North America News

US stocks close lower but recover from midday slump

US equities ended Thursday in the red, though losses were pared after hitting session lows around 1 p.m. ET.

- Dow Jones Industrial Average: -0.4%

- S&P 500: -0.5%

- NASDAQ Composite: -0.5%

- Russell 2000: -1.0%

Tesla (-4.4%) and Oracle (-5.5%) were among the biggest individual drags. Despite the late rebound, all major indexes posted solid declines.

US Treasury Sells $44 Billion in 7-Year Notes at 3.953%

The US Treasury auctioned $44 billion in 7-year notes at a high yield of 3.953%, slightly above the 3.947% when-issued level at the time of sale.

Auction details:

- Tail: +0.6 bps (vs. 6-month average of -0.7 bps)

- Bid-to-cover: 2.40x (vs. 2.60x 6-month average)

- Direct bidders: 31.6% (vs. 22.2% avg)

- Indirect bidders: 56.4% (vs. 68.1% avg)

- Dealers: 12.0% (vs. 9.7% avg)

While domestic demand was stronger, international participation was weaker than usual, leaving dealers with a larger allocation.

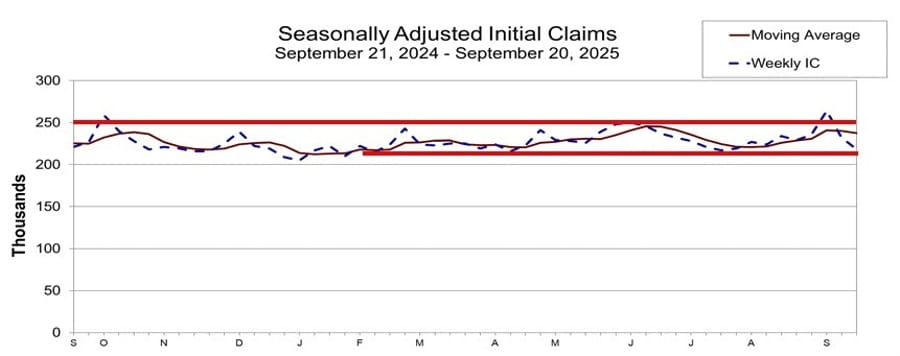

US Jobless Claims Fall Back Toward Yearly Lows

US initial jobless claims came in at 218,000, well below the 235,000 forecast and down from the revised 232,000 prior week.

Details:

- 4-week average of claims: 237,500 (vs. 240,250 prior).

- Continuing claims: 1.926m (vs. 1.935m estimate).

- 4-week average of continuing claims: 1.93m (unchanged).

After a brief spike in recent weeks, claims are again back near the bottom of their 2025 range, signaling a still-resilient labor market.

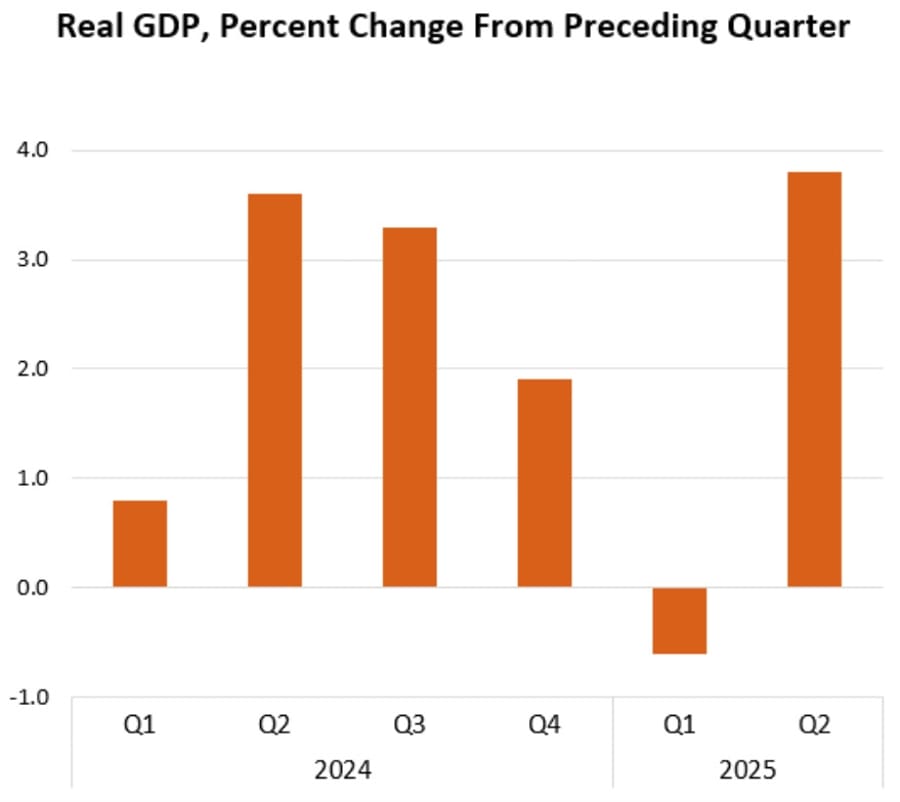

US Q2 GDP Revised Up to 3.8%

Final data showed US Q2 GDP growth at +3.8%, up from the +3.3% second estimate, and sharply higher than the -0.5% in Q1.

Breakdown:

- Final sales: +7.5% (vs. +6.8% prior).

- Consumer spending: +2.5% (vs. +1.6% prior).

- Core PCE: +2.6% (vs. +2.5% prior).

The revision highlights stronger underlying demand, particularly from consumers.

