North America News

U.S. Stocks Slip as Major Indices Pause After Recent Gains

U.S. equities closed lower Thursday, with the major indices pulling back as investors took profits following recent strength. The Dow Jones Industrial Average and small-cap Russell 2000 led the declines.

- Dow Jones Industrial Average: -243.36 points (-0.52%) to 46,358.42

- S&P 500: -18.61 points (-0.28%) to 6,735.11

- Nasdaq Composite: -18.75 points (-0.08%) to 23,024.63

- Russell 2000: -15.14 points (-0.61%) to 2,468.84

Losses were concentrated in industrials and financials, with Boeing (BA) tumbling 4.14%, extending a recent downtrend. Travelers (TRV) fell 2.95%, while Honeywell (HON) and 3M (MMM) each declined more than 2%.

Other notable Dow laggards included Apple (AAPL) and Home Depot (HD), both down 1.56%, while Chevron (CVX) lost 1.37% as crude prices softened.

Big decliners beyond the Dow featured:

- Dell Technologies (DELL): -5.21%

- Alibaba ADR (BABA): -4.11%

- RTX Corp (RTX): -3.79%

- Whirlpool (WHR): -3.47%

- Uber (UBER): -3.29%

- MicroStrategy (MSTR): -3.21%

- Paramount Skydance (PSKY): -2.86%

- Tapestry (TPR): -2.85%

- Schlumberger (SLB): -2.47%

- Mastercard (MA): -2.06%

- Ford Motor (F): -2.04%

- DoorDash (DASH): -2.00%

Select gainers bucked the broader weakness:

- Nebius NV (NBIS): +8.72%

- Delta Air Lines (DAL): +4.29%

- Zoom Video (ZM): +3.59%

- United Airlines (UAL): +3.34%

- Costco (COST): +3.07%

- Oracle (ORCL): +2.89%

- Arm Holdings (ARM): +2.33%

- Chewy (CHWY): +2.27%

- Meta Platforms (META): +2.18%

- Celsius (CELH): +2.15%

- Salesforce (CRM): +2.04%

The pullback follows a strong stretch for U.S. equities, suggesting investors are taking a pause as they assess earnings reports and inflation data due later in the week.

U.S. 30-Year Treasury Auction Draws Strong Demand at 4.734%

The U.S. Treasury’s $22 billion auction of 30-year bonds cleared at a high yield of 4.734%, slightly above the when-issued (WI) level of 4.730%, resulting in a small tail of 0.4 basis points, compared with a six-month average tail of −0.2 bps.

The bid-to-cover ratio came in at 2.38x, in line with the recent average. Direct bidders took 26.9%, and indirects — a proxy for foreign demand — absorbed 65.5%, both above their six-month averages. Dealers were left with only 8.7%, down from an average of 13.0%, underscoring robust demand across investor categories.

Delta Shares Jump as CEO Highlights Resilient Consumer Demand

Delta Air Lines shares rose 6.7% after the carrier issued a strong Q4 earnings forecast, citing a rebound in U.S. consumer spending and business travel.

The airline reported adjusted EPS of $1.71, beating expectations of $1.53, on $15.2 billion in revenue versus a forecast of $15.06 billion. Q4 guidance was set at $1.60–$1.90, above the $1.65 consensus.

CEO Ed Bastian said travel demand picked up sharply from July, describing the return of consumer spending after a “spring swoon.” Domestic sales rose 2% in Q3 after a 5% drop in Q2, while corporate travel climbed 8%, up from 1% in the first half.

“There are two consumers out there,” Bastian noted. “We’re focused on the premium customer — the lower-income consumer is still struggling.” He added that early holiday bookings look strong.

Fed’s Barr: Economic Uncertainty Warrants Caution on Further Rate Cuts

Federal Reserve Governor Michael Barr said the U.S. economy faces high uncertainty surrounding both inflation and employment, suggesting the Fed should proceed carefully with any additional interest rate cuts.

Speaking Thursday, Barr said inflation remains above target and could be influenced by new tariffs, though their impact so far has been “modest.” He expects core PCE inflation to remain above 3% by year-end and warned that waiting two more years for inflation to return to 2% would test consumer patience.

Barr added that the September rate cut was “appropriate” and that policy remains “modestly restrictive.” Recent data shows strong consumer spending and firm GDP growth in Q3.

He cautioned that slower payroll growth could signal weakness ahead, though productivity gains from generative AI may be pushing the neutral rate slightly higher. Barr noted signs of a two-speed economy, with upper-income households performing well while lower-income groups struggle.

“Judging how restrictive policy is right now is difficult,” he said. “AI is complementing the labor market in ways we are only beginning to understand.”

U.S. Treasury Secretary Bessent Pressed Fed Chair Candidates on Policy

FT reported that U.S. Treasury Secretary Bessent and his team conducted intensive interviews with 11 potential candidates for the Federal Reserve chair, quizzing them on monetary policy, governance, and views on quantitative easing.

