North America News

U.S. Stocks Close Lower as Nasdaq and Russell 2000 Extend Weekly Slide

U.S. equities finished broadly lower Wednesday, with the Nasdaq and Russell 2000 continuing to underperform as tech and small-cap shares faced renewed selling pressure.

At the close:

- Dow Jones Industrial Average: -334.33 points (-0.71%) at 46,590.41

- S&P 500: -35.92 points (-0.53%) at 6,699.43

- Nasdaq Composite: -213.27 points (-0.93%) at 22,740.40

- Russell 2000: -36.13 points (-1.45%) at 2,451.54

Investor sentiment remained cautious ahead of key economic data and escalating trade tensions.

Earnings in Focus:

- Tesla (TSLA) reported Q3 revenue of $28.1 billion, beating the $26.36 billion estimate. Adjusted EPS missed expectations at $0.50 vs. $0.54 est. Gross margin was 18% vs. 17.2% est., and operating income came in at $1.62 billion vs. $1.65 billion est. Shares slipped 0.67% in after-hours, after closing down 0.82% at $438.97.

- IBM posted EPS of $2.65 vs. $2.45 expected on revenue of $16.33 billion vs. $16.09 billion est.

- Lam Research (LRCX) reported EPS of $1.24 vs. $1.21 est. with revenue of $5.324 billion vs. $5.20 billion est.

The mixed corporate results added to volatility, especially across the tech-heavy Nasdaq.

U.S. Treasury Sells $13 Billion in 20-Year Bonds at 4.506% High Yield

The U.S. Treasury’s auction of $13 billion in 20-year bonds drew strong demand, clearing at a high yield of 4.506%, slightly below the when-issued level of 4.518%.

The auction produced a tail of -1.2 basis points, better than the six-month average tail of -0.2 basis points. The bid-to-cover ratio came in at 2.73 times, above the six-month average of 2.64.

Direct bidders took 26.3% of the total, up from the 20.4% average, while indirect bidders accounted for 63.6%, below the six-month average of 66.5%. Dealers were left with just 10% of the issue, notably lower than the 13.1% average.

Though the issue was off-the-run, demand was notably strong, with domestic buyers leading participation while international demand was modestly lighter.

U.S. Mortgage Applications Slip 0.3% as Rates Ease Slightly

U.S. mortgage applications fell 0.3% in the week ending Oct. 17, following a 1.8% decline the previous week, according to the Mortgage Bankers Association.

The market index stood at 316.2, with the purchase index at 157.3 and the refinance index at 1,214.7. The average 30-year fixed mortgage rate edged down to 6.37% from 6.42%.

The release typically has limited market impact.

U.S. Treasury Secretary Bessent: “Substantial” Russia Sanctions Coming Within Days

Treasury Secretary Scott Bessent said the U.S. will announce a “substantial pickup” in sanctions targeting Russia, likely within the next 48 hours.

In remarks Wednesday, Bessent said the new package will be “powerful and extensive”, aimed at tightening financial restrictions and closing sanction loopholes.

He confirmed that export control measures on China are also under discussion but emphasized they would be coordinated with G7 allies.

“If the U.S. stops aircraft sales, China could easily turn to Europe,” Bessent noted, implying alignment among allies is key to maintaining pressure.

Bessent is scheduled to travel to Malaysia for two days of talks with Chinese officials, describing the upcoming dialogue as a chance to “iron things out” ahead of the Trump–Xi meeting planned during the APEC summit in South Korea.

Following Malaysia, Bessent will join President Trump on a trip to Japan before heading to the APEC conference in South Korea, where Trump and Xi are expected to hold an informal “pull-aside” meeting.

On Russia, Bessent said President Vladimir Putin “has not come to the table in an honest fashion”, adding he was “disappointed with the lack of progress” in peace negotiations over Ukraine.

The U.S. is urging G7, Canada, Australia, and European allies to join in the forthcoming sanctions effort.

Trump Weighs Export Restrictions on China Over U.S. Software Content

U.S. stocks extended declines Wednesday after reports emerged that President Trump is considering new restrictions on exports to China that contain U.S. software or technology components.

Sources said the proposal — which could affect goods produced globally with U.S.-origin software — remains under review but reflects the administration’s intent to escalate pressure on Beijing.

The potential measures come as China curtails exports of rare earths and continues its boycott of U.S. agricultural products, including soybeans.

While Trump’s previously announced 155% tariff rate on Chinese imports takes effect Nov. 1, market reaction has been muted. Additional controls on software, aircraft, and other goods would heighten trade tensions further.

“This approach isn’t new for Trump,” one source noted. “He identifies where it hurts — and if that’s not enough, he doubles down.”

Equities turned lower on the headlines.

USTR Greer: Trump/Xi meeting on schedule. Makes sense to talk but we will see

- USTR Jamieson Greer speaking on CNBC

- On China trade, trade spot for Trump/Xi meeting on schedule

- Makes sense to talk but we will see.

- Bessent and I will meet with Chinese in Malaysia to see if room to move forward

- Rare earth move was totally disproportionate. The China rare earth move was broad and global.

- There is a good landing zone where we can be more balanced.

- Our job is to make sure that national security is not compromised.

- We don’t want countries to use US products to get competitive edge.

- China is specifically trying to hurt US farmers.

