North America News

Nasdaq and S&P 500 Close at Record Highs; Russell 2000 Posts Biggest Gain Since May

US equities rallied sharply on Tuesday, with all major indices gaining over 1.1%. The Russell 2000 surged 2.99%, its strongest one-day advance since May 12, when it climbed 3.41%. Both the S&P 500 and Nasdaq ended at record highs, closing near session peaks.

Closing levels:

- Dow Jones Industrial Average: +483.52 pts (+1.10%) at 44,458.61

- S&P 500: +72.31 pts (+1.13%) at 6,445.76

- Nasdaq Composite: +296.50 pts (+1.39%) at 21,681.90

- Russell 2000: +66.26 pts (+2.99%) at 2,282.77

The July CPI data matched expectations, reinforcing market confidence in the likelihood of a September Fed rate cut. Futures now price in around 60 basis points of cuts before year-end.

Sector highlight – Airlines: Airline stocks soared after July airfare data showed a 4% increase—the first monthly rise in six months—suggesting improved pricing power as carriers reduce capacity to match demand.

- American Airlines: +12.22%

- United Airlines: +10.19%

- Delta Air Lines: +9.23%

- Southwest Airlines: +5.73%

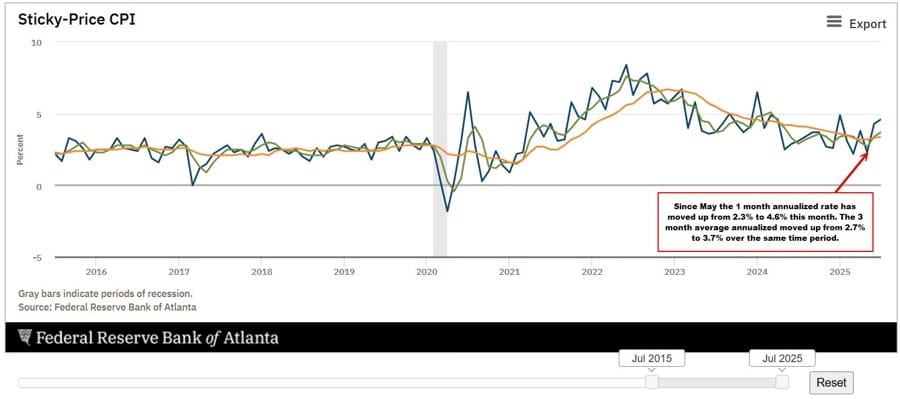

Atlanta Fed Sticky Price Index Rises to 4.6% in July

The Atlanta Fed Sticky Price CPI, which tracks prices that change infrequently, rose to 4.6% annualized in July from 4.3% in June.

- YoY Sticky CPI: 3.4%

- Core Sticky CPI (ex-food & energy): 4.8% annualized; 3.4% YoY

The Flexible Price CPI—covering goods that change prices frequently—fell 3.8% annualized in July, up just 0.8% YoY.

Economists use the Sticky CPI to gauge persistent inflation pressures, with July’s uptick signaling modest but ongoing upward pressure on long-term prices.

US Budget Deficit Widens to $291B in July

The US federal budget deficit for July came in at -$291.0 billion, well above the -$215.0 billion consensus.

- Outlays: $630B (record high for July) vs $574B last year

- Receipts: $338B vs $330B last year

For fiscal 2025 to date, the deficit totals $1.629 trillion, compared to $1.517 trillion for the same period in fiscal 2024. July marks a sharp swing from June’s surprise $27B surplus. Both year-to-date receipts and outlays are at record highs.

US July CPI in Line With Forecasts; Goods Lag Services

US consumer prices rose 0.2% in July, matching expectations, with core CPI up 0.3% as forecast. Unrounded, the gains were 0.197% headline and 0.322% core.

Year-over-year, headline CPI came in at 2.7% (vs. 2.8% expected) while core hit 3.1% (vs. 3.0% forecast). Real weekly earnings rose 0.4% after a revised -0.3% in June. The three-month annualized pace stands at 2.3%. Shelter costs increased 0.2% on the month, 3.7% year-over-year.

Inflation mix:

- Goods ex-food & energy: +0.2% m/m

- Services ex-energy: +0.4% m/m

Notable gainers: coffee (+2.3%), furniture/bedding (+0.9%), used cars/trucks (+0.5%), motor vehicle parts (+0.9%), tools/hardware/outdoor (+1.6%).

Weaker categories: motor fuel (-2.0%), appliances (-0.9%), fresh fruits (-1.4%), IT commodities (-1.4%), apparel (+0.1%).

