North America News

Dow, NASDAQ, and S&P 500 Close at Record Highs Led by Dow’s 1.37% Gain

U.S. equities surged to fresh record highs on Thursday, with the Dow Jones Industrial Average leading gains, up 1.37%. The S&P 500 rose 0.50% while the NASDAQ added 0.72%.

All but one of the 11 S&P sectors finished higher, with energy the lone decliner (-0.04%). Materials (+2.14%), healthcare (+1.73%), and consumer discretionary (+1.70%) topped the leaderboard.

Sector performance:

- Materials: +2.14%

- Health Care: +1.73%

- Consumer Discretionary: +1.70%

- Real Estate: +1.68%

- Financials: +1.67%

- Industrials: +0.96%

- Consumer Staples: +0.94%

- Utilities: +0.49%

- Technology: +0.18%

- Communication Services: +0.18%

- Energy: −0.04%

Key movers: Paramount Skydance surged on reports of a Warner Bros. Discovery bid, Synopsys jumped on strong AI-related demand, and Stellantis rose on stabilizing EV demand. Tesla, Micron, and Lam Research advanced with chip sector optimism, while Alibaba gained on positive China headlines. Biotech names like Moderna, Biogen, and ARKG also pushed higher.

Earnings highlight: After the close, EPS 5000 posted results above expectations with earnings per share at $5.31 (vs $5.18 est.) and revenue at $5.99B (vs $5.90B est.). The company raised Q4 guidance, forecasting EPS at $5.35–$5.40 and revenue between $6.075B–$6.125B. Shares rose 5.9% to $372.50 in late trading.

US Treasury Auctions $22 Billion of 30-Year Bonds at 4.651% Yield

The U.S. Treasury auctioned $22 billion of 30-year bonds at a high yield of 4.651%, in line with the when-issued level at the time of the sale. There was no tail, with the bid-to-cover ratio at 2.38x, matching the six-month average of 2.37x. Dealers took just 10%, well below the average of 14.9%, while direct bidders claimed 28% and indirect bidders 62%, both stronger than normal. The distribution suggests a balanced but stronger-than-usual investor appetite.

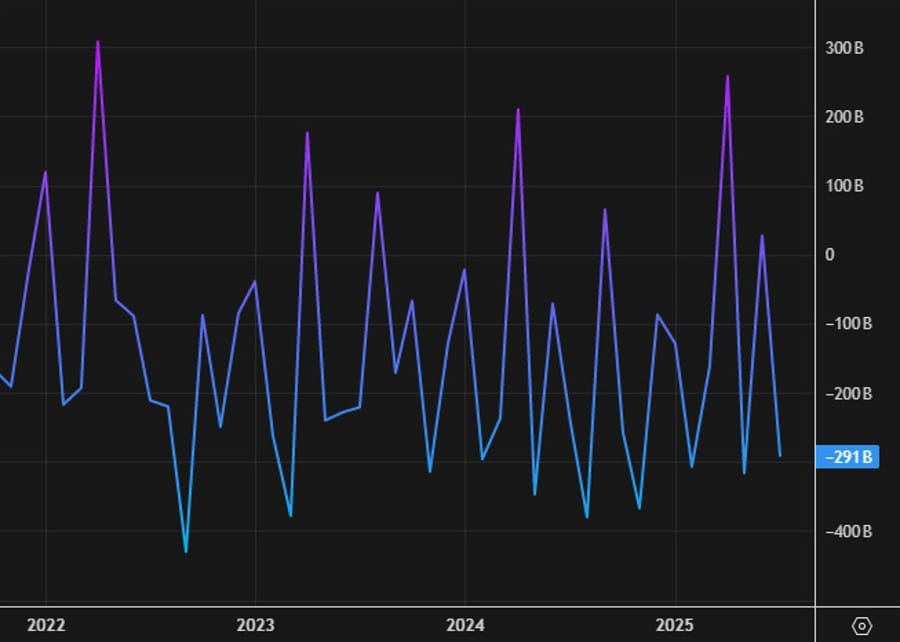

US August Federal Budget Deficit Hits $345 Billion, Above Expectations

The U.S. federal government posted a $345 billion budget deficit in August, wider than the $285.5 billion expected but smaller than the $371 billion shortfall from a year earlier. July’s deficit was $291 billion. Year-to-date, the deficit stands at $1.973 trillion, up from $1.897 trillion a year ago. August outlays reached $689 billion, slightly above last year, while receipts rose to $344 billion from $307 billion.

