North America News

U.S. Stocks Slip After Jobs Data, Weekly Gains Mixed

Wall Street swung sharply on Friday after a disappointing jobs report, with indexes finishing the session mixed. Early record highs gave way to selling as recession fears outweighed optimism over rate-cut bets.

- S&P 500: -0.36% (week: +0.3%)

- Nasdaq Composite: flat (week: +1.4%)

- Russell 2000: +0.45% (week: +1.0%)

- Dow Jones Industrial Average: -0.5% (week: -0.3%)

The Dow Jones Industrial Average dropped nearly 500 points at its intraday low, settling back below 45,500. The August U.S. Nonfarm Payrolls (NFP) report showed job gains of just 22K versus expectations of 75K, reinforcing bets of a Federal Reserve rate cut on September 17.

While a weaker labor print usually cheers equity markets by raising the odds of monetary easing, the scale of the miss sparked concerns that the slowdown is tipping toward recession. Traders are now pricing a 10% chance of a 50-basis-point cut, with expectations for easing running high into year-end.

The choppy session reflects investors’ struggle to balance two competing narratives: easing financial conditions versus fears of a deeper economic downturn.

Looking ahead, attention shifts to next week’s CPI inflation data (Sept. 11) and the University of Michigan sentiment and inflation expectations survey (Sept. 12), which will help shape Fed expectations heading into the September meeting.

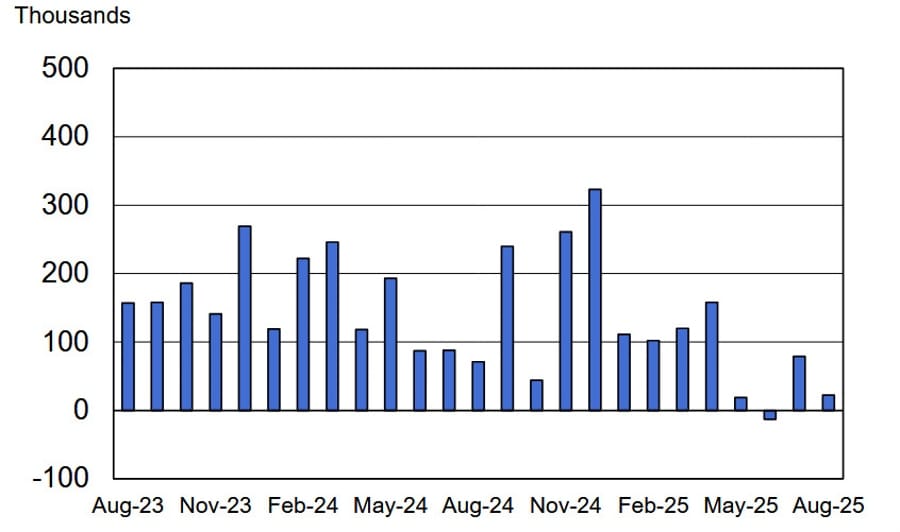

U.S. Non-Farm Payrolls Miss Forecasts in August

The U.S. economy added just 22K jobs in August, falling well short of the 75K expected, according to Friday’s employment report.

Breakdown:

- Private payrolls: +38K (expected +75K; prior +83K)

- Manufacturing payrolls: -12K (expected -5K; prior -11K)

- Government payrolls: -16K (prior -10K)

- Unemployment rate: 4.3% (in line; prior 4.2%)

Wage data:

- Avg hourly earnings MoM: +0.3% (expected +0.3%)

- YoY: +3.7% (expected +3.7%; prior 3.9%)

- Workweek: 34.2 hrs (expected 34.3; prior 34.3)

Other details:

- Labor force participation: 62.2% (prior 62.3%)

- U6 underemployment: 8.1% (prior 7.7%)

- Two-month revision: -22K

The market is now fully pricing in a September Fed rate cut, with a small 3% chance of 50 bps. Odds of an October cut rose to 80% from 60%, while 130 bps of easing are priced in over the next year.

US Lutnick: US economic data will get better and better after staff changes

- US Commerce Secretary, Howard Lutnick speaking on CNBC

- On tariffs ruling: Trump has all sorts of other authorities.

- On tariffs: These big deals are going to stay.

Trump Threatens Tariffs on Foreign Chipmakers

President Trump said his administration will soon slap tariffs on imported semiconductors from companies without U.S. production facilities. Speaking before a dinner with tech leaders, Trump described the duties as “substantial,” while clarifying they would not apply to firms building plants domestically.

Apple CEO Tim Cook, in attendance, was singled out by Trump as being “in good shape” given Apple’s pledge to invest $600 billion in the U.S. over the next four years.

Trump has floated tariffs of around 100% on imported chips, though exemptions would cover manufacturers like TSMC, Samsung, and SK Hynix that already plan U.S. facilities.

The move has rattled global markets and faces legal challenges. A lower court struck down parts of Trump’s earlier tariff program, but the administration has asked the Supreme Court to uphold broad presidential trade powers under a 1977 emergency law.

OpenAI to Produce Custom AI Chips with Broadcom

OpenAI is preparing to begin large-scale production of its own AI chips, co-designed with Broadcom, according to the Financial Times.

The chips, expected to ship next year, will be used internally by OpenAI rather than sold to outside customers.

Broadcom CEO Hock Tan said Thursday that the company has secured more than $10 billion in AI infrastructure orders from a new client—without naming OpenAI.

Trump to Reopen North American Trade Deal Talks

The U.S. is preparing to reopen negotiations on the U.S.-Mexico-Canada Agreement (USMCA), the country’s largest trade pact, according to the Wall Street Journal.

