise

Rengo, Japan’s biggest labor federation, will demand wage hikes of 5% or more for fiscal 2026, following this year’s negotiated 5.25% increase from an initial 6% target.

It would mark the third consecutive year of major pay raises, though Rengo acknowledged growing challenges as corporate profits weaken under US tariffs.

Sustaining wage momentum will be critical for the Bank of Japan’s goal of achieving stable inflation through stronger household incomes.

BOJ: Japan’s Financial System Remains Stable

Japan’s banking system remains sound and well-capitalized, according to the Bank of Japan’s semi-annual financial stability report released Thursday.

The central bank said lenders have sufficient buffers to absorb severe shocks comparable to the global financial crisis. However, it warned of persistent uncertainty around global policy, geopolitics, and markets.

The BOJ urged financial institutions to stay vigilant against potential risks, citing US trade policy and weak global demand as primary threats to Japan’s economy.

Former BOJ Official Says Markets Underpricing Rate Hikes

Ex-Bank of Japan Executive Director Maeda said markets are being “too dovish” about the central bank’s policy path, expecting rate increases later than likely.

He sees the BOJ hiking as soon as December or January, compared with market odds of 45% and 73%, respectively.

Maeda projects the policy rate could reach 1% by mid-2026, while BOJ futures currently peak around 0.91% next July. He noted that new Prime Minister Sanae Takaichi’s influence over the BOJ adds uncertainty as she balances inflation concerns with political pressure for low rates.

South Korea Says Trade Talks With US Still on Track

South Korean President Lee Jae Myung said ongoing trade talks with the United States are progressing slowly due to “differences in opinion” but remain on course for a deal.

“I believe in the rationality of the US,” he said, expressing confidence a “reasonable agreement” will be reached.

While negotiations have dragged, both sides continue to seek common ground amid tensions over tariffs and technology policy.

Crypto Market Pulse

XRP Rebounds Above $2.40 as Institutional and Retail Demand Grows

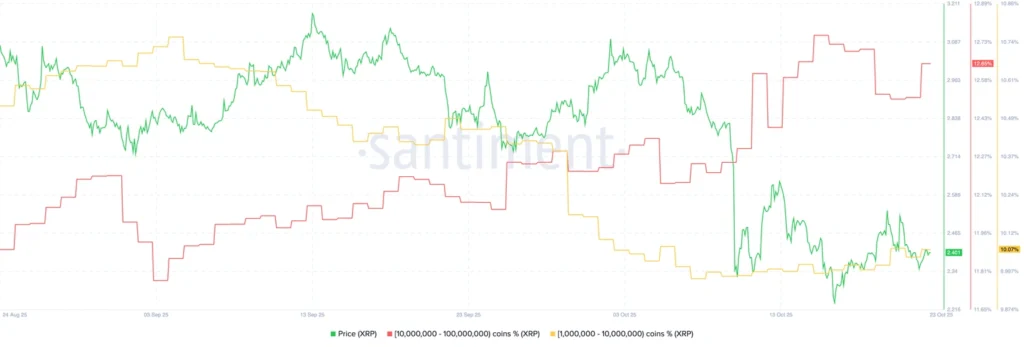

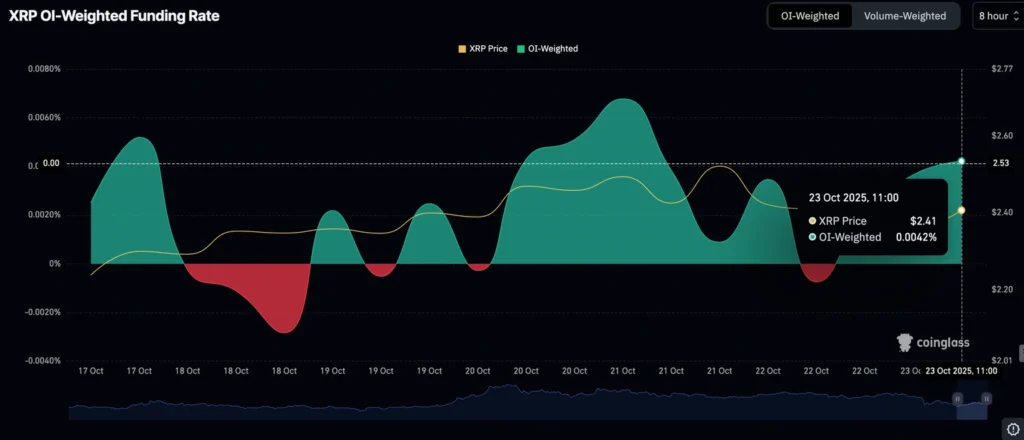

Ripple’s XRP advanced above $2.40 on Thursday, supported by renewed buying from both institutional and retail investors.

