North America News

Mega-cap surge lifts Nasdaq, masks broader market weakness

- Dow -24.58 to 45,271.23

- Nasdaq +218.10 to 21,497.73

- S&P 500 +32.72 to 6,448.26

Markets finished mixed Tuesday as a powerful rally in Alphabet overshadowed broader softness. A federal judge’s ruling allowing Google to keep Chrome intact fueled a 9% jump in Alphabet (GOOG $231.10, +19.11), which in turn powered the Nasdaq higher.

The S&P 500 managed a modest advance, but the Dow spent the day in the red. Gains were heavily concentrated in mega-cap tech and communication services, leaving most of the market lagging.

- Alphabet’s surge propelled communication services to a record high (+3.8%), with Apple (+3.8%) and Tesla (+1.4%) also boosting the tech-heavy trade.

- Outside of tech, Macy’s (+20.7%) rallied on strong earnings, while Dollar Tree (-8.4%) sank on flat guidance despite beating Q2 estimates.

- Energy (-2.3%) was the biggest drag as oil slid to $64.00/barrel on renewed OPEC+ output hike chatter.

Small- and mid-cap stocks underperformed, with the Russell 2000 -0.2% and S&P Mid Cap 400 -0.4%, underscoring how dependent indexes remain on mega-cap momentum.

Monetary policy backdrop:

- Fed Governor Waller backed a September rate cut, citing labor softness.

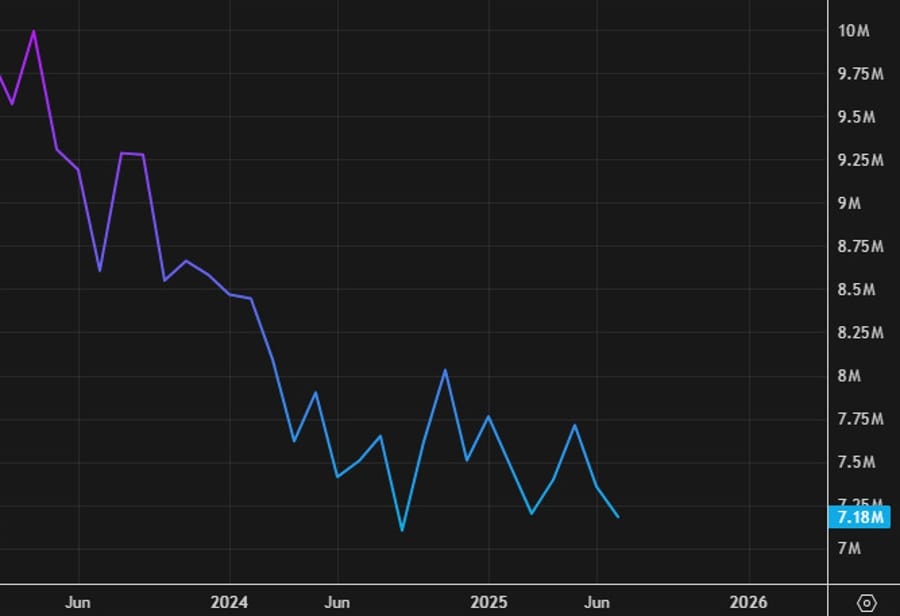

- JOLTS job openings came in weaker than expected at 7.18 million, reinforcing easing expectations.

- Fed officials Bostic and Musalem struck cautious notes on tariffs and growth, while Fed independence drew attention amid legal scrutiny of Governor Lisa Cook.

Market pricing: CME FedWatch shows a 95.6% probability of a 25 bp cut in September (up from 92.7%).

Bonds: Treasuries rallied, with the 2-yr yield down 5 bps to 3.61% and the 10-yr yield down 7 bps to 4.21%.

Year-to-date performance:

- Nasdaq +11.3%

- S&P 500 +9.6%

- Dow +6.4%

- Russell 2000 +5.4%

- S&P Mid Cap 400 +3.6%

Economic data:

- MBA Mortgage Applications: -1.2% (prior -0.5%)

- July Factory Orders: -1.3% (prior -4.8%); ex-transport orders rose across metals, machinery, electronics.

- July JOLTS: 7.18m job openings vs 7.36m prior (revised).

US July JOLTS: Job openings softer than expected

July job openings came in at 7.18m vs 7.38m expected, down from June’s 7.44m (revised 7.36m).

- Openings rate 4.3% (prior 4.4%).

- Hires steady at 5.31m.

- Quits unchanged at 3.21m.

- Layoffs flat at 1.79m.

Markets reacted dovishly, with Fed cut expectations rising and 2-year yields falling ~3 bps.

US factory orders improve from June slump

July factory orders fell 1.3%, slightly better than the -1.4% expected, and a notable improvement from June’s -4.8%.

- Ex-transport: +0.6%.

- Durable goods: -2.8% (as prelim).

- Non-defense capex ex-air: +1.1%.

The underlying details show resilience, suggesting July’s drop isn’t as concerning as June’s plunge.

U.S. Mortgage Applications Dip Again

Mortgage Bankers Association data for the week ending August 29 showed further weakness:

- Market index: 272.5 (prior 275.8)

- Purchase index: 158.7 (prior 163.8)

- Refinance index: 902.5 (prior 894.1)

- 30-year mortgage rate: 6.64% (down from 6.69%)

Applications fell 1.2% after a 0.5% drop the prior week.

Beige Book shows sluggish economy, uneven price pressures

The Fed’s latest Beige Book, compiled by the Philadelphia Fed, painted a picture of an economy losing steam.

Key takeaways:

- Most districts reported little or no change in economic activity.

- Business sentiment was mixed, with some firms expressing optimism and others cautious.

- Ten districts described price growth as moderate or modest, but several noted an expectation for prices to accelerate in coming months.