Interviews were led by Bessent, Treasury official Hunter McMaster, and adviser Francis Browne, and concluded earlier this week.

Bessent reportedly asked pointed questions about candidates’ stance on rate settings and their response to criticism of Fed “mission creep.”

Leading contenders include Kevin Warsh, Christopher Waller, and Kevin Hassett, with BlackRock CIO Rick Rieder also said to have impressed. President Trump will make the final appointment.

Current chair Jerome Powell’s term ends in May 2026, though he may remain on the Board until 2028. Historically, outgoing Fed chairs have stepped down once their terms expire.

Fed’s Williams Supports Further Rate Cuts in 2025

New York Fed President John Williams said more rate cuts are warranted this year as the labor market slows and hiring momentum fades.

Speaking to the New York Times, Williams said the U.S. economy remains far from recession but noted tariffs have lifted imported goods prices without triggering broader inflationary effects.

He said underlying inflation is moving gradually toward 2%, supporting a return to a neutral policy stance. Williams emphasized the importance of maintaining policy independence despite political scrutiny, adding, “Our job is to deliver on our mandate as best we can.”

Goldman Sachs: Tech Rally Overvalued but Not a Bubble

Goldman Sachs said the ongoing surge in technology and AI-linked equities, while stretched, does not yet qualify as a speculative bubble.

In a note to clients, the bank highlighted that unlike past manias, today’s rally is supported by earnings growth and robust balance sheets among major firms. Valuations are high but remain below extremes seen in previous bubbles.

Goldman analysts cautioned that market concentration and rising capital intensity warrant vigilance, especially as AI competition accelerates. They urged investors to stay diversified and avoid excessive exposure to high-flying sectors.

Trump Administration Drops Tariff Plan on Generic Drugs

The Trump administration has shelved plans to impose tariffs on generic pharmaceuticals, easing concerns of widespread price disruptions.

According to the Wall Street Journal, officials confirmed that the administration will no longer pursue Section 232 tariffs on generics under the ongoing national security trade probe.

Generics, which make up about 90% of U.S. prescriptions, will be exempt, while potential tariffs on brand-name drugs remain under review.

The move marks a retreat from earlier threats to impose sweeping levies on imported medicines and signals a more targeted approach to encouraging domestic production.

U.S. Approves Nvidia AI Chip Sales to UAE Under New Bilateral Deal

The United States has approved several billion dollars’ worth of Nvidia AI chip exports to the United Arab Emirates, marking the first such agreement under the new U.S.-UAE artificial intelligence partnership.

According to Bloomberg, the deal includes a reciprocal Emirati investment of similar size into the U.S., symbolizing a deepening of strategic technology cooperation. The approval, the first since President Trump took office, suggests a selective easing of export restrictions on advanced AI hardware.

Washington’s decision reflects a shift toward bolstering Gulf technology partnerships while tightening curbs on China.

Market implications:

- Equities: Nvidia may benefit from expanded export access.

- Geopolitics: Strengthens U.S.-UAE tech alignment amid global chip competition.

- AI sector: Signals intensifying race to secure AI infrastructure globally.

Hedge Funds Build Dollar-Long Positions Ahead of Year-End

Hedge funds are ramping up bullish bets on the U.S. dollar heading into year-end, according to traders cited by Bloomberg.

Options activity for December shows a surge in euro puts, with put volumes tripling call demand—an indication of growing conviction in further weakness for the euro, yen, and sterling. The Australian dollar remains more resilient thanks to the RBA’s hawkish policy stance.

Mukund Daga of Barclays said funds are pursuing “tactical long-dollar plays,” while Citigroup’s Nathan Swami noted that G-10 currency risk reversals point to shifting sentiment, though it’s “too soon to call a bottom” for the dollar.

The positioning reflects waning pressure from earlier U.S. political risks and renewed weakness in rival currencies due to France’s political turbulence, Japan’s slow normalization path, and New Zealand’s rate cut.

Canada’s Carney Signals Bilateral Deals Alongside USMCA

Canadian Prime Minister Mark Carney said Ottawa plans to pursue select bilateral trade deals alongside the USMCA, despite the pact’s original intent to eliminate the need for separate agreements.

Carney made the remarks during talks in Washington with President Trump, emphasizing that targeted bilateral arrangements could enhance North American competitiveness without undermining the broader trade framework.

Commodities News

Gold Cools After Rally Above $4,000, Buyers Tested as Momentum Fades

Gold prices eased Thursday, retreating from recent highs as traders took profits after a powerful run that briefly lifted the metal above $4,000 per ounce.

Spot gold reached $4,058.01 earlier in the session—just shy of Wednesday’s $4,059.31 peak—before slipping below key short-term support levels. The metal fell under its 100-hour moving average at $3,978.82 and the 38.2% retracement of the latest leg higher at $3,967.54, though it held above the 50% retracement at $3,939.20.