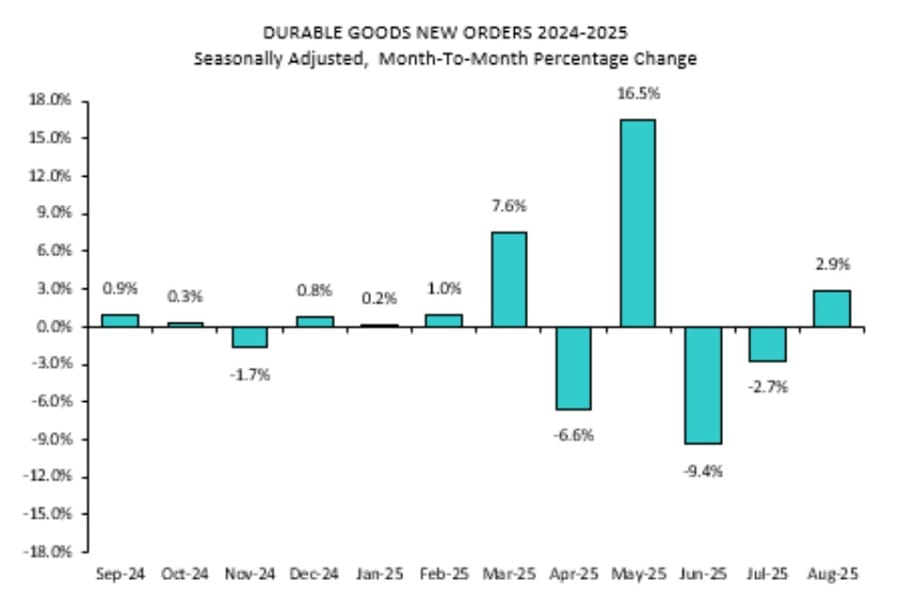

US Durable Goods Surge in August

US durable goods orders jumped +2.9% in August, far above the -0.5% forecast, after July’s decline was revised to -2.7%.

Key details:

- Core non-defense capital goods ex-air: +0.6% (vs. -0.1% expected).

- July revised to +0.8% from +1.1%.

- Ex-transportation: +0.4% (vs. flat expected).

- Ex-defense: +1.9% (vs. -2.5% prior).

The data marks the first solid reading after several weak months, offering relief for the manufacturing sector.

US Wholesale Inventories Slip in August

US wholesale inventories fell -0.2% in August, missing expectations of a +0.2% rise. July was revised to 0.0% from +0.1%.

Details:

- Retail inventories ex-autos: +0.3% (vs. +0.2% prior).

- Non-durable goods inventories: -0.6% (vs. +0.3% prior).

- Durable goods inventories: flat (vs. +0.2% prior).

- Yearly wholesale inventories rose +0.7%.

US 30-Year Mortgage Rate Rises to 6.30%

The average 30-year fixed mortgage rate increased to 6.30% from 6.26% last week, according to Freddie Mac.

The move ends an eight-week stretch where rates either fell or held steady, during which borrowing costs dropped from 6.75% to 6.26%. Although the latest increase is modest, the recent climb in yields suggests mortgage rates could continue to edge higher in the coming weeks.

US Existing Home Sales Edge Lower in August

US existing home sales came in at 4.00m in August, just above expectations of 3.96m, but down 0.2% from July’s +2.0%.

Additional details:

- Median price: +2.0% y/y.

- Inventory: 1.53m homes (down 1.3% m/m, but up 11.7% y/y).

The data follows yesterday’s 20% surge in new home sales, which analysts described as unusual. The overall housing outlook remains for a gradual U-shaped bottom rather than a sharp rebound.

US Goods Trade Gap Narrows in August

The US advance goods trade deficit narrowed sharply to -85.5bn in August, better than the expected -95.2bn and down from -102.8bn in July.

The improvement brings the deficit back to its 4-year average, after tariff frontloading caused a surge earlier in 2025.

Fed’s Goolsbee: Labor Market Stable, Inflation Still a Concern

Chicago Fed President Austan Goolsbee said the labor market remains stable with only mild signs of cooling, but warned against cutting rates too aggressively before inflation risks are fully resolved.

Key points:

- Concerned about inflation persistence.

- Strong business investment shows policy isn’t overly restrictive.

- Views tariffs as unlikely to cause broad inflation.

- Describes policy stance as mildly restrictive.

- Noted immigration trends could typically push inflation higher, though that effect is less visible now.

Fed Officials Split on Policy Outlook

Kansas City Fed President Schmid said the central bank is close to meeting its mandate but must keep a forward-looking stance.

- He called the recent rate cut appropriate to offset labor market risks.

- Inflation remains too high, but the job market is broadly balanced.

- Policy is “slightly restrictive,” which he considers the right place for now.

Meanwhile, Fed Governor Stephen Miran argued others are too focused on tariffs as a source of inflation, which he sees little evidence for.

Miran added:

- Demographics from immigration changes are reshaping the labor market.

- AI could add significant economic power, but forecasts should be cautious.

- He is more optimistic on growth than colleagues, and sees a lower rate path, partly due to tax and immigration policy impacts.

- He warned Fed policy may already be too tight, leaving the economy vulnerable to downside shocks.

BofA: S&P 500 Valuations Reflect “New Normal”

Bank of America says the S&P 500’s record valuations may be justified by stronger fundamentals, including healthier balance sheets, stable margins, and efficiency gains.

Of the bank’s 20 valuation metrics, 19 show expensive levels and four are at record highs. Yet strategist Savita Subramanian argues today’s higher multiples represent a structural shift, not a bubble.

The S&P 500 has gained 30% since April, with a forward P/E of 22.9 — surpassed only during the dot-com boom and the pandemic rally.

While Fed Chair Powell admitted valuations are stretched, BofA argues fiscal support, Fed easing, and a potential 2026 profit boom could validate current pricing.

