North America News

S&P and NASDAQ Close at New Highs as Dow Approaches Record

U.S. stock indices ended Friday in the green, with both the S&P 500 and NASDAQ Composite posting fresh record closing highs. The Dow Jones Industrial Average also gained ground, finishing just 113 points below its all-time closing high. Earlier in the week, the Dow came within four points of setting a new record before pulling back.

All four major indices posted weekly gains, led by the S&P 500.

Friday’s Close:

- Dow Jones: +208.01 points (+0.47%) to 44,901.92

- S&P 500: +25.29 points (+0.40%) to 6,388.64

- NASDAQ: +50.36 points (+0.24%) to 21,108.32

- Russell 2000: +8.93 points (+0.40%) to 2,261.06

Weekly Performance:

- Dow Jones: +1.26%

- S&P 500: +1.46%

- NASDAQ: +1.02%

- Russell 2000: +0.94%

The S&P’s strength continues to set the tone for broader market sentiment, as investors digest strong earnings and improved economic data.

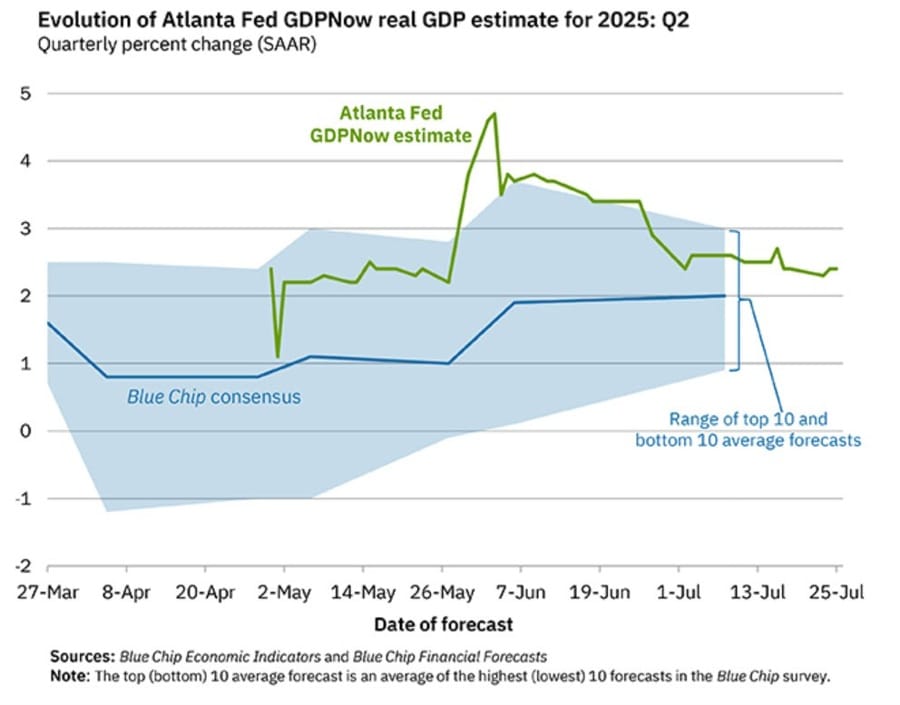

Atlanta Fed GDPNow Holds Q2 Growth View at 2.4%

The Atlanta Fed’s GDPNow model is unchanged ahead of next week’s Q2 advance GDP release. It still projects 2.4% annualized growth for the quarter. One more model update is due Tuesday before the official data drops Wednesday morning.

In their own words:

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the second quarter of 2025 is 2.4 percent on July 25, unchanged from July 18 after rounding. The forecasts of the major GDP subcomponents were all unchanged or little changed from their July 18 values after this week’s releases from the US Census Bureau and the National Association of Realtors.

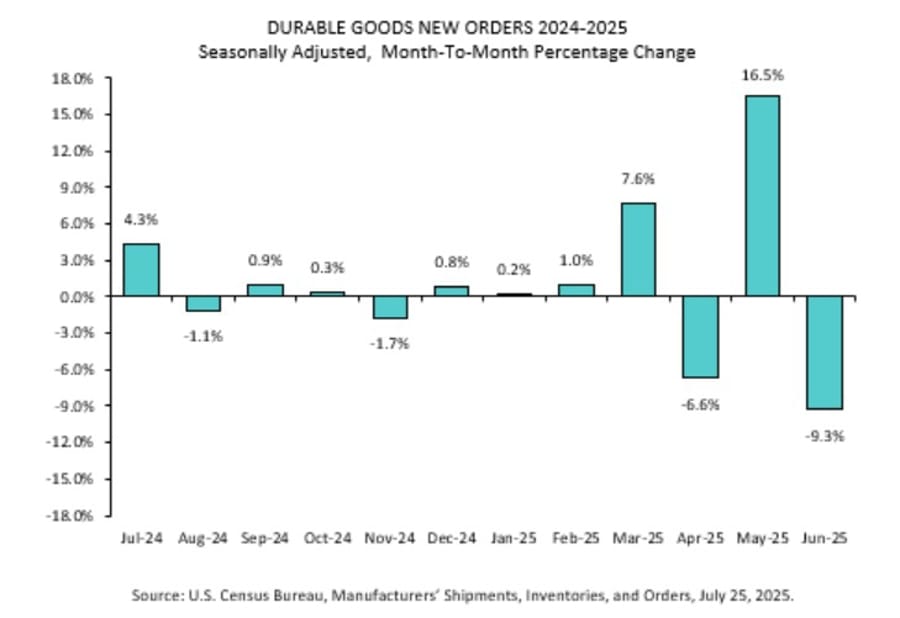

U.S. Durable Goods Orders Plunge in June, Worst Since Early Pandemic

June saw a sharp downturn in U.S. advanced durable goods orders, falling 9.3% compared to expectations for a 10.8% drop. This comes after May’s massive 16.5% gain—the largest since July 2014. June’s result now marks the steepest monthly drop since April 2020, when COVID disruptions were at their peak.

Orders excluding transportation edged up 0.2% (vs. 0.1% est), while the prior month was revised to a 0.6% rise. Ex-defense orders collapsed 9.4% after a 15.7% gain in May. Core capital goods excluding defense and aircraft declined 0.7%, well below the 0.2% estimate. May’s number was also revised higher to a 2.0% gain.

A full revision of factory orders is expected in the coming weeks.

From the Census Dept: U.S. durable goods orders fell 9.3% in June to $311.8 billion, following a 16.5% surge in May. The decline was driven by a 22.4% drop in transportation equipment, which fell by $32.6 billion. Excluding transportation, orders rose slightly by 0.2%, while orders excluding defense dropped 9.4%.