That positioning reflects a market in consolidation rather than full reversal. Historically, recent upward moves in gold have only corrected shallowly, often staying above the 50% retracement zone—suggesting the broader bullish bias remains intact.

For now, the 100-hour MA ($3,978.79) serves as immediate resistance. A break back above that level could reignite momentum toward the $4,000 handle. On the downside, a move through $3,939.20 would open the door for a deeper pullback.

Gold’s surge has been fueled by safe-haven demand and expectations of a softer U.S. dollar, but with the market now cooling, traders are watching to see if this is merely a pause—or the start of a broader correction.

Crude Oil Futures Fall 1.66% to $61.51 as Market Struggles for Direction

Crude oil futures settled lower on Thursday at $61.51 per barrel, down $1.04 (−1.66%), as traders continued to assess price momentum within a narrow technical range.

The market has been oscillating around the $61.45–$61.94 zone — a key swing area that served as an old support floor. After briefly breaking above this zone yesterday, prices reversed lower today, touching a session low of $61.25, breaching the lower edge of that range.

The repeated moves above and below this corridor highlight a market caught between correction and renewed downside pressure. A decisive break below $61.45 could trigger a move toward the $60.00 level, analysts said.

Separately, President Trump remarked that gasoline prices could “soon approach $2,” though AAA data shows the national average for regular gas at $3.11 per gallon — and $3.50 in some areas.

Silver Breaks $50 Barrier for First Time; Gold Holds Steady

Spot silver surged past $50 per ounce for the first time ever, reaching a high of $50.03 before easing to $49.94. The rally surpasses the 2011 peak of roughly $49.83, confirming a new record high.

Gold remained stable, rising $1.50 to $4,042, after touching an intraday high of $4,046.71. The metal has been trending upward since early September, when it broke above its April 22 peak of $3,500, and hit a record $4,059.31 yesterday.

China Tightens Controls on Rare Earth Exports

China’s Ministry of Commerce announced new export restrictions on rare earth materials, to take effect December 1, requiring special dual-use export licenses for items with potential military applications.

The move tightens oversight of materials essential to semiconductors, electric vehicles, and defense systems. Foreign and domestic firms must now obtain approval and disclose end-user destinations for shipments.

The ministry added that exports linked to weapons development or directed toward entities on official watchlists will be prohibited.

Analysts say the measures could heighten global supply chain stress and accelerate efforts in the U.S., Japan, and Europe to diversify sourcing of critical minerals.

Certain technologies—such as those related to rare earth mining, smelting, magnet production, and recycling—will also require separate authorization.

Copper Climbs to Five-Month High on Supply Disruptions – ING

LME copper prices moved above $10,800 per tonne, marking their highest level since May 2024, as mounting supply disruptions tighten global availability, according to ING analysts Ewa Manthey and Warren Patterson.

Teck Resources cut its production forecast for the Quebrada Blanca mine in Chile to 170–190 kt from a prior 210–230 kt for 2025, citing issues with tailings storage, ship loader damage, and pit instability. The company also trimmed output guidance for the next three years.

Copper has gained roughly 23% year-to-date, driven by mine disruptions that have outweighed weak industrial demand in major economies.

The International Copper Study Group (ICSG) now expects a 150 kt deficit in 2026, reversing its earlier surplus forecast of 209 kt, and cut its 2025 surplus outlook to 178 kt from 289 kt. Global mine supply is projected to grow 1.4% YoY in 2025 and 2.3% in 2026.

Refined copper production growth was raised to 3.4% YoY this year, supported by new capacity in China, the DRC, India, and Indonesia, though a slowdown to 0.9% is expected in 2026 due to limited concentrate availability. Consumption is seen rising 3% YoY in 2025 and 2.1% in 2026.

Oil Slips as Ceasefire Eases Middle East Tensions – ING

Crude oil prices edged lower as reports of a ceasefire between Israel and Hamas and a build in U.S. crude inventories eased supply risk concerns, ING’s Ewa Manthey and Warren Patterson noted.

The Energy Information Administration (EIA) reported a 3.7 million-barrel increase in crude inventories last week, following a 2.8 million-barrel rise reported by the API. U.S. stockpiles now stand just above 420 million barrels, around 4% below the five-year average.

At Cushing, inventories fell 763,000 barrels to 22.7 million barrels, their lowest since August. Imports rose 570,000 b/d to 6.4 million b/d, while exports declined 161,000 b/d to 3.6 million b/d.

Gasoline stocks dropped 1.6 million barrels, above expectations of a 1.46 million-barrel draw, while distillate inventories fell 2 million barrels, the largest drop since June. Refinery utilization rose 1 percentage point to 92.4%.

Europe News

ECB Accounts: No Immediate Need for Policy Change

European Central Bank minutes from the September meeting show policymakers agreed there was no urgency to adjust interest rates, viewing recent euro appreciation as largely temporary.

Members said the euro’s strength may reflect dollar weakness rather than improved eurozone fundamentals. Inflation was seen stabilizing around 2%, with risks on both sides but generally viewed as “contained.”

