North America News

U.S. Stocks Close Mixed Amid Volatile Session

U.S. stocks ended the day mixed after another rollercoaster session dominated by trade headlines.

The Dow Jones Industrial Average climbed 202 points (+0.44%), supported by late-session buying, while the S&P 500 slipped 0.16% and the Nasdaq Composite dropped 0.76%.

Markets opened sharply lower after China signaled a firm stance against President Trump’s new tariffs, triggering an early sell-off. The Dow fell more than 600 points, but optimism returned midday when U.S. Trade Representative Greer downplayed escalation risks.

That rebound faded after President Trump said he is considering terminating business ties with China, specifically citing cooking oil and soybean trade as retaliation for Beijing’s failure to buy U.S. soybeans.

Volatility remains high as investors weigh trade uncertainty, the ongoing U.S. government shutdown, and early signs of slowing employment.

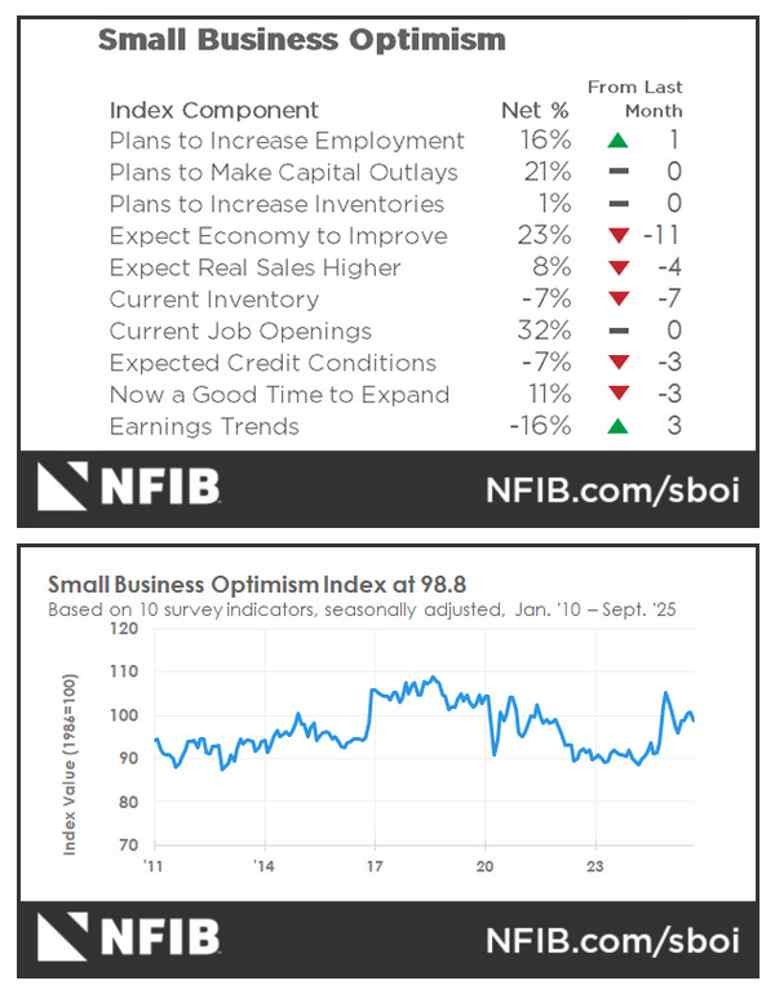

U.S. NFIB Small Business Confidence Falls to 98.8

The NFIB Small Business Optimism Index dropped to 98.8 in September, down from 100.8 and below expectations for 100.6, marking the first decline in three months.

Despite the pullback, the index remains above its 52-year average of 98. The Uncertainty Index rose 7 points to 100, its fourth-highest level in over five decades, suggesting growing concern among small firms about the economic outlook and policy direction.

NFIB Chief Economist Bill Dunkelberg said: “Optimism among small business owners decreased in September. While most owners evaluate their own business as currently healthy, they are having to manage rising inflationary pressures, slower sales expectations, and ongoing labor market challenges. Although uncertainty is high, small business owners remain resilient as they seek to better understand how policy changes will impact their operations”

Trump Escalates Anti-China Rhetoric

President Donald Trump reignited trade tensions with a fresh round of remarks targeting China.

Speaking Tuesday, Trump accused Beijing of engaging in an “economically hostile act” by halting U.S. soybean purchases. He said the U.S. is considering cutting business ties with China in sectors such as cooking oil as retaliation.

“We can easily produce cooking oil ourselves,” Trump said. “We don’t need to buy it from China.”

The comments sparked renewed selling in equity markets and reinforced the administration’s hardline stance as both economies prepare for another round of trade discussions.

Powell: Fed Policy Path to Remain Data-Driven Amid Rising Risks

Federal Reserve Chair Jerome Powell said the future course of U.S. monetary policy will depend on evolving data and risk assessments, emphasizing the Fed’s flexibility in responding to changing conditions.

Powell said growth before the government shutdown appeared stronger than expected but noted “rising downside risks” in the labour market. The September rate cut, he said, was justified by increasing risks to jobs.

He warned that tariffs are adding to price pressures and could create the appearance of persistent inflation if pass-through effects remain slow.

Powell added the Fed may be nearing the end of balance-sheet reduction “in the coming months” and that some money-market conditions have tightened. He said the central bank remains well equipped with policy tools and aims for a Treasury-only balance sheet over time.

He also cited ongoing debates within the Fed about balancing inflation and employment goals and said recent immigration trends have been stronger than expected. “We could be at the end of the job resilience phase,” Powell remarked, noting job listings have fallen even as employment remains steady.

Fed’s Collins Signals More Rate Cuts May Be “Prudent”

Boston Fed President Susan Collins said it appears “prudent” to cut interest rates further, citing increased downside risks in the labor market and the lingering effects of tariffs.

