North America News

U.S. Stocks Close at Record Highs as Russell 2000 Leads

Wall Street finished Thursday with fresh record closes for the S&P 500, Nasdaq Composite, and Dow Jones Industrial Average, while small caps outperformed.

Index performance:

- S&P 500: +0.1%

- Nasdaq Composite: +0.4%

- Dow Jones Industrial Average: +0.2%

- Russell 2000: +0.6%

With the U.S. government shutdown delaying key economic releases, traders leaned on private data. Challenger reported 54,064 job cuts in September, down from August but still putting 2025 layoffs at 946,426 YTD — the highest since 2020.

Fed speakers struck a cautious tone:

- Dallas Fed’s Logan: inflation still trending higher; warned against cutting rates too quickly.

- Chicago Fed’s Goolsbee: shutdown complicates data flow but said real-time indicators show steady unemployment.

Bond market: Yields slipped across the curve.

- 2-year: 3.542% (-0.2 bps)

- 5-year: 3.673% (-0.7 bps)

- 10-year: 4.086% (-1.9 bps)

- 30-year: 4.692% (-2.2 bps)

Markets continue to price a 99% chance of an October rate cut, with December also nearly locked in.

Tesla Q3 Deliveries Smash Expectations

Tesla delivered 497,099 vehicles in Q3 2025, well above analyst consensus of 444,000 and ahead of the 481,000 “whisper number.” Production reached 447,450 vehicles.

Breakdown:

- Model 3/Y: 435,826 produced, 481,166 delivered

- Other models: 11,624 produced, 15,933 delivered

Tesla also deployed a record 12.5 GWh of energy storage.

While Q3 benefited from the now-expired U.S. $7,500 EV tax credit, analysts warn Q4 will be the real demand test. Through three quarters, sales are down 5.86% y/y, and beating last year’s Q4 total of 495,570 will be tough.

U.S. Data Releases Frozen by Shutdown

The U.S. shutdown is delaying the release of key reports. Initial jobless claims, factory orders, and durable goods updates are all on hold, leaving markets without fresh government data.

Charts for jobless claims will remain static until operations resume.

U.S. Challenger Layoffs Eased in September but Remain Elevated

U.S. employers announced 54,064 job cuts in September, well below August’s 85,979, according to Challenger, Gray & Christmas.

Year-to-date layoffs stand at 946,426 — the highest since 2020, 55% above last year’s pace and already 24% higher than the full-year total for 2024.

Government sector cuts dominate, with 299,755 layoffs tied largely to DOGE-related impacts. The trend suggests labor conditions continue to weaken despite the monthly reprieve.

U.S. 30-Year Mortgage Rate Climbs to 6.34%

Freddie Mac reported that the average 30-year fixed mortgage rate rose to 6.34%, up from 6.30% the prior week.

The move mirrors the rebound in U.S. Treasury yields. The 10-year yield, which bottomed at 3.992% on September 17, has since rebounded to 4.101%, peaking at 4.187% this week.

Fed’s Goolsbee: Shutdown Means Decisions Without Official Data

Chicago Fed President Austan Goolsbee said the Fed must rely on real-time indicators as the U.S. government shutdown delays key releases.

- He noted unemployment appears steady in private-sector data.

- The shutdown’s immediate impact is delayed paychecks for federal workers.

- Goolsbee added he hopes the disruption ends quickly.

Fed’s Logan: Go Slow on Rate Cuts

Dallas Fed President Lorie Logan cautioned against moving too quickly with rate cuts, noting inflation is still above target and edging higher.

Key points:

- The recent cut was meant as insurance against a steep labor market downturn.

- Demand remains resilient, while payroll growth is cooling but steady.

- Risks exist on both sides of the Fed’s mandate.

Logan stressed the Fed must avoid cutting too aggressively, only to reverse course later.

U.S. Treasury’s Bessent Warns Shutdown Could Hit Growth

Treasury Secretary Scott Bessent told CNBC the government shutdown risks dragging on GDP, while outlining broader economic and policy updates:

- Democrats pushing more inflationary spending, he argued.

- Administration won’t reverse tax-cut-driven spending reductions.

- First round of Fed chair interviews nearly complete; Trump will get 3–5 candidates soon.

- Current China trade truce expires November 10, with the next round of talks expected to show “a big breakthrough.”

Fed’s Goolsbee Sounds Alarm on Inflation

Chicago Fed President Austan Goolsbee, typically one of the central bank’s dovish voices, warned he is growing uneasy about inflation trends.

He said relying on inflation being “transitory” is risky, adding that tariff effects could prove more persistent than hoped. While the economy is strong enough to justify rate cuts over time, Goolsbee urged caution.