US Initial Jobless Claims Jump to 263K, Above Forecasts

US initial jobless claims rose to 263,000 (estimate 235,000), the highest since October 2021.

- Prior week revised down to 236K (from 237K)

- Continuing claims: 1.939M (vs 1.951M expected)

- 4-week average of initial claims: 240,500 (prior 230,750)

- 4-week average of continuing claims: 1.945M

The spike in initial claims came as a surprise to analysts.

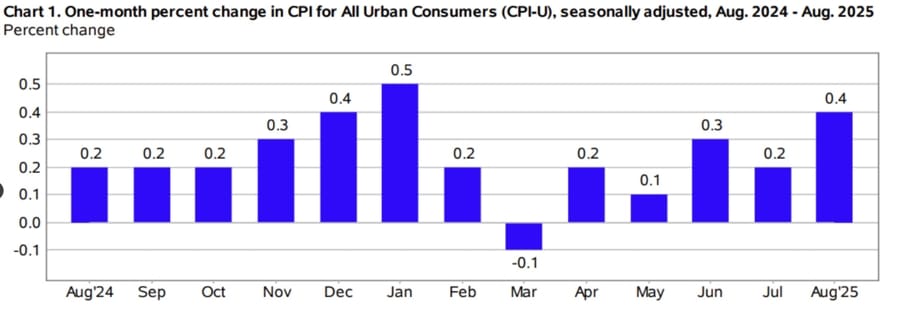

US CPI Hits 2.9% in August, Highest Since January

The US Consumer Price Index (CPI) rose 2.9% YoY in August, matching forecasts and the highest since January. The prior reading was +2.7%.

- Monthly CPI: +0.4% (vs +0.3% expected, unrounded +0.36%)

- Core CPI YoY: +3.1% (expected +3.1%)

- Core CPI MoM: +0.3% (expected +0.3%, unrounded +0.346%)

Other details:

- Real weekly earnings fell -0.1% (prior revised to +0.1%)

- Core goods +0.3% (prior +0.2%)

- Core services +0.3% (prior +0.4%)

- Owners’ equivalent rent +0.4% (prior +0.3%)

Freddie Mac: US 30-Year Mortgage Rate Drops to 6.35%, Lowest Since October 2024

The U.S. 30-year fixed mortgage rate fell to 6.35% this week from 6.5% last week, reaching its lowest level since October 2024, according to Freddie Mac. The rate peaked at 7.04% in mid-January before declining steadily. For a $337,920 loan on a median home, the drop from 7.05% to 6.35% lowers monthly payments by about $157, saving roughly $56,500 over 30 years. The decline could improve affordability for new buyers.

CIBC: Tariff Impacts Broadening but CPI Still Paves Way for Fed Cut

CIBC economists said August’s hotter-than-expected U.S. CPI report is unlikely to stop the Fed from cutting rates by 25 basis points next week. While headline inflation rose to 2.9% and core stayed at 3.1%, signs of tariff pass-through are emerging, with core goods prices rising at their fastest pace since tariffs were first imposed. CIBC expects cuts in September and October, followed by a pause, and another two cuts in the first half of 2026, totaling 121 basis points of easing.

Report: Treasury Secretary Bessent Pushes for Smaller Fed Balance Sheet

A CNBC report says Treasury Secretary Scott Bessent has pressed potential Fed chair candidates on reducing the central bank’s balance sheet. Bessent reportedly favors an “organic” reduction of bond holdings, meaning continued quantitative tightening. Among those recently meeting with him are Larry Lindsey, Kevin Warsh, and James Bullard. Trump is said to be focused on Warsh, Kevin Hassett, and current Fed Governor Christopher Waller as possible picks.

Goldman Sachs CEO Solomon: Expects Initial 25bp Fed Cut, With More Likely

Goldman Sachs CEO David Solomon told CNBC he anticipates the Federal Reserve will begin easing policy with a 25-basis-point cut this fall, followed by possibly one or two additional cuts.

He pointed to weaker job market data as evidence of a cooling economy. Despite the slowdown, Goldman Sachs has seen a surge in activity, with IPO volumes this week surpassing levels last seen in July 2021.

Trump’s Fed Nominee Miran Could Be Confirmed Monday

The Senate is preparing for a full vote on Stephen Miran, Donald Trump’s pick for the Federal Reserve Board, potentially as soon as Monday, September 15.

Miran would fill the seat left by Philip Jefferson Kugler but only until January. The Senate Banking Committee advanced Miran’s nomination in a 13–11 vote, setting the stage for approval largely along party lines, according to Politico.