Collins emphasized that even with additional easing, monetary policy would remain “mildly restrictive”, noting that inflation risks have eased but tariff-related price pressures persist.

She added that favorable financial conditions should continue to support households and markets, indirectly pointing to improved equity performance.

“Job market risks suggest more easing may be needed,” Collins said, while stressing that policy decisions are not on a preset path.

Fed’s Bowman Expects Two Rate Cuts Before Year-End

Federal Reserve Governor Michelle Bowman said she continues to expect two interest rate cuts before year-end, in line with market pricing.

Markets currently anticipate around 49 basis points of easing in 2025, which would bring the federal funds rate to a range of 3.50%–3.75%, amid signs of slower growth and moderating inflation.

USTR’s Greer: China realizes it over-stepped

- Comments from Greer

- China is putting restrictions on very small amounts of rare earths

- Asked about the US restricting chips, says ‘everyone does that’

- China realized they over-stepped and started to qualify what they’d done

- The President is a deal-maker

- We’ve been successful in finding a path forward

- China’s reactions are completely disproportionate

- We had senior staff talks yesterday

- Calls it a ‘major escalation’

- November 1 tariffs depends on what China does

- We’re trying to have a good relationship with the Chinese

- We want to make sure markets are responding to ‘appropriate information’

Goldman Says Trump Tariffs Keeping Inflation Sticky, Delaying Fed Cuts

Goldman Sachs warned that U.S. tariffs could add nearly one percentage point to core PCE inflation, keeping it around 3% through late 2025 and delaying Federal Reserve rate cuts.

The bank estimates tariffs imposed this year have already added 0.44 percentage points to inflation, with upcoming measures expected to contribute another 0.6 points.

Goldman said the inflation boost comes mainly from firms passing on higher import costs, even as domestic pressures ease. Without tariff effects, core PCE would likely be closer to mid-2%, the bank noted.

Persistent inflation tied to trade policy could keep the Fed cautious and weigh on Treasury markets and rate-cut expectations.

JPMorgan Blames Leveraged ETFs for Deepening Wall Street Selloff

JPMorgan analysts said leveraged ETFs exacerbated Friday’s Wall Street slump, estimating about $26 billion in forced selling tied to these products as markets tumbled on Trump’s tariff threats.

The bank’s Americas equity derivatives team said ETF-related hedging pressure intensified the late-session decline and warned that further volatility is likely as leveraged products proliferate.

Demand for 2x and 3x single-stock ETFs has surged this year, with nearly 900 such funds now trading, accounting for about a third of new ETF launches.

Canada August Building Permits Drop 1.2%

Canadian building permits fell 1.2% in August, missing expectations for a 0.2% rise, Statistics Canada data showed. July’s figure was revised to a 1.1% decline from a 0.1% drop.

Permits were down 5.9% year-on-year, with residential permits falling 2.4% month-on-month.

The data suggest a slowing construction pipeline as the Toronto condominium boom cools. Prime Minister Mark Carney is set to unveil his first budget on November 4, expected to include public infrastructure spending to offset weakening private investment.

Commodities News

Crude Oil Settles Lower at $58.70

Crude oil futures fell for a third session, settling at $58.70 per barrel, down $0.79 (-1.33%).

Prices briefly hit a five-month low of $57.68, with sellers maintaining control after breaking below key resistance at $59.55–$59.78.

Since the October 9 high, WTI futures have trended below their 100-bar moving average on the 4-hour chart. The next downside target is the year’s low near $55.15, while resistance remains at the $59–$61 range.

Analysts note persistent concerns over global demand and rising U.S. inventories continue to weigh on sentiment.

OPEC Keeps Demand Outlook Unchanged, Sees Balanced 2026 Market — Commerzbank

OPEC left its oil demand forecasts for 2025 and 2026 unchanged in its latest monthly report, expecting a near-balanced market next year, Commerzbank commodity analyst Carsten Fritsch said.

OPEC+ output among quota-bound members rose by 540,000 barrels per day in September, but total production still fell 260,000 bpd short of target as Iraq and Russia cut output to compensate for earlier excesses. Kazakhstan, however, continued to overproduce.

“Despite OPEC+ output reaching about 43 million bpd, the oil market should remain undersupplied in the current quarter,” Fritsch said.

He added that OPEC data point to a potential oversupply in the first half of 2026, before the market returns to deficit later next year, leaving the annual balance roughly even. Other agencies, including the EIA and IEA, forecast a larger surplus; the IEA is due to release updated projections later today.

Copper Faces Tight Supply as U.S.-China Trade Tensions Linger — Commerzbank

Copper prices fell sharply Friday after U.S. President Donald Trump threatened 100% tariffs on Chinese goods starting next month, Commerzbank’s Thu Lan Nguyen said.

The selloff reversed over the weekend as Trump struck a more conciliatory tone, though trade uncertainty persists. “A renewed escalation would severely impact both economies — two of the biggest consumers of copper,” Nguyen warned.

During the last bout of tension in April, copper prices plunged 16% from $9,600 to around $8,100 per ton.

Nguyen added that the copper market remains exceptionally tight: spot prices now trade at a $224 premium to three-month futures — the second-highest on record since 1994 — signaling strong near-term demand. LME inventories have risen since mid-June but have eased slightly in recent weeks.

European Gas Prices Extend Decline on Ample LNG Supply — ING

European natural gas futures fell for a fourth consecutive session as robust LNG inflows and steady inventories eased supply fears, ING analysts Ewa Manthey and Warren Patterson said.

TTF front-month futures settled below €31.5/MWh, continuing their downward streak. “LNG imports to the UK and EU have increased since the start of the heating season, while U.S. exports remain near record highs,” ING noted.

EU gas storage is about 83% full, up slightly even after last winter’s heavy drawdowns, suggesting the market is well-supplied heading into colder months.

Gold Defies Market Correction, Hits Record High — Commerzbank

Gold continued its rally while other markets stabilized, reaching a record near $4,180 per ounce early Tuesday, according to Commerzbank’s Thu Lan Nguyen.