The ECB highlighted elevated geopolitical risks and potential fiscal pressures, including higher defense spending needs, but noted the euro area economy remains resilient though fragile.

Policymakers agreed the current rate levels are appropriate to manage two-sided risks and stressed the importance of waiting for more data before taking further action.

EU Voices Concern Over China’s Rare Earth Export Curbs

The European Union has expressed concern over China’s tightening of rare earth export controls, warning that the measures could disrupt global supply chains.

While largely seen as a strategic signal aimed at the United States, the EU said the restrictions will affect all major importers dependent on Chinese materials for high-tech manufacturing.

Analysts said the move underscores Beijing’s readiness to use rare earths as leverage ahead of the Xi-Trump meeting later this month, recalling how similar tactics pressured Washington during the 2024 tariff standoff.

Germany’s August Trade Surplus Widens to €17.2 Billion

Germany’s trade balance expanded to €17.2 billion in August, beating expectations of €15.2 billion, data from Destatis showed.

Exports fell 0.5% MoM, while imports dropped 1.3% MoM, widening the surplus. Exports to the U.S. declined 2.5% to €10.3 billion, the lowest since November 2021 and the fifth consecutive monthly decline. Year-over-year, shipments to the U.S. are down more than 20%, partly reflecting the drag from new tariffs and weaker demand.

BoE’s Mann: Maintaining restrictiveness for longer is appropriate

- Comments from the BoE policymaker, Catherine Mann

- UK inflation remains persistently persistent and the outlook for growth remains modest

- I have argued that policy needed to remain restrictive for longer to squeeze out inflation persistence and rein in expectations drift

- To create an environment conducive to growth, monetary policy must remain restrictive for longer

- UK’s consumption gap is an outlier relative to its closest international peers

- The evidence from consumer behaviour is that we are not there yet on inflation expectations

UK Housing and Business Confidence Slide Before November Budget

Britain’s property market and business sentiment weakened further in September as uncertainty over Finance Minister Rachel Reeves’ upcoming budget weighed on confidence.

The RICS house price balance improved slightly to -15 from -18 in August, but demand and sales remained subdued. RICS analyst Tarrant Parsons said housing sentiment remains fragile amid speculation about potential tax measures in the November 26 budget.

Landlord listings hit their lowest level since 2020, while rental demand remained firm, suggesting rents could rise by around 3% in the next year.

A separate ICAEW survey showed business confidence at a three-year low, with firms citing higher taxes and labor costs as key concerns.

Market view:

- FX: Fiscal and housing uncertainty could pressure sterling.

- Rates: Weak data supports expectations of slower BoE tightening.

Bank of England Warns of AI-Driven Market Risks

The Bank of England cautioned that inflated valuations in technology and AI-linked equities could trigger a sharp market correction.

In its latest Financial Stability Report, the BoE said elevated valuations and growing market concentration have left indices vulnerable to shifts in sentiment if enthusiasm for AI fades.

The central bank also cited rising public debt, geopolitical uncertainty, and threats to central bank independence as additional sources of instability.

“Markets may be underestimating adverse outcomes,” the report warned, adding that a sudden correction could spill over into broader financial conditions.

Macron Moves to Appoint New French Prime Minister

French President Emmanuel Macron is preparing to appoint a new prime minister after progress in talks aimed at forming a coalition capable of passing the 2025 budget and avoiding snap elections.

Following Prime Minister Sébastien Lecornu’s resignation earlier this week, Macron instructed him to consult opposition leaders to gauge support for a new government. Lecornu said the discussions yielded progress and that dissolution of parliament is now unlikely.

A new prime minister could be named within days, easing political tension ahead of key fiscal debates.

Market takeaways:

- FX: Easing political risk could offer mild euro support.

- Bonds: Averted elections reduce volatility in French debt.

Asia-Pacific & World News

China Tightens Export Controls on Rare Earth and Battery Materials

China’s Ministry of Commerce announced new export controls on select rare earth equipment and materials, including items linked to lithium batteries, graphite anodes, superhard materials, and certain medium and heavy rare earths.

The move, framed as a step to “safeguard national security,” is set to take effect December 1 and is widely viewed as a signal to Washington ahead of a Xi-Trump meeting later this month.

The latest measures will further restrict global access to critical inputs for electronics and renewable technologies, echoing Beijing’s earlier use of rare earth curbs during trade tensions.

China Returns From Golden Week Holiday

Mainland Chinese markets reopen today after the week-long Golden Week holiday, with investors watching for post-holiday positioning in equities, bonds, and commodities.

While Hong Kong trading remained active during the break, activity across Asia was subdued. Market attention now shifts back to mainland flows, with focus on policy cues and economic data due later this week.

Japanese assets stayed in motion during China’s closure, supported by political developments and continued strength in gold prices.

PBOC sets USD/ CNY reference rate for today at 7.1102 (vs. estimate at 7.1484)

- PBOC CNY reference rate setting for the trading session ahead.