Goldman: Wealth Effect Now Boosting U.S. Spending

Goldman Sachs analysts say U.S. consumption is once again being supported by wealth effects.

In Q2, declines in housing and equities cut consumption by about 0.2 percentage points. But in Q3, rising asset values are expected to add 0.3pp, driven mainly by high-income households.

Looking ahead, Goldman projects gains in home and stock prices could continue adding around 0.2pp to quarterly consumption growth over the next year, provided prices track nominal GDP.

Deutsche Bank: Shutdowns Are Market Noise

Deutsche Bank says history suggests investors shouldn’t panic over U.S. government shutdowns.

The S&P 500 has risen during each of the last six shutdowns, including the record-long one in 2018–19. Meanwhile, 10-year Treasury yields fell in five of those six episodes as investors sought safety.

The bank argues shutdowns are usually more political drama than lasting market or economic damage.

Tesla’s Sales Slump Shows Signs of Stabilizing

Tesla is expected to report deliveries of about 439,600 vehicles in Q3 2025 — a 5% year-on-year drop but a clear improvement on the steeper 13% decline in the first half.

U.S. demand got a temporary lift from an expiring $7,500 EV tax credit, but the company still faces headwinds from an aging lineup, weaker policy support, and political controversy around Elon Musk.

Wall Street sees the Q3 numbers as pivotal. Tesla has tried to shift attention toward its robotaxi push, AI projects, and Musk’s $1 trillion compensation proposal.

Shares jumped 33% in September, their best month of 2025. But challenges remain: falling sales in China, sharp declines in Europe, and margin pressure from heavy discounting.

UBS: U.S. Shutdown Overblown, S&P 500 Seen at 6,800

UBS is urging investors not to overreact to U.S. government shutdown risks. The bank said shutdowns typically shave about 0.1 percentage points off GDP per week but rebound once the government reopens.

UBS expects another 75bps of Fed cuts over the next three meetings and sees solid corporate earnings and AI spending as key growth drivers.

- Equities: S&P 500 to 6,800 by June 2026, with a bull case of 7,500.

- Gold: $3,900/oz by mid-2026 as a hedge against shocks.

- Currencies: USD weakness expected over 6–12 months, with EUR and AUD favored.

Shutdown noise, UBS says, is not the real story. Rate cuts and earnings are.

Bank of Canada: Core Inflation Measures Still a Mess

Deputy Governor Rhys Mendes said Canada’s core inflation gauges remain confusing for markets, despite being designed to smooth out noise.

- CPI-trim: strips top and bottom 20% of price changes.

- CPI-median: selects the midpoint change across items.

- CPI-common: identifies broad-based trends (sidelined during pandemic).

In August:

- Headline inflation: 1.9% y/y

- Preferred core measures: ~3%

- Alternative core measures: ~2.5%

Mendes concluded that true underlying inflation is likely closer to 2.5%, above headline but below the official core signals.

Commodities News

Gold Slips as Dollar Recovers, Logan’s Hawkish Tone Weighs

Gold pulled back on Thursday as the U.S. dollar firmed following hawkish remarks from Dallas Fed President Lorie Logan. At the session low, bullion briefly dipped under $3,820, and last traded at $3,844 (-0.5%).

Logan said inflation is running above target and trending higher, urging caution on rate cuts. Still, with markets pricing a 99% probability of a 25 bp cut at the October 29 FOMC, gold retains underlying support.

Meanwhile, the U.S. government shutdown is delaying BLS releases, though September nonfarm payrolls data may still be published as collection was completed before the shutdown.

On labor trends, Challenger reported job cuts fell to 54,064 in September from 85,979 in August, though executives flagged a stagnating jobs market, higher costs, and disruptive new technologies as ongoing headwinds.

Ahead, traders will watch Friday’s ISM services PMI as one of the few major releases not disrupted by the shutdown.

WTI Crude Hits Four-Month Low on OPEC+ Supply Worries

West Texas Intermediate (WTI) crude extended losses for a fifth straight day, tumbling over 2% to trade near $60.33, the lowest since late May.

The slide follows last week’s brief peak at $66.19, which marked the highest since early August.

Bearish pressure is mounting on expectations that OPEC+ may approve further production increases at its next meeting. Reports that Saudi Arabia could lift output to protect market share further weighed on sentiment.

Technical outlook: WTI has broken below key support, with momentum indicators signaling potential for additional downside unless OPEC+ offers signs of restraint.

Copper Supply Hit by Major Production Outages

Copper supply concerns deepened after new disruptions at top producers, Commerzbank noted.