U.S. New Home Inventory Hits Recession-Linked Level

Single-family home inventory surged to a 9.8-month supply in June—matching rare levels typically seen before economic downturns. Only five other instances since records began have reached this high, and each preceded a recession in most cases. Although new home sales inched up 0.6% for the month, they were still down 6.6% from a year ago. Median home prices also dropped nearly 3%, to $401,800, as builders resort to price cuts amid slowing demand and rising mortgage rates near 7%.

U.S. Companies Absorbing Most Tariff Costs, But For How Long?

The Wall Street Journal reports that American companies—particularly importers—are shouldering the impact of the latest tariffs. Manufacturers like GM, retailers like Walmart, and firms like Nike are reportedly avoiding price hikes so far, wary of consumer backlash and potential criticism from President Trump.

Here’s how it’s breaking down:

- GM: $1B in tariff costs in Q2. No major price hikes yet.

- Stellantis: $350M profit loss.

- Hasbro: Projects $60M in annual tariff impact; price hikes planned.

- Nike: Expects $1B hit this fiscal year.

- RTX (Raytheon): Noted profit erosion from tariff costs.

- Walmart: Slight price hikes (bananas up from $0.50 to $0.54/lb) while cutting costs elsewhere.

Tariff burden overall has climbed to 17%—up from just 2.3% last year. CPI data shows inflation for affected goods is creeping up (June YoY CPI hit 2.7%, up from May’s 2.4%). While some foreign exporters (notably in China) have trimmed prices by around 20%, it falls short of the “full absorption” narrative pushed by the White House.

Small businesses are under increasing strain, and the question now is whether corporate America can keep absorbing costs—or if price hikes are inevitable later this year.

Trump Signals Rate Cuts, Trade Deals, and Tariffs in Wide-Ranging Comments

Speaking today, President Trump gave a rapid-fire update on several fronts:

- EU deal odds: “50-50 chance.”

- Powell rate cut: “Got the impression Powell may lower rates.”

- China: “Confines of a deal already in place.”

- Canada: Possibly just a tariff, not a negotiation.

- UK: Trade deal may be finalized tonight with PM Starmer.

- Tariffs: Nearly 200 letters going out; most will say 10%, some 15%.

- Currency remarks: “Strong dollar makes it hard to sell… but I’ll never say I want a weak dollar.”

Trump also commented that the EU might have to “buy down” tariffs as part of trade talks, and floated the idea of using tariff revenue to offer rebates to U.S. consumers.

Apple Expected to Beat Earnings Forecasts

Goldman Sachs projects Apple will top both revenue and earnings expectations in its upcoming quarterly results. Strength in services and strong product sales—spanning iPhones, Macs, iPads, and wearables—are driving the upside. Gross margins are also expected to beat forecasts, aided by favorable currency effects and tariff adjustments. Still, risks remain from advertising softness and policy uncertainty. Apple will report after markets close next Thursday.

Penny Stock Frenzy: Healthcare Triangle Volume Surges

Healthcare Triangle saw an eye-popping 3 billion shares traded on Thursday—about 15% of the day’s total U.S. exchange volume. The healthcare IT company’s stock price more than doubled to just over five cents. The $150 million in daily turnover was nearly seven times its market cap, signaling extreme volatility and speculative frenzy.

Early AI Adopters Outperform, Says Morgan Stanley

Morgan Stanley’s latest report finds that companies embracing AI are now pulling ahead in both profits and stock performance. Financial services saw major growth in AI adoption: 71% of insurers are now using it, up from 48% in January. In the consumer space, 44% of durable goods firms are onboard, with supply chain improvements driving adoption. AI exposure among REITs has risen to 32%. The firm says the performance gap between AI leaders and laggards is widening—and will keep growing.

Fed Leadership Doubts Weigh on Dollar, Says BofA

Bank of America says market anxiety over the Federal Reserve’s leadership has hurt the U.S. dollar more than other asset classes. With speculation rising over whether Powell will stay on if Trump wins another term, investors are betting on a less aggressive Fed stance. Even in a normal transition, BofA argues that the market is adjusting to the idea of looser monetary policy ahead.

Intel Cuts Jobs, Signals Exit From Advanced Chipmaking

Intel’s restructuring is intensifying. The company is slashing 15,000 jobs—roughly 15% of its global staff—and is rethinking its chipmaking future. Intel posted $12.9 billion in Q2 revenue, beating expectations, but its $0.10 per-share loss missed targets. It took nearly $3 billion in net losses, driven by workforce reductions, impairments, and one-time charges. Intel warned it may abandon advanced manufacturing within four years unless it attracts more external customers to its foundry business.

Trump: No Plans to Fire Fed Chair Powell

Touring the Federal Reserve’s construction project this week, Trump indicated he has no intention of removing Chair Jerome Powell, stating: “I don’t think that’s necessary.” During the visit, Trump handed Powell a paper showing a supposed $3.1 billion price tag, which Powell rebutted, noting a completed third building had been included. Despite past friction, Trump added with a laugh, “I’d love him to lower interest rates. Other than that, what can I tell you?”

Former Feds Warsh says he’d support a rate cut if he was still at the Fed

- Warsh interview with Fox, looks like he is still positioning for the job as Federal Reserve chair

The Federal Reserve’s monetary policy committee meet next week, July 29 and 30.

The Federal Open Market Committee (FOMC) is widely expected to leave rates unchanged.

Kevin Warsh was on the Board of Governors at the bank, from 2006 to 2011.

He is being interviewed on Fox.

Says he’d vote for a rate cut next week if was still on the FOMC.

Warsh is still jockeying for the job as Fed Chair (in the interview he said he would be honoured to serve if US President taps him to be the next Fed chair), so it does seem he is saying things to curry favour with Trump. Its always a possibility, of course, that he does believe a rate cut is best, though.

Trump-linked fund manager sues Fed over secrecy, while pushing its own political agenda

- Dirty politics again in an attack on the central bank

“Azoria Capital” has filed a lawsuit against Federal Reserve Chair Jerome Powell and other central bank officials, alleging the Fed is violating a 1976 law by holding monetary policy meetings in private.

- The firm is asking a Washington, D.C., court to issue an emergency order requiring the Federal Open Market Committee (FOMC) to open its upcoming policy meetings to the public, arguing that closed-door deliberations hinder transparency and accountability.

- Azoria claims the lack of real-time access prevents firms from adequately preparing for policy changes that may impact markets.

- It also alleges the Fed’s current high interest rate policy is politically motivated, aimed at damaging former President Donald Trump’s economic agenda.

