North America News

Nasdaq Composite hits record high after steep downside NFP revisions

U.S. equities closed higher Tuesday, with the Nasdaq Composite (+0.4%) reaching an intraday record of 21,891.42 and finishing at a new all-time high. The S&P 500 (+0.3%) and Dow Jones Industrial Average (+0.4%) also set fresh record closing highs.

- Dow Jones: +196.39 to 45,711.34

- Nasdaq Composite: +80.79 to 21,879.49

- S&P 500: +17.46 to 6,512.61

Sector performance: Gains were broad, with communication services (+1.7%) leading on strength from Alphabet (+2.5%) and Meta (+1.8%). Information technology (flat) and consumer discretionary (+0.1%) recovered late, helping lift the Nasdaq. Materials (–1.6%), industrials (–0.7%), and real estate (–0.1%) were the only laggards.

Corporate movers:

- UnitedHealth (+8.7%) jumped after amending its guidance disclosure.

- Apple (–1.5%) slipped following its product launch event, with focus on higher iPhone pricing: the new iPhone Air starts at $999, while the iPhone Pro rises to $1,099.

Macro backdrop:

The Bureau of Labor Statistics’ annual benchmark revision cut payrolls by 911,000 jobs, the largest downward adjustment on record, reinforcing expectations for a September Fed rate cut. CME FedWatch shows a 91.8% chance of a 25bp cut and 8.2% for 50bp.

Other market moves:

- Russell 2000: –0.6%

- S&P Mid Cap 400: –0.9%

- Treasuries eased after a four-day rally; 2-year yield +5 bps to 3.54%, 10-year +3 bps to 4.72%.

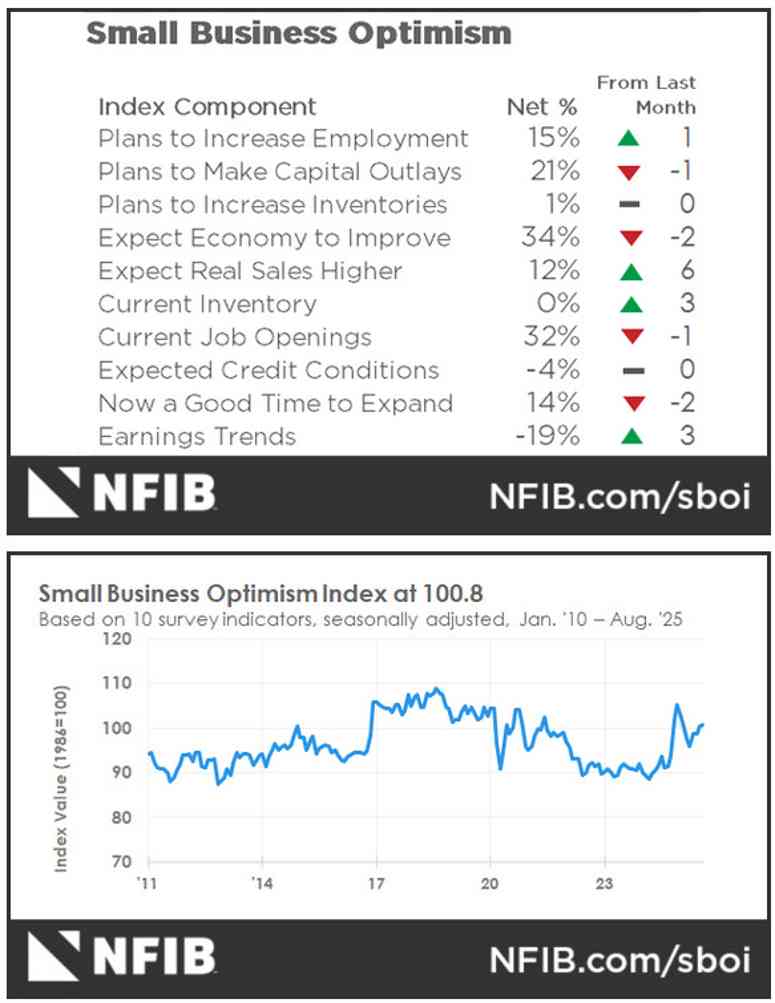

- August NFIB Small Business Optimism Index rose to 100.8 (from 100.3).

YTD performance:

- Nasdaq +13.3%

- S&P 500 +10.7%

- Dow +7.4%

- Russell 2000 +6.8%

- S&P Mid Cap 400 +4.7%

Focus now shifts to this week’s PPI (Wed), CPI (Fri), and Initial Jobless Claims (Thu), which could recalibrate expectations for further Fed moves in October and December.