- Labor market: 11 districts reported flat employment, one noted a modest decline. Wages were described as modest to moderate in most cases.

The report suggests a U.S. economy that is stagnating at best, with inflation pressures lingering even as growth momentum fades—an uncomfortable mix echoing stagflation undertones.

Fed’s Kashkari: Inflation fight not over

Minneapolis Fed President Neel Kashkari said the Fed still has “work to do” to bring inflation to target.

- Inflation remains too high, though the labor market is cooling.

- The September meeting could show a split vote.

- Warned tariff-driven inflation is rising and must be monitored.

Kashkari said the economy is slowing but still on track for a soft landing.

Fed’s Bostic: Still sees one cut appropriate this year

Atlanta Fed President Raphael Bostic said a single 25 bps cut remains appropriate in 2025.

- Warned firms can’t absorb tariff costs much longer.

- Uncertainty lingers on consumer spending.

- Fed policy is “not overly restrictive.”

- Inflation fight remains the priority.

Fed’s Waller: Labor market turns quickly, rate cuts coming

Fed Governor Christopher Waller said the central bank should begin cutting rates at the next meeting, though not necessarily at every one. He stressed flexibility, noting tariffs may create short-term inflation but aren’t recessionary.

- Sees 100–150 bps in cuts to get near neutral.

- Fed independence remains “critical.”

- Tariffs seen as a tax that slows growth but not a recession driver.

Waller added the Fed could speed up or slow down cuts depending on incoming data.

Fed’s Musalem: Current restrictive policy is in the right place given data

- Comments from the St Louis Fed President

- Fed needs to balance inflation and jobs goals going forward

- There’s a risk tariffs could cause a persistent inflation rise

- Expects inflation to ebb back to 2% by the second half of 2026

- Jobs market break even is between 30-80K per month

- Uncertainty lifting for economy, fiscal policy may add stimulus

- Sees modest GDP growth this year before returning to trend in 2026

- Sees job market holding near full employment

- Expects job market cooling with downside risks to labor sector

- Expects tariff inflation impact to fade eventually

- Tariffs will work through economy over 2-3 quarters

Morgan Stanley: September Fed Cut Not a Done Deal

Morgan Stanley continues to forecast two rate cuts from the Fed this year, with the first likely in September. Still, strategists caution it isn’t guaranteed.

- A strong payrolls print near 225k or inflation pressure from tariffs could delay action.

- Internal divisions within the Fed may add dissent to the decision.

- On the other hand, weaker jobs data could push the central bank to front-load cuts.

The bank still expects quarterly cuts through 2026, bringing the terminal rate to 2.75%–3.00%.

SocGen: Friday’s Payrolls Could Be Pivotal

Société Générale says August’s U.S. jobs report could be one of the most consequential in years.

- Their forecast: +68k payrolls, unemployment steady at 4.2% (risks skewed higher).

- Average hourly earnings expected at +0.3% m/m, bringing annual wage growth down to 3.7% on base effects.

- Strong data may hold back Fed easing, while very soft numbers could trigger up to 100 bps of cuts in coming months.

Markets, currently distracted by a global bond selloff, are expected to refocus on this labor print.

Goldman Sachs: Dollar Weakness Driven by Structural Shifts

Goldman Sachs sees the dollar’s downtrend as far from finished, citing long-term forces reshaping FX markets.

- Hedging flows: Political risks and declining U.S. institutional independence are driving investors to diversify away from dollar assets.

- China’s yuan strategy: Beijing is steering toward a stable yuan that can serve as a regional anchor, gradually expanding its global role.

Together, these forces could extend dollar weakness well beyond Europe, with Asia playing a bigger role in rebalancing FX dynamics.

Morgan Stanley’s Wilson: Buy the Dips

Morgan Stanley CIO Mike Wilson remains bullish, urging investors to buy market pullbacks as the Fed begins cutting rates.

- He rejected the idea that cuts are fully priced in.

- Small caps, still near relative lows, could benefit most.

- While September is seasonally weak, Fed easing and solid earnings should keep valuations supported.

UBS: Record Stock Levels No Cause for Concern

UBS argued investors shouldn’t fear record-high U.S. equities, with Fed rate cuts and earnings strength expected to keep markets supported.

- Historically, Fed cuts during periods of growth coincide with positive equity returns.

- The S&P 500 trades at ~22x forward earnings, but UBS says profit growth justifies it.

- Since 1960, the index has averaged +12% in the year after reaching records and +38% over three years.

Strategists: Dollar Likely to Ease, Not Collapse

Currency analysts say U.S. dollar weakness will likely be gradual, not a steep collapse.

- Rabobank: Much of the bearish positioning is already in place, limiting further downside.

- Mizuho: Fed cuts are priced in; upcoming data may slow, not break, the dollar’s path.

- U.S. trade policies continue drawing capital inflows, helping offset selling pressure.

JP Morgan: Fed Too Restrictive, Cuts Ahead but Limited

J.P. Morgan strategist Jack Manley told Fox that the Federal Reserve’s stance is overly tight given current economic conditions.

Takeaways:

- He sees reason for rate cuts but expects them to be modest, with labor markets still strong and wages climbing.

- Lower- and middle-income households are feeling strain, but wealthier consumers continue to drive momentum.

- He expects “Magnificent 7” earnings strength to persist, though by 2026, earnings growth between big tech and the broader S&P 500 should even out.

Ray Dalio: U.S. Faces Debt Crisis Within Three Years

Bridgewater’s Ray Dalio warned that U.S. debt excesses could lead to a “debt-induced heart attack” within three years, plus or minus two.

- He highlighted the imbalance between U.S. debt supply and investor demand.

- The Fed may face a dilemma: allow yields to rise, risking default risks, or intervene by buying bonds—both outcomes pressuring the dollar.

