North America News

NASDAQ Winning Streak Ends as Alphabet Extends Its Rally Ahead of Earnings

The NASDAQ’s six-day run of record-setting gains came to an end on Tuesday, as tech stocks weakened while the Dow and S&P 500 posted modest advances. The S&P closed at a new all-time high, while the NASDAQ slipped into the red for the first time in a week.

Closing Snapshot:

- Dow Jones Industrial Average: +179.37 points (+0.40%) to 44,502.44

- S&P 500: +4.02 points (+0.06%) to a new record of 6,309.62

- NASDAQ Composite: -81.49 points (-0.39%) to 20,892.69

- Russell 2000: +17.62 points (+0.79%) to 2,248.75

Stock Highlights:

- Alphabet gained $1.24 (+0.65%) to close at $191.34, marking its 10th straight daily gain. The tech giant reports earnings after market close tomorrow.

- Tesla rose $3.62 (+1.10%) to $332.11. Its earnings are also due tomorrow after the bell.

- Netflix reversed Monday’s gains, sliding 3.5% to its lowest price since June 10. The stock is now down 11.3% from its June 30 record.

- Semiconductors were under pressure: Broadcom fell 3.34%, Nvidia dropped 2.54%, and AMD slid 1.45%.

The NASDAQ’s pause comes amid growing caution ahead of earnings season and trade-related headlines. Analysts will be watching Alphabet and Tesla closely as bellwethers for tech sentiment.

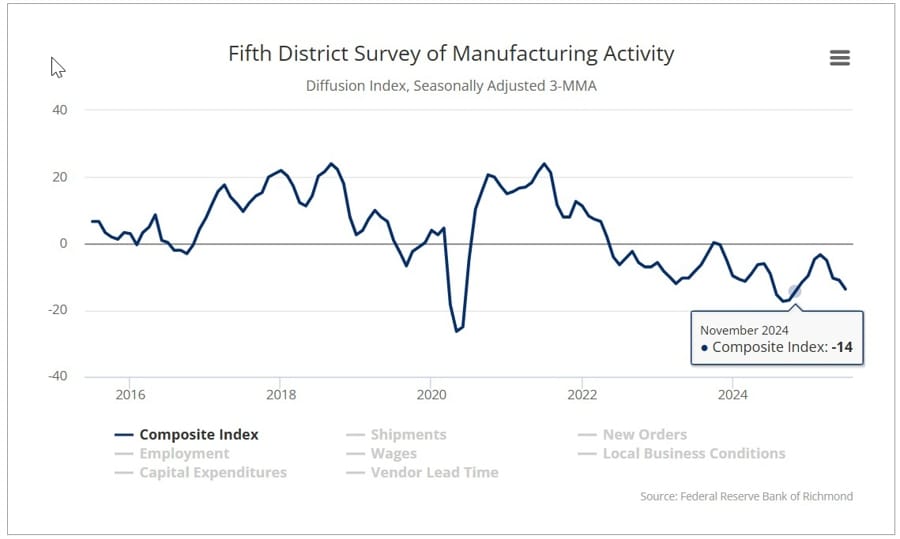

Richmond Fed Manufacturing Index Drops Sharply in June

The Richmond Fed’s regional manufacturing index plunged to -20 in June, a sharp deterioration from -8 the prior month. Revised data had shown May’s figure adjusted down from -7.

Key subcomponents weakened:

- Shipments: -18 (from -5)

- New orders: -25 (from -12)

- Employment: -16 (from -6)

- Backlog of orders: -30 (from -18)

Vendor lead times also fell, while input and output prices eased slightly:

- Prices paid: 5.65% vs 6.10% in May

- Prices received: 3.16% vs 3.57%

Despite the weakness, future expectations for shipments, orders, and business conditions ticked higher, while outlook for employment turned more negative. The data contrasts sharply with last week’s surprisingly strong Philadelphia Fed index (+15.9).

Trump Seals Trade Pact with Indonesia: 19% Tariff on All Imports

President Trump announced a new trade agreement with Indonesia on Tuesday, unveiling a sweeping deal that places a 19% tariff on all Indonesian goods entering the U.S. while granting American exports near-complete tariff relief in return.