U.S. Treasury 3-year auction draws strong international demand

The Treasury Department sold $58 billion of 3-year notes at a high yield of 3.485%, slightly below the when-issued level of 3.492%.

- Tail: –0.7 bps (vs. +0.7 bps 6m avg)

- Bid-to-cover: 2.73x (vs. 2.55x avg)

- Dealer allocation: 8.37% (vs. 15.9% avg)

- Direct bidders: 17.4% (vs. 21.9% avg)

- Indirect bidders: 74.24% (vs. 62.1% avg)

The result showed robust overall demand, with particularly strong international participation offsetting softer domestic buying.

BLS Revises Jobs Data Down by 911,000 — Largest on Record

The Bureau of Labor Statistics issued preliminary benchmark revisions showing U.S. nonfarm payrolls were overstated by 911,000 jobs (-0.6%) as of March 2025. Consensus had expected a smaller revision of -682,000.

This marks the largest annual adjustment on record, eclipsing the -548,000 revision in 2024.

Breakdown by sector:

- Trade, transportation, and utilities: -226K

- Leisure and hospitality: -176K

- Professional/business services: -158K

- Manufacturing: -95K

- Construction: -29K

- Information: -67K

- Government: -31K

- Transportation/warehousing (+6.6K) and utilities (+3.7K) were the only categories with gains.

The downward revisions underscore a softer labor market than previously believed, adding pressure on the Fed to consider deeper rate cuts.

U.S. NFIB Small Business Optimism Rises to 100.8

The NFIB Small Business Optimism Index climbed to 100.8 in August, beating expectations of 101.0 but still showing modest improvement from 100.3 in July.

Of the 10 components, four increased, four declined, and two held steady. Sales expectations were the biggest positive driver, while the Uncertainty Index dropped 4 points to 93 — though it remains elevated compared with history.

Chief economist Bill Dunkelberg said Main Street sentiment improved thanks to stronger sales and earnings expectations, but labor quality continues to dominate concerns.

Despite broader economic slowdown fears, business surveys remain relatively upbeat. The weak spot continues to be the labor market, where hiring remains sluggish even as layoffs stay low.

U.S. Weighs Ending Quarterly Earnings Reports

The Long-Term Stock Exchange (LTSE) plans to petition the SEC to replace quarterly reporting requirements with semi-annual disclosures.

LTSE CEO Bill Harts argued that the shift would cut compliance costs, ease pressure from short-term targets, and let executives focus more on strategy.

If adopted, the change would apply to all U.S.-listed companies, not just LTSE members. The idea has precedent — floated by former President Trump in 2018 — and has gained traction with regulators looking to revive public listings.

The U.S. count of listed firms has fallen to about 3,700, half of the 1997 peak. LTSE, launched in 2020, is positioning itself as a reform-minded venue emphasizing long-term value creation.

Wood Prices Plunge, Raising Economic Concerns

Lumber futures have tumbled 24% since early August, settling at $526.50 per thousand board feet, erasing gains made when prices hit a three-year high.

Two major sawmills in North America have announced production cuts in response, but the slide has stoked concerns about the housing market and broader economic health.

Wood is often seen as a leading signal of housing demand and economic momentum — making the downturn a red flag for Wall Street and Main Street alike.

Goldman Sachs CEO: Fed Doesn’t Need to Slash Rates Quickly

Goldman Sachs chief David Solomon pushed back against calls for aggressive rate cuts, saying he sees no urgent case for the Federal Reserve to ease policy rapidly.

“It doesn’t feel like the policy rate is extraordinarily restrictive when you look at risk appetite,” Solomon said during remarks at a Barclays financial-services event.

He described the environment as “mostly constructive,” but acknowledged that trade policy uncertainty has slowed investment. While risks remain, he pointed to a balance of supportive and challenging forces shaping the economy.

Morgan Stanley’s Wilson: Short-Term Volatility Could Precede Rally

Equity strategist Michael Wilson of Morgan Stanley said investors should brace for near-term turbulence but argued that any pullback could set the stage for a stronger year-end rally.

He cited seasonal market pressures, labor softness, and limited Fed policy room as drivers of volatility through September and October. However, Wilson expects these conditions to ultimately support a broad, earnings-led recovery that could extend into 2026.

Goldman’s Solomon: Trade Clarity Could Unlock Stronger U.S. Growth

Goldman Sachs CEO David Solomon argued that the U.S. economy stands to gain from greater trade certainty, emphasizing that business confidence hinges heavily on policy stability.

