North America News

US Stocks Close Flat, S&P Hits Another Record

U.S. equities ended Thursday almost unchanged, with all three major indices finishing within 0.03% of the prior day’s levels. The S&P 500’s modest 0.03% gain was just enough to notch another record close, following yesterday’s all-time high. The Nasdaq’s 0.01% dip kept it shy of a new record.

Closing levels:

- Dow Jones Industrial Average: 44,911.26 (-11.01, -0.02%)

- S&P 500: 6,468.54 (+1.96, +0.03%)

- Nasdaq Composite: 21,710.67 (-2.47, -0.01%)

- Russell 2000: 2,299.08 (-28.97, -1.24%)

Intel shares surged 7.3% to $23.86 after Bloomberg reported the Trump administration is discussing a possible government stake in the company. The talks reportedly followed a Monday meeting between Intel’s CEO and former President Trump.

Other chip stocks:

- Nvidia: +0.24%

- AMD: -1.88%

- Broadcom: +0.69%

In tech, Netflix rebounded 2.17% (+$26.12) after Wednesday’s slide, while Amazon advanced 2.86%.

US Jobless Claims Fall to 224K, Beating Expectations

Initial claims for unemployment benefits came in at 224K last week, below the 228K forecast and slightly under the revised 227K from the prior week.

Continuing claims totaled 1.953M, compared with expectations for 1.964M and down from the revised 1.968M previously. The figures suggest the labor market remains resilient despite signs of slower job creation.

US PPI Surges in July, Signaling Hotter Inflation

Producer Price Index data for July surprised sharply to the upside:

- Headline PPI: +0.9% m/m (vs. +0.2% expected), +3.3% y/y (vs. +2.5% expected).

- PPI ex-food & energy: +0.9% m/m (vs. +0.2%), +3.7% y/y (vs. +2.9%).

- PPI ex-food, energy & trade: +0.6% m/m (vs. 0.0% last month), +2.8% y/y (vs. 2.5% prior).

Breakdown:

- Final demand services: +1.1% m/m (vs. -0.1% prior).

- Final demand goods: +0.7% m/m (vs. +0.3% prior).

- Final demand trade services: +2.0% m/m (vs. -0.3% prior).

The data suggest broader price pressures in both goods and services, complicating the case for aggressive Fed easing.

Pantheon Sees July Core PCE at 0.26% MoM, 2.9% YoY

Pantheon Macroeconomics now estimates July core PCE rose 0.26% m/m, up from their prior 0.23% forecast following CPI and PPI data releases.

That pace would lift the annual core PCE rate to 2.9% from 2.8% in June, reinforcing the view that disinflation progress has slowed slightly heading into late summer.

30-Year Mortgage Rate Falls to 6.58%, Lowest Since October 2024

Freddie Mac reports the average 30-year fixed mortgage rate dropped to 6.58% for the week ending August 14, down from 6.63% last week. This is the lowest level since October 24, 2024.

In 2025, rates have stayed in a relatively tight range — peaking at 7.04% in January and bottoming this week at 6.53%. The 10-year Treasury yield, often used as a benchmark, started the year at 4.809%, hit a low of 3.860% in April, and currently sits at 4.30%, near the midpoint of its yearly range.

While the 10-year yield has fallen roughly 50 basis points from its high, mortgage rates have declined about 46 basis points. Notably, April’s yield low did not trigger a matching drop in mortgage rates, suggesting other market forces kept borrowing costs elevated.

Fed’s Barkin: Business sentiment has picked up in some ways but not hiring

- Richmond Fed Pres. Barkin is speaking

- Businesses sentiment has picked up in some ways, but not yet on the hiring side.

- Businesses still do not seem to be planning layoffs.

- Credit card, other data providing a sense that July consumer data may be stronger.

- Manufacturers are all struggling with supply chains to account for tariffs.

- Consumers are ready to trade down, may make firms more cautious about passing along tariff costs.

- Unemployment rate has been remarkably stable with slowing growth in job gain matched by slowing growth in labor force.

- Businesses have been holding back on hiring, so may not have much to cut even if there is pressure on costs.

- If firms get to the point of needing to reduce costs, they may turn to AI as a way to save on labor.

- The slowdown in labor force growth is not yet translating into wage pressure.

Fed’s Musalem: Inflation Above Target, Tariff Impact Still Unfolding

St. Louis Fed President Alberto Musalem told CNBC inflation is running about 3% above the Fed’s 2% target and that tariffs are a contributing factor, though he expects their effects to fade in 6–9 months — with the possibility they could persist longer.

