Introduction

The Global Economic Outlook is at a pivotal moment, with a complex mix of market movers, central bank decisions, and geopolitical risks set to shape investor sentiment. Global markets are preparing for influential data releases, policy shifts, and political developments that could redefine growth trajectories in major economies. From critical inflation data in the US and Europe to monetary policy signals in Australia and Norway, as well as high-stakes trade and diplomacy, the week ahead offers an unusually concentrated lineup of catalysts.

Inflation Data and Central Bank Signals

US Consumer Price Index (CPI)

The July CPI report is one of the most anticipated events in the Global Economic Outlook. Analysts expect headline inflation to ease slightly to 2.8% year-over-year, with core inflation stubborn at 3.0%.

- Market Impact: A softer CPI could strengthen expectations for a September Federal Reserve rate cut, while a surprise upside could keep policymakers cautious.

- Underlying Pressure: Higher tariffs are gradually filtering into consumer prices, but the full effect will emerge over coming months.

Reserve Bank of Australia (RBA) Rate Decision

With inflation easing and unemployment ticking up to 4.3%, markets are pricing in a near-certain 25 basis point cut to 3.60%. Governor Bullock’s forward guidance will be closely scrutinized for signs of further easing.

Norges Bank Policy Stance

Following a surprise rate cut earlier this year, Norway’s central bank faces renewed pressure as disinflation continues. Markets expect rates to hold at 4.25% but with dovish hints about future cuts.

Labor Market Updates and Growth Indicators

UK Employment Trends

The UK’s labor market remains a balancing act for policymakers: wage growth remains high at 5%, while unemployment has stabilized at 4.7%.

- Implication for BoE: Persistent wage growth could delay rate cuts, though economic softness may push easing into 2026.

Australian Jobs Report

Job creation slowed sharply last month, reinforcing the case for the RBA’s dovish stance. A rebound could temper market expectations for aggressive cuts.

UK GDP Data

June’s GDP is forecast to return to modest growth of 0.1% after contraction, with Q2 growth projected at 0.1% quarter-on-quarter. Signs of resilience could lift sentiment, while weakness may pressure fiscal plans.

Eurozone Inflation Landscape

German Final CPI

Germany’s final July inflation print will confirm whether price pressures are cooling enough to keep the European Central Bank on a dovish path. Preliminary data suggests continued disinflation.

Spanish Final CPI

Spain’s numbers will provide additional clarity for the Eurozone’s inflation trajectory, particularly given its earlier-than-expected slowdown in price growth.

Key Consumer and Producer Trends

US Producer Price Index (PPI)

As a leading indicator of CPI, the PPI will be crucial in shaping expectations for consumer price trends. A rise here could undermine hopes for rapid disinflation.

US Retail Sales

With consumer spending still a primary driver of US growth, July’s retail sales data will be watched for signs of resilience or fatigue. Analysts expect a modest 0.5% monthly increase.

Asia-Pacific Growth and Trade

Japanese GDP

Preliminary Q2 GDP is projected to contract by 0.7% year-on-year, as weak exports and inventory declines weigh on activity. The Bank of Japan is expected to maintain rates at 0.50%.

Chinese Economic Indicators

- Industrial Production: Expected to slow slightly to ~6.2% year-on-year.

- Retail Sales: Forecast growth of 4.6%, boosted by targeted stimulus.

- Fixed Asset Investment: Set to expand at ~2.8% year-to-date.

The outcome of US-China trade negotiations will heavily influence market reaction to these figures.

Geopolitical Risks and Diplomatic Shifts

US-China Tariff Truce

The tariff truce deadline is a critical focal point in the Global Economic Outlook. While both sides appear willing to extend the agreement by 90 days, any breakdown could lead to tariff escalations exceeding 100%.

Potential Trump-Putin Summit

A possible meeting between the US and Russian leaders could influence markets, depending on progress in Ukraine discussions. Outcomes range from easing tensions to renewed sanctions.

