North America News

NASDAQ Leads Wall Street Rally as Apple Soars; Peace Hopes Lift Markets Late

The NASDAQ closed as the day’s top performer, driven by a surge in Apple and late-session optimism over potential peace talks between Russia and Ukraine.

Apple shares surged 5.10% following news of a $100 billion investment in the United States, bringing its total U.S. commitment to $600 billion. In exchange, iPhones and other Apple products shipped from India will be exempt from incoming tariffs, a deal announced in coordination with President Trump.

Markets gained further momentum in the afternoon amid reports Trump may meet with Russian President Putin and Ukrainian President Zelenskiy as early as next week. The prospect of progress in ending the conflict added a risk-on tone across equities.

Not all stocks enjoyed the rally, though. AMD dropped 6.42%, as cautious data center guidance overshadowed a strong earnings beat. Super Micro Computer (SMCI) suffered a deeper hit, falling 18.29% on concerns that rising capital expenditures are eroding profitability.

Nvidia rose a modest 0.65%, lagging the broader NASDAQ ahead of its August 27 earnings. Broadcom gained 2.98%, while Intel tacked on 1.09%, still near its recent lows.

Other top gainers included:

- Shopify (SHOP): +21.64%

- Roblox (RBLX): +5.43%

- Walmart (WMT): +4.32%

- Amazon (AMZN): +3.69%

- Alibaba (BABA): +3.43%

- Tesla (TSLA): +3.26%

- Target (TGT): +3.18%

- Deutsche Bank (DB): +2.89%

- Costco (COST): +2.71%

- Cisco (CSCO): +2.63%

- Palantir (PLTR): +2.55%

Index closing snapshot:

- Dow Jones: +81.38 pts (+0.18%) at 44,193.12

- S&P 500: +45.87 pts (+0.73%) at 6,345.06

- NASDAQ: +252.87 pts (+1.21%) at 21,169.42

- Russell 2000: –4.38 pts (–0.20%) at 2,221.28

Post-close earnings highlights:

- Fortinet (FTNT):

- Q2 revenue: $1.63B (beat)

- Q2 billings: $1.78B

- FY revenue guide: $6.675B–$6.825B

- Adjusted margins: 32%–33.5% operating, 79%–81% gross

- Bumble (BMBL):

- Q2 revenue: $248M (beat)

- Net loss: –$367M, EPS –$2.45

- Paying users down 8.7% YoY to 3.8M

- Booked $398.1M in non-cash impairment charges

- Herbalife (HLF):

- Q2 EPS: $0.48; adjusted EPS: $0.59

- Net income: $49.3M

- DraftKings (DKNG):

- Q2 revenue: $1.51B (beat)

- Net income: $157.9M

- Adjusted EBITDA: $301M

- Virgin Galactic (SPCE):

- Q2 revenue: $406K (miss)

- Net loss: $67.3M

- OpEx: $70.3M

US Treasury Auction: 10-Year Notes See Weak Demand

The U.S. Treasury auctioned off $42 billion in 10-year notes at a high yield of 4.255%, slightly above the when-issued (WI) level of 4.244%. The 1.1 basis point tail highlights soft demand. The bid-to-cover ratio came in at 2.35x, falling below the six-month average of 2.58x.

Breakdown of participation:

- Direct bidders (typically domestic): 19.61% (vs. 16.4% average)

- Indirect bidders (mainly foreign): 64.23% (vs. 72.3% average)

- Primary dealers (required to take the rest): 16.16% (vs. 11.2% average)

Dealers were left with a significantly larger portion than usual, suggesting muted foreign interest. The lackluster demand came despite stablecoin-related buying in the domestic segment.

U.S. MBA Mortgage Applications Rise 3.1%

Mortgage applications in the week ending August 1 climbed 3.1%, reversing the prior week’s decline. The MBA index stood at 253.4, up from 245.7. Purchase activity rose to 158.0, while refi demand reached 777.4. The average 30‑year mortgage rate dropped to 6.77% from 6.83%.

Fed’s Daly: Policy Pivot Likely Coming Soon; Collins, Cook Flag Uncertainty and AI Impact

San Francisco Fed President Mary Daly signaled a policy shift is on the horizon, telling attendees at the Anchorage Economic Summit that waiting for perfect clarity could be a mistake.

“Inflation, absent tariffs, is easing. But the labor market has softened and further slowing would be unwelcome,” Daly said.

She emphasized the Fed will likely need to recalibrate policy in the coming months to reflect risks to growth and employment. Daly echoed other recent Fed voices that say tariffs may not have a lasting inflationary impact, suggesting the central bank could still justify rate cuts even amid new trade measures.

Meanwhile, Boston Fed President Susan Collins emphasized how economic uncertainty is distorting long-term business decisions and pricing strategies. Speaking broadly on financial stability, she warned against ignoring the ripple effects of ambiguity across sectors. Collins, a 2025 voting member, said July’s job data raised concerns and noted big revisions often happen around economic turning points.

Fed Governor Lisa Cook also spoke Wednesday, focusing on AI’s potential impact on the Fed’s dual mandate. Cook noted that AI could enhance productivity and contribute to price stability in the long term. She added that broader uncertainty isn’t slowing down AI adoption across the economy, highlighting that investment and deployment remain strong even in a fragile macro environment.

