North America News

U.S. Stocks Slip Ahead of Fed Decision as Record Run Pauses

Major U.S. equity indices pulled back Tuesday, breaking a string of record closes as investors adopted a more cautious stance ahead of several high-stakes events. The S&P 500 and NASDAQ both touched fresh intraday highs early in the session but gave up gains into the close. The Dow and Russell 2000 led the downside.

Closing Snapshot:

- Dow Jones: -204.57 pts (-0.46%) to 44,632.99

- S&P 500: -18.91 pts (-0.30%) to 6,370.86

- NASDAQ: -80.29 pts (-0.30%) to 21,098.29

- Russell 2000: -13.76 pts (-0.61%) to 2,242.96

The pullback comes ahead of several market-moving events: the Fed’s policy announcement Wednesday, Thursday’s GDP report, and Friday’s nonfarm payrolls. Big tech earnings from Amazon, Apple, Microsoft, and Meta are also in focus this week.

Notable Decliners:

- Whirlpool (WHR): -13.43% on disappointing results.

- PayPal (PYPL): -8.68% amid fintech weakness.

- Rivian (RIVN): -5.23% as EV sector pressure persists.

- Palo Alto Networks (PANW): -5.19% despite strong industry demand.

- Boeing (BA): -4.30% — better earnings, but traders sold the news.

Post-Close Earnings Movers:

- EA (Electronic Arts): Beat on earnings and revenue, but shares fell -1.62%.

- Visa (V): Strong beat, yet shares slid -3.07%.

- Seagate (STX): EPS and revenue beat, but stock dropped -7.67%.

- Starbucks (SBUX): Missed on EPS, beat on revenue, shares rose +4.48%.

- Booking Holdings (BKNG): Beat on both lines, still down -2.52%.

Macro & Market Drivers

Fed Policy in Focus:

After six straight record closes for the S&P 500, stocks are consolidating as investors await Wednesday’s Fed rate decision and guidance from Chair Powell. Treasuries saw modest gains as risk appetite faded.

US-EU Trade Deal Completed:

The finalized agreement between the U.S. and EU reduced tariff fears, with a 15% rate lower than expected. While energy stocks stand to benefit most, broader markets already priced in much of the optimism, leading to a muted response.

China Trade Watch:

Markets are also watching for developments from U.S.–China talks. Traders expect a formal agreement could result in “sell the news” action similar to what followed the EU deal.

Earnings in Focus:

- Boeing (BA): Investors want clarity on production and deliveries.

- Procter & Gamble (PG): Seen as a bellwether for consumer demand trends.

- Starbucks (SBUX): International performance and China exposure remain key questions.

Sector Watch:

- Energy: Likely winners from the EU trade deal as U.S. exports increase.

- Technology: Remains resilient but sensitive to rates and macro news.

- Defensive Stocks: P&G and peers could shape sentiment for staples this week.

Strategy Notes:

- A “sell the news” pattern continues as investors lock in gains following anticipated positive developments.

- Rate-sensitive sectors like housing, tech, and financials could swing sharply if Powell’s messaging surprises.

U.S. Treasury’s $44B 7-Year Note Auction Sees Strong Domestic Demand

The Treasury sold $44 billion in 7-year notes on Tuesday at a high yield of 4.092%, below the 4.118% when-issued (WI) level. The auction saw robust participation from direct bidders.

Auction stats:

- Bid-to-cover ratio: 2.79x (vs 6-month avg of 2.6x)

- Directs: 33.68% (vs avg 22.5%)

- Indirects: 62.26% (below avg of 67.0%)

- Dealers: 4.06% (far below the typical 10.5%)

While foreign participation was lighter than usual, strong domestic buying offset the shortfall, leaving dealers with minimal leftover inventory.

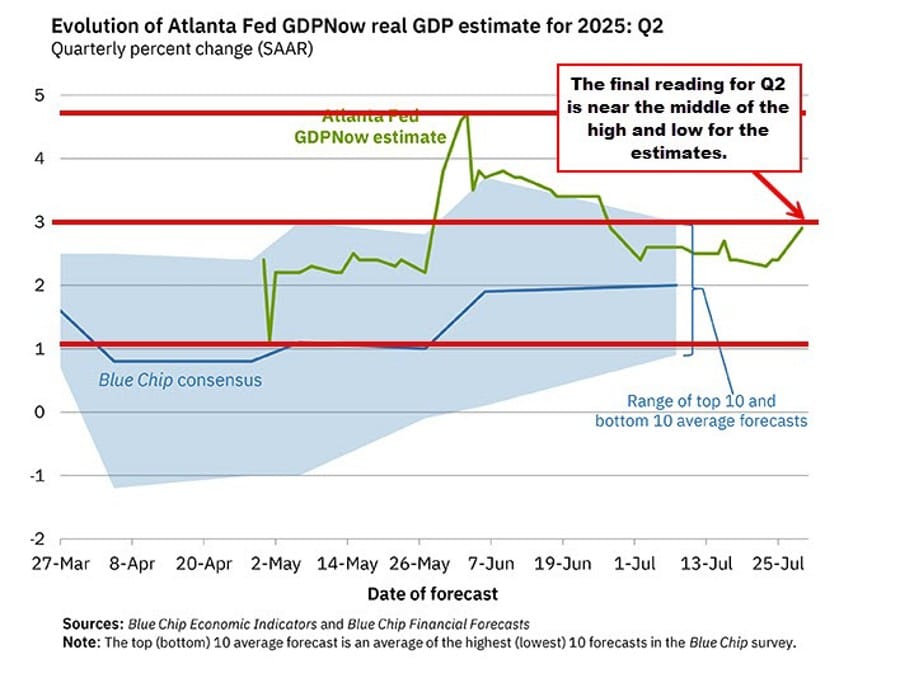

Atlanta Fed GDPNow Raises Q2 Forecast to 2.9%

The Atlanta Fed’s final GDPNow forecast for Q2 growth stands at 2.9%, up from its prior 2.4% estimate. The official advance GDP figure for the second quarter is set to be released tomorrow at 8:30 a.m. ET.

