North America News

Major Indices Close Lower, But Late Recovery Softens the Blow

US equities ended lower on Wednesday, though a late rebound helped limit the damage and kept key technical levels intact.

- S&P 500 fell -15.59 points (-0.24%) to 6,395.78, but managed to close back above its 100-hour moving average (6,382.43) after dipping briefly below both its 100- and 200-hour averages intraday.

- NASDAQ Composite dropped -142.10 points (-0.67%) to 21,172.86. The index sank as low as 20,905.99—breaking under its 200-hour moving average at 21,140.02—before recovering to finish just above that key level.

- Dow Jones Industrial Average eked out a gain of +16.04 points (+0.04%) to 44,938.13.

Despite the declines, the late-day bounce prevented a more bearish technical close. Sellers had the opportunity to push momentum lower, but the recovery leaves equities hovering near important moving averages. The setup keeps downside risk alive for tomorrow, but also preserves room for corrective upside if buyers reassert control.

US Treasury Sells $16B in 20-Year Bonds at 4.876%

The U.S. Treasury auctioned $16 billion in 20-year bonds at a high yield of 4.876%, essentially in line with the WI level of 4.877%.

Key metrics:

- Bid-to-cover: 2.54x (vs 2.63x avg.)

- Direct bidders: 26.5% (vs 18.3% avg.)

- Indirect bidders: 60.64% (vs 67.6% avg.)

- Dealers: 12.88% (vs 14.1% avg.)

The results were mixed, with strong direct demand offset by lighter indirect participation.

US Mortgage Applications Drop After Prior Surge

U.S. MBA mortgage applications for the week ending 15 August 2025 fell 1.4%, after a sharp 10.9% gain the week before.

- Market index: 277.1 (prior 281.1)

- Purchase index: 160.3 (prior 160.2)

- Refinance index: 926.1 (prior 956.2)

- 30-year mortgage rate: 6.68% (up from 6.67%)

The release is not typically market-moving.

Fed Minutes: Tariff Effects Add to Inflation Risks

Minutes from the July 29–30 FOMC meeting showed policymakers largely in agreement to keep rates steady at 4.25%–4.50%, while acknowledging tariff uncertainty.

Key takeaways:

- Inflation risks: Majority viewed upside risk to inflation as the greater concern.

- Tariffs: Effects increasingly visible in goods prices; most expect a near-term lift to inflation.

- Labor market: Still solid, but some noted softer job growth and rising youth unemployment.

- Divergence: Two members dissented, favoring a 25 bps cut due to employment risks.

Overall, the Fed remains cautious and data-dependent, with inflation risks outweighing employment concerns.

Fed Chair Candidate Zervos Says Policy “Too Restrictive”

David Zervos, a leading candidate for Federal Reserve Chair, told CNBC that current Fed policy is overly restrictive. Zervos, chief market strategist at Jefferies, is one of 11 candidates being considered, with interviews beginning after Labor Day.

He argued:

- Inflation remains too high.

- Tariffs were overstated as a major issue.

- Powell lacks independence.

- The Fed failed to push back on extreme asset-buying policies.

Separately, U.S. Federal Housing Director Pulte posted on X that FOMC member Lisa Cook is “cooked,” accusing her of property fraud related to declared primary residences.

WSJ: Musk Slows Effort to Launch Political Party

According to the Wall Street Journal, Tesla CEO Elon Musk is easing back on plans to establish a new political party. He has reportedly told allies that his focus will remain on his companies. Musk is also keen to maintain strong ties with Senator JD Vance, seen as a key figure in the future of the MAGA movement. By holding off on a new party, Musk avoids risking a break with influential Republicans.

Trump: Zelenskiy–Putin Meeting in the Works

Donald Trump said arrangements are being made for Ukrainian President Volodymyr Zelenskiy to meet with Russian President Vladimir Putin. He added that he is waiting to see what comes out of the talks once they take place.

Canada New Housing Prices Edge Lower in July

Canada’s new housing price index declined 0.1% in July 2025, after a 0.2% fall in June.

The data is not considered market-moving.

Commodities News

Gold Rises as Trump Pressures Fed Governor Cook Over Fraud Allegations

Gold prices advanced Wednesday as political pressure on the Federal Reserve rattled markets.

