North America News

U.S. Stocks Slip as NASDAQ Leads Declines; No New Record Closes

Major U.S. equity indices ended lower on Tuesday, with no fresh record highs. The NASDAQ led losses, falling 0.67% (-153.30 points) to 22,788.36, weighed down by weakness in large-cap tech stocks.

Oracle slid 2.52% amid concerns about rising chip costs tied to Nvidia, while Micron dropped 2.76%. Nvidia edged 0.29% lower. Bucking the trend, AMD gained another 3.83% to close at $211.51, notching a new record close above its prior peak of $211.38 after surging 23.71% the previous session.

Elsewhere, the Dow Jones Industrial Average lost 91.99 points (-0.20%) to 46,602.98, the S&P 500 fell 25.69 points (-0.30%) to 6,714.59, and the Russell 2000 underperformed with a 1.12% decline to 2,458.42.

Tech sector volatility and profit-taking after recent record runs kept sentiment cautious heading into midweek trading.

U.S. Treasury’s $58B 3-Year Note Auction Draws Strong Demand

The U.S. Treasury sold $58 billion of 3-year notes at a 3.576% high yield, slightly below the 3.584% when-issued level, showing solid investor demand.

- Tail: -0.8 bps (vs 6-month avg. +0.5 bps)

- Bid-to-cover: 2.66× (vs avg. 2.55×)

- Direct bidders: 26.58% (vs avg. 20.5%)

- Indirect bidders: 62.7% (vs avg. 64.1%)

- Dealers: 10.72% (vs avg. 15.4%)

Domestic demand was strong, particularly from direct bidders, while international participation was slightly below average. Analysts called the results “solid but not spectacular,” with the negative tail signaling buyers eager to participate.

NY Fed Survey: 1-Year Inflation Expectations Rise to 3.4%

The New York Fed’s latest consumer expectations survey showed one-year-ahead inflation expectations rising to 3.4% in September, up from 3.2% in August.

Three-year expectations were unchanged at 3%, while five-year expectations edged up to 3% from 2.9%.

Households reported mixed views — current personal finances improved, but outlooks for future finances declined. Expected household spending cooled, labor market expectations weakened, and food price expectations hit their highest level since March 2023.

Nvidia to Continue H-1B Visa Sponsorship, Cover Fees

Nvidia confirmed it will continue sponsoring H-1B visas for foreign workers and will cover associated fees — roughly $100,000 per employee per year, according to Business Insider.

The company said maintaining continuity among its international talent is vital to future innovation. Shares rose $0.51 (+0.27%) to $186.05, after setting a record close of $188.89 on October 2 and an intraday high of $191.05.

Atlanta Fed GDPNow Holds at 3.8% for Q3

The Atlanta Fed’s GDPNow model continues to project 3.8% real GDP growth (SAAR) for Q3 2025, unchanged from October 1.

Due to the U.S. government shutdown, the Fed said the next update — originally scheduled for October 9 — will be delayed until new data become available.

The latest estimate incorporates the October 3 ISM Non-Manufacturing report, after which the nowcast for private domestic investment growth slipped from 4.2% to 4.0%.

Carlyle Group Estimates U.S. Added Only 17,000 Jobs in September, Warns on Inflation

The Carlyle Group released its own internal estimate of U.S. job growth, projecting that employers added just 17,000 jobs in September. The investment firm, which employs 700,000 people globally, also issued a warning that inflation pressures remain broad-based.

“Inflation looks much more widespread than just durable goods subject to tariffs,” said Jason Thomas, Carlyle’s head of global research and investment management, in an interview with Bloomberg.

Carlyle’s internal data showed:

- GDP / Real Final Sales: 2.7% underlying growth

- Private Residential Construction: Down 2.5% year-over-year

- Corporate Spending: Up 4.8% on a three-month SAAR basis, led by tech and AI-related investments

- CPI Breakdown: Energy -3.8%, services ex-shelter +3.3%, durables +2.3%

Thomas noted that while payroll growth slowed sharply, business investment and tech spending remain resilient.

Fed’s Kashkari: Too Early to Judge Tariff-Driven Inflation Risks

Minneapolis Fed President Neel Kashkari said it’s “too soon to know” whether tariffs will make inflation sticky. He added that the economy is showing “some stagflation signals” but remains supported by strong labor markets.

Kashkari expressed skepticism about widespread AI-driven job losses but acknowledged that the nature of work is changing. He also warned that increased electricity and data center demand could lift prices and interest rates.

He said the Fed will continue to base decisions strictly on data, not politics, and cautioned that aggressive rate cuts could reignite inflation.

Trump, Carney Signal Optimism on Canada–U.S. Trade Talks

President Trump and Canadian Prime Minister Mark Carney met ahead of formal trade talks, with Trump saying he expects Canada will be “very happy on tariffs.”

Trump said discussions would cover trade and the Gaza conflict, adding that the U.S. has “made compromises with Canada, even on steel,” and wants “to make cars here.”

Carney responded that both nations “need agreements that work in areas where we compete.” Trump added that the new trade deal will be “comprehensive” and that the U.S. will “treat Canada fairly.”

Fed’s Bostic: AI Is Disruptive but Offers Opportunities

Atlanta Fed President Raphael Bostic said artificial intelligence is “disrupting and has the potential to be quite challenging” for the labor market, speaking at Fisk University in Nashville.

Bostic noted the Fed is exploring ways to retrain workers displaced by automation and acknowledged that “this is the hardest time to do my job due to structural changes.”

He said households and businesses are becoming more cautious, though he does not foresee an economic catastrophe. “Precautionary activity is a sign of stress for families,” Bostic said, adding that the current turbulence warrants vigilance but not panic.

Fed’s Miran: Inflation Cooling, Policy Should Remain Forward-Looking

Federal Reserve Governor Adriana Miran said first-half growth in 2025 was slower than expected but added that uncertainty has eased, giving reasons for optimism.

Miran emphasized the importance of forward-looking policy given long lags in monetary transmission. She described monetary policy as “restrictive,” but cautioned against over-tightening.

Key remarks:

- Neutral rate likely around 0.5%

- AI may be pushing up the neutral rate, though evidence remains unclear

- Average rent inflation expected to moderate

- Does not see tariffs as a major inflation driver

- Supports keeping the 2% inflation target intact

She reaffirmed the Fed’s independence and said U.S. government data remains the “gold standard,” stressing the importance of avoiding political interference.

Fed’s Daly: AI Investment Boom Not a Threat to Stability

San Francisco Fed President Mary Daly told Axios she doesn’t see evidence of widespread job displacement from artificial intelligence, calling the trend “a good bubble” that enhances productivity rather than threatening financial stability.

Daly argued that not all bubbles are harmful, adding that AI-related investment could support long-term growth. “The labor market is the best indicator of consumer spending, not asset prices,” she said, pointing out that companies are substituting technology for hiring as the economy cools.

She emphasized that AI-driven enthusiasm, unlike past speculative frenzies, is rooted in tangible productivity gains.

