North America News

S&P 500 and Nasdaq Set Fresh Records; Dow Ends Flat

U.S. stock indices closed mixed on Wednesday, with the S&P 500 and Nasdaq Composite reaching new record highs while the Dow Jones Industrial Average finished virtually unchanged.

The Nasdaq led gains, advancing 255.02 points (1.12%) to log its best session since August 22, when it rose 1.88%. The S&P 500 climbed 39.13 points (0.58%) to close at 6,753.72, while the Dow slipped 1.2 points, or less than 0.01%, to 46,601.78.

Tech Stocks Drive Rally

Technology shares powered the day’s advance, led by AMD, which jumped 11.34%. The chipmaker has surged 43.58% over the past week amid ongoing enthusiasm for semiconductor and AI-related names.

Other top performers included:

- Dell Technologies +9.04%

- Super Micro Computer (SMCI) +6.56%

- Snowflake +6.56%

- Micron Technology +5.85%

- CrowdStrike Holdings +5.24%

- Arm Holdings +4.58%

- Robinhood Markets +4.05%

- ARK Innovation ETF +3.70%

- Taiwan Semiconductor +3.56%

Treasury Yields Edge Higher

In fixed income, U.S. Treasury yields ended the day slightly higher following a 10-year note auction that drew average demand. Earlier in the session, yields had moved lower before reversing course.

- 2-year: 3.588%, +1.6 bps

- 5-year: 3.722%, +1.6 bps

- 10-year: 4.130%, +0.4 bps

- 30-year: 4.721%, -0.5 bps

Washington Stalemate Persists

The U.S. government shutdown entered its eighth day with no progress toward a resolution. Despite the political gridlock, equities have continued to advance, suggesting markets remain focused on monetary policy expectations and corporate strength rather than fiscal headlines.

Fed Minutes Reinforce Easing Outlook

Minutes from the latest Federal Open Market Committee (FOMC) meeting showed broad support for further policy easing through 2025. Nearly all participants backed the 25-basis-point rate cut in September, though a few favored holding rates steady, and one advocated a 50-basis-point reduction.

Some officials cautioned that financial conditions may no longer be “particularly restrictive,” calling for a measured approach to additional cuts.

On the macro outlook:

- Downside risks to employment have increased.

- Upside inflation risks have eased or remained unchanged.

- GDP projections for 2025–2028 were revised higher, driven by stronger consumer spending and business investment.

A few participants also highlighted the role of the standing repo facility in maintaining the federal funds rate within target and ensuring smooth market functioning amid ongoing quantitative tightening.

U.S. Treasury 10-Year Auction Draws Mixed Demand

The U.S. Treasury Department auctioned $39 billion in 10-year notes at a high yield of 4.117%, just above the 4.114% when-issued level.

Key results:

- Tail: +0.3 basis points (six-month avg: -0.9bps)

- Bid-to-cover: 2.48x (six-month avg: 2.57x)

- Direct bidders: 24.1% (six-month avg: 16.3%)

- Indirect bidders: 66.8% (six-month avg: 73.7%)

- Dealers: 9.09% (six-month avg: 10.0%)

While overall demand metrics came in slightly softer than recent averages, strong domestic participation helped offset weaker foreign interest, leaving dealers with a smaller-than-usual share.

U.S. MBA Mortgage Applications Down 4.7% in Early October

Mortgage demand in the United States fell for a second week, with MBA data showing a 4.7% decline in applications for the week ending 3 October 2025, following a 12.7% drop previously.

- Market index: 323.1 (prior 339.1)

- Purchase index: 170.6 (prior 172.2)

- Refinance index: 1,180.2 (prior 1,278.6)

- 30-year fixed rate: 6.43% (prior 6.46%)

The data highlight ongoing weakness in mortgage activity as elevated borrowing costs weigh on demand despite a marginal easing in average rates.

FOMC Minutes Show Broad Support for Further Rate Cuts in 2025

The latest Federal Open Market Committee (FOMC) minutes indicate that most policymakers consider additional rate cuts in 2025 to be appropriate as risks to employment rise and inflation pressures stabilize.

Almost all participants supported the 25-basis-point rate cut implemented at the September meeting. A few members, however, argued for holding rates steady, saying they could have backed such a decision.

Several officials observed that financial conditions may no longer be “particularly restrictive,” suggesting that a cautious approach to future policy remains warranted.

The minutes noted that:

- Most participants see downside risks to employment as increasing.

- Upside risks to inflation have either diminished or remained unchanged.

- Judgments on policy have shifted alongside a change in the balance of risks.

The Fed staff upgraded its GDP growth outlook for 2025–2028, reflecting stronger consumer spending, improved business investment, and slightly easier financial conditions. Inflation forecasts were largely unchanged, with the Fed still projecting inflation to reach 2% by 2027 and remain stable in 2028.

Risks around the inflation forecast remain skewed to the upside, according to staff analysis.

Nvidia’s Jensen Huang Highlights Four Key AI Investment Themes

Nvidia CEO Jensen Huang identified four areas of artificial intelligence that excite him most during an interview with CNBC, citing opportunities for future investment and innovation.

The four focal points are:

- Enterprise AI – integrating AI into business operations such as finance, logistics, HR, and customer service.

- Robotics – with references to industrial and autonomous robotics.