FINRA Scraps $25,000 Day Trading Minimum

The Financial Industry Regulatory Authority (FINRA) has voted to eliminate the $25,000 minimum equity rule for pattern day traders, pending SEC approval.

In place since 2001, the rule limited traders with less than $25,000 from making more than three day trades in five days. The new framework will instead tie buying power to intraday margin requirements, not a hard equity minimum.

The change could open the door to smaller retail accounts, boosting day trading and options activity while benefiting brokers like Robinhood.

Morgan Stanley: US Tariffs and Policy Shifts Reshape Markets

Morgan Stanley says entrenched tariffs and industrial policy are reshaping the US economy, pointing to steeper yield curves and a weaker dollar as lasting features.

Both the Trump and Biden administrations have embraced tariffs and intervention, shifting focus from eliminating trade barriers to managing them strategically. Sectors like semiconductors have seen major policy moves, including the CHIPS Act and new licensing fees.

The bank also notes a rebound in capital markets: IPO activity is up 68% y/y, while M&A rose 35%, fueled by strong balance sheets, private capital, and AI-driven investment needs.

Morgan Stanley concludes that markets now face a backdrop of stickier long-term yields and a structurally softer dollar.

White House Orders Agencies to Draft Mass Layoff Plans

The White House budget office has instructed federal agencies to prepare reduction-in-force (RIF) plans, according to a memo obtained by Politico. Unlike temporary furloughs, these plans could trigger permanent layoffs in the event of a government shutdown.

The directive applies to employees on programs not legally required to continue during a funding lapse. The move is seen as part of an effort by the administration to shrink the federal workforce permanently, escalating tensions around budget negotiations as a shutdown looms.

Deutsche Bank: Fed to Cut in October and December

Deutsche Bank forecasts the Federal Reserve will cut rates by 25bps in both October and December, bringing the federal funds rate to around 3.5%, a level the bank calls “neutral.”

Analysts caution, however, that stronger-than-expected labor market or inflation data could slow the pace of easing, with the Fed potentially skipping one of the meetings.

Looking into 2026, Deutsche does not currently project further cuts but says risks are tilted toward more easing if growth slows or disinflation accelerates.

Fed’s Daly says further monetary policy adjustments are likely to be needed

- Daly had previously said two cuts this year seemed reasonable, Daly gave no update to that view.

San Francisco Fed President Mary Daly said she fully supported last week’s quarter-point rate cut, the Fed’s first this year, and signaled more reductions are likely.

Daly noted that growth, consumer spending, and the labour market had slowed while inflation remained contained, mostly in tariff-affected sectors. She said the balance of risks had shifted, making it “time to act.”

She added that policy projections are not promises but scenarios subject to trade-offs at each decision point. While she previously said two cuts this year seemed reasonable, Daly gave no update to that view.

More now:

- the labor market is not weak

- the labor market is not as speedy as it was, its sustainable, and don’t want to see further softening

- once the labor market tips into weakness, its difficult to get it back out

- rate cut was like taking out insurance ion the labor market

- this is not stagflation

- we have work to do on inflation and don’t want the labor market to get weak

- the risk of recession is very low right now

- the evidence is consistent with tariffs have a one-time impact on inflation

- interest rate cut will help a little on housing, but even bringing it down to neutral won’t fix supply issues that is hurting affordability

Banxico cuts policy rate to 7.50%

Mexico’s central bank reduced its benchmark rate by 25 basis points to 7.50%, in line with expectations.

The decision was not unanimous, with one board member preferring to hold at 7.75%. Banxico said it still sees inflation converging to its 3% target by the third quarter of 2026.

Commodities News

Crude oil settles nearly flat at $64.98

WTI crude futures ended Thursday close to unchanged, settling at $64.98, down just $0.01 (-0.02%) from the prior session.

- Day’s range: $64.06 – $65.16

- Technical marker: Price briefly traded above and below its 100-day moving average at $64.50, which remains the key short-term pivot. A sustained move higher could target $66.36 (50% retracement) and the 200-day moving average at $66.83.

Headlines influencing sentiment:

- Trump pressed Turkey’s Erdogan to halt Russian oil purchases.

- EU officials reportedly warned Moscow they were prepared to shoot down jets.

- Ukraine launched naval drone attacks on a Russian oil terminal and pumping station.

- US producers signaled frustration with Trump’s policies, warning of possible output cuts.

Silver Holds Above $44 on Dovish Fed Signals

Silver prices held firm around $44 per ounce on Thursday, near Tuesday’s 14-year high of $44.47, supported by dovish commentary from Fed officials and geopolitical tensions.

Drivers:

- San Francisco Fed President Mary Daly said more rate cuts may be needed to restore price stability and support jobs.

- CME FedWatch tool shows a 92% chance of a Fed rate cut in October, up from 87% a week earlier.

- Safe-haven demand also grew after NATO’s warning to Russia and heightened rhetoric from US and Ukrainian leaders on the conflict.

Fed commentary diverged as Chicago Fed’s Goolsbee sounded less convinced about additional cuts, highlighting internal debate among policymakers.

Freeport-McMoRan Disaster Reshapes Copper Market

Shares of Freeport-McMoRan plunged nearly 20% yesterday and another 4.5% today, after revealing details of an 800,000-tonne mudslide at its massive Grasberg mine, the second-largest copper mine globally.

The incident has halted most operations, with the company warning 2026 output could fall 35% versus pre-incident forecasts, with effects lingering into 2027. Two workers were confirmed dead, and five are missing.

Macro impact: global copper supply is set to drop 1.2% in 2026.

Scotiabank downgraded Freeport to sector perform from outperform, slashing forecasts:

- 2025–26 EBITDA: cut by ~27% to $8.4bn and $9.0bn.

- NAVPS: reduced 10% to $19.15.

- Free cash flow forecasts: $0.3bn (2025), -$0.9bn (2026), $3.2bn (2027).