U.S. House Speaker Johnson Backs Backpay for Furloughed Workers

U.S. House Speaker Mike Johnson said he hopes furloughed federal workers will receive backpay once the government reopens.

President Trump echoed that view, saying he also supports compensating affected workers, though he acknowledged the issue remains uncertain amid the ongoing shutdown.

Trump added that “some furloughed workers may not return if the shutdown drags on,” suggesting potential longer-term disruptions.

Evercore Sees S&P 500 Reaching 9,000 by 2026, Raises “Bubble” Odds

Evercore ISI strategist Julian Emanuel raised his probability of a “bubble scenario” for U.S. equities to 30%, projecting the S&P 500 could climb to 9,000 by 2026. The firm’s base case remains a more moderate 7,750 target.

Emanuel said surging capital-market activity, including new leveraged buyouts, points to growing risk appetite reminiscent of late-cycle booms. He continues to favor AI-linked sectors as key drivers, while viewing health care as a tactical rotation opportunity as policy risks ease.

Evercore’s outlook reflects optimism about AI-driven growth and investor enthusiasm, though Emanuel warned that elevated valuations bring higher volatility risk heading into mid-decade.

Goldman Sachs Raises Nvidia Price Target to $210, Cites AI Strength

Goldman Sachs boosted its 12-month price target for Nvidia to $210 and reaffirmed its Buy rating, highlighting strong earnings momentum and expanding AI partnerships — including a tie-up with OpenAI.

The bank said Nvidia’s sweeping investments across the AI ecosystem reinforce its dominance as the sector’s leading infrastructure supplier.

Goldman noted some “circular revenue” from equity-linked deals with startups that also buy Nvidia hardware, but estimated this would account for less than 15% of 2027 revenue — too small to distort valuation multiples.

The firm said these alliances are strategically beneficial, strengthening Nvidia’s long-term growth outlook and ecosystem. The upgrade supports ongoing bullish sentiment across AI and semiconductor stocks.

Paul Tudor Jones: Expect Massive Rally Before Market Peak

Legendary hedge fund manager Paul Tudor Jones believes U.S. equities could see a “massive rally” before the current bull market tops out — a setup he compared to the 1999 tech bubble.

Speaking on CNBC, Jones said today’s unusual combination of a 6% federal deficit and a Federal Reserve easing cycle contrasts sharply with the late 1990s, when the U.S. ran a surplus and the Fed was tightening.

He warned that while this mix could push stocks sharply higher over the next year, the eventual peak may arrive suddenly and bring steep losses. Jones’s comments highlight concerns that loose fiscal and monetary policy may inflate asset prices before a sharp correction.

Morgan Stanley: U.S. Inflation Fears Ease, But Tariff Risks Linger

Morgan Stanley reports that inflation anxiety among U.S. consumers has fallen to its lowest level since early 2022. In its September survey, 56% of respondents cited inflation as their top concern, down from 60% in August and 63% a year earlier.

Consumer confidence in both the economy and personal finances improved modestly, with 36% expecting the economy to strengthen over the next year.

Still, the bank warned that tariffs and revived corporate pricing power could rekindle inflation pressures later in the year.

While reduced price anxiety supports spending and risk sentiment, Morgan Stanley cautioned that headline CPI could face renewed upward pressure if trade frictions intensify.

Tesla Shares Jump as Musk Teases Cheaper Model Y Reveal

Tesla stock surged 5.5% Monday after Elon Musk teased a possible new vehicle unveiling on October 7, sparking speculation that a lower-cost Model Y could be imminent.

Over the weekend, Musk posted a cryptic video featuring the date “10/7” and later shared an image of headlights in darkness, fueling investor excitement.

A budget-friendly Model Y has long been rumored as part of Tesla’s next growth phase. The current base Model 3 starts around $42,500, while the Cybertruck begins near $80,000. Analysts say a pared-down Y could reignite sales and interest amid mounting EV competition and an aging lineup.

While some investors see the cheaper Model Y as Tesla’s next key catalyst, others believe future growth will hinge more on the company’s AI and robotaxi ambitions than incremental vehicle launches.

Harvard’s Gopinath: Trump’s “Liberation Day” Tariffs Function as Domestic Tax

Harvard economist Gita Gopinath says the Trump administration’s “Liberation Day” tariffs have acted more like a domestic tax than a growth policy, calling the six-month results “negative overall.”

In her latest assessment, the former IMF chief economist said the tariffs have raised revenue for the U.S. government but at the expense of domestic firms — with higher costs passed to consumers. “The tariffs are effectively taxing American businesses and households,” she said.

According to Gopinath, the measures have nudged inflation up slightly, especially for appliances, furniture, and coffee, yet have failed to improve the trade balance or boost manufacturing.

Her critique echoes rising skepticism among economists over U.S. trade policy and may add to investor caution toward sectors exposed to higher input costs, reinforcing concerns about inflation persistence.

Fed’s Schmid: Inflation Still Too High, Price Pressures Spreading

Federal Reserve Governor Thomas Schmid said inflation remains uncomfortably high and warned that price increases are becoming more broadly distributed across sectors.

He described current monetary policy as “appropriately calibrated” but “only slightly restrictive,” adding that aggressively stimulating demand now could risk an “outsized increase” in prices.

Schmid said the Fed must maintain its inflation-fighting credibility while monitoring alternative labor and price data closely. The labor market, he noted, is cooling but remains healthy overall.

Other remarks included:

- Tariffs are expected to have only a muted inflation impact.

- The Fed’s balance sheet could end 2025 near $6 trillion.

- Current mortgage rates are 60–80 basis points lower than they would be without Fed MBS purchases.

- Businesses are slowing hiring to ride out current conditions.

- The U.S. dollar is likely to remain the world’s reserve currency “for a long, long time.”

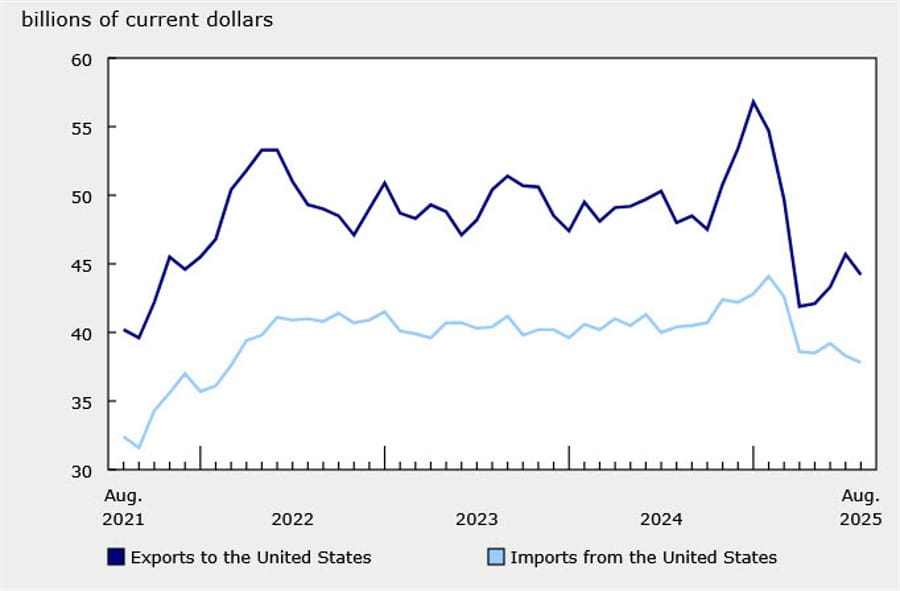

Canada’s August Trade Deficit Widens to C$6.32B as Exports Slide

Canada posted a larger-than-expected trade deficit in August, with the shortfall widening to C$6.32 billion, versus expectations for C$5.55 billion, according to Statistics Canada. July’s deficit was revised to C$3.82 billion from C$4.94 billion.