Whale accumulation has intensified, with addresses holding between 1 million and 10 million XRP now controlling 12.65% of total supply, up from 12.16% earlier this month. Larger holders with 10 million–100 million tokens also expanded their positions to 10.07% from 9.97%.

The futures open interest (OI)-weighted funding rate rose to 0.0042%, reversing from -0.0007% the prior day, reflecting a shift toward long positioning. The metric had plunged to -0.2040% after the sharp October 10 sell-off to $1.25, suggesting renewed confidence in XRP’s near-term outlook.

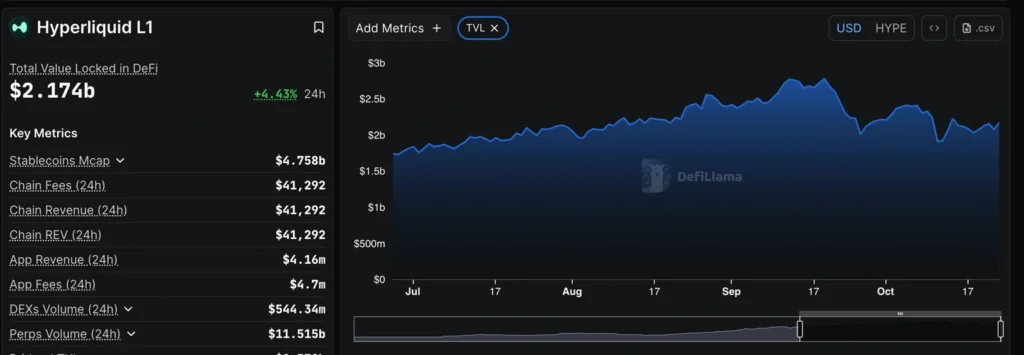

Hyperliquid (HYPE) Extends Rally, Eyes $45 Breakout

Hyperliquid’s HYPE token continued its upward momentum on Thursday, trading above $40.00 as bullish sentiment spread across the DeFi sector.

The token’s futures open interest has recovered to $1.37 billion, up from $1.27 billion last weekend, signaling renewed participation from traders.

The OI-weighted funding rate climbed to 0.0318%, after dipping into negative territory earlier this week, indicating growing demand for leveraged long exposure.

At the same time, DeFiLlama data show Hyperliquid’s total value locked (TVL) rose 4.4% over the past 24 hours to $2.17 billion, underscoring investor confidence in the protocol’s fundamentals.

Mantle (MNT) Eyes Breakout as Bullish Bets Build

Mantle (MNT) rebounded from its $1.50 support zone for the third time this month, signaling growing momentum toward a potential breakout from its descending triangle pattern.

Data from CoinGlass show a 5.85% jump in futures Open Interest over the past 24 hours to $185.8 million, alongside a shift in the OI-weighted funding rate from -0.0187% to 0.0092%, indicating renewed long-side demand.

Analysts view the shift as evidence that traders are re-entering bullish positions after a recent washout of leveraged longs. Funding rates above 0.010% typically reflect buyer dominance.

