North America News

U.S. Stock Market Closes Mixed as Early Gains Fizzle Out; NASDAQ Notches Record

U.S. equities started strong on Thursday but couldn’t hold the momentum. By the closing bell, only the NASDAQ finished in positive territory — just enough to set a fresh all-time high. The Dow and S&P 500, however, slipped into the red after surrendering earlier gains.

Final closing levels:

- Dow Jones: -224.48 points (-0.51%) at 43,968.64

- S&P 500: -5.06 points (-0.08%) at 6,340.00

- NASDAQ: +73.27 points (+0.35%) at 21,242.70

- Russell 2000: -6.56 points (-0.30%) at 2,214.71

At session highs:

- Dow was up +305.31 points

- S&P climbed +44.65 points

- NASDAQ surged +238.73 points

- Russell 2000 gained +21.87 points

Markets reversed lower throughout the afternoon session, with large-cap tech leading the charge early before fading into the close.

Earnings Highlights (Post-Close):

- The Trade Desk ($TTD):

Revenue: $694M (vs. $685.3M est.)

Net income: $90M, GAAP EPS: $0.18

Adj. EPS: $0.41 (vs. $0.40 est.)

EBIT: $116.8M, Adj. EBITDA margin: 39%

Pretax profit missed at $133.2M (vs. $197.3M est.) - Expedia ($EXPE):

Revenue: $3.79B (vs. $3.71B est.)

Gross bookings: $30.41B

Net income: $330M, GAAP EPS: $2.48

Adj. net income: $546M (vs. $536.4M est.)

Adj. EPS: $4.24 (vs. $4.10 est.)

Adj. EBITDA: $908M (vs. $853.6M est.) - Block ($XYZ):

Adj. EPS: $0.62 (missed vs. $0.69 est.)

Cash App gross profit: $1.50B

Square GPV: $64.25B

Q3 gross profit guidance: $2.60B

FY2025 gross profit guidance: $10.17B

Company expects to accelerate profit growth in Q4, aiming for 19% growth exiting the year - Pinterest ($PINS):

Revenue: $998.2M (vs. $974.8M est.)

Adj. EPS: $0.33 (missed vs. $0.35 est.)

Global MAUs: 578M (vs. 552.8M est.)

Q3 Revenue Guide: $1.03B–$1.05B (in line)

Adj. EBITDA guide: $282M–$302M (vs. $291.1M est.) - BuzzFeed:

Q2 revenue: $46.39M

Net loss: $10.63M

Adj. EBITDA: $1.98M

FY revenue outlook: $195M–$210M

FY adj. EBITDA: $10M–$20M - Twilio ($TWLO):

Q2 revenue: $1.228B (vs. $1.188B est.)

GAAP EPS: $0.14, Adj. EPS: $1.19 (vs. $1.05 est.)

Gross profit: $602.74M

Operating income: $37M, Adj. operating: $221M

Q3 revenue guide: $1.245B–$1.255B

Adj. EPS guide: $1.01–$1.06

Adj. operating income: $205M–$215M

U.S. Treasury Sells $25 Billion in 30-Year Bonds with Weak Demand

The U.S. Treasury auctioned off $25 billion in 30-year bonds at a high yield of 4.813%, well above the when-issued (WI) yield of 4.792% at the time of the sale.

- Tail: 2.1 basis points — the difference between the auction yield and WI — much wider than the six-month average of -0.2 bps, signaling poor demand.

- Bid-to-cover ratio: 2.27x vs a 2.38x average — another soft sign.

- Direct bidders (domestic): 23% vs 24.2% average.

- Indirect bidders (often foreign): 59.5% vs 61.9%.

- Dealers (who take up the slack): 17.5% vs 13.9%.

Every key participation metric came in below trend, forcing primary dealers to take a larger share than usual — a sign that buyers weren’t stepping up.

This follows an average 3-year note auction earlier in the week and a weak 10-year auction the day prior.

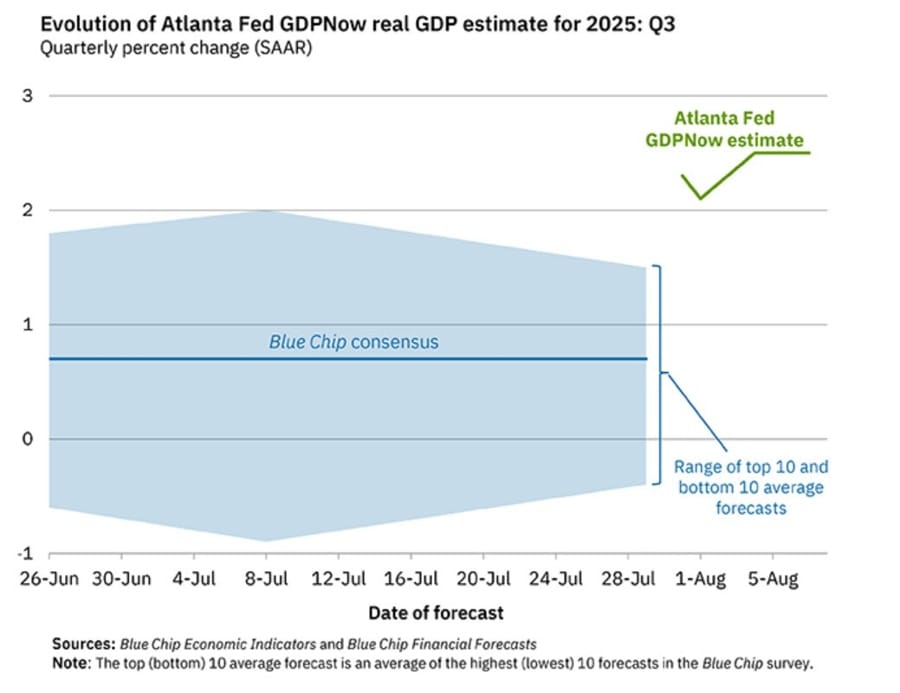

Atlanta Fed GDPNow Forecast Holds Steady at 2.5% for Q3

The Atlanta Fed’s GDPNow model remains unchanged, projecting 2.5% GDP growth for the third quarter of 2025. No new economic data inputs prompted an adjustment.