- Copper output: -12% vs. prior, at 3.5bn lbs (2025) and 3.8bn lbs (2026).

The bank stressed Grasberg’s importance, as it was Freeport’s lowest-cost producer, thanks to high gold credits.

Shanghai Gold Exchange Hikes Margins Again

The Shanghai Gold Exchange has raised margin requirements on gold and silver futures for the sixth time this year, aiming to cool speculative trading after the Fed’s first 2025 rate cut.

The move followed a record rally: COMEX gold futures surged above $3,800/oz in September, up 8% for the month, while silver hit $44.80, its highest since 2011, rising 9% this month and over 51% year-to-date.

The repeated margin hikes underscore regulators’ concern that sharp price swings could disrupt trading, even as investors continue flocking to precious metals as safe-haven assets.

Goldman Sachs Sees Higher Risk to Copper Price Forecast

Goldman Sachs says the latest production disruption has shifted risks to the upside for its December 2025 LME copper forecast of $9,700 per tonne, with prices likely to settle in a $10,200–10,500/t range.

The bank now expects a 250–260kt loss of copper output from Grasberg in 2025, compared to its earlier estimate of 700kt. Factoring in these disruptions, Goldman has cut its global mine supply forecast by 160kt for H2 2025 and by 200kt for 2026.

As a result, the bank lowered its copper production growth outlook to just +0.2% y/y for 2025 and +1.9% y/y for 2026, down from its prior forecast of +0.8% and +2.2% respectively.

UBS: Gold Rally Supported by Fed Easing and Dollar Weakness

UBS says gold still has room to climb as real rates decline and the US dollar softens, reinforcing one of the strongest rallies in recent years. Gold is up over 40% in 2025, now trading just shy of record highs, as markets price in Federal Reserve rate cuts and stubborn inflation.

The bank projects ETF holdings could rise to 3,900 tons by end-2025, near historic highs. UBS also notes that with real interest rates at their lowest levels since 2022, gold’s appeal as a store of value has strengthened. The metal’s traditional negative correlation with the dollar could provide an additional tailwind if the currency weakens further.

Europe News

European Equities End Lower; DAX Leads Declines

Major European stock indices closed weaker on Thursday, with the German DAX posting the sharpest loss.

Closing snapshot:

- DAX: -0.61%

- CAC 40: -0.41%

- FTSE 100: -0.39%

- Ibex 35: -0.27%

- FTSE MIB: -0.43%

Eurozone Money Supply Growth Slows in August

Eurozone M3 money supply grew 2.9% y/y in August, missing the expected 3.3% and down from 3.4% in July, according to ECB data.

The figures confirm a steady cooling trend since May, though overall money growth remains elevated compared to 2024 levels, when expansion first surged.

Germany Consumer Sentiment Improves Slightly in October

Germany’s GfK consumer sentiment index rose to -22.3 in October, a touch better than the -23.3 expected, and up from the revised -23.5 in September.

The improvement was largely driven by a sharp jump in income expectations, which surged to 15.1 from 4.1 previously. However, economic expectations slipped to -1.4 from 2.7, showing that households remain cautious.

GfK noted that persistent job concerns, rising inflation fears, and the geopolitical backdrop are likely to limit the potential for a full recovery in sentiment.

France Consumer Confidence Holds Steady in September

France’s INSEE survey showed household confidence steady at 87 in September, matching expectations and unchanged from the prior month.

The index has shown little movement in recent months, with both unemployment expectations and assessments of living standards appearing stable — offering some reassurance that conditions are no longer deteriorating.

UK Retail Sales Slump Continues in September

The UK’s CBI retail sales survey reported a reading of -29 in September, an improvement from -32 in August, but still marking 12 straight months of contraction.

The outlook for October deteriorated further, with the gauge of expected sales plunging to -36 from -16, the lowest since July.

The CBI noted:

- Weak demand continues to drag on sales.

- US tariffs are adding cost pressures for some retailers.

- Broader distribution sector activity is also suffering under lackluster conditions.

UK Car Output Drops 18% in August; JLR Cyberattack Worsens Outlook

UK car production fell sharply in August, with output down 18.2% y/y to 38,693 vehicles, according to the Society of Motor Manufacturers and Traders (SMMT).

The decline, already impacted by summer maintenance closures, is set to deepen in September as Jaguar Land Rover (JLR) halted all three UK plants following a cyberattack. JLR produces around 1,000 vehicles daily, and the extended shutdown raises concerns for jobs and supply chains.

While overall volumes slumped, electrified vehicle production jumped 40.9%, with hybrids, plug-ins, and BEVs now nearly half of August’s total. Exports, however, remain under pressure, falling 14.2% amid tariff threats and Chinese competition.

SNB Keeps Policy Rate at 0% in September

The Swiss National Bank kept its policy rate at 0% in its September decision, maintaining its zero-interest rate stance.

Key points:

- The SNB reiterated its willingness to intervene in FX markets if needed.

- Inflation pressures remain little changed from last quarter.

- The conditional inflation forecast shows only minor upward pressure in the short term, but medium-term projections are stable.

- The bank warned that higher US tariffs are weighing on exports and investment, weakening Switzerland’s economic outlook.