President Donald Trump has demanded Fed Governor Lisa Cook resign following reports that she falsified documents to obtain favorable loan terms—potentially amounting to mortgage fraud. Bloomberg cited Federal Housing Finance Agency (FHFA) Director Bill Pulte as the source of the allegations, while the Wall Street Journal reported Trump has considered firing Cook outright.

The controversy revived concerns about Fed independence, pushing gold higher as a safe-haven play. Spot gold climbed 0.84% to $3,342, after touching an intraday high near $3,350.

The US Dollar Index (DXY) slipped 0.05% to 98.21, reflecting pressure on the Greenback as traders weighed the political fallout.

Markets now turn their attention to the release of FOMC minutes, weekly jobless claims, and Fed Chair Jerome Powell’s speech at Jackson Hole for further clues on monetary policy.

US Crude Inventories Show Steeper Drawdown

EIA data showed a sharper-than-expected fall in U.S. crude oil stockpiles last week:

- Crude: –6.014M (vs –1.759M est.)

- Gasoline: –2.720M (vs –0.915M est.)

- Distillates: +2.343M (vs +0.928M est.)

- Cushing hub: +0.419M

WTI crude rose $0.73 to $62.50, after trading between $61.83 and $62.80 on the day.

Silver Slides to Two-Week Low at $37.15

Silver fell for a fifth straight session, hitting $37.15, its lowest level in two weeks.

- The U.S. Dollar Index is consolidating after a 0.5% rebound in recent days.

- Firmer Treasury yields are weighing on precious metals.

- Traders remain cautious ahead of Fed Chair Powell’s Jackson Hole remarks on Friday.

Momentum indicators show silver nearing oversold territory after reversing sharply from $38.20 on Tuesday.

Goldman Sachs Trims Near-Term Gas Forecasts, Remains Bullish for 2026

Goldman Sachs cut its short-term forecasts for U.S. natural gas prices, citing softer near-term demand, but maintained a strong outlook for 2026. The bank now sees September–October 2025 prices at $3.35/MMBtu (down $0.55) and November–December 2025 at $4.00/MMBtu (from $4.50). Its 2026 forecast remains at $4.60/MMBtu, above the forward curve of $3.81. Goldman continues to recommend a long April 2026 position, expecting supply-demand dynamics to improve over the medium term.

Europe News

European Indices Close Mixed as US Pressure Weighs

Major European stock markets ended Wednesday’s session mixed, tracking U.S. weakness.

- German DAX: –0.60%

- France’s CAC: –0.08%

- UK FTSE 100: +1.08%

- Spain’s Ibex: –0.08%

- Italy’s FTSE MIB: –0.36%

The FTSE 100 outperformed with a solid gain, while German and Italian equities lagged.

Eurozone July CPI Final Confirmed at 2.0%

Eurostat confirmed euro area inflation at 2.0% year-on-year in July 2025, unchanged from the preliminary reading and from June’s level. Core CPI held steady at 2.4%, matching both prior and preliminary figures.

German PPI Slips in July, Energy Prices Key Driver

Germany’s producer prices fell 0.1% month-on-month in July, missing expectations for a 0.1% increase. June saw a 0.1% gain.

Excluding energy, producer prices declined 0.2% on the month. Compared with July 2024, PPI dropped 1.5%, though stripping out energy costs shows a 1.0% annual rise, according to Destatis.