The stable outlook reflects moderate momentum in the U.S. economy, with inflation pressures and interest rate dynamics continuing to dominate the macro conversation.

In their own words:

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the third quarter of 2025 is 2.5 percent on August 7, unchanged from August 5 after rounding. After this morning’s wholesale trade report from the US Census Bureau, the nowcast of the contribution of inventory investment to third-quarter real GDP growth increased from 0.76 percentage points to 0.82 percentage points.

NY Fed: 1-Year Inflation Expectations Tick Up to 3.1%

Consumers expect inflation to average 3.1% over the next year, up slightly from 3.0% in June, according to the NY Fed’s latest consumer expectations survey for July.

Other outlooks:

- 3-year ahead: Unchanged at 3.0%

- 5-year ahead: Dropped to 2.9% from 3.0%

Additional takeaways:

- Home price expectations held steady at 3.0%

- Households feel more optimistic about current and future finances

- Expectations of credit access are improving

While short-term inflation views are creeping up, long-run forecasts remain anchored, supporting the Fed’s cautious tone.

U.S. Consumer Credit Rises $7.37 Billion in June

Total consumer credit outstanding rose $7.37 billion in June, just above the $7 billion estimate, per new Fed data. The previous month’s gain was revised to $5.13 billion from $5.10 billion.

Breakdown:

- Total Credit: $5,054.7B → +0.15%

- Revolving (credit cards): Fell by $1.1B to $1,297.0B → -0.08%

- Nonrevolving (auto/student loans): Rose $8.4B to $3,757.6B → +0.22%

Despite the slight dip in credit card balances, borrowing continues to climb, driven largely by loans not tied to card spending. Overall debt levels remain near historic highs.

U.S. 30-Year Mortgage Rates Drop to Lowest Level Since April

The average rate on a 30-year fixed mortgage dropped to 6.63%, down from 6.72% last week — the lowest level since April 10, 2025. Over the same period, the U.S. 10-year yield fell from 4.38% to 4.23%.

What this means for borrowers:

- At 2.65% (2021 low), a $100,000 loan carried a $402.69 monthly payment.

- At 7.79% (2023 high), that ballooned to $718.19.

- At today’s 6.63%, the payment comes out to $641.16 — a $238.47 increase from the 2021 low.

For context, on a median-priced existing U.S. home at $435,000, today’s rate adds roughly $1,037.35 per month compared to 2021. While off the peak, housing affordability remains historically tight.

U.S. Q2 Labor Costs and Productivity Come in Higher Than Expected

Preliminary data from the Bureau of Labor Statistics shows unit labor costs rose 1.6% in Q2, slightly exceeding the 1.5% estimate. That’s a sharp slowdown from Q1’s 6.9% surge. Nonfarm productivity increased 2.4%, beating the 2.0% consensus. In Q1, productivity was revised down to a -1.8% decline from -1.5%.

Key takeaways from the report:

- Output rose 3.7% while hours worked increased 1.3%

- Hourly compensation rose 4.0%, while real hourly compensation rose 2.3% in Q2 and 1.4% year-over-year

- Year-over-year productivity rose 1.3%; since Q4 2019, it’s averaged 1.8% annually—higher than the 1.5% seen from 2007–2019

In manufacturing:

- Productivity grew 2.1% overall

- Durable goods: +3.3% productivity, with output +4.1% and hours +0.8%

- Nondurable goods: +1.2% productivity, with output +0.5% and hours -0.7%

- Manufacturing unit labor costs rose 1.7%, driven by a 3.8% increase in nondurable goods, while durable goods costs dipped 0.2%

- Year-over-year manufacturing productivity rose 1.5%, the strongest since Q2 2021

The report highlights a positive trend in productivity and real wages—both critical inputs for growth—despite a messy backdrop shaped by tariffs and reshoring efforts.