- Dalio said confidence in U.S. fiscal stability is likely to weaken further.

McDonald’s CEO: Consumer Weakness Signals Risk for U.S. Economy

McDonald’s CEO flagged mounting stress among lower- and middle-income Americans.

- Traffic from lower-income customers is down double digits, with some even skipping meals.

- Wealthier households remain resilient, benefiting from stock market gains and travel spending.

- The widening gap raises concerns for overall consumption, which drives much of U.S. economic growth.

Treasury Secretary Bessent Starts Fed Chair Search

Treasury Secretary Scott Bessent begins interviewing candidates on Friday to find Jerome Powell’s successor at the Federal Reserve, according to the Wall Street Journal.

- Interviews will run into next week and be conducted in person or online.

- Around 11 names are under consideration, including Fed governors Christopher Waller and Michelle Bowman, ex-Fed governor Kevin Warsh, and NEC Director Kevin Hassett.

- Bessent aims to present President Trump with a shortlist following the process.

FTC Ruling Strengthens Powell’s Position

A U.S. appeals court voted 2-1 to reinstate Rebecca Slaughter to the FTC after Trump attempted to remove her without cause.

- The setback for Trump indirectly boosts Powell’s standing at the Fed.

- Powell’s term runs until May 2026, and the decision makes an early replacement less likely.

Google Antitrust Case: Judge Issues Sealed Ruling, Shares Soar

Google stock shot to fresh record highs after a U.S. judge issued a sealed ruling in the government’s monopoly case targeting its search business.

Key points from the decision:

- Google must provide rivals with access to certain information.

- The company will not be forced to sell Chrome.

- No divestiture of Android will be required.

Canada Q2 labor productivity falls sharply

Canadian labor productivity dropped 1.0% in Q2, the worst reading since late 2022. That compares to a prior +0.2% (revised to -0.1%). The decline underscores a weakening trend in output per hour worked, raising concerns about competitiveness heading into the second half of the year.

Carney: Canada’s budget to mix austerity with investment

Finance Minister Mark Carney said the upcoming budget—expected in autumn—will likely include across-the-board cuts of up to 15% for government departments.

- Transfers to provinces for education and direct support for individuals will be spared.

- Spending in its current form “is not sustainable.”

Carney also described his recent call with Trump as “good.”

Commodities News

Gold blasts to fresh record at $3,560

Gold pushed to a new all-time high above $3,560, extending its breakout after months of consolidation.

- Momentum points to a possible run toward $4,000.

- Broader demand fueled by political instability, tariff wars, and expectations of monetary easing.

- Biggest risk: a potential Supreme Court decision overturning Trump’s tariffs.

Silver hits 14-year high near $41

Silver surged to $40.98, its highest since 2011, extending a six-day winning streak.

- RSI above 70 signals possible overbought conditions.

- Key support: 9-day EMA at $39.77.

- Resistance: $41.50 channel top, then $42.00.

A break below the channel could trigger a deeper pullback toward $37.90 or even $35.80.

OPEC output climbs in August, more hikes possible

Reports show OPEC boosted production by 400k bpd in August, matching its scheduled increases. Reuters also said the group could announce another hike this weekend.

- Oil prices dipped on the news, then rebounded, with WTI up ~80 cents intraday.

The market remains focused on demand dynamics alongside Fed policy.

OPEC+ Weighs Another Output Boost

Reuters reports that OPEC+ may raise output again at its upcoming Sunday meeting, despite earlier guidance suggesting hikes were finished.

- Such a move would unwind 1.65 million barrels per day of prior cuts—1.6% of global demand—well ahead of schedule.

- Oil prices dipped initially on the headlines but quickly stabilized.

- Some members suggest OPEC+ may instead pause increases, leaving the decision unresolved.

Gold Surges Past $3,500 as Bonds Shake Markets

Precious metals remain the star performers this week, with gold pushing to fresh records above $3,500 an ounce.

The latest rally follows turbulence in global bond markets, where long-dated yields keep surging. That spike rattled risk assets, sending traders briefly into the dollar and dragging gold back toward $3,470. Buyers quickly stepped back in, however, powering bullion to new highs.

After months of consolidation since late May, this breakout gives gold bulls new momentum and breathing room.

Europe News

Eurozone Services Growth Cools

The eurozone’s final August services PMI eased to 50.5 from 50.7 flash, marking a two-month low.

- Composite PMI rose to 51.0, a 12-month high, thanks to manufacturing strength.

- Demand and jobs improved, but services drove higher input costs, with output prices rising at the fastest pace in four months.

HCOB notes that:

“Riding a bike too slowly can make you tip over. That’s the risk facing the eurozone. Yes, the economy has been growing since the start of the year, but the pace is painfully slow. In August, the HCOB Composite PMI Business Activity Index stood at 51.0 – barely above stall speed. Political tensions in France and Spain, uncertainty around the EU-US trade deal, and ongoing troubles in the key automotive sector aren’t helping. On the bright side, increased defense spending across Europe and Germany’s infrastructure program offer hope that the economy might keep moving forward – and avoid falling off the bike.

“Right now, the services sector feels more like stagflation than recovery. The rate of expansion has slipped even further from an already slow pace, while cost pressures have increased and selling price inflation nudged slightly higher. In fact, the performance of services has deteriorated across all four major eurozone economies: growth has slowed in Spain and Italy, and Germany and France are showing mild contractions. That said, we wouldn’t call it a downward trend just yet – there are signs of stabilization in both euro area new orders and backlogs. Still, the overall situation remains fragile.

“The European Central Bank is likely viewing the PMI prices data for services with mixed emotions. On the one hand, rising input costs point to mounting inflationary pressures. On the other, selling price inflation has barely moved, suggesting that service providers are struggling to pass those higher costs on to consumers in full. Increasing costs mean that inflationary pressures are building beneath the surface, however.