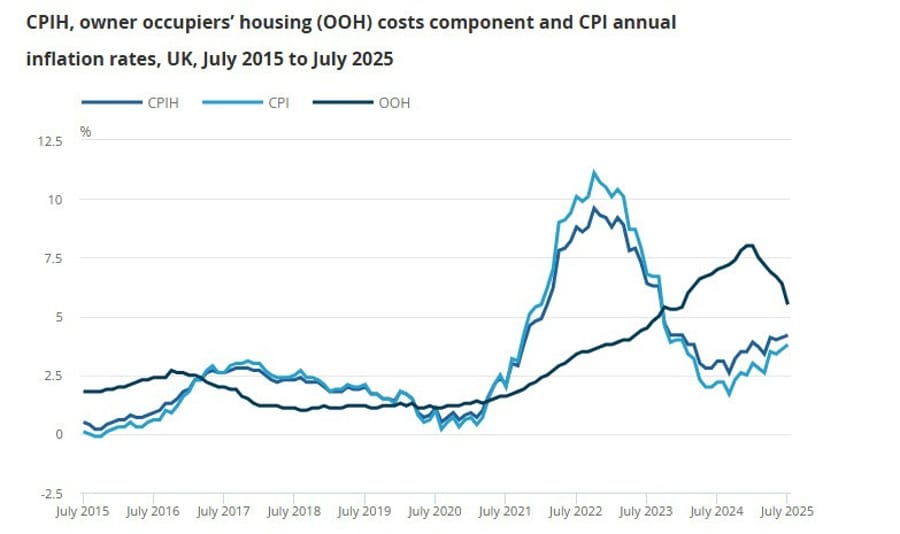

UK July CPI Hotter Than Expected at 3.8%

UK inflation in July 2025 rose 3.8% year-on-year, slightly above the forecast of 3.7% and up from June’s 3.6%, according to ONS. Core CPI also printed at 3.8% versus 3.7% expected.

The stronger reading supports the Bank of England’s stance to hold rates steady in September. However, markets had already priced in a ~94% chance of a pause, limiting the impact on sterling.

Looking at the breakdown, annual services inflation was unchanged at 5.2% in July. But in core terms, that is seen up from 4.7% in June to 5.0% in July. This will continue to present a headache for the BOE as they are dealing with the very real threat of stagflation pressures now.

ECB’s Lagarde: Growth Slowing Despite Trade Agreements

European Central Bank President Christine Lagarde said the euro area economy showed resilience earlier this year but is already slowing. Growth weakened in Q2 and is expected to soften further in Q3.

She added that although the trade deal with the U.S. provides some relief, it has not removed uncertainty, with risks to growth still evident.

Asia-Pacific & World News

China to Unveil Hypersonic Weapons at Parade

China will highlight its growing military capabilities at an upcoming parade, which will include 45 troop formations and several aircraft making their first appearance. Hypersonic precision strike weapons will be showcased for the first time. The parade will feature tens of thousands of personnel, hundreds of aircraft, and extensive ground equipment. Officials said Beidou satellite technology will also play a role in mobilization. The event is intended not just as a display of power but also as a large-scale training exercise.

PBoC Holds Loan Prime Rates Steady

The People’s Bank of China left its loan prime rates unchanged in August, marking the fourth consecutive month without adjustment. The one-year rate remains at 3.0% and the five-year at 3.5%, both in line with expectations. The last rate change was in May. The central bank has emphasized that reforms introduced in 2024 were aimed at improving the effectiveness of monetary policy and supporting economic growth.

China and India Resume Dialogue, Reaffirm Border Stability

Following a meeting with Indian Prime Minister Narendra Modi, Chinese Foreign Minister Wang Yi announced both countries agreed to restart dialogue mechanisms across multiple areas. He emphasized that cooperation between China and India has taken on greater strategic importance under the current global climate. Both sides reaffirmed the need to manage differences carefully to prevent border disputes from harming wider relations. A new consensus was also reached on keeping border controls stable and maintaining peace in frontier regions.

Treasury Chief Bessent: Optimistic on China Talks, U.S. Economy, and Possible Budapest Summit

U.S. Treasury Secretary Bessent reported that discussions with China have been highly productive and that current relations are on solid ground. He expects stronger U.S. economic growth in the fourth quarter but admitted that distributional issues within the economy remain. On the possibility of Budapest serving as the site of a trilateral summit, Bessent simply said, “could be.”

PBOC sets USD/ CNY mid-point today at 7.1384 (vs. estimate at 7.1897)

- PBOC CNY reference rate setting for the trading session ahead.

RBNZ Cuts Rates by 25bp, Signals More Could Come

The Reserve Bank of New Zealand lowered its cash rate by 25 basis points to 3.0%, as expected. Projections show the OCR dropping to 2.71% in December 2025 and 2.59% in September 2026. Inflation is expected to return to the 2% midpoint by mid-2026, with annual CPI seen at 2.2% in September 2026.

The central bank noted stalled growth, spare capacity, and cautious household and business sentiment as risks. Minutes showed a 4–2 vote in favor of the 25bp cut, with discussions also considering a 50bp move. While inflation may briefly rise above target, the RBNZ stressed that ongoing easing could continue if medium-term pressures fade.