Projections:

- GDP 2025: 1.0–1.5% (unchanged)

- GDP 2026: ~1.0% (down from 1.0–1.5%)

- CPI 2025: 0.2% (unchanged)

- CPI 2026: 0.5% (unchanged)

- CPI 2027: 0.7% (unchanged)

SNB chairman Schlegel: We remain willing to be active in the FX market as necessary

- Remarks by SNB policymakers after the monetary policy decision earlier

- Inflation forecasts remain within price stability range over the forecast horizon

- Inflation pressures are not changed whatsoever compared to Q2

- Uncertainty about inflation and economic developments though are still elevated

- US tariffs present a major challenge, likely to dampen economic activity

- But if necessary, we are ready to use all tools

- Switzerland has very high tariffs, can be challenging for companies

- A large part of the economy is not affected by tariffs

- So, tariffs impact as a whole is limited

- We are not speaking about reintroducing a minimum exchange rate

- The situation is different to 2011

- We would cut interest rates if inflation falls outside price stability range over the medium-term

- In the meantime, we can have negative inflation prints in the short-term

- But what is more important is how inflation will trend over the medium-term outlook

- We do not give any forward guidance, will decide things quarter to quarter

- Not limited in currency market interventions

- When we think it is the correct action, we will do so

Vice Chairman Tschudin:

- Global economic outlook has slowed, particularly in US

- Global developments have been dampened by US tariffs and ongoing high uncertainty

- Swiss economic outlook is uncertain, has deteriorated significantly due to US tariffs

- Main risk for Switzerland right now is US trade policy

ECB’s Kazimir: Inflation goal met, we will act only if needed

- Comments from the ECB policymaker, Peter Kazimir

No surprise here as the ECB made it clear that the easing cycle is over. For the next rate adjustments they will monitor the evolution of inflation but they will not react to small deviations from the 2% target.

HSBC and IBM Achieve Quantum Leap in Bond Trading

HSBC has become the first bank to deploy quantum computing at scale in bond trading, using IBM’s Heron quantum processor. Applying the technology to anonymized European bond data, the bank achieved a 34% improvement in predicting bond trades.

This marks the first use of real trading data rather than lab tests, signaling a breakthrough in quantum applications for financial markets. HSBC’s Philip Intallura called it a “Sputnik moment” for finance, expecting wider adoption across Wall Street.

Quantum is seen as a potential game-changer for risk management, portfolio optimization, and big data processing. Rivals like Goldman Sachs, Citi, and JPMorgan are also investing heavily in the field.

Asia-Pacific & World News

Chinese Delegation Visiting US Treasury for Talks

A Chinese delegation will meet with the US Treasury tomorrow for staff-level technical discussions on trade and the economy, according to Fox Business.

The meetings will not include US principals and will not cover the TikTok deal. Instead, talks will focus on technical follow-ups to prior discussions, not a fresh round of negotiations.

PBOC Deputy Governor: Foreign Investors Confident in China’s Bond Market

A senior People’s Bank of China official said foreign demand for Chinese bonds remains strong as the market’s global impact expands.

- China’s bond market reached a balance of 192 trillion yuan by end-August 2025, making it the world’s second largest.

- The PBOC is pushing to make onshore bonds eligible as collateral in Hong Kong and international markets.

- Currently, foreign investors hold 2% of yuan-denominated bonds, but officials see them as a reliable tool for value preservation.

- Reforms include expanding swap connect market makers, raising the daily trading cap from 20 billion to 45 billion yuan, and preparing yuan government bond futures in Hong Kong.

PBOC sets USD/ CNY reference rate for today at 7.1118 (vs. estimate at 7.1293)

- PBOC CNY reference rate setting for the trading session ahead.

PBOC injected 483.5bn yuan via 7-day reverse repos at 1.40%

- net 3.5bn yuan drain

BOJ July Minutes Signal More Hikes If Economy Aligns

Minutes from the Bank of Japan’s July meeting showed consensus that the BOJ will continue raising rates if growth and inflation stay on track.

Key points:

- Many members said the US–Japan trade deal reduced uncertainty, though tariffs still pose risks.

- Several noted that inflation above 2% could justify reducing monetary support.

- One warned the BOJ could lose control of short-term rates if account balances shrink too far.

- Members highlighted that firms are increasingly able to pass on costs via price hikes.

- Some saw inflation expectations approaching but not anchored at 2%.

- One member said Japan’s policy rate remains below neutral, meaning the BOJ shouldn’t be too cautious.

BOJ August Services PPI Slows Slightly

Japan’s Services Producer Price Index for August rose 2.7% y/y, slightly below expectations of +2.9% and down from +2.9% in July.

Ex-BOJ Board Member: October Hike Possible

Former BOJ board member Makoto Sakurai said the central bank could lift rates in October, echoing comments made by another ex-member earlier this week. He noted policymakers may wait for clearer signs of tariff impacts, which may only appear later in economic data.

Markets are increasingly pricing in another BOJ hike by year-end, particularly after the Sept. 19 meeting, where two members dissented from the decision to keep rates unchanged. Sakurai suggested the dissent might have been a coordinated signal of change.

He also flagged political risks: the LDP leadership election on Oct. 4 could delay action if front-runner Sanae Takaichi wins, given her past opposition to tightening.

Looking ahead, Sakurai expects the BOJ to raise rates by up to 100bps through 2028, pushing the policy rate to around 1.5%, slightly above market consensus.

Deutsche Bank: BOJ Likely to Resume Hikes in October

Deutsche Bank expects Japan’s economy to expand 1.2% in 2025, pointing to resilience despite trade frictions. A weaker yen has shielded exporters, particularly automakers, by allowing them to reprice goods abroad and offset tariffs.

With core-core CPI above 3%, Deutsche argues the Bank of Japan is behind the curve and will likely restart rate hikes in October 2025. However, the timing could be influenced by politics, specifically the Liberal Democratic Party’s leadership election on October 4.

Bessent Tells South Korea He’ll Raise $350bn Issue with Trump

US official David Bessent told South Korea’s Finance Minister Lee that he would bring up concerns over the $350 billion investment demand internally with President Trump, according to a Reuters report citing a presidential aide.

Bessent also acknowledged progress on easing South Korea’s non-tariff barriers, while signaling he will push for a more measured approach within the administration.