- Pres. Trump will raise agricultural with China.

- Already the US government has been investing in mining and processing rare earth to make it economic.

- We have a lot of mining and related facilities that have been mothballed over the last 10 or 15 years. We are looking to bring them back online.

- We are working with our allies including Australia.

Trump Says No Final Decision on Putin Meeting, Open to Talks if Productive

Donald Trump said no final decision has been made on whether he will meet Russian President Vladimir Putin, pushing back on reports that the meeting had been canceled.

Trump added he would consider talks only if they were “not a waste of time” and said he still sees potential for a Russia–Ukraine ceasefire.

Asked about meeting congressional leaders Schumer and Jeffries, Trump said he was open to it under one condition: “I will only meet if they let the country open.”

He also reiterated that, effective Nov. 1, U.S. tariffs on China will reach roughly 155%.

Commodities News

Gold Extends Losses After Historic Selloff; Buyers Defend $4,000 Level

Gold prices fell for a second straight session on Wednesday, deepening the losses from Tuesday’s 5.31% plunge — the worst single-day drop since August 2020.

The metal is currently down 1.23% at $4,073.46, though it has rebounded sharply from session lows near $4,004.40, where buyers stepped in to defend the $4,000 psychological support.

Technical Overview (4-Hour Chart):

- The rebound lifted prices above the 100-bar moving average at $4,060.04, signaling a possible short-term low.

- To confirm recovery momentum, bulls must hold above this level.

- A push above the 200-hour moving average at $4,179.36 would neutralize near-term bearish bias.

Downside Risks:

Failure to sustain above the $4,000 level or a break below the 100-bar MA could re-expose gold to the $3,900 region, which aligns with the 38.2% Fibonacci retracement of the May–October rally and the rising 200-bar MA now near $3,877.

From a broader perspective, gold remains technically vulnerable after an 8.5% high-to-low move this week, though dip-buying interest at $4,000 underscores resilient demand.

Crude Settles at $58.50 as White House Reiterates SPR Build Plans

Crude oil settled at $58.50 per barrel, up $1.26 or 2.2% on the day, as government data confirmed a surprise drawdown in U.S. inventories and renewed plans to refill the Strategic Petroleum Reserve.

EIA data showed crude stockpiles falling by 961,000 barrels against expectations for a 1.205 million-barrel build. Gasoline inventories dropped 2.147 million barrels, while distillates declined 1.479 million.

The White House reaffirmed its plan to replenish the SPR, with Energy Secretary Wright calling current prices “a great time to buy.”

President Trump, meanwhile, said earlier that oil prices “would move down to $2,” though national averages remain higher — between $2.50 and $2.75 in several states, with the U.S. average at $3.06 per gallon, according to AAA data.

U.S. Crude Inventories Show Surprise Drawdown of 961,000 Barrels

Weekly EIA data showed a crude oil drawdown of 961,000 barrels for the week, defying expectations for a 1.205 million-barrel build.

Distillate inventories fell 1.479 million barrels, compared with estimates for a 1.933 million draw, while gasoline inventories declined 2.147 million barrels, larger than the projected 0.809 million drop.

Crude prices traded higher following the release. West Texas Intermediate rose $1.28 to $58.52, after reaching a session high of $58.82 and a low of $57.34.

On the hourly chart, crude traded back above its 200-hour moving average at $58.32. A key upside zone sits between $59.78 and $60.10 — the latter aligning with the 38.2% Fibonacci retracement from the Sept. 26 high at $59.96.

Last week’s low near $55.96 remains a notable support level.

U.S. to Refill Strategic Oil Reserves, ING Says; Prices Edge Higher

Oil prices settled modestly higher on Tuesday, with Brent crude up 0.51%, as the U.S. prepares to replenish its Strategic Petroleum Reserve (SPR), according to ING analysts Ewa Manthey and Warren Patterson.

Despite the uptick, ING noted that the global surplus continues to weigh on the market, limiting the scope for further gains. “We continue to expect oil prices to trend lower in the coming months,” Manthey and Patterson wrote.

Trump’s recent trade remarks also lent some support, as did the cancellation of a planned Trump–Putin summit, which dampened hopes for a near-term Russia–Ukraine peace deal and added geopolitical risk to the outlook.

API data further underpinned sentiment, showing a 3 million-barrel decline in U.S. crude inventories, while Cushing stocks fell by 400,000 barrels. Gasoline and distillate inventories dropped by 200,000 barrels and 1 million barrels, respectively.

The U.S. Department of Energy announced plans to purchase 1 million barrels of crude for delivery in December and January as part of the SPR refill effort. The reserve currently stands at 408 million barrels, up from a 2023 low of 347 million but still far below the 656 million barrels held in 2020.

Precious Metals Under Pressure as Gold Sinks 5.3%, ING Reports

Gold came under heavy selling pressure Tuesday, plunging 5.3% as investors took profits after weeks of sharp gains, ING’s Ewa Manthey and Warren Patterson said. The selloff continued into early Asian trading Wednesday.

“The rally in gold has been extraordinary — prices surged nearly $1,000 per ounce since late August,” ING noted. “It’s no surprise that traders have grown increasingly anxious about the sustainability of that momentum.”

President Trump’s optimistic comments about trade talks with China further dampened safe-haven demand.