RBNZ’s Hawkesby: Future Cuts Possible, Data Will Decide

RBNZ Governor Hawkesby said the next two meetings are “live,” leaving the door open for additional cuts. He noted the OCR is projected to trough around 2.5%, with the timing of reductions depending on incoming data. Hawkesby emphasized the unusual nature of the latest 4–2 vote, reflecting a wide range of views among policymakers.

He added that government spending is trending lower, helping on the inflation front, but Q2 economic activity was far weaker than expected. The RBNZ sees house prices underperforming, and if businesses and consumers remain cautious, further easing may follow. Hawkesby also confirmed that past rate cuts totaling 250bp should aid growth and said the bank is comfortable with the decline in the NZD.

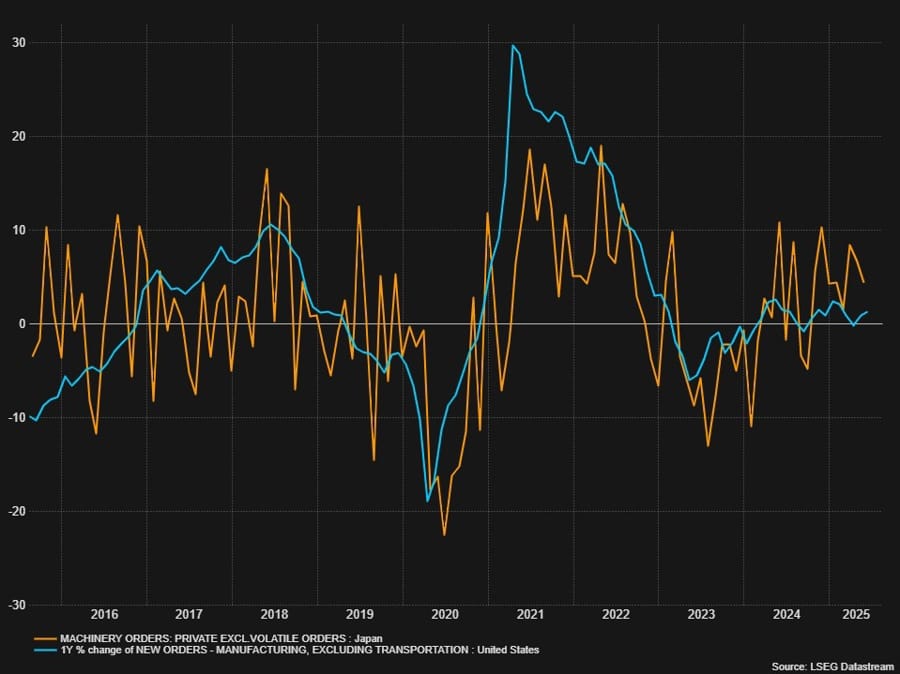

Japan Machinery Orders Stronger Than Forecast

Japan’s machinery orders for June 2025 rose 7.6% year-on-year, outperforming expectations of 5.0%. On a monthly basis, orders increased 3.0%, beating forecasts of a 1.0% decline.