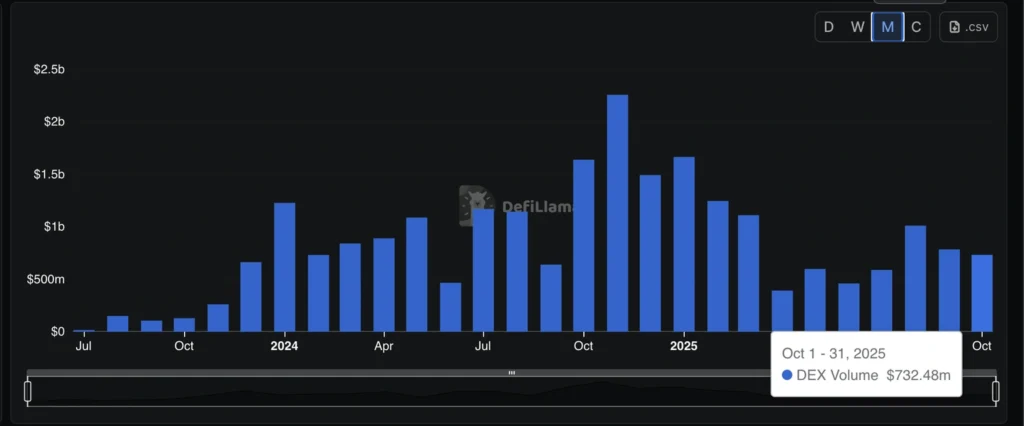

On-chain activity remains strong, with Mantle’s DEX volume topping $732.48 million in October, the third straight month above $700 million, according to DeFiLlama. Although down from $1 billion in August, the steady volume suggests robust network engagement amid market volatility.

Crypto Markets Eye Breakout as Bitcoin Tests $110,000

Bitcoin (BTC) held just below $109,000 Thursday after recovering from a prior-day low of $106,666, extending a tentative rebound as risk appetite returned to crypto markets.

Ethereum (ETH) traded near $3,900, and XRP climbed above $2.40, marking its first gain in two sessions.

Derivatives data show retail interest returning to Bitcoin following the October 10 deleveraging event, when roughly $19 billion in crypto assets were liquidated. The OI-weighted funding rate has stabilized around 0.0069%, up from negative territory earlier this month.

Bitcoin continues to trade in a volatile range between $102,000 and $114,000, with resistance seen at the upper bound tested Tuesday.

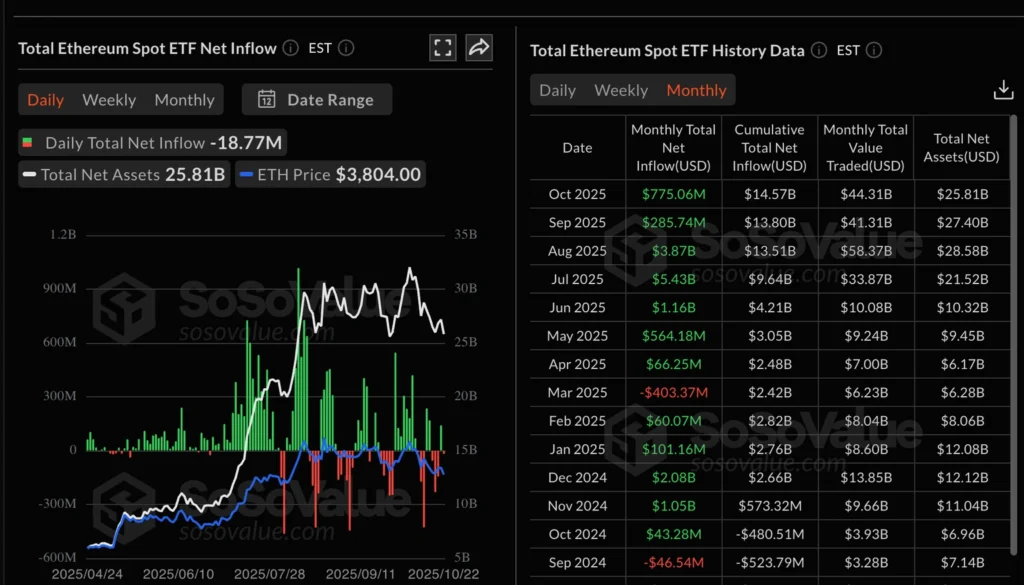

Institutional flows into Ethereum ETFs have weakened, totaling $775 million so far in October, down sharply from $5.43 billion in July and $3.87 billion in August.

After a brief rebound—$142 million of inflows on Tuesday—ETH funds saw $19 million in outflows Wednesday, according to SoSoValue data. Analysts warn that the lack of fresh catalysts could limit Ethereum’s ability to sustain a breakout above the $4,000 threshold.

Aster Rises as It Launches ‘Rocket Launch’ Platform for Early Crypto Projects

Aster (ASTER) climbed back above $1.00 Thursday, reflecting renewed strength across the cryptocurrency market as Bitcoin surpassed $109,000 and Ethereum topped $3,800.

The company introduced Rocket Launch, a new platform designed to boost liquidity and trading activity for early-stage crypto projects. The initiative aims to transform token launches from one-off events into ongoing growth cycles, “from alpha discovery to trading activation and sustained growth,” Aster said in a statement.