Fed’s Kashkari: Rate Cuts May Be Needed Soon

Minneapolis Fed President Neel Kashkari stated that rate cuts could be appropriate soon due to signs of a cooling economy.

Key takeaways:

- Two cuts may be justified this year

- Unclear how tariffs will impact inflation

- Tariff effects may take time to materialize

- Wage growth is slowing, pointing to softening labor market

Kashkari emphasized that it may be better to cut now and adjust later than to wait too long and risk falling behind.

Apple To Announce $100 Billion U.S. Investment

President Trump is expected to unveil Apple’s plan to invest an additional $100 billion in the U.S., bringing its total domestic investment to $600 billion.

While this may bolster Apple’s standing amid trade tensions, questions linger. The company still relies heavily on production in India and China—countries targeted by Trump’s tariffs.

Apple stock remains under pressure, trading just below its 100-day moving average ($206.05), last seen around $205.80. Without a rebound above that level, technical sentiment stays cautious.

Trump Advisors Favor Short-Term Fed Appointment

Advisors to President Trump are leaning toward a temporary appointment to the vacant Federal Reserve board seat following the resignation of Governor Kugler.

This approach would buy the administration more time to decide on a longer-term Fed Chair pick.

The favored candidate is expected to have prior government experience and Senate vetting. Meanwhile, Trump continues to criticize the Fed’s independence, calling it “his house”—an institution he aims to reshape with loyalists.

UBS Forecasts Fed to Cut Rates Starting September

UBS Global Wealth Management expects the Federal Reserve to resume rate cuts next month, projecting a total of 100 basis points in easing through early 2026.

UBS says:

- Lower rates typically support equities in non-recessionary periods

- A weaker USD from rate cuts would boost global risk assets

- Despite near-term tariff-related volatility, the equity bull market remains intact

UBS advises investors to stay focused on medium-term opportunities as short-term disruptions fade.

HSBC Lifts S&P 500 Target to 6,400 on AI Momentum

HSBC has raised its year-end 2025 target for the S&P 500 to 6,400, citing a combination of AI-driven earnings growth and diminishing policy uncertainty.

The bank points to two dominant trends:

- AI tailwinds lifting tech-heavy components (50% of the index)

- Reduced trade-policy volatility, providing support to the broader market

HSBC believes strong corporate earnings will continue to surprise to the upside, and expects further market gains as macro headwinds ease.

Fed’s 2025 Jackson Hole Symposium Set for August 21–23

The Federal Reserve Bank of Kansas City has announced the Jackson Hole Economic Policy Symposium will take place August 21–23 this year, under the theme: “Labor Markets in Transition: Demographics, Productivity, and Macroeconomic Policy.”

The annual event is a major gathering of central bankers, economists, government officials, and academics. Roughly 120 attendees are expected, with discussions set to focus on how shifting labor dynamics affect policy frameworks.

Canada, Mexico to Build Joint Work Plan; U.S. Trade Talks Ongoing

Canada’s Foreign Minister says trade negotiations with the U.S. remain constructive, while confirming a new initiative with Mexico to coordinate on supply chains, energy security, and other shared priorities.

The move signals deeper North American integration efforts amid lingering trade tensions and evolving economic strategies across the region.

Commodities News

Oil Closes Below Key Support as Tariffs, Inventories Fail to Spark Bids

Crude futures fell sharply on Wednesday, closing at $64.35 per barrel, down $0.81 or –1.24%, despite bullish inventory data and new geopolitical sanctions.

The decline marks a return below the 100-day moving average ($64.95), a level that had been acting as near-term support. Prices also broke through a swing zone spanning $64.41 to $65.27, with bears now eyeing the May 9 low of $63.61 as the next downside target.

The EIA’s weekly report showed:

- Crude stocks: –3.029M (vs –0.591M expected)

- Gasoline: –1.323M (vs –0.406M expected)

- Distillates: –0.565M (vs +0.775M expected)

- Cushing: +0.453M

Normally, this drawdown—combined with fresh U.S. sanctions and tariffs on India—would offer crude support. But the response was muted. After a brief uptick, prices resumed their decline, signaling a market increasingly focused on surplus fears and softening demand.

The failure to hold key technical support levels adds to the downside risk, reinforcing the view that even geopolitics might not be enough to reverse oil’s current path.

Gold Finds Its Footing as Dollar Softens, But $3,400 Proves Sticky

Gold prices clawed back early losses on Wednesday, trading back up to $3,374, as a retreat in the U.S. Dollar and tame Treasury yields lifted sentiment. The yellow metal remains stuck in a range, with $3,400 proving to be a hard ceiling for now.

The pullback earlier in the session followed a four-day rally, but dip-buying emerged as the Dollar slipped to weekly lows. Markets leaned further into Fed rate cut bets after recent weak labor data and slowing macro signals.

Trump’s renewed tariff push—targeting pharmaceuticals, semiconductors, and imports from India and Russia—also offered indirect support, reinforcing safe-haven demand.

Still, traders remain hesitant to chase gold higher ahead of the next round of inflation and labor data. A September rate cut remains priced in, but any surprises from the Fed could shift that outlook quickly.

Until then, gold likely continues ping-ponging between technical resistance at $3,400 and support zones near $3,340 and $3,300.