“Interestingly, the sluggish momentum in the services sector hasn’t made much of a dent in employment. In fact, headcounts ticked up slightly in August. Italy and Spain saw a slowdown in hiring, while German service providers even trimmed staff slightly, but France saw renewed jobs growth. Overall, this points to declining labor productivity across the euro area – a concern from an inflation standpoint. When productivity drops, the cost per unit of service rises, potentially offsetting the recent moderation in wage growth. The ECB is keeping a close eye on this dynamic, as highlighted in its latest meeting minutes.”

Eurozone Producer Prices Rise in July

Eurostat data showed eurozone PPI rose 0.4% m/m in July, beating expectations of 0.2%.

- Prior reading was +0.8%.

- Excluding energy, prices were flat, reflecting subdued underlying pressures in recent months.

Here’s the more detailed breakdown:

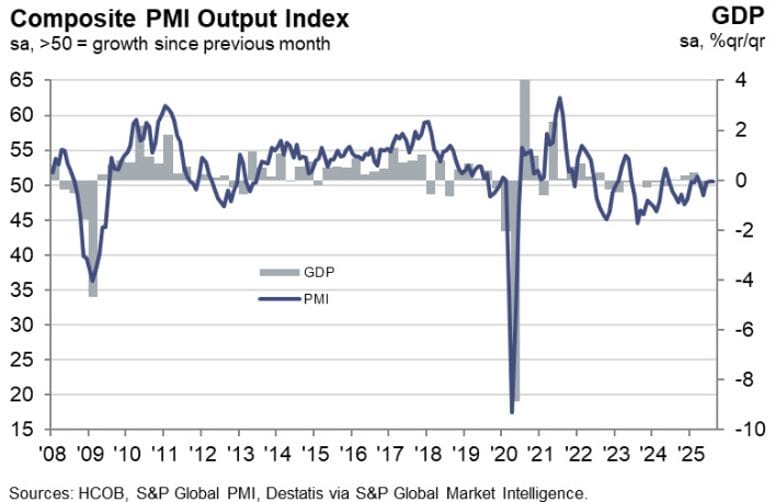

Germany Services PMI Revised Lower

Germany’s final services PMI for August was revised down to 49.3 from a 50.1 preliminary read, compared with 50.6 in July.

- Composite PMI finalized at 50.5, slightly below the flash estimate of 50.9.

- Activity is essentially flat, underscoring fragility in Europe’s largest economy.

Commenting on the PMI data, Dr. Cyrus de la Rubia, Chief Economist at Hamburg Commercial Bank, said:

“Economic momentum remains sluggish. Over the summer months, overall growth was just marginally positive. Clearly, the German government has not yet succeeded in pulling the economy out of the slow lane. In fact, service sector firms slightly scaled back their business operations in August. The good news comes from manufacturing, where things have been running more smoothly for a few months now: production has increased for six straight months.

“The weakness in demand within the service sector is, according to surveyed companies, partly due to ongoing uncertainty among their clients. This aligns with the decline in incoming orders, including those from abroad. Despite lower business activity, service providers still feel confident enough to raise their prices. Compared to the previous month, price hikes were noticeably stronger. On the one hand, this reflects higher costs being passed on; on the other, some firms likely managed to slightly improve their profit margins in August. The relatively solid pricing power suggests that companies aren’t yet in a critical situation.

“The rise in costs faced by service firms is, according to some survey participants, linked to wages, which appear to be climbing sharply despite the weak economic backdrop. In fact, official statistics show that collectively bargained hourly wages rose by an average of 5% year-on-year in July. The shortage of skilled labour, driven by demographic trends, remains a persistent challenge, despite the economic slowdown and despite advances in artificial intelligence. Against this backdrop, the weak economic environment hasn’t yet led to significant layoffs in the service sector. Employment has instead remained flat recently.”

France Services Sector Shows Stabilization

France’s final services PMI for August came in at 49.8, almost unchanged from the 49.7 flash and up from 48.5 in July.

- Composite PMI also finalized at 49.8.

- Conditions remain just below the 50.0 growth threshold.

- Demand is still sluggish, but employment rose for the first time since November 2024, offering some relief.

HCOB notes that:

“The French private sector economy is edging closer to stabilization. The HCOB Composite PMI rose to 49.8 in August, only marginally in contraction territory. This marks the highest reading in a year. Improvements stemmed from both services and manufacturing, with rates of decline cooling in both sectors. Overall, these are encouraging developments, though they must be viewed with caution given the broader climate of uncertainty and economic weakness in France, which now also faces the prospect of another government crisis. Despite the positive directional signals, the economic situation remains fragile, and political instability could quickly undo these early signs of recovery.

“Conditions in the French services sector still remain subdued. Declines in business activity and order volumes slowed, but overall index levels remain historically low. Foreign orders have dropped significantly, with companies reporting a decline in international clientele numbers. Nevertheless, backlogs of work increased during the reporting month, attributed to a mix of staff shortages and delays on the customer side. Despite the weak economic environment, service providers resumed hiring in August after eight consecutive months of workforce reductions.

“Business expectations remained below the long-term average. At the time of the August PMI survey dates, it was not yet known that Prime Minister Bayrou would seek a vote of confidence in parliament on September 8 to push through an austerity budget. However, the prospect of continued political uncertainty is likely to weigh further on companies’ outlook.

“Price dynamics in the services sector have changed little and input costs and output prices continue to edge up slightly. Persistently moderate price developments suggest that cost pressures in the services sector are neither escalating sharply nor easing significantly, which can be interpreted as a sign of relative stabilization, but also of a lack of momentum on the demand side.”

Spain Services PMI Slows in August

Spain’s services PMI slipped to 53.2 in August, below expectations of 54.4 and down from 55.1 prior.