Key Terms of the Agreement:

- Imports from Indonesia to the U.S. will face a flat 19% tariff

- U.S. exports of industrial goods, tech, and agriculture will enter Indonesia tariff-free, with 99% of previous barriers eliminated

- Indonesia will make large purchases of U.S. goods including Boeing aircraft, farm products, and energy—deals reportedly worth “tens of billions”

- U.S. auto safety standards will be accepted by Indonesia for American-made vehicles

- Critical materials will be supplied to the U.S. as part of the broader agreement

- E-commerce: Indonesia will end efforts to tax the internet and renew the WTO moratorium on e-commerce tariffs

- Trade transshipments will still face a hefty 40% tariff to prevent rerouting via third countries

Trump touted the deal as a “huge win” for U.S. industries and workers, from automakers to farmers. However, questions remain over how the 19% tariff will impact U.S. importers—whether Indonesian exporters will lower prices, or if American consumers will bear the brunt.

Trade Balance Snapshot (2024–2025):

- U.S. exports to Indonesia: $10.2 billion

- U.S. imports from Indonesia: $28.1 billion

- U.S. trade deficit: –$17.9 billion

This deal is part of Trump’s broader tariff strategy to reduce bilateral trade deficits while encouraging strategic resource deals and boosting U.S. exports.

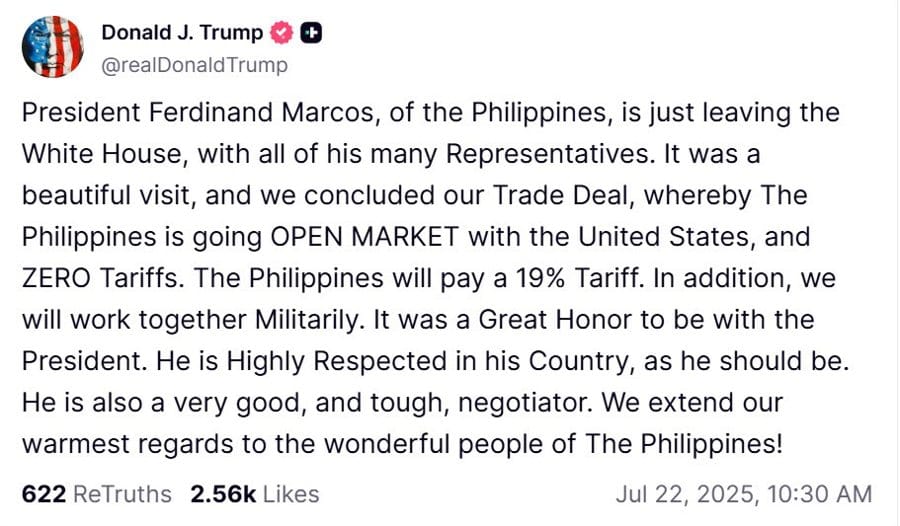

Trump Strikes Trade Deal with Philippines: 19% Tariffs on Imports

Trump announced a new trade deal with the Philippines via Truth Social, revealing a framework that mirrors the U.S.–Vietnam agreement.

Under the deal:

- Philippine imports to the U.S. will face a 19% tariff

- U.S. exports to the Philippines will be tariff-free

The agreement also includes plans for closer military cooperation. In 2024, U.S. exports to the Philippines totaled $9.3 billion, while imports were $14.2 billion, resulting in a $4.9 billion trade deficit.

In comparison, the U.S. trade deficit with Vietnam hit $123.5 billion last year. The Philippines agreement is seen as part of Trump’s broader push to narrow trade gaps through bilateral deals with tariff leverage.

Fed’s Bowman Emphasizes Need for Central Bank Independence

Federal Reserve Governor Michelle Bowman stressed the importance of Fed independence during a CNBC interview on Tuesday.

“Fed independence is very important with respect to monetary policy,” she said, echoing a widely held principle among central bankers. Ensuring autonomy is crucial for keeping inflation expectations anchored and shielding rate decisions from political influence.

Trump Hints at Powell’s Exit, Rants on Rates and China

In off-the-cuff comments from the Oval Office, former President Donald Trump hinted that Fed Chair Jerome Powell “will be out soon,” though he stopped short of confirming plans to fire him.

Trump criticized Powell’s rate decisions, claiming:

- Europe has cut rates 10 times; the U.S. has done “zero”

- High rates are crushing homebuyers

- The Fed should cut rates to 1% from the current 4%

He also accused Powell of attempting to help Kamala Harris by timing cuts before the election.

On China, Trump said President Xi had invited him for a visit, which he may accept soon. He also floated removing capital gains taxes on home sales and commented that U.S. imports from China—particularly rare earth magnets—are “going very well.”

US Bessent: August 1 is a pretty hard deadline

Comments from the US Treasury Secretary, Scott Bessent:

- Tariffs would boomerang back, we can still negotiate.

- We’re about to announce a rash of trade deals in coming days.

- A lot of deals include substantial investments in US.