The rally had been driven largely by ETF inflows, with investors purchasing record volumes of gold ETFs in September. In tonnage terms, the buying was the highest since March 2022.

Other precious metals also fell sharply — silver dropped more than 7%, platinum lost 5.2%, and palladium slid 6.1%.

WTI Extends Recovery Above $58 on U.S.–China Trade Hopes

West Texas Intermediate crude extended gains Wednesday, climbing to $58.40 per barrel — roughly $2.50 above Monday’s lows — as renewed optimism around a potential U.S.–China trade deal lifted sentiment.

President Donald Trump said he would meet Chinese Premier Xi Jinping next week, while Treasury Secretary Scot Bessent and China’s Vice Premier He Lifeng are expected to meet in Malaysia to prepare for the summit.

Trump also confirmed an agreement with India’s President Modi to cut import taxes on Indian goods from 50% to 15–16%, in exchange for reduced Indian purchases of Russian oil.

The American Petroleum Institute reported a 3 million-barrel draw in U.S. crude stocks for the week ending Oct. 17 — the first decline in four weeks — providing additional support for prices.

Even with the rebound, oil remains near multi-year lows around $55 per barrel amid weak global demand and expectations of increased supply from major producers.

U.S. Energy Secretary Wright: SPR Refill to Proceed Gradually

U.S. Energy Secretary Wright said the government will continue refilling the Strategic Petroleum Reserve (SPR) gradually, calling current oil prices “a great time to buy.”

The administration plans to purchase 1 million barrels for delivery in December and January.

Crude oil traded up $1.48 at $58.73 following the comments. Last week’s low was $55.96, narrowly above the 2025 low of $55.15.

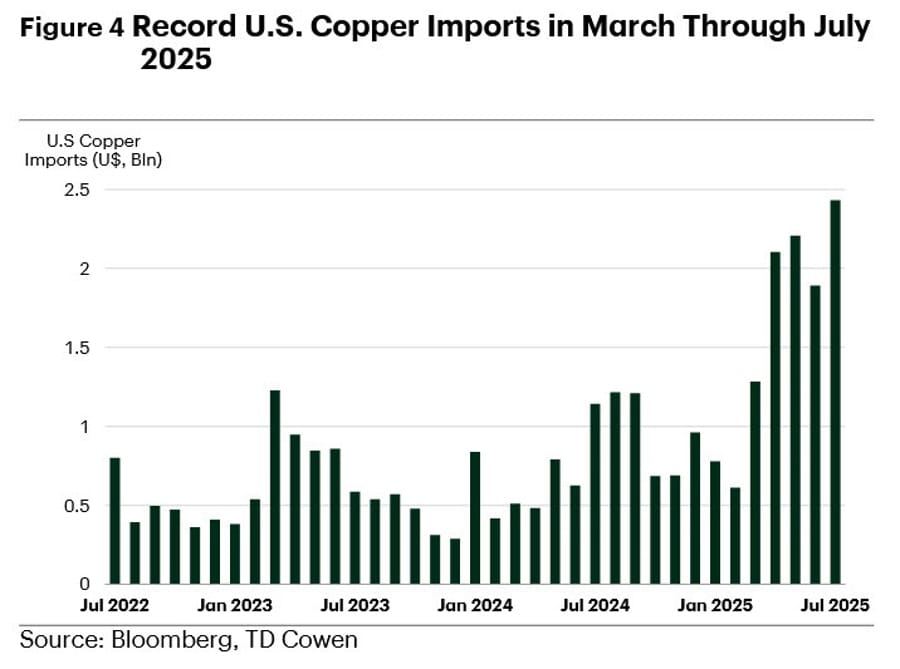

TD Cowen Raises 2026 Copper Forecast to $5.25, Sees Tight Market Ahead

TD Cowen lifted its 2026 copper price forecast to $5.25 per pound from $4.40, citing tightening global supply and ongoing disruptions at major mines. The firm also raised its long-term outlook to $4.50/lb from $4.25.

Copper futures traded around $4.94, holding firm despite recent pressure on precious metals.

Production issues have removed about 5% of global supply from the market. Freeport-McMoRan’s Grasberg mine in Indonesia remains offline after a September mudslide forced the company to declare force majeure. The event is expected to reduce output by 200–270kt over late 2025 and 2026. Additional setbacks include a seismic event at Kamoa-Kakula (≈200kt), ramp-up issues at QB (≈100kt), and the El Teniente collapse (≈48kt), totaling roughly 2% of global production.

TD Cowen forecasts a 222kt deficit in 2026, which it says may be conservative given aging mines and limited new projects.

Demand remains resilient, with Wood Mackenzie projecting 3.7% growth this year, supported by power generation, AI datacenters, and the clean energy transition.

Gold Drops Over 1% in Volatile European Session

Gold prices fell more than 1% in early European trade to around $4,070 per ounce. The metal had earlier rebounded from an overnight low of $4,004 to a high of $4,161 before sellers regained control.

Volatility remains elevated as traders weigh competing forces between safe-haven demand and profit-taking after recent swings.

Private Survey Shows Sharp Drawdown in U.S. Crude Inventories

A private sector oil inventory survey indicated a sizable drawdown in U.S. crude stockpiles, showing a 2.98 million-barrel decrease versus expectations for a 1.21 million-barrel build.