- Indonesia’s Grasberg mine remains offline, removing a potential 66,000 tons per month from global supply.

- Chile’s El Teniente mine, the world’s tenth-largest, saw output plunge nearly 10% in August (-47,000 tons y/y). Operations are resuming slowly but not yet at full scale.

The setbacks come as global demand remains steady, tightening market balances.

Gold Pushes Higher as Bears Struggle for a Catalyst

Gold extended its rally to fresh record highs this week, supported by falling real yields and a lack of downside triggers.

The weak U.S. ADP jobs report didn’t spark fresh buying, while ISM manufacturing data showed firm employment and softer price pressures. With the U.S. government shutdown blocking key releases like jobless claims and NFP, markets are drifting higher in inertia.

Technical picture:

- Daily: Buyers still in control; a break lower could target 3,120, but that would likely need strong U.S. data.

- 4-Hour: Momentum trendline intact; dips toward the line offer buying opportunities, while a breakdown opens 3,717.

- 1-Hour: Short-term trendline supports further highs; sellers eye a pullback toward 3,790 if broken.

The long-term uptrend remains intact, but short-term corrections are possible if U.S. data forces a hawkish Fed repricing.

G7 Vows Tougher Sanctions on Russia

The G7 pledged to tighten economic pressure on Moscow, vowing to cut remaining Russian imports and target countries helping finance the Kremlin’s war.

The group said it would expand trade measures such as tariffs, bans, and restrictions to shrink Russian revenues, including hydrocarbon imports.

It also warned of possible penalties on third parties enabling Russia’s financial lifelines. Officials said the move reflects renewed determination to close sanctions loopholes as the war grinds on.

Trump Eyes Cuts to Western Hydrogen Hubs

President Trump is considering cancelling federally funded hydrogen hubs in the western U.S., Bloomberg reported.

The hubs — part of a $7 billion program launched in 2021 under the Bipartisan Infrastructure Law — are designed to scale up low-carbon hydrogen production. Western projects include:

- ARCHES (California): renewable hydrogen for transport and industry.

- Western Interstate Hub (Wyoming, Colorado, New Mexico, Utah): focused on “blue hydrogen” from natural gas with carbon capture.

Trump is expected to argue the hubs are wasteful Biden-era spending, even though they are central to U.S. decarbonisation efforts.

Goldman Sachs Calls Gold Its Top Trade

Goldman Sachs reaffirmed its bullish call on gold, calling it the bank’s “favorite long commodity.”

Gold has surged 14% since late August, breaking out of its $3,200–$3,450 range to about $3,865 an ounce — up 47% year-to-date.

The rally is fueled by three pillars: rising ETF inflows, renewed central bank buying, and some speculative positioning. Goldman projects gold at $4,000/oz by mid-2026 and $4,300/oz by year-end 2026, with upside risks mounting.

Notably, speculation has contributed only marginally to the latest rally, suggesting more durable support from institutional demand.

China Eyes Malaysian Rare Earth Refinery in Strategic Move

China and Malaysia are in talks over building a rare earth refinery, with Khazanah Nasional expected to partner with a Chinese state-owned company, Reuters reported.

The project would mark a shift for Beijing, which has long barred the export of rare earth processing technology. In exchange, China would gain access to Malaysia’s 16.1 million tonnes of rare earth reserves.

If completed, Malaysia would join the small group of nations with both Chinese and non-Chinese processing capacity. However, obstacles remain: questions about supply capacity, regulatory approvals, and environmental concerns. The move also signals Beijing’s intent to counter Australian rival Lynas, which already operates in Malaysia.

Europe News

European Stocks End Mixed; DAX Leads, Ibex Lags

Major European indices closed with mixed results on Thursday. Germany’s DAX and France’s CAC outperformed, while Spain’s Ibex and the UK’s FTSE slipped.

Closing snapshot:

- Euro Stoxx 50: 5,655.80 (+0.83%)

- DAX (Germany): 24,422.57 (+1.28%)

- CAC 40 (France): 8,056.64 (+1.13%)

- FTSE 100 (UK): 9,427.74 (-0.20%)

- IBEX 35 (Spain): 15,496.20 (-0.27%)

- FTSE MIB (Italy): 43,078.12 (unchanged)

Eurozone Jobless Rate Inches Up to 6.3%

Eurozone unemployment ticked up to 6.3% in August, slightly above the expected 6.2% and up from July’s 6.2%, Eurostat reported.

Despite the small rise, the figure matches levels last seen in December 2024 and remains below the 6.5% rate of December 2023, underscoring labor market resilience despite sluggish growth.