Musalem described the labor market as stable at 4.2% unemployment, though payroll growth has slowed and demand for labor has eased alongside supply constraints. With lower immigration, he expects job growth could dip below 50K per month.

He stressed a meeting-by-meeting approach to policy and said it is too early to commit to a specific September decision. He does not see current conditions justifying a 50 bp cut. While businesses report slower growth and potential margin pressure, he said layoffs are not widely discussed.

US Treasury Sec. Bessent: Does not know if Putin will agree to ceasefire

- Treasury Sec. Bessent speaking on Fox

- Does not know if there will be a cease fire agreement with Putin

- New arms agreements are possible. (Putin refered to this earlier today)

- Does not tell the Fed what to do

- Maybe the Fed starts with a 25 basis point cut and accelerates.

- The Fed could cut by 50 basis points

- Says there is room for a series of cuts

- On Fed chair job, need someone who is going to rationalize it

- Models on neutral rate suggest it is lower

Fed’s Daly Says Large September Cut Not Justified

Speaking to the Wall Street Journal, San Francisco Fed President Mary Daly said she does not see a case for a large rate cut next month:

“I’m worried it would send an urgency signal that I don’t feel about the strength of the labour market. I just don’t see the need to catch up.”

She favors a gradual shift toward a more neutral policy stance over the next year.

Powell’s Jackson Hole Speech Could Disappoint Either Way — Morgan Stanley

Fed Chair Jerome Powell’s August 22 Jackson Hole address will be watched closely for clues on a September rate cut.

Morgan Stanley expects Powell to:

- Keep the door open for a September cut.

- Signal that a 50bp move is unlikely.

They still forecast a 25bp cut next month but say any pushback would be aimed at curbing expectations for more aggressive easing. A lack of pushback, however, could spark a “sell the fact” reaction before the September meeting.

Trump Mulls BlackRock’s Rieder for Fed Chair — Big Rate Cut Advocate

Trump is considering BlackRock’s Rick Rieder as a possible Federal Reserve chair nominee. Rieder has said he supports a 50bp cut in September, arguing recent inflation data, while not ultra-soft, was better than feared.

He believes the Fed could justify such a move given long-term inflation expectations and recent productivity gains across industries.

JPMorgan: Tariffs Set to Weigh on GDP, Push Inflation Higher

JPMorgan warns that the latest U.S. tariffs could trim GDP by about 1% and lift inflation by 1–1.5%, representing the largest post-war tariff shock in U.S. history.

Chief U.S. economist Michael Feroli said the hit to GDP will likely come from weaker consumption — which makes up two-thirds of U.S. output — with most of the impact concentrated in the second half of the year.

Key points:

- Effective tariff rates have surged to ~18% from 3% at the year’s start.

- Companies are showing less willingness to absorb higher costs.

- Economists see core inflation gains of 0.3–0.5% per month, pushing the Fed’s preferred inflation gauge into the low-to-mid 3% range.

The Aug. 29 expiry of de minimis tariff exemptions on imports under $800 could further drive up retail prices.

Commodities News

Gold Drops as Hot PPI Data Weakens Case for Big Fed Cut

Gold prices fell 0.60% to $3,334 on Thursday after the U.S. Producer Price Index for July came in well above expectations, reviving inflation concerns and tempering hopes for a large Federal Reserve rate cut next month.

The PPI report showed both headline and core readings accelerating, with core prices approaching 4% year-over-year. The data reinforced views that inflation pressures remain sticky, even as the White House pushes for rate cuts and downplays tariff-related inflation risks.

Weekly jobless claims also beat expectations, suggesting the labor market remains firm despite recent signs of cooling. Traders have now largely priced out a 50 bp cut in September, leaning instead toward a 25 bp move, with a small chance of no change.

St. Louis Fed President Alberto Musalem reiterated that inflation is running near 3% and that tariffs are feeding into prices. Markets will now look to upcoming Fed speeches, July retail sales, and the University of Michigan’s August consumer sentiment report for further clues.

Crude Oil Futures Climb Back Above $63.90

U.S. crude oil futures settled at $63.96, up $1.31 or 2.09% on Thursday, regaining ground lost earlier this week. The rally brought prices back into a technical “swing area” between $63.61 and $65.27, where the 100-day moving average sits at $64.73.