- Composite PMI eased to 53.7 from 54.7.

- Demand conditions stayed positive, but firms reported stronger cost pressures, with input prices rising at the fastest pace since February.

HCOB notes that:

“Spain’s private sector economy continues to hold steady, maintaining a comfortable position despite a modest dip in the HCOB Composite PMI in August. The slight slowdown in overall growth stems from a deceleration in service sector output. However, this was partly offset by a notable acceleration in manufacturing activity growth, signalling a solid stabilisation within the private sector. Overall, Spain’s economic performance remains strong, particularly when compared to its Eurozone peers.

“The service sector remains in solid shape. On the demand side, business activity growth slowed slightly in August, yet new business continued to develop steadily, in line with the previous month. These consistently positive trends in activity and demand are reflected in recent developments in employment and capacity. With outstanding business rising notably amid increasing sales, some panellists also point to shortages in capacity and staffing as key drivers of this surge. As a result, demand for personnel has grown, with the corresponding index now expanding continuously for nearly three years.

“Service sector price inflation in Spain remains persistently high. Both input cost and output price inflation continue to exceed historical averages and saw acceleration in August. Panellists frequently report sharp increases in supplier prices, alongside rising fuel and staffing costs. Supported by strong sales and sustained demand, companies felt confident in passing these costs on to clients through higher end prices. With this ongoing trend, service price inflation is increasingly becoming a point of concern.”

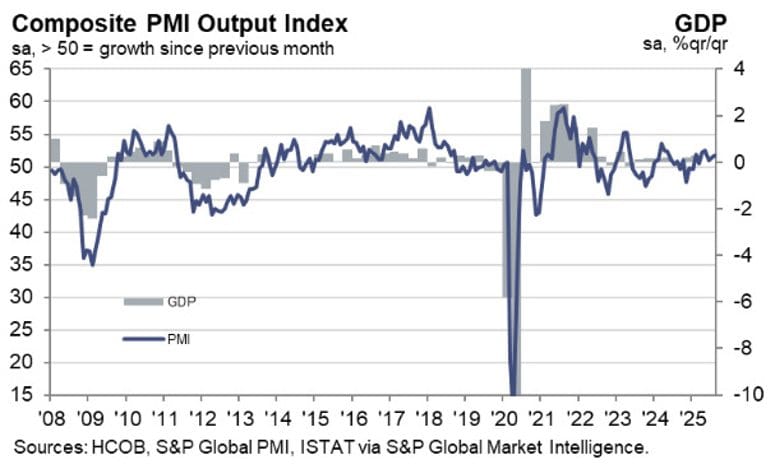

Italy Services PMI Holds at 51.5

Italy’s August services PMI printed 51.5, exactly as expected but down from July’s 52.3.

- Composite PMI rose slightly to 51.7 from 51.5.

- Businesses reported intensifying input costs, though output charge inflation moderated.

- Confidence remains subdued, with outlook readings at a 4.5-year low.

Commenting on the PMI data, Nils Müller, Junior Economist at Hamburg Commercial Bank, said:

“Italy’s services sector lost momentum in August, with the HCOB Services PMI slipping to 51.5 from 52.3 in July – its lowest reading since January. While the sector remained in expansion territory for a ninth consecutive month, the pace of growth was modest and subdued by historical standards. This slowdown came despite a solid uptick in new business, which firms attributed to new client wins and improved domestic demand. However, the divergence between domestic and foreign sales persisted, as export business contracted for the thirteenth straight month, albeit at a slower pace.

“Employment growth continued but slowed again, reflecting a more cautious hiring stance. Backlogs of work declined for the sixth month in a row, which suggests that current staffing levels may be sufficient to meet demand. Cost pressures intensified, with firms reporting higher expenses for fuel, energy, rent and other business inputs. At the same time, service providers moderated their output price increases to the weakest rate in nine months, indicating margin compression.

“Business confidence deteriorated, as firms’ expectations for the year ahead sank to one of the lowest levels recorded in over four-and-a-half years. While some firms remained optimistic that new projects and client acquisitions would support future growth, sentiment was broadly weighed down by muted economic conditions.

“The broader picture across Italy’s private sector was slightly more encouraging: the HCOB Composite PMI edged up to 51.7. This improvement was driven by renewed growth in manufacturing output, which helped offset the softer services expansion. New business growth at the composite level accelerated to its strongest pace in 16 months, suggesting that underlying demand across Italy’s private sector is becoming increasingly robust.”

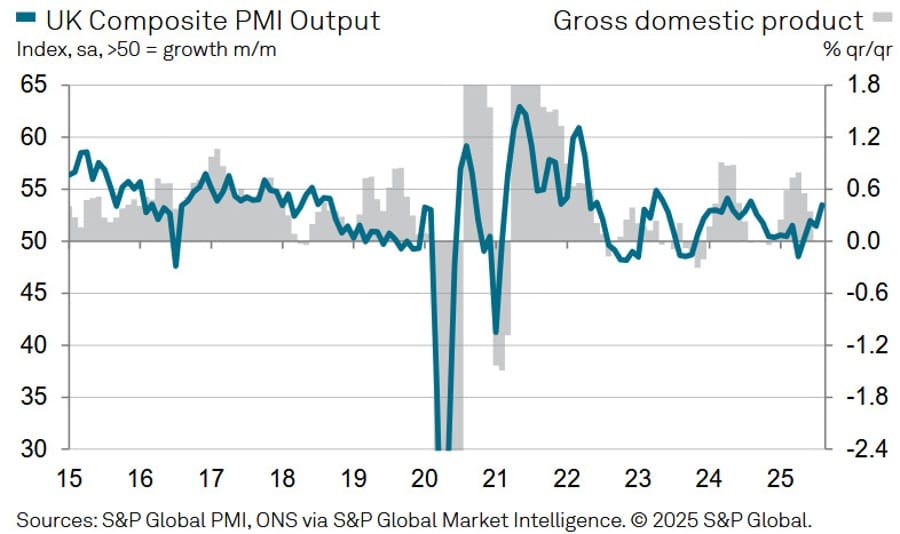

UK Services Sector Surprises to the Upside

The UK’s final August services PMI came in at 54.2, well above July’s 51.8 and ahead of the 53.6 flash.