In Open market operations (OMOs) the PBOC inject 612bn yuan at an unchanged rate of 1.4%

- after accounting for maturities today it’s a 1451.3bn yuan drain

Australia’s Inflation Expectations Edge Higher in October

Australia’s Melbourne Institute survey showed consumer inflation expectations rising to 4.8% in October, up from 4.7% in September.

The modest increase keeps expectations near the upper end of the 3–5% range typical of recent years. The data suggest households remain alert to persistent price pressures, potentially complicating the Reserve Bank of Australia’s task of anchoring expectations.

Elevated expectations could influence wage negotiations and pricing behavior, reducing the central bank’s flexibility to ease policy even as cost-of-living pressures persist.

Adviser to Japan’s Takaichi Urges Caution on Further Rate Hikes

Etsuro Honda, economic adviser to Prime Minister Sanae Takaichi, said the Bank of Japan should proceed cautiously with additional rate hikes, citing subdued inflation expectations.

Honda said a rapid move could destabilize markets, adding that the USD/JPY is unlikely to breach 155, a level seen as a psychological ceiling. He emphasized that a weaker yen remains broadly supportive during Japan’s recovery phase.

Honda previously argued that an October hike would be premature, echoing growing caution among government-linked economists about tightening too quickly.

Japan’s Takaichi: A Weak Yen Has Both Benefits and Risks

Prime Minister Sanae Takaichi said the yen’s decline offers both advantages and drawbacks, boosting exports but increasing import costs.

Speaking in Tokyo, Takaichi noted that Japan’s bond market remains stable, with securities “overwhelmingly held by domestic investors,” calling it “the most stable in the world.”

Her comments reflect a balancing act between supporting growth and avoiding excessive currency weakness that could further strain households and importers.

Former BOJ Deputy Says Further Rate Hike Unlikely in 2025

Former Bank of Japan Deputy Governor Masazumi Wakatabe said another rate hike this year is unlikely given Japan’s fragile growth outlook.

In an interview with Reuters, Wakatabe supported the BOJ’s gradual approach to policy normalization, emphasizing that rate adjustments should depend on sustained economic recovery and stable inflation near the 2% target.

He pointed to sluggish economic data, weak labor conditions, and the risk of a negative Q3 GDP reading as reasons for caution. While inflation expectations have inched higher, Wakatabe said raising rates too soon could undercut recovery.

He added that the BOJ should coordinate closely with incoming Prime Minister Sanae Takaichi but avoid keeping rates artificially low to support fiscal spending.

Japan 5-Year Bond Auction Signals Investor Caution

Japan’s latest 5-year government bond auction showed a slight dip in demand, reflecting investor restraint ahead of the Bank of Japan’s late-October policy meeting. The auction’s bid-to-cover ratio came in at 3.69, just below 3.70 at the September sale.

The tail—the spread between the average and lowest accepted prices—widened to 0.06 yen from 0.03 yen, indicating more dispersed bidding and less aggressive participation.

The result points to modest caution among investors as weak domestic data has tempered expectations for near-term tightening. Despite the softer tone, overall demand remains solid by historical standards, underscoring steady appetite for mid-term JGBs amid low inflation and limited market volatility.

Crypto Market Pulse

Crypto Market Pulls Back as Traders Lock In Profits

Bitcoin (BTC), Ethereum (ETH), and Ripple (XRP) retreated Thursday as traders booked profits following strong recent gains. Bitcoin fell toward $121,000, while Ethereum extended its correction toward the 50-day EMA, and XRP weakened further amid falling momentum indicators.

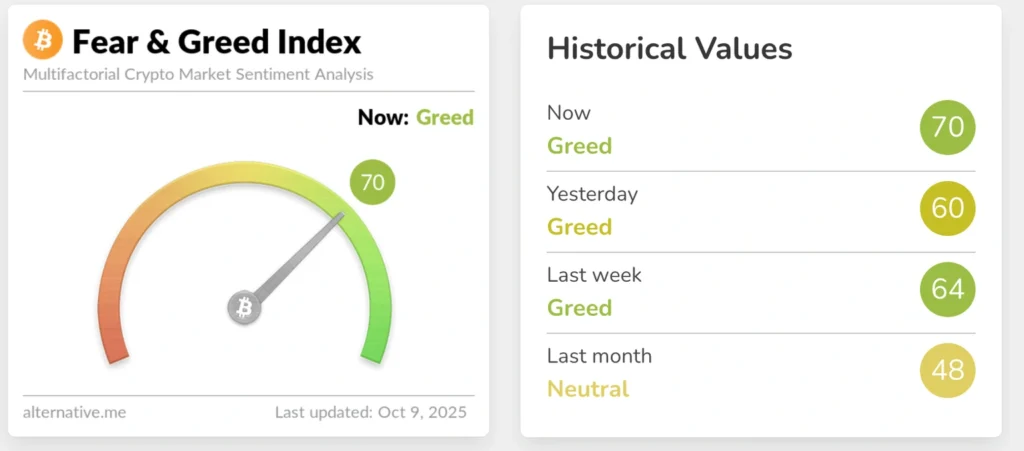

The Crypto Fear & Greed Index rose to 70, reflecting persistent optimism and “greed” sentiment despite the pullback. Analysts warned that elevated sentiment could lead to sharper corrections as investors react quickly to red days.