The 100-day average remains an important short-term resistance point. Earlier in the week, crude fell below that level and held under it for three straight sessions. A sustained break above could trigger additional upside momentum if the recent bearish breakdown fails.

Crude Oil Pressured Ahead of Trump–Putin Meeting

Crude oil prices remain under pressure as traders focus on the Alaska summit between U.S. President Trump and Russian President Putin.

Market backdrop:

- Prices have trended lower since early August after a softer U.S. jobs report raised demand concerns.

- OPEC+ production increases and reduced fears over tougher U.S. sanctions on Russia have weighed further.

- Positive news from the summit could spark a “sell the fact” bottom and shift focus to Fed rate cuts, which would be supportive for demand.

Technical view:

- Daily: Trading below key 64.00 support (now resistance). Bears target 55.00; bulls need a break above 64.00 to aim for 72.00.

- 4H: Downtrend line caps price; sellers may enter at the trendline and resistance.

- 1H: Sellers watching for rejections at trendline; buyers looking for breakout opportunities.

Silver Retreats Below $38.30 as Dollar Recovers

Silver failed to break the $38.75 resistance level and slid to session lows below $38.30, turning negative on daily charts. The move coincided with a modest rebound in the U.S. Dollar Index, which remains near two-week lows.

Traders remain focused on whether the Fed will cut rates in September, with dovish expectations supported by earlier inflation data and remarks from Treasury Secretary Bessent hinting at potential policy easing.

Short term, silver shows a bearish divergence, raising the risk of a deeper pullback if buying momentum continues to fade.

Gold Holds in Range as Market Waits for Catalyst

Gold continues to trade sideways, with no clear breakout ahead of September’s key U.S. economic releases. The market remains focused on interest rate expectations — a hot September NFP could quickly change the outlook.

Fundamentals:

- U.S. CPI matched forecasts and was shrugged off by markets.

- Traders still expect a September Fed cut, with some pricing a small chance of 50bp — considered overly aggressive.

- Longer term, gold’s uptrend is supported by expected Fed easing and lower real yields, though short-term corrections are likely if rate-cut bets are repriced.

Technical view:

- Daily: Price is mid-range between 3,438 resistance and 3,245 support.

- 4H: Minor support near 3,330 where buyers stepped in; sellers eye a break lower to target 3,245.

- 1H: Uptrend line supports bullish bias; a break below could shift momentum to sellers.

Citi Sees Brent Oil Swinging from $60 to Above $90 on Geopolitics, Demand

Citibank analysts say Brent crude could drop to the low $60s/bbl if the U.S. and Russia make progress on a geopolitical deal — but could climb above $90 if demand strengthens or tensions persist.

Further declines below $60 would likely require a sharper slump in Chinese oil imports and refinery runs.

Oil Falls Below $66 on Bearish IEA, EIA Data — ING

Brent crude settled under $66/bbl for the first time since early June after bearish reports from the IEA and EIA.

IEA outlook:

- Large inventory builds expected late 2025 through 2026.

- Global demand seen rising by 680k b/d in 2025 and 700k b/d in 2026.

- Supply forecast raised due to unwinding OPEC+ cuts.

EIA weekly report:

- U.S. crude inventories up 3.04m barrels (vs. +1.5m API estimate).

- Gasoline stocks down 792k barrels; distillates up 714k barrels.

Markets are also eyeing Friday’s Trump–Putin meeting, which could ease sanctions — or worsen tensions if no ceasefire is reached.

Europe News

Eurozone Q2 GDP Second Estimate Confirms 0.1% Growth

Eurostat’s second estimate for Q2 2025 GDP leaves quarterly growth unchanged at +0.1% q/q, with annual growth steady at +1.4% y/y, matching the preliminary reading. This marks a slowdown from Q1’s +0.3% quarterly pace.