Exports dropped 3.0% to C$60.58 billion, while imports rose 0.9% to C$66.91 billion. Year-to-date, exports are up just 0.3% from a year earlier.

Gold was the key driver of the headline decline. Exports of unwrought gold, silver, and platinum group metals fell 11.8%, while imports in the same category jumped 24.2%. Exports of industrial machinery, equipment, and parts plunged 9.5%, and lumber exports collapsed 25.4% — the lowest since May 2020 — amid continued U.S. tariffs.

The loonie’s recent moves have been increasingly tied to gold prices, a trend reinforced by this report. In U.S.–Canada trade, exports in the first eight months of 2025 were 3.3% lower than the same period in 2024, while imports fell 0.5%, underscoring how little the trade war has altered the flow of goods so far.

Canada’s Ivey PMI Surges to 59.8, Crushing Expectations

Canada’s Ivey PMI jumped to 59.8 in September, far exceeding the 51.2 forecast and the prior month’s 50.1 reading. The sharp rise suggests stronger private-sector activity, though economists cautioned the index is volatile and not typically a major market mover.

Commodities News

Gold Nears $4,000 as Shutdown Fears, Rate-Cut Bets Fuel Rally

Gold prices surged to another record, briefly touching $3,991 per ounce before settling near $3,982, up 0.6% on the day. The rally was driven by mounting U.S. government shutdown fears, growing expectations of Federal Reserve rate cuts, and steady central bank demand.

Market anxiety deepened after the New York Fed’s consumer expectations survey showed higher inflation expectations and softer labor market confidence. Meanwhile, Fed officials struck cautious tones:

- Neel Kashkari said it’s too soon to determine whether tariff-related inflation will persist.

- Stephen Miran noted slower first-half growth and urged a forward-looking approach to policy.

Geopolitical tension — including the Russia–Ukraine conflict and political instability in France and Japan — added to safe-haven flows.

Goldman Sachs raised its 2026 gold forecast from $4,300 to $4,900, citing strong ETF inflows and persistent central bank buying. The People’s Bank of China increased its gold reserves for the 11th consecutive month in September.

Analysts say the mix of fiscal uncertainty, global instability, and monetary easing expectations continues to make gold the standout hedge in a turbulent macro environment.

Copper’s Rally Looks Overstretched — Commerzbank

Copper prices are approaching $10,800 per ton, the highest level since May 2024, but Commerzbank’s head of commodity research, Thu Lan Nguyen, warns the move may not be justified.

Nguyen drew parallels to last year’s rally, when fears over mine closures — notably in Panama — sent prices soaring before a sharp correction followed. “Production remained strong despite those concerns,” she noted, adding that similar speculative dynamics may be at play now.

Commerzbank remains cautious, saying this year’s rally could again prove unsustainable as fundamentals don’t support the current price levels.

Palladium Seen Reaching $1,350 by End-2026 — Commerzbank

Palladium prices have surged 44% year-to-date, though they continue to lag behind gold, silver, and platinum. Commerzbank’s Barbara Lambrecht said weaker auto demand — particularly for combustion engines — remains a drag, as the sector accounts for a large share of palladium use.

Earlier forecasts from the World Platinum Investment Council (WPIC) projected a supply surplus as early as 2025, but the group has now delayed that to 2028, citing slightly improved demand.

Commerzbank has raised its palladium forecast to $1,350 per ounce by end-2026, up from $1,300, though Lambrecht said upside potential remains limited.

China’s Gold Reserves Rise for 11th Straight Month

The People’s Bank of China boosted its gold holdings again in September, marking the 11th consecutive month of accumulation.

Reserves rose to $283.29 billion, up from $253.84 billion in August, with total holdings reaching 74.06 million fine troy ounces — up slightly from 74.02 million the prior month.

China now holds roughly 2,300 tonnes of gold, continuing its effort to diversify reserves away from the U.S. dollar. Analysts believe Beijing aims for about 5,000 tonnes, which would make it the world’s second-largest official holder after the United States.

Despite the buildup, gold still represents only around 7% of China’s total reserves, far below the ratios of the U.S. (78%), Germany (78%), or even Russia (37%). The steady accumulation underscores a global trend of central banks bolstering gold holdings amid currency and geopolitical uncertainty.

OPEC+ Takes a Small Step Toward Higher Output — Commerzbank

OPEC+ producers that had voluntarily cut supply opted to ease their restrictions again, adding 137,000 barrels per day of output this month — a smaller increase than many expected.

Thu Lan Nguyen of Commerzbank said the move “eased concerns” about a large production jump. Between April and September, OPEC output had already risen 1.7 million barrels per day.

Oil prices initially climbed on the news but later reversed as traders focused on the still-comfortable supply outlook.

Falling Temperatures Lift European Gas Prices — Commerzbank

European natural gas prices climbed sharply, with benchmark TTF futures nearing €33 per MWh, driven by forecasts for colder-than-usual weather next month, according to Commerzbank.

Thu Lan Nguyen noted that refilling of EU gas storage “has nearly stalled,” rising only from 82.5% to 82.75% last week — far slower than September’s average pace. In Germany, storage even dipped slightly from 76.7% to 76.3%.

Reduced flows from Norway due to maintenance and the prospect of higher heating demand have reignited supply worries heading into winter.

Gold Shines as Fiscal Risks Undermine Bond Havens — Commerzbank

Gold extended its rally toward $4,000 per ounce, outpacing traditional safe havens like government bonds. Commerzbank attributes the surge to mounting fiscal concerns across major economies, not simply the ongoing U.S. government shutdown.

Head of research Thu Lan Nguyen noted that political instability — including the resignations of prime ministers in France and Japan — has lifted risk premiums on government debt. Meanwhile, fiscal strains in the U.S. and U.K. are adding to investor unease.

Commerzbank raised its year-end gold forecast to $4,000, and $4,200 by end-2026 (from $3,600 and $3,800). Silver was also upgraded to $49 and $50, respectively. “With central banks reluctant to let their currencies strengthen, gold remains one of the few attractive safe havens,” Nguyen said.