“This is likely due to renewed concerns about an escalation in the conflict between the U.S. and China,” Nguyen said, noting that Beijing’s sanctions on the U.S. units of a South Korean shipping company — in retaliation for recent U.S. sanctions on China’s shipping sector — have heightened tensions.

“These developments show the conflict between the two superpowers goes well beyond trade,” she added. “It’s no surprise that gold remains in high demand ahead of the planned Trump-Xi meeting at the APEC summit in South Korea.”

China Tightens Rare Earth Magnet Export Licensing

China has made it harder for firms to obtain export licenses for rare earth magnets, according to Reuters sources, as Beijing strengthens its grip on strategic materials used in defense and high-tech manufacturing.

Companies have faced longer review periods and more frequent requests for supplementary documentation since September, the report said. Approvals remain within the official 45-business-day deadline, but the process has become more stringent—similar to the tough stance seen in April when China used export controls as leverage in trade talks.

The measures appear designed to pressure Washington to roll back recent tariffs and restrictions. Rare earths remain one of China’s most powerful tools in the U.S.-China trade dispute.

Silver Tops Record $52.70 as Tight Market and Short Squeeze Fuel Rally

Silver prices surged to an all-time high above $52.70 an ounce, surpassing the 1980 record, amid a powerful short squeeze and tightening physical supply.

Elevated borrowing costs in London—where one-month silver lease rates jumped above 30%—have made it increasingly expensive for traders to hold short positions. The combination of tight liquidity and momentum trading has driven the rally, though analysts warn volatility could remain elevated.

Goldman Sachs said silver’s small and less liquid market, roughly one-ninth the size of gold’s, magnifies price swings. The bank noted silver’s lack of central-bank demand leaves it vulnerable to sharp reversals if investment inflows slow.

Beijing Defends Rare Earth Controls, Accuses U.S. of Misusing Export Rules

China’s Ministry of Commerce defended its new export controls on rare earth materials, calling them lawful and transparent, and said Washington had been informed in advance.

In remarks carried by the Global Times, a ministry spokesperson accused the U.S. of abusing national security justifications for trade restrictions and said such actions have “severely harmed China’s interests and the atmosphere for bilateral consultations.”

Beijing said the new controls aim to improve domestic export management, not impose an outright ban, and that compliant companies can still obtain licenses. The ministry added that communication with the U.S. continues under existing trade consultation frameworks and confirmed that working-level talks were held Monday.

Reiterating its long-standing position, MOFCOM said: “We will fight if we must, but our door remains open to dialogue.”

China’s Crude Imports Stay Robust, Supporting Oil Prices — Commerzbank

Oil prices rebounded this week after the U.S. signaled readiness to negotiate following its latest tariff threat against China, with support from steady Chinese crude imports, Commerzbank’s Carsten Fritsch reported.

China imported 47.25 million tons (11.5 million barrels per day) of crude in September, up 3.9% year-on-year. The 4.5% month-on-month drop was mainly a calendar effect, he said.

Imports by independent refiners were capped by tight quotas, limiting purchases from Russia and Iran. Over the first nine months, imports rose 2.6% from a year earlier.

“These inflows are largely tied to reserve purchases, helping absorb growing global supply,” Fritsch said. “It’s crucial for market stability that these reserve purchases continue as oversupply risks build.”

Silver Prices Surge on Supply Fears — Commerzbank

Silver prices climbed to a new record high above $53 per ounce before paring gains on Tuesday, driven by supply concerns and strong physical demand, Commerzbank’s Head of FX and Commodity Research Thu Lan Nguyen said.

Silver has gained roughly 120% year-to-date, outpacing gold’s rally. “Reports indicate that physical metal demand from India has recently picked up significantly, fueling fears of supply bottlenecks, particularly in the London market,” Nguyen noted.

Lease rates for silver — the cost of borrowing the metal — have jumped sharply, signaling tight liquidity. Meanwhile, declining inventories at COMEX suggest outflows toward London.

Nguyen added that while today’s correction shows signs of overheating, silver remains attractive relative to gold. “If the gold rally continues, silver is likely to remain well-supported as investors look for cheaper alternatives,” she said.

EU, U.S. Explore Alliance Against China’s Rare Earth Restrictions

The European Union is in talks with the U.S. on a coordinated response to China’s tightening of rare earth exports, EU trade commissioner Maros Sefcovic said.

Sefcovic noted that G7 finance ministers are planning a video conference soon to discuss the issue, calling it a “critical concern.” He said he would also speak with U.S. Commerce Secretary Howard Lutnick and his Chinese counterpart next week.

Denmark’s Foreign Minister Lars Rasmussen said Europe and the U.S. should act jointly: “If we stick together, we can better pressure China to act fairly.”

Meanwhile, Beijing has reinstated tougher export license scrutiny, echoing restrictions introduced earlier this year.

Bank of America Sees Gold at $5,000, Silver at $65 by 2026

Bank of America expects gold and silver to extend their bull run into 2026, forecasting prices of $5,000 and $65 an ounce, respectively.

Analysts said U.S. fiscal expansion, rising debt, and political pressure for lower interest rates are likely to weaken the dollar and drive demand for safe-haven assets.

BofA said these conditions should keep precious metals supported as investors hedge against inflation and policy uncertainty, suggesting the rally has further to go despite record highs in 2025.

Europe News

European Stocks End Mixed as DAX, CAC Slip

Major European equity indices closed mixed on Tuesday.

- Germany’s DAX fell 0.64% to 24,231.89.

- France’s CAC 40 slipped 0.18% to 7,919.63.

- Italy’s FTSE MIB declined 0.22% to 42,075.65.

- UK’s FTSE 100 edged up 0.10% to 9,452.76.

- Spain’s IBEX 35 rose 0.29% to 15,586.01.