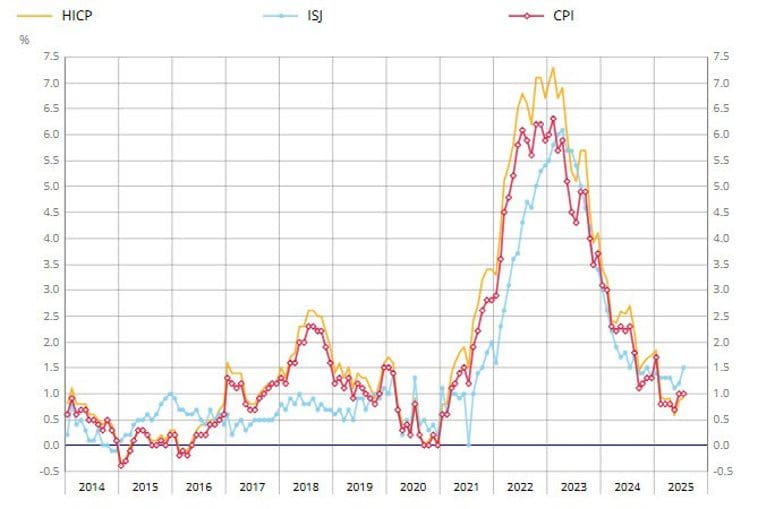

France Final July CPI Confirms 1.0% Annual Rise; Core Inflation Picks Up

Final July CPI data from INSEE shows prices up 1.0% y/y, in line with preliminary figures and unchanged from June. HICP also held at +0.9% y/y.

Core inflation rose to 1.5% y/y from 1.2% in June, still below the ECB’s 2% target but consistent with upward trends also seen in Spain and Germany.

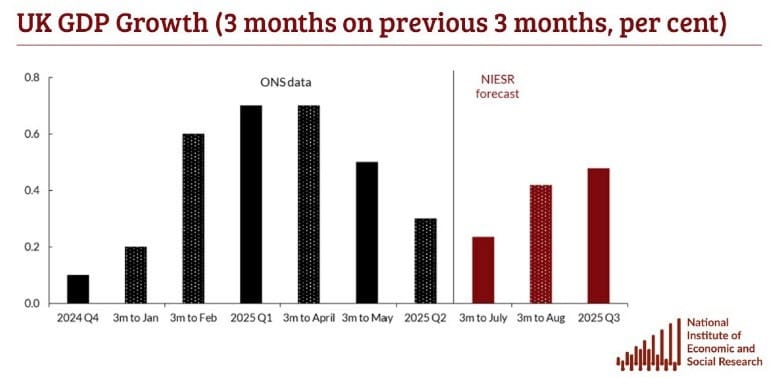

NIESR Projects UK Q3 Growth at 0.5% After Q2 Upside Surprise

Following stronger-than-expected Q2 GDP, the National Institute of Economic and Social Research forecasts UK GDP to grow 0.5% q/q in Q3. The institute credits robust services and construction activity, as well as fiscal support offsetting weak external demand.

They note that negative growth in April and May should mechanically boost Q3 figures. However, risks include potential fiscal tightening in the Autumn Budget and prolonged policy uncertainty, which could weigh on debt dynamics and slow growth.

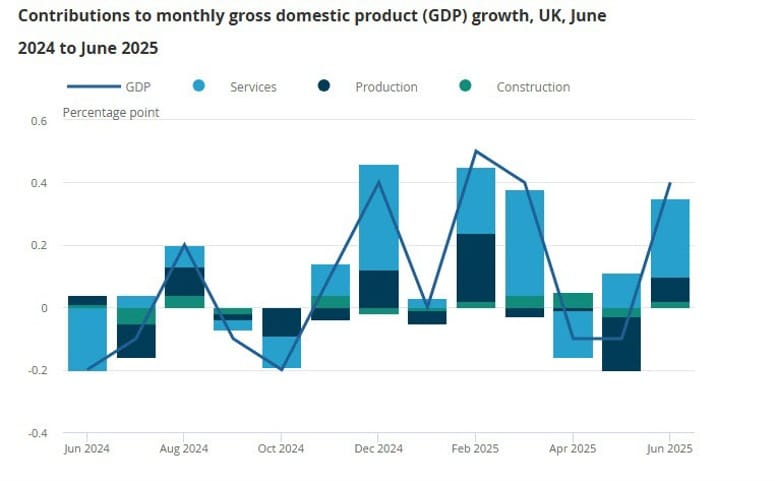

UK June GDP Up 0.4%, Driven by Services and Industrial Gains

June GDP rose 0.4% m/m, beating the 0.1% forecast and reversing May’s -0.1% decline.

Sector breakdown:

- Services output: +0.3% (vs. +0.2% expected; prior +0.1%).

- Industrial output: +0.7% (vs. +0.2% expected; prior revised to -1.3%).

- Manufacturing: +0.5% (in line with forecast; prior -1.0%).

- Construction: +0.3% (vs. 0.0% expected; prior revised to -0.5%).