The Fed’s September 16–17 FOMC meeting is widely expected to deliver a 25bp cut, regardless of whether Miran has been seated by then.

Barclays Sees Fed Cutting Rates This Month, Three Moves in 2025

Barclays economists say the Federal Reserve will begin cutting rates this month, forecasting three reductions in total for 2025.

The bank expects the first move to be a 25bp cut, although some market participants are positioning for a larger 50bp move. Analysts cite a rapid slowdown in the U.S. labor market as the main driver.

Barclays does not see cuts beyond 25bp unless inflation collapses unexpectedly. Instead, the bank expects tariffs to gradually push consumer prices higher, forcing the Fed to balance weak job growth against renewed inflation risk.

Deutsche Bank Lifts S&P 500 Target to 7,000 by Year-End

Deutsche Bank raised its S&P 500 year-end target to 7,000 (from 6,550), citing accelerating earnings and resilient growth.

Chief strategist Binky Chadha noted equities are advancing at an annualized 22.7% pace since rebounding from the Liberation Day selloff. Corporate profits grew 10% in Q2, compared with 8.7% in Q1.

The bank now sees 2025 EPS at $277 (up from $267) and 2026 at $315. With investor positioning still neutral, Deutsche believes upside remains if sentiment improves. Tariff effects have so far been modest, while inflation risks are considered temporary.

Gun Stocks Jump After Assassination of Charlie Kirk

The assassination of Charlie Kirk during a Utah college event triggered a sharp rally in gun manufacturers’ shares.

Witness footage suggested the shooter fired from nearly 200 meters away, indicating a sniper-level attack. The suspects remain at large.

Stocks including Smith & Wesson ($SWBI) and Outdoor Holding Company ($POWW) surged on speculation that the killing will prompt tighter gun control—a dynamic that has historically driven higher firearms demand.

Amid recent violence, including the murder of Ukrainian refugee Iryna Zarutska, analysts warn that heightened security fears could further boost demand for personal defense weapons.

Commodities News

Gold Slips as Traders Take Profits Despite Rising Fed Cut Bets

Gold edged lower on Thursday, down 0.14% to $3,635 per ounce, as profit-taking outweighed support from weaker yields, a softer U.S. dollar, and elevated Fed rate cut expectations.

The pullback came even as U.S. jobless claims climbed to a four-year high, reinforcing a 90% probability of a 25 bps cut at next week’s Fed meeting—the first since December. Odds of a deeper 50 bps move remain slim at 10%.

Consumer inflation data showed headline CPI holding below 3%, largely in line with forecasts, while producer prices also eased. Despite the soft inflation backdrop and rising unemployment claims, gold has struggled to hold gains.

Traders appear to be locking in profits after the metal’s recent rally, though ongoing geopolitical tensions—including Poland’s downing of Russian drones over NATO territory—continue to underpin gold’s safe-haven appeal.

Crude Oil Futures Settle at $62.37 as Sellers Regain Control

Crude oil futures fell $1.30, or 2.04%, to settle at $62.37 on Thursday. Prices slipped below both the 200-hour moving average at $63.59 and the 100-hour at $62.86, signaling sellers are back in control. The next downside targets are the September 8 low at $61.94 and the September 5 low at $61.45. Earlier in the week, oil briefly moved higher on geopolitical risk in Russia and Israel, but that momentum has faded.

Silver Slides Below $41 as Dollar Strengthens

Silver prices fell under $41.00, reversing recent momentum as the US dollar rebounded.

The metal had gained more than 10% since mid-August, but traders now see signs of topping.

Market attention is turning to the US CPI release, which could shape expectations for Fed policy. Silver remains range-bound around the $41 level in a consolidation phase.

IEA Raises 2025 Oil Supply Outlook After OPEC+ Production Hike

The International Energy Agency (IEA) now expects global oil supply to increase by 2.7 million barrels per day in 2025, up from its previous 2.5 million bpd forecast.

Demand growth for 2025 is projected at 740,000 bpd (previously 680,000), while the 2026 estimate holds at 700,000 bpd.

The IEA said the market is being pulled in opposite directions—sanctions on Russia and Iran could cut supply, even as OPEC+ production rises, creating the risk of “bloated oil balances.”