The Office of the U.S. Trade Representative is expected to start consultations within the next month, a required step under the 2020 implementation law. Requests for input from businesses and unions could be released as soon as this week, though the Trump administration has previously pushed back deadlines.

The process marks the start of a lengthy renegotiation tied to the deal’s mandatory six-year review. After consultations, the administration must host at least one public hearing and brief Congress by January 2026, ahead of the July 1, 2026, trilateral review.

Trump championed the USMCA during his first term, calling it a key accomplishment, but has since reversed course in his second term, labeling it a “terrible deal.”

Fed’s Goolsbee says there is a bit of wait and see because of uncertainty

- Federal Reserve Bank of Chicago President Austan Goolsbee

- Labor market might be deteriorating

- Inflation might be picking back up

- There is a bit of wait and see because of the uncertainty

- Rates are better indicators for labor market than raw job growth

- The impact of tariffs on price increases depends on the sector

- The September meeting is a live meeting, I haven’t made up my mind

UBS: U.S. Equities Still Appealing Despite Pricey Valuations

UBS argues that American stocks remain attractive even though they trade at historically high multiples. In a research note Thursday, the bank highlighted that the S&P 500 is valued at roughly 22 times forward 12-month earnings—placing it in the most expensive 5% of readings since 1985 and raising alarms about steep pricing.

Still, UBS cautioned against treating valuation levels as a short-term predictor of market moves. Historically, elevated multiples have not shown a strong correlation with one-year returns.

Instead, the firm pointed to two key forces supporting equities:

- Solid corporate earnings momentum

- A Federal Reserve expected to shift toward easier policy

According to UBS, these drivers have historically helped stocks grind higher even when valuations looked stretched.

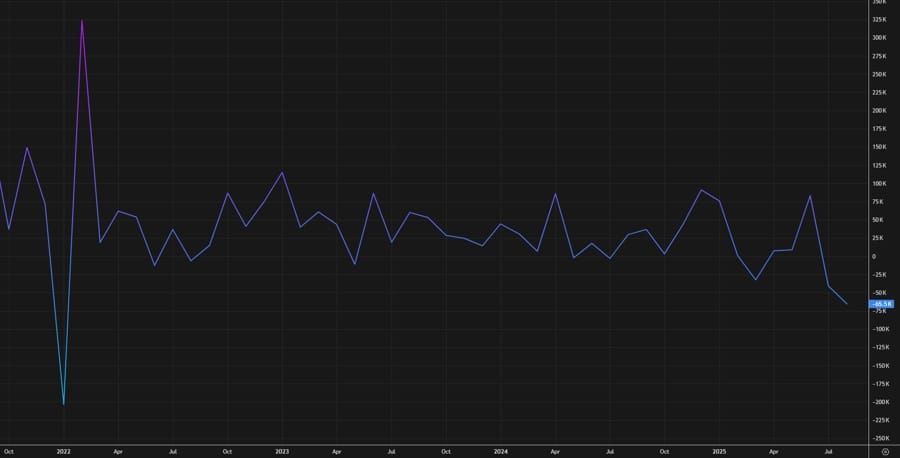

Canada Jobs Report: Employment Plunges by 65.5K in August

Canada’s labor market weakened further in August, with employment dropping 65.5K, far worse than expectations for a 10K gain.

- Prior reading: -40.8K

- Unemployment rate: 7.1% (up from 7.0%)

- Full-time jobs: -6.0K

- Part-time jobs: -59.7K

- Participation rate: 65.1%

- Avg hourly wages for permanent workers: +3.6%

This marks the worst headline jobs number since January 2022. Markets are now pricing in a 90% chance of a September Bank of Canada rate cut, up from 75% before the release.

Canada Pushes Back EV Sales Mandate

Canada will delay its zero-emission vehicle sales mandate, easing pressure on automakers struggling with tariffs, according to Bloomberg.

The policy, introduced by former Prime Minister Justin Trudeau, required 20% of new vehicles sold by 2026 to be electric. Prime Minister Mark Carney’s government is expected to announce Friday that the target will be reviewed, with officials stressing that the standard should not impose excessive burdens on manufacturers.

The delay comes as Ottawa prepares a broader package of support measures for industries most exposed to U.S. trade tensions.

Commodities News

Gold Soars to Record $3,600 as Fed Cut Bets Intensify

Gold surged to an all-time high Friday, breaking above $3,600, after a weak U.S. jobs report fueled expectations of aggressive Federal Reserve easing. Spot gold last traded at $3,594, up 1.3% on the day.

The August NFP report showed just 22K jobs added, unemployment rising, and wage growth holding steady. That sent Treasury yields sharply lower, with the 2-year yield down 11 bps to 3.48%, its steepest drop since July, while the U.S. Dollar Index (DXY) fell 0.70% to 97.57.

Gold’s rally also reflects political risk, with traders citing concerns over Fed independence after reports of political pressure on policymakers.

Analysts at Standard Chartered argued the Fed could deliver a 50 bps cut in September, pointing to last year’s July–September job revisions that prompted larger-than-expected easing. They expect upcoming revisions to April 2024–March 2025 data to reinforce that case.

With yields sliding and the dollar weakening, gold remains supported as investors seek safety. Traders now turn to U.S. CPI data next week: if disinflation continues, it could lock in expectations for a September 16–17 rate cut.

Saudi Arabia Pushes OPEC+ to Speed Up Oil Supply Hike

Saudi Arabia is pressing OPEC+ to accelerate its next output increase at the September meeting, according to Bloomberg.

The news weighed on crude prices, with Brent and WTI both sliding amid concerns that looser supply and weaker U.S. economic data could deepen the recent downturn.