BOE Survey: UK Firms Lift Near-Term Inflation Expectations

UK companies now expect inflation at 3.4% over the coming year, up 0.1pp from August, according to the Bank of England’s September Decision Maker Panel survey.

Longer-term expectations remain stable at 2.9% for the three-year horizon.

Firms also reported:

- Realised annual price growth rose to 3.8% (+0.1pp).

- Own-price inflation expectations for the next year held steady at 3.7%.

The survey reflects only a slight upward shift, but shows businesses remain cautious about price pressures.

Switzerland Inflation Stays Weak in September

Swiss CPI came in at +0.2% year-on-year in September, short of the +0.3% forecast, while monthly inflation dropped -0.2%, in line with expectations.

Core inflation held steady at +0.7% y/y.

The statistics office noted falling costs for hotels, package holidays, air travel, and private transport rentals. Offsetting gains came from higher prices in clothing (notably knitwear), berries, and furniture. The overall picture points to muted inflationary pressures.

ECB’s Kazaks: Current interest rate level is very appropriate

- Comments from the ECB policymaker, Martins Kazaks

- Rates can stay where they are if no further shocks

- Uncertainty remains very high

- Must retain full freedom of action

Asia-Pacific & World News

China Prepares to Unveil 5-Year Plan: Markets Eye AI Push

China’s Communist Party will hold its annual conclave in Beijing from October 20–23, where it is expected to outline a new five-year plan that could become a major market driver.

Speculation points to a large-scale spending package for artificial intelligence, which would boost Chinese tech stocks, Nvidia, and related commodity plays.

- The Politburo has already reviewed a draft, with final approval expected at the National People’s Congress in March.

- President Xi Jinping emphasized balancing growth with security, while accounting for domestic and global risks.

- Reports suggest the plan could include a rebooted version of “Made in China 2025,” targeting high-value technology and new “productive forces.”

Longer-term, the plan may attempt to shift the economy toward consumption-led growth, though risks include renewed deleveraging given local government debt strains.

China Tightens Grip on Nokia and Ericsson Contracts

China is stepping up restrictions on European telecom suppliers Nokia and Ericsson, the Financial Times reported.

Contracts with the firms must undergo opaque “black box” security reviews by the Cyberspace Administration of China, with the companies left in the dark on how their equipment is evaluated. Buyers are also requiring exhaustive disclosures, down to the component level and sourcing breakdowns.

The measures further raise barriers for Western players in China’s telecom sector, highlighting Beijing’s push to keep critical infrastructure firmly under its control.

U.S. to Provide Ukraine Intel for Deep Missile Strikes

The U.S. will begin supplying Ukraine with intelligence to guide long-range missile strikes against Russian energy infrastructure, the Wall Street Journal reported.

This marks the first time Washington has directly backed deep strikes inside Russia. The aim: enable Kyiv to target refineries, pipelines, and power plants, choking off Russian revenues.

President Trump approved the shift and is urging NATO allies to follow. Washington is also weighing the option of arming Ukraine with long-range missiles such as Tomahawks and Barracudas, though no final decision has been made.

RBA Highlights Global Risks, Urges Caution on Housing Credit

In its October 2025 Financial Stability Review, the Reserve Bank of Australia flagged offshore threats while stressing domestic resilience.

- Key risks include asset-price corrections, sovereign debt strains, leveraged trading, and a rapidly growing non-bank sector.

- China’s prolonged property slump continues to pressure banks and is expected to drag on.

- Australian banks remain strong — well capitalized, profitable, liquid, and able to absorb shocks.

Households are managing mortgage payments with support from lower rates and inflation, though insolvencies remain elevated in construction, hospitality, and retail. The RBA urged lenders to keep standards tight, noted growing cyber and geopolitical risks, and pointed to superannuation funds’ expanding FX hedging as a challenge. Housing stability remains a central focus.

Australia’s Trade Surplus Shrinks Sharply in August

Australia’s trade balance for August came in at +1,825 million AUD — a huge miss against expectations of +6,500 million and well below July’s +7,310 million.

Exports slumped 7.8% month-on-month, reversing a 3.3% rise in July. The sharpest hit came from a 47% collapse in non-monetary gold exports. Imports, by contrast, rose 3.2% on stronger demand for consumer goods, aircraft, and telecom equipment.

Household spending barely grew, up just 0.1% from July’s 0.4% pace. Services like air travel and hotels climbed 0.5%, while goods purchases slipped 0.2%. On a year-on-year basis, spending rose 5.0%, just shy of forecasts.