Investors weighed mixed economic data from Germany and expectations for Fed policy easing later this year.

Germany’s ZEW Economic Sentiment Rises, Current Conditions Sink

Germany’s October ZEW survey showed current conditions deteriorating further to -80.0, below expectations for -74.8 and worse than September’s -76.4.

Economic sentiment improved modestly to 39.3, up from 37.3 but missing forecasts for 41.0. The data highlight persistent weakness in the present economy despite cautious optimism about a recovery later in the year.

ZEW noted that investor confidence is based largely on hope for a medium-term turnaround rather than evidence of immediate improvement.

Germany Final September CPI Confirmed at 2.4%

Germany’s final September CPI was confirmed at 2.4% year-on-year, matching the preliminary estimate and up from 2.2% in August, data from Destatis showed. The EU-harmonized HICP also rose 2.4%, in line with initial readings.

Core inflation edged higher to 2.8%, from 2.5% the previous month, underscoring persistent underlying price pressures that could keep the European Central Bank cautious about the timing of further rate cuts.

UK Unemployment Rises to 4.8% as Job Market Softens

UK unemployment edged up to 4.8% in August, above expectations for 4.7%, according to data from the Office for National Statistics. Employment rose by 91,000, missing forecasts for 123,000 and sharply lower than July’s 232,000 gain.

Average weekly earnings including bonuses rose 5.0% year-on-year in the three months to August, ahead of the 4.7% forecast and up from a revised 4.8%. Excluding bonuses, pay increased 4.7%, matching expectations.

September payrolls fell by 10,000, though the August figure was revised up to a 10,000 gain from a prior 8,000 decline.

While pay growth remains elevated, real wage gains are modest. Total real pay rose 0.8%, while regular real pay slipped to 0.6%, signaling limited purchasing power growth. The figures point to a gradually cooling labour market even as nominal wage pressures persist.

Lagarde says she cannot say how high the bar is for cutting rates further

- Lagarde on CNBC

- We are meeting-by-meeting and data dependent

- Says she was surprised by resilience of economy

- Economy is more-balanced than what it was

- There has not been tariff retaliation by Europe

- We have both upside and downside risks to inflation

- My hope for US-China trade is certainty

- Chinese exports could be directed to Europe and that will have consequences for growth

- The movement of Chinese goods to Europe has increased but not as much as feared

BOE’s Bailey: Today’s labour market data back my view of softening

- Comments from the Bank of England Governor

- There is stretched pricing in equity market related to AI

- We are not seeing a lot of impact yet on prices from tariffs

- UK businesses tell me they are delaying investment decisions due to uncertainty

BoE’s Taylor: Soft landing scenario is receding

- Comments from the BoE policymaker, Alan Taylor

- Current view is a preponderance of downside risks

- Upside risks to inflation low compared to the downward trajectory in output and inflation fundamentals

- I see wage settlements close to or below 3% next year

- Wage inflation will not re-kindle an upward spiral

UK Retail Sales Cool as Households Await Reeves Budget

UK retail and consumer spending growth slowed in September as households braced for Chancellor Rachel Reeves’s upcoming budget and higher energy costs.

The British Retail Consortium reported total sales up 2.3% year-on-year, the weakest since May, while Barclays said card spending dropped 0.7% from a year earlier.

BRC Chief Executive Helen Dickinson said inflation concerns and budget uncertainty were weighing on Christmas plans. Barclays added that non-essential spending was at its lowest in more than a year.

Despite stronger wages, nearly half of consumers said they were cutting back ahead of the budget. The data signal softer demand into winter, which could ease inflation but dampen growth, supporting a cautious Bank of England stance.

Asia-Pacific & World News

China Pulls Ahead in Global Robotics Race

Western executives are warning that China is outpacing the West in robotics and automation, according to a report in The Telegraph.

China added 295,000 industrial robots last year — nearly nine times more than the U.S., which added 34,000.

Executives from Fortescue Metals, Octopus Energy, and Ford described visits to fully automated Chinese factories, where vehicles and electronics are produced with minimal human labor.

Fortescue’s Andrew Forrest said:

“You walk alongside a conveyor for 900 meters, and a finished truck drives out — no people, just robots.”

Ford CEO Jim Farley called the experience “humbling,” warning that China’s manufacturing cost and quality advantages could threaten Western automakers’ survival.

Analysts say China’s edge now lies not in cheap labor but in engineering talent and large-scale automation investment, suggesting the West may already be losing the industrial race.

China’s Premier Li Calls for Boost in Domestic Demand

Premier Li Qiang reiterated Beijing’s focus on supporting domestic consumption, aligning with calls from the IMF and the U.S. for China to rely more on internal demand to sustain growth.

Speaking on CCTV, Li said China must “continuously form new growth points for expanding domestic demand” and pledged stronger measures to curb disorderly competition.

The remarks lifted Chinese equity sentiment, but analysts warn that renewed stimulus and consumption-driven growth could add inflationary pressure globally.

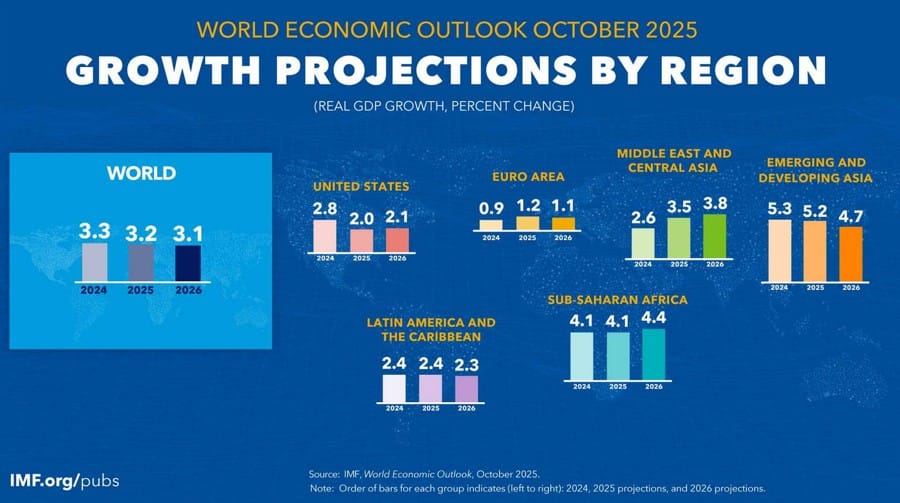

IMF Raises 2025 Global Growth Forecast to 3.2%

The IMF raised its 2025 global growth forecast to 3.2%, from 3.0% previously, citing stronger U.S., European, and Japanese performance.