Gasoline inventories fell 236,000 barrels, and distillates dropped 974,000 barrels. The prior week saw a 3.52 million-barrel crude build.

Europe News

European Stocks Close Mixed as U.K. Inflation Data Misses Forecasts

Major European indices ended Wednesday’s session mixed, as softer U.K. inflation data underwhelmed expectations and pressured regional sentiment.

- Germany’s DAX: -0.71%

- France’s CAC 40: -0.63%

- Italy’s FTSE MIB: -1.03%

- Spain’s IBEX 35: +0.11%

- U.K.’s FTSE 100: +0.93%

The weaker-than-expected U.K. CPI data fueled speculation that the Bank of England could pivot toward a more accommodative stance sooner than expected.

UK September Inflation Cools to 3.8%, Below Expectations

UK consumer prices rose 3.8% year-over-year in September, undershooting expectations for a 4.0% increase, according to data from the ONS. Core CPI came in at 3.5%, below the 3.7% forecast.

Services inflation held steady at 4.7%, while airfare prices fell about 29% year-over-year — less sharply than last September’s 35% drop, the steepest since 2001.

Food inflation eased from 5.1% to 4.5%, helping offset other price pressures. The data suggest the Bank of England could have more flexibility to consider rate cuts sooner, with markets now eyeing the December meeting for possible signals.

U.K. Poised to Announce Emergency Housing Measures; Pound Rebounds

The U.K. government is preparing to unveil emergency measures aimed at accelerating London housebuilding, potentially as early as Thursday, according to Bloomberg.

The report triggered a late-session rebound in the pound, lifting GBP/USD toward its 200-hour moving average before stabilizing flat on the day.

Market participants are awaiting further details, with expectations that the measures will target easing planning restrictions and stimulating residential development amid the capital’s ongoing housing shortage.

ECB’s Kazaks: Next Move Could Be Either a Hike or a Cut

European Central Bank policymaker Martins Kazaks said the next monetary policy adjustment could “just as easily be a hike as a cut.”

His remarks highlight the ECB’s ongoing data-dependent stance amid uncertainty over inflation and growth across the euro area.

ECB’s de Guindos: Current ECB interest rate level is adequate

- Comments from the ECB Vice President, Luis de Guindos

- Development of inflation is positive

- Inflation risks are balanced

SNB Chairman Schlegel: US tariffs could increase downside risks for the economy

- Comments from the SNB Chairman, Martin Schlegel

- Planned US tariffs on certain pharma products could increase downside risk for the economy

- The SNB will continue to observe the situation and adjust monetary policy where necessary

- Inflation is expected to rise slightly in the coming quarters

- Economic uncertainties remain high

Asia-Pacific & World News

China’s Commerce Ministry Vows to Address Growth Concerns, Protect Supply Chains

China’s Commerce Ministry said it will take active steps to resolve concerns about its economic development while safeguarding global supply chain stability.

Beijing continues to face scrutiny over industrial overcapacity in sectors such as steel, metals, autos, and high-tech manufacturing. While officials signal a willingness to tackle those issues, skepticism remains among global trade partners wary of China’s expanding dominance in key industries.

Japan’s Finance Minister Katayama Says Deflation Exit Still Incomplete

Japan’s Finance Minister Satsuki Katayama said it is too early to declare Japan fully free from deflation.

Katayama, the country’s first female finance minister, emphasized the need for close cooperation between the government and the Bank of Japan on economic policy but declined to comment on specific monetary decisions or the size of a potential supplementary budget.

Japan Preparing Major Economic Stimulus Under PM Takaichi

Japan’s government is preparing a new economic stimulus package expected to exceed last year’s ¥13.9 trillion plan, according to Reuters, citing government sources.

The package will reportedly focus on three areas: countering inflation, boosting investment in growth sectors, and strengthening national security.

Economists Expect BOJ Rate Hike in Q4, Poll Shows

A Reuters poll found 60% of economists expect the Bank of Japan to raise interest rates by 25 basis points in the fourth quarter of 2025.

Nearly all respondents — 96% — see the BOJ’s policy rate at 0.75% by March 2026. Among economists surveyed, 46% expect the next move in January 2026, 31% in December 2025, and 14% as early as October.

Most respondents (67%) said they do not expect Prime Minister Takaichi’s policies to delay a rate hike, though 65% expressed concern about Japan’s long-term fiscal position.