Solomon also highlighted a noticeable uptick in mergers and acquisitions activity, signaling that firms are becoming more willing to deploy capital despite macroeconomic risks.

Within Goldman, he pointed to its asset and wealth management division as a growth driver, with expansion potential in the high single digits. While acquisitions there will remain selective, Solomon noted the firm is open to pursuing opportunities that fit.

U.S. Job-Finding Probability Collapses to Record Low

New York Fed survey data shows that the odds of securing a new job in the U.S. have fallen to their weakest level ever. According to the Survey of Consumer Expectations, the mean probability of finding work dropped to 44.9%, marking a record low.

Research from Renaissance Macro (RenMac) flagged this as a growing labor-market risk. Interestingly, the chance of losing a current job has not surged, but expectations of being able to replace lost work have eroded steadily. This divergence raises doubts about the resilience of U.S. employment conditions going forward.

Commodities News

Gold hits $3,674 record before Dollar rebound caps rally

Gold extended its rally Tuesday, touching a fresh record high of $3,674 before retreating as Treasury yields and the U.S. Dollar rebounded.

- Spot gold: $3,646, +0.3%

- U.S. Dollar Index: 97.68, +0.24%

- Treasury yields: 10-year +3 bps to 4.72%

Drivers:

- The Bureau of Labor Statistics revised payrolls down by 911,000 jobs, far worse than the –682,000 estimate, reinforcing expectations for a September Fed rate cut.

- Fed funds futures fully price a 25bp cut next week, with traders watching inflation releases for scope of easing.

Data ahead:

- PPI (Wed) and CPI (Fri) will be critical for gauging Fed flexibility.

- Initial Jobless Claims (Thu) could provide an updated read on labor market conditions.

Gold’s third straight daily gain reflects strong safe-haven demand, though inflation surprises could temper Fed easing bets and cap bullion’s momentum.

Oil market faces pressure as OPEC+ barrels return

Crude oil prices inched higher Tuesday but remain fragile after last week’s steep drop sparked by confirmation of new OPEC+ supply.

- OPEC+ will add 137,000 bpd next month, marking the start of unwinding voluntary cuts.

- Traders expect the pace to continue, potentially pushing the market back toward surplus.

Technical outlook: The recent range bottom failed to hold, with $60 support likely to be tested. A break lower could drag prices toward $55 — levels considered unsustainable given current fundamentals.

Macro risks:

- China’s stockpiling has supported demand but is unlikely to persist at current levels.

- U.S. shale faces declining Tier 1 drilling inventory, limiting future production growth.

- Global exploration spending remains depressed near $10B annually — a fraction of AI-related capital expenditure.

Long-term view: While near-term risks point to a breakdown, analysts warn that underinvestment and depleting spare capacity could set up a tight market in 2026–27, when OPEC’s ability to offset shortages diminishes.

Qatar Condemns Israeli Strike on Hamas Delegation, Oil Jumps

Qatar condemned Israel for attacking a Hamas delegation in Doha, calling it a flagrant breach of international law.

Israeli media reported that Washington was notified ahead of the strike, with President Trump allegedly giving the go-ahead.

The escalation sent crude higher. WTI rose $0.92 (1.49%) to $63.20, briefly touching $63.52. Prices also cleared the 100-hour moving average at $63.10, while testing the 38.2% retracement of the September decline.

China Stockpiling Crude at Record Pace

Commerzbank said China has been building strategic oil reserves at a rapid clip, absorbing excess supply in global markets.

Since March, stockpiling has averaged 1 million barrels per day, with implied levels closer to 1.4 million bpd between March and July.

This reserve-building has been instrumental in supporting oil prices, and analysts expect China to maintain purchases at a similar pace through next year, limiting downside pressure in crude markets.

LME Aluminium Cancelled Warrants Jump to 3-Month Highs – ING

Aluminium activity picked up sharply on the London Metal Exchange (LME), with cancelled warrants surging 32,000 tons to 42,850 tons, the highest since June 5.

This marked the largest single-day increase since January, though cancelled warrants still account for only 9% of inventories, down from 54% at the start of 2025 amid weak physical demand.

On-warrant inventories fell 31,400 tons to 442,425 tons, but overall LME stocks edged up by 600 tons to 485,275 tons, the highest since March.

Aluminium 3M prices responded by hitting $2,625/ton, boosted by the uptick in withdrawal requests, ING said.