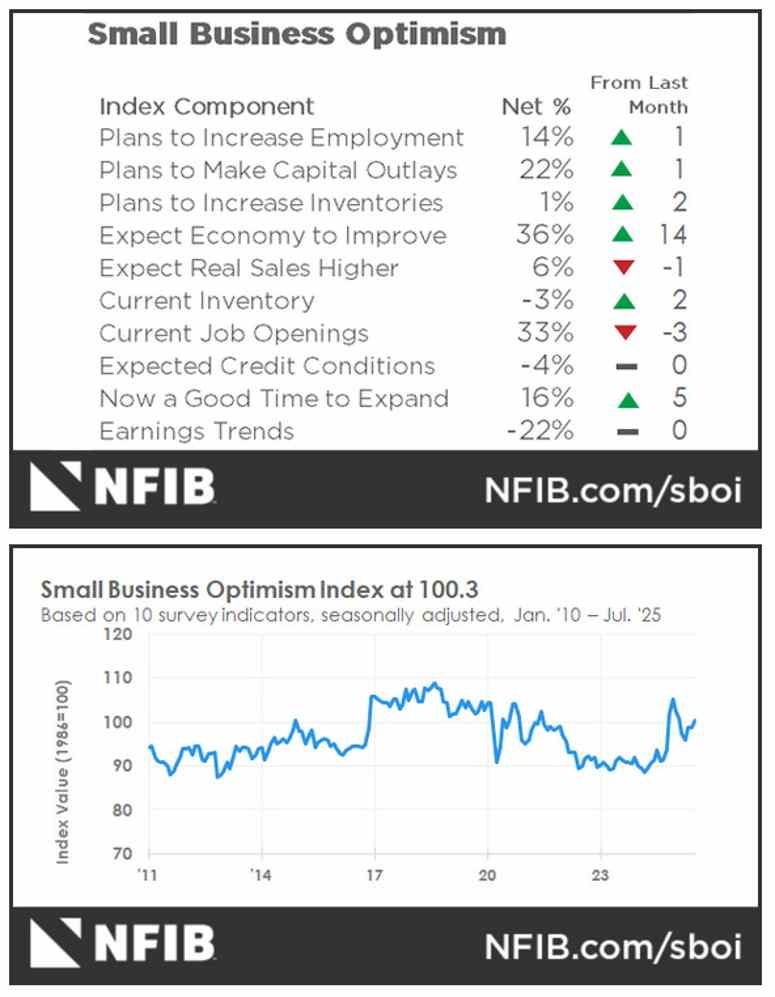

US Small Business Optimism Index Jumps to 100.3 in July

The NFIB’s small business optimism index rose to 100.3 in July, beating expectations of 98.6. The improvement was driven by better views on business conditions and expansion opportunities.

However, the uncertainty index climbed eight points to 97. Labor quality was cited as the most pressing issue by 21% of owners, up from 16% in June.

NFIB Chief Economist Bill Dunkelberg noted optimism about policy clarity in the coming months, especially after Congress moved to make the 20% Small Business Deduction permanent.

Gold Holds $3,340 Support; Awaiting CPI Data for Next Move

Gold prices reversed from $3,400 but found strong support between $3,335–$3,345, a zone that coincides with the 50% Fibonacci retracement of the early August rally and where price was contained on August 4–5.

The metal is consolidating in a sideways range during Tuesday’s European session as the US Dollar Index steadies ahead of the US CPI release later today. The market remains cautious, limiting both downside momentum and upside breakouts.

Technical outlook:

- Gold confirmed a trend shift Monday after breaking below the ending wedge support at $3,390.

- Price hit the wedge’s measured target at $3,345 and is now consolidating.

- A decisive drop below $3,335 would target the July 29 low and July 31 highs ($3,305–$3,315) before the August 1 low at $3,282.

- On the upside, initial resistance sits at the August 8 low ($3,380), followed by the $3,400–$3,410 area where August 7 and 10 highs align with a reverse trendline. A breakout above $3,410 would invalidate the bearish bias and open the way toward the late July high at $3,440.

Fed’s Schmid Signals Hawkish Tilt, Prefers Holding Rates

Kansas City Fed President Jeff Schmid said the current policy stance—“modestly restrictive”—is appropriate for now, advocating a patient approach to rate changes.

- Inflation remains too high; tariffs’ muted impact supports holding rates.

- Policy rate seen “near neutral,” but Schmid favors keeping it tight until demand weakness is clear.

- Willing to adjust if economic growth slows sharply.

Schmid, a 2025 voting member, joins Musalem in leaning toward holding rates, while Bowman and Waller favor cuts. Markets still price in a 90% chance of a September cut.

White House Pressures Japan to Boost Defense Spending

According to Nikkei, the US is urging Japan to raise its defense spending above 3.5% of GDP as part of the Trump administration’s Buy America Defense push.

Japanese officials say such an increase would be politically difficult given the government’s minority status. The pressure highlights Washington’s broader push for allies to take on greater security responsibilities in the Asia-Pacific.

New BLS head Antoni suggests suspending monthly jobs report

- Speaking on FOX Business:

- Suggests suspending monthly jobs report

- Argues that it’s underlying methodology, economic modeling and assumptions are fundamentally flawed.

- Says, “How are businesses supposed to plan for the Fed conduct of monetary policy”

- Says that “no one knows how many jobs are being added or lost economy”

- Says that until the problems are corrected, the BLS should suspend issuing the monthly jobs report but key publishing the more accurate though last timely quarterly data.

Pantheon: CPI Points to 0.23% Core PCE Rise

Pantheon Macroeconomics estimates the July CPI data aligns with a 0.23% increase in core PCE, to be confirmed later this month. That’s still above the Fed’s 2% target (≈2.76% annualized) but not hot enough, they argue, to derail September rate-cut expectations.