- Self-driving vehicles.

- Medical diagnostics, mentioning applications like Open Evidence.

Huang also praised Cursor, an AI-powered code editor widely used by Nvidia developers.

He summarized Nvidia’s broader AI outlook by saying:

“AI is energy, it’s chips, it’s infrastructure, it’s AI models and it’s AI application,” emphasizing that all layers of the AI ecosystem are experiencing rapid growth.

Trump Delays Farm Aid Amid Government Shutdown

The Trump administration has postponed plans to roll out financial aid for farmers due to the ongoing U.S. government shutdown, Politico reported, citing sources familiar with the discussions.

The delay affects scheduled economic support measures that were expected to be announced this week. No new timeline has been confirmed.

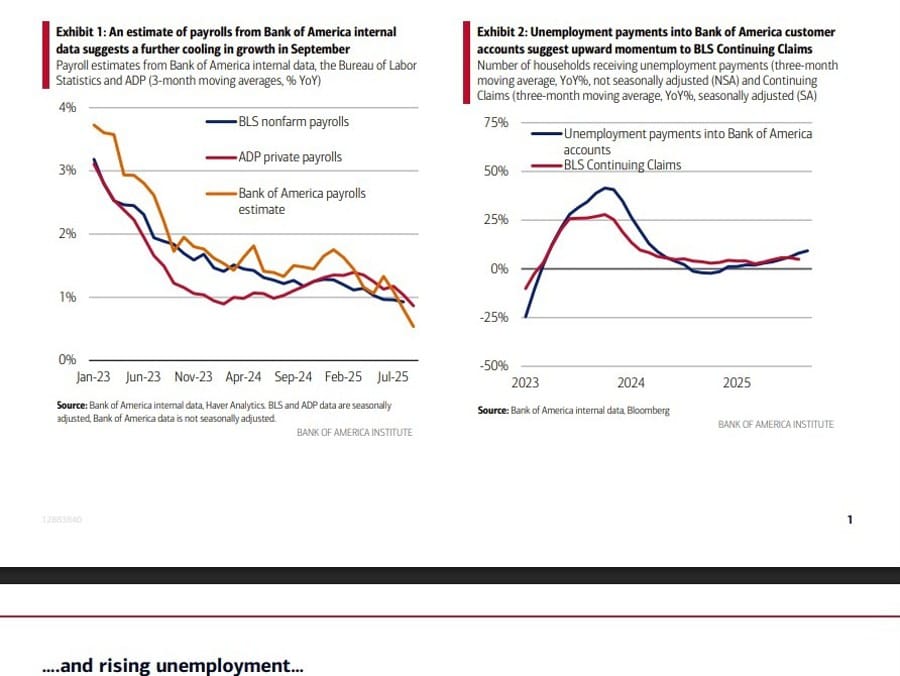

BofA Data Show Slower U.S. Job Growth, Higher Claims

Bank of America’s internal data point to continued cooling in the U.S. labor market during September, with slower job growth and rising unemployment claims.

The bank’s payroll tracker, based on customer accounts receiving paychecks, showed employment growth softening over a three-month average. Unemployment-related deposits rose about 10% year-on-year in October, twice the 5% increase reported in official data for August.

Wage growth remained uneven: 4.0% for higher-income households, 2.4% for middle-income, and 1.4% for lower-income earners.

Implications:

- FX: Weaker job data may strengthen rate-cut expectations, pressuring the dollar.

- Rates: Could lower Treasury yields as investors price in slower growth.

- Equities: May benefit rate-sensitive sectors but underline consumer strain.

Musk’s xAI Expands Fundraising to $20 Billion with Nvidia Backing

Elon Musk’s xAI is expanding its capital raise to roughly $20 billion, supported by Nvidia’s investment of up to $2 billion in equity and a GPU-linked financing structure for the company’s planned Colossus 2 data centre in Memphis.

The package includes about $7.5 billion in equity and $12.5 billion in GPU-backed debt, according to sources. The financing is being executed through a special purpose vehicle (SPV) that will acquire Nvidia GPUs and lease them back to xAI over five years.

The model, arranged with Apollo Global Management, Diameter Capital Partners, and Valor Capital, allows lenders to recover funds through the hardware rather than the company’s balance sheet.

Neither xAI nor Nvidia has publicly commented on the deal. Musk previously said in September that xAI was “not raising any capital right now.”

Uber Under Investigation Over Sexual Assault Handling

The New Jersey Attorney General’s Office is investigating Uber Technologies Inc. for its handling of sexual assault cases, according to a report by The New York Times.

The probe focuses on how the company responded to allegations and managed internal reporting procedures. Uber has not commented on the ongoing investigation.

Traders are monitoring potential legal and reputational impacts for the ride-hailing company.

Commodities News

Gold Sets New Records as U.S. Shutdown Limits Downside Risks

Gold prices extended their record-breaking rally as the ongoing U.S. government shutdown curbs the risk of bearish catalysts and delays key economic releases.

With the shutdown stalling data publication and limiting Federal Reserve commentary, the market remains firmly bullish. Even the U.S. CPI report could face delays if the shutdown persists.

The only immediate risk for gold remains a potential hawkish shift in rate expectations, but the shutdown’s data blackout shields the metal from such repricing for now.