In their own words:

The final GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the second quarter of 2025 is 2.9 percent on July 29, up from 2.4 percent on July 25. After this morning’s Advance Economic Indicators report from the US Census Bureau, a decline in the nowcast of real gross private domestic investment growth from -11.7 percent to -12.7 percent was more than offset by an increase in the nowcast of the contribution of net exports to real GDP growth from 3.31 percentage points to 4.04 percentage points.

U.S. Consumer Confidence Surges in July

Consumer sentiment in the U.S. rebounded in July, with the Conference Board’s index rising to 97.2, beating expectations of 95.0. The prior month was revised up to 95.2 from 93.0.

- Present Situation Index: 131.5 (vs 129.1 prior)

- Expectations Index: 74.4 (vs 69.0 prior)

- 1-year inflation expectations: 5.8% (down from 6.0%)

The upbeat reading signals stronger confidence in both current and future economic conditions despite persistent inflation.

Stephanie Guichard, Senior Economist, Global Indicators at The Conference Board said: “Consumer confidence has stabilized since May, rebounding from April’s plunge, but remains below last year’s heady levels.

“In July, pessimism about the future receded somewhat, leading to a slight improvement in overall confidence. All three components of the Expectation Index improved, with consumers feeling less pessimistic about future business conditions and employment, and more optimistic about future income.

“Meanwhile, consumers’ assessment of the present situation was little changed. They were a tad more positive about current business conditions in July than in June. However, their appraisal of current job availability weakened for the seventh consecutive month, reaching its lowest level since March 2021. Notably, 18.9% of consumers indicated that jobs were hard to get in July, up from 14.5% in January.”

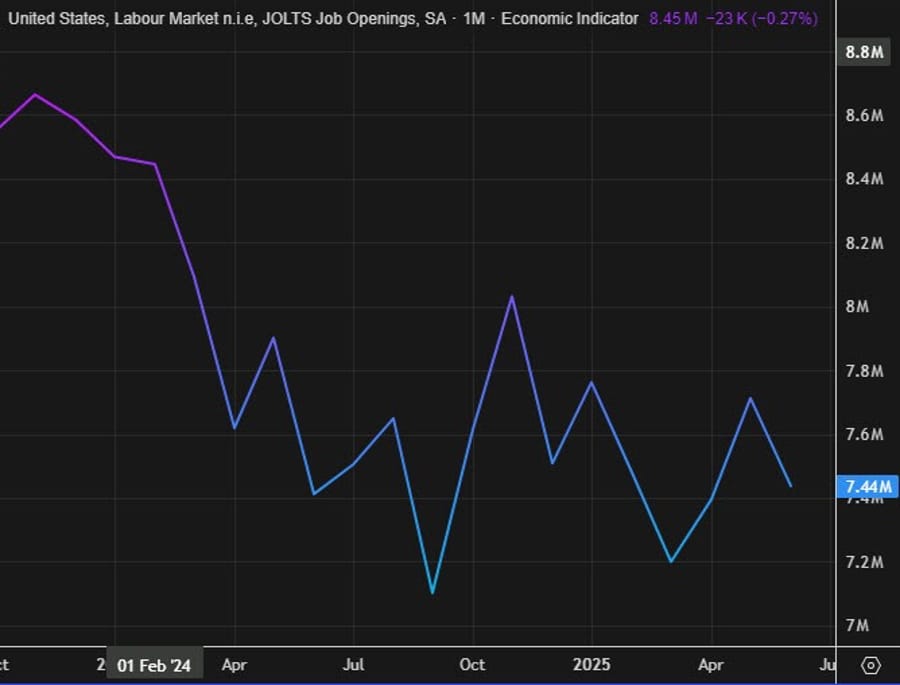

U.S. Job Openings Drop to 7.437 Million in June

Job openings in the U.S. fell to 7.437 million in June, missing the 7.5 million estimate and hitting the lowest level since April. The vacancy rate declined to 4.4% from 4.6%.

Key Labor Metrics:

- Hires: 5.2M (unchanged)

- Quits: 3.1M, or 2.0% (down from 2.1%)

- Layoffs/Discharges: 1.6M (flat)

- Separations: 5.1M total

Sectors such as government education and professional services saw notable declines in voluntary quits, hinting at growing worker caution.

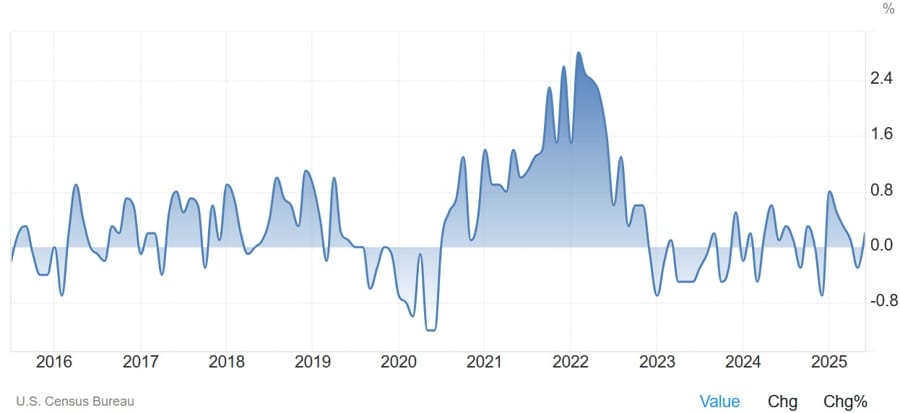

U.S. Goods Trade Deficit Narrows Sharply in June

The U.S. goods trade deficit narrowed to $85.99 billion in June, well below the expected $98.2 billion and a sharp improvement from May’s $96.42 billion. The contraction was driven largely by a steep drop in imports, which fell $11.5 billion to $264.2 billion. Exports edged down slightly by $1.1 billion to $178.2 billion.