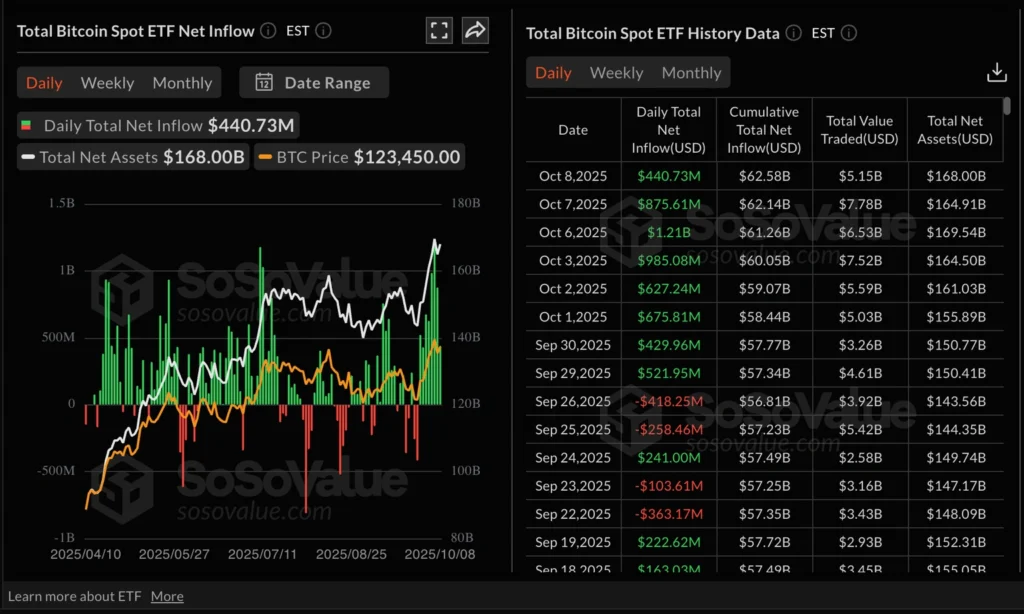

ETF flows remain strong, however. Bitcoin spot ETFs logged an eighth straight day of inflows on Wednesday, attracting $441 million, bringing cumulative inflows near $63 billion and net assets to $168 billion.

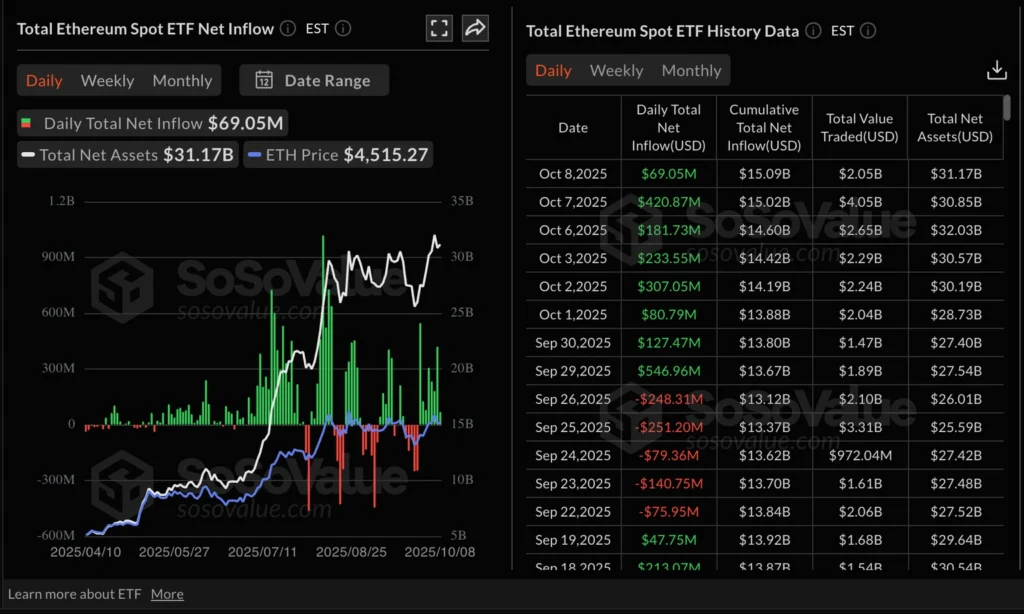

Ethereum ETFs saw $69 million in inflows Wednesday, compared to $421 million a day earlier. The nine active U.S. Ethereum ETFs now hold about $31.17 billion in assets, with total inflows of $15.1 billion, according to SoSoValue data.