Crypto Market Pulse

Ethereum leads broad crypto selloff

The cryptocurrency market extended losses on Thursday, with Ethereum (ETH) down 7.5%, outpacing Bitcoin’s 3.8% drop.

Other notable declines:

- Cardano: -6%

- Solana: -7.2%

- Ripple (XRP): -5.6%

- Binance Coin: -6.1%

The selloff pushed ETH back into its long-standing $2,800–$4,000 trading range, underscoring how crypto has become more vulnerable to leveraged downside moves without benefiting from recent equity rallies.

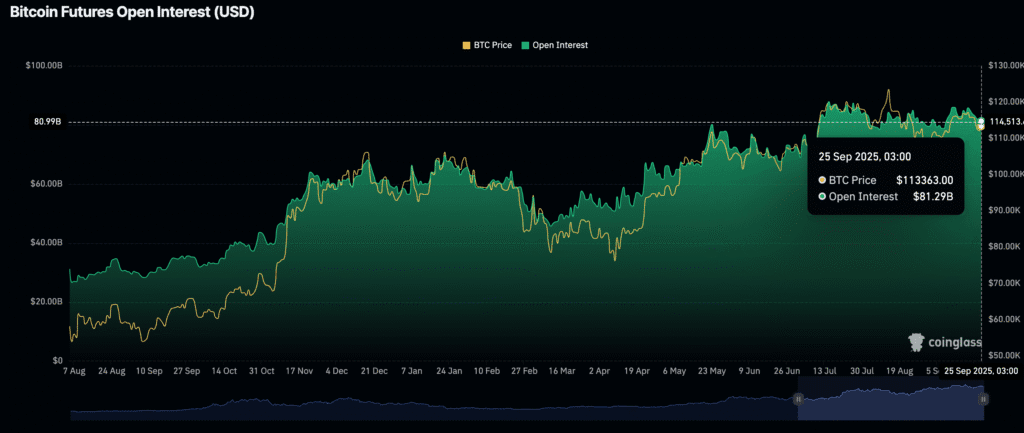

Bitcoin, Ethereum, XRP Extend Weekly Losses

Cryptocurrencies extended losses on Thursday, with Bitcoin drifting toward $110,000, Ethereum sliding to $4,000, and XRP holding near $2.83 support.

Market signals:

- BTC down ~3% in a week, after failing to sustain an uptrend capped near $118,000.

- Retail participation fading: CoinGlass shows futures open interest down to $81.29bn from $85.79bn last week.

- Aggressive profit-taking among large holders continues to weigh on sentiment.

Overall, crypto markets remain in a risk-off environment, with technical weakness across major coins.

XRP Dips as Jobless Claims Fall Below Expectations

XRP traded between $2.83 and $2.93 on Thursday, struggling to hold above its 100-day EMA, as falling US jobless claims pressured the broader crypto market.

Data impact:

- Initial jobless claims: 218K (vs. 235K est; prior revised 232K).

- GDP final Q2: 3.8% (vs. 3.3% second estimate).

- Core PCE final Q2: 2.6% (vs. 2.5% prior).

The drop in claims underscored a resilient labor market, which could delay further Fed easing. XRP has lost about 8% since Sept 17, with traders watching the upcoming Core PCE release for direction.

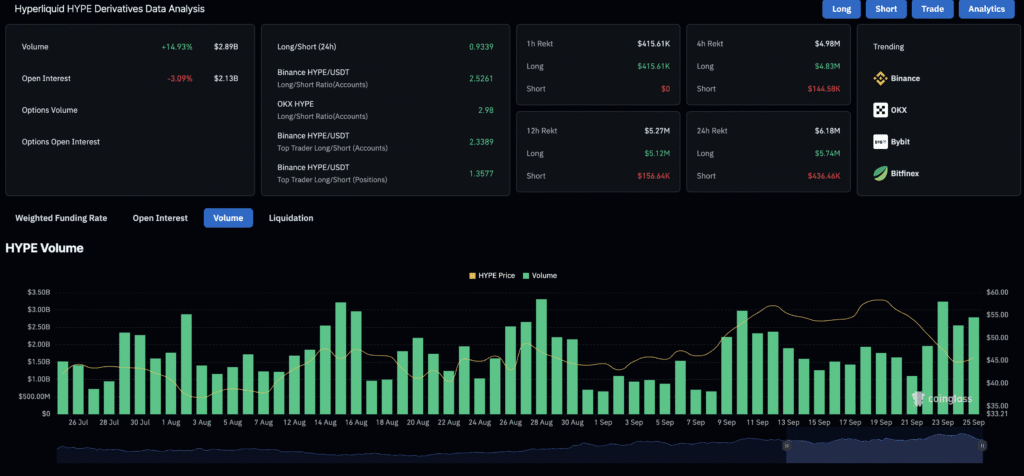

Hyperliquid Slumps as TVL and OI Slide

Hyperliquid (HYPE) dropped over 6% on Thursday, its seventh straight day of declines, trading below its 100-day EMA and testing the lower edge of a rising channel.

Key factors:

- USDH stablecoin launch quickly reached $24m supply, but failed to spark demand.

- TVL fell to $2.14bn, down from a record $2.78bn last Friday.

- Open interest declined 3.1% in 24 hours to $2.13bn, reflecting waning trader interest.

The weak momentum suggests HYPE could face further downside risks unless new inflows return.