Fundamentally, gold continues to benefit from expectations of lower real yields and a dovish Fed reaction function. A correction could emerge only if upcoming labor market data surprises on the upside.

Technical Outlook – Daily Chart:

Gold has gone parabolic on the daily timeframe, making short-term analysis more relevant.

Technical Outlook – 4-Hour Chart:

An upward trendline continues to define bullish momentum. A pullback toward this line may invite renewed buying, with support expected near trendline levels. Sellers will look for a clean break lower to extend the move toward recent lows.

Technical Outlook – 1-Hour Chart:

A secondary trendline confirms near-term strength. A break below it could trigger a pullback toward $3,940, while sustained buying above trend support keeps the path open for new all-time highs.

Crude Oil Futures Settle at $62.55, Up 1.33%

Crude oil futures rose on Wednesday, settling $0.82 higher at $62.55, a 1.33% gain for the session. Prices reached an intraday high of $62.92 and a low of $62.05.

From a technical perspective, the day’s move was constructive for buyers, with prices reclaiming a key swing support zone that acted as resistance during August and September. After briefly slipping below this floor on October 1 and spending much of the past two sessions beneath it, oil prices have now recovered above the threshold and are holding steady, reinforcing buyer confidence.

A sustained move above this area could open the way for further gains if momentum builds. On the downside, sellers would need a clear break back below the $61.45–$61.94 region to regain control.

Earlier, EIA data showed a 3.715 million barrel build in U.S. crude inventories, exceeding expectations for a 1.830 million increase. Gasoline and distillate inventories both posted drawdowns of -1.601 million and -2.018 million barrels respectively, also larger than forecast.

U.S. Crude Oil Inventories Rise 3.7M Barrels

The EIA weekly petroleum report showed U.S. crude inventories up by 3.715 million barrels, exceeding forecasts for a 1.83 million increase.

- Prior: +1.792 million

- Gasoline: -1.601 million (expected -0.690 million)

- Distillates: -2.018 million (expected -0.842 million)

The data reflect a build in crude stocks offset by continued draws in refined products, suggesting uneven trends in consumption and refinery activity.

HSBC Lifts Silver Forecast, Sees Break Above $50

HSBC has raised its silver price forecasts again, expecting the metal to track gold’s rally and possibly breach the $50 per ounce level.

The bank now sees silver averaging $38.05/oz this year, up from its previous forecast of $35.14/oz, with a year-end target of $49/oz. For 2026, HSBC projects an average of $44.50/oz, up from $33.96/oz, though it expects prices to ease to $41.50/oz by the end of next year.

HSBC analysts said:

“The silver market stands on the cusp of the record high of nearly $50/oz set in May 2011, but is likely to surpass that level in the near term. We look for a wide $45–53/oz range for the remainder of 2025 and a $40–55/oz range next year.”

They added that gold’s momentum continues to pull silver higher:

“Gains in gold attract ancillary buying in silver.”

The bank reiterated that the current rally is more tied to silver’s correlation with gold than to standalone supply-demand fundamentals.

Teck Resources Production Cut Highlights Copper Supply Strain

Teck Resources has reduced its copper production forecasts through 2028, underscoring the ongoing challenges in bringing new supply to market amid surging demand for electrification.

The revision follows operational setbacks at QB2, Teck’s major new mine, and comes amid broader disruptions such as the Freeport-McMoRan Grasberg mine shutdown after a mudslide and the ongoing suspension of Cobre Panama due to political unrest.

Teck’s updated guidance (kt, midpoint):

- 2025: 180 vs consensus 208

- 2026: 217.5 vs consensus 257

- 2027: 257.5 vs consensus 274

- 2028: 237.5 vs consensus 272

The company also raised cash cost estimates to $2.65–$3.00/lb, warning of downside risks if sand drainage or mechanical raises underperform in 2026–27.

Analysts say the revisions highlight the long lead times and execution risks facing new copper projects globally, even as the energy transition fuels unprecedented demand.

Goldman’s Kaplan Flags Gold’s $4,000 Rally as Fiscal Warning

Goldman Sachs Vice Chairman Robert Kaplan said the metal’s 40% year-to-date rally to $4,000 is a warning signal of deepening fiscal concern in the U.S.

Speaking on CNBC, Kaplan said: “That’s a red light that deserves our attention.” He noted that gold has replaced Treasuries as the preferred safe haven, as deficit fears weigh on bond sentiment.

“The 10-year Treasury isn’t acting like a safe haven right now — gold is,” he said, citing investor unease about U.S. debt levels.

Kaplan emphasized that addressing the deficit is crucial: “We need to show we’re making progress on deleveraging — and the jury’s still out on that.”

India Resumes Yuan Payments for Russian Oil

India’s state-owned refiners have resumed payments in Chinese yuan for purchases of Russian oil, according to trade sources cited by Reuters.

Indian Oil Corp (IOC) recently used yuan for two to three cargoes, marking the first such transactions since 2023, when payments were halted amid tensions with Beijing.

The renewed use of yuan follows an improvement in India-China relations, including the resumption of direct flights and Prime Minister Narendra Modi’s visit to China for the Shanghai Cooperation Organisation summit.

Western sanctions on Russia have encouraged traders to shift away from the dollar and dirham. The yuan offers a direct conversion path to roubles, simplifying settlements and reducing costs.