Every major import category posted a decline, suggesting that tariffs are beginning to reshape purchasing behavior and dampen demand for foreign goods. Some of the dip may also reflect preemptive stockpiling ahead of tariff hikes. On the export side, nearly all categories showed gains—except industrial supplies, which slumped 8.65% (-$5.7B).

Key Data Breakdown:

- Trade balance change: +$10.44B (less negative, -10.83%)

- Exports: -0.61% overall

- Industrial supplies: -8.65%

- Consumer goods: +1.42%

- Imports: -4.06% overall

- Industrial supplies: -5.60%

- Consumer goods: -3.11%

Case-Shiller Index Shows Home Price Dip in May, Growth Diverging Sharply by City

The S&P CoreLogic Case-Shiller index for the 20 largest U.S. cities declined 0.3% in May (seasonally adjusted), worse than the -0.2% forecast. The year-over-year growth rate fell to 2.8%, down from 3.4% in April.

Regional Highlights:

- New York led with +7.4% YoY, followed by Chicago (+6.1%) and Detroit (+4.9%).

- Tampa was the weakest, down -2.4% YoY — its 7th consecutive annual decline.

- San Francisco turned negative YoY at -0.6%, joining other weak West Coast markets.

Momentum Slowing:

- Only four cities — Cleveland, Minneapolis, Charlotte, and Tampa — showed monthly acceleration.

- National home price momentum has stalled amid tight lending, low sales volume, and affordability issues.

Monthly Changes by City (MoM / YoY):

- Atlanta: +0.56% / +1.70%

- Boston: +1.31% / +4.64%

- Charlotte: +1.08% / +2.55%

- Chicago: +1.22% / +6.10%

- Cleveland: +1.42% / +4.82%

- Dallas: +0.73% / +0.61%

- Denver: +0.15% / -0.01%

- Detroit: +1.08% / +4.91%

- Las Vegas: +0.44% / +3.30%

- Los Angeles: +0.11% / +1.10%

- Miami: -0.12% / +0.59%

- Minneapolis: +0.36% / +2.55%

- New York: +0.49% / +7.40%

- Phoenix: +0.20% / +0.90%

- Portland: +0.56% / +0.74%

- San Diego: +0.09% / +0.40%

- San Francisco: -0.05% / -0.64%

- Seattle: +0.12% / +0.37%

- Tampa: +0.52% / -2.42%

- Washington: +0.70% / +3.26%

U.S. Home Prices Slip in May, YoY Growth Slows

According to FHFA data, U.S. home prices dropped 0.2% in May, after falling 0.3% the month before. Year-over-year price growth slowed to 2.8%, down from 3.2% in April. The home price index slipped to 434.4 from 435.1.

U.S. Wholesale Inventories Post Small June Gain

Advance data for June shows U.S. wholesale inventories rising 0.2%, reversing the 0.3% decline recorded in May. Retail inventories excluding autos were flat on the month, down from an initially reported +0.2%, later revised to +0.1%.

Lutnick: The EU deal was a Masterclass by Pres. Trump

- The Commerce Secretary speaks on the CNBC

- The EU trade deal was a Masterclass by Pres. Trump

- EU Committed to $750 million of energy purchases. 15% tariffs

- US now has an open market to the 20 trillion European market 235

- EU has a $235B every year, and Europe buys America.

- EU can onshore to get rid of the trade deal or pay tariffs

- The key of the deal was autos and pharmaceuticals. If you are going to sell in the US, you are going to produce here.

- Trump will come out with a new pharmaceutical plan that if you are going to produce and send pharmaceuticals to the US, you will produce them in the United States. The EU got ahead by agreeing to pay 15%.

- There is plenty of horse trading still to do. Digital services will be on the table. Steel and aluminum also on the table

- Trump accepts that natural resources won’t face tariffs.

- With other countries, need completely open markets.

- Deals are on the table for Trump to consider but he can just set the price.

- Trump decides if he wants to do a deal or not do a deal.

- China is a separate deal. We are going to have things done by Friday.

Earnings Week: Key Reports Coming from Tech Giants

Markets are gearing up for a major wave of earnings this week, with several heavyweight tech companies set to report:

Tuesday (pre-market):

- Boeing

- Spotify

- PayPal

- UnitedHealth Group

Tuesday (post-market):

- Visa

- Starbucks

Wednesday (post-market):

- Microsoft

- Meta

- Qualcomm

- Ford

Thursday (post-market):

- Apple

- Amazon

- Mastercard

Friday (pre-market):

- Exxon Mobil

- Chevron

Investors are watching closely for signs of momentum — or warnings — as macroeconomic uncertainty continues to swirl.

USTR: Tariff Pause Not Final—Trump Holds Decision

Following the conclusion of the U.S.–China trade meetings, U.S. Trade Representative Jamieson Greer and Treasury Secretary Scott Bessent addressed reporters, outlining several unresolved issues.