Services contributed roughly +0.25pp to GDP, production added +0.08pp, and construction added +0.02pp. While the 0.4% monthly gain looks strong, it mostly reflects moderate sector improvements rather than a major acceleration — still, it adds resilience to the UK’s Q2 performance and supports BOE policy flexibility.

UK Q2 Preliminary GDP Beats Forecasts at 0.3%

Preliminary data from the ONS for Q2 2025 shows the UK economy expanded 0.3% q/q, above the 0.1% forecast but slower than the 0.7% growth seen in Q1. On a yearly basis, GDP rose 1.2%, beating the 1.0% projection but easing from 1.3% previously.

Growth in June across all major sectors helped offset a sluggish April and May. The report gives the Bank of England more flexibility in policy decisions, although a sharp 4% quarterly drop in business investment stands out as a negative element in the data.

UK Housing Market Loses Momentum on Tax, Rate Jitters — RICS

The RICS house price balance dropped to -13 in July from -7 in June, missing the consensus forecast of -5 and marking the weakest reading since July 2024.

RICS said price growth has slowed as the market faces:

- Concerns over possible tax hikes in Chancellor Rachel Reeves’ autumn budget.

- Uncertainty about the Bank of England’s next move after last week’s narrow rate cut vote.

Buyer demand and agreed sales both turned negative, while the near-term sales outlook was flat.

Rental market pressures are also growing, with new landlord instructions at their lowest since April 2020 — likely pushing rents higher as landlords brace for tighter tenant protections.

Swiss Producer and Import Prices Slip in July

July producer and import prices in Switzerland fell 0.2% m/m, matching neither forecasts nor the prior month’s -0.1%.

- Producer prices: -0.3% m/m.

- Import prices: +0.1% m/m.

On a yearly basis, combined producer and import prices were down 0.9%, driven mainly by a 2.8% drop in imports. Producer prices were flat y/y.

Macron: Trump Open to Ukraine Security Guarantees but Rules Out NATO Entry

French President Emmanuel Macron said Trump expressed willingness to offer Ukraine U.S. security guarantees as part of ceasefire efforts with Russia but made clear Ukraine would not join NATO.

NATO membership has been a major sticking point in peace talks. Macron cautioned that while discussions touched on multiple ideas, no concrete plan was set. He also noted the summer holiday atmosphere among European leaders, which dampens urgency. Macron’s remarks came from his summer residence in southern France.

Asia-Pacific & World News

China’s July Economic Data Preview Splits Analysts

China’s July economic numbers, due Friday, are dividing opinion among economists. Some see resilience, while others expect the slowdown in domestic demand to continue.

ANZ Research forecasts improvement across retail sales, industrial output, and fixed-asset investment, arguing that targeted policy measures and solid export performance should help stabilize activity.

Moody’s Analytics predicts a broad deceleration:

- Retail sales growth to slow to 4% y/y from 4.8% in June.

- Industrial production to ease to 6.5% from 6.8%.

- Fixed-asset investment growth to slip to 2.6% from 2.8%.

Moody’s points to weak confidence weighing on both investment and domestic demand.

These figures will come after weekend data showed the PPI down 3.6% y/y and consumer prices flat, highlighting ongoing deflationary pressure in parts of the economy. The July report will be closely scrutinized for signs that recent policy support is taking effect — or if more stimulus will be required to bolster second-half growth.

PBOC Expected to Move Slowly on Rate Cuts Despite Weak Credit Data

Citi economists say the People’s Bank of China is unlikely to rush into rate cuts, even after July saw new yuan loans fall by 50 billion yuan — the weakest monthly result ever recorded. Both short- and long-term household loans declined, but mortgage repayment issues are not viewed as a major problem.

The bank emphasized that financial support for the economy remains strong and that GDP growth should hold up, helped by robust July export figures. However, they warned that Beijing’s clampdown on excessive competition could dampen already soft corporate demand, with business borrowing also down last month.

China Plans “Anti-US” Summit After Trump–Putin Alaska Meeting

China will host the Shanghai Cooperation Organization (SCO) summit in Tianjin on August 31–September 1, about two weeks after U.S. President Donald Trump meets Russian President Vladimir Putin in Alaska.

The meeting — described by Nikkei as an “anti-U.S. summit” — is expected to cover:

- The war in Ukraine.

- Trade and political tensions stemming from new U.S. tariffs.

Leaders from over 20 nations, including Putin, are expected to attend.

PBOC sets USD/ CNY reference rate for today at 7.1337 (vs. estimate at 7.1743)

- PBOC CNY reference rate setting for the trading session ahead.