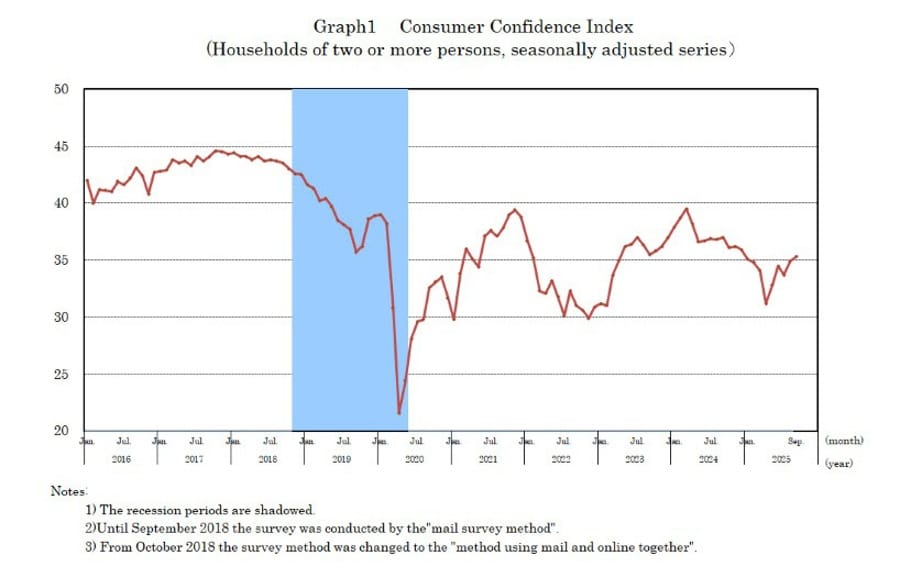

Japan Consumer Confidence Extends Gains in September

Japan’s consumer sentiment edged higher again in September, with the Cabinet Office index rising to 35.3 from 34.9 a month earlier.

The breakdown showed:

- Overall livelihood: 33.2 (+0.5)

- Income growth: 39.4 (unchanged)

- Employment: 39.9 (+0.6)

- Willingness to buy durable goods: 28.8 (+0.8)

The steady climb highlights improving household outlooks, even as inflation and rate expectations remain in focus.

BOJ’s Uchida says expects to keep raising rates if economy, prices adhere to forecast

- Remarks by BOJ deputy governor, Shinichi Uchida

- Japan’s economy recovering moderately but with some weak signs

- Consumption trend is moving on a firm note

- Expects moderate recovery after slowdown as overseas economies are returning to growth

- Expects to continue raising interest rates if economy, prices move in line with forecasts

- Uncertainties over trade policies remain high

- Underlying inflation likely to stagnate for some period before reaccelerating gradually

US, Japan reportedly arranging for Trump to make a visit to Japan on 27 October

- Kyodo News reports on the matter

This was already rumoured last week but at least now there’s a tentative date to work with. The visit if confirmed will be directly after the ASEAN Summit, which will be held in Malaysia on 25-26 October. That is one that Trump is supposedly confirmed as attending but there’s no official word from the US camp just yet.

Asia Attracts $100 Billion as Investors Diversify

Asia outside of China has pulled in roughly $100 billion in capital inflows over nine months, Goldman Sachs Asia-Pacific president Kevin Sneader said at the Milken Institute Asia Summit.

Japan has been the biggest winner as investors look beyond U.S. markets. China’s equity rally, meanwhile, has been largely driven by domestic investors and tech-sector demand, though foreigners are slowly returning.

Sneader emphasized these flows reflect diversification, not abandonment of the U.S., and are often driven by fast-moving hedge funds rather than long-term funds. Tech, consumer discretionary, and industrials are top draws, with healthcare rising in private markets.

Japan’s 10-Year Bond Auction Sees Demand Cool

Japan’s latest 10-year government bond sale drew less investor interest than the previous month, with the bid-to-cover ratio slipping to 3.34 from September’s 3.92.

The average yield climbed to 1.6350%, up from 1.6120%. The bid-to-cover ratio reflects appetite for debt relative to supply, and the decline points to caution among buyers. With yields hovering near multi-year highs and speculation swirling about a possible Bank of Japan rate hike in October, the weaker demand underscores market unease.

South Korea Inflation Rebounds in September

South Korea’s CPI climbed 2.1% year-on-year in September, above the 2.0% consensus forecast and rebounding from August’s nine-month low of 1.7%.

Month-on-month prices rose 0.5%, beating the 0.4% forecast and reversing a 0.1% fall. The dip had been linked to temporary mobile discounts.