Implications:

- Strengthens yuan’s role in global energy trade.

- Expands Indian refiners’ access to Russian crude.

- Reflects deepening India-China economic engagement under sanctions pressure.

Investors Flock to Gold and Bitcoin in “Debasement Trade”

A growing number of investors are shifting funds into gold, bitcoin, and other non-dollar assets, in what traders are calling the “debasement trade”, according to a Wall Street Journal report.

The move is being driven by concerns over U.S. fiscal imbalances, rising debt, and political dysfunction. Gold futures have climbed above $4,000 per ounce for the first time, with prices up 52% year-to-date, even in the absence of a financial crisis.

The rally follows comments by Fed Chair Jerome Powell in August indicating that rate cuts may come despite persistent inflation and a strong labor market.

Economists describe a split market: some investors are betting on extended equity gains driven by AI optimism, while others hedge against fiscal deterioration. Vanguard’s Joe Davis called it a “tug of war” between growth-chasers and those preparing for long-term inflation and currency risk.

OCBC: Gold Momentum Remains Strong Above $4,000

Gold prices extended gains, breaking above $4,040 per ounce, according to OCBC analysts Frances Cheung and Christopher Wong.

The analysts said underlying momentum remains bullish despite overbought RSI conditions.

“The U.S. government shutdown persisted, raising concerns on broader economic activity. Underlying momentum remains bullish,” they wrote.

Key levels: Resistance at $4,120, with support at $3,890 and $3,775 (21-DMA). The bank noted the rally underscores gold’s dual role as both a geopolitical hedge and a store of value during policy uncertainty.

ING: Gold Surges Past $4,000/oz in Historic Rally

Spot gold surged past the $4,000/oz mark for the first time, extending a rally fueled by U.S. fiscal worries and the government shutdown, according to ING analysts Ewa Manthey and Warren Patterson.

They noted that December futures in New York had already surpassed the level earlier this week.

Gold’s value has doubled in under two years, supported by central bank diversification, trade tensions, and geopolitical conflicts in the Middle East and Ukraine.

ETF demand also surged: global holdings rose by 30.2koz for a ninth straight session to 97.4moz, with 14moz net inflows year-to-date — the highest since September 2022.

ING: EIA Raises U.S. Oil Output Estimates

WTI crude extended gains above $62/bbl, marking a fourth consecutive session higher, following mixed data from the American Petroleum Institute (API) and updated supply forecasts from the Energy Information Administration (EIA).

The API reported a 2.8 million barrel rise in U.S. crude inventories last week, exceeding expectations for a 497,000-barrel increase. Cushing stocks fell by 1.2 million barrels, while gasoline and distillate inventories dropped 1.2m and 1.8m barrels, respectively.

Meanwhile, the EIA raised its production forecasts, now expecting output to average 13.53m b/d in 2025 (previously 13.44m b/d) and 13.51m b/d in 2026 (up from 13.3m b/d).

U.S. petroleum consumption is forecast to remain near 20.5m b/d, slightly below prior projections of 20.6m.

Europe News

European Stocks Close Higher; DAX Breaks Out

European equities closed broadly higher, with major indexes finishing at session peaks amid strong global risk appetite.

Closing levels:

- Stoxx 600: +0.8%

- DAX: +1.0%

- CAC 40: +1.2%

- FTSE 100: +0.8%

- IBEX 35: +1.1%

- FTSE MIB: +1.1%

The DAX appears to be staging a technical breakout as momentum builds across European markets, led by gains in industrial and consumer discretionary sectors.

Germany Industrial Production Slumps 4.3% in August

Germany’s industrial output plunged 4.3% month-on-month in August, sharply underperforming expectations for a 1.0% decline, according to data from Destatis released on 8 October 2025. The prior month saw a 1.3% increase.

The drop was led by a steep contraction in the automotive sector, where production fell 18.5% from July. Analysts attributed the weakness to seasonal factors such as the summer holiday period and production line changeovers.

Excluding energy and construction, overall industrial output was down 5.6%, underscoring the ongoing challenges in German manufacturing through the third quarter.

UK Statistics Office Revises Borrowing Figures After VAT Reporting Error

The UK Office for National Statistics (ONS) has revised its public borrowing data following a correction by HM Revenue & Customs (HMRC), which identified an error in reported VAT cash receipts.

According to HMRC, VAT collections were £2.4 billion higher than initially reported, equivalent to about 3% of year-to-date receipts. The revision affects figures from April to August 2025, with the ONS noting its calculations could extend back to January 2025.

As a result, public sector net borrowing across the current and previous fiscal years is now estimated to be £3 billion lower in total.

Per the ONS:

“Correcting for the error reduces public sector net borrowing by between £200 million and £500 million per month within the period affected, resulting in a reduction of £1 billion for the financial year ending March 2025 and a reduction of £2 billion for the financial year to date.”

While the ONS was not directly responsible for the discrepancy, the episode adds to scrutiny over the reliability of recent official statistics.