- Tariffs are bringing manufacturing back to the US.

On August 12 deadline with China:

- We’ll be in talks on Monday and Tuesday.

- Will likely work out an extension.

- Hope to see Chinese pull back on glut of manufacturing.

- Want them to open up.

- If we can do more manufacturing, China does more consumption that would be a home run.

Commerce Sec Lutnick: Another win for American manufacturing

- AstraZeneca announces its plan to build a $50 billion manufacturing facility in the US

- Tariff strategy at work.

- The investment will bring high-paying jobs to Virginia, Indiana, Texas, and across the country

- The plant will harden our supply chains

- Reshoring pharma production is one of our top priorities.

JPMorgan Flags Dangerous Crowding in High-Beta Stocks

JPMorgan strategists warn that investor crowding in high-beta stocks has reached its most extreme level in three decades. They cite a rapid shift from the 25th percentile to the 100th percentile in just three months.

The rotation into speculative growth names like Palantir, Coinbase, Nvidia, Super Micro, and Tesla reflects overconfidence in a soft-landing scenario. JPMorgan advises clients to rotate into low-volatility names with more favorable risk/reward ahead of looming risks like August’s tariff deadlines.

U.S.-India Mini Trade Deal Now Unlikely Before August Deadline

Hopes for a limited trade deal between the U.S. and India before August 1 have dimmed, despite earlier optimism. CNBC TV18 reports the two sides are unlikely to reach a deal in time, raising questions about whether India will face the full 26% tariffs originally announced in April.

India has been pushing for tariff relief on steel, aluminum, autos, and more, while the U.S. wants greater market access for agriculture and industrial goods. With a broader trade agreement still under negotiation, the mini-deal may be shelved until later this year.

Trump’s Attacks on Fed Could Backfire, Economists Warn

A study cited by T.S. Lombard economists finds that political interference in Fed policy has historically led to persistently higher inflation and weaker asset returns. Economist Thomas Drechsel’s research draws from presidential records and builds a “political pressure index” to track such events.

The report highlights past cases, including Nixon and Johnson, where the Fed bent to political will. If Trump follows through on threats to fire Fed Chair Jerome Powell, the study warns it could damage confidence in U.S. monetary policy and boost the euro, perceived as backed by a more independent ECB.

AstraZeneca Commits $50B to U.S. Expansion

Pharmaceutical giant AstraZeneca plans to invest $50 billion in the United States to ramp up its research and manufacturing footprint. Details remain sparse for now, but the investment signals a major commitment to U.S.-based operations. The firm is headquartered in Cambridge, UK.

Stellantis Suffers $2.7B Hit as Tariffs Wreak Havoc on Sales

Stellantis revealed it may post a $2.7 billion loss for the first half of 2025, with North American sales down 25% in Q2. Trump-era tariffs cost the automaker roughly $350 million so far this year, with losses stemming from both direct duties and idle production.

Additional costs have come from compliance with reinstated emissions standards and attempts to shore up profitability in a tough regulatory and trade environment.

Goldman Sachs Sees Fed Cutting Rates at All Remaining 2025 Meetings

Goldman Sachs expects the Federal Reserve to begin a rate-cutting cycle in September, forecasting three 25bp reductions—one at each of the remaining meetings this year (Sept 16–17, Oct 28–29, Dec 9–10).

The outlook hinges on inflation staying under control. If current trends hold, Goldman believes the Fed has room to shift toward easier policy without reigniting inflation.

U.S. Treasury’s Bessent Calls for Overhaul of Bank Capital Rules

Speaking at a Fed-hosted conference, U.S. Treasury official Daleep Bessent criticized the current bank capital regime, calling it outdated and misaligned with risk realities. He argued that the dual-capital framework imposes unnecessary burdens and proposed that community banks be allowed to opt into a modernized standard.

Bessent emphasized that any reform must still meet the legal mandates of financial stability and consumer protection, but insisted the current rules don’t reflect actual risk exposure.

Canada’s PM Carney Says U.S. Trade Deal Must Prioritize Canadians

Canadian Prime Minister Mark Carney said Ottawa would only sign a trade agreement with the U.S. if it serves Canadian interests.

Speaking at a press briefing, Carney said:

- Canada will “use all the time necessary” to reach a good deal

- Talks with the U.S. are complex, and August 1 isn’t a hard deadline

- The government is preparing aid for workers in the steel and lumber sectors facing potential tariffs

Carney’s comments reflect cautious optimism but suggest Canada is preparing for all outcomes, including new protectionist measures from Washington.