US Weekly Crude Inventories: Larger-Than-Expected Draw

According to the EIA, crude oil inventories dropped more than expected last week:

- Crude: -3.029 million (vs. -0.591 million forecast)

- Gasoline: -1.323 million (vs. -0.406 million forecast)

- Distillates: -0.565 million (vs. +0.775 million forecast)

- Cushing: +0.453 million

The draw in inventories reflects stronger demand and refining activity.

US Targets Russia’s Shadow Oil Fleet With New Sanctions

The Trump administration is preparing sanctions aimed at Russia’s hidden oil tanker fleet and the companies that support its operations. This comes alongside new penalties for nations importing Russian oil.

India, in particular, was hit with a 25% tariff increase (raising total tariffs to 50%) as punishment for ongoing purchases of Russian crude. The White House is sending a clear warning: trade with Russia and risk U.S. market access.

Oil prices edged up on the news, with WTI crude trading around $65.75 after bouncing off technical support at the 100-day moving average ($64.96).

In parallel, Trump plans to speak with Ukraine’s President Zelensky, following talks between U.S. envoy Witkoff and Putin. Russia has reportedly responded with cautious optimism, signaling interest in future talks.

Trump Slaps India With 25% Tariff Hike Over Russian Oil

President Trump announced an additional 25% tariff on Indian imports, citing the country’s continued reliance on Russian oil despite U.S. objections. The total duty rate now stands at 50%.

This measure aims to both punish India and redirect its trade flows toward U.S. oil. The broader objective is to squeeze Russia’s energy revenues while boosting American exports.

Oil rose on the announcement, with WTI bouncing off the 100-day moving average ($64.96) and now hovering near $65.68. Key upside resistance levels are at $66.97 and $67.89.

Central Banks Bought Net 22 Tonnes of Gold in June

Central banks added a net 22 tonnes of gold to official reserves in June, bringing H1 net buying to 166 tonnes—still 41% above the 2010–21 quarterly average, though Q2 demand cooled 33% from Q1.

A 2025 WGC survey reveals 95% of reserve managers expect gold holdings to rise over the next year, and 43% plan to increase allocations. Diversification, inflation protection, and geopolitical uncertainty remain strong motives.

Oil Faces Secondary Tariff Risk Supply Uncertainty

Uncertainty persists around U.S. secondary tariffs on buyers of Russian oil, especially India—and possibly China next. If major buyers cut ties, the market could unwind surpluses projected through late 2025, potentially boosting prices if OPEC taps spare capacity. U.S. crude inventories fell 4.2m barrels last week, while gasoline stocks dropped, oil markets await EIA data for confirmation; distillate stock draws are easing bottlenecks.

Gold Technical Views: Eyes on Jobless Claims & CPI

Gold’s upward push since Friday’s weak nonfarm payrolls continues, underpinned by falling real yields and dovish rate repricing. The next data risks are upcoming U.S. jobless claims and CPI figures.

Daily chart: price is nearing $3,438 resistance—a break above would point to fresh highs, while a rejection could bring a pullback toward $3,245 support.

4‑hour chart: range-bound between $3,349 and $3,385.

1‑hour timeframe: buyers eye a push above $3,385, while sellers may target a break below $3,349. Corrections are likely if hawkish surprises emerge.

Shanghai Gold Inventories Surge on Arbitrage Opportunity

Gold holdings at warehouses tied to the Shanghai Futures Exchange have climbed to an all-time high of 36+ tonnes, nearly doubling in a month. The spike reflects aggressive arbitrage by traders capitalizing on the widening spread between elevated futures prices and cheaper spot gold—turning a profit by delivering physical gold into the exchange.

The World Gold Council attributes the buildup to speculative demand fueled by low interest rates in China. However, the broader gold rally has created dislocations: retail jewelry sales in China plunged 45% quarter-over-quarter, even as demand for bars and coins held up. Meanwhile, outflows from gold ETFs suggest investors are favoring equities over safe-haven exposure.

Europe News

European Stocks End Higher, Led by Spain

European markets closed with gains across the board, led by a strong performance from Spain’s Ibex. Final numbers at the close:

- Spain’s Ibex: +0.90%

- Italy’s FTSE MIB: +0.65%

- German DAX: +0.33%

- UK’s FTSE 100: +0.24%

- France’s CAC: +0.18%

Eurozone June Retail Sales Rise 0.3%

Eurostat reported a 0.3% m/m increase in retail sales in June, slightly below expectations for +0.4%, and following a downward revision to May’s –0.3%. Gains were recorded across food, non-food goods, and auto fuel, though the data is dated and less indicative of current trends.