PBOC injected 128.7bn yuan via 7-day reverse repos at 1.40%

- 160.7bn yuan mature today

- net 32bn yuan drain

Australia’s July 2025 Jobs Report: Steady Unemployment, Strong Full-Time Gains

Australia’s July employment data showed the jobless rate at 4.2%, matching forecasts and down from 4.3% in June.

Key details:

- Employment change: +24.5K (vs. expected +25K; prior +2K).

- Full-time jobs: +60.5K — the best result in 17 months (prior -38.2K).

- Part-time jobs: -36K (prior +40.2K).

- Participation rate: 67.0% (vs. 67.1% expected; prior 67.0%).

- Underemployment rate: 5.9% (prior 6.0%).

- Underutilisation rate: 10.1% (prior 10.3%).

Japanese Firms Mostly Back US Tariff Deal, Many Plan Price Hikes

A Reuters survey shows 75% of Japanese companies view the July U.S.–Japan tariff agreement positively, after Washington reduced planned duties:

- General goods tariffs cut to 15% from a planned 25%.

- Auto tariffs reduced to 15% from 27.5%.

Still, the auto rate is well above the pre-Trump 2.5% level. While 38% of firms expect earnings to drop under the deal, 20% see gains.

Toyota cut its profit outlook by 16%, while Sony raised its by 4%. More than half of companies expect to raise prices further, though many warn higher costs are already hurting demand.

US Treasury Secretary Slams Bank of Japan for Lagging on Rate Hikes

US Treasury Secretary Scott Bessent openly criticized the Bank of Japan’s approach to inflation during a Wednesday interview with Bloomberg TV, saying the central bank is “behind the curve” and should move to raise interest rates to better control price pressures. Bessent said he has discussed the matter directly with BOJ Governor Kazuo Ueda.

Japan continues to hold one of the lowest policy rates among major economies, even though its key inflation metric has stayed at or above the 2% target for more than three years. Last month, Ueda kept a dovish stance and offered no timeline for tightening.

Bloomberg commentary:

- Hideo Kumano from Dai-Ichi Life Research Institute noted that such rare, public remarks on another country’s monetary policy might be a way to push down the U.S. dollar — and could complicate the BOJ’s decision-making.

- Marito Ueda of SBI Liquidity Market said the pressure from Washington increases the likelihood of a rate hike in Japan before year-end, possibly in October or December.

Crypto Market Pulse

US Treasury Secretary Bessent: No Crypto Purchases for Reserves

Treasury Secretary Scott Bessent said the U.S. will not purchase cryptocurrency for reserves, instead using confiscated assets where applicable.

The remarks put mild pressure on Bitcoin as traders scaled back expectations for official demand. However, analysts note crypto markets remain largely tied to the credit cycle, much like equities, making the policy impact modest.

Pi Network Targets Channel Breakout Amid Rising Altseason Hopes

Pi Network’s PI token is trading at $0.40, consolidating within a falling channel pattern but holding above recent lows. Bulls are looking for a breakout as selling pressure eases.