They note that tomorrow’s PPI release will further refine that projection. The Wall Street Journal echoed that the print wasn’t “no inflation,” but also wasn’t strong enough to stop the Fed from easing next month.

Fed’s Barkin: May well see pressure on inflation and unemployment

- Says that balance between inflation and unemployment is unclear

- May still see pressure on inflation and unemployment, with the balance between the two unclear.

- Fed policy is well positioned to adjust as visibility about the economy lifts.

- For the economy to falter, consumer spending would have to pull back more significantly.

- Though spending has softened, it’s hard to envision a serious pullback given low unemployment and ongoing wage gains.

- Shifts in consumer spending may be helping dampen the impact of tariffs on inflation.

- Employment could take a hit if consumers pull back, but large layoffs are hoped to be avoided.

- Any increase in the unemployment rate may be less than expected due to decreased immigration and lower labor supply growth.

Fed nominee Miran on CNBC: Pleased the BLS number is well behaved

- “No evidence of tariff inflation”

- Pleased the BLS number is well behaved

- there is no evidence of tariff inflation

- There will always be an outlier in the data

- Thus far there is no evidence of tariff inflation. Only see relative price changes.

- US cars and airfares were some of the big contributors and they aren’t impacted from tariffs

- How much of the inflation is from illegal immigrants. Suggested the contributions from illegal immigrants to increases in rents

- Possibility of disinflation in services as policy tackles immigration.

- We generally don’t get revised data from the CPI.

- We can think about incentive schemes to increase response rates.

- When asked if he expected to be on the Fed Board by September, said that it is up to the Senate on the timing.

- I cannot comment on current Fed policy at the moment.

- The more Inflexible party bears the burden of the tariffs/taxes. There can be a shift to other goods, and other producers

- Confident that the tariffs will be borne by the countries that are being tariffed

Fed’s Bullard: Would be happy to proceed regarding the Fed Chair role

- Bullard speaking on CNBC

- Would be happy to proceed regarding the Fed chair role. Spoke with Treasury Secretary Bessent last week.

- Says he would accept Fed chair job if a for low and stable inflation, respect independence of the Fed

- He would work within the structure the Fed reserve act.

- I don’t think tariffs don’t really cause inflation. They are a one-time increase in price level.

- Rates are ready to come down.

- Sees the Fed cutting in September and probably again later in the year

- Probably get 100 basis points by this point next year.

- Anyone on the list would want to be set up for success versus failure, and insist on Fed independence.

- Expects that the tariffs will cause a growth slow down

- Global taxes all slow down global economy.

- Don’t think slow growth will be a continuum into next year.

- Less regulation, more of a pro-business, the AI boom going on would keep growth going into next year

Bank of America: September Fed Rate Cut Would Be Premature

Bank of America says the Federal Reserve should hold off on cutting interest rates in September, warning that inflation remains above target and may prove more persistent following the latest tariff increases.

The bank argues that some policymakers are underestimating the inflationary impact of labor supply disruptions. It also sees the risk of “bad cuts” — easing prompted by labor market weakness rather than clear progress on inflation. BofA still does not expect rate cuts this year.

Goldman Sachs Sees Consumer Tariff Costs Jumping Another 70%

Goldman Sachs estimates consumer costs from tariffs will rise another 70% by autumn, based on early data through June 2025.

They calculate that foreign exporters have absorbed 14% of US tariffs so far, US companies 64%, and consumers 22%, with domestic producers in protected sectors also raising prices. JPMorgan also notes that tariff impacts are beginning to appear, with goods prices climbing and consumption weakening.

JPMorgan Warns of Emerging Stagflation Risks in the US

JPMorgan is cautioning that the US economy could drift into a “somewhat stagflationary” phase in the latter half of the year. Early signs point to tariff-related price increases coinciding with slower consumer demand and a cooling labor market.

In a Monday note, strategist Mislav Matejka said goods prices are already moving higher as tariffs take effect, while consumption is easing and payroll growth has dipped below what he calls “stall speed.” The combination suggests a softer jobs backdrop, which has prompted markets to largely expect the Federal Reserve to cut interest rates in September.

Trump’s Pick for BLS Chief Raises Concerns Over Bias and Credentials

President Trump has nominated EJ Antoni, chief economist at the Heritage Foundation, to lead the Bureau of Labor Statistics after removing the prior commissioner over revisions to jobs data.

Critics point to Antoni’s reputation as strongly partisan and note that his background is in economics rather than statistics — a potential concern for an agency that relies heavily on statistical expertise. Market watchers are wary about possible impacts on the perceived accuracy and trustworthiness of key BLS data, including employment and inflation reports.