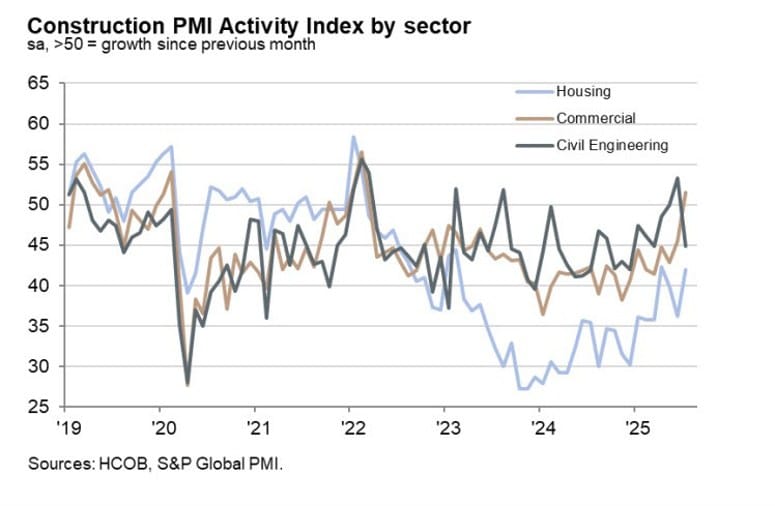

Germany July Construction PMI Rises to 46.3

Germany’s HCOB construction PMI improved to 46.3 in July, up from 44.8, the highest since February 2023 and suggesting a gradual thaw in the construction slump. The recovery is driven by a renewed lift in commercial building activity, although firms continue to trim staffing and order volumes due to a lack of new contracts.

HCOB notes that:

“Germany’s construction sector continues to show signs of recovery, but the sector is not out of the woods yet. The HCOB Construction PMI indicates the highest reading since February 2023 and has improved by roughly four points since the beginning of the year. On the other hand, the sector remains in deep recession, especially when viewed in comparison with the trends in manufacturing and services. Input prices also continue to rise, and overall, this is no cause for celebration. Construction firms share this view, as their business expectations for the next twelve months remain below the expansion threshold.

“The residential and commercial construction sectors showed some signs of recovery, with commercial construction even expanding for the first time since March 2022 and residential construction contracting at a slower pace. However, civil engineering activity left much to be desired in July following its strong performance in June, with activity in this segment shrinking for the first time in three months.

“The outlook for Germany’s construction sector remains bleak. Not only are construction firms themselves not particularly confident, but new orders, employment conditions, and pricing dynamics also remain subdued. According to anecdotal evidence, new orders continued to decline due to high prices and customer hesitation, which particularly affects residential construction. Employment continued to fall in July, marking a continuous decline over the past 40 months. Input prices rose for the fifth month running, though at a rate that was below the long-term average.”

Germany June Industrial Orders Drop 1.0%

Germany’s factory orders contracted by 1.0% in June, missing expectations for a +1.0% gain, despite earlier indications of modest improvement. The slump was driven by a 23.1% drop in transport equipment orders (aircraft, ships, military vehicles), along with new orders in autos (-7.6%) and metal products (-12.9%) that weighed heavily. A bright spot: electrical equipment orders jumped 23.5%. On a year-over-year basis, total orders were up 0.8%, and excluding large, volatile orders, new orders edged up 0.5%, while Q2 orders rose 3.1%.

UK July Construction PMI Collapses to 44.3

The UK’s construction PMI for July plunged to 44.3, sharply missing forecasts of 48.8 and hitting the weakest reading since May 2020. All three subsectors saw volume declines, with residential building suffering the steepest drop, signaling deep contraction in industry activity.

S&P Global notes that:

“Having trended upwards in recent months, our survey data for July signal a fresh setback for the UK construction sector, with total industry activity falling at the sharpest rate since May 2020. Dissecting the latest contraction, we can see a fresh and sharp drop in residential building, as well as an accelerated fall in work carried out on civil engineering projects.

“Forward-looking indicators from the survey imply that UK constructors are preparing for challenging times ahead. They’re buying less materials and reducing the number of workers on the payroll. Expectations also continue to underwhelm, despite a modest pick-up in confidence from June’s two-and-a-half-year low.

“Anecdotally, companies reported a lack of tender opportunities and a hesitancy from customers to commit to projects. Broader themes of uncertainty, both domestically but also internationally, will do little to reignite investment appetites.”

Commerzbank: Swiss Franc May Bounce If U.S. Trade Deal Materializes

Commerzbank believes the Swiss franc could recover modestly if Switzerland manages to reach a trade agreement with the U.S. before Thursday’s deadline. Without a deal, Swiss exports face a 39% U.S. tariff.

Analysts expect Switzerland to offer concessions to avoid the tariff cliff. If successful, the franc could stabilize near EUR/CHF 0.9300. But if talks fail, the currency may come under fresh pressure as trade risks escalate.

Deutsche Bank: BoE Likely to Cut Again, ECB May Be Done

Deutsche Bank expects the Bank of England to lower its benchmark rate by 25 basis points to 4.00% at this week’s meeting. It would be the BoE’s fifth cut this cycle, as policymakers respond to softening demand and declining inflation.

In contrast, Deutsche now sees the European Central Bank on pause, potentially done easing for now. While there’s a small chance of another ECB cut in December or March, it’s unlikely in September, per the bank’s revised outlook.

The divergence in policy paths could see EUR/GBP edge higher, supported by stable eurozone data and more hawkish ECB tones.

Swiss Pres. set to leave Washington without reaching a tariff deal

- Fails to make a deal from the 39% tariff rate currently being charged to Swiss exports into the US

The Swiss president is leaving Washington without a tariff deal.Recall, the Trump administration set the Switzerland tariff rate at 39%. Trump said that Switzerland’s $40 billion trade deficit is too big.