European Gas Prices Jump 5% as Supply Fears Grow — ING

European gas prices spiked more than 5% to above €33/MWh, lifted by worsening supply risks and cold-weather forecasts, ING analysts Ewa Manthey and Warren Patterson reported.

The move follows intensified Russian strikes on Ukraine’s gas infrastructure and EU storage levels slipping below the five-year average. Storage now stands at 82.9%, down from 94.4% a year ago.

“Prices remain supported amid persistent supply concerns,” ING said, noting that colder weather will likely slow further injections as Europe braces for heating season.

Goldman Sachs Lifts 2026 Gold Target to $4,900

Goldman Sachs has raised its end-2026 gold price forecast to $4,900 per ounce from $4,300, citing sustained central bank buying, de-dollarisation, and geopolitical instability.

The bank expects central banks to keep purchasing roughly 80 tonnes of gold in 2025 and 70 tonnes in 2026, reinforcing long-term demand. Emerging market central banks, in particular, are seen diversifying reserves away from the dollar.

Goldman said most of the recent rally reflects structural accumulation rather than speculative trading, leaving room for further upside. The firm’s analysts see inflation risk, policy accommodation, and currency weakness as supportive of the higher target — and maintain that risks remain “skewed to the upside.”

Bank of America Warns Gold Rally May Be Nearing Its Peak

Bank of America analysts say gold’s powerful rally could soon stall as the metal approaches $4,000 an ounce, showing early signs of “uptrend exhaustion.”

Gold prices have soared nearly 50% this year, supported by President Trump’s tariff policy, his public clashes with the Federal Reserve, and aggressive central bank buying worldwide. Those factors have fuelled relentless demand for the metal as a hedge against policy and currency risk.

In a note to clients, BofA said the fourth quarter could bring a pause or mild correction after gold’s record-setting run, as momentum begins to fade despite continued geopolitical and monetary uncertainty.

Trump Reverses Biden-Era Block on Ambler Road — Mining Access to Proceed

The Trump administration has overturned a previous Biden-era decision and cleared the way for construction of the Ambler Road in Alaska — a 211-mile private industrial corridor linking the Dalton Highway to the Ambler Mining District.

The road, a key component of the Ambler Access Project, is designed to enable development and ore transport from the mineral-rich Ambler region. Access will be strictly controlled, limited to authorized commercial operators.

The Ambler Mineral Belt is known for significant deposits of copper, cobalt, and other critical minerals — resources seen as vital for both industrial and clean-energy supply chains.

Europe News

European Markets End Mixed Amid Light Trading

Major European indices finished Tuesday with modest moves and mixed direction.

| Index | Close | Change | % |

|---|---|---|---|

| Euro Stoxx 50 | 5,613.20 | -20.70 | -0.37% |

| DAX | 24,385.79 | +7.49 | +0.03% |

| CAC 40 | 7,974.86 | +3.07 | +0.04% |

| FTSE 100 | 9,483.59 | +4.44 | +0.05% |

| IBEX 35 | 15,527.01 | -29.70 | -0.19% |

| FTSE MIB | 43,070.94 | -75.18 | -0.17% |

Traders described the session as “muted,” with no major catalysts driving sentiment.

Germany’s Industrial Orders Fall Again in August

Germany’s manufacturing sector continues to struggle, with industrial orders down 0.8% month-over-month in August, well below expectations for a 1.1% rise, according to Destatis. July’s figure was revised slightly higher, from -2.9% to -2.7%.

Excluding large-scale contracts, new orders plunged 3.3%, highlighting weakness across core industries. The biggest drag came from the automotive sector, where orders dropped 6.4% from the prior month. The data marks yet another setback for German industry, adding to concerns about the country’s fragile recovery.

France’s Trade Deficit Narrows Slightly in August

France’s trade gap narrowed modestly in August to €5.53 billion, from a revised €5.74 billion in July, according to the Ministry of Finance. Exports fell 0.1%, while imports slipped 0.4%, leaving the overall balance largely unchanged.

Trade levels have stayed broadly stable over the past year, suggesting limited new momentum in external demand. Analysts say the latest figures are steady but unremarkable — “nothing exciting on this front.”

UK House Prices Slip in September — Halifax

UK house prices unexpectedly dipped in September, falling 0.3% month-on-month versus forecasts for a 0.2% gain, Halifax reported. The average price dropped to £298,184, though values remain 0.3% higher since the start of the year.

Quarterly prices rose 0.4%, and annual growth stood at 1.3%, suggesting overall stability despite the pullback. Halifax noted that the “slight monthly dip” reflects a broadly steady market, with affordability slowly improving and expectations for modest growth through year-end.

JPMorgan Turns Bullish on Eurozone Equities, Lifts Region to Overweight

JPMorgan has upgraded Eurozone stocks to “overweight,” saying improved valuations and a sentiment reset after a long stretch of stagnation make the region more attractive. “The time is coming to turn bullish,” strategist Mislav Matejka wrote, citing catalysts such as pending German fiscal stimulus.

Matejka noted that while markets in the U.S., China, and Japan hit new highs this year, Eurozone indices have lagged, consolidating for months and flushing out excessive optimism. This, he said, has created a healthier risk-reward profile.

The Euro Stoxx 50 still trails the S&P 500 by nearly 18% year-to-date, but JPMorgan keeps its 5,800 target intact. Matejka added that valuation gaps between the U.S. and international markets remain “extreme,” leaving room for a potential rotation into overseas equities even if U.S. markets face stagflation risk.

The bullish call could trigger renewed investment inflows into Eurozone assets, especially if German stimulus helps spark growth — and might encourage some investors to rotate away from pricier U.S. markets.

Asia-Pacific & World News

World Bank Raises China 2025 GDP Forecast to 4.8%

The World Bank upgraded its outlook for China’s economy, forecasting 4.8% GDP growth in 2025, up from its previous 4.0% estimate issued in April. Growth in 2026 is now expected at 4.2%, also above the earlier projection.

The revision reflects easing tensions in the U.S.–China trade conflict. Earlier this year, heightened tariffs under Trump’s “reciprocal” trade push had clouded the outlook. With both sides now signaling a truce, the World Bank sees less economic damage than previously feared.

Australia’s Consumer Confidence Falls for Second Straight Month

Australian consumer sentiment deteriorated again in October, with the Westpac-Melbourne Institute Consumer Confidence Index dropping 3.5% month-on-month to 92.1 — its lowest level in six months. That follows a 3.1% decline in September, keeping the index well below 100, the line separating optimism from pessimism.

Respondents reported increased concern over family finances and growing doubts about future rate cuts after the Reserve Bank of Australia skipped a reduction last week, citing stronger-than-expected inflation.

Expectations for the economy over the next year fell 2.5%, while the five-year outlook edged up 1.4%. Confidence had been recovering midyear as the RBA cut rates three times, but optimism has faded as policymakers signal a longer battle with price pressures.