Europe News

European Markets Close Higher as ECB Holds Rates Steady

Major European stock indices ended the day higher after the ECB left rates unchanged. President Christine Lagarde said the “disinflationary process is over,” suggesting downward pressure on inflation has eased. Traders have scaled back expectations for near-term rate cuts, with odds of another move by mid-2026 now around 50%. Despite the less dovish stance, markets gained: DAX +0.30%, CAC +0.80%, FTSE 100 +0.78%, Ibex +0.68%, FTSE MIB +0.89%.

ECB Tweaks Inflation Outlook: Higher in 2025–26, Lower in 2027

The ECB adjusted its inflation forecasts slightly:

- 2025 HICP: 2.1% (from 2.0%)

- 2026 HICP: 1.7% (from 1.6%)

- 2027 HICP: 1.9% (from 2.0%)

The updated GDP projections show 2025 growth at 1.2% (up from 0.9%), while 2026 was trimmed to 1.0% (from 1.1%). The 2027 estimate stays at 1.3%.

Markets may see the lower 2027 inflation number as leaving the door open for another cut, though current year-end pricing is unchanged at 40% odds.

ECB Holds Rates Steady in September Meeting, Keeps Data-Dependent Stance

The European Central Bank left its key rates unchanged in September:

- Deposit rate: 2.00% (unchanged)

- Main refinancing rate: 2.15% (unchanged)

- Marginal lending facility: 2.50% (unchanged)

New staff projections show headline inflation averaging 2.1% in 2025, then easing to 1.7% in 2026 and 1.9% in 2027. Core inflation is expected at 2.4% in 2025, 1.9% in 2026, and 1.8% in 2027.

The ECB raised its 2025 GDP growth forecast to 1.2% (from 0.9%), while lowering 2026 slightly to 1.0%. Growth for 2027 is unchanged at 1.3%.

Officials stressed they will continue to follow a meeting-by-meeting approach without committing to a fixed rate path.

UK House Prices See Broadest Decline Since Early 2024

The RICS House Price Balance dropped to -19% in August (expected -10%, prior -13%), marking the weakest reading since January 2024.

Buyer demand fell sharply, with new enquiries at -17% (lowest since May), and agreed sales slipped to -24%. High inflation (3.8% in July, with a BoE-expected 4% peak in September) and rate uncertainty are weighing on sentiment.

On rentals, demand remains strong, but landlord listings plunged -37%, the steepest since April 2020. Rents are expected to rise further, with a +27% balance projecting increases in the next three months.

ECB Policymakers Signal No Further Rate Cuts Needed to Reach 2% Inflation

European Central Bank policymakers believe no additional interest rate cuts are required to achieve their 2% inflation target, even though projections point to a potential undershoot over the next two years. Officials say borrowing costs will remain stable unless the eurozone faces another significant shock. The December meeting will serve as a reassessment point, when forecasts will be extended to include 2028.

Lagarde press conference: Headwinds on growth should fade next year

- Lagarde press conference highlights on September 11, 2025

- Higher tariffs, stronger euro and competition are holding growth back

- Investment should be underpinned by government spending

- Recent surveys point to growth both in the manufacturing and services sectors

- Growth shows resilience of domestic demand

- Economic risks more balanced (previously were tilted to the downside)

- Inflation outlook is more uncertain that usual (no hint on upside or downside risks)

- Stronger euro could bring inflation down more than expected

- The disinflationary process is over

- We are still in a good place

- Inflation is where we want it to be, the domestic market is showing resilience

- Decision was unanimous

- Trade uncertainty has diminished

- Minimal deviation from target will not necessarily justify movement

ECB sources: The rate-cut debate is not over but real discussion not until December

- ECB sources cited by Reuters

The ECB sources are out:

- ECB rate cut debate isn’t over but October is seen as too soon and the next real discussion is more likely in December

The market is only pricing in an 18% chance of a December cut but that could change with low inflation or poor economic data in the interim.

EU: Too Early for Details on 19th Sanctions Package Against Russia

The European Union confirmed it is working on its 19th sanctions package against Russia but said it was too early to release details.

European Commission President Ursula von der Leyen said the package would likely focus on Russia’s fossil fuel revenues, including the so-called “shadow fleet” of tankers.

Other possible measures could hit payment systems, credit card networks, and crypto exchanges, but no final decision or timing has been confirmed.

ECB to Hold Rates Steady, Lagarde Expected to Stay Cautious

The European Central Bank is set to keep interest rates unchanged as inflation aligns with the 2% target.

President Christine Lagarde is expected to maintain a cautious stance, citing risks from global trade disputes and political uncertainty. While policymakers see little urgency for immediate action, they remain open to easing if external shocks weigh on growth and prices.