Canada Swings to Deficit in May Budget Balance

Canada posted a C$230 million budget deficit in May 2025, reversing a surplus of C$1.17 billion from the same month last year. On a year-to-date basis, the deficit has narrowed sharply to C$6.5 billion from C$43.15 billion a year ago, according to federal finance data.

Economists See Bank of Canada Cutting Rates Further in 2025

All 28 economists polled by Reuters expect the Bank of Canada to hold its benchmark rate at 2.75% during the upcoming July 30 decision. However, 17 of them now expect the rate to fall to 2.25% or lower by year-end.

The BoC last moved in March 2025, cutting rates by 25 bps. Since then, persistent inflation, softening growth, and tariff risks—especially from the U.S.—have kept policymakers on pause.

Commodities News

Gold Slips as Strong U.S. Data and Trade Progress Weigh on Safe-Haven Demand

Gold prices are on track for a weekly loss, with spot prices hitting a low of $3,325 amid reduced safe-haven interest. As of Friday afternoon, gold was trading near $3,336, down roughly 1% for the week.

What’s driving the drop:

- U.S. labor market strength: Jobless claims fell for the fourth straight week

- Durable Goods slump: June orders fell 9.6% due to weak aircraft demand

- USD rebound: The U.S. Dollar Index (DXY) rose 0.17% to 97.68

- Trade optimism: The U.S. struck deals with Japan and is progressing with the EU

Trade news, especially hints that a U.S.-EU deal might arrive before the August 1 deadline, has helped reduce gold’s appeal. President Trump gave the odds of a deal with Europe as “50-50” and indicated that tariff letters (with 10% to 15% rates) are on the way.

Meanwhile, strong economic data reinforces the case for the Federal Reserve to hold interest rates steady. The Fed is widely expected to keep its target rate unchanged at 4.25%–4.50% during its July 30 meeting. Markets currently see a 96% probability of a hold, with only a 4% chance of a rate cut.

While U.S. bond yields remain soft, the dollar’s rebound and risk-on sentiment in equities are undermining gold’s support.

Crude Oil Ends Week Lower at $65.16

Crude oil prices slipped on Friday, with WTI crude futures settling at $65.16, down $0.87 on the session.

Earlier in the week, prices briefly dipped below the declining 100-day moving average, but each time buyers returned, pushing daily closes back above that technical line. The repeated failure to hold below that level suggests bearish momentum remains weak—for now.

Key levels to watch next week:

- Support: $63.61 – a key swing low; a break here could intensify selling pressure

- Resistance: $66.96, followed by the 200-day moving average near $67.99

To tilt momentum decisively in favor of sellers, oil would need a firm close below the 100-day moving average and that $63.61 support zone.

U.S. Rig Count Falls, Canada Adds 10 Rigs

Baker Hughes reported the U.S. rig count fell by 2 to 542 this week. Oil rigs dropped 7 to 415, while gas rigs added 5 to reach 122. The total is 47 rigs below last year’s levels.

The offshore U.S. rig count held steady at 13, but is down 8 YoY.

Canada’s rig count rose 10 to 182, with oil rigs up 8 and gas rigs up 2. However, that still trails last year’s total of 211 by 29 rigs.

OPEC+ Reportedly Set to Keep Production Policy Unchanged

According to Reuters, sources suggest the OPEC+ panel reviewing production levels on Monday is leaning toward maintaining its current output strategy. The report cites unnamed insiders familiar with the group’s discussions.

U.S. Allows Chevron to Restart Venezuela Oil Operations

Chevron is set to resume oil production in Venezuela, a move expected to boost exports by over 200,000 barrels per day. This development comes as the U.S. secures the release of detained Americans and concludes several trade deals globally.

Despite increased Venezuelan supply, distillate markets remain tight. U.S. distillate inventories are still at their lowest seasonal level since 1996. ING notes that refinery margins remain strong, especially in Europe and Singapore, where gasoil stocks are historically low. This should encourage refiners to ramp up runs, particularly with additional OPEC+ supply entering the mix.

Surging LNG Supply Pushes Down European Gas Prices

European gas prices have retreated to just over €32/MWh, near April’s lows, as LNG supply surges and geopolitical tensions ease. Commerzbank reports that storage levels are back up to 65%, with the gap to seasonal norms shrinking.

The IEA noted that Europe’s gas demand rose 6.5% in H1 2025, mainly from greater use of gas-fired power plants. Global LNG output is expected to grow 5.5% this year and another 7% next year—marking the fastest expansion since 2019. Commerzbank has cut its year-end gas price forecast to €35/MWh (from €45), though longer-term gains remain possible as Asia’s demand recovers.

Kazakhstan Oil Exports Resume After Brief Disruption

Kazakhstan’s oil shipments faced temporary disruption due to new Russian port regulations restricting foreign tanker access at Black Sea terminals. The delay affected 1.66 million barrels per day of exports routed through Russia. However, loadings resumed after Russian intelligence authorities granted clearance.

Earlier, exports through Turkey’s Ceyhan port were also briefly delayed following contamination checks. Despite these hiccups, oil flows have normalized, likely reducing short-term support for Brent prices, which had moved near $70 during the supply crunch.

U.S. Natural Gas Prices Rebound on Storage Surprise

Natural gas prices in the U.S. bounced back after three straight sessions of losses. The EIA reported a smaller-than-expected inventory build of 23 billion cubic feet last week—below both market expectations (27 bcf) and the five-year average (30 bcf).

The unexpected drawdown points to potentially tighter supply conditions moving forward. According to ING, the market is starting to reprice some of the recent bearishness, with storage dynamics offering fresh support for prices.

Commerzbank Ups Outlook for Silver, Platinum, and Palladium

Commerzbank has raised its year-end price forecasts for several precious metals, leaving gold unchanged. Silver is now expected to hit $39/oz (up from $37), platinum $1,350/oz (up from $1,250), and palladium $1,200/oz (up from $1,100).

Analyst Carsten Fritsch says recent price rallies appear sustainable as valuations relative to gold have normalized. The gold/silver and gold/platinum ratios are now closer to long-term averages. However, palladium may lag due to weaker demand fundamentals.

Chinese Gold Demand Slows Overall, But Investment Soars

China’s gold consumption dropped 3.5% in the first half of 2025, according to the China Gold Association. But Commerzbank notes that a 24% surge in bar and coin demand—to 264 tons—offset a 26% plunge in jewelry demand.

Analyst Carsten Fritsch says geopolitical uncertainty, especially U.S. tariff policy, is driving the shift. Jewelry demand tends to weaken when prices are high, while investment interest increases, underscoring gold’s dual nature as a safe haven and consumer product.