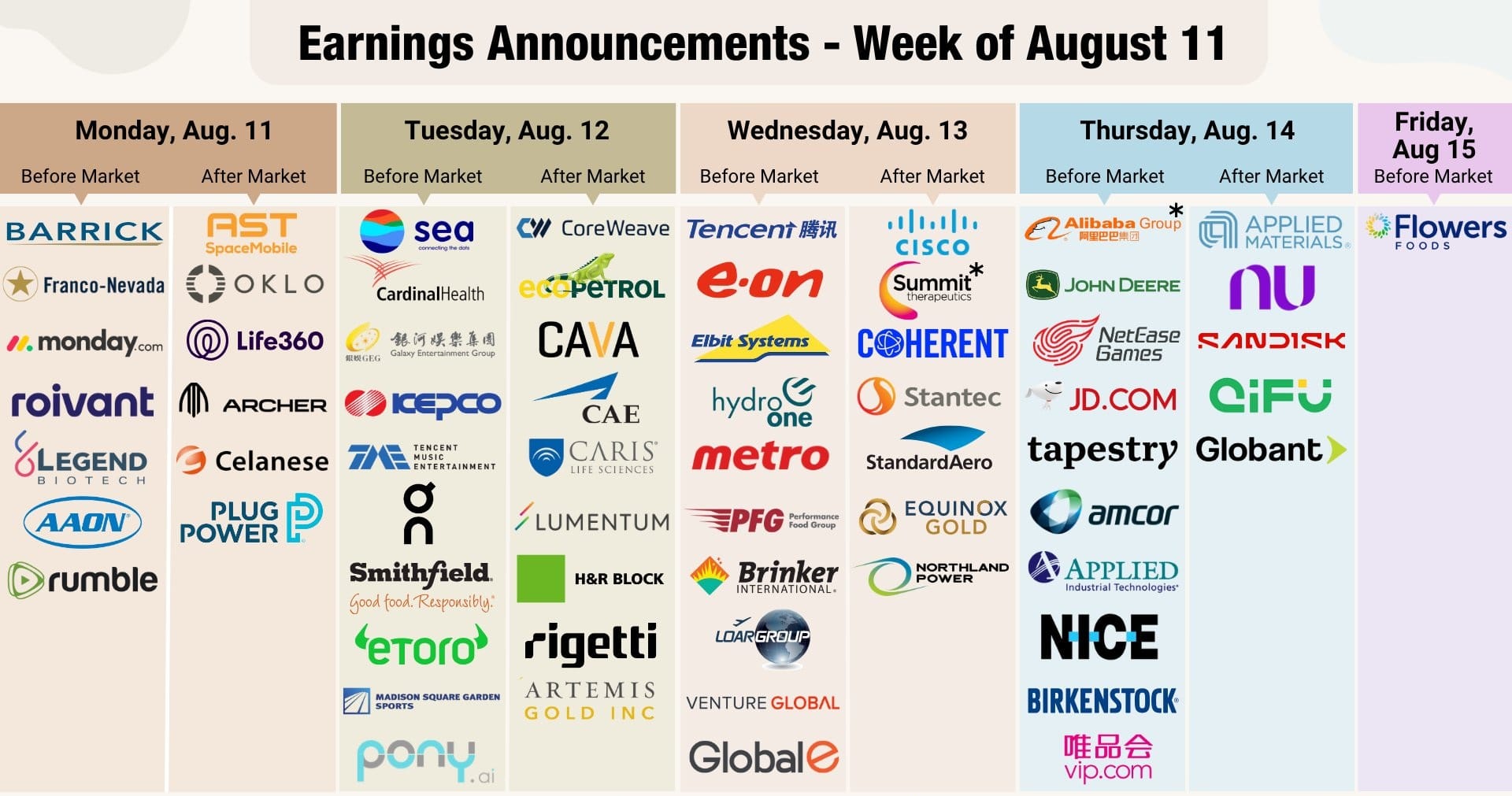

Corporate Earnings Spotlight

Several high-profile companies are due to release earnings, including:

- Oklo (OKLO): Expected to post strong results on investor optimism.

- AMC Entertainment (AMC): Likely to benefit from a strong box office season.

- Cisco Systems (CSCO): Anticipated to beat forecasts on AI and cloud demand.

Strategic Takeaways for Investors

- Watch Inflation Trends: US CPI and PPI will dictate central bank policy paths.

- Follow Central Bank Decisions: RBA and Norges Bank moves will signal broader monetary easing trends.

- Track Trade Negotiations: The US-China truce outcome could shift risk appetite sharply.

- Monitor Geopolitics: Developments in US-Russia and US-China relations carry significant market implications.

Conclusion

The Global Economic Outlook remains in flux, with market movers, central bank decisions, inflation data, and geopolitical risks converging to create a potentially volatile environment. Traders, investors, and policymakers alike must stay agile, aligning strategies with evolving macroeconomic signals.