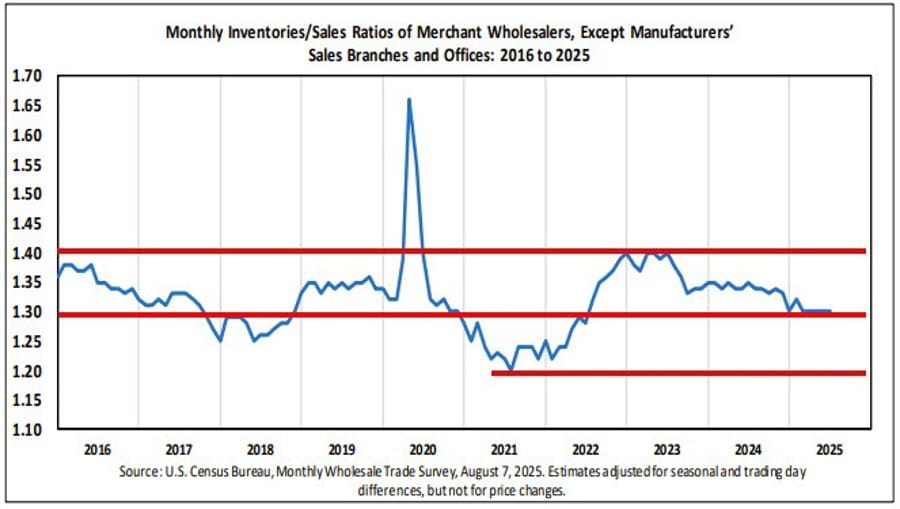

U.S. Wholesale Sales Beat Forecasts, But Inventory-to-Sales Ratio Continues Falling

Wholesale sales in June rose 0.3% month-over-month, topping the 0.1% estimate. Sales for May were revised down from -0.3% to -0.4%. Inventories climbed 0.1% from May, in line with a downward revision of the prior month from +0.2%.

Key figures:

- June sales totaled $698.5 billion, up 5.5% from a year earlier

- Inventories stood at $906.3 billion, up 1.3% from June 2024

- The inventories-to-sales ratio fell to 1.30 from 1.35 a year ago

A continued drop in this ratio could indicate tightening inventory conditions. During the post-COVID supply chain crunch, the ratio dropped as low as 1.20, contributing to price spikes. With tariffs still a factor, any persistent decline in this metric will draw close attention as a potential inflationary signal.

U.S. Jobless Claims Edge Higher, Continuing Claims Also Climb

Initial jobless claims in the U.S. came in at 226,000 for the latest week, slightly above the forecast of 221,000. The prior figure was revised up to 219,000 from 218,000.

Continuing claims also rose more than expected, hitting 1.974 million compared to the anticipated 1.950 million. The previous number was adjusted down slightly to 1.936 million. While still historically low, the uptick adds to recent signs of softening in the labor market.

ICYMI: McDonald’s Q2: Solid Earnings Driven by Budget-Conscious Diners

McDonald’s reported stronger-than-expected Q2 earnings, likely lifted by consumers looking to cut costs. The numbers:

- EPS: $3.14 (Adjusted: $3.19 vs. $3.14 est.)

- Revenue: $6.84B (vs. ~$6.7B est.)

- Global same-store sales: +3.8% (vs. +2.6% est.)

- U.S. same-store sales: +2.5% (vs. -0.7% y/y)

- Net income: $2.25B, up 11% y/y

Economists often point to fast food as an “inferior good”—meaning demand rises when incomes fall. McDonald’s seems to be benefiting from that dynamic as inflation pinches real wages.

Fed’s Bostic: Tariffs Pose Long-Term Inflation Risk, Economy Still Fundamentally Sound

Atlanta Fed President Raphael Bostic, a 2027 voter, says tariffs may have longer-lasting inflationary effects than previously thought. Speaking Thursday, Bostic highlighted several concerns and policy uncertainties:

- Economy is slowing but still fundamentally strong

- Firms remain hesitant about hiring

- Tariff-related price pressures could persist 6 to 12 months or longer

- The Fed’s response depends on whether these are one-time price adjustments or more structural shifts

Bostic said the current uncertainty makes it hard to interpret the impact of tariffs, especially as businesses react unevenly. The economy still shows signs of resilience, but lower-income households are under increasing pressure, with pandemic-era savings now largely gone.

He also commented on recent labor data, saying revisions raised questions about whether the U.S. remains at full employment. He sees scope for one rate cut this year, but stressed the Fed will need to stay flexible.

US Commerce Secretary Lutnick: US likely to extend China deadline by 90 days

- The original deadline compliance was August 12

- Expects the China deadline to be extended another 90 days (the initial deal was set to expire on August 12)

- Reiterates that Trump will not charge tech companies a tariff on semiconductors if they are manufactured in the US.

- The US expects 50 billion a month in tariff revenue. (earlier Lutnick had said that the US revenues from tariffs would be $700 billion.So he is revising down his number to $600 billion).

US Bessent: Trade deals are largely done

- Remarks from the US Treasury Secretary, Scott Bessent

- I don’t think this is biggest trade re-set since 1935

- The biggest trade re-set was the China trade shock.

- Regulation pushed US manufacturing offshore.

- $300 billion is a good start for annual tariff revenue estimate.

- There’s a chance 2026 tariff revenue could be over $300 billion.

Trump Celebrates Tariff Revenues: “Billions Flowing In”

Trump took to Twitter to declare the success of his reciprocal tariffs, saying:

“RECIPROCAL TARIFFS TAKE EFFECT AT MIDNIGHT TONIGHT! BILLIONS OF DOLLARS… WILL START FLOWING INTO THE USA.”

“IT’S MIDNIGHT!!! BILLIONS OF DOLLARS IN TARIFFS ARE NOW FLOWING INTO THE UNITED STATES OF AMERICA!”

The latest data supports the boast—tariff revenue reached $30 billion last month, up 242% from a year earlier.

But with rising costs, inflation is also part of the picture. The revenue helps offset the U.S. deficit, but it’s not a silver bullet.

GM and Hyundai Plan Five New Vehicles for the Americas by 2028

General Motors and Hyundai are teaming up to develop five new vehicle models aimed at the Americas. Four will be designed for South and Central America: a compact SUV, a passenger car, a pickup, and a mid-size truck. Launches are expected by 2028.