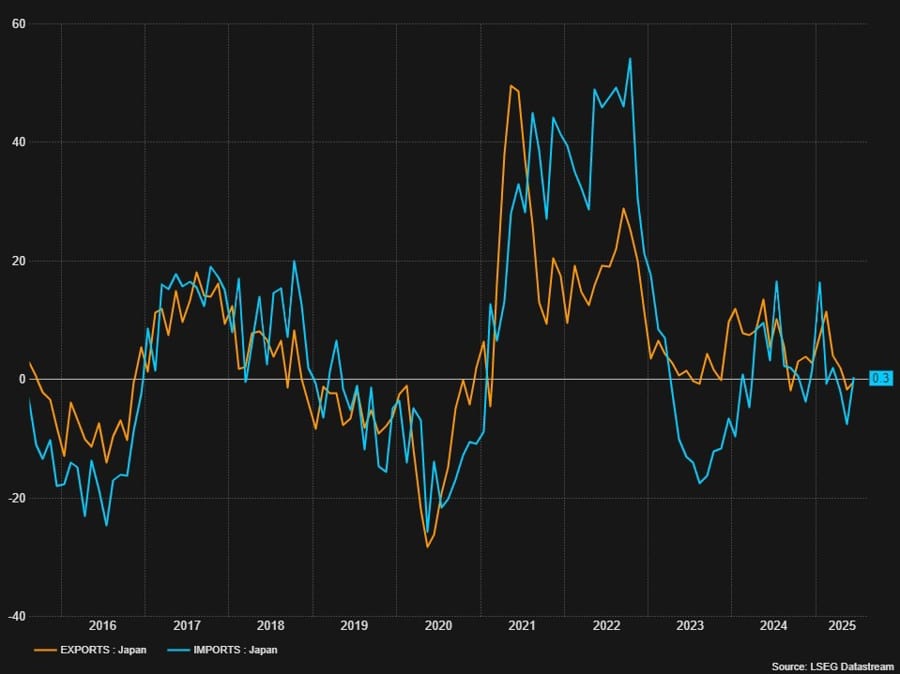

Japan’s July Exports Weaken, Trade Deficit Recorded

Japan’s exports in July 2025 fell 2.6% year-on-year, slightly worse than the forecasted 2.1% drop. Imports decreased 7.5%, a smaller fall than the expected 10.4%. The trade balance posted a deficit of ¥117.5 billion, missing projections for a ¥196.2 billion surplus. Export breakdown:

- To Asia: down 0.2%

- To China: down 3.5%

- To the U.S.: down 10.1%

- To the EU: down 3.4%

Crypto Market Pulse

Bitwise Sees Bitcoin Delivering 28% Annual Returns Through 2035

Bitwise CIO Matt Hougan forecast that Bitcoin will deliver annualized returns of 28.3% over the next decade, outperforming all major asset classes. He also projected volatility will decline to 32.9%, though still higher than traditional assets.

Highlights:

- Institutional demand for long-term BTC exposure is accelerating.

- US spot Bitcoin ETFs have already attracted over $54B in inflows since January 2024.

- Treasury firms now hold $111.2B in BTC, reinforcing its role as a corporate reserve asset.

Hougan said Bitcoin is shifting from a speculative play to a potential core institutional holding.

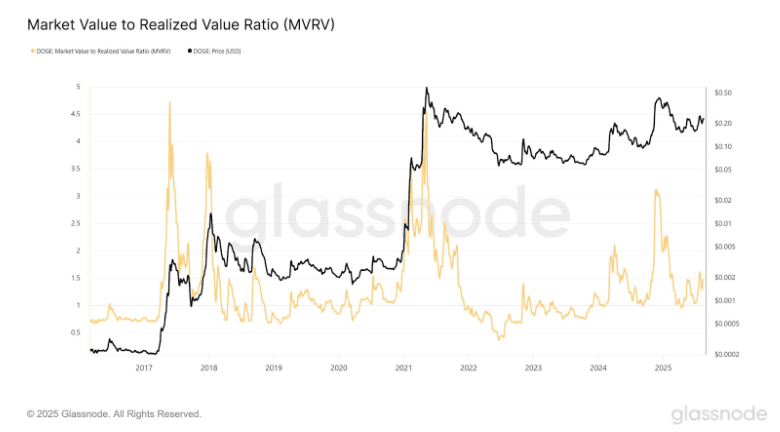

Dogecoin Hits 8 Million Holders, Fuels Bull Cycle Hopes

Dogecoin (DOGE) reached an all-time high of 8 million holders in August 2025, adding over 1 million new wallets this year alone—faster growth than in 2024, when it took a full year to achieve the same milestone.

Despite price volatility, adoption has accelerated, signaling strong community conviction. On-chain data also shows:

- DOGE’s MVRV ratio at 1.5, well below its historical peak of 4.5, suggesting undervaluation.

- Tight correlation with Ethereum, further strengthening bullish projections.

Many investors see these metrics as the foundation for a potential 2025 supercycle.