Core inflation rose to 2.0% from 1.3% as services prices gained 2.2%. The return to the 2% range raises questions about the Bank of Korea’s next policy steps as inflation pressures show resilience.

Crypto Market Pulse

Crypto Market Rally Extends: Bitcoin Above $120K

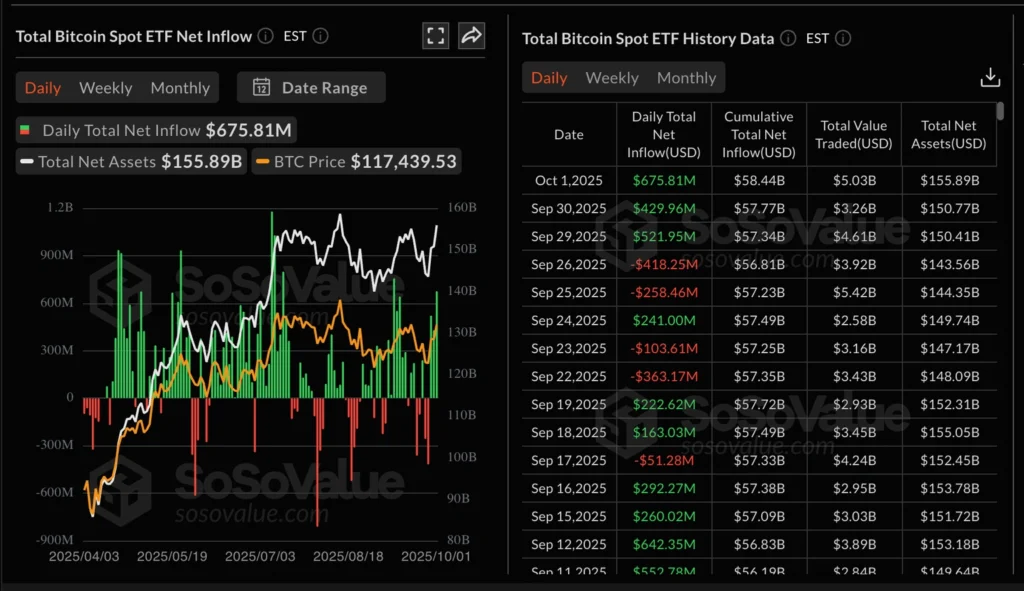

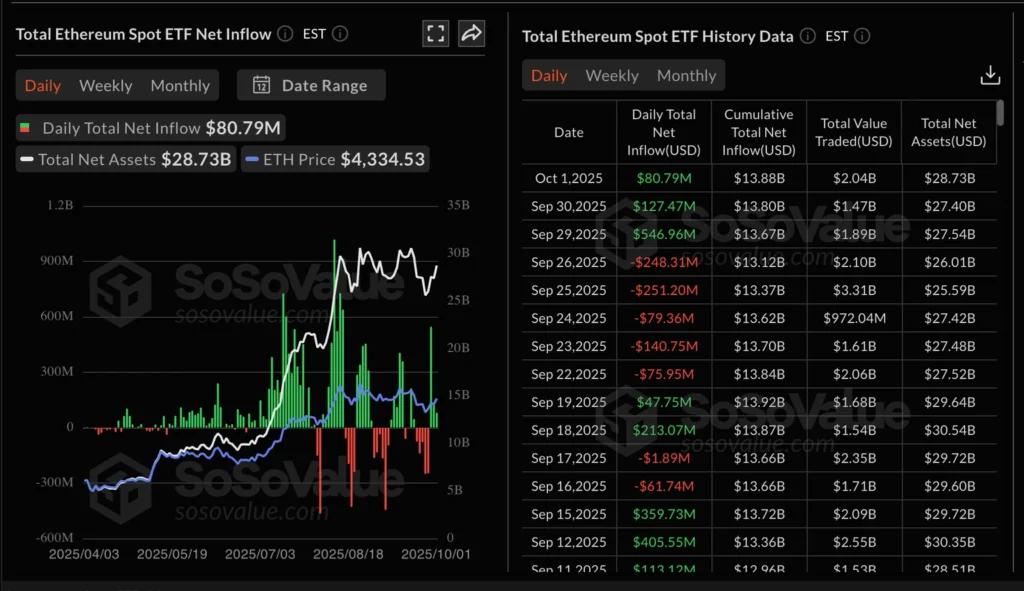

Bitcoin broke above $120,000 on Thursday, lifted by surging ETF inflows. Ethereum and XRP also extended gains, supported by bullish sentiment ahead of a potential Fed rate cut this month.