Highlights from USTR Greer:

- Discussions on tariff suspension are ongoing; a 90-day extension remains a leading option.

- No agreement was reached on altering export controls.

- The U.S. is focused on enforcement, including ensuring rare earth magnets continue to flow.

Bessent added:

- Final decision on extending the August 12 tariff pause lies with President Trump, who will be briefed in the Oval Office tomorrow.

- Expressed frustration over China’s oil imports from Iran, which were not resolved during this round.

- Described the overall tone as “very constructive,” saying talks have grown “more engaged” from Geneva to London to Stockholm.

He also mentioned:

- Trump received an invitation to visit China during a recent call with Xi.

- On secondary tariffs tied to Russian oil, Bessent warned China could face penalties if purchases persist.

Despite positive language, the decision still hinges on Trump’s final word—whether he opts for further diplomacy or plays hardball on tariffs.

Oppenheimer Lifts S&P 500 Year-End Target to 7,100

Oppenheimer has increased its S&P 500 forecast for the end of the year to 7,100, up from its earlier call of 5,950.

The firm continues to expect 2025 earnings of $275 per share, implying a forward P/E ratio of 25.8. Its outlook is buoyed by strong Q2 earnings (84% of companies beat forecasts), new trade deals with Japan and the EU, and the Fed’s success in cooling inflation from 9% to 2.7% without triggering a recession.

U.S. Treasury Now Expects to Borrow $1 Trillion in Q3

The U.S. Treasury has significantly raised its Q3 borrowing forecast, now estimating $1.01 trillion in new debt — nearly double the $554 billion projected in April.

The spike comes after the debt ceiling suspension, which lifted borrowing limits by $5 trillion. The Treasury aims to rebuild its cash reserves to $850 billion by the end of September.

Q4 borrowing is expected to taper to $590 billion. Tariff revenue is helping offset some of the need, though weaker corporate tax collections are a concern. Further details on bond auctions are due Wednesday.

Fed Split Into Three Camps Ahead of Key Rate Decision

Federal Reserve officials are no longer in lockstep. According to a Wall Street Journal preview by Nick Timiraos, policymakers are divided over whether to resume rate cuts — just not this week.

The internal disagreement now hinges on what kind of economic evidence should trigger a move. While earlier unity came from pausing cuts amid inflation fears linked to tariffs, milder-than-expected price spikes and signs of a cooling labor market have fractured the consensus into three camps.

The spotlight will be on Fed Chair Jerome Powell’s press conference Wednesday, where markets will look for any signal about the path ahead, including the potential for a September cut.

Morgan Stanley Sees S&P 500 Hitting 7,200 Amid Earnings Rebound

Morgan Stanley has reaffirmed its bullish stance on U.S. equities, projecting the S&P 500 will reach 7,200 within the next 12 months — a 12% rise from current levels. Chief Investment Officer Michael Wilson attributes this to a “rolling recovery” in corporate earnings.

Supporting factors include:

- Improving operating margins,

- Accelerating AI adoption,

- Dollar weakness,

- Tax benefits from the One Big Beautiful Bill Act,

- Favorable year-over-year comps,

- Rebounding consumer demand,

- And likely Fed rate cuts by early 2026.

The bank views April’s selloff, sparked by Trump’s tariff announcements, as the final leg of the earnings downturn. Valuations may be high, but Morgan Stanley says they’re justified by improving fundamentals and reduced economic uncertainty, including new U.S.-EU trade deals.

Berkshire Trims Long-Held Stake in VeriSign, Nets $1.23 Billion

Berkshire Hathaway has offloaded roughly one-third of its stake in VeriSign, selling 4.3 million shares at $285 apiece and reducing its position from 14.2% to 9.6%.

This marks a rare retreat from a position Berkshire has held since 2012. Despite purchasing more shares as recently as January, the firm is now below the 10% threshold, potentially paving the way for additional sales. VeriSign itself did not benefit financially from the divestment but noted that Berkshire could sell another 515,000 shares in response to investor demand.

The move comes as Berkshire finished Q1 with a record $347.7 billion in cash and has now been a net equity seller for ten straight quarters.

Commodities News

API Survey Shows Surprise Crude Build Ahead of Official Report

Private oil inventory data released Tuesday evening showed a surprise crude build, defying analyst expectations for a drawdown. The figures come ahead of the official EIA report due Wednesday morning.

API Inventory Estimates:

- Crude Oil: +1.539 million barrels (vs expected -2.5M draw)

- Gasoline: -1.739 million barrels

- Distillates: +4.189 million barrels

- Cushing: +465,000 barrels

- Strategic Petroleum Reserve (SPR): +200,000 barrels

The unexpected rise in crude stocks may temper bullish sentiment, especially with crude prices already climbing due to geopolitical risk and sanction threats on Russian oil.

Oil Prices Jump as Trump Threatens Russian Crude Sanctions

Crude oil surged on Tuesday as President Trump reiterated that new sanctions on Russian oil could take effect within 10 days. He also warned that countries continuing to buy Russian crude may face steep tariffs.

Market reaction:

- WTI crude jumped $2.50, closing at $69.21, up 3.75% on the day.

- Price cleared the 200-day moving average at $67.97 and peaked intraday at $69.41, just shy of the key resistance level of $69.61.

The threat of removing Russian barrels from the global market is fueling a renewed risk premium in oil, especially with global inventories tightening and uncertainty over secondary tariffs rising.