Swiss exports of watches, chocolate, machinery, and other non-pharma items face a major cost penalty entering the U.S., likely reducing competitiveness and hindering trade flows

Asia-Pacific & World News

Nvidia Rejects U.S. AI Chip Backdoor Plan

Nvidia has again refused U.S. proposals to integrate tracking or kill-switch features in its AI chips exported abroad, citing severe cybersecurity risks. In a dual-language blog post, the company warned that any such backdoor would represent a vulnerability exploitable by malicious actors.

The company emphasized that its current chips contain no hidden access points and that building them in would undermine global trust in American technology. The post follows a request from China for clarification on potential U.S. export rules mandating location verification. While no rules are in place yet, the debate remains active.

DOJ Charges Californians Over Illegal Nvidia Chip Exports to China

Two individuals have been indicted for illegally exporting Nvidia’s restricted H100 AI chips to China in violation of U.S. export controls. The DOJ alleges they used ALX Solutions, a California-based company established after chip export bans began, to send tens of millions in processors through Singapore and Malaysia before final delivery to China.

The H100s are subject to tight controls due to their strategic value in AI development. The case comes amid broader concerns that over $1B in restricted chips may have entered China despite U.S. restrictions.

Chile’s Central Bank to Start Gradual Dollar Buying Program

Banco Central de Chile will begin daily purchases of USD 25 million starting August 8, aiming to gradually build reserves while phasing out foreign credit lines.

Key details:

- Goal: accumulate $18.5 billion over 3 years

- All purchases will be sterilized via central bank notes to avoid peso liquidity shocks

- Program reviewed semi-annually, with room for adjustments if market conditions shift

This move supports the bank’s long-term financial stability and reserve diversification strategy.

PBOC sets USD/ CNY mid-point today at 7.1409 (vs. estimate at 7.1797)

- PBOC CNY reference rate setting for the trading session ahead.

PBOC injected 138.5bn yuan via 7-day reverse repos at 1.40%

- 309bn yuan mature today

- net 170.5bn yuan drain

Australia Construction Activity Improves, But Manufacturing Stays Weak

Australia’s AIG Construction Index improved to -1.3 in July, recovering from June’s -14.9. The data suggests construction is stabilizing, though still slightly in contraction.

Meanwhile, the AIG Manufacturing Index remained deeply negative at -23.9, though up from -29.3 previously. The sector continues to struggle, reflecting weak new orders and pressure from input costs.

New Zealand Unemployment Rises to 5.2% in Q2

New Zealand’s jobless rate ticked up to 5.2% in Q2, slightly below expectations of 5.3%, but up from 5.1% in the previous quarter.

Breakdown:

- Employment change (QoQ): -0.1% (in line with forecasts)

- Labor Cost Index (YoY): 2.2% (missed 2.3% estimate)

- Participation rate: fell to 70.5% from 70.8%

Overall, the labor market is showing signs of softness, with flat job creation and easing wage pressure.

Japan Wages Climb, But Inflation Still Outpaces Pay

Japan’s nominal cash earnings rose 2.5% y/y in June, falling short of forecasts (3.1%). More importantly, real wages declined 1.3%, marking the sixth consecutive monthly drop after adjusting for inflation.

Same-sample base earnings, which offer a cleaner view of wage growth trends by tracking the same companies over time, rose 3.0%. However, purchasing power continues to erode, underscoring the challenges in translating nominal wage gains into real household income improvements.

HSBC: Yen Faces More Weakness as BoJ Likely to Wait

HSBC anticipates further yen depreciation, citing ongoing divergence between Japanese and U.S. monetary policy. While the Bank of Japan may raise rates by 25bp in October, analysts believe the central bank may wait for the Federal Reserve to act first.

Key reasons for the bearish JPY view:

- USD/JPY remains sensitive to strong U.S. data and Fed hawkishness

- JPY is tracking weak Japanese bond yields

- Political uncertainty in Japan could tilt the LDP toward looser policy

These combined pressures are keeping the yen vulnerable in the near term.

Japan’s Taro Kono Calls for Rate Hikes to Boost Yen

LDP politician Taro Kono renewed calls for the Bank of Japan to raise interest rates, saying stronger policy action is needed to address the yen’s persistent weakness. Speaking at a press conference, Kono highlighted how the yen’s depreciation against the dollar has contributed to rising domestic prices through cost-push inflation.

Kono has been urging the BOJ to tighten policy since mid-2024.

South Korea in Talks to Exit U.S. Currency Watchlist

South Korea is engaging with U.S. financial regulators to restore its removal from the U.S. Treasury’s currency manipulation watchlist. First added in 2016, removed in late 2023, and reinstated in November 2024 due to ongoing trade and current account surpluses, South Korea is now seeking a resolution as part of broader trade negotiations with Washington.

It emphasized that in principle, exchange rates should be market-determined, with no specific FX target in mind. Success in trade talks could help resolve the currency classification issue.