Europe News

European Stocks Finish Week Mixed; DAX Lags

European equity indices ended the week with mixed performance:

Friday’s Close:

- DAX -0.32%

- CAC 40 +0.21%

- FTSE 100 -0.20%

- IBEX -0.13%

- FTSE MIB +0.31%

Weekly Totals:

- DAX -0.30%

- CAC 40 +0.15%

- FTSE 100 +1.43%

- IBEX +1.77%

- FTSE MIB +1.03%

The DAX underperformed as auto earnings and tariff concerns weighed on sentiment.

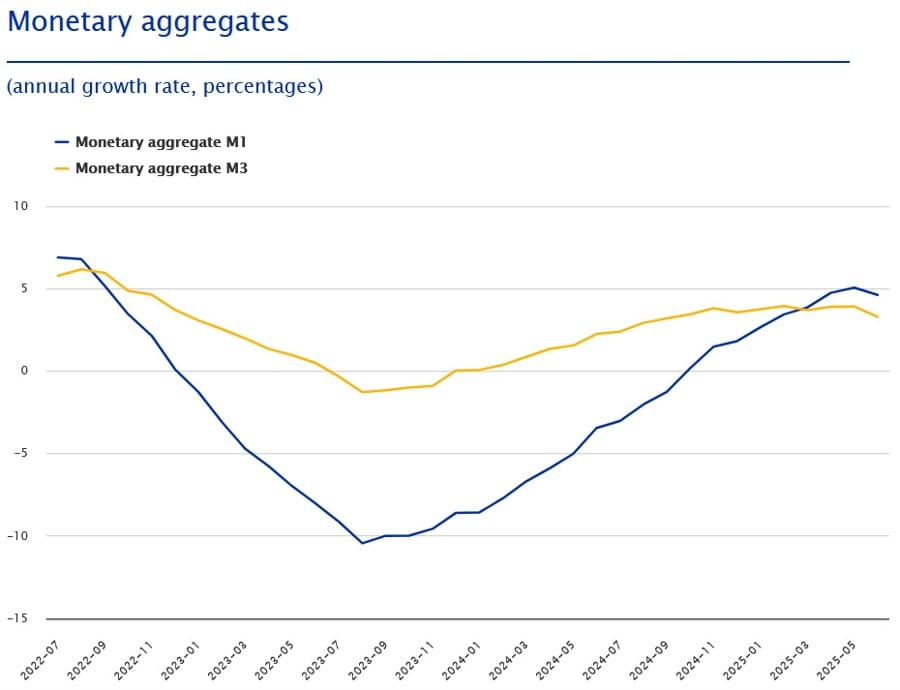

Eurozone Money Supply Slows in June

The European Central Bank reported a 3.3% annual rise in M3 money supply for June—below the expected 3.7% and down from 3.9% the previous month. However, credit growth remained firm, with loans to households rising 2.2% year-over-year and loans to businesses climbing 2.7%.

ECB Survey Predicts Lower Inflation in 2025 and 2026

The ECB’s Q3 2025 survey of professional forecasters now sees Eurozone inflation averaging 2.0% in 2025, down from 2.2%. For 2026, inflation is projected at 1.8% versus 2.0% previously. On growth, 2025 GDP is expected to expand by 1.1% (up from 0.9%), while 2026 growth has been trimmed to 1.1% from 1.2%.

Germany’s Business Sentiment Rises Slightly in July

Germany’s Ifo business climate index came in at 88.6 for July, narrowly missing the 89.0 estimate but improving on June’s 88.4. The current conditions index rose to 87.8 (vs. 86.7 expected), and expectations stayed flat at 90.6. Confidence appears to be gradually improving ahead of Q3, though concerns remain about Trump-era tariffs impacting German exporters, as reflected in recent earnings from Volkswagen.

French Consumer Confidence Ticks Up Slightly

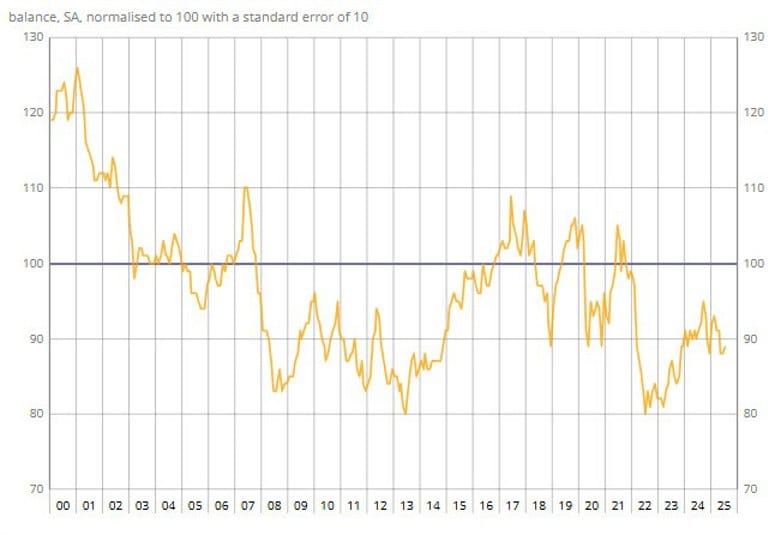

France’s July consumer confidence index edged up to 89, just ahead of the forecast of 88. While the improvement is modest, it comes with some notable shifts: households are more optimistic about job prospects, and savings intentions rose to match the record high previously seen in February 2025. That said, overall confidence remains well below the long-term average of 100.

UK Retail Sales Recover in June, But Lag Expectations

UK retail sales bounced back in June, rising 0.9% month-over-month—but still below the 1.2% forecast. May’s figure was revised downward to a 2.8% decline.

Year-over-year, sales grew 1.7%, missing the 1.8% estimate. Stripping out auto fuel, monthly sales rose just 0.6%, falling short of the 1.2% expected. Online retail performed strongly, with a 1.7% increase in non-store sales—the best showing since February 2022. Warm weather and retailer promotions played key roles in the rebound.

UK Consumers Grow Wary Ahead of Budget

British consumer sentiment dipped slightly in July, with GfK’s confidence index slipping to -19 from June’s -18. The modest drop still exceeded expectations but signals unease over potential tax hikes this autumn. The savings index jumped seven points to +34, the highest since 2007, as households brace for tighter economic conditions.

ECB’s Nagel: Holding rates makes sense after eight cuts

- Comments from the ECB policymaker

- Economic outlook has improved slightly since June.

- Steady-hand policy is appropriate amid uncertainty.

JP Morgan Shifts ECB Rate Cut Call to October

JP Morgan has adjusted its forecast for the next European Central Bank rate cut, moving it from September to October. The bank continues to expect a terminal deposit rate of 1.75%.