ANZ-Indeed: Australian Job Ads Fall for Third Month

Australia’s job market continues to cool, with ANZ-Indeed data showing job ads fell 3.3% in September — the largest monthly drop since February — and are now 4.3% lower than a year earlier.

It marks the third straight monthly decline, reinforcing evidence that labor demand is softening as growth slows and firms adjust to higher borrowing costs.

Economists say the trend supports an easier monetary stance from the RBA later this year, though rising price pressures complicate the outlook. If job postings continue to decline, markets may start pricing in potential rate cuts in 2025 as employment growth weakens further.

ING: RBNZ to Deliver October Rate Cut, Markets Too Dovish on Further Easing

ING Bank expects the Reserve Bank of New Zealand to lower rates by 25 basis points at its October 8 policy meeting, in line with consensus. However, the bank cautioned that markets are moving too quickly by pricing in two additional cuts without confirmation from upcoming Q3 inflation data.

ING analysts said while domestic demand and labor conditions have softened, the RBNZ is unlikely to commit to an extended easing cycle before seeing clear evidence that inflation is sustainably declining.

The bank added that with markets already heavily positioned for rate cuts, the New Zealand dollar’s downside appears limited in the near term. The NZD could stabilize toward year-end if inflation stays sticky or global risk sentiment improves.

New Zealand Q3 Business Confidence Slips; NZIER Sees Two More RBNZ Cuts

New Zealand business confidence fell in the September quarter, with NZIER’s Quarterly Survey of Business Opinion showing a net 18% of firms optimistic, down from 22% previously. Capacity utilization also eased slightly to 89.1%.

A net 15% of companies expect better conditions ahead, but actual activity weakened — 14% reported lower trading. Hiring and investment intentions dropped sharply: 23% cut staff, 13% plan to reduce machinery spending, and 20% expect to scale back building investment.

Weak demand remains the top concern, cited by 63% of firms, while labor shortages have eased, signaling slack in the job market. Manufacturing confidence was the weakest due to falling export demand and profits. Construction stayed cautious, while retail and services sectors showed relatively stronger optimism, hoping lower rates will lift demand in 2025.

Inflation pressures ticked up, with 11% of firms raising prices after a quarter of declines. NZIER expects CPI to stay slightly above 3% before easing toward 2%, forecasting two more 25-basis-point rate cuts from the RBNZ in October and November.

BOJ Rate Hike Now Expected in December — Société Générale

Société Générale has shifted its forecast for the next Bank of Japan rate hike from October to December, citing political and fiscal developments following the ruling LDP leadership election. The result saw fiscal dove Sanae Takaichi secure victory, which the bank says will likely lead to a more expansionary fiscal stance compared to rival Shigeru Ishiba’s administration.

Although Takaichi has dropped her proposal to cut the consumption tax, her broader policies point toward continued fiscal stimulus. Combined with U.S. government shutdown risks, these factors have led the firm to delay its BOJ rate call.

SocGen still sees potential for three policymakers to dissent in favor of a hike in October, but maintains that rising wages and sustained inflation will justify a move later this year. The bank’s base case now targets December, though it notes the decision could slip to January if global risk sentiment worsens.

Deutsche Bank: Japan’s New PM Takaichi’s Fiscal Push to Delay BoJ Tightening

Deutsche Bank expects Japan’s next rate hike to be postponed until January 2026, citing aggressive fiscal stimulus under new Prime Minister Sanae Takaichi.

Japan economist Ken Koyama said Takaichi’s pro-growth stance — heavy on spending — is creating what he called a “high-pressure economy” in an environment already defined by labor shortages, persistent inflation, and a weakened yen.

The bank now projects:

- A first BoJ rate hike in January 2026

- Follow-ups in July 2026 and January 2027

- Policy rate reaching 1.25% by early 2027

Market expectations have shifted sharply. Before the leadership change, traders saw a 58% chance of an October 2025 hike; that probability has since dropped to 23% as investors brace for prolonged accommodation.

Japan Finance Minister Kato Vows to Watch for Excess FX Volatility

Japan’s new finance minister, Shunichi Kato, said the government will closely monitor currency markets for “excessive fluctuations or disorderly movements,” following the yen’s sharp decline after the weekend’s leadership election.

The comment signals Tokyo’s readiness to intervene if volatility escalates, though officials have so far limited themselves to verbal warnings.

Japan’s Household Spending Jumps in August

Japanese household consumption picked up in August, with spending up 2.3% year-on-year — nearly double expectations of a 1.2% gain and well above July’s 1.4% increase. On a monthly basis, spending rose 0.6%, beating forecasts of just 0.1%.

The stronger data suggest Japan’s consumer sector is showing resilience, providing modest support to growth despite persistent inflation and a weak yen.