TDS: Gold Selling May Have Peaked as CTA Pressure Eases

TD Securities believes gold could be nearing a bottom as recent selling—mainly driven by commodity trading advisors (CTAs)—shows signs of exhaustion. CTA selling is expected to halt unless gold drops below $3,040/oz, providing a wide buffer for a rebound.

Senior strategist Daniel Ghali says that most of the recent liquidation in Chinese ETFs has also subsided, and while discretionary traders remain net short, their exposure is shrinking. The current technical setup points to stabilization ahead.

U.S. May Reopen Oil Access to Venezuela, Commerzbank Reports

According to sources cited by Commerzbank, the U.S. is weighing a plan to allow limited oil operations in Venezuela. The move would reverse Trump’s prior ban and potentially issue licenses similar to those under the Biden administration.

U.S. oil inventories remain well below their five-year average, and there’s a shortage of heavy, high-sulfur crude, which Venezuela supplies and U.S. refiners need to mix with light shale oil. Any resumption would be structured via swap deals to prevent direct cash transfers to the Maduro regime.

Copper Drops as Chile Seeks U.S. Tariff Exemption

Comex copper prices fell sharply after Chile’s finance minister revealed plans to lobby for an exemption from U.S. copper tariffs set to take effect August 1. Chile supplies around 40% of U.S. refined copper imports.

Traders have already flooded U.S. warehouses with record shipments to beat the tariff, creating a 25% price premium over global benchmarks. ING analysts believe once current inventories clear, Comex copper prices could rise significantly to reflect the 50% tariff burden.

Crude Oil Stuck in Range as Market Awaits Fresh Drivers

Crude oil prices remain directionless, stuck in a tight range since the Israel–Iran conflict cooled down. With most geopolitical and supply-related factors already priced in, attention now turns to U.S. economic data and Federal Reserve signals as the next market movers.

Daily Chart: Prices are bouncing off support near $64. Buyers continue defending the level, eyeing $72 as the next upside target. A break below $64 could send prices tumbling toward $55.

4-Hour View: A clear range has formed between $64 and $69. Traders are likely to buy at support and sell at resistance until a decisive breakout.

1-Hour Snapshot: Price action has turned choppy, typical in sideways markets. Levels at $67.68 (resistance) and $65.50 (trendline) may offer some short-term structure, but traders would be wise to wait for stronger catalysts before committing.

Gold Rangebound as Bulls Wait for Fed Signal

Gold continues to trade sideways after failing to break the $3,438 resistance level last week. The recent series of trade agreements and a lack of clear bullish momentum have stalled upward movement as markets now look toward Wednesday’s Fed meeting.

The central bank is expected to keep rates unchanged, but investors will be watching for any clues about a possible September cut, especially if Friday’s jobs report shows economic softness. Weaker data could open the door to multiple cuts, while stronger figures might delay policy easing.

Daily Chart Outlook: Price broke below a key trendline, with bears now eyeing $3,120 as the next support. Dip-buyers may return at that level for another attempt toward $3,438.

4-Hour View: No strong technical levels in play, but downward pressure could drive a move toward $3,246 in the short term.

1-Hour Snapshot: Momentum is defined by a downward trendline. Sellers are likely to defend it unless a breakout sparks a rebound toward the broken trendline around $3,370.

Fidelity Forecasts Gold to Hit $4,000 by Late 2026

Fidelity International sees gold prices soaring to $4,000 an ounce by the end of 2026, driven by a cocktail of macro tailwinds — including expectations for lower U.S. rates, continued central bank purchases, and a weakening dollar.

Ian Samson, a portfolio manager at the firm, said their bullish stance has led some funds to double their gold holdings after the metal dipped from its April highs above $3,500. Despite recent price stagnation, gold is still up over 25% this year.

Geopolitical risks and policy uncertainty under Trump are further reinforcing gold’s safe-haven appeal. Samson added that Trump’s tariffs effectively tax the domestic economy, potentially slowing growth — another reason to stay defensive.

Europe News

ECB Survey: Inflation Outlook Softens for Next Year

The European Central Bank’s latest Consumer Expectations Survey shows inflation expectations one year out dropping to 2.6%, down from 2.8%. However, projections remain unchanged for the medium and longer terms — at 2.4% over three years and 2.1% over five years — suggesting anchored sentiment over the long run.

Spain Beats Growth Forecasts in Q2 with 0.7% Expansion

Spain’s economy expanded by 0.7% in the second quarter of 2025, outperforming the 0.6% forecast, according to preliminary figures from INE. The prior quarter also posted a 0.6% increase. On a yearly basis, GDP rose 2.8%, underscoring Spain’s position as one of the Eurozone’s stronger performers.

UK Mortgage Approvals Rise Above Expectations in June

New Bank of England data shows UK mortgage approvals climbed to 64,170 in June, surpassing the forecast of 63,000. The previous month’s figure was revised upward to 63,290.

Meanwhile, net consumer credit rose by £1.4 billion (vs £1.2B expected), up from £0.9 billion in May. Mortgage borrowing also jumped, rising £3.1 billion to £5.3 billion — nearly double May’s increase. Year-on-year, consumer credit growth is now at 6.7%, up from 6.5%.

UK Shop Prices Rise at Fastest Rate Since April 2024

Retail prices in the UK saw their sharpest year-on-year increase since April 2024, according to new British Retail Consortium data. July’s BRC Shop Price Index rose 0.7% versus expectations of just 0.2%.

Food inflation was the main culprit, climbing 4.0% — the highest since February. Cost spikes in essentials like meat and tea, driven by global supply pressures, extended grocery price increases for a sixth straight month.

This persistent inflation complicates the Bank of England’s rate outlook, especially following a recent jump in headline inflation to 3.6% in June.