For now, the ECB is likely to stick with a “wait and see” approach, watching for potential downside risks.

Asia-Pacific & World News

China Mulls State Aid to Help Local Governments Pay Bills

Bloomberg reports China is considering state-backed lending to help local governments settle more than $1 trillion in unpaid bills owed to private firms.

Officials are discussing a first phase of ¥1 trillion ($140 billion) in support, with the aim of clearing obligations by 2027.

Unpaid bills, estimated at ¥10 trillion (7% of GDP), have fueled dissatisfaction among businesses and workers. Delayed payments risk undermining Beijing’s push for “common prosperity.”

PBOC sets USD/ CNY reference rate for today at 7.1034

- PBOC CNY reference rate setting for the trading session ahead.

PBOC injected 292bn yuan via 7-day reverse repos at 1.40%

- net 79.4bn injection yuan

RBNZ Governor: OCR Projected to Fall to 2.50% by Year-End

RBNZ Governor Christian Hawkesby said the official cash rate is projected to decline to 2.50% by year-end, though the pace will depend on how the economic recovery develops.

Speaking at the Financial Services Council’s annual conference, Hawkesby highlighted that trust in the central bank is being tested. He noted that the speed of recovery will ultimately determine the trajectory of monetary policy.

Japanese Firms Oppose Stricter Foreign Worker Rules Amid Record Bankruptcies

A Reuters survey found 77% of Japanese firms oppose tighter foreign worker rules, warning such measures would worsen labor shortages.

Tokyo Shoko Research reported 238 bankruptcies tied to staff shortages in the first eight months of 2025, putting the year on track for a record.

On earnings, 47% of firms expect October–March profits to meet forecasts, while 32% see downside risks. Key concerns include raw material prices, FX volatility, rate moves, and U.S. tariffs.

Japan Wholesale Inflation Hits 2.7% in August, BOJ Under Pressure

Japan’s PPI rose 2.7% in August, matching forecasts, driven by food prices up 5%. Energy costs fell, with electricity and gas down 2.9%, while import prices slid 3.9%.

Economist Yutaro Suzuki of Daiwa Securities expects wholesale inflation to stay above 2% due to high food and farm costs.

The BOJ meets Sept. 18–19 after raising rates to 0.5% in January. While core inflation remains above target, tariff risks and wage dynamics are complicating the policy outlook.

Poll: BOJ Expected to Hold Rates at 0.50% in September

A Reuters poll showed 96% of economists (65 of 68) expect the BOJ to keep its rate at 0.50% this month.

Looking ahead:

- 55% expect at least one hike to 0.75% by year-end.

- Median forecast for December remains 0.75%.

- Most economists see spring 2026 wage hikes slowing to ~4.8%, down from 5.25% this year.

While another rate increase in Q4 is possible, wage growth uncertainty poses challenges for BOJ policymakers.

Japan August PPI Rises 2.7% YoY, Matches Forecasts

Japan’s Producer Price Index (PPI) climbed 2.7% year-on-year in August (expected 2.7%), up from 2.6% in July. On a monthly basis, prices fell -0.2% (expected -0.1%).

The Q3 business survey showed a rebound in sentiment:

- Large manufacturers index at +3.8% (prior -4.8%)

- Non-manufacturers at +5.2% (prior -0.5%)

South Korea Trade Data: Exports Up 3.8%, Imports Up 11.1%

In the first 10 days of the month, South Korea reported exports rising 3.8% YoY and imports climbing 11.1% YoY, leaving a provisional $1.23 billion deficit.

Meanwhile, Seoul is in talks with Washington after 475 Korean workers were detained in a U.S. immigration raid at a Hyundai site.

Discussions include creating a new visa category for Korean workers. A chartered plane is set to return the detained employees to South Korea. Officials said Koreans were “hurt and shocked,” stressing that workers came to support U.S. manufacturing.