The fifth vehicle—an electric delivery van for North America—will be led by Hyundai and built in the U.S.

GM is taking the lead on the mid-size truck, while Hyundai will focus on the small car and EV van. Combined, the companies project sales of over 800,000 units annually.

Trump Threatens 100% Tariffs on Foreign Chips, Targets Apple

Trump has declared plans for a 100% tariff on all imported semiconductors and chips, aiming to ramp up U.S. manufacturing. Companies already building facilities in the U.S. would be exempt.

Speaking about Apple, Trump added several eyebrow-raising claims:

- iPhones should be made in the U.S.

- Apple will build chip plants in Texas, Utah, Arizona, and New York

- The company will power itself independently

- Apple will open a training academy in Detroit

- A rare earth recycling line is in the works for California

The tariff may fuel domestic production, but could also drive up prices for electronics, vehicles, and appliances.

Trump Plans Putin Meeting, Followed by Talks with Zelensky

Donald Trump has told European leaders he’s arranging a face-to-face with Vladimir Putin next week, followed by a three-way summit including Volodymyr Zelensky. The goal: hammer out an end to Russia’s war on Ukraine.

Although Trump hasn’t personally commented on social media, the White House has confirmed the upcoming meetings. If talks move forward, markets may see a boost:

- Risk assets could rally

- Oil and gas prices may drop if Russian supply returns

- Inflation pressures might ease

- European stocks and the euro could benefit from improved sentiment

The real impact depends on what kind of peace agreement is reached—whether it’s durable, how sanctions are handled, and if it looks credible.

Commodities News

Gold Rallies as Job Market Weakens, Tariffs Fan Stagflation Concerns

Gold prices pushed higher on Thursday as investors shifted toward safe havens amid mounting stagflation fears. The metal traded at $3,385, up 0.45% on the day, fueled by soft labor market data and the economic impact of new tariffs.

Labor market signals:

- Jobless claims came in above expectations, but it was the continuing claims that caught the market’s attention.

- Continuing claims have now climbed to levels not seen since November 2021, suggesting cracks in employment are widening.

This shift is nudging investor sentiment toward a more dovish Fed path, with growing bets on rate cuts resuming as early as September.

Additional catalysts:

- Trump’s tariffs went into effect Thursday, hitting imports from Switzerland, Brazil, and India after trade talks failed.

- This adds to inflation pressure while the labor market weakens — a mix that has Wall Street increasingly murmuring about stagflation.

A Bloomberg headline summed up the mood:

“Stagflation Concerns Ripple Through Wall Street as Tariffs Hit”

At the same time, falling Treasury yields have strengthened gold’s appeal, especially as inflation-adjusted returns on cash fade.

Looking ahead, traders will watch speeches from Federal Reserve officials and Friday’s release of the University of Michigan Consumer Sentiment report — which includes key updates on inflation expectations.

Oil Drops to $63.88 After Failing to Hold Above Key Technical Level

Crude oil futures ended the session down $0.47, or -0.73%, settling at $63.88.

- Session high: $65.11 — briefly cleared the 100-day moving average at $64.92 but couldn’t hold

- Session low: $63.76 — testing key support near $63.61

The failure to maintain upward momentum after touching resistance levels triggered a reversal. Traders will be watching if oil can stabilize above the $63–$64 zone or risks falling further.

Silver Eyes $38.30 Resistance as Dollar Weakens

Silver extended its rally Thursday, approaching the $38.30 resistance level last seen in late July. The move is driven by a weakening U.S. Dollar and speculation that the Fed may soon cut rates.

Momentum indicators suggest the rally may be nearing exhaustion, with the 4-hour RSI hitting overbought territory. The U.S. Dollar Index has dropped more than 2% since last Friday, testing the 98.00 support zone.

Next bullish targets for silver are $38.75 and $39.20, while support lies at $37.30 and $36.21 if momentum reverses.

China Increases Gold Reserves for Ninth Straight Month

China’s central bank added more gold in July, pushing reserves to 73.96 million ounces, up from 73.90 million in June. In dollar terms, holdings rose to $243.99 billion, compared to $242.93 billion the prior month.

This marks the ninth consecutive month of reserve increases. Analysts point to central bank buying as a major contributor to recent gold price strength, alongside growing skepticism about U.S. policy consistency since April, which has weighed on the dollar’s credibility.

Saudi Arabia Hikes Oil Prices for Asia Amid Supply Tightness

Saudi Arabia is raising its crude oil prices for Asian buyers for September deliveries, citing tight supply and stronger demand—particularly from India, which may pivot further toward Gulf suppliers due to new U.S. tariffs.

The flagship Arab Light crude is now priced at $3.20 above the Oman/Dubai benchmark, up $1 from August.

Saudi Aramco also raised prices for U.S. customers but trimmed prices for Europe.

BP Sees Oil Demand Growing, OPEC+ Regains Influence

BP CEO Murray Auchincloss says global oil demand is set to climb roughly 1% in both 2025 and 2026. In his CNBC appearance, he emphasized that supply growth from non-OPEC nations is no longer outpacing demand.

That dynamic hands pricing power back to OPEC+.

With non-OPEC production flattening, the group could wield greater control over global oil prices, even without surprises on the demand side.

Europe News

Most European Markets Rise, FTSE 100 Falls After BOE Rate Cut

European stock indexes closed mostly higher on Thursday, with one outlier: the UK’s FTSE 100, which dropped 0.69% following a Bank of England rate cut seen as overly hawkish.