Deutsche Bank: ECB’s Next Move Will Be a Hike, Not a Cut

Deutsche Bank has scrapped its previous forecast for another ECB rate cut, now projecting the next move will likely be a hike. The bank had earlier anticipated a final cut in September, but rising risks to their 1.50% terminal rate forecast — including the possibility of a halt at 1.75% or even 2.00% — led to a full reversal in outlook.

German economic minister: EU is currently negotiating from a position of weakness

German economic minister is on the wires saying:

- EU is currently negotiating from a position of weakness and must change this.

- New tariffs bring an enormous burden.

- Will measure US against commitments from Sunday.

- Cannot say how much of the USD $600 billion investment in the US will fall on Germany

ECB’s Makhlouf: We have reached the wait and see point in ECB easing cycle

- Comments from the ECB policymaker

- Inflation in the Euro Area has stabilised.

- Growth is developing broadly in line with expectations.

- There is not enough detail available to analyze US-EU deal.

Asia-Pacific & World News

U.S.–China Talks Conclude With Trade Truce Extension

Talks between U.S. and Chinese officials in Stockholm have wrapped up, with both sides agreeing to extend the current trade truce. According to Chinese lead negotiator Li, the meetings were described as “candid, in-depth, and constructive.” Officials reviewed the Geneva consensus and held detailed discussions on macroeconomic issues.

Key takeaways from China’s statement:

- Both sides reaffirmed the value of stable U.S.–China relations.

- The trade consultation mechanism will remain in place.

- Reciprocal tariffs and countermeasures are on hold, pending further discussion.

- Communication channels will stay open as negotiations progress.

The outcome signals a continued commitment to avoid tariff escalation, at least for now.

IMF Upgrades Global Growth Forecast to 3.0% for 2025

The IMF has boosted its global growth outlook for 2025 to 3.0% (from 2.8%) and for 2026 to 3.1% (from 3.0%). Despite the upgrade, the fund emphasized that the near-term momentum reflects tariff distortions more than true economic strength.

Headline global inflation is projected to fall to 4.2% in 2025 and 3.6% in 2026. However, tariff effects—especially in the U.S.—are expected to drive inflation higher in the second half of 2025. The effective U.S. tariff rate has been revised lower to 17.3%, down from 24.4% in April.

Country Forecasts:

- U.S.: 2025 growth up to 1.9%, 2026 to 2.0%

- China: 2025 growth raised to 4.8%, 2026 to 4.2%

- Euro Area: 2025 growth up to 1.0%, 2026 unchanged at 1.2%

- Emerging Markets: 2025 lifted to 4.1%, from 3.7%

The IMF also called on central banks to maintain credibility and warned that undermining their independence could lead to inflation instability.

U.S.–China Trade Talks Continue in Stockholm

U.S. and Chinese officials reconvened in Stockholm for the second day of negotiations aimed at extending their tariff ceasefire, which is set to expire on August 12.

So far, both sides appear cautious but willing. China is acknowledging the reality of higher tariffs, while the U.S. seems wary of pushing too hard and risking restrictions on rare earth imports. Talks are ongoing as each side looks for middle ground.

Trump Bars Taiwan President From U.S. Stopover, Signals Softening Toward China

President Trump has reportedly denied Taiwan’s president permission to transit through New York en route to Central America, according to the Financial Times.

The move is widely interpreted as an attempt to ease tensions with China and pave the way for broader trade cooperation. Markets are viewing the development as a bullish signal amid signs of thawing relations.

U.S.–China Talks Resume on Tariff Truce Extension

U.S. and Chinese officials resumed high-level talks in Stockholm on Monday, aiming to extend their current trade ceasefire by another 90 days.

The five-hour session featured U.S. Treasury Secretary Scott Bessent and China’s Vice Premier He Lifeng. While neither side offered public comment after the talks, negotiations are expected to continue Tuesday.

Sources suggest a Trump–Xi summit may be on the table to finalize a broader agreement. The deadline to seal a long-term deal is August 12.

Nvidia Still Awaiting U.S. Approval to Ship H20 Chips Amid China Demand Surge

Despite strong demand from Chinese clients, Nvidia has yet to secure U.S. government approval to export its H20 AI chips, sources close to the matter say. The chipmaker recently placed an order for 300,000 H20 units with Taiwan’s TSMC, signaling a pivot from its earlier plan to rely on existing stock.

Although Nvidia stated in mid-July that it had received informal assurance from authorities about forthcoming approvals, no formal export licenses have been granted by the Commerce Department so far. Without those licenses, the shipments remain in limbo.

PBOC sets USD/ CNY reference rate for today at 7.1511 (vs. estimate at 7.1891)

- PBOC CNY reference rate setting for the trading session ahead.

PBOC injected 449.2bn yuan via 7-day reverse repos at 1.40%

- 214.8bn yuan mature today

- net 234.4bn injection yuan

Ex-BOJ Official Predicts Return to Rate Hikes

Former Bank of Japan Deputy Governor Hiroshi Nakaso believes the central bank is likely to resume interest rate hikes to reinforce confidence in its inflation outlook.

Nakaso cited persistent food inflation and the potential for expectations to spiral higher as key risks. While the dollar remains the global reserve standard, he warned of cracks forming as investors look to diversify into other currencies.

Singapore’s Central Bank Expected to Hold Steady on Policy

The Monetary Authority of Singapore (MAS) is expected to maintain its current monetary policy stance this week, despite lingering risks from potential U.S. tariffs.

A Bloomberg survey shows 14 of 19 economists predicting no change. Earlier in the year, MAS cut policy twice to support growth, but stronger-than-expected data — including solid performance in manufacturing and exports — may warrant a pause.