The change puts JP Morgan in line with institutions like Goldman Sachs (which recently revised its forecast to 2%), Commerzbank, UBS, Danske Bank, and Societe Generale. Meanwhile, Deutsche Bank, Barclays, Citi, and Nomura maintain a more dovish view, projecting a 1.50% terminal rate.

ECB’s Villeroy: The increases in US tariffs are not expected to cause inflation to rise

- Comments from the ECB policymaker

- The increases in US tariffs are not expected to cause inflation to rise.

- It is therefore important to remain completely open about future monetary policy decisions.

- Inflation remains well under control.

- More than ever, in a volatile environment, agile pragmatism in light of data and forecasts is of the essence.

- Risks to growth still tilted to the downside.

- Euro rise has significant disinflationary effect.

ECB’s Rehn: Will continue to base our decisions on a meeting by meeting assessment

- Comments from the ECB policymaker

- We will continue to base our monetary policy decisions on a meeting-specific assessment of the inflation outlook and the risks surrounding it.

- Increasingly worried over economic growth.

- Makes sense to take extra time for decisions.

ECB appoints Isabel Vansteenkiste as principal counsellor to president Lagarde

- Vansteenkiste will also be coordinator of the counsel to the Executive Board at the central bank

She will be taking over from Roland Straub, who has been appointed Deputy Director General Market Operations. Vansteenkiste has been with the ECB for 23 years and is currently serving as Director General International and European Relations at the central bank. She will take up the new role starting on 15 September.

She is to advise president Lagarde on “a wide range of economic and strategic policy matters and support preparations” for both the Executive Board and Governing Council meetings.

ECB’s Simkus: Inflation is expected to stay at 2% level in the medium term

- Comment from the ECB policymaker

- Inflation is expected to stay at 2% level in the medium term.

ECB’s Kazaks: There’s no urgent need to adjust rates

- Comments from the ECB policymaker

- There’s value holding rates at current level.

- ECB easing still working its way through the economy.

- The era of straightforward decisions to hike or cut is over.

- Steady hand ECB policy is appropriate at current time.

- The euro is still near historical averages, but monitoring.

- There’s untapped potential in the economy.

Goldman Sachs Withdraws ECB Rate Cut Forecast

Goldman Sachs has walked back its prediction of another European Central Bank deposit rate cut in 2025. The firm had previously expected a 25 basis point cut in September. Instead, it now sees the terminal deposit rate staying at 2% through next year, up from its earlier estimate of 1.75%.

Asia-Pacific & World News

Nvidia Chip Repairs Surge in China Despite Export Ban

Chinese repair shops are overwhelmed with broken Nvidia AI chips—like the H100 and A100—even though these are banned from legal export to China. Some Shenzhen firms say they handle hundreds of repairs a month, often for chips never officially sold there. The underground demand points to widespread smuggling, with military and government-linked entities among buyers. Despite U.S. sanctions, many Chinese firms still favor Nvidia’s banned GPUs over legal alternatives.

Country Garden Moves Forward in Debt Talks

Chinese developer Country Garden has met critical demands from its banking creditors, including a $178 million payment tied to collateral disputes. The agreement paves the way for a possible resolution ahead of an August 11 court hearing that could force liquidation. Investors responded positively, with some narrowing in bond spreads and modest gains for Asian property stocks.

Trump Shifts Toward Bargaining With China

The Wall Street Journal reports that President Trump is pivoting from economic pressure to negotiation as trade talks with China resume next week. Insiders say this marks a push for a more conciliatory deal—particularly one that expands U.S. access to Chinese tech and business sectors. One major sign of the shift: the U.S. recently relaxed export controls on Nvidia’s AI chips to China. Vice Premier He Lifeng is set to lead China’s negotiating team, with talks scheduled in Stockholm.

PBOC sets USD/ CNY reference rate for today at 7.1419 (vs. estimate at 7.1609)

- PBOC CNY reference rate setting for the trading session ahead.

PBOC injected 789.3bn yuan via 7-day reverse repos at 1.40%

- 187.5bn yuan mature today

- net 601.8bn injection yuan

Trump Announces U.S. Beef to Enter Australian Market

Trump publicly declared that Australia has agreed to accept American beef imports—news already reported earlier in the week down under. While Australia had previously banned U.S. beef over biosecurity issues, the country is now reopening its market. However, Trump’s 10% tariffs on Australian goods still stand. Prime Minister Albanese said retaliating would only fuel domestic inflation.

Japan Upgrades May Leading Index Data

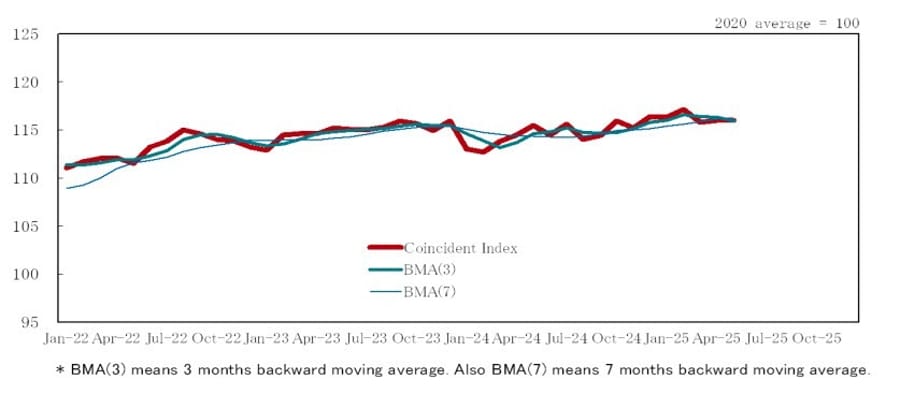

Japan’s Cabinet Office revised its May leading index figure upward to 104.8 from 104.2, while the coincident index held steady at 116.0. The government continues to describe the trend as “halting to fall,” reflecting a pause in any further economic deterioration.

Here’s the trend of the coincident index over the past few years:

BoJ is said to see potential rate hike environment this year

- Bloomberg headlines on the latest reports about a BoJ hike after the US-Japan trade deal

- BoJ is said to see no need to make a drastic change to the outlook.

- BoJ is said to expect enough data by year-end to weigh a hike.

- BoJ is said to see trade deal with US reducing uncertainty.