ECB’s Escrivá: We are at appropriate level of interest rates, no need for further guidance

- Remarks by ECB policymaker, José Luis Escrivá

- Risks to inflation are well much balanced

- But trade disruptions from US could be potentially inflationary

- Downside risks to growth in the euro area have not emerged

- Meeting-by-meeting approach is to keep full optionality

- The environment is still uncertain

- There could be an option for another move on rates, optionality means optionality

ECB’s Rehn: Current situation is good but medium-term downside risks visible

- Comments from the ECB policymaker, Olli Rehn

- Downside inflation risks are apparent due, among other factors, to the appreciation of the euro and the stabilization of wage and services inflation.

- Will stick to meeting-by.meeting and data-driven approach in setting monetary policy due to uncertainty.

ECB’s Nagel: Current monetary policy is appropriate

- Comments from the ECB policymaker, Joachim Nagel

- We are currently in a good situation.

- Inflation close to 2% target, seen remaining there in the coming years.

BOE’s Pill: Mon policymakers should make a clear and credible commitment to targets

- Comments from the Bank of England chief economist

- Doesn’t address monetary policy in speech

- Monetary policymakers should make a clear and credible commitment to achieve their price stability objective

Outgoing French prime minister Lecornu: France must get a budget by end of this year

- Sébastien Lecornu makes an address at the Matignon Palace

- Talks so far show that there is a desire to get this budget through by year-end

- Will present findings to president Macron this evening

Analysts Warn French Bonds “Remain Uninvestable”

Analysts at BCA Research have cautioned that French government bonds continue to be “uninvestable” following the resignation of Defence Minister Sébastien Lecornu, calling it a sign of ongoing political instability.

They warn that as long as France’s parliament lacks a clear majority, no administration will be able to address the nation’s growing fiscal and debt challenges.

According to BCA, a “full-blown crisis in the OAT market” may ultimately be needed to spur political consensus and reform.

Asia-Pacific & World News

RBNZ Cuts Cash Rate by 50bp, Exceeding Market Expectations

The Reserve Bank of New Zealand cut its Official Cash Rate (OCR) by 50 basis points to 2.5%, a larger move than the 25bp reduction markets had expected.

The decision came amid weak economic activity and lingering inflation pressures. The NZD/USD weakened following the announcement.

The Monetary Policy Committee said inflation remains near the upper end of its 1–3% target band but is projected to return to 2% by the first half of 2026.

“The Committee remains open to further reductions in the OCR as required for inflation to settle sustainably near the 2 percent target mid-point in the medium term,” the statement read.

Meeting minutes revealed policymakers debated both 25bp and 50bp options, with the larger cut justified by persistent spare capacity and downside risks to growth.

ANZ Expects Additional 25bp Rate Cut from RBNZ in November

ANZ now anticipates the Reserve Bank of New Zealand (RBNZ) will trim its Official Cash Rate by another 25 basis points at its upcoming policy meeting on November 26, 2025.

The bank described the RBNZ’s recent 50bp reduction as a balanced step, neither overtly dovish nor hawkish.

“I’d call this a pretty neutral 50 basis point cut,” ANZ noted, adding, “They have said they are open to further easing but have not explicitly signalled further easing.”

The forecast implies a continued, but measured, approach to policy easing from the central bank as it manages slowing domestic activity and inflation expectations.

Japan’s Real Wages Drop for Eighth Consecutive Month

Japan’s real wages fell for the eighth straight month in August, as inflation continued to outpace pay growth, according to government data.

Inflation-adjusted earnings declined 1.4% year-on-year, the steepest fall in three months, after a 0.2% drop in July. The fall was largely due to a 10.5% slump in special payments, including bonuses.

Nominal wages rose 1.5% to an average of ¥300,517 ($1,994), with regular pay up 2.0% and overtime earnings up 1.3%.

Consumer inflation stood at 3.1%, the lowest in ten months but still high enough to erode purchasing power. The Bank of Japan expects wage momentum to continue into next year, though softer data and U.S. trade pressures complicate the outlook.

Market impact:

- Weak wages likely reinforce expectations for BOJ caution, keeping yen soft.

- Limited inflation persistence could cap JGB yields.

- Consumer sectors may weaken; exporters could benefit from a weaker currency.

Japan Manufacturing Sentiment Falls as Auto Sector Slumps

Japan’s manufacturers’ confidence fell sharply in October, led by a steep decline in the automotive sector, according to the Reuters Tankan survey.

The overall manufacturing index dropped to +8 from +13, its first fall in four months, with the auto and transport machinery subindex plunging to +9 from +33.

Automakers, heavily exposed to U.S. tariffs of 15%, cited rising input costs and weaker global demand. Machinery and precision equipment firms also reported softer sentiment, pointing to the burden of U.S. tariffs on steel and aluminium.

The non-manufacturing index held steady at +27, supported by retail and tourism recovery.

The survey, covering 237 of nearly 500 major companies, indicates the risk of an annualised 1.1% GDP contraction in Q3.

Japan’s LDP Postpones Diet Session Amid Coalition Impasse with Komeito

Japan’s ruling Liberal Democratic Party (LDP) has delayed the start of an extraordinary Diet session to October 20 or later, after talks between new party leader Sanae Takaichi and Komeito chief Tetsuo Saito failed to produce an agreement on extending their coalition.

The postponement also delays the parliamentary vote to confirm a successor to former Prime Minister Shigeru Ishiba, who stepped down last week. The session had initially been planned for around October 15.

Komeito’s hesitation stems from unease over Takaichi’s conservative positions, which the party believes could complicate their long-standing partnership. Negotiations are set to continue in the coming days.