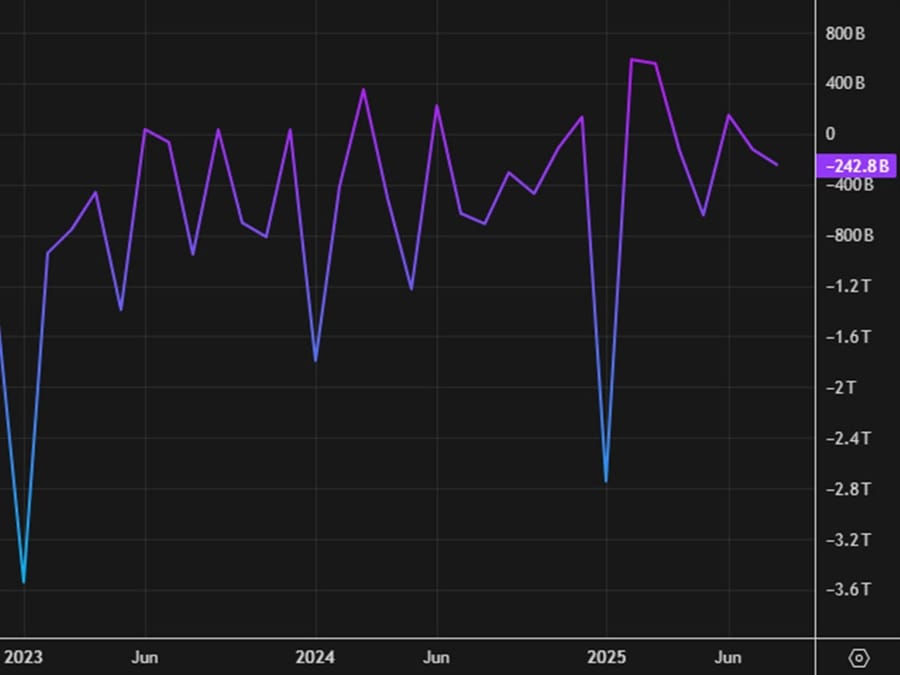

Japan Posts Trade Deficit as Imports Rise Unexpectedly

Japan’s trade balance for September showed a deficit of ¥234.6 billion, missing expectations for a ¥22.2 billion surplus. The prior month recorded a ¥242 billion deficit.

Exports grew 4.2% year-over-year, below the 4.6% forecast, while imports jumped 3.3%, sharply higher than the 0.6% expected increase. The stronger import growth offset export gains and kept Japan in deficit.

Export breakdowns showed declines to the U.S. (-13.3% y/y) but gains to Asia (+9.2%), the EU (+5%), and China (+5.8%).

Nikkei 225 Pulls Back After Record High

The Nikkei 225 fell 0.5% after hitting a record high earlier in the week, as investors took profits following two strong sessions.

The index briefly approached the symbolic 50,000 level before easing, though late-session buying helped stabilize losses.

Trump to Visit Japan Oct. 27–29 Ahead of APEC Summit

Donald Trump will make a stop in Japan from Oct. 27–29 as part of his Asia tour before attending the APEC Summit later this month.

The updated schedule reverses earlier reports that had placed his Japan visit after the summit, slated for Oct. 31–Nov. 1. The two-day stop, though not unexpected, is viewed as a positive signal amid a shifting regional agenda.

The visit could help lay groundwork for talks with Japan’s new prime minister, though striking a deal may prove challenging. Trump is also expected to visit South Korea. Over the weekend, Seoul’s chief policy adviser Kim Yong-beom said prospects for a U.S.–Korea deal had improved, with discussions centering on Seoul providing $350 billion in investment support in exchange for roughly a 15% adjustment in commitments.

Crypto Market Pulse

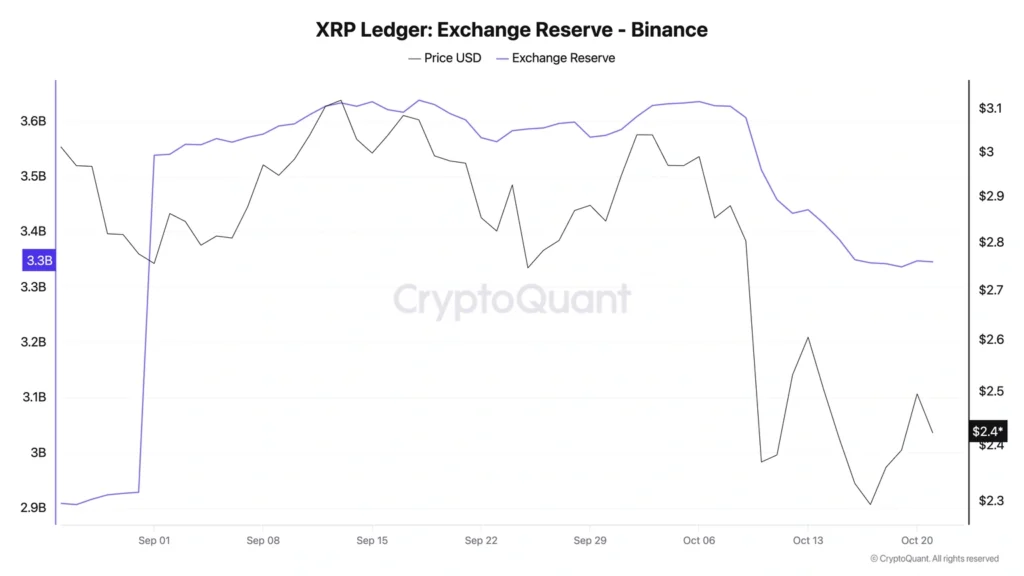

XRP Faces Renewed Pressure Despite Decline in Exchange Reserves

Ripple (XRP) extended losses for a second day Wednesday, trading slightly below $2.40 as risk-off sentiment weighed on altcoins. The token was rejected from $2.55 earlier in the week, sparking profit-taking among short-term holders.

Market Position:

Futures Open Interest (OI) sits at $3.76 billion, down from $8.36 billion on Oct. 10, highlighting reduced speculative demand. Broader crypto sentiment remains weak following the Oct. 10 liquidation event, which erased $19 billion in open positions.