Continued ETF demand suggests institutional interest remains intact, even as short-term traders take profits across the broader crypto space.

Solana Falls 5% After JPMorgan Predicts Weak ETF Demand

Solana (SOL) dropped 5% on Thursday after JPMorgan analysts projected that upcoming spot Solana ETFs would attract modest inflows of around $1.5 billion in their first year — roughly one-seventh the inflows seen in Ethereum ETFs.

In a note led by Nikolaos Panigirtzoglou, JPMorgan said institutional perception of Solana remains weak, with declining on-chain activity and meme coin trading dampening enthusiasm.

The analysts referenced the REX Osprey Solana Staking ETF (SSK), which drew $350 million post-launch, compared with $2.3 billion flowing into Ether ETFs within their first three months.

Grayscale’s Solana Trust (GSOL) premium to net asset value has also collapsed from over 750% last year to near zero — suggesting optimism over ETF approvals may already be priced in.

Still, the analysts said ETF approval odds remain strong given that CME already lists Solana futures. The SEC is expected to decide on several altcoin ETF applications in October, following its recent approval of generic digital asset ETF listing standards.

SOL is currently hovering above the $219 support level and 50-day SMA, with a break below both likely to test an ascending trendline support zone.

Deutsche Bank: Bitcoin and Gold Could Join Central Bank Reserves by 2030

Deutsche Bank projects that Bitcoin and gold could both become part of central bank reserve portfolios by 2030, as countries seek alternatives to the weakening U.S. dollar.

In its report “Gold’s Reign, Bitcoin’s Rise,” the bank noted that Bitcoin has surpassed $125,000 this year, while gold has climbed nearly 50% to around $4,000.

The report said improving liquidity, institutional credibility, and diversification motives could make Bitcoin a complementary reserve asset to gold. Both are expected to gain prominence as hedges against inflation, currency volatility, and geopolitical risk.

XRP Faces Further Downside Despite Ripple’s Middle East Expansion

Ripple (XRP) traded lower on Thursday, down 3% to $2.79, amid broader crypto market weakness and profit-taking.

Despite the decline, Ripple Labs announced an expansion in the Middle East, partnering with Bahrain FinTech Bay to strengthen its regional presence. The initiative builds on Ripple’s existing Dubai license and aims to support Bahrain’s digital asset ecosystem.

Futures open interest (OI) in XRP fell for a second consecutive day to $8.47 billion, down from $9.09 billion on Monday. Analysts said the decline signals waning retail confidence in XRP’s ability to maintain levels above $3.00, raising the risk of an extended correction.

Standard Chartered Warns Stablecoins Could Drain $1 Trillion From EM Banks

Standard Chartered warned that the rapid adoption of U.S. dollar-pegged stablecoins could divert up to $1 trillion in deposits from emerging market banks by 2028.

The bank estimates that stablecoin holdings in developing economies will rise from $173 billion to $1.22 trillion within three years, equivalent to about 2% of total bank deposits across 16 key markets.

It said that even with U.S. restrictions on yield payments, stablecoins will remain attractive to savers seeking protection from local currency instability.

The shift could intensify dollarization pressures, elevate funding costs, and expose emerging markets to greater capital flight risk.

Square Launches Bitcoin Payment Tools, Calls for Tax Relief

Square, a subsidiary of Block Inc., has introduced new merchant tools allowing businesses to accept Bitcoin payments and convert sales directly into Bitcoin with zero transaction fees from November 10.

The company said the initiative aims to make Bitcoin a practical payment option for everyday use. It also renewed calls for a tax exemption on small crypto purchases, arguing that routine transactions such as buying coffee shouldn’t trigger capital gains reporting.

Square said the rollout aligns with its long-term vision of advancing Bitcoin’s role in global commerce.

Potential impacts:

- Crypto: Boosts real-world Bitcoin adoption.

- Equities: Reinforces Block’s positioning as a key crypto infrastructure player.

The Day’s Takeaway

United States Markets

U.S. Stocks Slip as Major Indices Pause After Recent Gains

U.S. equities ended lower Thursday as investors booked profits following a strong run. The Dow Jones Industrial Average fell 0.52% to 46,358.42, while the S&P 500 dropped 0.28% and the Nasdaq Composite edged down 0.08%. The Russell 2000 underperformed, sliding 0.61%.

Losses were concentrated in industrials and financials. Boeing (−4.14%), Travelers (−2.95%), Honeywell (−2.68%), and 3M (−2.03%) weighed on the Dow.

Apple and Home Depot each declined 1.56%, while Chevron slipped 1.37% amid softer crude prices.

Beyond the Dow, notable laggards included Dell (−5.21%), Alibaba (−4.11%), RTX Corp (−3.79%), Uber (−3.29%), MicroStrategy (−3.21%), and Whirlpool (−3.47%).