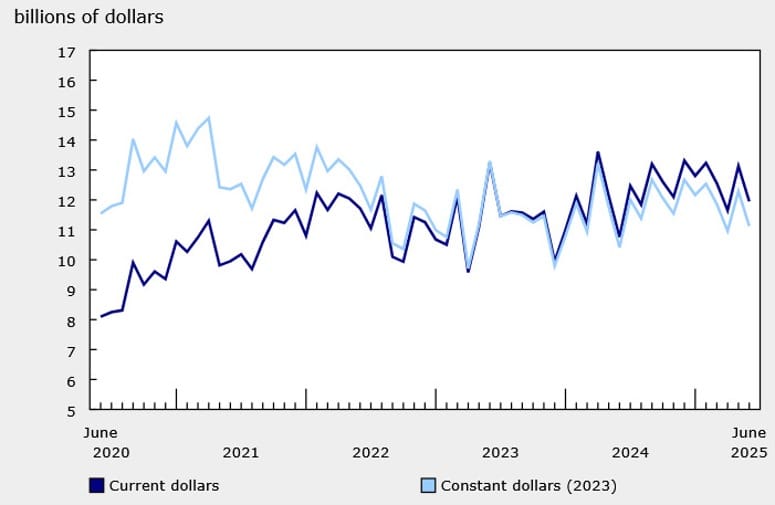

Canada June Building Permits Slip 0.9% vs -3.4% Forecast

Canadian building permits fell 0.9% in June, a softer decline than the -3.4% expected. May’s figure was revised up to a 12.8% gain from the initial 12.0%.

The data suggests some cooling in construction approvals after May’s surge, though the drop was smaller than markets anticipated.

Commodities News

WTI Crude Oil Futures Drop to $63.17, Sellers in Control

WTI crude oil futures settled at $63.17, down $0.79 (-1.24%) on Tuesday. Prices hit a low of $63.06 and a high of $64.34 during the session.

On the hourly chart, WTI is moving away from its 100-hour moving average at $64.82 and has dipped below the lower bound of the $63.61–$65.27 swing area. Buyers would need a recovery above $65.27 and the 100-hour MA to regain momentum. Without that, sellers remain firmly in control, with downside targets near $60.00 (May lows) and further toward $55.15 (April–May lows).

OPEC Holds 2025 Oil Demand Growth Forecast Steady at 1.29M bpd

OPEC’s latest monthly report keeps its 2025 global oil demand growth projection unchanged at 1.29 million barrels per day. For 2026, the group now expects a stronger increase of 1.38 million bpd.

On the supply side, OPEC trimmed its 2026 non-OPEC+ production growth estimate to 630,000 bpd, down from 730,000 bpd, and sees US tight oil output slipping by 100,000 bpd next year.

July crude output averaged 41.94 million bpd — up 335,000 bpd from June — after the latest OPEC+ production hike. While these forecasts rarely move markets in real time, traders still track them for forward balance cues. In practice, actual demand expectations often shift first in response to macro data and monetary policy moves.

OCBC Says Gold Tariff Confusion Has Eased

President Trump said on Truth Social that gold imports will not face tariffs, helping clear up earlier media reports suggesting 1-kg and 100-oz gold bars from Switzerland would be taxed at 39%.

OCBC analysts noted that this clarification cooled mild bullish momentum in gold prices. The metal was last trading near $3,351, with support seen at $3,340–$3,350 and stronger support at $3,290. Resistance is at $3,450 and $3,500, the 2025 peak.

Oil Prices Slide Ahead of Trump–Putin Meeting

Oil prices fell to their lowest in two months last week, with Brent down 7% and WTI 7.5% from the start of August. Commerzbank analyst Carsten Fritsch cited rising supply from OPEC+ and demand worries tied to weak data from the US and China.

The upcoming Trump–Putin meeting has raised hopes for a Ukraine ceasefire and possible sanctions relief, lowering the risk of new penalties on Russian oil buyers. If a breakthrough occurs, prices could drop further; if not, sanctions could tighten, but the price rise might be smaller than the potential drop.

Gold Edges Lower Ahead of CPI as Traders Hedge Bets

Gold prices slipped on Monday alongside a stronger US dollar, with moves suggesting pre-CPI hedging rather than a fundamental shift. The inflation print, followed by Federal Reserve commentary, will be key ahead of the Jackson Hole Symposium, where Chair Powell could hint at a September rate cut.

A softer CPI reading could reinforce dovish bets and boost the chance of a third cut this year; a hotter reading might trigger a hawkish shift, pressuring gold in the short term. Longer term, the metal remains supported by expectations for falling real yields.

Daily chart: Gold has been trending toward the $3,438 resistance but pulled back, leaving the market rangebound. Sellers may see better entries near resistance; buyers near $3,245 support.

4H chart: Momentum faded near the $3,340 zone — a possible buy level for those targeting $3,438. A break lower could extend declines toward $3,245.

ING: Gold Futures Surge on Tariff Confusion, Then Ease

Gold futures in New York jumped Friday after reports that 1-kilo bullion bars might be subject to US tariffs, contradicting market assumptions. These bars — the most traded on Comex — make up most of Switzerland’s gold exports to the US.

The news widened the premium of New York futures over London spot prices to the largest since the pandemic. Contracts for December delivery rose over $100 above global benchmarks before easing on reports that the White House will clarify the issue, with expectations now leaning toward gold bar imports remaining tariff-free.

Europe News

European Stocks Mostly Higher; Italy and France Lead

Major European equity indices closed mostly higher on Tuesday, led by gains in Italy and France.