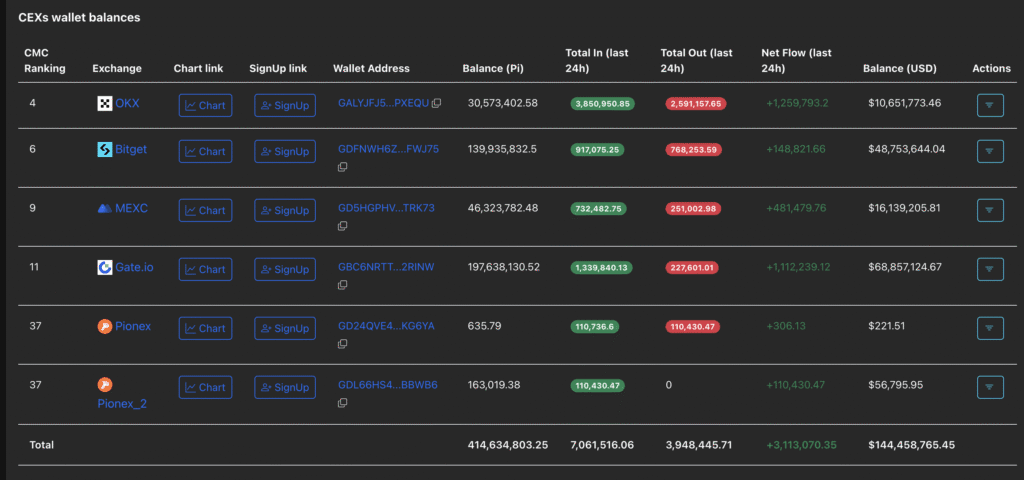

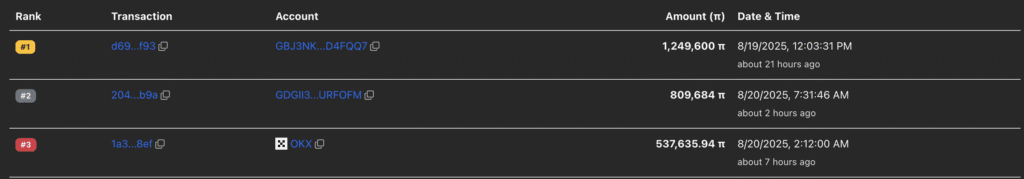

Large CEX Deposits Pressure Pi Token to Fresh Lows

Pi Network’s PI token slid to a record low of $0.3220, pressured by rising deposits into centralized exchanges (CEXs). The coin remains within a falling channel, signaling risk of further downside.

Key Data:

- Net inflows: 3.11 million PI tokens (≈$1.08 million).

- CEX wallet balances rose 0.75% to 414.63 million tokens.

- Two of the biggest transactions: 1.24 million and 809,684 PI deposits to OKX.

The heavy inflows suggest investors are preparing to sell, reinforcing bearish sentiment.

Bitcoin Technical Outlook: Powell Speech in Focus

Bitcoin slipped back to a key support near 111,900 after strong U.S. economic data pushed traders to book profits ahead of Fed Chair Jerome Powell’s Jackson Hole speech.

Fundamentals:

- US PPI exceeded expectations, jobless claims improved, and UMich inflation expectations surprised higher.

- These data releases fueled speculation Powell may lean hawkish, triggering a Bitcoin pullback.

- Markets expect Powell to avoid firm commitments and stress data dependence.

- If Powell hints at a September rate cut, Bitcoin could rally sharply; if he signals otherwise, more downside is likely.

Daily Chart: BTC testing key support at 111,900. A bounce here could set up a rally to fresh highs, while a break lower exposes 100,000.

4H Chart: Minor downtrend line reinforcing bearish pressure. Bulls need a breakout to regain momentum.

1H Chart: Resistance sits near 114,500 with trendline confluence. Sellers may lean there, while buyers require a clean break higher to flip bias.

Crypto Industry Pushes Back on Stablecoin Law Rewrite

Crypto groups are resisting Wall Street’s push to amend the GENIUS Act, the U.S. stablecoin law passed in July. Banks want to roll back provisions allowing state-chartered subsidiaries to operate nationwide and challenge affiliates offering yield programs.

Crypto groups’ stance:

- Section 16(d) ensures national redemption access and competition.

- Yield-sharing for affiliates benefits underbanked consumers.

- Most stablecoin reserves remain in commercial banks and Treasuries, supporting lending.

Banking associations argue the law risks $6.6 trillion in deposit flight, but crypto advocates cite studies showing no link between stablecoins and community bank outflows.

The Digital Asset Market Clarity Act, already through the House and pending in the Senate, could reshape policy before regulators draft rules. Final negotiations are expected in September.

Treasury Eyes Stablecoins as New Buyer of U.S. Debt

Treasury Secretary Bessent is steering more issuance toward short-term bills, betting that stablecoin issuers will emerge as a major source of demand for U.S. Treasuries, according to the Financial Times. JPMorgan’s Jay Barry noted that Treasury’s shift toward short-term issuance reflects confidence in real demand from stablecoins.