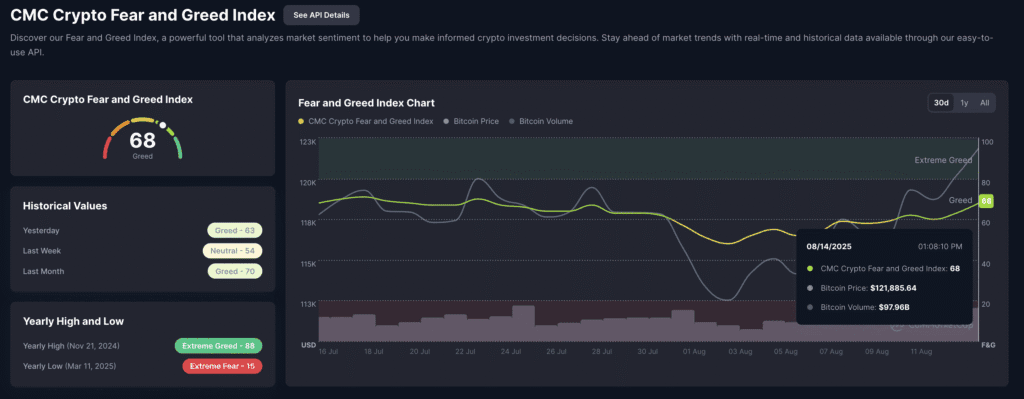

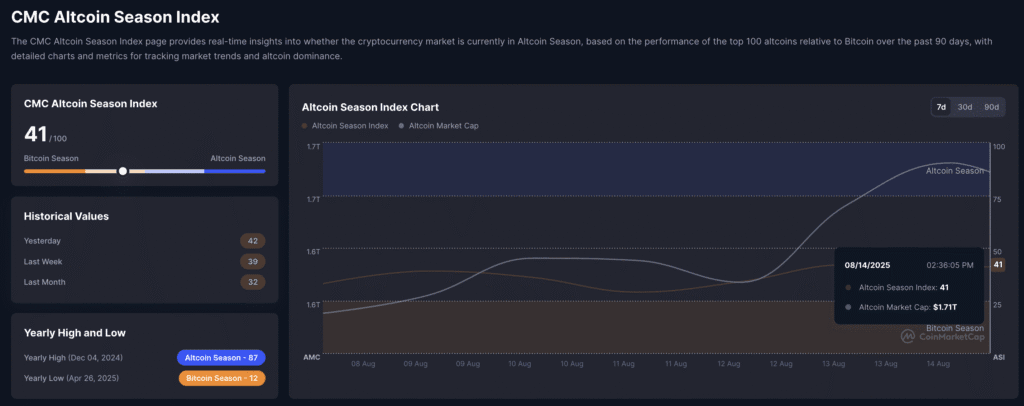

Crypto market sentiment is risk-on, with total market cap at a record $4.15T. CoinMarketCap’s Fear & Greed Index is at 68 (up from 63), and the Altcoin Season Index has risen to 41 from 39 last week, signaling rising chances of an altseason.

If capital rotates from Bitcoin into smaller-cap altcoins, PI could benefit from increased inflows in the next bullish phase.

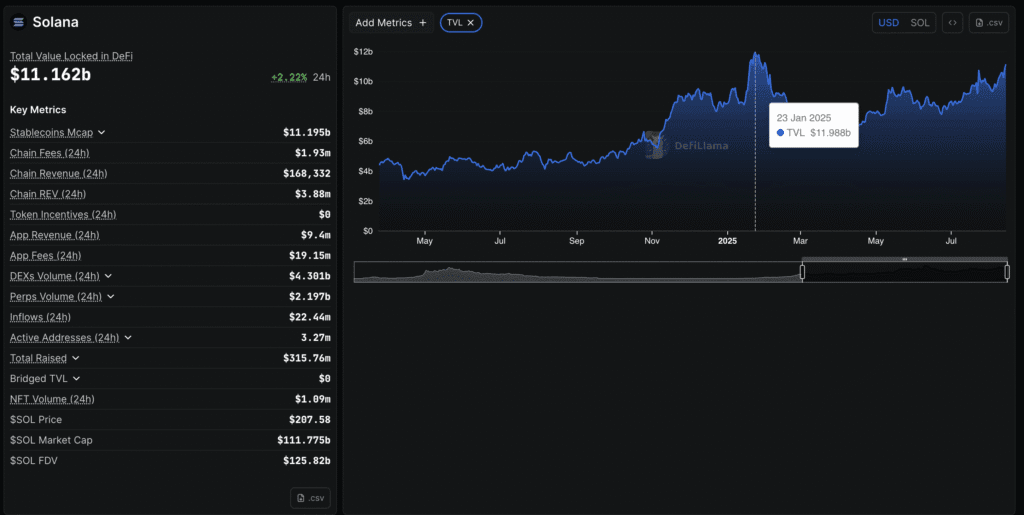

Solana Breaks $200 as Open Interest and TVL Hit Records

Solana (SOL) surged past the $200 mark, logging its third straight day of gains and the highest price since February 4. Open Interest in SOL derivatives hit a record $12.55B.

Drivers include:

- Partnership between Squads and Coinbase to boost USDC adoption on Solana.

- Bullish’s IPO announcement that it will migrate infrastructure to Solana-native stablecoins.

TVL: Total Value Locked rose to $11.162B from $10.920B a day earlier, nearing the record $11.988B. Circle minted 750M USDC in the past 24 hours, increasing network liquidity.

ARK Invest Buys $172M in Bullish IPO Shares

Cathie Wood’s ARK Invest bought 2.53 million shares of crypto exchange Bullish in its IPO debut across three ETFs:

- ARKK: 1,714,522 shares.

- ARKW: 545,416 shares.