- Italy’s FTSE MIB: +0.85%

- France’s CAC 40: +0.71%

- UK FTSE 100: +0.20%

- Spain’s IBEX: +0.02%

- Germany’s DAX: -0.23% (only decliner)

Germany’s ZEW Current Conditions Sink Further in August

Germany’s August ZEW survey showed the current conditions index dropping to -68.6 (vs. -65.0 expected) from -59.5 prior. The expectations index fell sharply to 34.7 (vs. 39.8 expected) from 52.7.

ZEW said sentiment weakened mainly due to disappointment over the US–EU trade agreement, with the outlook particularly souring for the chemical and pharmaceutical sectors.

UK Unemployment Holds at 4.7% in June, Wage Growth Slows

UK labor market data for June showed the ILO unemployment rate steady at 4.7%, matching forecasts. Employment rose by 239,000, beating expectations for a 185,000 gain, while average weekly earnings grew 4.6% year-on-year (vs. 4.7% expected) and regular pay rose 5.0%, in line with forecasts.

July payrolls fell by 8,000, following a revised 26,000 drop in June. Real wages eased to +0.5% for total pay and +0.9% for regular pay, the lowest in nearly two years.

The Bank of England is likely to hold rates in September, but if the labor market continues to soften, rate cuts could be on the table for November or December — though CPI trends remain a complicating factor.

UK Retail Sales Rise in July on Warm Weather and Food Prices

UK consumer spending rose in July, boosted by hot weather early in the month — the UK’s fifth-warmest July on record — which lifted clothing sales before momentum slowed later.

BRC data showed total retail sales up 2.5% year-on-year, down from June’s 3.1% increase, with like-for-like sales up 1.8%. Barclays reported overall spending up 1.4%, recovering from a 0.1% drop in June. Food sales jumped 3.9% from a year earlier, while clothing sales surged 4.2%, the fastest pace since September 2024. Economists are watching whether households will dip into savings as job losses rise and wage growth slows.

ECB’s Nagel: Interest rates are at a very good level

- Comments from the ECB policymaker

- Inflation is no longer a major challenge.

- We can react flexibly if necessary.

- Tariff uncertainty is lower but not fully removed.

Asia-Pacific & World News

China Advises Firms to Avoid Nvidia H20 Chips for Sensitive Work

Bloomberg reports that Chinese regulators have instructed domestic companies to steer clear of Nvidia’s H20 processors, particularly for projects tied to government or security. The guidance, framed as discouraging use of “less-advanced” chips, specifically warns against deploying H20s in official or sensitive applications.

It’s unclear whether AMD’s MI308 chips fall under the same directive. Both Nvidia and AMD had previously secured approval from the Trump administration to resume selling lower-end AI chips to China, with Washington expecting to collect a 15% revenue cut.

If Chinese firms comply with the new guidance, it could significantly disrupt those sales, undermining the anticipated US windfall.

Xi and Lula Hold Talks as Soybean Trade Tensions Rise

China’s state media reports that President Xi Jinping spoke by phone with Brazilian President Luiz Inácio Lula da Silva, though no official readout was provided. The timing is notable — President Trump has been pressing China to quadruple soybean purchases from the US, a move that could unsettle Brazil, currently China’s top soybean supplier.

China is the world’s largest soybean importer but faces an unusual challenge this year. After record imports early in 2025, demand has slumped, while Brazil’s peak supply season is lasting longer than usual. That leaves Beijing heading into Q4 — the prime marketing period for US soybeans — with ample supply already on hand.

In fact, China exported about 127,000 tons of soybean oil in the first half of 2025, surpassing its entire 2024 total. June shipping data shows 9.73 million tons of soybeans came from Brazil — a record for that month — while only 724,000 tons arrived from the US. So far, there are no Q4 bookings for US cargoes, with buyers citing trade negotiation uncertainty.

Given the glut and market conditions, any uptick in US purchases would likely be symbolic, much like the temporary boost during the 2019–2020 trade truce before flows reverted back to Brazil.

Trump Extends Pause on China Tariffs for 90 Days

President Trump announced that he has signed an executive order extending the suspension of tariffs on China for another 90 days. All other terms of the agreement will stay in place.

China Relaxes Some Export Controls, Removes Restrictions on 12 US Firms

China has adjusted its export control framework, allowing companies to request licenses for trade with currently restricted entities. In the process, Beijing has lifted curbs on 12 US-based companies and paused adding certain US firms to the restricted list for 90 days.

The change signals a move toward a more selective approach to trade restrictions, with exemptions granted on a case-by-case basis. Analysts believe this could help defuse tensions in targeted sectors while retaining the ability to enforce strategic or security-related controls.

Beijing to Detail New Loan Subsidy Measures on August 13

China’s government will hold a press conference at 10 a.m. local time on August 13 to roll out subsidized loan policies aimed at spurring personal spending and bolstering service-sector activity.

These initiatives are part of Beijing’s wider effort to counter slowing growth and trade challenges by stimulating domestic demand. Officials are set to clarify who qualifies for the loans, the terms offered, and the sectors included. Analysts will be watching to see whether the plan targets areas such as tourism, hospitality, and retail, or takes a broader approach to consumer credit.

Markets are also looking for clues on the size of the fiscal commitment and how this fits into China’s pro-growth roadmap for the rest of 2025.