Traders now warn that oil could soon trade with a “$5-handle” if bearish momentum continues.

Baker Hughes Rig Count: U.S. +1, Canada +6

The Baker Hughes rig count showed a modest rise this week:

United States:

- Total rigs: +1 to 537

- Oil rigs: +2 to 414

- Gas rigs: -1 to 118

- Miscellaneous: unchanged at 5

- Offshore rigs: unchanged at 13 (down 6 y/y)

- YoY: -45 rigs (oil -69, gas +24)

Canada:

- Total rigs: +6 to 181

- Oil rigs: +3 to 123

- Gas rigs: +3 to 58

- Miscellaneous: unchanged

- YoY: -39 rigs (oil -29, gas -9, misc -1)

OPEC+ Weighs More Production Increases

Oil prices came under fresh pressure Wednesday after Reuters reported that OPEC+ may consider another production hike at its upcoming meeting, Commerzbank said.

Such a move would surprise markets, as most participants expect current voluntary cuts—totaling 1.65 million barrels per day—to remain in place until 2026.

If output is raised further, the existing oversupply could balloon, potentially forcing the group to cut production again next year to prevent crude from dropping well below $60 per barrel.

WGC Proposes Digital Gold

The World Gold Council (WGC) has unveiled a plan to modernize the gold market with a new product dubbed Pooled Gold Interests (PGIs), according to Commerzbank.

PGIs would allow investors to hold fractional shares of physical gold in a pooled structure. They could also be transferred between parties and used as collateral, similar to how digital currencies function.

The initiative responds to the rise of stablecoins and central bank digital currencies. Still, Commerzbank noted that unlike fiat-backed stablecoins or CBDCs, gold is politically independent, its supply driven mainly by slow-moving mining output.

Russian Oil Exports to China and India Surge

Russia has sharply increased seaborne oil shipments to China and India despite intensifying U.S. sanctions pressure, Commerzbank said, citing Bloomberg data.

Exports from Baltic ports rose nearly 30% last week to 3.5 million barrels per day. The four-week average climbed to 3.15 million barrels per day.

Shipments to China hit 1.6 million barrels per day, the highest since January, while flows to India jumped to 1.34 million barrels, rebounding from the prior week’s decline.

Discounted Russian crude remains too attractive for buyers, while Ukrainian drone strikes have reduced domestic refinery capacity, freeing more barrels for export. Damage to pipelines and ports has so far proved less disruptive than feared.

OPEC Output Rose in August

OPEC crude production climbed to 28.55 million barrels per day in August, up 400,000 from the prior month, according to a Bloomberg survey cited by Commerzbank.

The increase aligned with planned target hikes, but July output was revised lower after Saudi Arabia reported weaker numbers than initially estimated.

While OPEC nations bound by quotas overshot targets by 340,000 barrels per day in August, the gap was smaller than earlier months.

Commerzbank warned the oil market now faces a fourth-quarter oversupply of about 2.8 million barrels per day, even before September’s planned increases are included.

JPMorgan: Gold Gains as Fed Autonomy Concerns Drive Market Shifts

JPMorgan says fears about the Federal Reserve’s independence are shaping investor moves across bonds, equities, and commodities.

The bank highlighted three major shifts in positioning:

- Fixed income: Short bets against long-dated Treasuries, including ETFs like TLT, have risen as investors brace for higher inflation and risk premiums.

- Equities: A rotation into value stocks has accelerated, with JPMorgan tying the shift directly to political uncertainty over Fed policy.

- Commodities: Industrial metals like copper and oil are seeing repricing as markets anticipate looser monetary policy and a potentially overheating economy.

But the clearest winner is gold. JPMorgan noted that long positions in gold futures spiked following Trump’s attempt to dismiss Fed Governor Lisa Cook, underscoring gold’s role as the most direct hedge in what analysts are calling the “Fed independence trade.”

Oil Slips Ahead of OPEC+ Meeting as U.S. Inventories Surprise

Oil prices extended losses for a third straight session Friday, with traders waiting on an OPEC+ meeting this weekend that could bring an early production hike.

Sources told Reuters that eight OPEC members and allies, including Russia, are weighing an October output increase. The proposal would start rolling back 1.65 million barrels per day of additional cuts, roughly 1.6% of global demand, more than a year ahead of schedule.

Adding pressure, U.S. crude stockpiles unexpectedly rose 2.4 million barrels last week, versus forecasts for a 2-million-barrel draw. The American Petroleum Institute reported a smaller build of 600,000 barrels.

Goldman Sachs: Gold Could Surge to $5,000 Amid Fed Interference Fears

Goldman Sachs warned that political meddling in the Federal Reserve under President Trump could propel gold to $5,000 an ounce. The bank said growing doubts about the Fed’s independence threaten confidence in U.S. assets such as Treasuries, equities, and the dollar—pushing investors toward safe-haven gold.

Gold is now near $3,545, hovering close to all-time highs. Samantha Dart, Goldman’s head of commodities research, wrote that weakening trust in the Fed could trigger higher inflation, falling stock prices, and a diminished role for the dollar as the world’s reserve currency—conditions that would favor gold as a store of value independent of institutions.

The White House has stepped up its attacks on the central bank, with Trump pushing for criminal investigations into Chair Jerome Powell and Governor Lisa Cook while attempting to oust Cook. His push to appoint loyalists supportive of lower rates has intensified concerns about the Fed’s autonomy.

Goldman estimated that just a small rotation from U.S. Treasuries could spark a massive rally:

- A 1% shift of privately held Treasuries into gold could send prices close to $5,000

- A “tail risk” scenario points to $4,500

Gold remains Goldman’s top conviction call in commodities.