U.S. Inflation Data Could Test Gold’s Momentum – Commerzbank

Gold prices touched another record, trading near $3,660/oz, supported by Fed rate cut expectations, Commerzbank said.

The weak August jobs report, which showed just 22,000 jobs added, has markets fully pricing in a 25bp Fed cut next week, with some betting on a larger move.

However, Commerzbank cautioned that U.S. inflation data due this week could swing sentiment. A stronger-than-expected CPI print could dampen rate-cut speculation and trigger a pullback in gold. Conversely, a soft reading might fuel bets on a 50bp cut, sending prices higher still.

China’s Oil Imports and Exports Both Expand in August

China imported 49.49 million tons of crude oil in August, up 4.9% from the prior month, customs figures show. Cumulative imports for January–August reached 376.5 million tons, 2.6% higher than last year.

State-owned refineries kept processing volumes steady, while independents expanded capacity.

At the same time, oil product exports climbed 8.4% year-on-year to 5.33 million tons, sustaining the high levels seen in June and July.

China’s Copper Ore Imports Surge Even as Refined Demand Slows

Copper prices slipped below $10,000/ton after weak U.S. labor data reignited demand worries, Commerzbank said.

China’s August trade data showed a drop in refined copper imports — the lowest since February — reflecting softer industrial demand. But copper ore imports surged to 2.76 million tons, the second-highest on record and just 6% below April’s all-time peak.

For the first eight months of 2025, copper ore imports were up nearly 8% year-on-year to around 20 million tons, ensuring ample feedstock for smelters.

Separately, operations at Indonesia’s Grasberg Mine, the world’s second-largest copper site, were halted after an incident, lending fresh support to prices.

China’s Gas Imports Hit 11-Month High

China imported nearly 12 million tons of natural gas in August, up 11.5% month-on-month, Commerzbank noted.

The jump suggests demand is strengthening in the second half of the year, after imports had lagged in the first half — running almost 8% below 2024 levels.

It’s unclear how much of the increase reflects higher pipeline deliveries versus LNG purchases, but signs point to stronger Chinese presence in the global gas market going forward.

China’s Coal Imports Rise Sharply in August

China brought in 42.7 million tons of coal in August, the highest monthly volume since December 2024, customs data showed.

That’s about 16% (6 million tons) above the average pace of the first seven months. Drivers included a government cap on production that lifted domestic prices, plus a heatwave that boosted demand for air conditioning.

Still, imports remain weaker on a year-to-date basis — down 12.2% year-on-year in the first eight months. Commerzbank expects coal imports to decline over time as renewable capacity expands.

Credit Agricole: Gold Strength Backed by Debt, Inflation, and Policy Risks

Credit Agricole said the surge in gold prices reflects more than Fed rate cut bets — it’s being fueled by a cocktail of market turmoil, rising debt concerns, and persistent inflation in major economies.

The firm noted that a global bond selloff and equity weakness have reinforced gold’s safe-haven appeal. On top of that, ballooning public debt and sticky inflation are keeping real yields under pressure.

With U.S. policy seen as inconsistent, gold is increasingly viewed as a diversification play away from the dollar. Credit Agricole also pointed to emerging market central banks — particularly China — steadily adding to reserves.

The bank sees gold’s upside risks extending well beyond its current forecasts, expecting strong support in the months ahead.

Gold Surges to Record High Above $3,650

Gold prices have blasted to fresh records, rising above $3,650 per ounce as investors pile in.

Momentum has been fueled by expectations of lower Federal Reserve rates, heightened political instability, and sustained demand from large buyers.

US and Pakistan Seal $500m Critical Minerals Pact with Refinery Plan

Pakistan and the United States have struck a major minerals agreement worth $500 million, kickstarting immediate exports of antimony, copper, gold, tungsten, and rare earth elements. The deal also paves the way for a U.S.-funded poly-metallic refinery to be built in Pakistan.

The partnership, between Missouri-based US Strategic Metals (USSM) and Pakistan’s Frontier Works Organization (FWO), offers American firms a non-Chinese supply of strategic minerals vital for defense, aerospace, technology, and clean-energy production.

Exports begin right away, while longer-term plans include USSM’s proprietary refinery, designed to produce intermediate and finished products to feed U.S. demand. For American manufacturers, the agreement could ease both cost and security pressures tied to critical mineral sourcing.

Europe News

European indices close mostly higher, DAX lags

European equities ended Tuesday largely in positive territory, with Germany’s DAX the only major index to finish lower:

- DAX: –0.37%

- CAC 40: +0.19%

- FTSE 100: +0.23%

- IBEX 35: +0.14%

- FTSE MIB: +0.68%

U.S. equities were trading mixed at the same time, hovering around unchanged levels.