PBOC sets USD/ CNY central rate at 7.1418 (vs. estimate at 7.1901)

- PBOC CNY reference rate setting for the trading session ahead.

PBOC injected 114.6bn yuan via 7-day reverse repos at 1.40%

- 160.7bn yuan mature today

- net 46.1bn yuan drain

RBA Cuts Cash Rate to 3.60% in August Decision

The Reserve Bank of Australia lowered its cash rate by 25 basis points to 3.60% in August, after surprising markets with a hold in July. The prior rate was 3.85%.

The bank cited continued moderation in inflation, gradual recovery in private demand, and slightly looser labor market conditions — though indicators still show a degree of tightness. Globally, uncertainty remains high, but clarity on US tariff policy suggests extreme scenarios may be avoided.

The RBA said slower-than-expected consumption growth poses a risk, and with inflation edging back toward its target band, further easing was appropriate. The central bank reiterated its focus on maintaining price stability and full employment, adding that upcoming decisions will be data-driven.

RBA governor Bullock: There was no discussion of a larger rate cut

- Remarks by RBA governor, Michele Bullock, in her press conference

- We will take things meeting by meeting

- Forecasts imply that cash rate might need to be lower for price stability

- Don’t put a lot of emphasis on the neutral rate

- Neutral rate is a long run concept but only in the absence of shocks

- Our forecasts are dependent on more rate cuts

- Would not rule out back-to-back rate cuts

- We will take into account data at each meeting and assess them at said particular meeting

- We do not target asset prices

- No promises on what the RBA will deliver on rates if financial markets face volatility bout

- There are risks to volatility in markets if things go pear shaped in the US

- People look to central banks to do something but not necessarily we will do

- Being pre-emptive suggests that we will take action based on something that we expect might happen

- And we are already doing that to some extent by reacting to our forecasts

- We are looking for confirmation along the way

- So, being pre-emptive and data dependent are not separate things; they are linked

- But when things are really uncertain, might lean towards wanting to see firm information before moving

- Policy is forward looking and assumes that we can continue to lower interest rates

Australian Business Confidence Climbs to Three-Year High in July

The July 2025 National Australia Bank Business Survey showed business confidence rising to 7, up from 5 in June — the highest level in three years — driven by strength in services and construction.

However, business conditions eased to 7 from 9 previously. Sub-measures showed:

- Sales at 11 in July (previously 8)

- Profitability at 2 (down from 4)

- Employment at 1 (down from 4)

Price data revealed retail prices up 1.1% in July, compared with 0.5% in June, while producer prices climbed 0.9%. NAB said the results signal improved Q2 activity and resilience in local hiring and investment despite global uncertainty, though retail and wholesale remain weak.

Japan’s Nikkei and Topix Indices Reach All-Time Highs

Japan’s two major stock benchmarks — the Nikkei and the Topix — have both hit record highs.

The Topix, or Tokyo Price Index, tracks all domestic companies listed in the Tokyo Stock Exchange’s First Section, covering more than 2,000 firms. It is a free-float adjusted market-cap-weighted index, meaning only shares available for trading are factored into calculations.

Singapore Q2 GDP Beats Estimates, Forecast Upgraded

Singapore’s economy expanded by 4.4% year-on-year in Q2, exceeding the earlier 4.3% estimate, with quarterly growth of 1.4% after contracting 0.5% in Q1.

The Ministry of Trade and Industry raised its 2025 GDP growth outlook to 1.5–2.5% from 0.0–2.0%, citing strong first-half performance. Non-oil domestic exports are still expected to rise 1.0–3.0% this year. Officials warned, however, that growth will likely slow in the second half and risks remain tilted to the downside.

Singapore Central Bank Says Policy Stance Remains Appropriate

The Monetary Authority of Singapore’s chief economist reaffirmed that the current policy stance is suitable, taking into account domestic growth and inflation drivers.

He said the MAS remains well positioned to handle risks and that a gradual, step-by-step approach under uncertainty is valuable, with assessments updated regularly at quarterly reviews.

Trump and South Korea’s Lee to Meet in Washington August 25

South Korean President Lee Jae-myung will travel to the United States from August 24–26 for his first official summit with President Donald Trump, according to his office.

The two leaders are scheduled to meet on August 25 in Washington, where talks will focus on reinforcing the US–South Korea strategic alliance and expanding cooperation in the field of economic security.

Crypto Market Pulse

Bitcoin, Ethereum, Solana Rally After US CPI Data

Cryptos rebounded Tuesday after US CPI data came in slightly cooler than expected.

- Bitcoin (BTC): Above $120,000, eyeing $122,335 weekly high. MACD buy signal supports upside toward $123,218 and $125,000.

- Ethereum (ETH): Above $4,400, targeting $4,878 ATH and $5,000 milestone. Backed by $1B in spot ETF inflows on Monday.

- Solana (SOL): Near $200 breakout with Golden Cross pattern and rising RSI.

US CPI rose 0.2% MoM (2.7% YoY) vs expectations of 0.2%/2.8%. Core CPI up 0.3% MoM (3.1% YoY). Economists see the data keeping a September Fed rate cut on the table, with markets focusing on labor market softness and tariff impacts.