Europe News

European Stocks End Week Lower

European equities closed the first week of September on a soft note, with most major indexes slipping. The DAX attempted a midweek recovery but ended near session lows after fresh selling on Friday.

Daily moves (Friday):

- Stoxx 600: -0.2%

- German DAX: -0.85%

- France CAC 40: -0.4%

- UK FTSE 100: -0.1%

- Spain IBEX: -0.6%

- Italy FTSE MIB: -0.9%

Weekly performance:

- Stoxx 600: -0.2%

- German DAX: -1.3%

- France CAC 40: +0.1%

- UK FTSE 100: +0.2%

- Spain IBEX: -0.7%

- Italy FTSE MIB: -1.4%

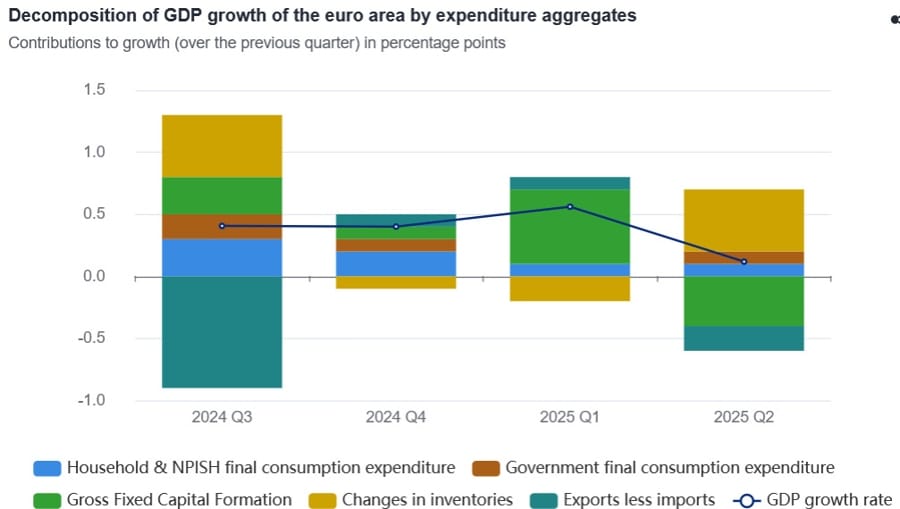

Eurozone GDP Growth Holds at 0.1% in Q2

Eurostat confirmed that the euro area economy expanded 0.1% quarter-on-quarter in Q2 2025, in line with estimates. That’s slower than the 0.6% growth in Q1.

Year-on-year, GDP grew 1.5%, slightly above the 1.4% expected.

Breakdown of Q2 activity:

- Household consumption rose 0.1% in the eurozone, 0.3% in the EU.

- Government spending climbed 0.5% in the euro area, 0.7% in the EU.

- Fixed capital formation dropped 1.8% in the euro area, 1.7% in the EU.

- Exports fell 0.5% in the eurozone, 0.2% in the EU.

- Imports were flat in the eurozone, but rose 0.3% in the EU.

Germany Industrial Orders Drop in July

German industrial orders fell sharply in July, down 2.9% month-on-month, compared with expectations for a 0.5% increase. June’s result was revised to -0.2% from -1.0%.

Destatis noted that stripping out large-scale orders, new orders actually rose 0.7% from the prior month. Over the three months from May to July, orders were 0.2% higher than in the previous three-month period.

The decline was mainly due to a 38.6% plunge in orders for transport equipment, covering aircraft, ships, trains, and military vehicles.

France Narrowed Trade Gap in July

France’s trade deficit came in at €5.56 billion in July, narrower than the €6.1 billion expected, according to the Finance Ministry.

That’s an improvement from June’s revised €7.16 billion.

- Exports increased to €52.1 billion, up from €50.8 billion.

- Imports slipped to €57.7 billion, compared with €58.0 billion previously.

Italy Retail Sales Flat in July

ISTAT data showed that Italy’s retail sales were unchanged in July, at +0.0% m/m, versus expectations of a 0.4% rise. June was revised up to +0.7%.

Year-on-year, sales grew 1.8%, compared with a revised 1.1% in June.

The agency noted:

- Over the three months to July, retail sales rose 0.6% in value and 0.1% in volume.

- Compared with July 2024, sales were up 2.8% in large-scale retail, 0.6% in small-scale stores, and 0.9% in non-store channels.

- Online sales advanced 2.9% y/y.

- Cosmetics saw the strongest growth (+3.7%), while electronics recorded the sharpest drop (-3.1%).