Crypto Market Pulse

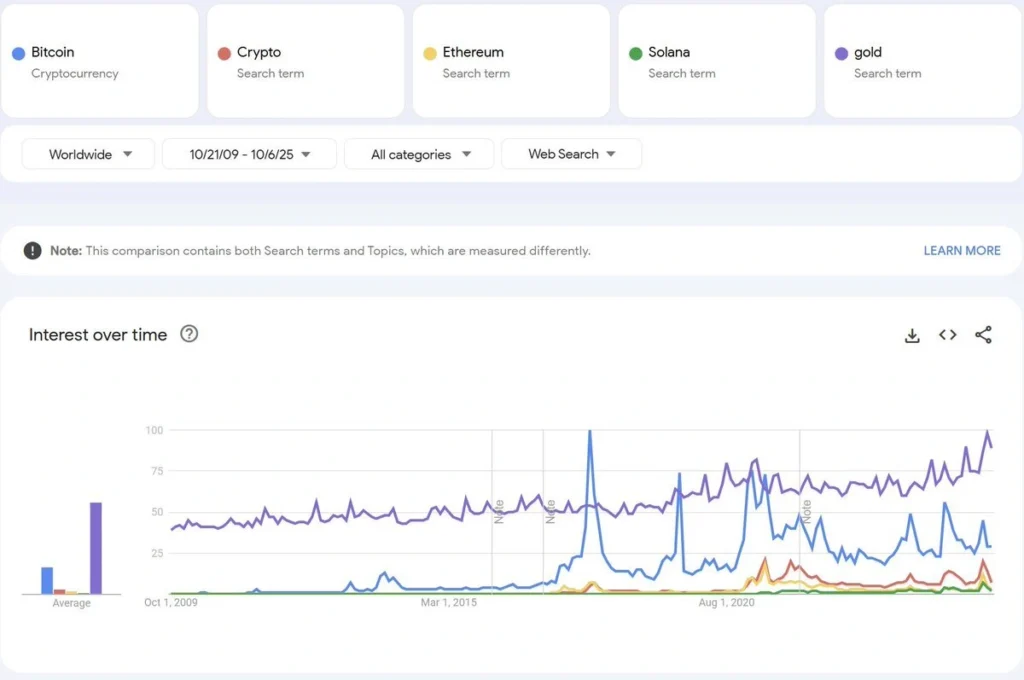

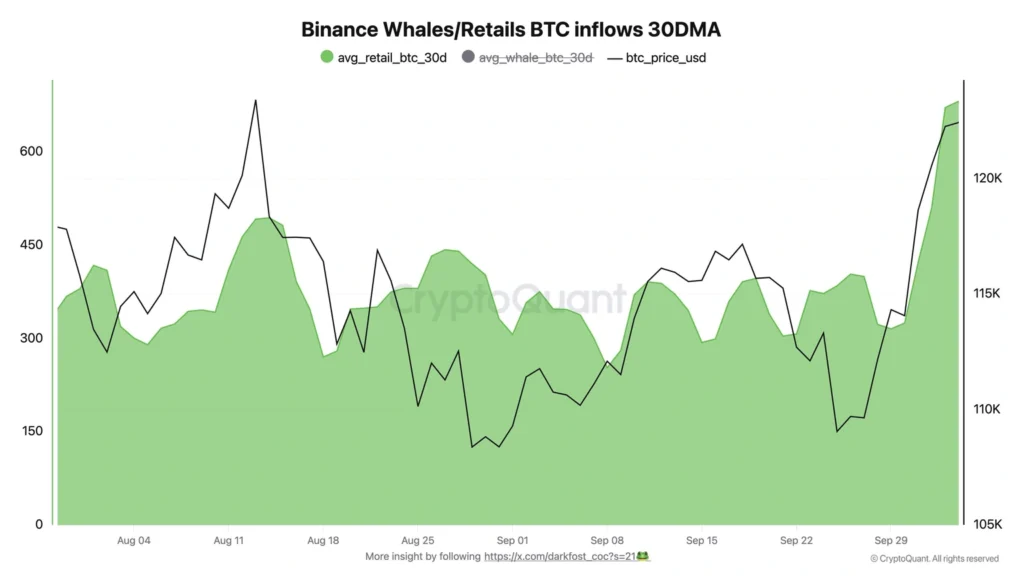

Retail Investors Missing from Bitcoin’s Record Rally

Bitcoin has surged past $126,000, pushing total crypto market capitalization above $4.2 trillion — yet retail investors remain largely absent.

Retail money shifts to gold and silver

Google Trends data show search interest in gold at its highest since 2009, while crypto-related searches remain flat. Gold hit a new all-time high above $3,950, and silver topped $48, nearing its 2011 record. Retail investors appear more focused on safe-haven metals than digital assets.

Analysts see institutional “stealth rally”

Analyst Panama calls Bitcoin’s current move a “stealth mode rally,” driven by institutions and sovereigns quietly accumulating BTC. Others, like Shanaka Anslem Perera, predict that when retail returns, they’ll buy from ETFs and funds such as BlackRock — not miners — since most supply will already be institutionally held.

Signs of retail comeback emerging

Recent weekend volatility suggests small traders are re-entering. Former exchange head Dave Weisberger noted Bitcoin has been surging on weekends when institutional desks are quiet.

Data from Darkfost on X also shows rising BTC inflows from wallets under 1 BTC on Binance, a sign of renewed small-scale buying.

In short, Bitcoin’s record-breaking rally appears institutionally led — but history suggests retail investors will return, potentially setting off the next explosive phase of the bull market.

Bitcoin Near Record Highs on Fiscal Turmoil, ETF Inflows

Bitcoin climbed to an all-time high of $126,100 before easing to $124,000, supported by fiscal instability across major economies and surging ETF inflows.

The total crypto market cap hit $4.32 trillion, topping its September peak. Spot Bitcoin ETFs drew $1 billion in new inflows — the second-largest ever — bringing cumulative inflows to $61.5 billion since launch.

Political upheaval in the U.S., Japan, and France has weakened fiat currencies, fueling demand for store-of-value assets like Bitcoin, gold, and silver. The yen and euro both fell sharply as fiscal doves gained power and France’s prime minister resigned.

Technically, BTC remains bullish above $123K, with targets at $132K, $138K, and $150K, though overbought RSI readings suggest short-term consolidation.

BNB Hits Record $1,280 as Blockchain Activity Soars

BNB, the native token of Binance’s BNB Chain, hit a record $1,280, rising more than 5% in 24 hours as blockchain usage surged to new highs.

The rally followed reports of 58 million monthly active addresses, surpassing Solana’s 38.3 million, according to TokenTerminal. The spike was driven by activity around the new decentralized exchange Aster, which saw total value locked jump over 500% to $2.4 billion, per DeFiLlama.

BNB Chain also announced a partnership with Chainlink to bring U.S. economic data on-chain. Trading volumes exceeded daily averages, underscoring institutional demand. The move comes amid broader crypto market strength fueled by expectations of Fed rate cuts and a weaker dollar.

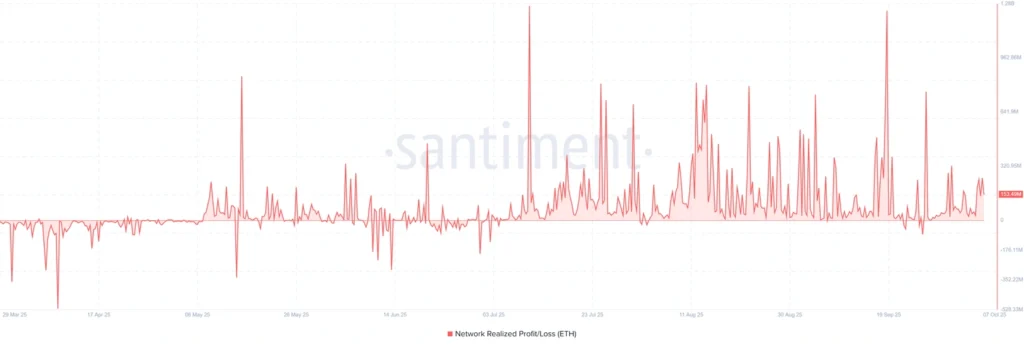

Ethereum Slips 4% on Profit-Taking, Institutional Demand Remains Strong

Ethereum (ETH) fell 4% on Tuesday to around $4,480, as mild profit-taking followed last week’s rally despite continued accumulation from institutional and corporate investors.

ETH briefly hit a three-week high of $4,755 before retreating in early Asia trading. Profit-taking has remained subdued compared to prior rallies — a sign, analysts say, that traders expect the bullish trend to resume.

Institutional flows remain robust. Ethereum investment products attracted $1.48 billion in net inflows last week, lifting 2025 totals to $13.7 billion, nearly triple last year’s figure, according to CoinShares. U.S. spot ETH ETFs accounted for $1.3 billion of that total.

On Monday alone, ETH products recorded $181.7 million in inflows, per SoSoValue. Grayscale became the first ETF issuer to enable staking, adding 32,000 ETH within 24 hours, while BitMine Immersion Technologies (BMNR) purchased $800 million worth of ETH for its treasury. Combined ETF and treasury holdings now total 12.49 million ETH, or roughly 10.3% of circulating supply, StrategicETHReserve data show.