Analysts say the delay underscores the fragility of Japan’s ruling alliance, raising the risk of short-term legislative deadlock and potential policy delays.

Market implications:

- FX: Political uncertainty may trigger near-term volatility in the yen.

- Rates: Fiscal decisions could be postponed, keeping JGB yields muted.

- Equities: Domestic sectors reliant on government spending could face temporary sentiment pressure.

Crypto Market Pulse

Crypto Market Steadies as Bitcoin and Ethereum Rebound

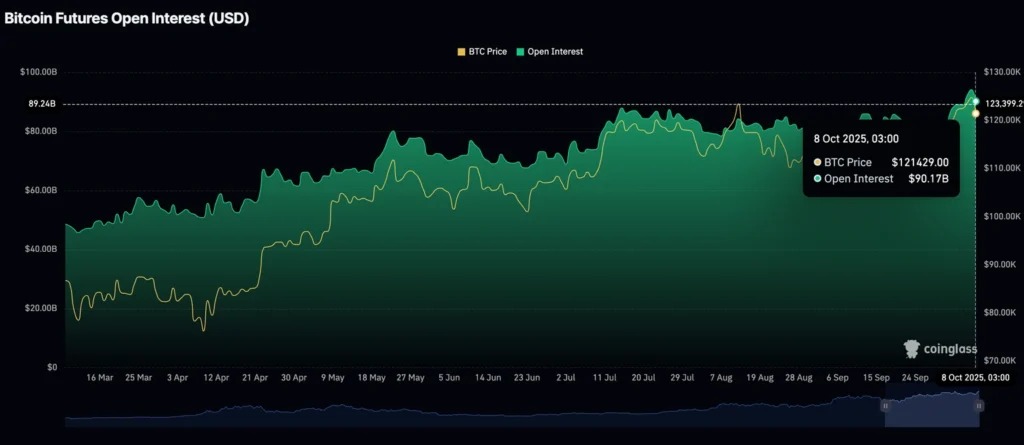

Bitcoin (BTC) held firm above $122,000 on Wednesday after a sharp pullback the previous day, while Ethereum (ETH) and Ripple (XRP) consolidated near key support zones.

Futures open interest in Bitcoin declined to $90.17 billion from $94.12 billion, reflecting a cooling in leveraged long positions. A drop in open interest often signals fading speculative enthusiasm or profit-taking among traders.

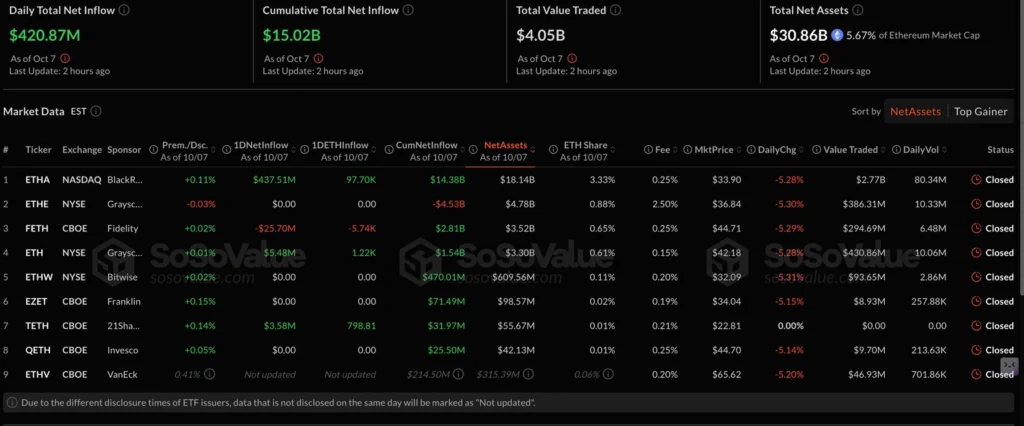

Ethereum, however, continued to attract institutional inflows through spot ETFs, which saw $421 million in net inflows on Tuesday — the seventh straight day of gains, according to SoSoValue.

The nine U.S.-listed ETH ETFs have accumulated total inflows of $15 billion, with net assets averaging $30.86 billion, underscoring sustained institutional demand for the asset.

MetaMask Launches Perpetual Futures Trading, Plans Polymarket Integration

MetaMask, the Consensys-backed self-custody wallet, has launched perpetual futures trading directly within its platform, powered by decentralized exchange Hyperliquid.

The new feature enables users to trade derivatives across EVM-compatible chains with one-click funding and no swap fees, available initially in select regions.

“We’re not just bringing people on-chain, but creating reasons they’ll never want to leave,” said Gal Eldar, Global Product Lead at MetaMask.

The rollout coincides with the launch of a seasonal rewards program, allowing users to earn points through token swaps, perpetual trades, referrals, and later, spending on the MetaMask Card or holding the mUSD stablecoin.

MetaMask also plans to integrate Polymarket, the leading decentralized prediction marketplace, enabling users to trade events across sectors including sports, crypto, and politics within the wallet.

The initiative aligns with MetaMask’s goal of evolving into a comprehensive on-chain finance hub. Eldar added:

“MetaMask was built to give people true ownership of their assets. Now we’re extending that to the world’s most important markets — without giving up custody.”