Commodities News

Gold Rallies to 5-Week High as Yields Fall and Trade Fears Escalate

Gold surged to its highest level in five weeks on Tuesday, climbing more than 0.9% to trade at $3,427, as sliding U.S. Treasury yields and trade tension between the U.S. and Europe fueled safe-haven demand. The metal briefly touched $3,433 intraday after bouncing off lows of $3,383.

Market Drivers:

- U.S. yields have declined for five straight sessions, dragging the U.S. Dollar lower. The DXY index fell 0.44% to 97.43.

- Trade uncertainty intensified after the U.S. imposed 30% tariffs on EU imports, with no agreement in sight before the August 1 deadline. The EU is preparing retaliatory measures.

- Safe-haven demand increased amid speculation that talks with the EU are stalling, and with few major economic reports this week to shift market momentum.

Comments from Washington:

- Treasury Secretary Scott Bessent said he plans to meet with Chinese officials next week and hinted at a possible delay to the August 12 deadline on China tariffs.

- President Trump recently announced a deal with the Philippines that exempts U.S. imports from tariffs while imposing 19% duties on goods coming into the U.S.

Macro Context:

- While recent U.S. inflation data shows CPI nearing 3%, Retail Sales came in strong, signaling robust consumer demand.

- The Fed is widely expected to keep rates steady at its July 30 meeting, with futures pricing in a 94% chance of no change and just 6% for a cut.

With trade talks in limbo and economic data mixed, gold continues to benefit from a cocktail of uncertainty, falling yields, and declining real rates.

Saudi Arabia Boosts Oil and Product Exports in May

Saudi Arabia ramped up its crude oil and refined product exports in May, driven by increased production and a pullback in domestic refining.

According to JODI data cited by Commerzbank analyst Carsten Fritsch, the kingdom exported just under 6.2 million barrels of crude per day in May—up 1.2% year-over-year and slightly higher than April. The production increase to 9.18 million bpd followed the latest OPEC+ agreement.

Meanwhile, refinery throughput dropped 7.6% to 2.72 million bpd. Refined product exports surged 12.2% year-on-year to 1.37 million bpd, with gasoline and aviation fuel leading the rise, while diesel exports dipped slightly but remained the top category at nearly 600,000 bpd.

Crude consumption for power generation rose 23% YoY, though the absolute level was modest at 48,000 bpd. June data is expected to confirm whether higher production translated into even greater export volumes, especially to China, which sharply increased its intake.

Gold Finds Lift From Dovish Fed Signals

Gold began the week on the front foot, with rising expectations of rate cuts giving the metal a tailwind, according to Commerzbank’s Thu Lan Nguyen.

Fed in Focus:

Fed Governor Christopher Waller reiterated support for rate cuts as early as July, suggesting a total of 125–150bps to return policy to a “neutral” 3% level. He also downplayed tariff-driven inflation, indicating a willingness to tolerate near-term price increases.

While markets still see a July cut as unlikely, Waller’s stance could improve his odds of replacing Powell—something likely to please Trump.

Price Implications:

Waller’s inflation stance implies a lower real rate environment ahead, which makes gold more attractive. A renewed push toward the recent $3,500/oz peak now looks increasingly plausible.

Brent Struggles Near $72 Resistance

Brent crude remains capped below its 200-day moving average around $72, facing renewed resistance, Société Générale analysts note.

Key Levels:

Price action has been stuck between the 50-day and 200-day moving averages. A failure to break through $72 could see Brent retesting support near $66.30. A clean break lower could target the $63.00 area, where prices bottomed last month.

China’s Surging Oil Imports From Malaysia Raise Eyebrows

China’s crude oil import data for June shows a notable uptick in shipments from Malaysia—likely a backdoor route for sanctioned Iranian oil, according to Commerzbank.

June Imports:

China imported 49.9 million tons of crude in June. Russia led the pack with 8.35 million tons, followed by Saudi Arabia at 7.9 million. But Malaysian imports surged 40% to 7.1 million tons—far exceeding Malaysia’s production capacity of ~350,000 bpd.

Sanctions Workaround:

The mismatch suggests Malaysia is acting as a hub for rebranded Iranian (and possibly Venezuelan) crude. Official Chinese customs data show zero barrels from Iran or Venezuela.

H1 Trends:

For the first half of 2025, China’s oil imports from Russia fell 11% year-on-year but still topped the supplier list. Saudi volumes dipped 3.5%, while Malaysia jumped over 30%—underscoring Iran’s stealthy rise as a key supplier.

Crude Oil Sideways as Traders Watch Support Near $64

After a turbulent June driven by Middle East tensions, crude oil has settled into a tighter range, with key support near $64 holding strong.