- Global 2026 growth seen at 3.1% (unchanged).

- U.S. 2025: 2.0% (from 1.9%); 2026: 2.1% (from 2.0%).

- Eurozone 2025: 1.2% (from 1.0%); 2026: 1.1% (from 1.2%).

- Japan 2025: 1.1% (from 0.7%); 2026: 0.6% (from 0.5%).

- China: unchanged at 4.8% (2025) and 4.2% (2026).

The IMF said the Bank of Japan is likely to raise rates gradually toward a neutral level of 1.5%. Global inflation is projected to fall to 4.2% in 2025 and 3.7% in 2026.

Chief economist Pierre-Olivier Gourinchas warned that U.S.-China trade tensions remain a key downside risk but have not yet altered baseline forecasts. The report said the impact of recent tariff measures appears less severe than feared earlier in the year.

China Says It Seeks Dialogue to Resolve U.S. Trade Concerns

China’s Commerce Ministry said it hopes to address trade tensions with the U.S. through “constructive dialogue,” while urging Washington to correct its “mistaken actions.”

Officials said recent U.S. measures threaten global supply chain stability. Reuters reported that Beijing has increased scrutiny of export license applications for rare earth magnets since last week, tightening oversight amid an escalating trade standoff over port fees and export controls.

China Begins Charging Port Fees on U.S. Ships

China has officially started levying special port fees on U.S.-linked vessels, according to state broadcaster CCTV.

The annual billing cycle for the fees began April 17. The new rules exempt China-built ships owned by U.S. companies and allow adjustments to the special charges as needed, authorities said.

China Urges U.S. to Show Sincerity in Trade Talks After Rare Earth Dispute

China’s Commerce Ministry urged the U.S. to “correct its wrong practices” and show sincerity if it wishes to resume meaningful trade dialogue, following Washington’s proposal for talks after Beijing’s rare earth export measures.

The ministry said it’s inappropriate for the U.S. to call for dialogue while simultaneously threatening new restrictions, adding that both sides have maintained contact under the bilateral consultation framework. Working-level discussions were held Monday, it said.

JPMorgan Aims to Double Asia AUM to $600 Billion by 2030

JPMorgan Asset Management plans to double its Asia-Pacific assets under management to $600 billion by 2030, with a long-term goal of $1 trillion, Asia-Pacific CEO Dan Watkins said in Seoul.

The firm’s regional assets climbed to $302 billion by the end of 2024, more than double 2019 levels, driven by growth in active ETFs and entry into new markets. Watkins said those segments will remain central to JPMorgan’s expansion strategy.

He added that Asia’s growing wealth and demand for diversification will continue to make the region a key driver of the bank’s global business.

PBOC sets USD/ CNY central rate at 7.1021 (vs. estimate at 7.1353)

- PBOC CNY reference rate setting for the trading session ahead.

In Open market operations (OMOs) the PBOC inject 91bn yuan at an unchanged rate of 1.4%

- net injection of 91bn yuan

RBA Minutes Signal Caution, Policy Still Slightly Restrictive

The Reserve Bank of Australia kept the cash rate at 3.60% in September, saying policy remains “probably still a little restrictive” but that prior cuts are beginning to support housing activity.

Minutes released Tuesday showed the board will make future moves cautiously and base them on incoming data, particularly third-quarter inflation figures.

The RBA cited a resilient consumer sector, sticky services inflation, and a tight labour market as key factors. Housing prices and loan approvals have picked up, suggesting earlier easing is filtering through.

Policymakers highlighted uncertainty around U.S. tariffs and China’s slowdown as risks to the global outlook.

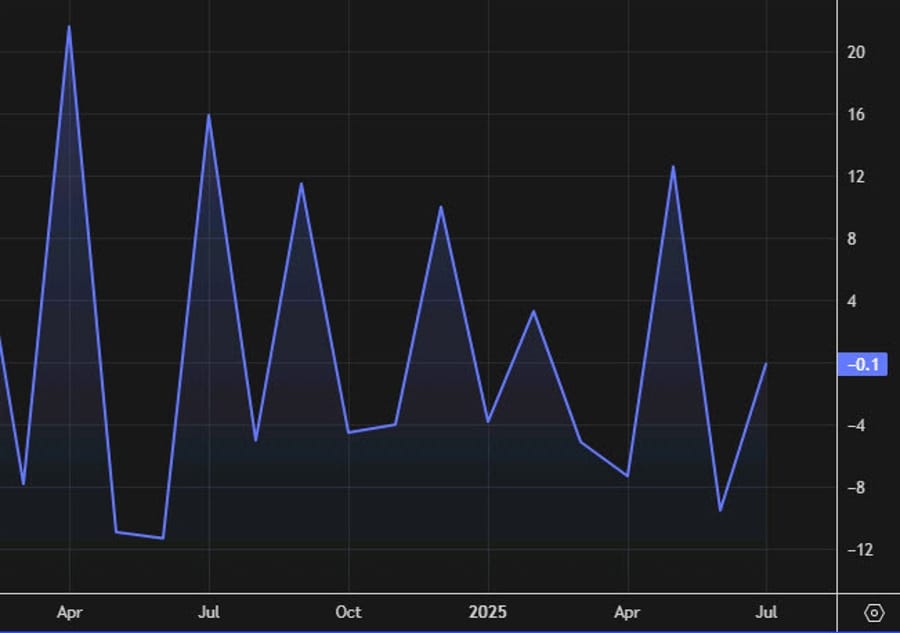

Australia’s Business Confidence Rises to +7 in September

Australia’s business confidence improved in September, with National Australia Bank’s index rising to +7 from +4 in August, while business conditions held steady at +8.