Select gainers stood out amid the broader weakness: Nebius NV (+8.72%), Delta Air Lines (+4.29%), Zoom Video (+3.59%), United Airlines (+3.34%), Costco (+3.07%), Oracle (+2.89%), and Meta Platforms (+2.18%).

The pullback suggests a short-term pause as investors await upcoming inflation data and earnings releases later this week.

Federal Reserve & Bonds

Fed’s Barr: Economic Uncertainty Warrants Caution on Further Rate Cuts

Federal Reserve Governor Michael Barr said Thursday the U.S. economy faces “high uncertainty” around inflation and employment, warranting a cautious stance on future rate cuts.

Barr expects core PCE inflation to stay above 3% through year-end, warning that tariffs could add modest upward pressure. He described policy as “modestly restrictive” and said September’s cut was “appropriate.”

He also noted uneven economic performance, with upper-income households faring better than lower-income groups, and suggested AI-driven productivity gains could be nudging the neutral rate higher.

Barr added that while payroll growth is softening, overall GDP data and consumer spending remain strong in the third quarter.

U.S. 30-Year Treasury Auction Draws Strong Demand at 4.734%

The Treasury’s $22 billion 30-year bond auction saw strong demand, clearing at a 4.734% yield — a slight 0.4 basis-point tail versus the 4.73% WI level.

The bid-to-cover ratio of 2.38x was steady, with indirect bidders (foreign demand) taking 65.5%, above the six-month average. Dealers were left with just 8.7%, signaling robust investor appetite for long-dated paper despite rate uncertainty.

Commodities

Crude Oil Futures Fall 1.66% to $61.51 as Market Struggles for Direction

Crude oil futures settled lower Thursday at $61.51 per barrel, down $1.04 (−1.66%), as the market continued to test a tight technical band between $61.45 and $61.94.

Prices dipped to an intraday low of $61.25, breaking below the lower edge of that range — a move traders say signals indecision between correction and renewed downside momentum.

A sustained break under $61.45 could open the door toward $60, analysts noted.

Separately, President Trump suggested gasoline prices could “soon approach $2,” though AAA pegs the national average at $3.11 per gallon, and as high as $3.50 in parts of the U.S.

Gold Cools After Rally Above $4,000, Buyers Tested as Momentum Fades

Gold prices retreated after a powerful run to $4,058.01, just shy of Wednesday’s high. The metal fell below its 100-hour moving average ($3,978.82) and the 38.2% retracement ($3,967.54) but held above the 50% retracement ($3,939.20) — a signal the broader uptrend remains intact.

Traders view the move as consolidation rather than reversal. Resistance sits near $3,979, with a rebound above that level likely reigniting momentum toward $4,000.

Gold’s surge has been driven by safe-haven demand and a softer dollar outlook, though near-term cooling reflects profit-taking after a steep climb.

Global Overview

European Markets: Major European indices followed Wall Street lower, weighed by weaker energy and financial stocks. Bond yields eased slightly, and the euro traded steady against the dollar.

Asia-Pacific: Asian shares were mixed overnight as investors assessed U.S. inflation implications and China’s trade balance data, which showed modest improvement in exports.

Crypto Markets

Crypto Market Pulls Back as Traders Lock In Profits

Cryptocurrencies traded lower as traders took profits from recent highs. Bitcoin (BTC) slipped toward $121,000, Ethereum (ETH) extended its decline near its 50-day EMA, and Ripple (XRP) fell 3% to $2.79 amid waning retail participation.

Despite the pullback, the Crypto Fear & Greed Index climbed to 70, reflecting strong optimism. Analysts warned that such elevated sentiment often precedes volatility spikes.

ETF inflows remain supportive:

- Bitcoin ETFs logged an eighth straight inflow day, adding $441 million, bringing cumulative inflows to $63 billion and net assets to $168 billion.

- Ethereum ETFs attracted $69 million on Wednesday, maintaining total inflows near $15.1 billion and assets around $31.17 billion.

Solana Falls 5% After JPMorgan Predicts Weak ETF Demand

Solana (SOL) slid 5% after JPMorgan forecast that upcoming spot ETFs would draw just $1.5 billion in first-year inflows — about one-seventh of Ethereum’s pace.

The bank cited weak institutional perception and falling on-chain activity as drags.

JPMorgan analysts pointed to the REX Osprey Solana Staking ETF, which raised $350 million, versus $2.3 billion flowing into Ether ETFs over their first three months.

Despite muted expectations, SOL remains supported by an ascending trendline near $219 and the 50-day SMA, with a breakdown there likely to invite further losses.

XRP Faces Further Downside Despite Ripple’s Middle East Expansion

Ripple Labs expanded in the Middle East through a new partnership with Bahrain FinTech Bay, extending its regional footprint after securing a Dubai license.

However, XRP fell 3% to $2.79, pressured by risk-off sentiment and a second straight drop in futures open interest — now $8.47 billion, down from $9.09 billion earlier in the week — suggesting traders are reducing bullish exposure above the $3.00 threshold.