The company confirmed plans to launch a native governance token to support decentralization and platform participation.

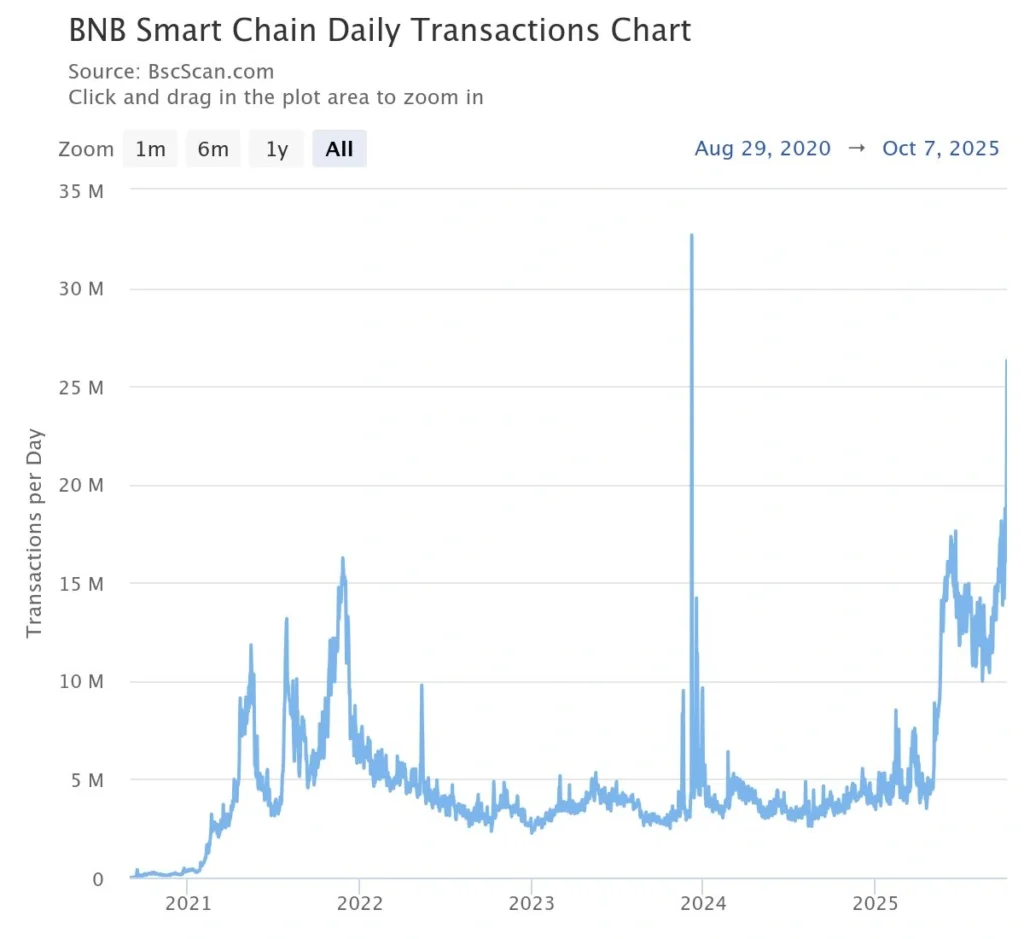

BNB Trades Near Record High as YZi Labs Unveils $1 Billion Builder Fund

Binance Coin (BNB) traded just below $1,300 on Wednesday after touching a record $1,350 the previous day, amid growing momentum in the BNB ecosystem.

The rally coincides with YZi Labs, Binance’s venture arm, announcing a $1 billion builder fund to accelerate project development on the BNB Chain.

The fund aims to support innovation in trading, AI, DeFi, real-world assets, and wallet infrastructure, according to a company statement.

“YZi Labs is committed to leveraging the BNB ecosystem as the backbone for humanity’s new scaling laws — Web3 for democratized ownership, AI for enhanced human potential, and biotech for better quality of life,” the company said on X.

The BNB Chain continues to post strong on-chain activity, with 26 million daily transactions, the highest DEX trading volume, and leading user participation among major blockchains.

BNB’s recent surge has pushed its market capitalization to $183 billion, surpassing Ripple (XRP) to become the third-largest cryptocurrency, according to CoinGecko.

“BNB’s climb into the top three reflects both the maturity and fragility of the current crypto cycle — signaling ecosystem-driven growth but also potential overheating,” said Jamie Elkaleh, CMO of Bitget Wallet.

XRP Stays Range-Bound as Open Interest Slides

Ripple’s XRP traded in a narrow range on Wednesday, hovering near $2.85, as futures open interest fell to $8.85 billion, reflecting waning retail participation.

The token continues to hold above its 100-day EMA support, though it remains confined below a multi-month descending trendline. Attempts to reclaim the $3.00 level late last week failed to gain traction, triggering mild profit-taking and a slide toward $2.82.

If the $2.85 support level holds, buyers may again attempt a breakout above the $3.00 psychological barrier.

Derivatives data show soft sentiment among retail traders. According to CoinGlass, long position liquidations totaled $21.17 million on Tuesday compared to just $2.17 million in shorts. The pullback has since eased, though $3.35 million in long positions were still liquidated as of Wednesday, versus $447,000 in shorts — underscoring reduced conviction in the uptrend.