- Composite PMI reached 53.5 versus 51.5 prior.

- New orders rebounded, output accelerated, and optimism climbed to a 10-month high.

Tim Moore, Economics Director at S&P Global Market Intelligence, said:

“August data highlights a welcome acceleration of output growth and a swift rebound in order books after July’s dip, leaving the UK service economy on a much stronger footing as the end of summer comes into view.

“The seasonally adjusted New Orders Index rose by over six points in August, which was the largest one-month gain since March 2021 and indicative of a decisive improvement in customer demand. This was helped by greater domestic business and consumer spending, alongside the first increase in export sales since March.

“Hiring trends remained subdued in comparison to those seen for business activity and new order intakes. Total workforce numbers have decreased in each month since October 2024, with elevated payroll costs again cited as holding back recruitment. Some firms also reported a focus on automation and investments in productivity improvements to help alleviate margin pressures.

“Business activity expectations meanwhile hit a ten- month high in August, providing a clear signal that growth prospects for the UK service economy have moved up from the lows seen this spring. Improved sales pipelines, lower borrowing costs and receding fears about US tariffs all helped to boost business optimism. However, many service providers still commented on elevated government policy uncertainty and worries about forthcoming tax-raising measures expected in the autumn Budget.”

BOE’s Bailey plays down gilt surge

Governor Andrew Bailey said the steepening UK yield curve is driven mainly by global factors, not domestic ones.

- Rates are still on a downward path.

- Supply-side risks are the main threat to inflation.

- Long-end yields (30-year gilts at highest since 1998) should not dominate focus.

MPC member Lombardelli added she sees the neutral rate in the 2–4% range, toward the higher end.

Bank of England policymakers highlight divisions

The BOE’s annual report revealed sharp differences on policy direction.

- Lombardelli: Not confident rate cuts would be restrictive enough; inflation risks remain high; labor loosening may reflect normalization, not slack.

- Taylor: Rates should stay restrictive but not longer than necessary; risk lies in keeping policy too tight.

Markets currently price a 35% chance of a 25 bps cut this year.

UK Finance Minister Reeves: Britain’s economy is not broken

- Comments from the UK Finance Minister, Rachel Reeves

- We need to bring inflation and borrowing costs down.

- We will do that by keeping a tight grip on day-to-day spending and enforcing fiscal rules.

- Fiscal rules are non-negotiable.

Asia-Pacific & World News

China August Services PMI at 53.0

China’s services sector expanded at the fastest pace in 15 months in August.

- Services PMI rose to 53.0 (expected 52.5, prior 52.6).

- Composite PMI improved to 51.9 from 50.8.

- Data, released under S&P Global, reflects what was previously known as the Caixin PMI.

Trump Accuses China, Russia, North Korea of Conspiracy

During China’s large-scale military parade in Beijing’s Tiananmen Square, attended by Kim Jong Un and Vladimir Putin, U.S. President Trump accused the three nations of colluding against the U.S.

He told Xi Jinping:

“Please give my warmest regards to Vladimir Putin, and Kim Jong Un, as you conspire against The United States of America.”

PBOC sets USD/ CNY mid-point today at 7.1108 (vs. estimate at 7.1476)

- PBOC CNY reference rate setting for the trading session ahead.

PBOC injected 229.1bn yuan via 7-day reverse repos at 1.40%

- 379.9bn yuan mature today

- net drain is 150.8bn yuan

Australia Q2 GDP Beats at +0.6%

Australia’s economy grew 0.6% q/q in Q2 2025, beating expectations of 0.5%.

- Annual growth hit 1.8%, the fastest in two years.

- Consumption rose 0.9%, boosted by a drop in savings to 4.2% from 5.2%.

- Government and business spending contributed little.

- The GDP chain price index fell -0.5%, easing inflation pressures.

Australia August Services PMI Hits 55.8

Australia’s services sector accelerated in August, with PMI rising to 55.8, the fastest pace in over three years. Composite PMI climbed to 55.5.

Key details:

- Domestic demand stayed firm, while external demand recovered.

- Employment improved.

- Cost pressures persisted but eased slightly.

- Data points to solid Q3 GDP growth.

New Zealand Commodity Prices Rebound in August

The ANZ World Commodity Price Index rose 0.7% m/m in August after a 1.8% decline in July.

- Year-over-year, the index gained 9.3%.

- In NZD terms, prices rose 2.1% due to a weaker currency.

- All components rose except aluminium.

- Dairy weakness that dragged earlier months reversed in August.

BOJ governor Ueda: There is no change to our stance on rate hikes

- Remarks by BOJ governor, Kazuo Ueda, following a discussion with Japan prime minister, Shigeru Ishiba

- Exchanged views with PM Ishiba on economy, financial markets in a regular meeting

- Had discussion on various topics about the economy, forex

- Exchange rate should move in a manner that is reflecting fundamentals

- No change to our stance on rate hikes

- No change to the stance of raising interest rates if economy, prices move in line with forecast

- Want to work closely with the government, watching FX moves carefully

- Discussed forex as part of broader discussion on markets but won’t comment on details

Japan trade negotiator Akazawa reportedly making arrangement for US visit tomorrow

- Jiji Press reports on the matter

His trip last week was abruptly cancelled as there was still a significant gap between both sides on agricultural issues. To be more specific, Japan wasn’t pleased that the US wanted to include plans for Tokyo to increase purchases of American rice and a reduction of tariffs on agricultural products.