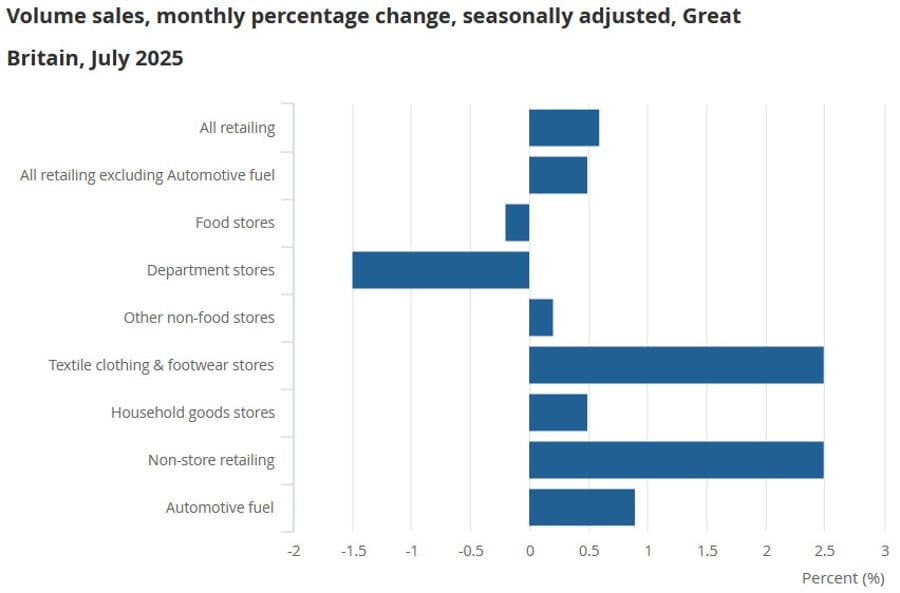

UK Retail Sales Beat Expectations in July

The Office for National Statistics said Friday that UK retail sales rose 0.6% month-on-month in July, stronger than the 0.2% expected.

Year-on-year, sales climbed 1.1%, missing expectations for 1.3%. June’s figure was revised down to 0.9% growth from 1.7%.

- Retail sales excluding autos and fuel rose 0.5% m/m (forecast 0.4%).

- Year-on-year, that measure increased 1.3%, slightly above the 1.2% forecast.

In volume terms, sales fell 0.6% over the three months to July compared with the prior three-month period, ending four straight quarters of growth.

ONS noted that non-store retailers and clothing outlets saw strong demand in July, citing new product launches, favorable weather, and a boost from the UEFA Women’s EURO 2025 tournament.

The Bank of England is unlikely to shift policy on the back of these numbers, as inflation remains its primary concern.

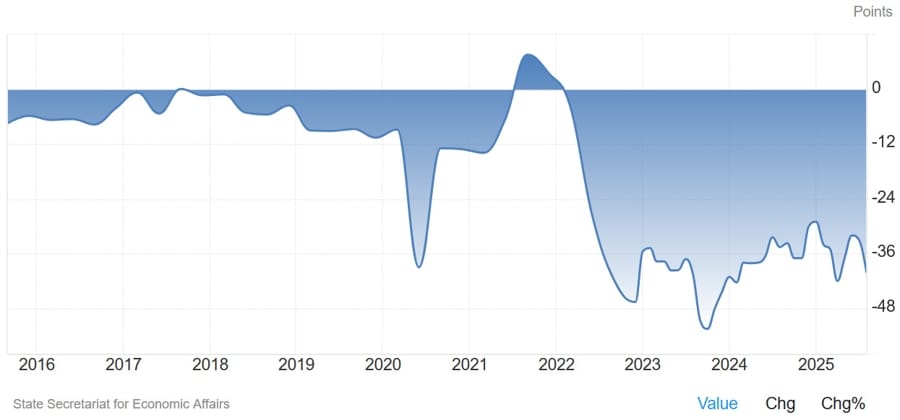

Switzerland Consumer Confidence Slips

Swiss consumer confidence fell to -39.9 in September, missing expectations of -36.5, according to SECO.

The prior reading was -32.8.

Confidence had been improving since April’s low, but momentum has stalled, with sentiment weakening again since June. The indicator is not considered a major market mover.

Bank of America: Euro Could Strengthen to $1.25 as Dollar Risks Undervaluation

Bank of America projects the euro will climb into the $1.20–$1.25 range next year, arguing that the U.S. dollar may slip from slight overvaluation into undervaluation.

For much of the past decade, the dollar has traded above fair value. But so far in 2025, it has drifted closer to equilibrium amid:

- Fiscal stimulus from Germany

- Ongoing global trade disputes

- Concerns over U.S. political and institutional stability

BofA warned that further institutional erosion in the U.S. could drive the dollar below fair value, opening the door to a more aggressive rally in the euro.

Asia-Pacific & World News

PBOC sets USD/ CNY reference rate for today at 7.1064 (vs. estimate at 7.1390)

- PBOC CNY reference rate setting for the trading session ahead.

PBOC injected 188.3bn yuan via 7-day reverse repos at 1.40%

- net 594.6bn drain yuan

Earlier news via the China Securities Journal:

- PBoC may inject reasonably ample liquidity into the money markets this month

Japan: Wages and Spending Pick Up in July

Japan’s July economic data showed stronger household spending and wage growth, giving the Bank of Japan fresh momentum toward its inflation target.

Key figures included:

- Household spending up 1.7% month-on-month (forecast +1.3%)

- Household spending up 1.4% year-on-year (forecast +2.3%)

- Total cash earnings up 4.1% y/y (forecast +3.0%)

- Overtime pay up 3.3% y/y, the strongest since late 2022

- Real wages up 0.5% y/y, the first positive reading in seven months

Growth in real wages was supported by robust summer bonuses (+7.9%), steady base pay increases (+2.5%), and a rise in overtime income. Overall, cash earnings grew at the fastest pace in seven months.

Japan July Leading Index Matches Forecast at 105.9

The Cabinet Office reported Japan’s leading economic index at 105.9 in July, exactly in line with forecasts and slightly higher than June’s revised 105.6.

The coincident index came in at 113.3, down from 116.7 previously.

This release is generally not a market-moving event, though the leading index shows a modest improvement from the prior month.

ING: Bank of Japan Likely to Hike in October as Wages Rise

ING said Friday that Japan’s latest wage and spending data bolster the case for a Bank of Japan rate hike in October.