A continued decline in open interest typically signals traders are closing positions and could point to a deeper consolidation phase ahead.

Solana Eyes $250 Resistance as On-Chain Activity Softens

Solana (SOL) traded above $220 on Wednesday as traders bought into the recent dip, positioning for a potential breakout toward $250.

Optimism around the ‘Uptober’ narrative and speculation about future ETF approvals has lifted sentiment, though declining on-chain activity remains a concern.

DefiLlama data show Solana’s DeFi Total Value Locked (TVL) fell 3% in the past 24 hours, dropping from $12.91 billion to $12.48 billion, indicating reduced investor confidence.

Active addresses on the network have also fallen sharply — to 6.2 million from 33.33 million in May — signaling weaker user engagement. Meanwhile, total weekly transactions declined to 173.72 million from 613.14 million recorded in late July.

While technicals suggest near-term upside potential, the persistent drop in activity could limit follow-through momentum unless participation rebounds.

Pi Network Faces Selling Pressure as Price Targets $0.20

Pi Network (PI) extended its decline on Wednesday, falling 3% to trade near $0.24, following a 6% drop the previous day.

The token broke below $0.2565 support, and technical signals point toward possible losses toward the $0.20 round-number level.

Data from PiScan show large user deposits to exchanges, with transactions of 532,434 PI and 473,426 PI sent to OKX, suggesting investors are increasing their exposure to centralized exchanges — a trend often associated with rising supply pressure.

Analysts note that consistent outflows to exchanges typically precede additional downside as holders move to liquidate positions.

The Day’s Takeaway

U.S.

- Equities Rally to New Highs: The S&P 500 and Nasdaq Composite closed at record highs, driven by tech gains, with AMD surging 11.34%. The Dow ended flat as strength in semiconductors offset broader stagnation.

- FOMC Minutes Signal Easing Bias: Fed minutes revealed broad support for further rate cuts in 2025, citing rising employment risks and easing inflation pressures. GDP forecasts were revised higher due to stronger consumer spending and business investment.

- Treasury Auction Draws Mixed Demand: The 10-year note auction saw weaker-than-average foreign interest but strong domestic participation, leaving dealers with a smaller allocation. Yields edged higher post-auction.

- Government Shutdown Persists: The U.S. government shutdown entered its eighth day, delaying economic data releases and keeping gold bullish as bearish catalysts remain muted.

Europe

- Industrial Production Slump in Germany: German industrial output plunged 4.3% in August, led by an 18.5% drop in automotive production. The weakness highlights ongoing challenges in manufacturing.

- French Bonds Deemed “Uninvestable”: Analysts warn French bonds remain uninvestable amid political instability, calling for reforms to address fiscal and debt challenges.

- European Stocks Rally: Major indices closed higher, with the DAX breaking out technically as industrial and consumer discretionary sectors led gains.

Asia

- Japan’s Political and Economic Challenges: An LDP-Komeito coalition impasse delayed Japan’s Diet session, raising risks of legislative deadlock. Real wages fell for the eighth consecutive month, eroding purchasing power despite nominal wage growth.

- Manufacturing Sentiment Weakens: Japan’s manufacturing confidence dropped sharply in October, with automakers citing U.S. tariffs and input cost pressures. Non-manufacturing sentiment held steady, supported by retail and tourism.

- India Resumes Yuan Payments for Russian Oil: Indian refiners resumed yuan payments for Russian oil, strengthening the yuan’s role in global energy trade and reflecting improved India-China ties under sanctions pressure.

Rest of World

- New Zealand Rate Cut Exceeds Expectations: The RBNZ cut its cash rate by 50bps to 2.5%, exceeding market expectations. Policymakers cited weak economic activity and lingering inflation pressures but left room for further easing.

- ANZ Forecasts Additional RBNZ Cut: ANZ expects another 25bp rate reduction in November, signaling a measured approach to policy easing amid slowing domestic activity.

Commodities

- Crude Oil Futures Rise: Crude oil settled at $62.55, up 1.33%, reclaiming key support levels. A larger-than-expected build in U.S. inventories was offset by draws in gasoline and distillate stocks.

- Gold Surges Past $4,000: Spot gold hit historic highs above $4,000/oz, fueled by U.S. fiscal worries and the government shutdown. ETF demand surged, with global holdings rising to 97.4moz.

- Silver Price Outlook Strengthened: HSBC raised its silver forecasts, expecting prices to breach $50/oz as gold’s rally pulls silver higher. The bank projects a $45–53/oz range for 2025.

- Copper Supply Strain Widens: Teck Resources cut copper production forecasts through 2028, highlighting execution risks and operational setbacks amid surging electrification demand.

Crypto

- Bitcoin and Ethereum Rebound: Bitcoin held above $122,000, while Ethereum attracted $421 million in spot ETF inflows, underscoring sustained institutional demand.

- BNB Nears Record High: Binance Coin traded near $1,300, boosted by YZi Labs’ $1 billion builder fund to accelerate BNB Chain development.

- Solana Faces Activity Decline: Solana traded above $220 but saw declining on-chain activity, with DeFi TVL and active addresses dropping sharply.

- XRP Stays Range-Bound: XRP traded near $2.85 as open interest slid, signaling reduced retail participation and potential consolidation ahead.