UK Retail Sales Accelerate in August

UK retail activity gained momentum in August, according to the British Retail Consortium (BRC). Like-for-like sales rose 2.9%, the fastest pace of the year outside of April’s Easter surge, while total sales advanced 3.1% year-on-year.

The increase was driven largely by higher food sales (+4.7%) versus modest gains in non-food categories (+1.8%). Warmer weather also boosted demand for furniture and back-to-school goods.

Still, consumer caution remains. Barclays data showed spending growth slowed to 0.5% from 1.4% in July, suggesting underlying demand is fragile. With fiscal uncertainty ahead of November’s budget and speculation over further Bank of England rate cuts, retailers remain wary heading into Christmas.

Asia-Pacific & World News

China and Canada Hold High-Level Trade Talks

China’s Ministry of Commerce said it held in-depth discussions with Canada focused on strengthening trade ties and regional economic cooperation.

Talks involved China’s top trade negotiator Li Chenggang, Saskatchewan Premier Scott Moe, and Kody Blois, parliamentary secretary to Canada’s prime minister.

The meeting highlighted Beijing’s engagement with both federal and provincial leaders as the two countries look to deepen cooperation across agriculture, energy, and other sectors.

PBOC sets USD/ CNY central rate at 7.1008 (vs. estimate at 7.1225)

- PBOC CNY reference rate setting for the trading session ahead. Strongest setting for CNY since November 6 2024.

PBOC injected 247bn yuan via 7-day reverse repos at 1.40%

- net 8.7bn drain yuan

Australia Business Confidence Slows in August

The National Australia Bank (NAB) business survey showed confidence slipping in August. Sentiment eased to 4 from 8 in July, closer to its long-term average.

Business conditions held at 7, with profitability (+4) and employment (+6) improving, while forward orders edged positive for the first time in two years.

Cost pressures also cooled, with purchase costs rising just 1.1% quarterly — the slowest since 2021 — and retail price growth halving to 0.5%.

NAB said industries previously under pressure are showing better signs, adding to optimism about a stronger second half of the year.

Australia Consumer Confidence Slips in September

Consumer sentiment in Australia retreated in September after hitting multi-year highs in August. The Westpac-Melbourne Institute index fell 3.1% month-on-month to 95.4, down from +5.7% previously.

Readings below 100 indicate pessimists still outnumber optimists. Westpac noted that while cost-of-living pressures may be easing and policy support is helping, uncertainty continues to weigh on households.

ANZ Plans 3,500 Job Cuts by 2026

Australian lender ANZ, one of the nation’s “big four” banks, has announced plans to cut around 3,500 jobs by September 2026.

The reductions form part of a restructuring effort, signaling further cracks in Australia’s labor market outlook.

New Zealand Manufacturing Sales Slide in Q2

Manufacturing activity in New Zealand weakened sharply in the second quarter. According to Statistics New Zealand, sales volumes fell 2.9%, reversing a prior +4.8% gain.

Key export industries dragged the numbers lower, with dairy and meat product volumes dropping 4.8%.

BoJ Still Sees Possibility of a 2025 Hike Despite Political Turmoil

Bloomberg reports the Bank of Japan still considers a rate hike possible later this year, even amid political uncertainty.

Officials see U.S. trade progress as removing some growth risks and note steady movement toward the bank’s inflation target.

For now, rates are expected to remain unchanged at the September 19 meeting, but policymakers appear open to tightening if conditions continue to align.

Japan to Cut U.S. Tariffs on Goods by Mid-September

Japan’s chief trade negotiator Akazawa confirmed that U.S. tariffs on Japanese exports — including autos — will be reduced by September 16th.

While the step marks progress, Akazawa noted unresolved trade disputes remain, particularly around pharmaceuticals and semiconductors. Washington has issued a presidential order on auto tariffs, but no broader agreement has been reached on most-favored-nation status.

Nikkei Sets New Record High at 44,000

Japan’s Nikkei 225 surged to an all-time high of 44,000, lifted by falling government bond yields and strong equity flows.

The rally came despite political turbulence, as Prime Minister Ishiba resigned over the weekend.

South Korea Delays U.S. Trade Talks Over $350 Billion Fund Dispute

South Korea confirmed that negotiations with the United States remain stalled, with the core sticking point being a proposed $350 billion fund.