The July data showed:

- Labour cash earnings up 4.1% y/y (forecast +3.0%)

- Bonus pay jumping 7.9%

- Base pay rising 2.6%

- Real wages up 0.5% y/y, the first increase since December

- Household spending up 1.4% y/y, though below forecasts

Japan’s minimum wage is also set for a record increase to ¥1,121 from ¥1,055, further supporting inflationary momentum. ING expects a 25bp hike in October, citing wage strength and resilient GDP growth.

Risks remain. Trump signed an executive order this week locking in a 15% U.S.-Japan tariff agreement, while Prime Minister Shigeru Ishiba faces possible leadership challenges inside the ruling LDP.

Crypto Market Pulse

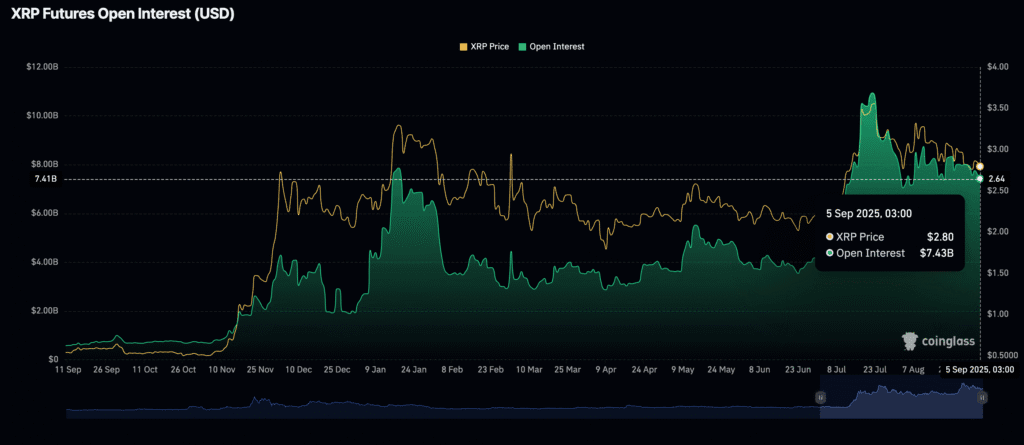

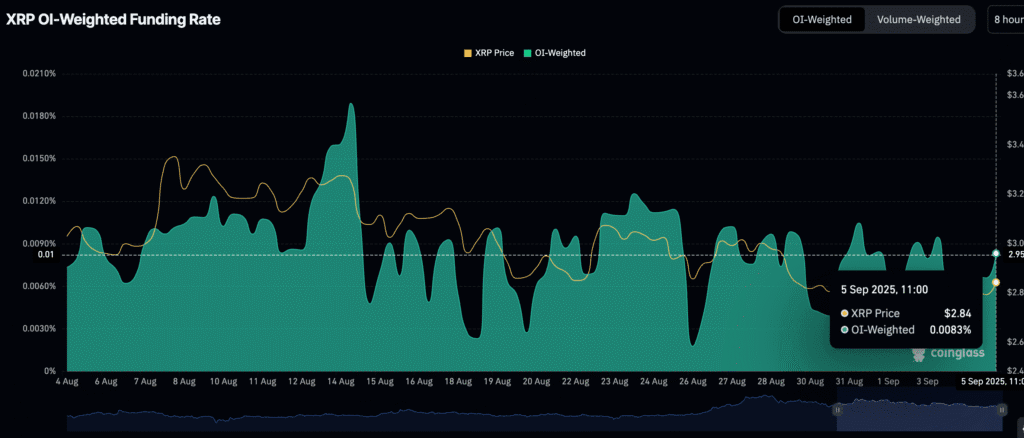

XRP Stays Volatile Below $3

Ripple’s XRP traded above $2.80 Friday, but an intraday breakout attempt failed at resistance near $2.90, leading to a quick dip back to support.

Market context: Traders remain focused on upcoming U.S. data ahead of the Sept. 17 FOMC meeting, where the Fed is expected to cut rates. Risk assets, including crypto, could benefit, though volatility remains high.

Derivatives signals:

- Futures open interest fell to $7.4B, down from a July 22 peak of $10.94B, highlighting weaker retail participation.

- Despite that, the funding rate remains positive at 0.0083%, signaling demand for leveraged long positions.

If funding continues to rise, XRP could retest the $3.00 psychological level. Otherwise, downside risks point toward $2.70 support.