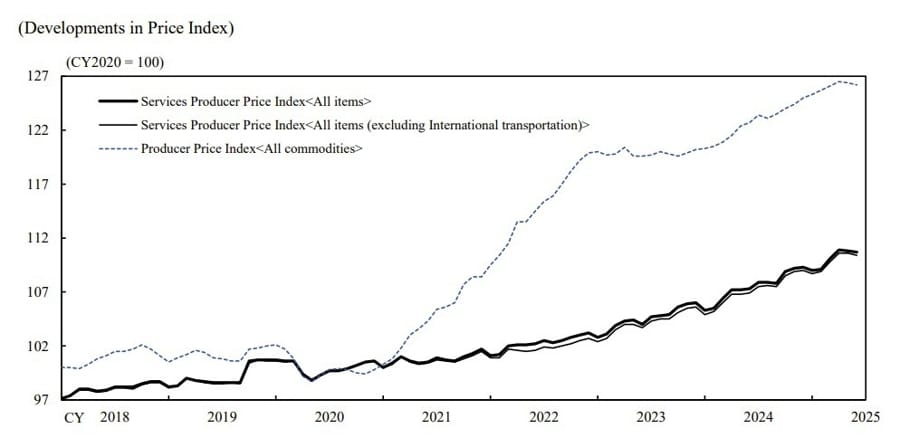

Japan’s Services Inflation Matches Forecasts

Japan’s Corporate Services Price Index (services PPI) rose 3.2% year-over-year in June, in line with market expectations. The data shows steady service-sector inflation in Japan, keeping pressure on the Bank of Japan as it gauges future monetary tightening.

Tokyo July CPI Slightly Below Forecasts

Inflation in Tokyo for July came in just under expectations, with headline CPI at 2.9% year-over-year versus the 3% consensus. Core CPI (excluding fresh food) also hit 2.9%, while the core-core measure (excluding food and energy) stood at 3.1%. All remain above the Bank of Japan’s 2% target. However, the central bank continues to hold off on rate hikes due to concerns about economic drag from tariffs and global uncertainty.

Crypto Market Pulse

Crypto Snapshot: Bitcoin Under Pressure, ETH and XRP Hold Key Levels

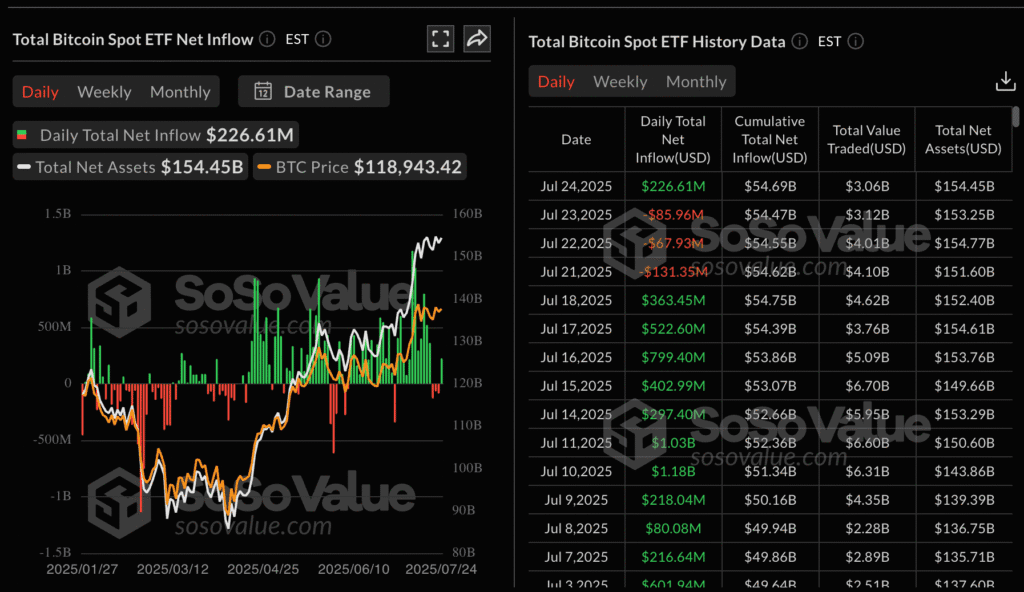

Bitcoin dipped as low as $114,723 before bouncing back above $115,800 amid a wave of profit-taking and broader risk-off sentiment. The Index Bitcoin Cycle Indicators (IBCI) suggests the market is in the distribution phase, though not at a euphoric peak.

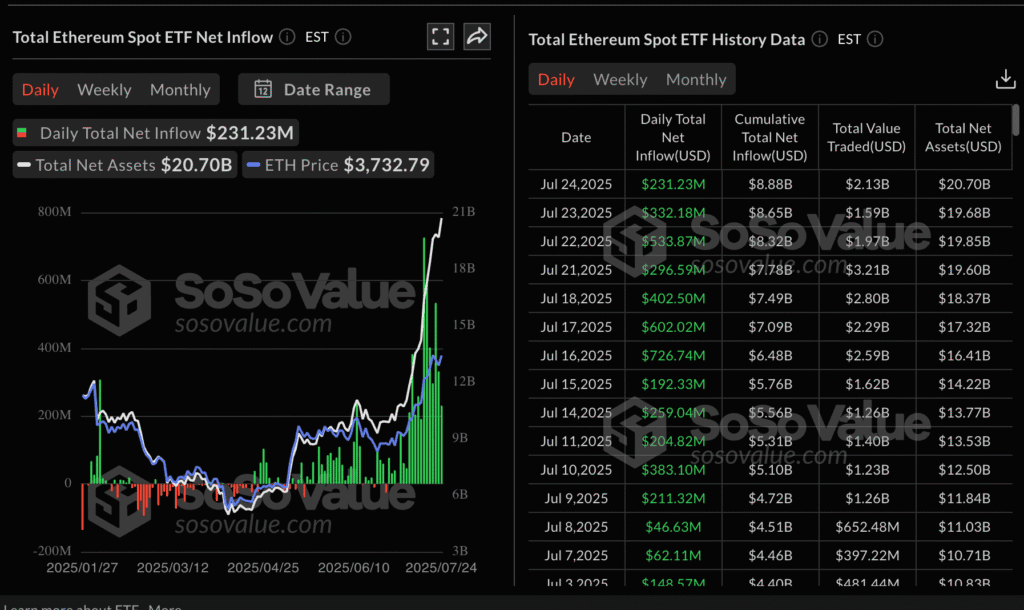

Ethereum is holding above $3,500 and inching toward a potential breakout. Spot ETF inflows remain strong, with ETH ETFs reporting $231M in new capital Thursday, bringing the total to $8.88B.