In derivatives, ETH open interest ticked up to 13.71 million ETH, still well below July’s record of 15.33 million ETH, while Bitcoin’s open interest hit new highs — suggesting some capital rotation toward BTC.

Technical analysts warn ETH could test $4,100 if bulls fail to defend the 50-day moving average, though institutional accumulation continues to support long-term strength.

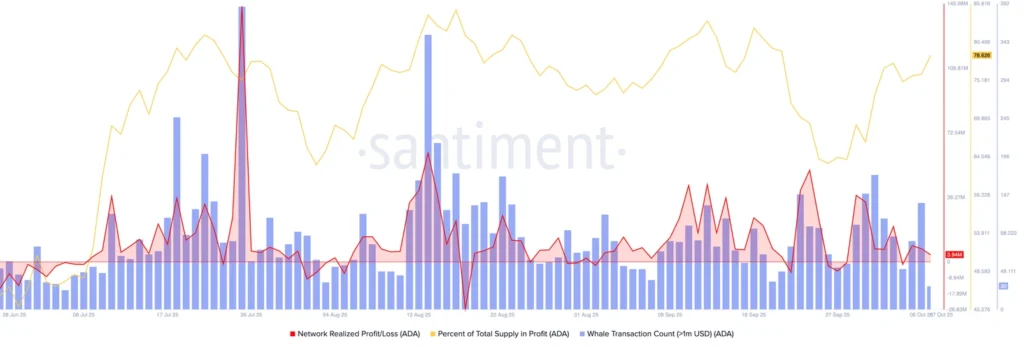

Cardano (ADA) Eyes More Upside as Selling Pressure Fades

Cardano is consolidating within a symmetrical triangle pattern on the daily chart, slipping 1% Tuesday after a 4% gain the prior day. On-chain data suggests sellers are easing off as more holders move into profit.

Santiment data shows profit-taking peaked at 51.57 million ADA on September 24 and has since declined, while the share of supply in profit rose to 78.62% from 69.21%.

Open Interest in Cardano futures rose 5% to $1.72 billion, according to CoinGlass, signaling renewed retail participation. The setup points to potential breakout conditions as optimism builds across crypto markets.

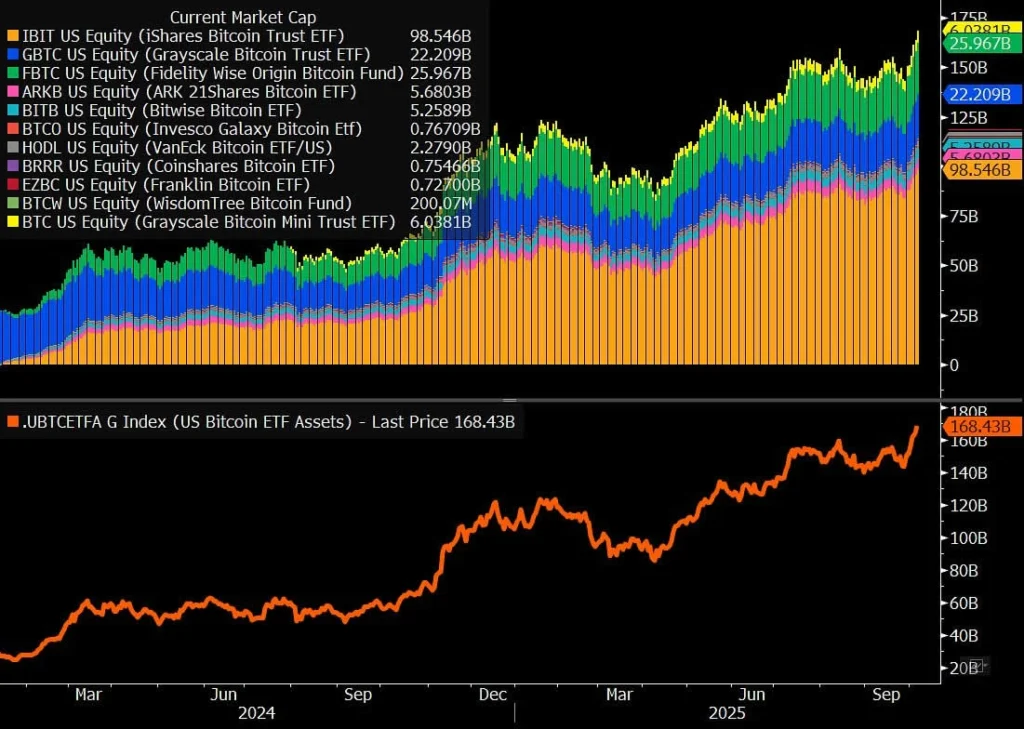

U.S. Bitcoin ETFs Post Second-Highest Inflows Ever

Spot Bitcoin ETFs in the U.S. logged $1.18 billion in inflows Monday — their second-largest day since launch — as Bitcoin reached a new record high.

October’s total has already hit $3.47 billion in just four trading days, per CoinGlass. Since January 2024, cumulative inflows have topped $60 billion, Bloomberg’s James Seyffart noted.

BlackRock’s iShares Bitcoin Trust (IBIT) dominated with $967 million of inflows, followed by Fidelity’s FBTC with $112 million, and Bitwise’s BITB with $60 million.

IBIT’s assets under management are nearing $100 billion, holding 783,767 BTC, making it one of the fastest ETFs in history to reach that milestone — fewer than 450 days compared to over 2,000 for Vanguard’s S&P 500 ETF.

The Day’s Takeaway

U.S. Stocks Slip as NASDAQ Leads Declines; No New Record Closes

Major U.S. equity indices ended lower Tuesday, with no fresh record highs. The NASDAQ led losses, falling 0.67% (-153.30 points) to 22,788.36, pressured by weakness in large-cap tech.

Oracle slid 2.52% on rising chip cost concerns tied to Nvidia, while Micron dropped 2.76% and Nvidia eased 0.29%. AMD extended gains another 3.83% to $211.51, closing at a record high above its previous $211.38 peak after Monday’s 23.7% surge.

Elsewhere, the Dow Jones lost 0.20% to 46,602.98, the S&P 500 fell 0.30% to 6,714.59, and the Russell 2000 declined 1.12% to 2,458.42.

Tech sector volatility and mild profit-taking kept sentiment cautious ahead of midweek trading.

Canada’s August Trade Deficit Widens to C$6.32B as Exports Slide

Canada’s trade deficit widened to C$6.32 billion in August, exceeding forecasts for C$5.55 billion, according to Statistics Canada. July’s gap was revised to C$3.82 billion from C$4.94 billion.

Exports dropped 3.0% to C$60.58 billion, while imports rose 0.9% to C$66.91 billion.

Gold exports fell 11.8%, while imports in the same category jumped 24.2%. Industrial machinery exports slid 9.5%, and lumber exports plunged 25.4% — the weakest since May 2020 amid persistent U.S. tariffs.