Japan August Services PMI at 53.1

Japan’s services sector remained in growth territory in August, though momentum cooled slightly.

- Services PMI slipped to 53.1 from 53.6.

- Composite PMI rose to 52.0, the best since February, aided by resilient services.

- Domestic orders grew strongly, but foreign demand contracted at the sharpest pace in three years.

- Employment fell for the first time since 2023, while input costs rose again.

Japanese Bond Yields Surge to Multi-Decade Highs

Japanese government bond yields continued climbing:

- 20-year yield hit 2.685%, the highest since 1999.

- 30-year reached 3.28%.

The trend mirrors a global rise in yields, as investors demand higher returns for long-term lending.

Crypto Market Pulse

Ethereum poised for Q4 breakout despite cooling sentiment

Ethereum trades at $4,470 and could accelerate higher in Q4, says Derive founder Nick Forster, citing institutional demand and Fed rate cut bets.

- ETFs added 250k ETH last week; SER entities accumulated 330k.

- Institutions now hold close to 4% of ETH supply, nearing ETF levels at 5.5%.

- Traders’ $6,000 October target odds fell from 45% to 30%.

- CME futures basis shrank from 10% to 6.5%, showing cooling momentum.

Still, expectations of lower rates keep the long-term bull case alive.

XRP gains on easing US regulation, new payments deal

XRP is pushing toward a $3.00 breakout, lifted by regulatory clarity and a new payments partnership.

- SEC and CFTC issued a joint statement clearing the path for select spot crypto assets to trade on US-registered exchanges.

- Ripple partnered with Thunes to expand real-time cross-border payments globally.

Ripple now holds 64 licenses across 90 markets, supporting 55+ currencies. The new collaboration aims to extend reach and efficiency, reinforcing XRP’s role in global payments.

Trump-Linked WLFI Token Slumps After Debut

The Trump-affiliated World Liberty Financial (WLFI) token dropped about 12% to $0.2355 on its Sept. 1 trading debut.

- Market cap: just under $7B; intraday low: $0.2335.

- Listings on Binance, OKX, and Bybit fueled volatility.

- Only 20% of early investor holdings were unlocked, with founder/team allocations locked longer.

Critics warn the thin float creates inflated valuations, exposing retail to losses. Compass Point highlighted parallels to earlier Trump-linked memecoins ($TRUMP, $MELANIA), where insiders controlled ~80% of supply.

Despite the selloff, the Trump family’s stake—22.5B WLFI—was valued above $5B on launch. Donald Jr., Eric, and Barron Trump are co-founders; former President Trump is “Co-Founder Emeritus.”

Stellar’s Whisk Upgrade Faces Tepid Demand

Stellar validators are set to vote on Protocol 23 (Whisk), which introduces unified events for smart contracts and parallel transaction processing.

- Vote scheduled for Wednesday at 17:00 GMT.

- XLM price slipped ~1% after a 3% gain the prior day, reflecting muted sentiment.

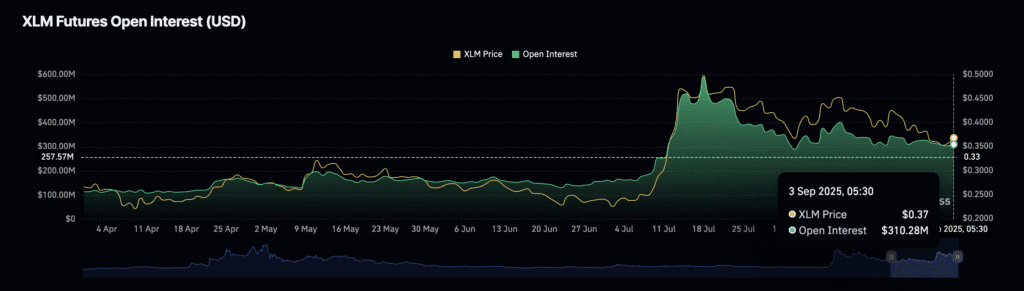

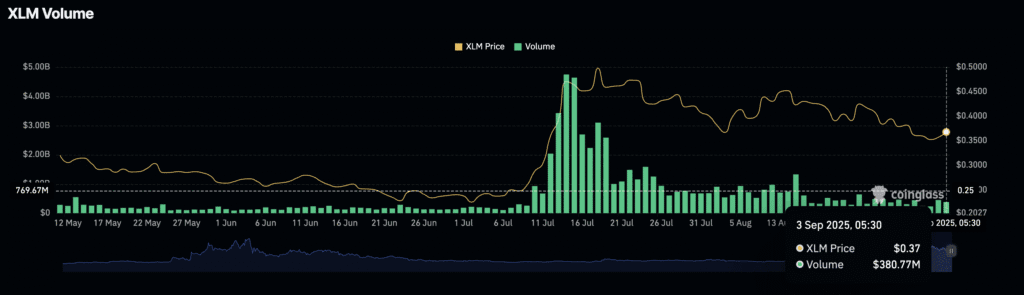

- Open interest rose slightly to $310M, but volumes remain in decline since mid-July.

Analysts warn that unless engagement picks up, XLM could underperform despite the technical upgrade.

KuCoin Launches KuMining Platform

KuCoin has rolled out KuMining, a cloud mining service designed to make industrial-scale crypto mining accessible to retail users.

Highlights:

- Supports Bitcoin, Dogecoin, and Litecoin merge mining.

- Backed by 300 MW to 2 GW of global power resources, with instant activation.

- Real-time hashrates: 10,000,000 TH/s for Bitcoin; 200 TH/s for DOGE and LTC.

- Launch set for September 16, with daily yield credits, transparent pricing, and DCA features.