Crypto Market Pulse

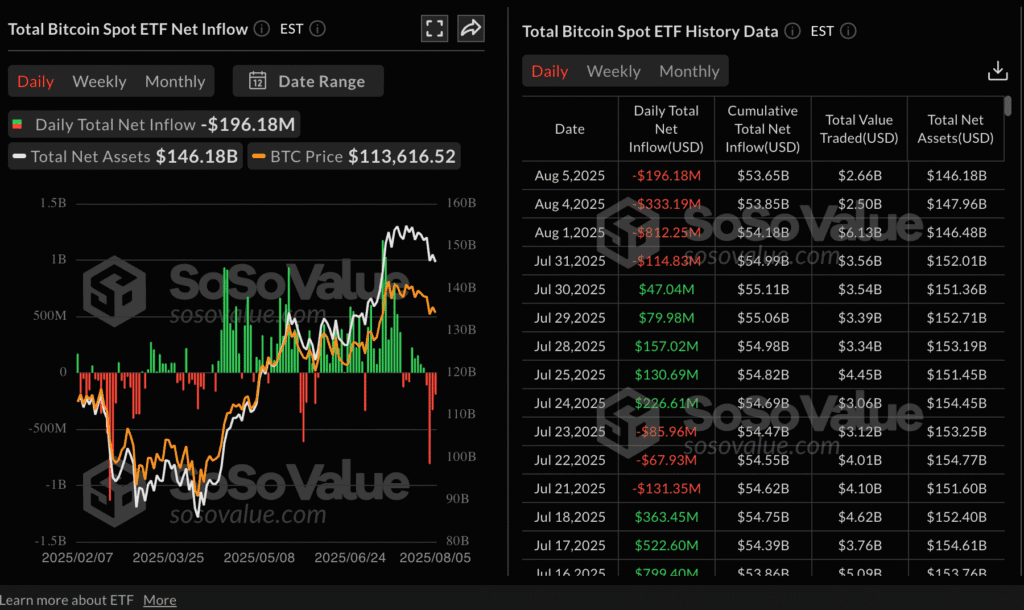

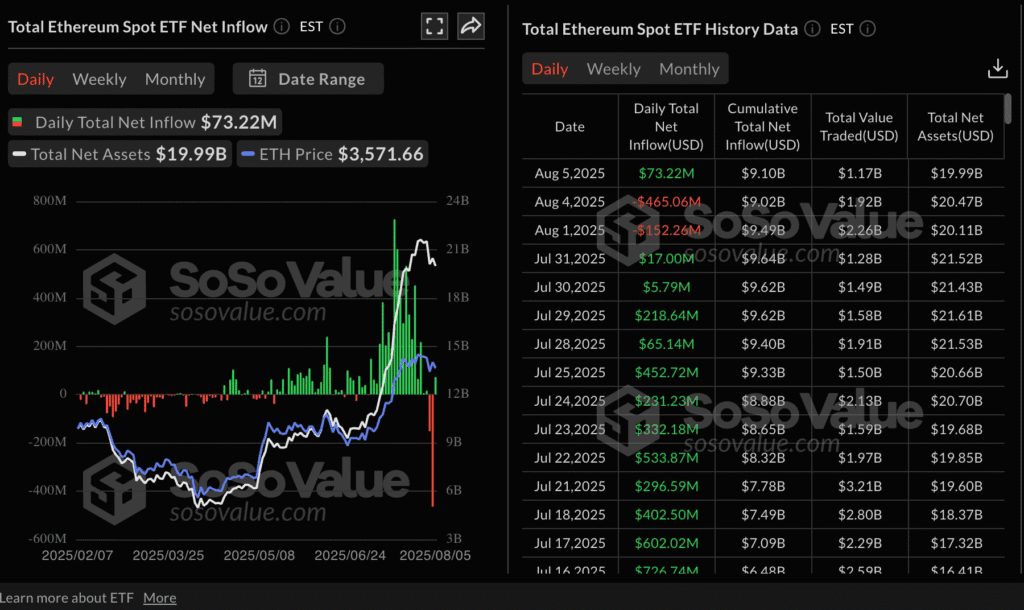

Bitcoin and XRP Unmoved by ETF Filings as Ethereum Sees Inflows

Bitcoin hovers around $114,000 as Japan’s SBI Holdings files for Bitcoin and XRP ETFs. Despite the move, BTC and XRP prices remain sluggish amid macroeconomic concerns.

Ethereum holds above $3,600, buoyed by $73 million in ETF inflows on Tuesday. That follows a massive outflow of $465 million the day before.

Altcoin outlook:

- ETH: Buy signals triggered by MACD and SuperTrend indicators point toward a potential run to $4,000. Key support lies between $3,500–$3,620.

- XRP: Price continues downward, now below $3.00. Bearish targets include $2.80, $2.60, and $2.35 based on EMA levels.

No U.S.-listed crypto ETFs saw inflows Tuesday. Fidelity’s FBTC led with $99 million in outflows.

Nomura’s Laser Digital Approved for Crypto Derivatives in Dubai

Laser Digital, a crypto unit of Japan’s Nomura, secured regulatory clearance from Dubai’s VARA to offer over-the-counter (OTC) crypto derivatives.

The firm becomes the first licensed player to offer client-facing crypto options in Dubai under this framework. Products will include mid-dated options based on major tokens and will be executed via ISDA agreements.

The approval underscores Dubai’s growing status as a crypto hub, drawing institutional players with its transparent yet flexible regulatory model.