XRP’s OI previously peaked near $10.94 billion in mid-July, days after prices hit a record $3.66, signaling the importance of sustained derivatives participation for bullish follow-through.

Funding Rate Signals:

The OI-weighted funding rate dropped to -0.0007% from 0.0035% Tuesday, suggesting a tilt toward short positions. However, it remains close to neutral, implying sentiment could stabilize in the near term.

Exchange Reserves and Investor Behavior:

Data from Binance shows XRP exchange reserves fell 3.36% in October, to around 3.45 billion tokens. The decline suggests holders are transferring assets to self-custody wallets, typically a sign of confidence in long-term recovery.

Despite short-term weakness, lower exchange supply supports a moderately bullish outlook for XRP as the market awaits stronger institutional inflows.

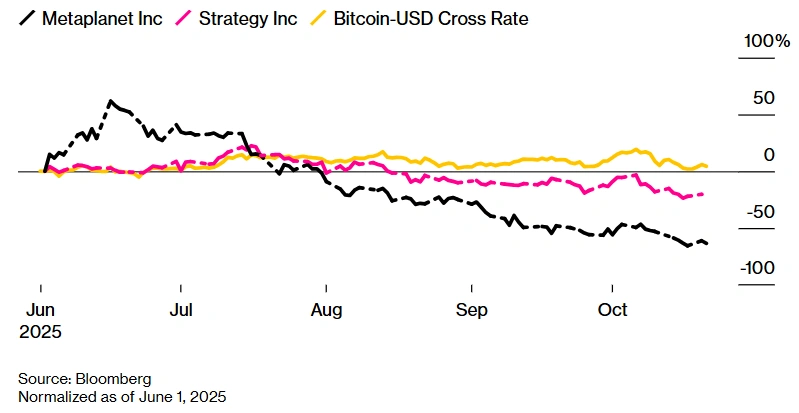

Asia’s Biggest Exchanges Push Back on Crypto-Hoarding Firms

Major stock exchanges across Asia are clamping down on companies attempting to pivot into digital-asset treasury strategies, a move that threatens to halt the wave of crypto-hoarding listed firms.

Hong Kong Exchanges & Clearing Ltd. has reportedly challenged at least five such applications in recent months, citing regulations that bar companies from maintaining large liquid crypto holdings, according to sources familiar with the matter. Similar resistance has emerged in India and Australia.

The pushback comes amid growing scrutiny of “digital-asset treasury” (DAT) models that stockpile cryptocurrencies like Bitcoin.

Bitcoin has surged 18% this year to a record $126,251 on Oct. 6, fueled partly by firms adopting Michael Saylor–style treasury models. Many of these companies trade at valuations exceeding the value of their crypto reserves, underscoring speculative fervor.

Recently, DAT stocks have slumped alongside the broader crypto market, with retail investors estimated to have lost $17 billion in related trades, according to 10X Research.

In Hong Kong, shares of Boyaa Interactive fell as much as 3.9% Wednesday, while DL Holdings Group and Ourgame International also declined.

“Listing regulations directly determine how quickly and efficiently digital-asset treasury models can operate,” said Rick Maeda, a Tokyo-based crypto analyst at Presto Research. “Predictable frameworks attract capital; restrictive ones slow execution.”

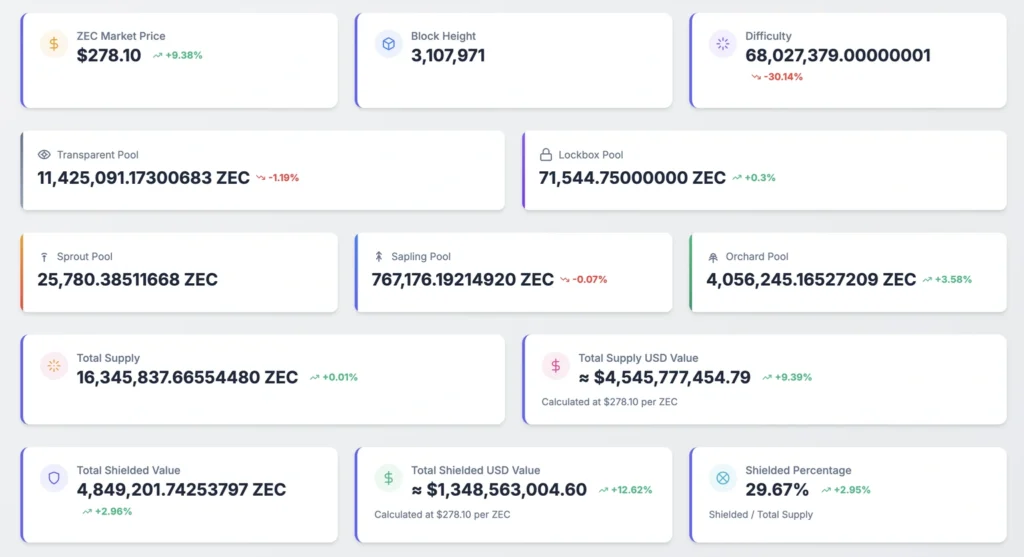

Zcash Eyes $300 Breakout as Network Activity and Retail Demand Climb

Zcash (ZEC) is edging closer to the $300 mark after rebounding off its 20-period EMA on the four-hour chart, supported by rising on-chain activity and renewed retail interest.