CEO BC Wong said the goal is to “return hashrate to the community” and reduce reliance on institutional mining dominance.

Japan Considers Tighter Crypto Regulation

Japan’s Financial Services Agency proposed shifting crypto oversight under the Financial Instruments and Exchange Act, treating it like securities.

- Would impose tougher rules on issuers and exchanges.

- Aims to reduce misconduct and improve investor transparency.

- Legislative amendment expected in next year’s Diet session.

- Near-term pressure likely on exchanges, but long-term confidence could improve.

The Day’s Takeaway

North America

United States

- Google Antitrust Case: A judge’s sealed ruling in the government’s monopoly case spared Chrome and Android from forced divestiture. Alphabet surged 9%, lifting the Nasdaq despite broader market weakness.

- Markets Mixed: Dow -24.58 to 45,271.23; Nasdaq +218.10 to 21,497.73; S&P 500 +32.72 to 6,448.26. Gains concentrated in mega-cap tech. Energy (-2.3%) lagged as oil slid.

- Fed Signals:

- Waller backed a September cut, sees 100–150 bps to neutral, stresses flexibility.

- Bostic favors one cut in 2025, warns tariffs strain firms.

- Kashkari says inflation still too high; September meeting could split.

- Beige Book: economy flat, price growth modest but risks accelerating; stagflation undertones.

- Labor Market: July JOLTS showed job openings at 7.18m (weaker than expected), hires steady, quits unchanged.

- Factory Orders: July orders fell 1.3% (better than June’s -4.8%), ex-transportation orders showed resilience.

- Economic Concerns:

- McDonald’s CEO flagged steep declines in lower-income traffic.

- Dalio warned of a U.S. debt crisis within three years.

- Manley (JPM) called Fed policy too tight but expects only modest cuts.

- SocGen sees Friday’s payrolls as pivotal for Fed policy.

- Morgan Stanley warned September cut not guaranteed if jobs/inflation stay firm.

- Goldman Sachs sees structural shifts driving dollar weakness.

- UBS dismissed equity record highs as a risk, citing historical returns.

- Morgan Stanley CIO Mike Wilson urged “buy the dip.”

- Mortgage Market: MBA applications fell 1.2%, with purchase index slipping; 30-year fixed at 6.64%.

- Treasuries: Rally wiped out earlier week’s losses; 2-yr yield -5 bps to 3.61%, 10-yr -7 bps to 4.21%.

Canada

- Labor Productivity: Q2 dropped 1.0%, worst since late 2022, highlighting competitiveness risks.

- Fiscal Policy: Finance Minister Carney previewed autumn budget with up to 15% departmental cuts, sparing education transfers and direct aid.

Europe

- BOE Policy Rift:

- Lombardelli: skeptical cuts would remain restrictive, inflation risks persist.

- Taylor: warns against staying tight too long, economy fragile.

- Market pricing: 35% chance of a 25 bps cut this year.

- Bailey on Yields: UK governor said long-end gilt surge is globally driven, not domestic; still sees path lower for rates. Lombardelli sees neutral near upper 2–4% range.

- Services Data:

- Spain: PMI 53.2 (miss, down from 55.1).

- Italy: PMI 51.5, steady but confidence subdued.

- France: PMI 49.8, stabilizing, first employment gain since Nov. 2024.

- Germany: PMI revised down to 49.3, activity flat.

- Eurozone: services PMI 50.5 (2-month low), composite 51.0 (12-month high).

- UK: PMI 54.2, surprise strength, optimism highest in 10 months.

- Eurozone Producer Prices: PPI +0.4% m/m in July, beating expectations, but core pressures subdued.

Asia

- Japan:

- Services PMI 53.1, growth slowing; foreign demand weakest in three years. Employment fell for first time since 2023.

- Bond yields surged: 20-yr at 2.685% (highest since 1999), 30-yr at 3.28%.

- FSA proposed stricter crypto oversight under securities law.

- China: August services PMI 53.0, best in 15 months; composite 51.9, driven by services rebound.

- Geopolitics: Trump accused China, Russia, and North Korea of conspiring against the U.S. during Beijing’s military parade attended by Xi, Putin, and Kim Jong Un.

- Australia:

- Services PMI 55.8, fastest in 3+ years. Composite 55.5.

- Q2 GDP +0.6% q/q, +1.8% y/y. Savings rate fell to 4.2%, consumption drove growth.

- New Zealand: August commodity price index +0.7% m/m, +9.3% y/y, boosted by dairy rebound.

Commodities

- Gold: Blasted to a record $3,560, eyeing $4,000. Driven by instability, tariffs, easing bets. Risk: Supreme Court could strike down tariffs.

- Silver: Hit $40.98, highest since 2011. Overbought RSI >70. Resistance at $41.50–42.00, support at $39.77, deeper pullback risk to $37.90–35.80.

- Oil: OPEC output +400k bpd in August; may hike further this weekend. WTI dipped to $64, later rebounded.

Crypto

- Ethereum (ETH): $4,470, institutions adding heavily. ETFs +250k ETH, SER entities +330k. Traders cut odds of $6,000 by Oct (30% from 45%). Long-term bull case intact.

- XRP: Near $3.00 breakout after SEC/CFTC joint statement on spot crypto trading and Ripple–Thunes cross-border payments partnership. Ripple now licensed in 90 markets.

- Stellar (XLM): Preparing vote on Protocol 23 upgrade. XLM slipped ~1%, engagement muted, underperformance risk.

- WLFI Token: Trump-linked project slumped 12% post-debut to $0.2355, market cap ~$7B. Thin float risks highlighted, but Trump family stake valued >$5B.

- KuCoin: Launched KuMining platform for retail cloud mining, supporting BTC, DOGE, LTC. Launch Sept. 16.