ETF inflows (Wednesday):

- Bitcoin ETFs: $676M total (BlackRock IBIT $406M, Fidelity FBTC $179M, Bitwise BITB $59M). None of the 12 ETFs saw outflows.

- Ethereum ETFs: $81M total, led by Fidelity and BlackRock.

Ethereum also shows strong technicals for a breakout, while XRP benefits from record retail futures demand.

CME to Launch 24/7 Trading for Crypto Derivatives in 2026

CME Group announced plans to roll out round-the-clock trading for its crypto futures and options starting in 2026, subject to regulatory approval.

- Products will trade continuously on CME Globex, with only a two-hour weekend maintenance window.

- Client demand for 24/7 trading has risen as participants seek to manage risks during off-hours.

- In August, CME’s crypto products saw open interest surge 95% y/y to 335,200 contracts, with daily volume up 230% to 411,000 contracts.

CME has expanded beyond Bitcoin and Ethereum to include XRP and Solana derivatives, and will add options on XRP and SOL futures later this month.

Citi Trims Bitcoin Outlook but Sees Major 2026 Upside

Citi has nudged its year-end Bitcoin forecast lower, now calling for $133,000 versus $135,000 projected in July. Ether, however, got an upgrade: the bank raised its year-end target to $4,500 from $4,300 set in mid-September.

Just two weeks ago, Citi argued Ether’s rise was sentiment-driven, but reaffirmed its growing role as a corporate favorite for active returns.

Looking ahead, the bank still expects crypto momentum to build:

- Bitcoin 12-month view: $181,000

- Ether 12-month view: $5,440

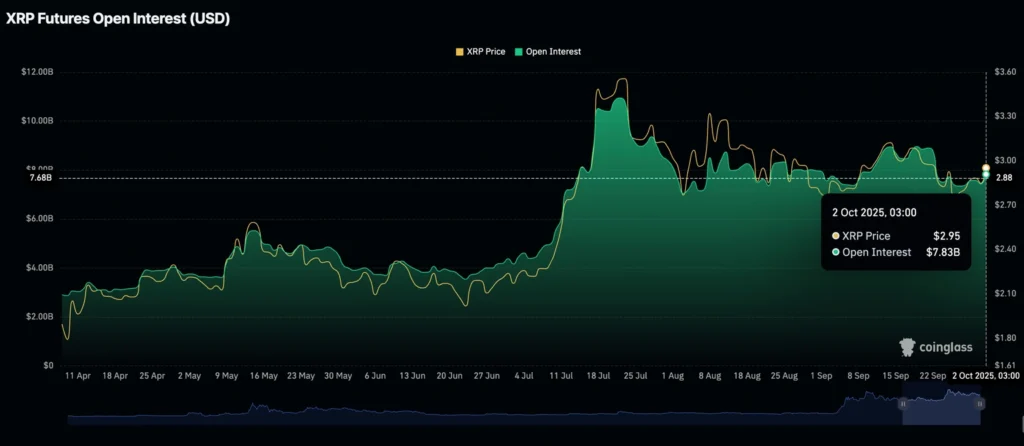

XRP Nears Breakout as Institutional Demand Rises

XRP is approaching the $3.00 level, buoyed by rising institutional interest and retail futures activity.

- Open Interest (OI): averaged $7.83B this week, up from $7.35B on Saturday, signaling higher conviction in long positions.

- Traders anticipate a Fed rate cut in October, supporting broader crypto momentum.

Meanwhile, VivoPower raised $19M in equity at $6.05/share to expand its XRP treasury strategy and reduce debt. The firm, which launched its XRP reserve in May, also pledged support for XRPL-based DeFi and blockchain-as-a-service initiatives.

Singapore Dollar Stablecoin XSGD Debuts on Coinbase

XSGD, the Singapore dollar-pegged stablecoin, launched on Coinbase October 1. Issued by StraitsX and fully backed by reserves at DBS and Standard Chartered, it’s the only SGD-linked token in circulation.

Stablecoins represent 7% of the global crypto market, now worth about $250 billion. Standard Chartered forecasts the sector could grow to $2 trillion by 2028.

Singapore has positioned itself as a digital-asset hub, rolling out a stablecoin regulatory framework in 2023. XSGD’s Coinbase debut highlights growing investor demand amid expectations of looser monetary policy worldwide.

Corporate Bitcoin Treasury Craze Cools

The wave of companies piling bitcoin onto their balance sheets is losing steam. Corporate purchases slowed steadily through recent months, falling in September to their weakest pace since April, according to K33 Research.