Pi Network Slides Toward Key $0.3700 Support

Pi Network (PI) extended its decline Tuesday, trading under $0.4000 and down more than 3% on the day. The selloff follows Sunday’s 9% drop from a $0.4661 high, with price failing to hold above the 200-EMA ($0.4253) on the 4-hour chart.

Volume is down nearly 30% in 24 hours, signaling weaker participation. The move mirrors mid-July’s Adam and Eve breakout reversal, which led to a 10% drop after the neckline gave way.

If the current neckline at $0.3700 fails, a similar 10% slide could test $0.3334 support — last Wednesday’s low. RSI is at 43, showing more room for downside before oversold conditions.

Metaplanet Adds $61M in Bitcoin, Lifts Holdings to 18,113 BTC

Metaplanet purchased 518 BTC between July 1 and Aug. 12 at an average price of $118,519, totaling about $61 million. The Tokyo-based investment firm now holds 18,113 BTC — the sixth-largest corporate stash — valued around $1.85 billion, with an average acquisition cost of $101,911.

The company reported a 26.5% BTC Yield for the period, measuring bitcoin holdings relative to fully diluted shares. That compares to 41.7% in Q3 2024, a spike to 309.8% at year-end, then 95.6% in Q1 and 129.4% in Q2.

Metaplanet shares fell 2.7% to 975 yen ($6.60) on Tuesday.

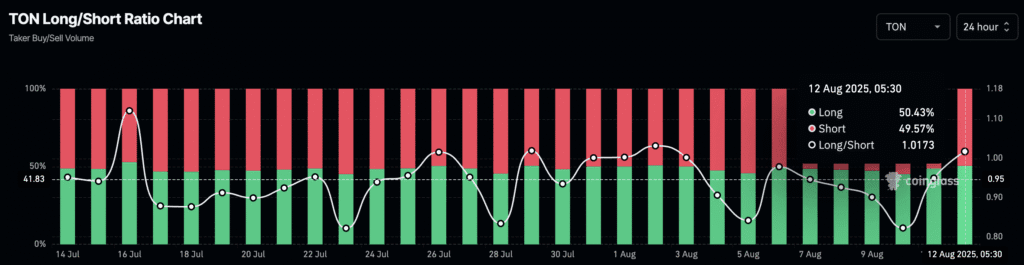

Toncoin Eyes Breakout as Coinbase Ventures Invests

Toncoin (TON) is consolidating just below its 200-day EMA, with traders watching for a breakout. Despite only gaining around 1% on Monday, sentiment turned more bullish after Coinbase Ventures took an undisclosed stake in TON.

The TON Foundation confirmed Coinbase’s investment, joining backers like Sequoia Capital and Ribbit Capital. Data from CoinGlass shows long positions rising to 50.43% of taker volume, up from 48.71% the day before, reflecting growing confidence in a price rebound.

Chainlink Partners with ICE Markets to Deliver FX and Metals Data On-Chain

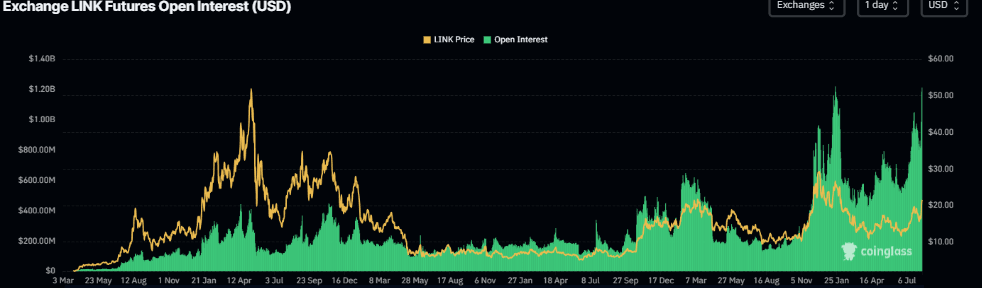

Chainlink (LINK) is trading near $21.47 after rallying 35% last week, but faces resistance at $22.05. A close above could open the door to further gains.

On Monday, Chainlink announced a deal with ICE Markets to stream high-quality FX and precious metals data on-chain via Chainlink Data Streams, tapping ICE’s consolidated feed from 300+ exchanges and marketplaces.

Open interest in LINK futures has surged to $1.21 billion, near its January 2022 record, as traders position for further upside.