Zcash, a privacy-focused cryptocurrency, enables users to “shield” transactions between transparent and anonymous pools through zero-knowledge proof encryption. A spike in shielding activity indicates growing adoption.

According to analytics platform zkp.baby, more than 4.84 million ZEC tokens — roughly 30% of total supply — are now shielded, reflecting a sharp uptick in privacy usage and pushing demand for the remaining unshielded coins.

Data from CoinGlass shows ZEC futures open interest surged 17.05% in the past 24 hours to $307.78 million. Rising open interest suggests growing speculative appetite despite market volatility.

The OI-weighted funding rate improved to -0.0024% from -0.0197% earlier in the day, signaling a decline in short positioning as traders pivot toward a more bullish outlook.

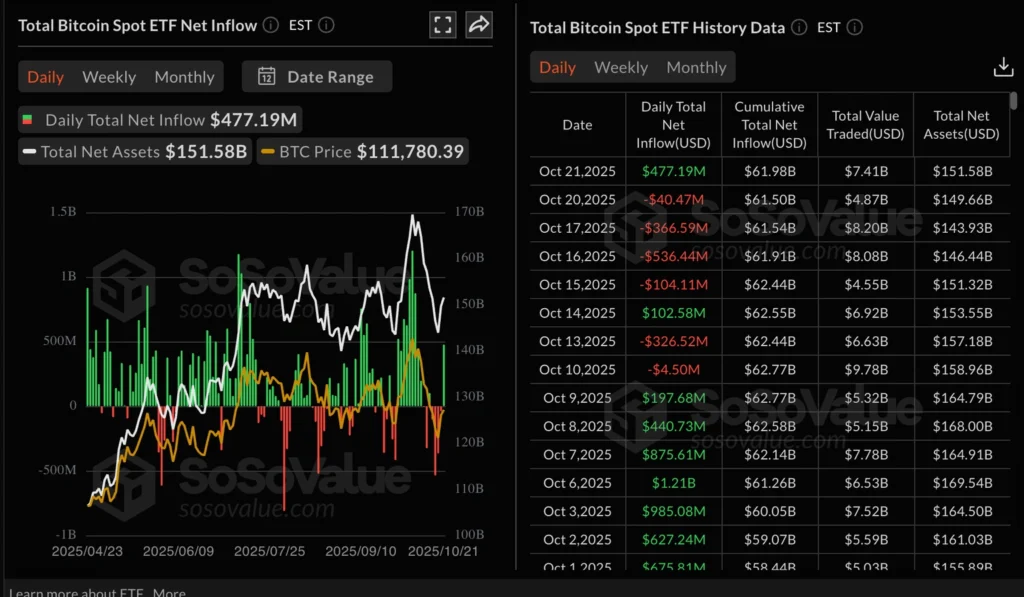

Crypto Today: Bitcoin, Ethereum, XRP Steady as ETF Inflows Return

Bitcoin (BTC) held near $108,000 on Wednesday after a failed attempt to break $114,000 resistance, while renewed ETF inflows pointed to improving institutional demand.

Bitcoin ETFs listed in the U.S. saw $477 million in inflows on Tuesday, ending a four-day streak of outflows and bringing total net inflows close to $62 billion.

Ethereum (ETH) and XRP (Ripple) extended declines amid risk-off sentiment tied to macro uncertainty and profit-taking. Ethereum ETFs attracted $142 million in inflows, bringing cumulative net assets to around $27 billion. Total net inflows now stand near $15 billion.

Ethereum has fallen below its 100-day EMA at $3,967 and is hovering just above $3,800 support. Technical indicators — including a bearish MACD crossover and RSI below 50 — suggest sellers retain control. Key supports lie at $3,800 and $3,680, while resistance sits near $4,000.

XRP’s chart structure also weakened, with a “death cross” pattern signaling further downside risk.

ETF demand remains the main stabilizing factor for crypto markets, helping absorb selling pressure as institutional inflows resume.

FalconX to Acquire 21Shares in Undisclosed Deal, Expanding Crypto ETF Reach

Crypto brokerage FalconX will acquire exchange-traded product (ETP) provider 21Shares in a merger aimed at expanding its crypto fund offerings, according to the Wall Street Journal.

The deal — whose financial details remain undisclosed — will enable FalconX to move beyond liquidity and market-making services into crypto exchange-traded funds and structured products.

Executives from both companies said the combined entity plans to develop new crypto investment vehicles tied to derivatives and structured assets.

21Shares manages more than 50 listed ETPs with over $11 billion in assets, making it one of the leading players in the space. The merger was completed through a mix of cash and equity.

Founded in 2018 by Raghu Yarlagadda, FalconX has facilitated over $2 trillion in crypto transactions for more than 2,000 institutional clients.

The tie-up comes as regulators in the U.S. push for clearer rules under the GENIUS Act. The SEC and other agencies have pledged to support innovation while ensuring investor protection.

The approval of spot Bitcoin ETFs in early 2024 reshaped the market, accelerating institutional participation and lending legitimacy to crypto as an asset class.

Bitcoin Stuck in Neutral as Momentum Fades

Bitcoin slipped back to around $108,000 after failing to hold gains from yesterday’s brief move above $114,000.