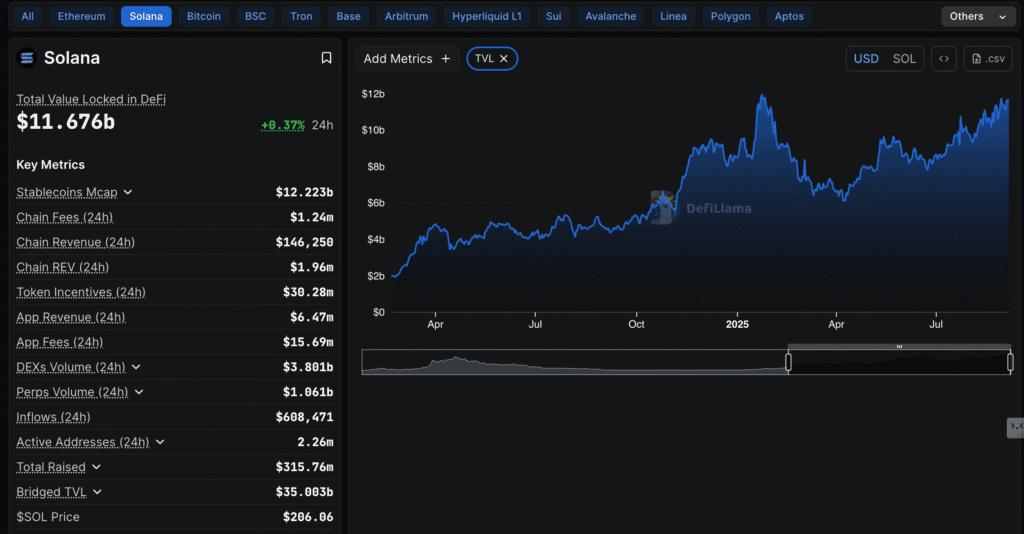

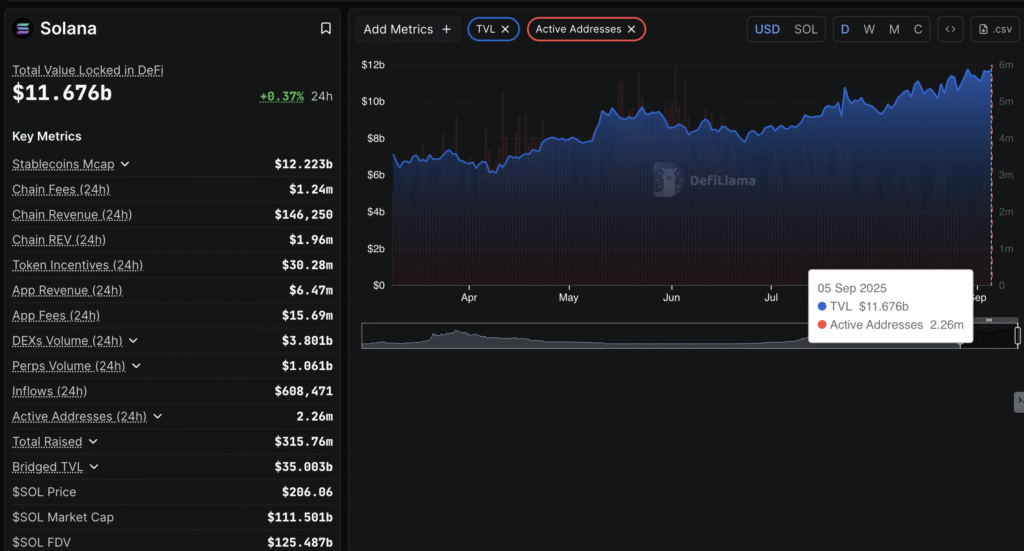

Solana Tests Breakout as DeFi TVL Rises

Solana (SOL) traded above $205 Friday, aiming at resistance levels near $220 and $250. The move follows Bitcoin’s rebound, with risk appetite rising after weak U.S. jobs data.

CoinGlass showed Solana’s futures open interest retreating from a record $13.68 billion to $12.39 billion, a healthy correction in what remains a bull market.

DefiLlama data highlighted that Solana’s DeFi total value locked rose by $1.8 billion in August, reaching $11.7 billion, reflecting investor confidence.

Still, activity on-chain has weakened. Active addresses dropped 62% from June peaks, down to 2.26 million from 6 million. This signals lower user engagement despite rising locked value.

LATAM Crypto Media Traffic Halved in Q2 Despite Adoption Boom

Latin America saw strong crypto adoption in Q2 2025 but crypto media traffic in the region fell by half compared to the previous quarter, according to Outset PR’s analytics team.

Adoption trends:

- The region posted an 18.3% rise in unique crypto users.

- Argentina (19.8% of population), Brazil (18.6%), and El Salvador (14.6%) lead in ownership.

- Fastest growth came from Bolivia (+355%), Guatemala (+87.8%), and Paraguay (+51.6%).

- Millennials dominate adoption, with 21.9% ownership, compared to 14.1% of Gen X.

Stablecoins are reshaping payments. Visa and Bridge launched stablecoin-linked cards in Argentina, Colombia, Ecuador, Mexico, Peru, and Chile. Merchants receive fiat while users pay with stablecoins.

Infrastructure continues to expand: Bybit launched a LATAM P2P promotion in August, while Tether invested €30m in Bit2Me to boost stablecoin use in Spanish-speaking markets.

Policy developments are diverging. Brazil’s central bank dismissed a Bitcoin reserve, while Argentina advanced tokenization rules and introduced municipal crypto tax payments.

Despite adoption, only 32% of Latin Americans consider crypto transactions secure, and educational gaps persist.

Methodology: Outset PR analyzed 55 media outlets across 19 countries using SimilarWeb traffic data. Crypto-native outlets (38) were reviewed separately from mainstream media (17). Caribbean markets were excluded except for Puerto Rico and the Dominican Republic, due to limited data reliability.

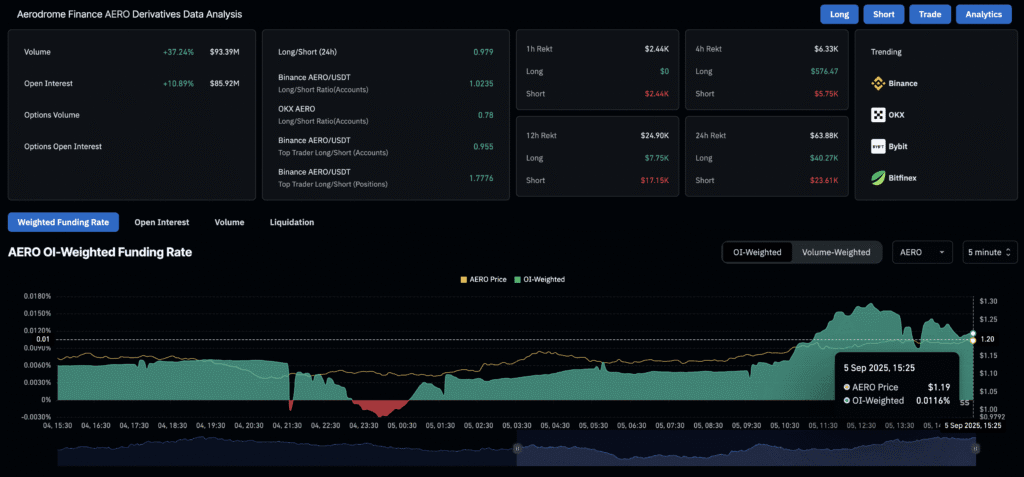

AERO Rebounds as Open Interest Surges

Aerodrome Finance (AERO) bounced more than 4% Friday, rebounding from its 50-day Exponential Moving Average and signaling renewed bullish momentum.