Presidential policy chief Kim Yong-beom explained that Seoul cannot match Japan’s $550 billion deal due to the severe impact such a package would have on the FX market. He stressed that South Korea only manages to secure $20–30 billion annually, making the U.S. demand unrealistic.

Kim warned that forcing through the deal could cause a massive short-term economic shock, urging Washington to address these FX concerns before talks can move forward.

Crypto Market Pulse

Bitcoin slips after historic payrolls revision

Bitcoin fell below $111,000 Tuesday after briefly topping $113,000, as investors digested the sharp downward revision to U.S. employment data.

The Bureau of Labor Statistics cut nonfarm payrolls by 911,000 for the 12 months through March, the largest adjustment on record and well above the consensus of –682,000.

The weaker labor backdrop has fueled expectations the Federal Reserve will cut rates on September 17. Futures imply a 91.8% chance of a 25bp cut and the remainder on a 50bp move.

Lower rates are seen as supportive for risk assets, including Bitcoin, though near-term volatility remains high.

XRP nears record high as Ripple, BBVA strike custody deal

XRP is testing a breakout toward its $3.66 all-time high after reclaiming $3.00 support on Tuesday. The token traded briefly above $3.00 before easing to $2.96.

Ripple announced a partnership with Spanish bank BBVA, which will use Ripple Custody to provide digital asset custody services, covering Bitcoin, Ethereum, and tokenized assets.

The collaboration comes as BBVA expands its crypto offering under the EU’s MiCA framework. Retail customers in Spain already have access to Bitcoin and Ether trading through the bank, now backed by institutional-grade custody.

Ripple said the deal strengthens its role as a secure, regulatory-compliant custody provider for institutions.

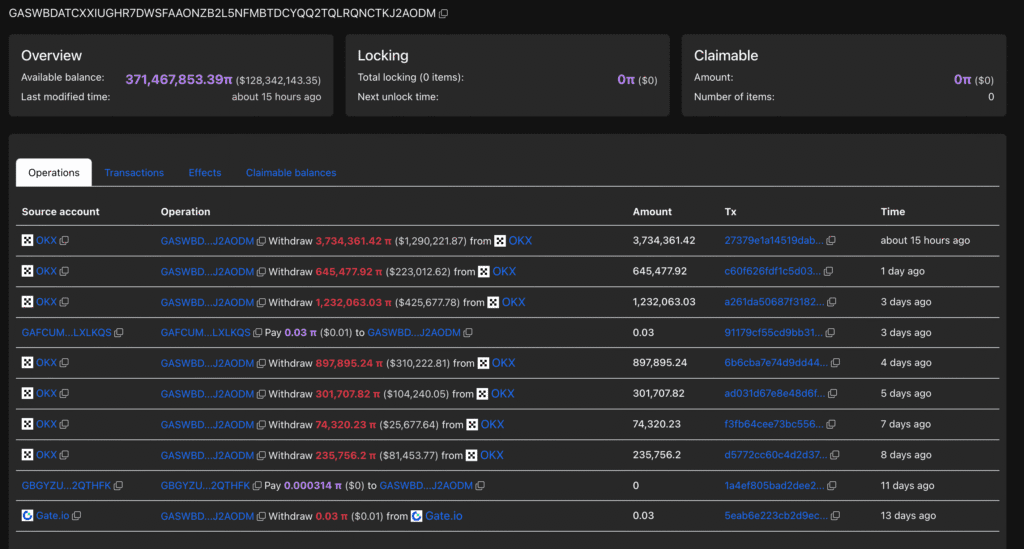

Whale buying, CEX outflows support Pi Network

Pi Network (PI) continues to consolidate above $0.34, with bullish signals emerging from whale activity and declining exchange reserves.

- The largest PI holder added 3.73 million tokens on Monday, raising total holdings to 371 million PI.

- Centralized exchange (CEX) reserves saw a net outflow of 2 million PI in the past 24 hours.

Withdrawals from exchanges are often seen as a sign of rising retail demand, reinforcing the case for accumulation during consolidation.