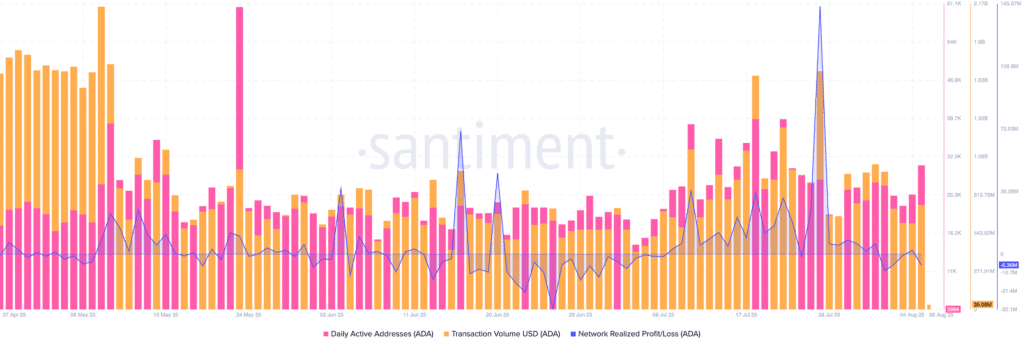

Cardano (ADA) Traders Reduce Exposure as Activity Slows

ADA is down nearly 2%, trading within a descending channel. On-chain activity has cooled—transaction volume has fallen from $1.69B to $744M, despite daily active addresses rising to ~31,000. Large holders are trimming positions, increasing supply pressure and dampening recovery prospects.

Stellar (XLM) Technical Weakness Builds

XLM is down nearly 2%, trading inside a descending channel on the 4‑hour chart. Open interest has decreased 9% to approximately $309M, while short positions have climbed to 54.26%, indicating rising bearish sentiment and potentially deeper downside ahead.

Hyperliquid (HYPE) Momentum Falters, Bears Aim below $30

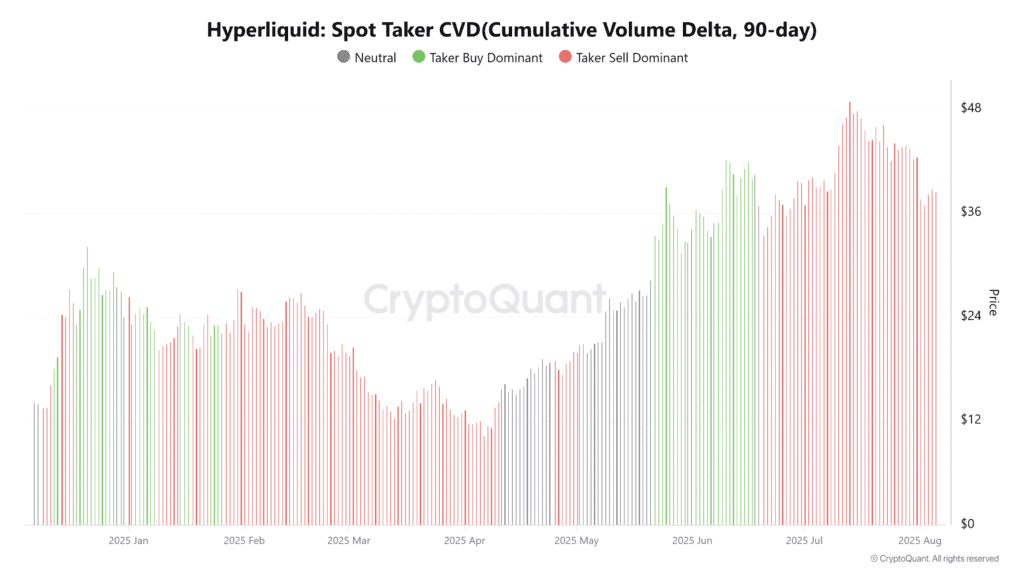

HYPE trades around $37.50, failing to break resistance and showing bearish trend continuation. On-chain metrics confirm selling pressure: the Spot Taker CVD is negative, and short activity is at a one-month high. Bears target levels below $30 if downside momentum persists.

Toncoin (TON) Pullback Pressures 50-Day EMA

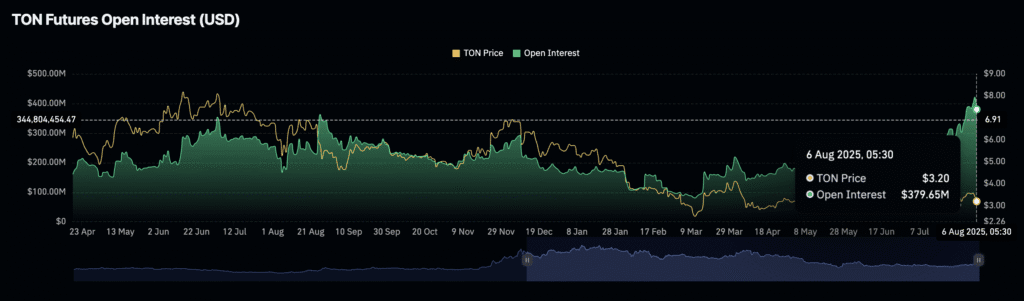

Toncoin has dropped over 10% in two days, touching its 50‑day EMA (~$3.18). Open interest fell 10% to $379.65M, while the MACD shows a bearish crossover. Traders’ reduced confidence and technical signals point to further downside risk unless support holds.

The Day’s Takeaway

North America

Stocks Rise, NASDAQ Leads Gains

U.S. equities closed higher across the board, with the NASDAQ outperforming thanks to strength in megacaps and tech names.