Crypto Market Pulse

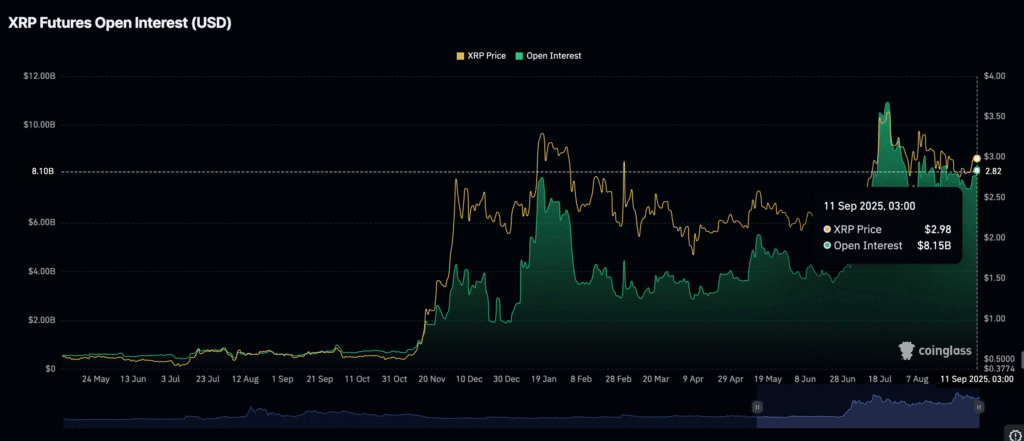

XRP Holds $3.00 as Traders Eye Breakout After CPI Report

Ripple’s XRP is trading near $3.00, with volatility rising after the US CPI report showed 2.9% YoY inflation.

Retail interest remains firm, with futures open interest climbing to $8.15 billion, up from $7.37 billion earlier this week.

The report slightly reduced expectations of a 25bp Fed cut in September (from 91% to 88.7%, per CME’s FedWatch).

Traders are watching whether XRP can retest its July high of $3.66 as buying interest builds.

Solana Surges as Forward Industries Secures $1.65 Billion for SOL Treasury

Solana (SOL) jumped to $228, a seven-month high, after Forward Industries announced a $1.65 billion private investment in public equity (PIPE) deal to establish a Solana treasury. The offering was backed by $300 million from Galaxy Digital, Multicoin Capital, and Jump Crypto, alongside support from other digital asset investors. The funds will primarily be used to acquire SOL. On-chain data shows Galaxy has already moved over $300 million in SOL from exchanges. The deal positions Forward Industries to become the largest corporate holder of Solana, fueling optimism for a year-end rally.

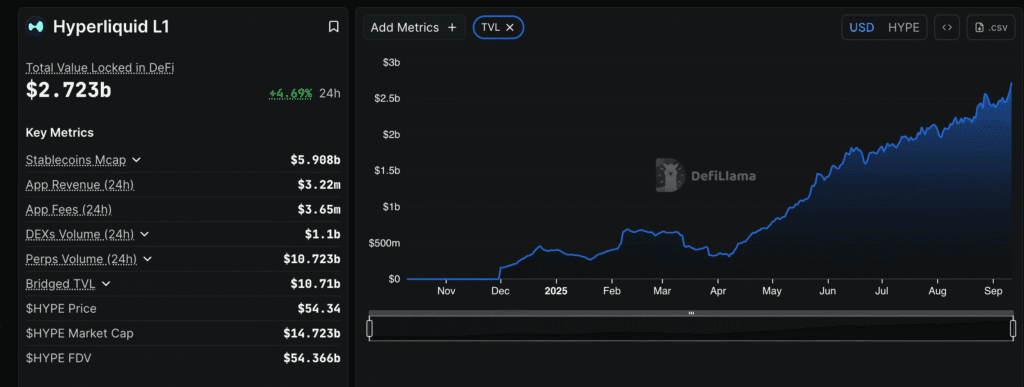

HYPE Rally Pauses as DeFi TVL and Stablecoins Hit Records

Hyperliquid (HYPE) is trading just below $54, down about 2.5% after recently hitting a record $58.78.

Despite the pullback, DeFi activity on Hyperliquid is surging:

- TVL reached $2.72 billion, up from $330 million in April

- Stablecoin market cap on the protocol hit $5.83 billion, a 65.9% rise since April

The protocol plans to launch USDH, a native stablecoin, which could increase competition with USDC and USDT while boosting liquidity and demand for HYPE.