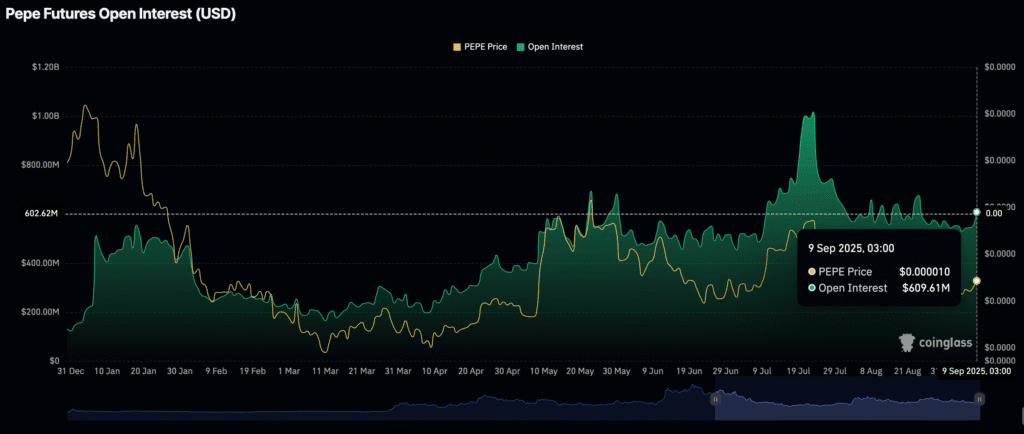

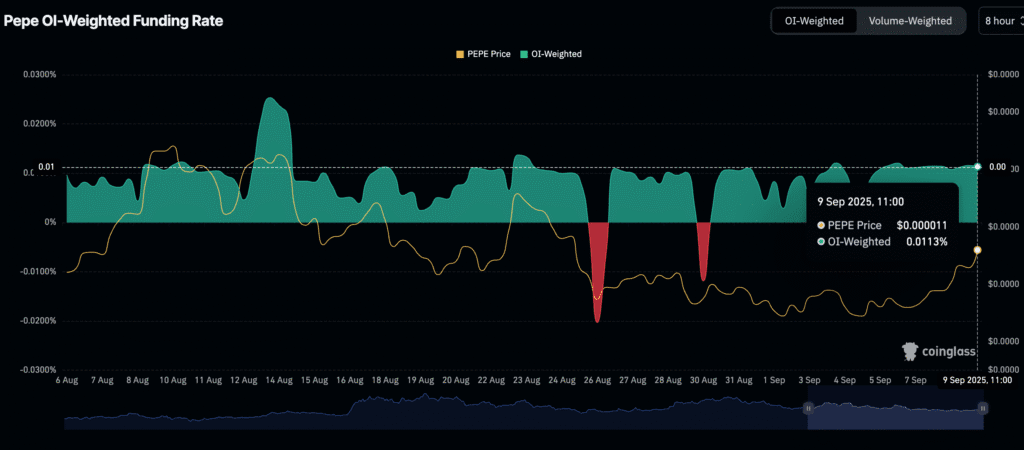

Pepe rebounds as meme coin sentiment revives

Pepe (PEPE) climbed back above $0.00001000 on Tuesday, mirroring renewed appetite for meme coins.

- Futures open interest rose to $609 million, up from $531 million last week.

- Technicals improved, with MACD issuing a buy signal and RSI strengthening.

- Weighted funding rates remain stable near 0.0113%, suggesting leveraged traders are positioning long.

If open interest extends toward $1 billion, analysts see potential for a sustained recovery in Pepe’s price.

Van Eck backs Agora in Hyperliquid stablecoin contest

The race to issue the USDH stablecoin on decentralized exchange Hyperliquid is heating up, with contenders including Paxos, Frax, Agora, and Sky.

Jan Van Eck, CEO of global investment manager VanEck, threw his support behind Agora, highlighting Hyperliquid’s speed, governance, and user alignment.

Agora has proposed a U.S.-compliant stablecoin, starting with $10 million liquidity. Net revenues after custodian fees would be allocated to HYPE buybacks and community funds.

The proposal also includes partnerships with Rain (for global cards) and LayerZero (cross-chain interoperability). Validators will vote on the issuer this Sunday.

ARK Invest adds $4.4M BitMine stake as ETH treasury surpasses 2M

Cathie Wood’s ARK Invest increased exposure to BitMine Immersion Technologies (BMNR), buying 101,950 shares worth $4.4 million across three funds.

The purchases came as BitMine announced its Ether (ETH) treasury surpassed 2 million ETH, worth nearly $9 billion. The firm now holds 1.7% of ETH supply and 42% of all ETH held by corporations.

BitMine shares rose 4.1% to $44.10 in after-hours trading and are up 460% year-to-date.

Chairman Tom Lee said the company remains committed to its target of owning 5% of ETH supply, calling Ethereum “one of the biggest macro trades of the next 10–15 years.”

Markets now await the Fed’s September 17 meeting, with an 89.4% probability of a 25bp rate cut priced in.