- NASDAQ: +1.21%

- S&P 500: +0.73%

- Dow: +0.18%

- Russell 2000: –0.20%

Apple soared 5.10% on news of a $100B investment in the U.S., bringing its total to $600B. In exchange, Apple devices imported from India will be exempt from tariffs. This marked a rare shift in investor sentiment back toward the stock, which had lagged in recent months.

Late in the day, stocks got an additional boost from reports that President Trump may meet with Putin and Zelenskiy next week to discuss a potential Russia–Ukraine peace deal.

Not all tech names rallied:

- AMD dropped 6.42% on data center concerns despite beating earnings.

- Super Micro (SMCI) collapsed 18.29% after earnings revealed rising capital costs were hurting margins.

- Nvidia inched up 0.65%, with earnings set for August 27.

Winners on the day included:

- Shopify: +21.64%

- Roblox: +5.43%

- Walmart: +4.32%

- Amazon: +3.69%

- Alibaba: +3.43%

- Tesla: +3.26%

- Target: +3.18%

- Costco, Palantir, Cisco, Deutsche Bank: +2.5%–3%

Post-close earnings:

- Fortinet beat revenue and guided inline.

- DraftKings beat across the board with $157.9M net income.

- Bumble beat top-line but reported a $367M net loss.

- Virgin Galactic missed badly, with just $406K in revenue.

Federal Reserve Signals Policy Shift

Fed officials sent a coordinated message that policy easing is likely coming soon.

- Fed’s Daly: “Policy will likely need to adjust in coming months.” She said the labor market is softening and warned against waiting for perfect clarity.

- Fed’s Collins emphasized how uncertainty is delaying price-setting and investments, especially in long-term projects.

- Fed’s Cook highlighted how AI will influence both sides of the Fed’s mandate, saying it could help achieve price stability.

Commodities

Oil Sinks Despite Bullish Inventories, Tariff Sanctions

- WTI Crude settled at $64.35, down $0.81 (–1.24%)

- EIA report showed a bullish –3.029M draw in crude inventories

- Gasoline: –1.323M | Distillates: –0.565M | Cushing: +0.453M

Despite tighter inventory data and new 25% tariffs on India for buying Russian oil, crude fell below its 100-day moving average. That break is now a key technical risk level. Sellers are in control unless oil reclaims $64.95.

The market is pricing in weaker global demand, shrugging off geopolitical tailwinds from U.S. sanctions targeting Russia’s covert oil fleet and Indian imports.

Gold Holds Gains as Dollar Softens, Traders Eye Fed

- Gold settled near $3,374, bouncing off intraday lows on a weaker USD

- Price remains capped below $3,400 resistance, rangebound for now

- Fed rate cut bets and global tariff risks continue to support the metal

Gold remains a battle between policy-driven optimism and profit-taking at highs. Traders are hesitant to take large positions ahead of U.S. jobless claims and CPI.

Trump Targets Russia’s Oil Network, Raises Pressure on Allies

The Trump administration is set to sanction Russia’s covert oil tanker fleet, along with entities that enable their operations. This comes after raising tariffs on Indian imports by 25% as punishment for Russian oil purchases.

The White House aims to cut off Moscow’s oil cash flow while warning partners: keep trading with Russia, and your exports to the U.S. will suffer.

Europe

Equities Close Higher, Spain Leads Gains

European markets ended the session in positive territory:

- Germany DAX: +0.33%

- France CAC: +0.18%

- UK FTSE 100: +0.24%

- Spain IBEX: +0.90%

- Italy FTSE MIB: +0.65%

Germany’s economic data remained mixed:

- Industrial orders (June): –1.0% vs. +1.0% expected

- Construction PMI (July): 46.3, highest since Feb 2023

UK construction PMI disappointed, falling to 44.3, the weakest since May 2020.

Eurozone retail sales (June): +0.3% m/m (missed estimate of +0.4%) but improved from prior –0.3% after revision.

Asia

South Korea Looks to Exit U.S. Currency Manipulator List

South Korea confirmed it is in talks with U.S. officials to resolve its currency manipulation status. Seoul reiterated that FX rates should be market-driven. Korea was dropped from the watchlist in 2023 but reinstated in 2024.

The move comes as South Korea finalizes a new trade framework with the U.S., and it hopes resolving this FX issue will help solidify bilateral economic ties.

Crypto

Mixed Signals in Crypto as Regulatory Developments Diverge

- Bitcoin: Holding near $114,000

- Ethereum: Stable above $3,600

- XRP: Slipped below $3.00

- ETH spot ETF inflows: $73M Tuesday

- BTC spot ETF outflows: $196M total; Fidelity, BlackRock, Grayscale all negative

SBI Holdings (Japan) filed with regulators to launch Bitcoin and XRP ETFs, signaling growing institutional demand despite little reaction in prices.

Laser Digital (Nomura-backed) received Dubai regulatory approval to offer direct OTC crypto derivatives under the VARA framework.

Altcoin pressure deepens:

- XLM: Continues falling channel, OI down 9%, shorts rising

- Hyperliquid (HYPE): Falls to $37.50, short positions at 1-month high

- TON: Down 10% in two days, OI down 10%, MACD flashes sell

- ADA (Cardano): Drops 2%, whales selling, volume slowing after July 25 profit booking