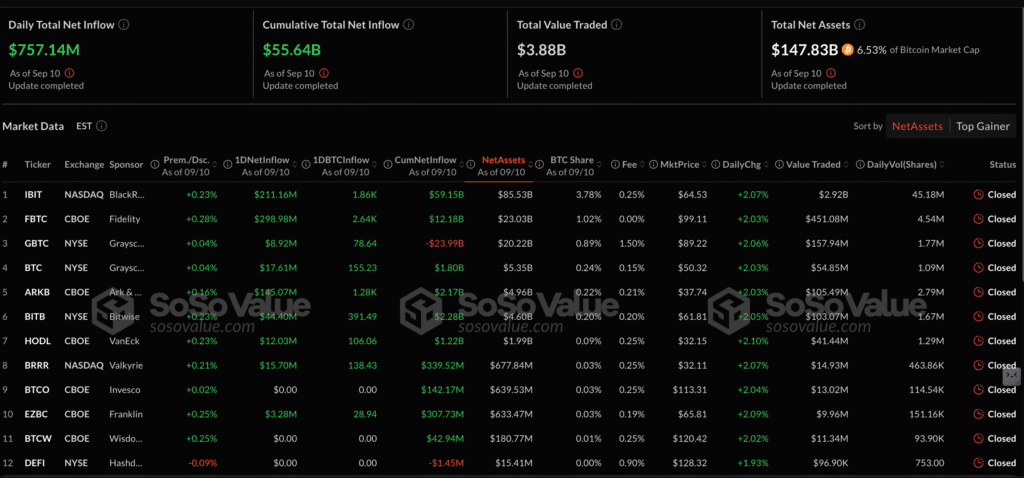

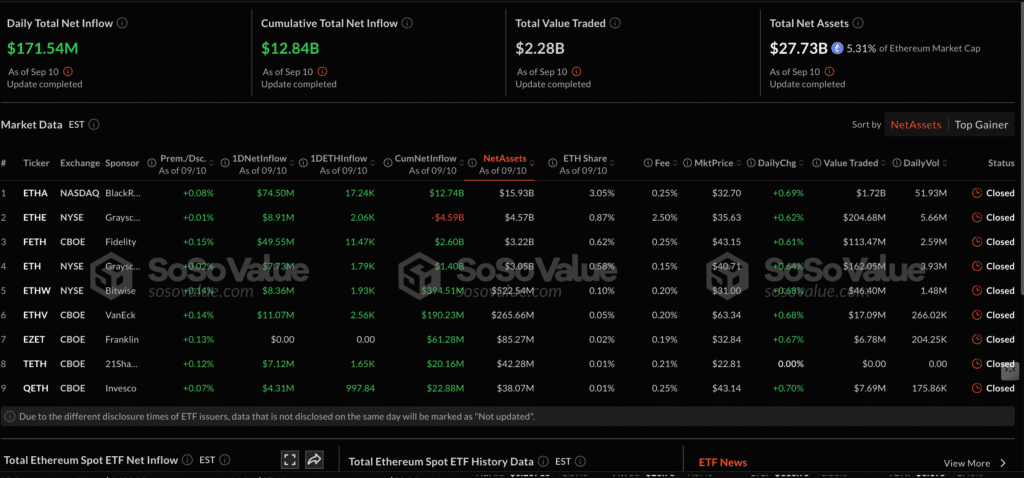

Crypto Today: Bitcoin Holds $114K, Ethereum Rallies, XRP Consolidates

Bitcoin remains firm above $114,000, supported by strong ETF inflows and institutional demand.

Ethereum extended its rally for a fifth straight day, trading above $4,400 with ETF inflows of $172M this week, led by BlackRock ($75M) and Fidelity ($50M).

XRP consolidates near $3.00, maintaining support ahead of the Fed’s upcoming policy decision.

Key Ethereum technicals:

- RSI at 54 (bullish momentum intact)

- Above 50-, 100-, and 200-day EMAs

- Next resistance: $4,500, then record $4,956

Avalanche Foundation Seeks $1B to Fund Two Crypto Treasury Firms

The Avalanche Foundation is aiming to raise $1 billion to establish two treasury firms holding AVAX tokens, according to the Financial Times.

The plan includes:

- Up to $500M private investment led by Hivemind Capital via a Nasdaq-listed company

- A second deal using a SPAC to create an AVAX treasury company

The tokens would be sold at a discounted price, similar to Michael Saylor’s MicroStrategy model, which now holds 640,000 BTC ($73B).

AVAX gained nearly 8% in the last 24 hours, but remains down about 2% since midnight UTC.

Belarus Turns to Crypto as Lukashenko Pushes Digital Strategy

Belarus President Alexander Lukashenko urged banks to expand the use of cryptocurrencies to sidestep sanctions and stabilize the economy.

At a meeting with financial leaders, Lukashenko called digital assets a “strategic tool” and pressed for immediate action. He has also encouraged lawmakers to build a transparent regulatory framework.

With sanctions tied to Belarus’s support of Russia deepening economic troubles, authorities are looking to crypto as a potential financial lifeline.