The Day’s Takeaway

North America

Nasdaq hits record high after steep payroll revisions

U.S. equities closed higher Tuesday, with the Nasdaq Composite (+0.4%) reaching a new intraday record of 21,891.42 and ending at an all-time high. The S&P 500 (+0.3%) and Dow (+0.4%) also set fresh record closes.

- Dow Jones: +196.39 to 45,711.34

- Nasdaq Composite: +80.79 to 21,879.49

- S&P 500: +17.46 to 6,512.61

Sectors: Broad gains led by communication services (+1.7%) on Alphabet (+2.5%) and Meta (+1.8%). IT (flat) and consumer discretionary (+0.1%) recovered late. Laggards: materials (–1.6%), industrials (–0.7%), real estate (–0.1%).

Corporate movers:

- UnitedHealth +8.7% after amending guidance disclosure.

- Apple –1.5% post-product launch, with iPhone Air starting at $999 and iPhone Pro rising to $1,099.

Macro backdrop:

BLS revised payrolls down by 911K, the sharpest cut on record. Fed funds futures price a 91.8% chance of 25bp cut at September 17 FOMC; 8.2% for 50bp.

Other indices: Russell 2000 –0.6%, S&P Mid Cap 400 –0.9%.

Treasuries: Yields rose modestly (2y +5 bps to 3.54%, 10y +3 bps to 4.72%) after a strong four-day rally.

3-year auction: $58B sold at 3.485% (below WI 3.492%). Tail –0.7 bps vs +0.7 avg; bid-to-cover 2.73x vs 2.55 avg. Indirect (foreign) demand surged to 74.2% vs 62.1% avg; dealer allocation dropped to 8.4%.

Data: NFIB Small Business Optimism Index 100.8 (vs. 100.3 prior).

YTD: Nasdaq +13.3%, S&P 500 +10.7%, Dow +7.4%, Russell 2000 +6.8%, S&P Mid Cap 400 +4.7%.

Commodities

Oil under pressure as OPEC+ barrels return

Crude remains fragile after confirmation OPEC+ will add 137K bpd next month, starting to unwind voluntary cuts.

- Technicals: $60 support likely tested; break risks $55.

- Macro: China’s stockpiling cushioning demand but temporary; U.S. shale Tier 1 drilling inventory declining; exploration capex depressed near $10B/year.

- Long-term: Underinvestment + dwindling spare capacity could set up supply squeeze in 2026–27.

Gold retreats after record high

Gold hit a record $3,674 before easing to $3,646 (+0.3%). Gains capped by stronger USD (DXY +0.24% to 97.68) and higher yields (10y +3 bps to 4.72%).

Payroll revisions bolstered Fed cut bets, but inflation prints (PPI, CPI) could limit easing scope.

Europe

European equities mostly higher, DAX lags

- DAX –0.37%

- CAC 40 +0.19%

- FTSE 100 +0.23%

- IBEX 35 +0.14%

- FTSE MIB +0.68%

Germany underperformed, while peers closed modestly higher.

Crypto

XRP nears record high on Ripple–BBVA custody deal

- XRP reclaimed $3.00 support, eyeing $3.66 ATH.

- Ripple Custody to support BBVA’s expansion under MiCA, covering BTC, ETH, tokenized assets.

Pi Network (PI) accumulation signals

- Holding above $0.34.

- Whale added 3.73M PI (total 371M).

- Net CEX outflows: 2M PI in 24h — bullish.

Bitcoin slips on payroll revisions

- Fell below $111K after topping $113K.

- Fed cut odds: 91.8% for 25bp, 8.2% for 50bp.

- High volatility into September 17 FOMC.

Pepe (PEPE) rebound with meme coin sentiment

- Back above $0.00001000.

- Futures OI $609M vs $531M last week.

- MACD buy signal, RSI stronger; funding stable.

- Recovery potential if OI nears $1B.

VanEck backs Agora in Hyperliquid stablecoin race

- Endorsed Agora’s USDH proposal: $10M liquidity, revenue to HYPE buybacks/community.

- Partners: Rain (cards), LayerZero (interoperability).

- Validator vote Sunday.

ARK Invest boosts BitMine stake

- Added 101,950 shares ($4.4M).

- BitMine ETH treasury >2M ETH (~$9B), 1.7% of supply.

- Shares +4.1% after-hours, +460% YTD.

- Chairman Tom Lee targets 5% ETH supply, calls ETH a “top macro trade” for the next 10–15 years.