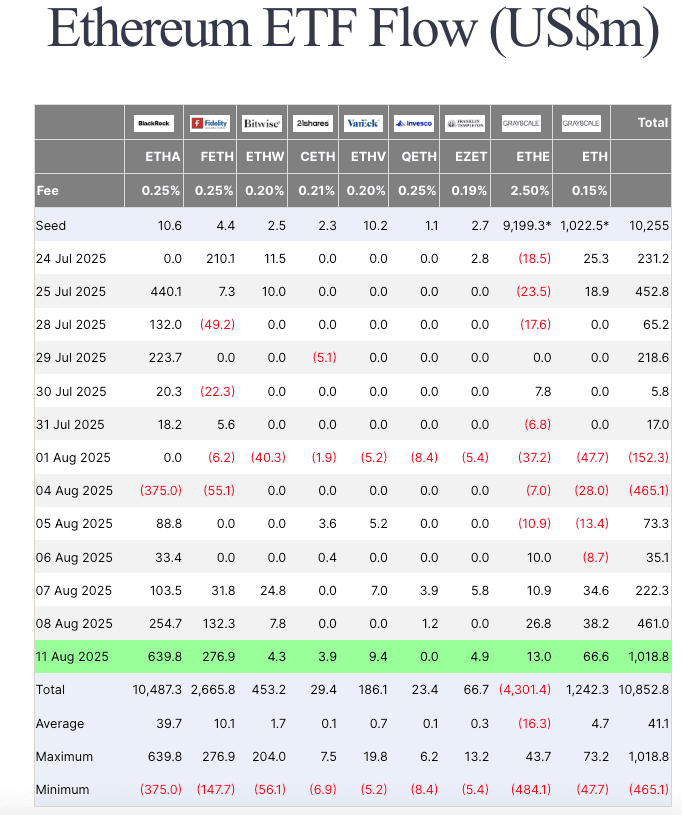

Ether ETFs See Record $1B Single-Day Inflows

Spot Ether ETFs logged $1.01 billion in net inflows on Monday — their largest daily haul ever — as ETH traded at $4,312, up 45% over the past month.

BlackRock’s iShares Ethereum Trust ETF (ETHA) led with $640 million in new money, followed by Fidelity’s Ethereum Fund (FETH) with $277 million. By comparison, Bitcoin ETFs took in $178 million.

NovaDius president Nate Geraci said Ether ETFs had been “severely underestimated” by traditional finance, which is now recognizing ETH as the “backbone of future financial markets.”

The Day’s Takeaway

North America

US Equities Hit Records; Small Caps Surge

US markets rallied strongly on Tuesday, with all major indices posting gains above 1.1%. The S&P 500 and Nasdaq closed at record highs, while the Russell 2000 surged 2.99%—its best day since May 12.

- Dow Jones: +483.52 pts (+1.10%) to 44,458.61

- S&P 500: +72.31 pts (+1.13%) to 6,445.76

- Nasdaq: +296.50 pts (+1.39%) to 21,681.90

- Russell 2000: +66.26 pts (+2.99%) to 2,282.77

July CPI data matched expectations, reinforcing bets on a September Fed rate cut. Markets are pricing in roughly 60 bps of easing by year-end.

Airlines Outperform

Airline shares surged after July airfare data showed the first monthly rise (+4%) in six months:

- American Airlines: +12.22%

- United Airlines: +10.19%

- Delta Air Lines: +9.23%

- Southwest Airlines: +5.73%

Fed Commentary – Schmid (Hawkish Lean)

Kansas City Fed President Jeff Schmid, a 2025 voter, signaled support for holding rates steady, citing inflation still above target and the muted inflationary effect of tariffs. While some Fed members are in the “cut” camp, Schmid’s comments tilt toward patience and modestly restrictive policy until demand shows clearer weakness.

US Federal Budget Deficit Widens

July’s deficit came in at $291B, above the expected $215B, following a surprise $27B surplus in June. Outlays hit a record $630B for July, while receipts totaled $338B. Year-to-date, the deficit is $1.629T, exceeding last year’s $1.517T.

Atlanta Fed Sticky Price CPI

The Sticky Price CPI rose to 4.6% annualized in July from 4.3% in June, indicating persistent inflationary pressures. Core sticky prices climbed 4.8% annualized, while the flexible-price CPI dropped 3.8% annualized.

Commodities

Oil – WTI Falls Below Key Levels

WTI crude settled at $63.17, down $0.79 (-1.24%). The session range was $63.06–$64.34. Price remains below the 100-hour moving average ($64.82) and has broken under the $63.61–$65.27 support zone. Next downside targets: May lows near $60, then April/May lows at $55.15.

Gold – Holding Support at $3,340

Gold reversed from $3,400 but found strong support at $3,335–$3,345, aligning with the 50% retracement of the early August rally. A break below $3,335 would open $3,305–$3,315, then $3,282. Resistance stands at $3,380, then $3,400–$3,410, with $3,440 as the bullish breakout target.

Europe

European equities ended mostly higher:

- Italy’s FTSE MIB: +0.85% (best performer)

- France’s CAC: +0.71%

- UK’s FTSE 100: +0.20%

- Spain’s Ibex: +0.02%

- Germany’s DAX: -0.23% (sole decliner)

Rest of World

White House Pressures Japan on Defense Spending

The US is urging Japan to increase defense spending above 3.5% of GDP, part of the “Buy America Defense” push. Japanese officials say such a move is difficult given the minority government’s position.

Crypto

Post-CPI Rally in Major Cryptocurrencies

Crypto markets turned green after US CPI data matched expectations, boosting sentiment.

- Bitcoin (BTC): Back above $120,000; eyeing a break past $122,335 weekly high toward $125,000. MACD buy signal in play.

- Ethereum (ETH): Above $4,400; targeting November 2021 ATH of $4,878, with $5,000 in sight. Backed by $1B+ ETF inflows.

- Solana (SOL): Approaching $200 breakout, supported by a Golden Cross and rising RSI.

- XRP: Rebounded above $3.21 after recent SEC case resolution; potential target $3.66 if sentiment improves.