The BoE reduced its rate by 25 basis points to 4.00% in a 5-4 split vote — deviating from the expected 7-2 consensus. The hawkish tone, despite the cut, weighed on sentiment in UK equities.

Elsewhere in Europe:

- German DAX: +1.11%

- France’s CAC 40: +0.97%

- Spain’s IBEX: +1.06%

- Italy’s FTSE MIB: +0.93%

Investor appetite stayed strong outside the UK, even with central bank moves still influencing rate-sensitive sectors.

Germany’s Industrial Output Slumps Sharply in June, Prior Data Revised Down

Germany’s industrial production dropped 1.9% in June, far worse than the anticipated -0.5%, according to Destatis. Making matters worse, May’s initially reported 1.2% rise has been sharply revised down to a 0.1% drop.

The June figures mark the weakest manufacturing output since May 2020, driven in part by a steep correction in data from automotive firms, per the statistical agency. While markets are likely to look past this since it’s backward-looking Q2 data, the deep cut highlights ongoing weakness in Germany’s industrial base.

Germany’s Trade Surplus Shrinks as Imports Surge in June

Germany’s trade balance came in at €14.9 billion for June, missing the €17.3 billion forecast and slipping from a revised €18.6 billion in May.

Destatis data shows exports climbed just 0.8% month-over-month, while imports jumped 4.2%. The narrower surplus reflects higher inbound demand, but also suggests weakening export momentum heading into Q3.

France’s Trade Deficit Holds Steady in June

France reported a trade deficit of €7.6 billion in June, matching the revised figure from May, as both exports and imports rose on the month.

Exports increased by 3.4%, while imports grew by 2.9%, according to the Finance Ministry. The figures reflect solid trade activity, although the gap remains persistent.

Bank of England Cuts Rates by 25 bps to 4.00%, Split Vote Forces Second Round

The Bank of England reduced its base interest rate by 25 basis points to 4.00%, aligning with expectations but reached through an unusual two-round vote.

The final breakdown was 5-4-0 (cut-hold-hike), after an initial 4-4-1 deadlock, with Taylor shifting from a 50 bps cut to 25 bps to avoid a tie. The BoE cited easing pay pressures and subdued GDP growth as reasons for the move but emphasized that the disinflation trend remains uneven. Future policy moves will hinge on incoming inflation data, with no preset path.

UK House Prices Rise More Than Expected in July, Annual Growth Eases

The Halifax House Price Index rose 0.4% in July, beating the 0.3% forecast. June’s figure was revised up to +0.1% from flat.

The average property price now sits at £298,237, with annual price growth slowing slightly to 2.4% from June’s 2.7%. Halifax noted that affordability pressures still loom large for buyers, but improving mortgage rates and rising wages are helping to stabilize activity. Price trends vary significantly by region and property type, but the national picture remains relatively strong.

BOE Governor Bailey: Rate Cuts Must Be Measured, Not Premature

Bank of England Governor Andrew Bailey stressed that future interest rate reductions must be handled with care, warning against overly aggressive easing.

He reaffirmed that policy remains restrictive and that decisions will depend on incoming data—particularly inflation trends. Bailey also noted ongoing uncertainty around the “neutral rate” and the long-term trajectory for rates, with the BoE committee estimating a range between 2% and 4%.

This rate decision marked the first time the BoE required two rounds of voting. Bailey explained that while he holds the power to break a tie, the final vote showed a clear preference for a 25 bps cut.

Swiss Officials Scramble After U.S. Tariff Blow, No Deal Secured

Switzerland’s Federal Council is holding an emergency session following the return of its trade delegation from Washington—empty-handed.

No meeting with Trump materialized, and no trade deal was reached. Swiss exports are now facing a 39% tariff under new U.S. rules.

Pharmaceuticals and gold are spared for now, but everything else is on the hook.

Asia-Pacific & World News

Russia Confirms Preparations for Trump-Putin Summit Underway

The Kremlin confirmed that preliminary arrangements for a summit between Donald Trump and Vladimir Putin are advancing, with a meeting expected “in the coming days.”

The location has reportedly been decided but will be revealed later. The summit is part of a broader diplomatic push aimed at launching ceasefire talks. On the Ukrainian side, President Zelensky is consulting with European allies including Germany, France, and Italy to determine next steps.

If it goes ahead, this will mark the first U.S.-Russia presidential meeting since June 2021, and the first direct contact between Putin and Zelensky since December 2019.

China’s July Trade Surges Past Forecasts, Despite Falling U.S. Shipments

China posted better-than-expected trade results for July 2025:

- Exports: +7.2% y/y (vs. +5.4% est.)

- Imports: +4.1% y/y (vs. -1.0% est.)

- Trade surplus: $84.2B (vs. $105B est.)

Despite the overall gains, exports to the U.S. plunged 21.6% y/y. However, rerouted trans-shipments may be masking some of the impact.

Year-to-date (Jan–Jul):

- Exports: +6.1% y/y

- Imports: -2.7% y/y

- Trade surplus: $683.5B

- U.S.-bound exports down 12.6% y/y

Taiwan’s TSMC Says It Will Be Exempt from Trump’s 100% Chip Tariff

Taiwan Semiconductor Manufacturing Company (TSMC) says it’s secured an exemption from Trump’s sweeping 100% tariff on imported chips.