NAB said stronger sales and profitability offset weaker employment trends. Sales rose to +16 and profits to +6, continuing gains seen since May. Forward orders, however, fell below average into negative territory.

Chief Economist Sally Auld said both confidence and conditions are consolidating slightly above trend as firms navigate cost pressures and a still-uncertain rate environment.

RBA Says Aussie Dollar Near Fair Value, Not Adding Tightness

The Reserve Bank of Australia said the Australian dollar’s modest appreciation reflects widening yield spreads with other economies and is consistent with long-run fundamentals.

Minutes from the latest policy meeting noted that the real trade-weighted index is close to equilibrium, based on historical relationships with the terms of trade and real yield differentials.

Policymakers said the currency’s strength isn’t adding to financial tightening beyond the effects of current interest rates, suggesting comfort with the exchange rate’s current level.

RBNZ to Ease Mortgage LVR Limits From December

The Reserve Bank of New Zealand will loosen its mortgage loan-to-value (LVR) restrictions from December 1, 2025.

For owner-occupiers, the share of new lending allowed with an LVR above 80% will rise to 25%. The central bank said it reviewed debt-to-income (DTI) settings but will keep them unchanged.

The move is expected to support first-home buyers and slightly boost housing demand, while the retention of DTI caps underscores a cautious stance on household leverage.

New Zealand Retail Card Spending Falls 0.5% in September

New Zealand’s electronic retail card spending fell 0.5% month-on-month in September but rose 1.0% from a year earlier, according to official data.

The series, which covers roughly 68% of core retail sales, remains the country’s main indicator of monthly consumer activity.

Japan’s Kato Flags Rapid Yen Moves, Market Unmoved by Familiar Remarks

Japan’s Finance Minister Shunichi Kato said he has recently observed “one-sided and rapid” currency moves, reiterating standard warnings about excessive volatility in the yen.

Kato declined to comment on specific exchange-rate levels but stressed that stable currency movements reflecting economic fundamentals are important. He added that interest rates are shaped by multiple factors and said the government will continue to monitor developments in the bond market closely.

The finance minister also said Tokyo would maintain dialogue with market participants and pursue appropriate bond management policies. Kato noted that Japan would assess the economic fallout from U.S.-China trade tensions and reiterated that monetary policy decisions rest with the Bank of Japan.

He further remarked that growth strategies under Abenomics had proved insufficient to sustain robust expansion.

MAS Keeps Policy Unchanged, Sees Growth Moderating in 2026

The Monetary Authority of Singapore left its policy stance unchanged, maintaining the slope, width, and centre of its exchange-rate band, in line with expectations.

The central bank said GDP growth is projected to ease to near-trend levels in 2026 as external demand cools, with the output gap narrowing to around zero.

MAS expects core inflation to average 0.5% in 2025 and between 0.5%–1.5% in 2026, with the potential for slower price gains if growth softens further.

Singapore’s Q3 GDP grew 2.9% year-on-year, beating forecasts of 2.0%, but slowed from 4.4% in Q2.

Crypto Market Pulse

Ripple Partners with Immunefi to Test XRP Lending Protocol

XRP slipped to around $2.40 on Tuesday, extending losses despite Ripple’s partnership with Immunefi to test its proposed XRP Ledger Lending Protocol.

The partnership includes a $200,000 “Attackthon” running from October 27 to November 24, inviting security researchers to identify vulnerabilities for RLUSD rewards.

Market sentiment remains cautious after last week’s deleveraging, though derivatives markets show signs of stability. K33 Research said, “With excessive leverage purged and structural risks reduced, the market setup now looks far healthier.”

Open interest in XRP futures averages $4.34 billion, up modestly from a four-month low of $4.2 billion. Retail participation remains muted, but a steady rise in OI could indicate renewed investor confidence.

Circle and Safe Partner to Boost USDC Use in DeFi and Self-Custody

Circle and the Safe Foundation have formed a strategic partnership to promote the adoption of the USDC stablecoin in decentralized finance (DeFi) and institutional self-custody.

Safe — which secures over $60 billion in digital assets and accounts for about 4% of Ethereum transactions — will integrate USDC as a key settlement asset within its ecosystem. Safe’s smart contracts currently hold $2.5 billion in USDC.

Circle’s Chief Commercial Officer Kash Razzaghi said the collaboration will “equip organizations with the tools they need to operate seamlessly in next-generation capital markets.”

Safe co-founder Lukas Schor added that institutional demand for secure, scalable custody solutions is accelerating. Safe processed $1 trillion in transactions this year, including $189.6 billion in Q1 alone.

Circle went public in June on the New York Stock Exchange, marking the first major IPO by a stablecoin issuer and signaling deeper institutional acceptance of blockchain finance.

Cardano Faces Breakdown Risk Below $0.63

Cardano (ADA) faces a crucial technical test around $0.7260 after a failed recovery attempt following last week’s crypto sell-off.

The token recently broke below a key descending trendline that had served as support throughout September. A successful break above resistance would target $0.7665 and $0.8148 — the latter marking the top of last Friday’s selloff candle.

However, a fall below the $0.6369 channel floor would invalidate the near-term bullish structure and expose ADA to a potential slide toward $0.51, analysts warned.