CoinGlass data showed open interest surged over 10% in 24 hours, reaching $85.92 million, pointing to rising derivatives activity.

The OI-weighted funding rate also flipped positive, climbing to 0.0116% from -0.0026% earlier, suggesting traders are leaning bullish, with buyers paying premiums to align swaps with spot prices.

Technical charts suggest AERO could target $1.48 if momentum continues.

MARA Mines 705 BTC in August, Treasury Tops 52,000

MARA Holdings said its Bitcoin holdings reached 52,477 BTC at the end of August, after mining 705 BTC during the month.

The company mined 208 blocks, securing a 4.9% share of network rewards. Energized hashrate rose 1% m/m to 59.4 EH/s.

MARA did not sell any Bitcoin in August, with CEO Fred Thiel saying the price dip provided a chance to add to reserves.

Despite Bitcoin dropping over 6% in August, its worst month since February, MARA expanded its holdings.

The company said it remains on track to finish its Texas wind farm in Q4, with miners already installed and connected. It also acquired a 64% stake in Exaion, a subsidiary of EDF, with the option to raise its stake to 75% by 2027.

Additionally, MARA opened a European HQ in Paris to strengthen its sustainability push, grid partnerships, and energy repurposing projects.

AI Tokens Poised for Rally as Fed Cut Bets Grow

Bitcoin briefly surged above $113,000 Friday before retreating under $112,000, as weak U.S. labor data fueled speculation of a September Fed rate cut.

- Nonfarm Payrolls rose 22,000 in August, far below the 75,000 forecast.

- Unemployment ticked up to 4.3% from 4.2%.

The cooling labor market reinforced expectations that the Fed will ease policy, which could lift risk assets including crypto.

Bitcoin is now trading above $111,000, after an intraday high at $113,384. Analysts say a breakout above $118,000 could set the stage for a test of the $120,000 level and potentially a move beyond the all-time high of $124,474.

Meanwhile, altcoins show bullish setups:

- Bittensor (TAO) eyes a 16% breakout toward $375.

- Internet Computer (ICP) is close to a 13% upside move, supported by multiple buy signals.

The Day’s Takeaway

US

- Jobs Data Weakens: August NFP came in at +22K (vs. +75K expected), with downward revisions (-22K). Manufacturing (-12K) and government (-16K) dragged the total lower. Unemployment ticked up to 4.3% while participation slipped to 62.2%.

- Markets Reaction: Fed cut for September is fully priced, with 3% odds of a 50 bps move. October cut odds jumped to 80%, with 130 bps easing priced for the next 12 months.

- Equities: Wall Street swung sharply. S&P 500 -0.36% (week +0.3%), Nasdaq flat (week +1.4%), Russell 2000 +0.45% (week +1.0%), Dow -0.5% (week -0.3%). Traders balanced the relief of rate cuts with rising recession concerns.

- Gold: Blasted to a record $3,600 (+1.3%) as yields sank (2-year -11 bps to 3.48%) and the dollar fell (DXY -0.7% to 97.57). Bets for a 50 bps Fed cut gained traction.

Canada

- Jobs Report: Employment plunged -65.5K in August (vs. +10K expected), worst since Jan 2022. Full-time -6K, part-time -59.7K.

- Unemployment: Rose to 7.1% (from 7.0%), participation dipped to 65.1%. Wages for permanent workers grew +3.6%.

- Market Impact: Odds of a September BoC cut surged to 90% (from 75%).

- Rig Count: Canada +6 rigs to 181, though still down -39 y/y. Oil rigs +3, gas +3.

Commodities

- Oil: Prices slid after reports Saudi Arabia wants OPEC+ to accelerate output hikes at the September meeting. Weak US data compounded bearish sentiment, with traders warning crude could soon have a “$5-handle.”

- Baker Hughes US Rig Count: +1 to 537 (oil +2, gas -1). YoY: -45 rigs (oil -69, gas +24). Offshore rigs unchanged at 13.

Europe

- Equities: A soft first week of September.

- Friday: Stoxx 600 -0.2%, DAX -0.85%, CAC -0.4%, FTSE 100 -0.1%, IBEX -0.6%, FTSE MIB -0.9%.

- Weekly: Stoxx 600 -0.2%, DAX -1.3%, CAC +0.1%, FTSE 100 +0.2%, IBEX -0.7%, FTSE MIB -1.4%.

- Narrative: DAX tried to rebound midweek but selling pressure persisted.

Crypto

- XRP: Volatile around $2.80. Failed breakout at $2.90, retraced to support. Open interest dropped to $7.4B (from July peak $10.9B), reflecting weaker retail participation.

- Derivatives Signal: Positive funding rate (0.0083%) shows leveraged longs remain active. If momentum persists, XRP could retest $3.00; otherwise, $2.70 support is in play.