Rocket Launch will reward traders for participation based on their share of total volume, while listed projects gain visibility and liquidity. Aster expects the program to support continuous buybacks and bolster long-term value for ASTER token holders.

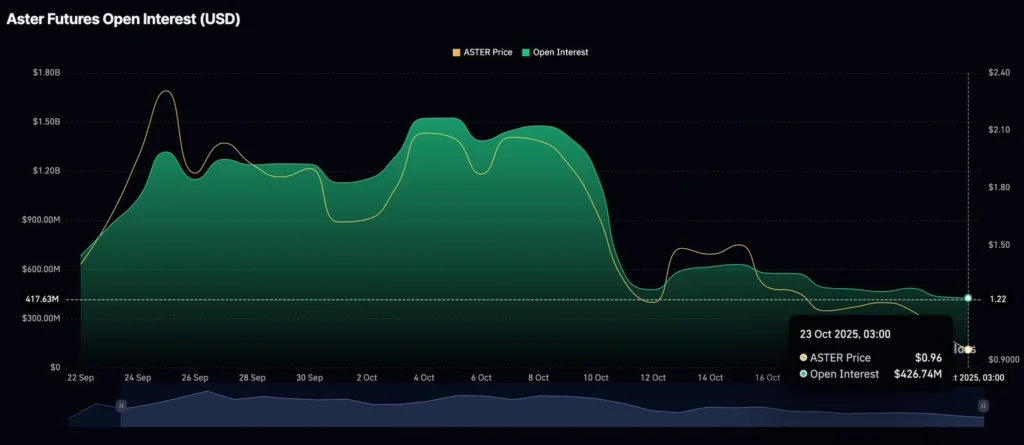

Despite the upbeat news, futures Open Interest (OI) remains subdued at $427 million, down from a record $1.52 billion in early October, suggesting traders are waiting for signs of renewed speculative momentum.

Solana Holds Steady Through AWS Outage, Showcases Network Resilience

The Solana blockchain continued to operate seamlessly during a 16-hour AWS US-East-1 outage on October 20, 2025, underscoring its decentralized network strength.

While major platforms including Coinbase, MetaMask, Infura, and several Ethereum Layer-2 networks such as Polygon and Arbitrum experienced significant downtime, Solana maintained full throughput with no drop in validator participation.

The outage, caused by DNS and DynamoDB issues, exposed the industry’s dependence on centralized infrastructure. Solana’s distributed validator base and Proof-of-History consensus were key to maintaining performance.

According to DeFiLlama, Solana’s stablecoin market cap reached $15 billion following the incident, highlighting growing institutional confidence. Analysts said the event reinforced Solana’s image as one of the most resilient Layer-1 blockchains.

The Day’s Takeaway

North America

U.S. Stocks Rise on Quantum Tech Momentum

Major U.S. indices advanced Thursday, lifted by gains in quantum computing names following reports that Washington may boost investment in the field. D-Wave Quantum jumped 13.78%, Rigetti Computing rose 9.82%, IonQ gained 7.07%, and Quantum Computing Inc. climbed 7.20%.

- Dow Jones: +144.20 points (+0.31%) to 46,734.61

- S&P 500: +39.04 (+0.58%) to 6,738.44

- NASDAQ: +201.40 (+0.89%) to 22,941.80

Bond yields also firmed, with the 10-year note rising 5.4 bps to 4.006%.

Ford Trims 2025 Outlook; Intel Beats on Margin Recovery

Ford Motor Co. (F) posted adjusted EPS of $0.45 versus estimates of $0.36, but reduced its full-year EBIT forecast to $6B–$6.5B (prior $6.5B–$7.5B) and free cash flow outlook to $2B–$3B (prior $3.5B–$4.5B). The automaker cited lingering production challenges and warned of a $1.5B–$2B EBIT hit in 2025 linked to the Novelis fire.

Intel Corp. (INTC) reported EPS of $0.23 (est. $0.012) and revenue of $13.65B, up 2.8% year-on-year, driven by stronger data center and AI demand. The company guided Q4 revenue between $12.88B–$13.8B and reported a 40% adjusted gross margin.

Kansas City Fed Manufacturing Index Jumps to 15

Factory activity across the Midwest accelerated in October, with the Kansas City Fed’s manufacturing index rising sharply to 15 from 4. The composite index increased to 6 from 4, reflecting higher output and new orders.