- ARKF: 272,755 shares.

At Wednesday’s $68 close, the stake was worth about $172 million.

Bullish’s IPO priced at $37, raising $1.1 billion, and the stock jumped 83.8% on day one, briefly hitting $118 before closing with a $10B+ market cap.

Bullish Stock Surges 83% on NYSE Debut

Bullish (BLSH) opened at $90 on the NYSE, rose to $118, and closed at $68 — up 83% from its $37 IPO price. The offering raised $1.1 billion, giving the exchange a $9.9 billion market cap at the close.

The crypto exchange, backed by Peter Thiel, offers spot, margin, and derivatives trading for institutions and has processed $1.25T in trades since 2021. Co-founded by Block.one CEO Brendan Blumer, Bullish previously abandoned a 2021 SPAC plan due to regulatory headwinds.

Shares gained another 11% in after-hours trading to $75.

Bitcoin Hits Record Above $123K, Up Over 30% YTD

Bitcoin has surged to a fresh all-time high above US$123,000, gaining just over 30% year-to-date. Ethereum is also climbing, trading above US$4,700.

While there is no new direct catalyst, expectations of U.S. Federal Reserve rate cuts are fueling broad gains against the dollar.

The Day’s Takeaway

North America

US Stocks Hold Steady, S&P Extends Record Streak

U.S. equities ended little changed, with all three major indices closing within 0.03% of Wednesday’s levels. The S&P 500 added 0.03% to 6,468.54, marking a fresh record close. The Dow slipped 0.02% to 44,911.26, while the Nasdaq dipped 0.01% to 21,710.67. Small-caps underperformed, with the Russell 2000 dropping 1.24%.

Intel surged 7.3% after reports the Trump administration is considering taking a government stake in the company. Netflix gained 2.17%, erasing the prior day’s losses, while Amazon climbed 2.86%. Nvidia (+0.24%), AMD (-1.88%), and Broadcom (+0.69%) saw mixed moves.

Mortgage Rates Ease to Lowest Since October 2024

The average 30-year fixed-rate mortgage fell to 6.58% from 6.63% a week earlier, the lowest since October 24, 2024. Rates have traded in a narrow 2025 range, peaking at 7.04% in January. The 10-year Treasury yield is currently 4.30%, down about 50 bps from its January high but near the midpoint of this year’s range.

Fed’s Musalem Cautious on Rate Path

St. Louis Fed President Alberto Musalem said inflation is running close to 3%, partly due to tariffs, which could fade in 6–9 months but might persist longer. He described the labor market as stable but slowing, with sub-50K monthly payroll gains possible if immigration remains low. Musalem sees risks of more persistent inflation but does not support a 50 bp cut without further data.

US Jobless Claims Slightly Better Than Forecast

Initial claims came in at 224K vs. 228K expected, with continuing claims at 1.953M, below the 1.964M forecast.

Pantheon Macroeconomics Lifts Core PCE Forecast

Based on CPI and PPI inputs, Pantheon now sees July core PCE up 0.26% MoM (vs. 0.23% prior estimate), lifting the YoY rate to 2.9% from 2.8%.

US Producer Prices Surge

July PPI jumped 0.9% MoM vs. 0.2% expected, with core PPI also up 0.9%. Headline YoY rose to 3.3% from 2.4%, while core YoY climbed to 3.7% from 2.6%. Both goods and services prices accelerated sharply, led by a 2.0% rise in trade services.

Commodities

Crude Oil Futures Rebound

WTI crude settled at $63.96, up $1.31 or 2.09%, climbing back into a technical swing zone between $63.61 and $65.27. The 100-day moving average at $64.73 remains a key resistance level.

Gold Drops as Hot PPI Data Cuts Big Fed Cut Bets

Gold fell 0.60% to $3,334 after stronger-than-expected U.S. PPI data dampened expectations for a 50 bp Fed cut. Traders now largely expect a 25 bp move in September, with a small chance of no change.

Silver Retreats on Dollar Strength

Silver reversed from highs near $38.75, falling below $38.30 amid a modest U.S. dollar recovery. Bearish divergence patterns suggest potential for a deeper pullback.

Crypto

US Treasury Says No Plans to Buy Crypto for Reserves

Treasury Secretary Scott Bessent said the U.S. will not purchase cryptocurrencies for reserves, instead using confiscated assets when needed. The remarks weighed slightly on Bitcoin, though analysts noted crypto markets are more tied to the credit cycle, making the move less significant.