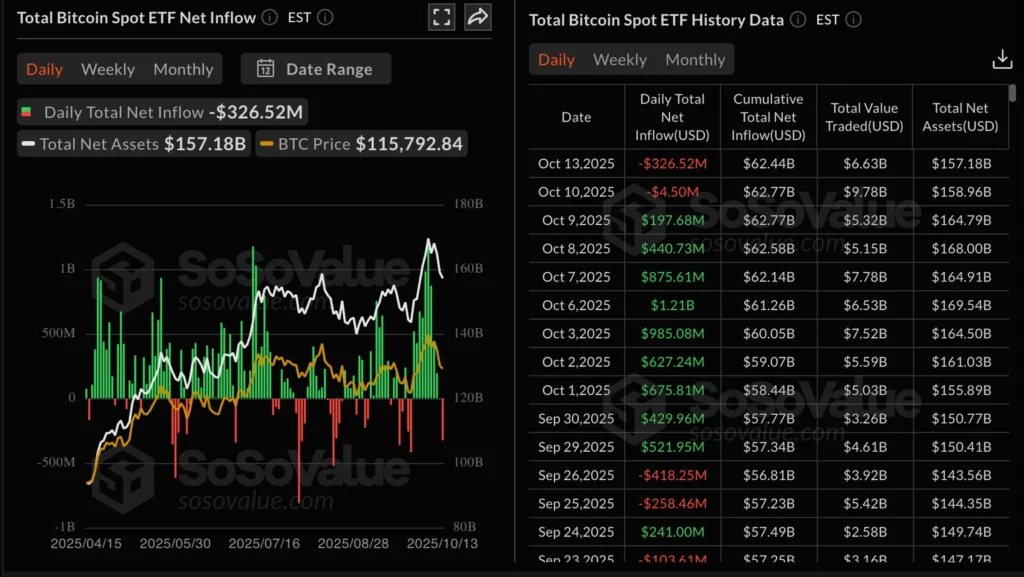

Crypto Market Update: Bitcoin, Ethereum, XRP Under Pressure

Cryptocurrency markets resumed declines Tuesday, with Bitcoin (BTC) dropping below $112,000, Ethereum (ETH) sliding under $4,000, and XRP trading below $2.50.

The broader sell-off follows last week’s flash crash amid macro headwinds, including the U.S. government shutdown, renewed U.S.-China tensions, and weakening institutional demand.

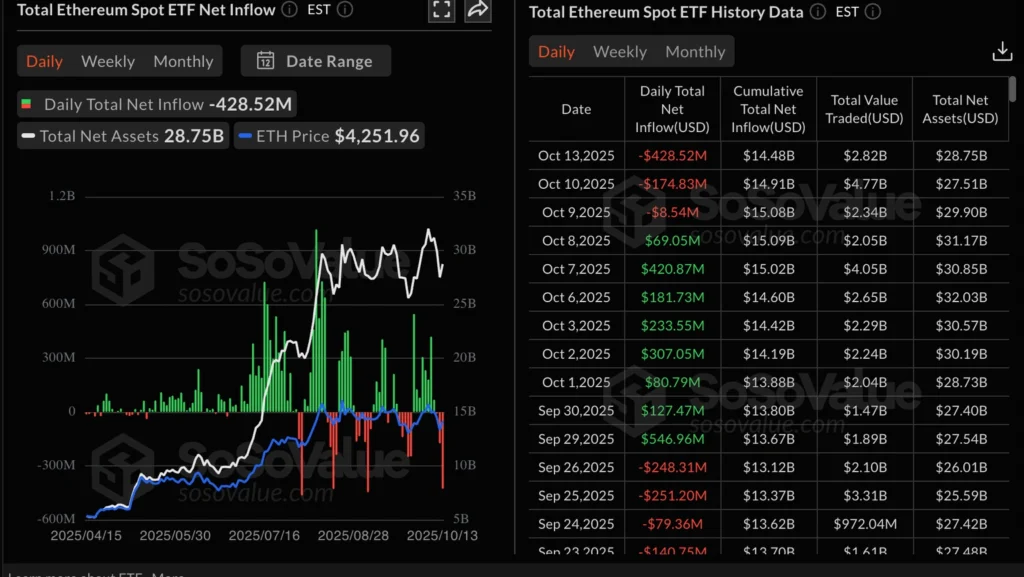

ETF outflows underline waning appetite:

- U.S. Bitcoin ETFs saw $327 million in outflows Monday and $4.5 million Friday.

- Ethereum ETFs recorded $429 million in outflows Monday and $175 million Friday.

“With risk appetite fading, it will be difficult for bulls to sustain recovery,” analysts said, noting that institutional flows remain a key driver of sentiment.

Solana Falls Below $200 as U.S.-China Trade Tensions Escalate

Solana (SOL) traded below $200 on Tuesday, extending losses amid renewed trade frictions between Washington and Beijing that triggered broad risk aversion.

China introduced new port fees on U.S.-linked vessels in response to U.S. tariffs on Chinese shipping, timber, and furniture imports. The move comes ahead of a planned meeting between President Trump and President Xi Jinping in South Korea later this month.

China’s Commerce Ministry confirmed it had held talks with the U.S. over its rare earth export controls, adding another layer of tension to the trade dispute.

“Escalating trade tensions have fueled risk-off sentiment, weighing on major cryptocurrencies,” analysts said. Technical indicators for SOL suggest a possible dead-cat bounce scenario as the broader crypto market remains under pressure.

Japan to Ban Cryptocurrency Insider Trading – Nikkei

Japan’s Financial Services Agency (FSA) will introduce new rules to ban insider trading in cryptocurrencies, Nikkei reported.

Under the plan, individuals found profiting from non-public crypto information will face surcharges proportional to their illicit gains.

The move reflects Japan’s push to tighten oversight of its digital asset market, following years of rapid growth and high-profile exchange scandals.

The Day’s Takeaway

North America

U.S. stocks closed mixed after a volatile session dominated by trade headlines. The Dow rose 202 points (+0.44%), while the S&P 500 slipped 0.16% and the Nasdaq fell 0.76%. Markets swung sharply as China pushed back against new U.S. tariffs, prompting early selling before rebounding on reassurance from USTR Greer. Gains faded again after President Trump said he is considering terminating business ties with China over soybean and cooking oil trade disputes.