More than 200 firms had embraced crypto-treasury strategies this year, fueled in part by President Trump’s pro-crypto stance. But the trend has backfired for many. A quarter of those stocks now trade below the value of their token holdings, and some have plunged over 50% since announcing their bitcoin bets.

The surge of private stock sales to finance bitcoin buys has left investors oversaturated, regulators are tightening scrutiny, and the “corporate bitcoin treasury” fad is fading fast.

The Day’s Takeaway

North America

U.S. Stocks Close at Record Highs as Small Caps Lead

Wall Street ended Thursday with fresh record closes across the S&P 500, Nasdaq Composite, and Dow Jones Industrial Average, while the Russell 2000 led the day.

Index performance:

- S&P 500: +0.1%

- Nasdaq Composite: +0.4%

- Dow Jones Industrial Average: +0.2%

- Russell 2000: +0.6%

The government shutdown delayed major data releases, leaving traders to parse private indicators. Challenger reported 54,064 job cuts in September, a drop from August but pushing 2025 layoffs to 946,426 YTD, the highest since 2020.

Fed speakers:

- Dallas Fed’s Logan: Inflation is still trending higher; warned against cutting rates too quickly.

- Chicago Fed’s Goolsbee: Shutdown complicates decision-making, but real-time indicators show unemployment holding steady.

Treasuries: Yields slipped modestly.

- 2-year: 3.542% (-0.2 bps)

- 5-year: 3.673% (-0.7 bps)

- 10-year: 4.086% (-1.9 bps)

- 30-year: 4.692% (-2.2 bps)

Markets still price in a 99% chance of an October Fed rate cut, with December nearly locked in.

- Fed’s Goolsbee: Warned that without official government data during the shutdown, policy will rely on real-time indicators. Immediate impact: delayed pay for federal workers.

- U.S. Mortgages: Freddie Mac reported the 30-year fixed rate rose to 6.34%, tracking the rebound in Treasury yields (10-year now 4.101% after a 3.992% low in mid-September).

- Bank of Canada: Deputy Gov. Mendes said core inflation measures remain messy. He estimates true underlying inflation near 2.5%, higher than headline (1.9% y/y) but below official core gauges (~3%).

Commodities: Gold Steady, Oil Weak

- Gold: Pulled back to $3,844 (-0.5%) as the dollar firmed after Logan’s hawkish remarks. Prices briefly slipped below $3,820, though October rate cut expectations continue to provide a floor. Gold remains in striking distance of $3,900, a record high.

- WTI Crude Oil: Fell to $60.33 (-2%), the lowest since May. Concerns over a potential OPEC+ supply boost and reports of Saudi Arabia considering production hikes intensified selling pressure. Technical momentum signals further downside unless OPEC+ intervenes.

- Copper: Supply fears grew as Indonesia’s Grasberg mine stayed offline (loss of ~66,000 tons/month), while Chile’s El Teniente mine saw a 10% y/y drop in August output. Production issues are tightening balances amid steady demand.

Europe: DAX and CAC Outperform, FTSE and Ibex Lag

European equities closed mixed Thursday, with German and French markets leading gains while the UK and Spain slipped.

- Euro Stoxx 50: 5,655.80 (+0.83%)

- DAX (Germany): 24,422.57 (+1.28%)

- CAC 40 (France): 8,056.64 (+1.13%)

- FTSE 100 (UK): 9,427.74 (-0.20%)

- IBEX 35 (Spain): 15,496.20 (-0.27%)

- FTSE MIB (Italy): 43,078.12 (flat)

Asia: China’s 5-Year Plan in Focus

China’s Communist Party will meet in Beijing on October 20–23 to outline a new five-year plan, likely finalizing at the March National People’s Congress.

Markets expect:

- AI and tech spending push → boosting Chinese tech, Nvidia, and commodity demand.

- Possible reboot of “Made in China 2025”, with focus on high-value industries.

- Shift toward consumption-led growth, though debt risks linger.

President Xi stressed balancing growth with security.

Crypto: Rally Broadens, CME Plans 24/7 Derivatives

- Bitcoin: Broke above $120,000, driven by record ETF inflows. Wednesday saw $676M net inflows, led by BlackRock’s IBIT (+$406M). None of the 12 ETFs recorded outflows.

- Ethereum: Added $81M in ETF inflows; technicals point to breakout.

- XRP: Nearing $3.00, supported by rising institutional demand. Open interest averaged $7.83B this week (vs $7.35B Saturday). VivoPower raised $19M to expand its XRP treasury strategy.

- CME Group: Announced 24/7 crypto futures and options trading from 2026, with only a two-hour weekend maintenance window.