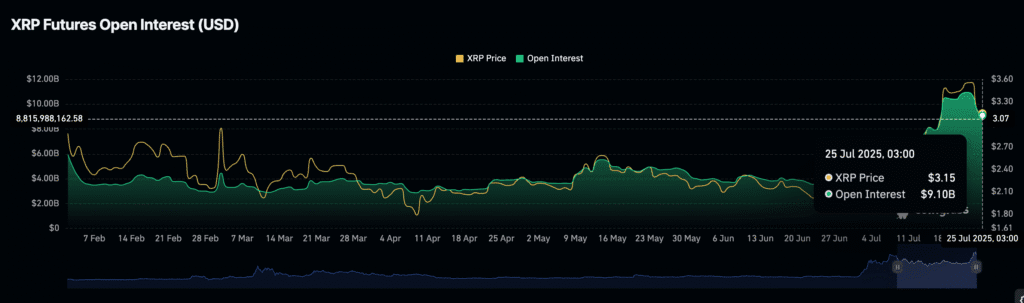

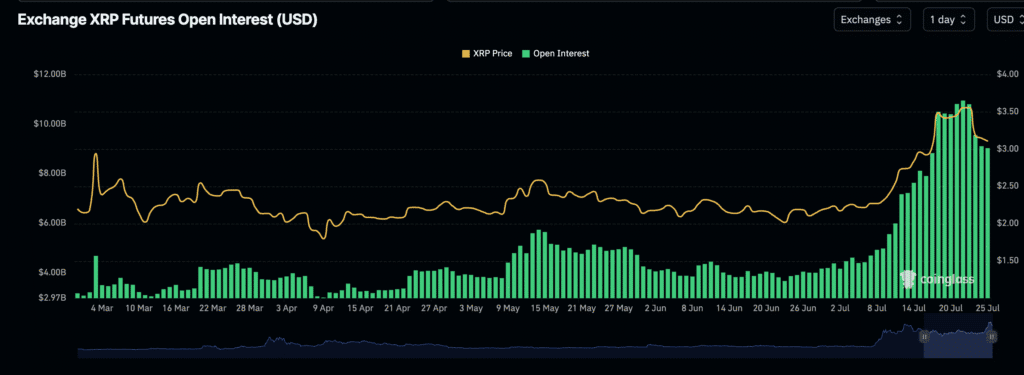

XRP remains above its 100-period EMA at $3.07, though waning Open Interest and funding rates show weakening conviction. If it fails to hold this level, support near $2.80 (its 200-EMA) may be tested again.

Bitcoin ETFs also saw $227M in inflows Thursday—marking a return of interest just as Trump’s new tariffs stir uncertainty in the dollar. The next week could prove critical for whether crypto assets continue recovering or slide further.

XRP Slips as Active Addresses and Futures Interest Drop

Ripple’s XRP token is showing signs of weakening after peaking at $3.66. It now trades about 17% below that level. Active addresses on the XRP Ledger have dropped 44% to just 28,000. Open Interest in XRP futures has also declined sharply—from $10.94B down to $9B.

The decline in both on-chain activity and derivatives suggests speculative appetite is fading, and without renewed momentum, XRP risks extending its pullback in the near term.

Dogecoin Slides as Altcoin Momentum Cools

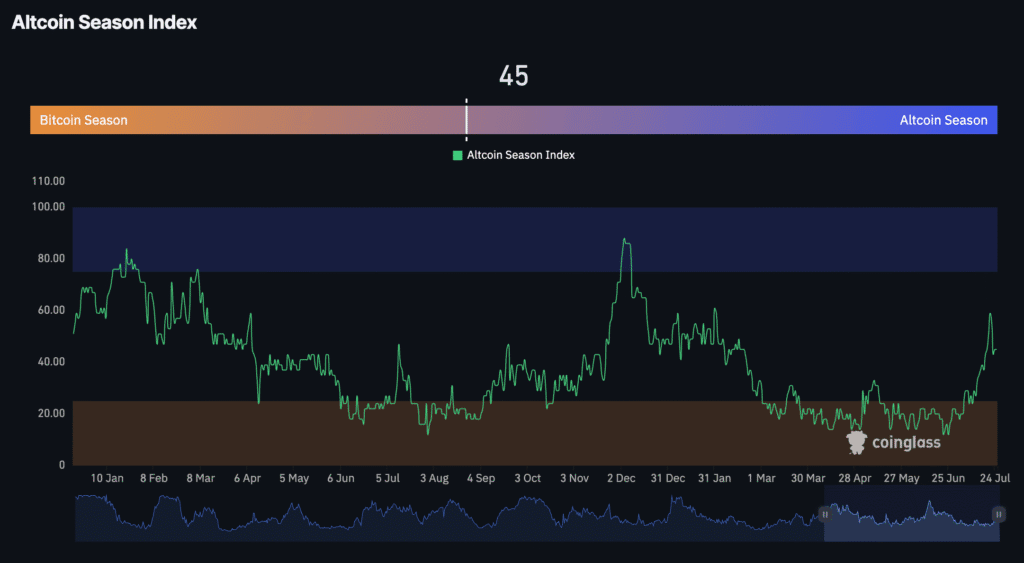

Dogecoin is down 22% from its recent high, trading around $0.2251. The Relative Strength Index (RSI) and MACD point to weakening momentum, while the Altcoin Season Index has dropped from 59 to 45.

DOGE’s price could revisit key support around $0.20 if the current correction continues. Marketwide profit-taking and a pause in the altcoin rally are undermining sentiment across meme tokens.

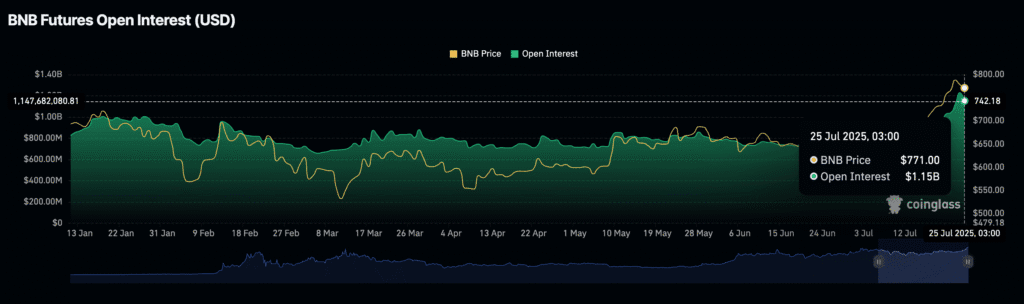

BNB Pulls Back After Peak as Windtree Unveils $520M Treasury Plan

BNB fell 5% from its all-time high of $809, now trading around $771. The drop coincides with broader risk-off sentiment in crypto and the announcement from Windtree Therapeutics of a $520 million capital plan, including a strategic push to build a BNB treasury.