U.S. Treasury Lines Up $183B in Note Auctions

The U.S. Treasury Department announced upcoming auctions totaling $183B, including $69B in 2-year, $70B in 5-year, and $44B in 7-year notes. The schedule shift accommodates next week’s FOMC rate decision on Wednesday.

Separately, the department sold $26B in 5-year TIPS at a 1.182% high yield, slightly above the when-issued level. The auction drew a 2.51x bid-to-cover ratio, with strong direct participation.

U.S. Existing Home Sales Rise to 4.06 Million; Inventory Highest in 5 Years

September existing home sales matched expectations at an annual rate of 4.06 million, up 1.5% month-on-month, the fastest in seven months. Inventory rose 14% year-over-year to 1.55 million units, a 4.6-month supply, marking a five-year high.

- Median price: $415,200 (+2.1% YoY)

- Northeast: 490,000 sales (+2.1%), median $500,300 (+4.1%)

- Midwest: 940,000 (-2.1%), median $320,800 (+4.7%)

- South: 1.86M (+1.6%), median $364,500 (+1.2%)

- West: 770,000 (+5.5%), median $619,100 (+0.4%)

Freddie Mac: 30-Year Mortgage Rate Falls to 6.19%

The average 30-year fixed mortgage rate dropped to 6.19% from 6.27%, the lowest since early October. The decline mirrors the slide in Treasury yields, with the 10-year note touching 3.936% before rebounding to 4.001%.

Canada’s Carney Vows to Defend Workers if U.S. Talks Falter

Canadian Prime Minister Mark Carney said Ottawa would act to safeguard domestic workers if U.S. trade discussions stall, emphasizing that Canada “will not allow unfair access” without reciprocal treatment.

Commodities

Crude Oil Futures Surge 5.6% to $61.79

Oil prices rallied on renewed U.S. sanctions against Russian energy firms, fueling supply concerns. WTI crude settled up $3.29 at $61.79 per barrel, after trading between $59.64 and $62.40.

- Resistance zone: $61.45–$61.94

- Bullish trigger: Above $62 opens target near $64.40

- Support: $59.78–$60.10

Europe

European Markets End Higher; FTSE 100 Leads Gains

European equities advanced on Thursday, supported by upbeat earnings and optimism ahead of next week’s Fed meeting.

- FTSE 100 (UK): +0.67%

- DAX (Germany): +0.23%

- CAC 40 (France): +0.23%

- FTSE MIB (Italy): +0.41%

- Ibex 35 (Spain): +0.07%

Asia

White House Confirms Trump’s Meetings with Asian Leaders

The White House confirmed President Donald Trump’s itinerary for next week’s Asia trip:

- Tuesday: Japan’s PM Sanae Takaichi

- Wednesday: South Korea’s PM Kim Min-seok

- Thursday: China’s President Xi Jinping

The Xi meeting, previously uncertain, is now confirmed. The trip comes as Washington prepares to raise tariffs on Chinese imports to 155% on Nov. 1, while China tightens rare-earth and soybean export controls.

According to The New York Times, the U.S. is also planning a Section 301 probe into China’s compliance with the 2020 Phase One trade deal, a move that could set the stage for further tariffs.

Rest of World / Global Trade

U.S. to Probe China’s Compliance with 2020 Trade Pact

The New York Times reported that Washington will launch a Section 301 investigation into Beijing’s adherence to its 2020 trade commitments, which included $200B in additional U.S. goods purchases and market access reforms. Analysts say the move signals intensifying U.S.–China trade friction ahead of Trump’s meeting with Xi.

Crypto

XRP Rebounds Above $2.40 as Whale Demand Rises

Ripple’s XRP surged past $2.40, driven by institutional accumulation. Wallets holding 1M–10M tokens now control 12.65% of total supply, up from 12.16% earlier in October.

The funding rate turned positive at 0.0042%, reversing prior short pressure and reflecting bullish sentiment.

Hyperliquid (HYPE) Targets $45 as DeFi Momentum Builds

HYPE, the native token of Hyperliquid, extended its rally above $40.00, supported by rising leverage demand and growing DeFi inflows. Open interest recovered to $1.37B, while TVL rose 4.4% in 24 hours to $2.17B, signaling broadening investor engagement.