Year-to-date exports are up just 0.3%, while U.S.–Canada trade flows remain largely unchanged from 2024.

Carlyle Group Estimates U.S. Added Only 17,000 Jobs in September

The Carlyle Group projected U.S. payrolls increased by just 17,000 in September, warning of broad inflation pressures.

Carlyle’s Jason Thomas said inflation remains “widespread beyond tariffed goods.”

Key internal data:

- Real Final Sales: +2.7%

- Residential Construction: -2.5% y/y

- Corporate Spending: +4.8% (SAAR, led by tech & AI)

- CPI: Energy -3.8%, Services ex-shelter +3.3%, Durables +2.3%

Canada’s Ivey PMI Surges to 59.8, Crushing Forecasts

Canada’s Ivey PMI jumped to 59.8 in September, sharply above the 51.2 forecast and 50.1 prior.

The rebound points to stronger private-sector momentum, though economists note the index’s high volatility.

U.S. House Speaker Johnson Supports Backpay for Furloughed Workers

House Speaker Mike Johnson said he hopes furloughed federal workers receive backpay once the government reopens.

President Trump voiced similar support but warned some furloughed staff “may not return” if the shutdown drags on.

Fed’s Bostic: AI Disruptive but Manageable

Atlanta Fed President Raphael Bostic said AI is “disrupting and has the potential to be quite challenging,” but offers opportunity.

He noted the Fed is exploring worker retraining and described the current environment as “the hardest time to do my job due to structural changes.”

Bostic said households and businesses are cautious but stressed that “no catastrophe is on the horizon.”

Fed’s Miran: Growth Slowed, Inflation Cooling

Fed Governor Adriana Miran said first-half 2025 growth was weaker than expected, though uncertainty has eased.

She emphasized a forward-looking approach and said:

- Neutral rate likely near 0.5%

- Rent inflation expected to moderate

- Tariffs not a major inflation driver

- Inflation target should remain at 2%

Miran reaffirmed Fed independence and called U.S. data the “gold standard.”

NY Fed Survey: 1-Year Inflation Expectations Rise to 3.4%

The NY Fed’s September survey showed 1-year inflation expectations up to 3.4% (from 3.2%), 3-year steady at 3%, and 5-year up to 3% (from 2.9%).

Households reported improved current finances but weaker future expectations. Food price expectations hit their highest since March 2023.

Atlanta Fed GDPNow Holds at 3.8% for Q3

The Atlanta Fed kept its Q3 GDPNow growth estimate at 3.8% (SAAR).

Due to the government shutdown, the next update will be delayed until further data is available.

The latest nowcast incorporated ISM non-manufacturing data, showing a slight dip in private investment growth from 4.2% to 4.0%.

Fed’s Kashkari: Too Early to Gauge Tariff-Driven Inflation

Minneapolis Fed President Neel Kashkari said it’s “too soon to know” if tariffs will make inflation sticky.

He cited “some stagflation signals” but highlighted labor market strength.

Kashkari said AI will change the nature of work, not eliminate jobs, and warned that aggressive rate cuts could risk a burst of inflation.

European Markets End Mixed

Major European indices closed mixed after a quiet session:

- Euro Stoxx 50: 5,613.20 (-0.37%)

- DAX: 24,385.79 (+0.03%)

- CAC 40: 7,974.86 (+0.04%)

- FTSE 100: 9,483.59 (+0.05%)

- IBEX 35: 15,527.01 (-0.19%)

- FTSE MIB: 43,070.94 (-0.17%)

Traders cited muted sentiment with no major catalysts.

Trump, Carney Express Optimism on U.S.–Canada Trade Talks

President Trump and Canadian PM Mark Carney met ahead of trade talks.

Trump said Canada will be “very happy on tariffs” and noted progress on steel and auto discussions.

Carney said both sides “need agreements that work where we compete.”

Trump added the deal would be “comprehensive” and “fair.”

Nvidia to Continue H-1B Visa Sponsorship

Nvidia confirmed it will continue sponsoring H-1B visas and covering associated fees, estimated at $100,000 per employee per year.

The firm said international talent is critical to its innovation pipeline.

Shares rose 0.27% to $186.05, just below the record close of $188.89 set October 2.

U.S. Treasury’s $58B 3-Year Note Auction Sees Solid Demand

The U.S. Treasury sold $58B of 3-year notes at a 3.576% high yield (vs WI 3.584%), indicating strong demand.

- Tail: -0.8 bps (vs 6-mo avg +0.5 bps)

- Bid-to-cover: 2.66× (vs avg 2.55×)

- Direct bidders: 26.6% (↑ vs avg 20.5%)

- Indirect: 62.7% (slightly below avg 64.1%)

- Dealers: 10.7% (below avg 15.4%)

Analysts called it a “solid” auction, with strong domestic participation and mild international pullback.

Retail Investors Missing from Bitcoin’s Record Rally

Bitcoin surged past $126,000, lifting total crypto market cap above $4.2T, but retail investors remain largely absent.

Retail capital shifts to gold and silver:

Search trends show gold interest at its highest since 2009, while crypto searches stay flat. Gold hit a record $3,950, silver topped $48, nearing its 2011 peak.

Institutional accumulation driving rally:

Analysts say BTC is in “stealth mode,” with institutions and nations quietly accumulating. When retail returns, they’ll likely buy from ETFs and funds like BlackRock.

Early signs of retail comeback:

Weekend volatility and small-wallet BTC inflows on Binance hint at renewed activity. Analysts see this as the potential spark for the next retail-driven leg higher.

Gold Nears $4,000 as Shutdown Fears, Rate-Cut Bets Fuel Rally

Gold rallied to a new record, briefly touching $3,991 before closing near $3,982, up 0.6%.

Safe-haven demand rose amid U.S. shutdown uncertainty, Fed rate-cut bets, and geopolitical risks.

Goldman Sachs lifted its 2026 target to $4,900, citing ETF inflows and sustained PBoC gold buying for the 11th straight month.

Fed comments remained cautious — Kashkari flagged tariff uncertainty, while Miran emphasized a patient, data-driven approach.

Analysts say gold remains the preferred hedge amid global instability and dovish policy signals.

Ethereum Slips 4% on Profit-Taking; Institutional Demand Strong

Ethereum (ETH) fell 4% to $4,480 after touching $4,755, as mild profit-taking followed last week’s rally.

Despite the dip, institutional accumulation remains strong. ETH investment products drew $1.48B in inflows last week, lifting 2025 totals to $13.7B — nearly triple 2024’s full-year figure.

Grayscale enabled staking for its ETH ETF, pledging 32,000 ETH, while BitMine Immersion Technologies added $800M in ETH to its treasury.

ETH open interest edged up to 13.71M ETH, still below July’s record 15.33M, while BTC’s OI hit new highs — suggesting rotation toward Bitcoin.

Analysts warn ETH could test $4,100 if bulls fail to defend the 50-day SMA, but long-term institutional support remains intact.