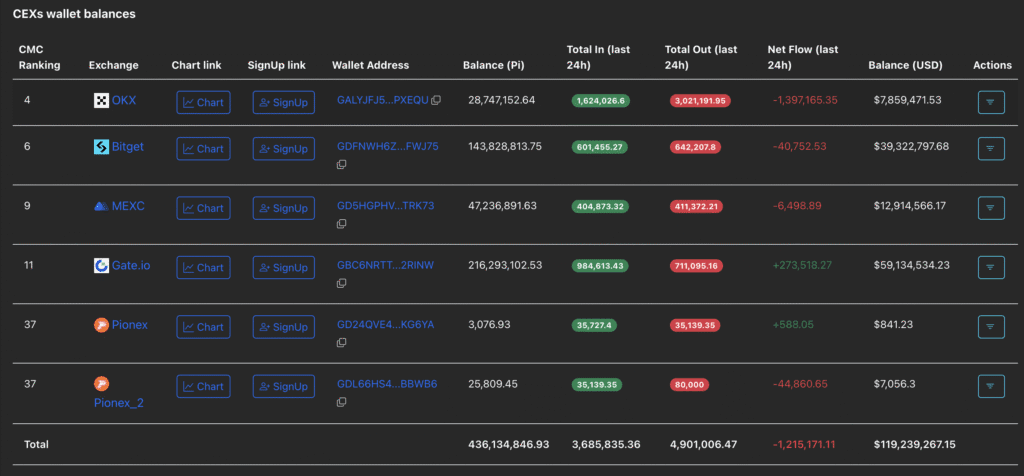

Pi Network Stays Flat as Market Weakens

Pi Network (PI) traded sideways above $0.27 on Thursday, its third straight day of flat performance after Monday’s 19% drop.

Headwinds and developments:

- Scheduled upgrade (Stellar protocol v23 shift) temporarily halted signups and logins.

- CEX balances continue to show net outflows, with 1.21m PI tokens withdrawn, building on earlier declines of 1.94m and 7.96m.

- Mainnet upgrade will follow after testnet updates are complete.

Despite weak sentiment, the withdrawals suggest traders are buying PI on dips.

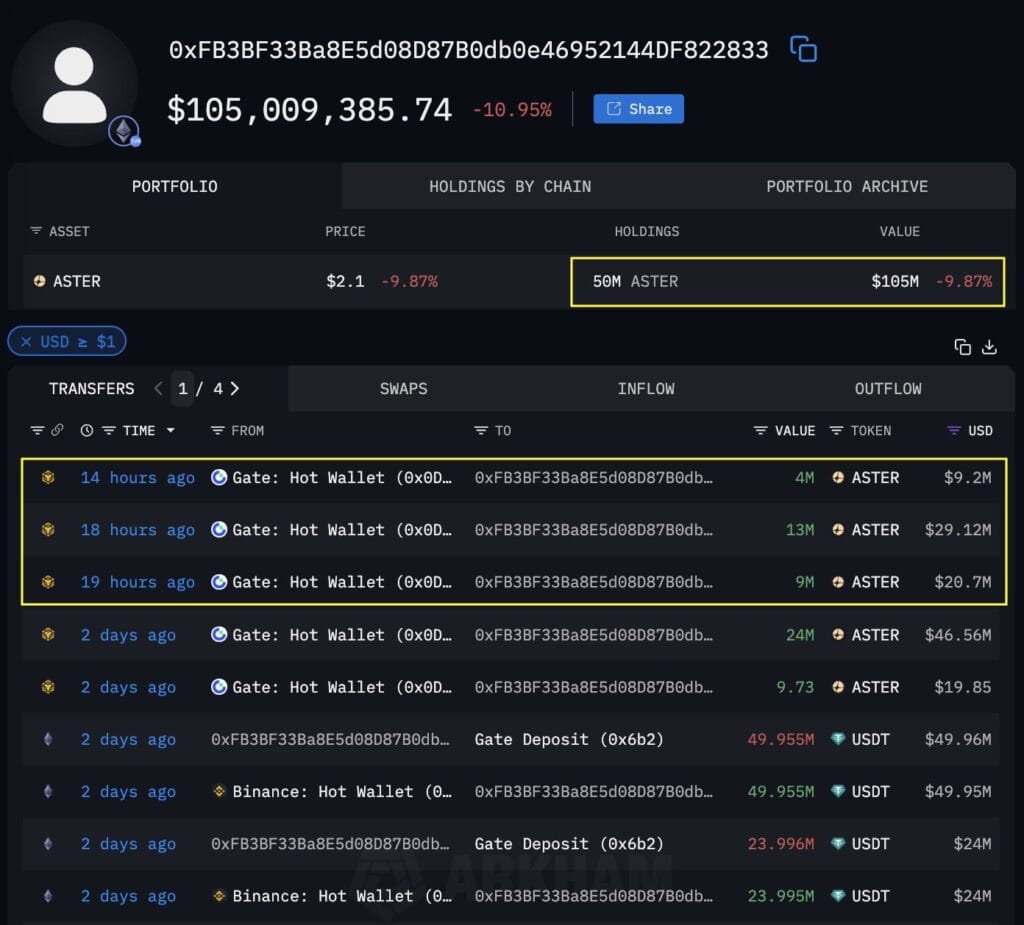

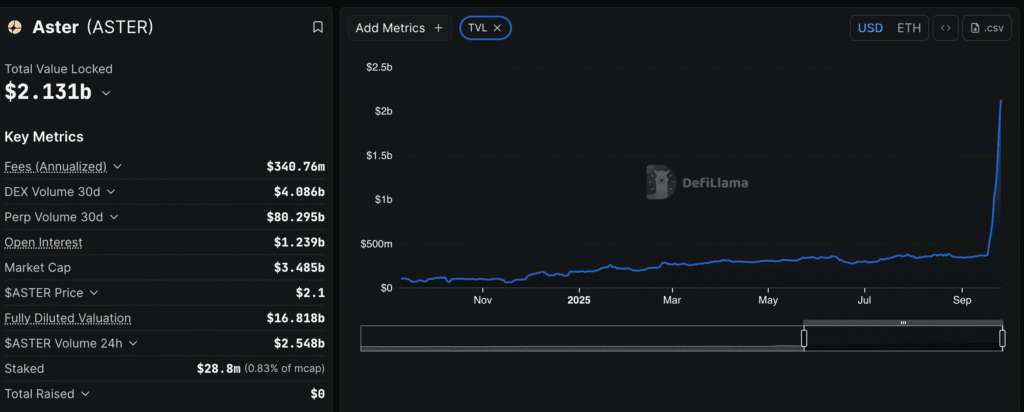

Aster Drops 10% as Whales Accumulate

Aster (ASTER) fell more than 10% on Wednesday, trading near $2.00 and down about 17% from its record $2.43 high.