Windtree aims to raise $500 million via a common stock agreement and an additional $20 million through a deal with Build and Build Corp. CEO Jed Latkin says the goal is to accumulate BNB holdings over time. Technical indicators show BNB’s RSI cooling off and MACD potentially signaling a broader pullback.

Bitcoin and Ethereum Retreat as Crypto Rally Falters

Bitcoin dropped more than 3% today, sliding below the $116,000 level for the first time since July 11. That decline puts pressure on the bullish trend seen over the past two weeks, as the crypto struggles to build upward momentum. If Bitcoin fails to reclaim $116,000 soon, the next key level could be $110,000.

Despite the latest pullback, Bitcoin remains up nearly 8% for July overall. Ethereum, meanwhile, has had an even stronger month—surging 45% so far—even with a nearly 3% dip today. ETH recently stalled near $3,800 and has now fallen toward the $3,600 area. For bulls eyeing further gains, a clean break above $4,000 remains the critical hurdle.

Ethereum Slides Amid Market Disappointment

Ethereum saw a notable dip of roughly 3% on the day, shedding value as crypto enthusiasm early in the week gave way to reality. Initial buzz had surrounded a proposed strategic Bitcoin reserve aiming to raise $500 million for new purchases. But by week’s end, the market had cooled. Ethereum lost momentum alongside other major digital assets.

The Day’s Takeaway

United States

- Stocks Close Higher; S&P and NASDAQ at Record Highs

The S&P 500 and NASDAQ Composite set fresh record closes, while the Dow gained 208 points, now just 113 points from its record high. All major indices ended the week higher: S&P +1.46%, Dow +1.26%, NASDAQ +1.02%, and Russell 2000 +0.94%. - Durable Goods Plunge in June

U.S. advanced durable goods orders dropped 9.3% in June—better than the expected -10.8% but still the worst month since April 2020. Core orders (excluding transportation) rose 0.2%. Non-defense capital goods ex-air fell 0.7%. - Fed Expected to Hold Rates Next Week

With strong labor data and inflation under control, the Fed is 96% likely to hold rates steady at 4.25%–4.50% in its July 30 meeting. Key data next week includes GDP, Core PCE, and Nonfarm Payrolls. - Trump Comments on Trade and Rates

Trump said there’s a “50-50 chance” of an EU deal, hinted that Powell might cut rates, and confirmed nearly 200 tariff letters are set to go out, most with rates of 10–15%. He reiterated he won’t advocate for a weak dollar—“but with a strong dollar, you can’t sell anything.”

Canada

- BoC Seen Cutting Rates to 2.25% by Year-End

While the Bank of Canada is expected to keep rates at 2.75% at its July 30 meeting, most economists surveyed expect at least one more cut this year, potentially taking rates to 2.25% or lower. - May Budget Balance Turns to Deficit

Canada reported a C$230 million deficit in May 2025, compared to a C$1.17 billion surplus a year earlier. Year-to-date, the deficit has narrowed to C$6.5 billion, down sharply from C$43.15 billion last year.

Commodities

- Oil Slips, Settles at $65.16

Crude oil futures ended lower, down $0.87 to $65.16. The market tested below the 100-day moving average multiple times but failed to stay there, showing weak bearish follow-through. Key support sits at $63.61, while resistance remains at $66.96 and $67.99 (200-day MA). - Rig Count Rises

Canadian rig count climbed +10 to 182, led by gains in both oil and gas rigs. - Gold Down as Dollar Rebounds, Trade Sentiment Improves

Safe-haven demand faded amid stronger U.S. data and trade deal optimism. Gold dipped to $3,325, its lowest level this week. The dollar rose and Treasury yields stayed muted, reducing appetite for non-yielding assets. - Durable Goods Slump Led by Aircraft Orders

June’s 9.6% MoM decline in headline durable goods was primarily due to a 22.4% plunge in transportation equipment. Core orders excluding transportation posted a modest 0.2% gain. - OPEC+ Likely to Hold Output Steady

According to Reuters, sources suggest OPEC+ will keep current production policy unchanged at its next review. Traders are watching for formal confirmation early next week.

Europe

- Markets Mixed to End the Week

European indices finished with modest changes on Friday:- DAX -0.32%, CAC +0.21%, FTSE 100 -0.20%

- Weekly: DAX -0.30%, CAC +0.15%, FTSE 100 +1.43%, IBEX +1.77%, FTSE MIB +1.03%

- ECB Rate Cut Timing Shifted by Analysts

JP Morgan now expects the next ECB rate cut in October, not September. It maintains a 1.75% terminal rate forecast, joining firms like Goldman Sachs and UBS. Other banks, like Barclays and Citi, see a more dovish 1.50% end point. - German Business Sentiment Improves Slightly

The July IFO index rose to 88.6. Current conditions rose to 87.8, beating expectations. Expectations remained flat. Optimism persists despite lingering tariff concerns. - Eurozone Money Supply Slows

M3 money supply growth eased to +3.3% YoY in June, below the expected 3.7%. Loans to households and businesses both ticked higher. - ECB Survey Predicts Lower 2025 Inflation

ECB’s Q3 forecaster survey now sees 2025 inflation at 2.0% (from 2.2%) and GDP growth at 1.1%. 2026 projections were also adjusted slightly lower. - French Consumer Confidence Inches Up

July’s reading rose to 89, slightly above forecast, though still well below the long-run average of 100. - UK Retail Sales Rebound

June retail sales rose 0.9% MoM, under the 1.2% estimate but an improvement from May’s -2.8%. Online and food sales led the gains.

Asia

- Japan Leading Index Revised Up

May’s leading economic index was revised to 104.8 from 104.2. The coincident index held steady at 116.0, suggesting no further deterioration in near-term economic momentum.

Crypto

- Bitcoin Pulls Back, Ethereum Holds Support

Bitcoin dropped as low as $114,723 before bouncing back near $115,868. Traders see dip-buying interest, but the IBCI indicator suggests the market is entering a possible distribution phase. - Ethereum (ETH): Recovered off support at $3,500, now pushing toward $3,717. ETFs show consistent inflows, with net assets near $20.7B.

- XRP: Down 17% from its high. Active addresses plunged 44%, and futures Open Interest fell from $10.94B to $9.1B, pointing to weakening bullish conviction.

- Dogecoin: Dropped 22% from its recent high to trade around $0.2251. RSI and MACD hint at further downside. Altcoin Season Index fell to 45 from a high of 59, signaling cooling altcoin momentum.

- BNB: Dropped 5% from its record high of $809 after Windtree Therapeutics announced a $520M BNB treasury strategy, including new stock agreements. Despite the dip, institutional interest remains elevated.