The July “Genius Act” requires stablecoins to be fully backed by ultra-safe, liquid assets such as T-bills. Treasury believes the law will encourage stablecoin adoption while broadening demand for government debt.

Today, stablecoins represent a ~$250 billion market compared with ~$29 trillion in Treasuries. Bessent has told Congress the sector could grow to $2 trillion. Treasury officials have increased outreach since January, with heightened concern about sustaining demand for U.S. debt.

The Day’s Takeaway

North America

US equities closed lower but staged a late recovery, softening the bearish tone.

- S&P 500 fell -15.59 points (-0.24%) to 6,395.78, rebounding back above its 100-hour moving average (6,382.43) after briefly slipping below both the 100- and 200-hour averages.

- NASDAQ Composite dropped -142.10 points (-0.67%) to 21,172.86, after plunging as low as 20,905.99. A late rebound helped the index close just above its 200-hour moving average (21,140.02).

- Dow Jones Industrial Average managed a modest gain of +16.04 points (+0.04%) at 44,938.13.

While downside pressure persisted, the close above technical supports prevented a more damaging outcome. The indices remain near critical moving averages, leaving room for both renewed selling or corrective upside in the sessions ahead.

In political developments, gold drew support from heightened concerns over Fed independence. President Donald Trump demanded the resignation of Fed Governor Lisa Cook over alleged mortgage fraud, following reports from Bloomberg and WSJ. Trump reportedly discussed the possibility of dismissing Cook outright. The controversy weighed on the US Dollar and boosted safe-haven demand.

Separately, the US Treasury auctioned $16 billion in 20-year bonds at a high yield of 4.876%, essentially matching the WI level of 4.877%. The bid-to-cover ratio came in at 2.54x, slightly below the six-month average, with dealers taking on a marginally smaller share than usual.

The FOMC minutes from July reflected a divided Fed:

- Majority saw upside inflation risk as the bigger concern, especially given new tariffs.

- Almost all favored holding rates steady at 4.25%–4.50%, with only two members dissenting in favor of a cut.

- Several participants noted vulnerabilities in asset valuations, investment uncertainty, and tariff impacts.

- The overall bias was to hold policy steady, pending more clarity from employment and inflation data.

Commodities

Oil: US crude oil inventories posted a sharp drawdown of -6.014M barrels (vs -1.759M expected). Gasoline also fell -2.720M (vs -0.915M expected), while distillates rose +2.343M (vs +0.928M expected). Cushing stocks increased +0.419M. Crude settled at $62.50, up $0.73 on the day, after trading between $61.83 and $62.80.

Gold: Prices rebounded from early weakness, finding support near the 100-day moving average ($3,304). After touching a session low of $3,311.62, gold rallied to $3,341.76, up $26.77 on the day. The bounce was aided by safe-haven flows on equity weakness and political pressure on the Fed. Holding above the 100-day average keeps the broader bullish bias intact, though resistance remains at the 200-hour moving average ($3,350).

Silver: Continued to slide, hitting a two-week low of $37.15, pressured by a firmer US Dollar and higher Treasury yields. This marks the fifth straight day of declines, with oversold momentum indicators suggesting potential stabilization ahead. Traders remain cautious ahead of Powell’s speech at Jackson Hole.

Europe

Major European indices closed mixed as US market weakness spilled over:

- German DAX: -0.60%

- France’s CAC: -0.08%

- UK FTSE 100: +1.08%

- Spain’s Ibex: -0.08%

- Italy’s FTSE MIB: -0.36%

The UK outperformed with a strong gain in the FTSE 100, while Germany and Italy lagged. France and Spain ended little changed.

Crypto

Bitcoin is projected to significantly outperform traditional assets over the next decade, according to Bitwise CIO Matt Hougan.

- Annualized returns expected at 28.3% through 2035.

- Volatility projected to decline to 32.9%, though still elevated versus traditional assets.

- Institutional interest is rising sharply, with major platforms overseeing trillions increasingly requesting long-term forecasts.

Bitcoin’s growing legitimacy has been fueled by the success of US spot Bitcoin ETFs (over $54 billion inflows since launch in January 2024) and corporate treasuries holding more than $111 billion in BTC. Hougan argues Bitcoin is shifting from a speculative trade to a core portfolio holding for large investors.