Highlights:

- Large holders continue to buy the dip, with one whale withdrawing 26m ASTER ($59m) from Gate and another purchasing 1.56m ASTER ($3.5m) from Bybit.

- Whales now hold 50m ($105m) and 8.28m ($17.4m) respectively.

- TVL in DeFi protocols tied to ASTER surged to $2.13bn, up from $347m at the start of September.

Despite the correction, rising staking balances and TVL growth suggest continued confidence in the token’s ecosystem.

NY Fed Notes JPMorgan-Barclays Use of Tokenized Fund

The New York Fed highlighted that tokenized funds are slowly entering mainstream finance, citing JPMorgan’s transaction with Barclays using BlackRock’s tokenized money market fund, BUIDL, as collateral in a derivatives trade.

Economists said the deal shows blockchain-based assets are beginning to integrate with traditional systems. However, they cautioned that transparency, operational, and regulatory risks remain.

Although still early, the involvement of BlackRock, JPMorgan, and Barclays demonstrates institutional appetite for tokenization, which could reshape collateral and settlement practices globally.

The Day’s Takeaway

North America

- Equities: US stocks closed lower but pared losses after midday.

- Dow: -0.4%

- S&P 500: -0.5%

- Nasdaq: -0.5%

- Russell 2000: -1.0%

Tesla (-4.4%) and Oracle (-5.5%) weighed heavily.

- Treasuries: $44B in 7-year notes sold at 3.953%, slightly above the when-issued.

- Tail: +0.6 bps vs. -0.7 bps 6-mo avg.

- Bid-to-cover: 2.40x vs. 2.60x avg.

- Domestic demand was strong, but weak foreign participation left dealers with a larger share.

- Housing: 30-year fixed mortgage rate rose to 6.30% (from 6.26%), ending an 8-week easing streak.

- Fed Commentary: Chicago Fed’s Goolsbee said the labor market is stable but inflation risks remain.

- Policy “mildly restrictive.”

- Tariffs unlikely to drive broad inflation.

- Business investment still strong.

- Macro Data:

- Jobless claims: 218K vs. 235K est.

- Q2 GDP final: +3.8% vs. +3.3% prior est.

- Q2 Core PCE: +2.6% vs. +2.5% prior.

Growth and labor strength reinforce a cautious Fed stance.

- Mexico (Banxico): Cut rates 25 bps to 7.50%. Decision not unanimous (1 vote for hold at 7.75%). Inflation still seen converging to 3% by Q3 2026.

Commodities

- Crude Oil: Settled nearly flat at $64.98 (-$0.01).

- Range: $64.06 – $65.16.

- Traded around 100-day MA ($64.50), key pivot.

- Upside levels: $66.36 (50% retracement), $66.83 (200-day MA).

- Headlines: Turkey pressured to halt Russian oil buys; EU warned Moscow on jets; Ukraine struck Russian oil terminal; US drillers threatened output cuts over Trump’s policies.

- Silver: Held firm at $44/oz, near Tuesday’s 14-year high ($44.47).

- Supported by dovish Fed expectations (92% chance of Oct cut vs. 87% last week).

- Geopolitical tensions added safe-haven demand.

- Fed officials diverged, with Daly dovish and Goolsbee more cautious.

Europe

- Equities: Major indices closed weaker.

- DAX: -0.61%

- CAC 40: -0.41%

- FTSE 100: -0.39%

- FTSE MIB: -0.43%

- Ibex 35: -0.27%

- Germany: GfK October consumer sentiment improved to -22.3 (vs. -23.3 est., prior -23.5). Income expectations jumped, but inflation fears and job concerns persist.

- France: September consumer confidence steady at 87, showing stabilization.

- Switzerland (SNB): Held policy rate at 0.0%, citing risks from higher US tariffs. GDP outlook for 2025 left at 1.0–1.5%, CPI unchanged.

- Eurozone: August M3 money supply +2.9% y/y (vs. +3.3% est., prior +3.4%). Broad money growth continues slowing trend.

- UK: CBI retail sales index for September at -29 (vs. -32 prior), marking 12 straight months of declines. October expectations plunged to -36, lowest since July. Weak demand, tariffs, and sluggish conditions remain drags.

Crypto

- Ethereum: Led losses, down 7.5%, back in $2,800–$4,000 range.

- Bitcoin: Fell toward $110,000, down ~3% this week after failing to break $118,000.

- XRP: Slipped to $2.83–$2.93 range after jobless claims data signaled labor market strength. Down ~8% since Sept 17.

- Altcoins:

- Cardano: -6%

- Solana: -7.2%

- Binance Coin: -6.1%

- Pi Network (PI): Flat above $0.27 for third day after 19% drop Monday. Net outflows continue from exchanges, suggesting dip buying.

- Aster (ASTER): Dropped 10% to ~$2.00, ~17% off highs. Whales accumulated, DeFi TVL surged to $2.13B (from $347M start Sept).

- Hyperliquid (HYPE): Fell >6%, seventh straight day of declines. TVL slipped to $2.14B (from $2.78B last week), OI down 3.1% in 24h. Momentum remains weak.