TSMC stock rose sharply on the news, though no further details were disclosed.

Meanwhile, the head of the Philippines Semiconductor Industry warned the policy could be “devastating,” as semiconductors account for 70% of the country’s exports.

Navarro Urges Caution on China Tariffs Despite Russia Oil Link

White House trade adviser Peter Navarro is urging restraint when it comes to hitting China with new tariffs over its Russian oil imports.

While India just saw a 25% increase in tariffs due to its ties with Moscow, Navarro says China’s case is different—especially given that many Chinese goods are already under a 50% tariff.

“We don’t want to damage our own economy,” he warned, signaling a more cautious tone than Trump’s.

Trump Considers Tariffs on China Over Continued Russian Oil Imports

Trump says China could soon face tariffs similar to those imposed on India, following its continued purchase of Russian oil. While he stopped short of announcing anything definitive, he teased that new duties “could happen.”

The U.S. just doubled tariffs on Indian imports, citing the same energy-related issue. If China is next, the economic stakes are higher.

PBOC sets USD/ CNY reference rate for today at 7.1345 (vs. estimate at 7.1709)

- PBOC CNY reference rate setting for the trading session ahead.

- PBOC drains 122.5b yuan net in open market operations

Australia Posts Surging June Trade Surplus on Export Spike

Australia’s June trade surplus hit AU$5.37 billion—well above the AU$3.25 billion forecast and more than double the previous month’s AU$2.24 billion.

Driving the surprise:

- Exports surged 6.0% m/m (prior -2.7%)

- Imports dropped 3.1% m/m (prior +3.8%)

That import drop might raise eyebrows, since robust economies usually consume more. Still, the export growth marks the strongest since September 2022.

Japan Slashes Growth Outlook as U.S. Tariffs, Weak Spending Weigh

Japan’s government has downgraded its economic growth projection for the current fiscal year to 0.7%, down from January’s estimate of 1.2%.

The revision reflects multiple headwinds: higher U.S. tariffs are likely to dampen Japanese exports and corporate investment, while domestic consumption remains fragile amid persistent inflation. However, the outlook for the next fiscal year remains more upbeat, with officials expecting GDP to expand 0.9%, helped by rising wages and stronger household spending.

Ishiba Says U.S.-Japan Tariff Rate Was Never Meant to Be Stacked

Japanese Prime Minister Shigeru Ishiba clarified that the new 15% U.S. tariffs on Japanese imports are not intended to be cumulative with existing duties, aiming to ease confusion after the yen briefly dropped from 147.05 to 147.70.

Ishiba has called on the U.S. to amend its executive orders to reflect the agreed interpretation—that 15% is the cap, not an additional layer. The tariff ambiguity rattled currency markets and exposed yet another point of contention in U.S.-Japan trade relations.

U.S. to Apply Blanket 15% Tariff on All Japanese Imports, No Exceptions

More details are emerging from Asahi newspaper: The U.S. is moving forward with a blanket 15% tariff on all Japanese imports—no carve-outs, even for items already taxed above that level.

Japan had hoped that high-tariff goods like beef would be excluded from the new duty. But under the current plan, everything from Tokyo will face the extra 15%.

The yen has slid again in response.

Yen Tumbles on Reports of New 15% Tariff from U.S. Against Japan

Japanese media, including Kyodo, report that the U.S. is preparing to slap an extra 15% tariff on all goods from Japan. This move is hammering the yen.

Initial expectations in Tokyo were that only items with tariffs below 15% would be hit, while high-tariff goods like beef would be spared. But Washington now appears to be going further, applying the 15% increase across the board regardless of the existing tariff rate.

Crypto Market Pulse

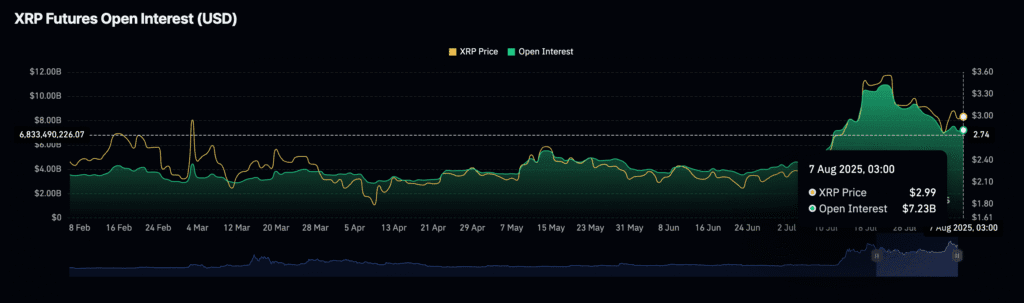

XRP Climbs Past $3.00 as Ripple Acquires Rail for $200M

Ripple’s XRP climbed to an intraday high of $3.08, before easing slightly to around $3.05, breaking out of a short-term descending channel amid a broader crypto rebound.

Boosting momentum, Ripple announced it acquired Rail, a $200 million purchase aimed at strengthening its stablecoin and blockchain payment infrastructure.

Rail will integrate with Ripple Payments, which now supports:

- Stablecoin on/off-ramps

- Virtual accounts

- Digital asset liquidity

- Treasury services

- Fully compliant, enterprise-grade payment infrastructure

Ripple President Monica Long said the move positions the firm to lead stablecoin innovation globally.

Interest in XRP, however, remains muted in the futures market. Open Interest has dropped 34% from its July peak of $10.94 billion to an average of $7.23 billion. Despite that, the acquisition and broader market recovery could reignite demand.