The Day’s Takeaway

North America

Equities at Record Highs

The Dow, S&P 500, and NASDAQ all closed at fresh records, led by a 1.37% gain in the Dow. Materials (+2.14%), healthcare (+1.73%), and consumer discretionary (+1.70%) topped the S&P sector leaderboard, while energy was the only laggard (-0.04%). Paramount Skydance, Synopsys, Stellantis, Tesla, and Micron were among the day’s top movers. Biotech and chip-related names also outperformed.

Earnings highlight: EPS 5000 beat estimates and raised guidance, sending shares nearly 6% higher after hours.

Inflation Data & Labor Market

August CPI rose 2.9% YoY, the fastest pace since January, while core held steady at 3.1%. Initial jobless claims jumped to 263K, the highest since 2021, signaling a cooling labor market.

Treasury Auctions & Yields

The Treasury sold $22B of 30-year bonds at 4.651%, matching the when-issued level. Demand was strong from both direct and indirect bidders, with dealers taking just 10%, well below average.

Fiscal Update

The U.S. budget deficit hit $345B in August, wider than expected, pushing the fiscal-year shortfall to nearly $2T.

Housing & Credit

Freddie Mac reported the 30-year mortgage rate at 6.35%, the lowest since October 2024, easing affordability pressures after last year’s peak.

Policy Positioning

Treasury Secretary Scott Bessent has pressed Fed chair candidates on reducing the central bank’s balance sheet, signaling a push for continued quantitative tightening.

Commodities

Gold Slips on Profit-Taking

Gold edged down 0.14% to $3,635 as traders booked profits despite weaker yields, a softer dollar, and rising Fed cut expectations. Safe-haven demand remains underpinned by geopolitical risks after Poland intercepted Russian drones.

Oil Sellers Back in Control

WTI crude dropped 2.04% to $62.37, falling below its 100- and 200-hour moving averages. Next support lies at $61.94 and $61.45. The IEA raised its 2025 supply outlook by 2.7M bpd on expected OPEC+ production increases.

Silver Retreats

Silver slipped back under $41, giving up recent strength as the dollar rebounded.

Europe

ECB Holds, Markets Gain

The ECB kept rates unchanged. Lagarde said the “disinflationary process is over,” dampening hopes for near-term easing. Policymakers see no further cuts necessary unless a shock emerges, with December set as a reassessment point.

Markets still closed higher: DAX +0.30%, CAC +0.80%, FTSE 100 +0.78%, Ibex +0.68%, FTSE MIB +0.89%.

UK Housing Weakness

UK home prices fell at the steepest pace in months, with RICS data showing declining sales momentum amid rate and inflation uncertainty.

Sanctions in Progress

The EU is preparing a 19th sanctions package on Russia, likely targeting oil revenues and the tanker “shadow fleet.”

Asia

Japan Prices Steady, BOJ Seen on Hold

Japan’s PPI rose 2.7% YoY in August, in line with expectations. A Reuters poll shows nearly all economists expect the BOJ to hold rates in September, though over half see at least one hike by year-end.

South Korea Trade & Labor Developments

Exports rose 3.8% YoY and imports 11.1%, leaving a modest deficit. Meanwhile, Seoul is negotiating with Washington after hundreds of Hyundai workers were detained in a U.S. immigration raid.

RBNZ Signals Lower Rates

RBNZ Governor Hawkesby said the OCR could fall to 2.50% by year-end if recovery momentum holds.

China Debt Strategy

Beijing is weighing state-backed loans to help local governments clear ¥10T ($1.4T) in unpaid bills, with a first phase of ¥1T under discussion.

Crypto

Solana Surges on Treasury Plan

Solana jumped to $228 after Forward Industries announced a $1.65B PIPE deal to establish a Solana treasury, backed by Galaxy Digital, Jump Crypto, and Multicoin.

Market Snapshot

Bitcoin held above $114K with steady ETF inflows. Ethereum traded above $4,400, while XRP consolidated near $3.00.

DeFi Activity Rises

Hyperliquid (HYPE) pulled back to $54, but DeFi TVL climbed to $2.72B and stablecoins hit $5.83B. A native stablecoin (USDH) launch is upcoming.

Avalanche Treasury Strategy

Avalanche is seeking $1B to build two treasury firms holding AVAX, taking a page from MicroStrategy’s corporate crypto playbook.

Belarus Turns to Crypto

Belarus President Lukashenko called on banks to expand crypto use to bypass sanctions and stabilize the economy.