Unlike traditional central banks, MAS manages policy through exchange rate settings rather than interest rates and seems inclined to wait and monitor external developments before acting again.

Crypto Market Pulse

Bitcoin Faces Pullback Risk to $112K as On-Chain Metrics Cool

Bitcoin continues to retreat, sliding below $118,000 on Tuesday amid signs of fading momentum. The price remains in correction mode after peaking above $120,000 and briefly dipping to $114,728 last week.

Technical signals:

- RSI dropped from overbought levels to 56.

- Daily Active Addresses down from 725K to 708K.

- On-chain Transfer Volume fell by 23.1%, from $14B to $10.8B.

The pullback is partially driven by broader market caution ahead of this week’s FOMC decision and the expected rollout of Trump’s reciprocal tariffs on Friday.

Glassnode Insights:

- 96.9% of BTC supply remains in profit, up from 96.7%, reinforcing bullish sentiment.

- But high unrealized gains can also trigger selloffs as traders take profits.

- Cooling address activity and declining volume may indicate a broader slowdown before the next push higher.

Despite short-term risks, sentiment remains constructive, with bulls eyeing a rebound if macro conditions stabilize.

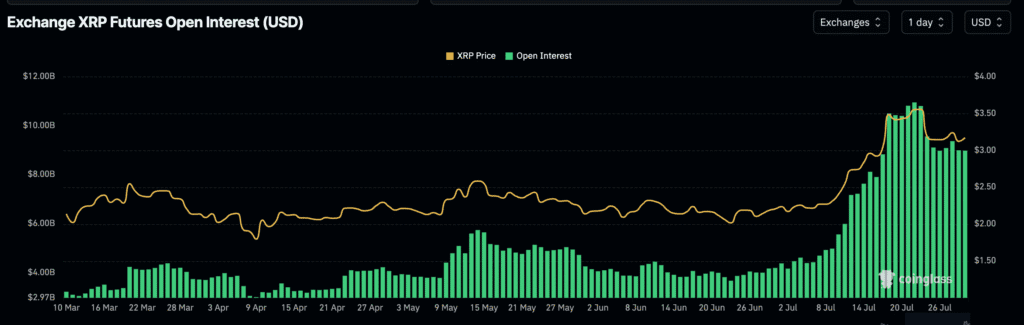

XRP Struggles Despite $3 Support Holding

Ripple’s XRP is hovering above $3.00, showing signs of consolidation as buyers try to regain momentum following a 16% pullback from its all-time high of $3.66. A dip to $2.95 was quickly bought up, but the rally stalled as open interest in futures contracts dropped sharply.

- MACD: Turning bearish

- RSI: Holding above 50

- Open Interest: Down from $10.94B (July 22) to $8.97B

This week’s Fed meeting, Trump’s tariff rollout, and key U.S. labor data may determine whether XRP breaks higher or continues its rangebound drift.

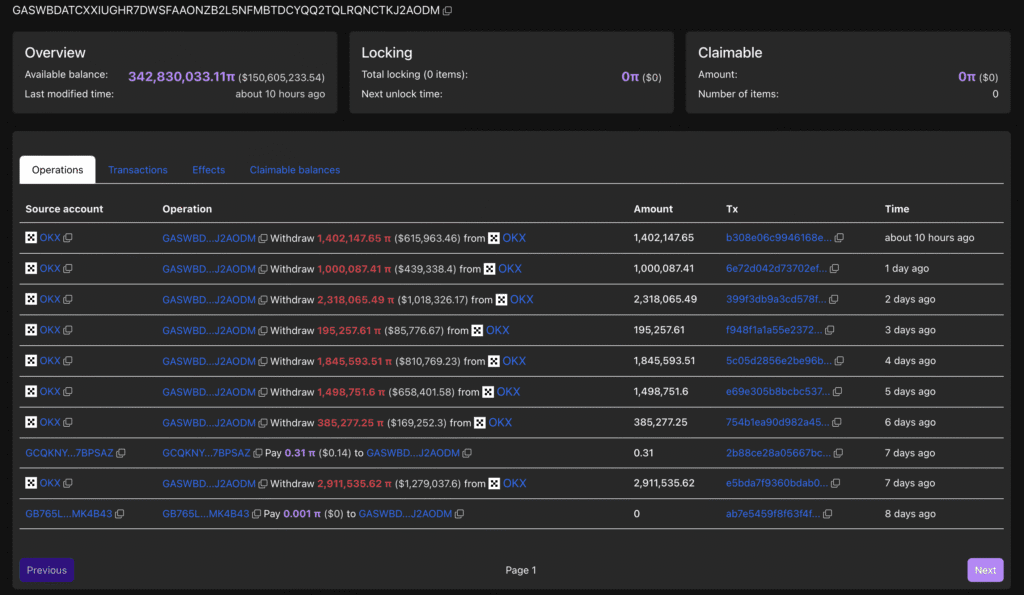

Pi Network Pressured at $0.43 Support, Despite Whale Accumulation

Pi Network’s token is edging lower, now testing support at $0.43 as downside momentum continues on the 4-hour chart. The asset dropped 0.61% on the day amid reduced buyer conviction.

Despite the weakness, an anonymous wallet acquired 1.4 million PI tokens, bringing its seven-day accumulation to over 11 million tokens, according to PiScan data. The transaction came from OKX, marking the network’s largest transfer in the past 24 hours.

Technically, however, the price continues to carve lower highs, and fading bullish pressure raises the risk of a breakdown below key support.