Also giving the crypto space a boost: reports that President Trump will sign an executive order allowing crypto and other alternative assets into 401(k) retirement plans.

Two Polish Gaming Firms Embrace Bitcoin Treasury Strategy

Inspired by MicroStrategy’s Bitcoin playbook, two smaller Polish gaming firms—Ice Code Games and Immersion Games—are shifting their financial strategy to Bitcoin.

Ice Code secured €1 million in funding to begin building a BTC reserve. Meanwhile, Immersion Games plans to exit game development entirely and move into blockchain investment. It aims to allocate up to €100 million into Bitcoin using capital raised via convertible bonds.

This mirrors a broader trend among global firms using Bitcoin as a long-term store of value. MicroStrategy leads the pack with 628,000 BTC, now worth close to $72 billion—far exceeding its $463 million in annual revenue. Other notable adopters include Trump Media, Tesla, and Metaplanet.

There are clear risks: Bitcoin’s volatility can wreak havoc on company balance sheets. Raising capital through debt or stock sales adds pressure. Still, proponents say it offers exposure to crypto without holding the asset directly and may bring tax benefits.

If the bull market continues, the upside could be huge. If not, these companies may face severe losses. Either way, more Polish firms may follow.

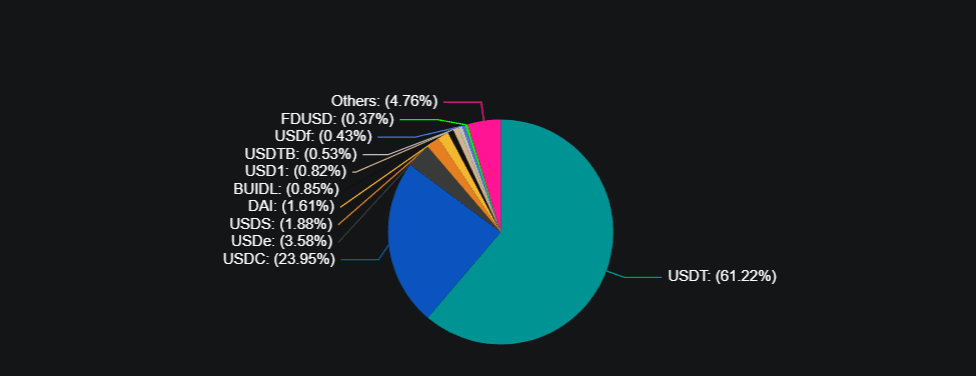

China Prepares First Stablecoins to Compete with Dollar-Dominated Market

China is gearing up to launch its first regulated stablecoins in a move aimed at challenging the U.S. dollar’s global dominance, the Financial Times reports.

Hong Kong will act as the launchpad, thanks to its new legal framework for fiat-backed digital tokens. While crypto remains banned on the mainland, Hong Kong passed its stablecoin legislation earlier this year and plans to begin issuing licenses next year.

The initiative is part of a larger push to internationalize the yuan. But obstacles remain:

- U.S. dollar-backed coins dominate—Tether’s USDT alone holds 61.22% market share

- Most Chinese exporters prefer USDT for cross-border payments to avoid FX risk and capital controls

- Licensing will be limited, and regulators are cautious about speculative mania

Chen Lin of the University of Hong Kong noted that despite Hong Kong’s efforts, competing with USD-based stablecoins is still a steep climb. The timing of this move coincides with the U.S. recently signing the GENIUS Act, a bill regulating dollar-pegged stablecoins.

Whether China’s entry shifts the balance will depend on adoption, regulation, and trust—three hurdles not easily overcome.

Pi Network Eyes Rebound as Whale Activity Picks Up

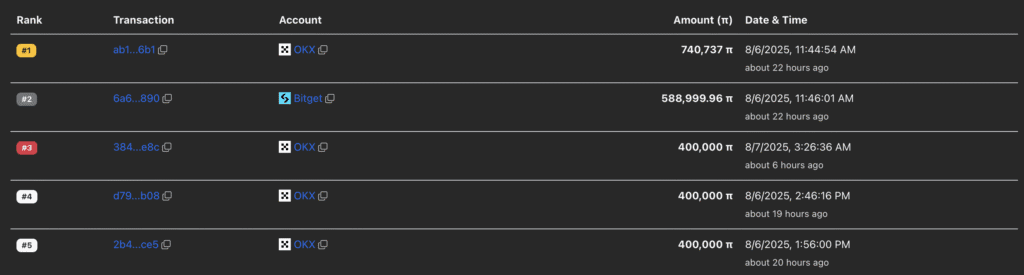

Pi Network (PI) posted a modest 1% gain on Thursday, finding support above the $0.3200 mark. Although the broader trend remains bearish, on-chain data shows large-wallet investors have been accumulating.

PiScan reveals that four of the five biggest recent transactions involved withdrawals from OKX—signaling potential long-term confidence. In total, nearly 1.94 million PI tokens were scooped up by large players over the past 24 hours.

In addition, Pi Network confirmed its partnership with Onramper, Transfi, and Banxa for on-ramp services, allowing users to purchase PI directly. The announcement follows a soft rollout that had been quietly tested over the last month. Despite the big update, price action has so far been muted.