Once known for its extreme volatility, the cryptocurrency has been trading in a narrowing range since July, with repeated false breakouts. Despite the Nasdaq rally and dollar weakness, Bitcoin’s 17% year-to-date gain feels modest — leaving it roughly where it stood last December.

Investors continue to await a clear catalyst to break the stalemate.

The Day’s Takeaway

North America

U.S. equities closed broadly lower Wednesday, with persistent weakness in tech and small-cap shares dragging major indices deeper into weekly losses.

- Dow Jones: -334.33 (-0.71%) at 46,590.41

- S&P 500: -35.92 (-0.53%) at 6,699.43

- Nasdaq: -213.27 (-0.93%) at 22,740.40

- Russell 2000: -36.13 (-1.45%) at 2,451.54

Corporate earnings were mixed. Tesla beat on revenue ($28.1B vs. $26.36B est.) but missed on EPS ($0.50 vs. $0.54), while IBM and Lam Research topped expectations.

Trade & Policy:

President Trump is considering export restrictions on goods containing U.S. software or tech as part of a broader escalation with China. Treasury Secretary Scott Bessent confirmed a “substantial” new sanctions package against Russia within 48 hours and said U.S. export controls on China will be coordinated with G7 allies.

Bessent will meet Chinese officials in Malaysia before traveling with Trump to Japan and the APEC summit in South Korea, where Trump and Xi are expected to hold informal talks.

Bonds & Auctions:

The U.S. Treasury’s $13B 20-year bond auction cleared strongly at a 4.506% yield with a 2.73x bid-to-cover, underscoring steady demand despite rising yields.

Housing & Rates:

Mortgage applications fell 0.3% last week as rates edged down slightly to 6.37%. The housing market remains sluggish but stable.

Commodities

Oil:

Crude prices rose sharply after a surprise drawdown of 961,000 barrels in EIA data, defying expectations for a build.

- WTI settled at $58.50, up 2.2%, while gasoline and distillate inventories also fell.

- The White House reaffirmed plans to replenish the Strategic Petroleum Reserve, calling current prices “a great time to buy.”

- Key technical levels: Support at $55.96, resistance between $59.78–$60.10.

Copper:

TD Cowen raised its 2026 copper forecast to $5.25/lb from $4.40, citing tighter supply and ongoing mine disruptions. Production shortfalls across major sites like Grasberg and Kamoa-Kakula could create a 222kt deficit next year, even as demand stays strong from AI datacenters and renewable energy projects.

Gold:

Gold extended Tuesday’s record 5.3% crash, dropping another 1.2% to $4,073/oz before rebounding off the critical $4,000 support.

- Buyers defended the level aggressively, though prices remain below key 200-hour resistance at $4,179.

- A failure to hold above $4,000 risks a slide toward $3,900, while maintaining support could set up a short-term recovery.

Europe

European markets ended mixed as UK inflation cooled more than expected, fueling speculation of an earlier Bank of England pivot.

- DAX: -0.71% CAC 40: -0.63% FTSE MIB: -1.03%

- IBEX 35: +0.11% FTSE 100: +0.93%

ECB’s Martins Kazaks said the next policy move could be “a hike or a cut,” underscoring uncertainty over inflation trends.

UK Housing:

Reports suggest the UK government will announce emergency measures to accelerate London housing construction. The pound rebounded modestly on the headlines, with GBP/USD stabilizing near its 200-hour moving average.

Asia

Japan:

- Nikkei 225 fell 0.5% after touching record highs, as traders took profits near the 50,000 mark.

- The government is preparing a major stimulus package exceeding ¥13.9 trillion, focused on inflation relief, growth investment, and defense spending.

- Exports rose 4.2% y/y in September but missed forecasts; imports climbed 3.3%, leading to a ¥234.6B trade deficit.

- BOJ Outlook: A Reuters poll found 60% of economists expect a Q4 rate hike, with most predicting policy rates at 0.75% by March 2026.

- Finance Minister Katayama said Japan has not fully exited deflation, signaling continued caution on tightening.

China:

The Commerce Ministry pledged to address slowing growth and protect global supply chains amid ongoing Western scrutiny of industrial overcapacity.

U.S.–China Relations:

President Trump will visit Japan Oct. 27–29 before the APEC summit, meeting regional leaders to discuss trade and investment commitments.

Crypto

Market Overview:

Bitcoin (BTC) slipped to $108,000 after failing to sustain gains above $114,000. ETF inflows returned, but momentum remains muted.

- BTC ETFs recorded $477M in inflows, ending a four-day outflow streak.

- Ethereum ETFs added $142M, though ETH remains below its 100-day EMA at $3,967.

XRP:

Traded around $2.40, with futures open interest at $3.76B, down sharply from October highs. Exchange reserves dropped 3.36% this month, hinting at longer-term holding behavior despite short-term weakness.

Zcash (ZEC):

Approaching $300 as shielding activity surges — over 30% of total supply now anonymized. Futures open interest jumped 17% to $308M, and funding rates improved, suggesting growing bullish sentiment.

M&A & Regulation:

FalconX will acquire 21Shares, combining liquidity and ETF product strength to expand institutional crypto access. The merger underscores accelerating convergence between traditional finance and digital assets.

Asia Regulation:

Major Asian exchanges, including HKEX, are pushing back against companies hoarding crypto reserves, signaling tighter oversight of “digital-asset treasury” models following large retail losses earlier this year.