President Trump accused Beijing of an “economically hostile act” for halting U.S. soybean purchases, escalating rhetoric ahead of renewed trade discussions. The remarks, paired with a lingering government shutdown and softer employment signals, kept volatility elevated.

Federal Reserve Chair Jerome Powell said policy remains data-dependent, citing “rising downside risks” in the labour market and noting tariffs are adding to price pressures. He hinted balance-sheet runoff could end “in the coming months.” Boston Fed President Susan Collins said further rate cuts appear “prudent,” though monetary policy remains “mildly restrictive.” Fed Governor Michelle Bowman reaffirmed expectations for two cuts before year-end.

Goldman Sachs warned tariffs could add nearly one percentage point to core PCE inflation, delaying the Fed’s easing timeline. The NFIB small business confidence index fell to 98.8, its first decline in three months, underscoring growing uncertainty among small firms.

In Canada, building permits dropped 1.2% in August amid a cooling Toronto condo market. Prime Minister Mark Carney’s first budget on November 4 is expected to emphasize infrastructure spending to counter private investment weakness.

Europe

European markets ended mixed. Germany’s DAX fell 0.64%, France’s CAC 40 slipped 0.18%, and Italy’s FTSE MIB lost 0.22%, while the UK’s FTSE 100 edged up 0.10% and Spain’s IBEX 35 gained 0.29%.

Economic data showed Germany’s September CPI confirmed at 2.4%, matching initial readings, with core inflation at 2.8%. The ZEW survey revealed sentiment improving to 39.3, but current conditions deteriorated to -80.0, underscoring ongoing economic malaise.

The UK’s unemployment rate rose to 4.8%, and retail growth slowed as households await Chancellor Reeves’s budget. The British Retail Consortium cited the weakest sales growth since May, while Barclays reported falling card spending. Real wage growth remains modest despite elevated nominal pay.

EU officials are coordinating with Washington to counter China’s rare earth export restrictions. Trade Commissioner Maros Sefcovic confirmed upcoming G7 talks, calling the issue a “critical concern.”

Asia

Chinese equities were supported by Premier Li Qiang’s call to boost domestic consumption and “form new growth points for expanding domestic demand.” The statement echoed IMF and U.S. requests for China to rely more on internal drivers, lifting sentiment though raising global inflation concerns.

China’s Commerce Ministry defended new rare earth export controls as “lawful and transparent,” accusing the U.S. of abusing national security exemptions. Additional reports indicated tighter rare earth magnet export licensing and the introduction of special port fees on U.S.-linked ships — all escalating trade friction. Beijing nonetheless reaffirmed willingness for “constructive dialogue.”

Japan’s Finance Minister Shunichi Kato warned against “one-sided and rapid” yen moves, though markets largely shrugged off his remarks. The IMF raised Japan’s 2025 growth forecast to 1.1% and sees gradual BOJ tightening toward a 1.5% neutral rate. Separately, Japan’s FSA will ban cryptocurrency insider trading, marking a global regulatory milestone.

In Australia, RBA minutes indicated policy remains “slightly restrictive” and that rate adjustments will proceed cautiously. The Aussie dollar is near fair value, and business confidence rose to +7 in September. The RBNZ will ease mortgage LVR limits from December, supporting first-home buyers, while New Zealand retail card spending fell 0.5% in September.

Singapore’s MAS held policy steady, citing moderating growth into 2026. Q3 GDP rose 2.9% y/y, ahead of forecasts. JPMorgan aims to double its Asia-Pacific AUM to $600 billion by 2030, reflecting strong regional wealth trends.

Rest of World

The IMF lifted its 2025 global growth forecast to 3.2%, with upgrades for the U.S., Europe, and Japan, while China’s outlook was unchanged at 4.8%. Chief Economist Gourinchas warned that U.S.-China trade tensions remain the biggest downside risk but have not yet altered baseline assumptions.

Commodities

Precious metals extended record-breaking runs. Silver surged past $53/oz, driven by tight supply and strong Indian demand before paring gains. Lease rates above 30% indicate extreme scarcity in the London market. Gold hit a fresh record near $4,180/oz, supported by geopolitical tension ahead of the Trump-Xi meeting and safe-haven inflows.

OPEC kept its demand outlook unchanged, projecting a balanced 2026 oil market, while production shortfalls persist among quota-bound members. WTI crude settled lower at $58.70 (-1.33%), marking a five-month low. Analysts warned the $59–$61 zone remains key resistance.

China’s crude imports stayed robust at 11.5 million bpd, providing stability amid trade headwinds. Copper markets remain tight despite price volatility tied to U.S.-China tariffs, with spot prices holding a $224 premium over three-month futures. European natural gas extended losses below €31.5/MWh, pressured by strong LNG inflows and high storage levels.

Bank of America projected gold to reach $5,000 and silver $65 by 2026, citing fiscal expansion and debt-driven dollar weakness.

Crypto

Crypto markets extended declines, with Bitcoin dropping below $112,000, Ethereum under $4,000, and XRP below $2.50. Institutional outflows persisted, with U.S. Bitcoin ETFs seeing $327 million in Monday outflows. Analysts warned fading risk appetite could limit recovery momentum.

Ripple partnered with Immunefi to test its XRP Lending Protocol through a $200,000 “Attackthon.” Despite short-term weakness, open interest is rising, suggesting gradual stabilization.

Circle and Safe Foundation announced a partnership to expand USDC use in DeFi and institutional custody, integrating it as a settlement asset across Safe’s $60 billion ecosystem.

Cardano (ADA) faces breakdown risk below $0.63, while Solana (SOL) fell below $200 amid renewed U.S.-China trade tensions and risk-off sentiment.