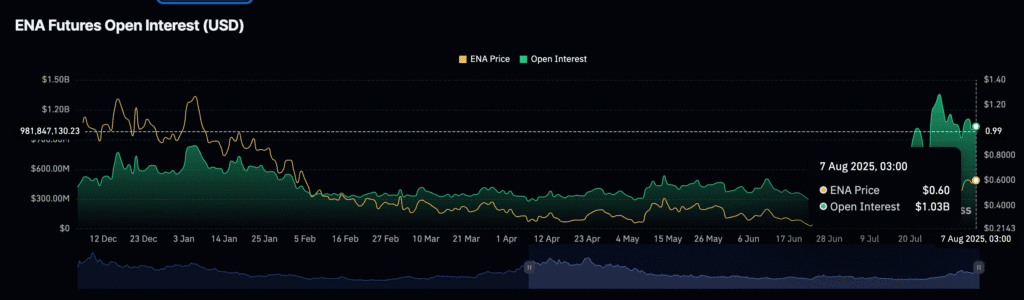

Ethena (ENA) Rallies as Open Interest Returns to $1 Billion Mark

Ethena (ENA) rose over 5% Thursday, climbing to around $0.63, as futures Open Interest rebounded to above $1 billion after briefly dipping to $916 million last week.

According to CoinGlass data, the uptick in Open Interest—combined with a positive funding rate—signals growing trader confidence. The market now eyes resistance at $0.70. If momentum holds, ENA could aim for $1.00 in the near term, fueled by revived demand and reduced bearish pressure.

Trump to Allow Bitcoin and Crypto Assets in 401(k) Retirement Plans

According to Bloomberg, Trump is set to sign an executive order that would allow retirement plans such as 401(k)s to include crypto, private equity, real estate, and other alternative assets.

The move instructs the Department of Labor to relax current fiduciary guidelines that discourage plan administrators from offering these investment options. Bitcoin rallied sharply on the news, anticipating increased demand for digital assets if the order is implemented.

The Day’s Takeaway

North America

- Markets Mixed: U.S. stock indices reversed strong early gains. The NASDAQ eked out a 0.35% gain to a new record close at 21,242.70, while the S&P 500 slipped 0.08% and the Dow dropped 0.51%. The Russell 2000 fell 0.30%.

- Highs before the fade: Dow +305 pts, S&P +44.65 pts, NASDAQ +238.73 pts.

- Treasury Auction Weak: The Treasury sold $25B in 30-year bonds at a high yield of 4.813%, above the WI of 4.792%. The bid-to-cover ratio was 2.27x, below the 6-month average of 2.38x. Weak demand was evident across all buyer categories, with dealers taking 17.5% of the issuance, much higher than usual.

- Labor Data Signals Softening:

- Initial jobless claims: 226K (vs. 221K est.)

- Continuing claims: 1.974M (highest since Nov 2021)

- Weakening employment, alongside elevated inflation, triggered stagflation concerns and increased bets on Fed rate cuts by September.

- Mortgage Rates Fall: The 30-year fixed rate dropped to 6.63%, its lowest level since April, down from 6.72% last week. That still leaves monthly payments up $1,037/month on a median-priced home vs 2021 lows.

- GDPNow Holds: Atlanta Fed’s real-time Q3 GDP estimate stayed at 2.5%, unchanged.

- Consumer Credit: Rose by $7.37B in June, with nonrevolving loans (+$8.4B) driving the increase as credit card balances dipped slightly (-$1.1B).

- Inflation Expectations (NY Fed):

- 1-year ahead: 3.1% (vs. 3.0%)

- 3-year ahead: 3.0%

- 5-year ahead: 2.9% (vs. 3.0%)

- Earnings (Key Highlights):

- The Trade Desk: Revenue beat, adjusted EPS beat, but pretax profit missed.

- Expedia: Beat across the board with strong bookings.

- Block: Missed on EPS, guided to stronger Q4 profit growth.

- Pinterest: Revenue beat, EPS miss; MAUs strong; in-line guidance.

- Twilio: Solid beat and upbeat Q3 outlook.

- BuzzFeed: Small revenue, ongoing net loss, full-year guide intact.

Commodities

- Gold: Rose to $3,385/oz, gaining 0.45% as risk-off sentiment intensified. The rise was fueled by weaker labor data, falling Treasury yields, and new tariffs from Trump on Switzerland, Brazil, and India, reviving stagflation fears.

- Crude Oil: WTI settled at $63.88, down $0.47 or -0.73%. The price briefly broke above its 100-day MA at $64.92 but failed to hold. Key support tested at $63.61.

Europe

- Equities Mostly Higher:

- France CAC: +0.97%

- Germany DAX: +1.11%

- Spain IBEX: +1.06%

- Italy FTSE MIB: +0.93%

- UK FTSE 100: -0.69% — the outlier after the Bank of England cut rates by 25 bps in a split 5-4 vote, signaling a hawkish tilt despite easing.

Crypto

- XRP Breaks Out, Ripple Acquires Rail:

- XRP hit $3.08, pulled back to $3.05, breaking a short-term descending channel.

- Ripple acquired Rail for $200M, aiming to expand stablecoin-powered payments and bolster enterprise adoption through Ripple Payments infrastructure.

- XRP Futures Open Interest: Down 34% from July highs, now averaging $7.23B — showing lackluster speculative interest despite technical breakout.

- Executive Order on 401(k)s: A White House official confirmed Trump will sign an executive order allowing crypto, real estate, and private equity into U.S. 401(k) retirement plans, a move expected to boost institutional crypto legitimacy.