Ethereum Bounces Back as $4,000 Remains Key Target

Ethereum has rebounded 2% after recovering from a pullback that followed Monday’s push to $3,941. Buyers held the line at the 200-hour moving average near $3,736, and the crypto is now testing the waters again for a potential breakout above $4,000.

With Wall Street holding near all-time highs, crypto sentiment remains bullish. However, major tech earnings later this week could sway investor appetite and determine whether Ethereum can finally breach the psychological barrier.

Ray Dalio: Gold or Bitcoin Should Be 15% of Portfolios

Speaking on CNBC’s Master Investor podcast, Bridgewater founder Ray Dalio recommended investors allocate about 15% of their portfolios to assets like gold or bitcoin.

Dalio made clear he prefers gold over crypto but emphasized that diversification into hard assets is crucial given the deteriorating fiscal outlook.

“The real issue is monetary debasement,” he said, warning that the U.S. may need to issue another $12 trillion in debt next year just to stay afloat. He called the current trajectory a “point of no return” not just for America, but for most developed economies stuck in what he called a “debt doom loop.”

Bitmain to Establish First U.S. Factory as Bitcoin Politics Heat Up

Crypto hardware heavyweight Bitmain Technologies is setting up its first American manufacturing site, expected to open in late Q3 2025. The new facility — potentially located in either Texas or Florida — will also serve as the company’s U.S. headquarters.

Operations are targeted to start in early 2026 with an initial 250 hires. The move comes as former President Trump champions domestic Bitcoin mining, creating a favorable environment for expansion. Bitmain’s AI affiliate was previously blacklisted amid trade tensions, prompting the company to diversify its production base.

Meanwhile, U.S.-based American Bitcoin Corp., co-founded by Trump’s sons in partnership with Hut 8, recently placed a 31,000-unit order with Bitmain, underscoring growing synergy between policy and industry.

The Day’s Takeaway

North America

Stocks Pause Near Highs as Fed Looms:

U.S. markets cooled off after a strong run, with the S&P 500 and NASDAQ both slipping into the red despite setting new intraday highs. Traders moved cautiously ahead of Wednesday’s Fed rate decision and Thursday’s GDP report, with the Friday jobs report adding another layer of anticipation.

- Dow: -0.46%

- S&P 500: -0.30%

- NASDAQ: -0.30%

- Russell 2000: -0.61%

Earnings Movers:

- Whirlpool: -13.43% after weak guidance

- PayPal: -8.68% as fintech struggles

- Rivian: -5.23% amid EV headwinds

- Starbucks: +4.48% in after-hours despite missing EPS

Post-close Earnings Highlights:

- Visa, EA, Seagate beat expectations but dropped post-close

- Booking Holdings beat but also declined

- Starbucks gained after revenue beat

Trade Talks with China:

U.S. and Chinese officials agreed to extend the trade truce after two days of meetings in Stockholm. However, final approval rests with President Trump, who is expected to decide on a 90-day tariff pause extension. No agreement was reached on export controls, and tensions remain over China’s oil imports from Iran.

U.S.-EU Trade Agreement Finalized:

A new trade deal featuring a 15% tariff cap eased market nerves. While the news was largely priced in, it removed a key source of uncertainty, particularly benefiting sectors tied to exports and energy.

Treasury Auction:

The U.S. Treasury’s 7-year note auction saw strong demand, especially from domestic buyers, with a high yield of 4.092% and a bid-to-cover of 2.79x. Dealers were left holding just 4%, far below average.

Fed in Focus:

Markets are bracing for Fed Chair Powell’s tone on inflation and future rate moves. With equities near highs and bond yields in play, rate-sensitive sectors are poised to react sharply.

Commodities

Oil Rallies on Sanction Threats:

Crude prices jumped 3.75%, closing at $69.21, after Trump warned that sanctions on Russian oil could take effect in 10 days, potentially triggering secondary tariffs on nations that continue buying Russian supply.

- WTI broke above its 200-day moving average ($67.97)

- Intraday high: $69.41, just shy of key $69.61 resistance

API Inventory Data (Private Survey):

- Crude: +1.539M barrels (expected: -2.5M)

- Gasoline: -1.739M

- Distillates: +4.189M

- Cushing: +465K

- SPR: +0.2M

The surprise crude build could temper bullish momentum ahead of Wednesday’s EIA report.

Rest of the World

IMF Raises Global Growth Forecasts:

The IMF lifted its 2025 global growth outlook to 3.0% (from 2.8%) and 2026 to 3.1%, citing tariff distortions more than underlying strength.

- U.S. Growth: 2025 revised to 1.9%

- China: Upgraded to 4.8%

- Euro Area: Now at 1.0%

- Emerging Markets: Lifted to 4.1%

The IMF warned that high tariffs, fiscal deficits, and geopolitical tensions remain major risks. Tariff pass-through effects are expected to lift U.S. inflation in late 2025.

Crypto

Bitcoin Retreats Toward $112K Support:

BTC slipped below $118K intraday as momentum cooled. Metrics suggest fading interest:

- Daily Active Addresses: down from 725K to 708K

- Transfer Volume: -23.1% to $10.8B

- RSI: dropped from overbought to 56

Glassnode noted that although 96.9% of supply is still in profit, such high levels increase the risk of profit-taking selloffs.

XRP Consolidates Above $3.00:

XRP is struggling to regain upside traction after pulling back from its all-time high of $3.66. Futures open interest has declined significantly, signaling weaker conviction among traders.

Pi Network Slides to $0.43 Support:

Despite a whale accumulation of 1.4 million PI tokens, Pi Network remains under pressure with a series of lower highs pointing to possible further downside.