Macro Setup:

With geopolitical risk premiums now largely priced out, markets are shifting focus back to global demand and policy trends. Expansionary fiscal and monetary policy continues to support a mildly bullish view. The August 1 tariff deadline is a potential wildcard, though markets may be pricing in Trump backing off again.

Upside potential remains, though hawkish central bank pivots or renewed tariff shocks could change that outlook quickly.

Daily Chart:

Crude’s recent downtrend stalled right at the $64 level, where buyers continue to defend aggressively. If that zone gives way, expect a slide toward $55. Until then, bulls remain in control.

4-Hour Chart:

The $69–64 range is becoming the dominant battleground. Traders are playing this range, buying dips and fading rallies until a breakout emerges.

1-Hour Chart:

A short-term descending trendline is guiding the current pullback into the support zone. Expect bulls to lean in near the base to drive another leg higher, while bears will use the trendline as resistance to try pushing prices lower.

Platinum Market Sends Mixed Signals Despite Supply Cuts

The outlook for platinum is caught between reduced supply and bearish investor flows, according to Commerzbank’s Carsten Fritsch.

Production Forecasts:

Russia’s top palladium producer slightly trimmed its annual forecast, now expecting 2.68–2.73 million ounces, down from 2.7–2.76 million. Platinum output is also revised lower to 645–662k ounces, previously 662–675k.

This could widen the expected 200,000-ounce platinum supply deficit forecasted earlier this month.

ETF Flows:

However, sentiment doesn’t reflect that tightness. Since mid-last week, platinum ETFs tracked by Bloomberg have shed over 160,000 ounces. Total July outflows now exceed 250,000 ounces—undermining price support.

WPIC had projected net ETF inflows of 100,000 ounces this year, so current flows are far off that target.

Europe News

European Markets Mixed as Tariff Jitters Hit Germany, France

Major European indices closed Tuesday with mixed results, with Germany and France lagging while other benchmarks held steady.

- DAX: -1.09%

- CAC 40: -0.69%

- FTSE 100: +0.12%

- Ibex 35: +0.07%

- FTSE MIB: Flat

German stocks were hit hardest on concerns over looming U.S. tariffs. The EU is reportedly preparing countermeasures if no deal is reached by August 1. Trump has floated a 30% tariff on EU imports, with Commerce Secretary Lutnick suggesting large partners would face minimum rates of 20%.

Despite Tuesday’s dip, Germany’s DAX remains up more than 20% year-to-date after strong gains last year.

EU Trade Comm Sefcovic: This week’s EU/China summit is an opportunity to discuss trade

- Looking for a more balanced partnership

While the US/EU trade negotiations are ungoing, the EU commissioner Sefcovic is looking at China too:

- This week’s EU-China Summit is an opportunity to discuss critical trade and investment issues.

- We must work towards a more balanced partnership

BOE governor Bailey: Short dollar is now the most crowded trade in the market

Remarks by BOE governor, Andrew Bailey:

- We have seen steeper yield curves, that is a global phenomenon

- Cause of steeper yield curve reflects greater uncertainty on trade policy

- Steeper yield curve also reflects uncertainty on fiscal policy

- Long-term investors appear not to want to be so overweight on dollar assets

- We need to watch this very carefully

Asia-Pacific & World News

China Smartphone Market Shrinks Slightly in Q2; Apple Down, Huawei Up

China’s smartphone shipments slipped 2.4% year-on-year in Q2, according to Counterpoint Research. Apple posted a 1.6% drop in China sales, while Huawei jumped 17.6%—a notable divergence in the competitive landscape. Trade tensions continue to cast a shadow over Apple’s performance in the region.

China’s Swap Curve Reverses as Stimulus Boosts Confidence

For the first time in months, China’s interest-rate swap curve has steepened—an early signal that fears of entrenched deflation are easing. The five-year swap rate climbed above the one-year rate, reversing a long-standing inversion that reached a 15 basis point spread in February.

Standard Chartered’s Becky Liu says this shift points to optimism around supply-side reforms that could lift inflation over the next 12–24 months. ANZ’s Xing Zhaopeng added that the steepening trend could stick, reflecting changing market expectations for China’s growth prospects.

PBOC sets USD/ CNY central rate at 7.1460 (vs. estimate at 7.1635)

- PBOC CNY reference rate setting for the trading session ahead.

In open market operations (OMOs), PBOC injects 214.8bn via 7-day RR, sets rate at 1.4%

- 87.1bn mature today

- net drains 127.7bn yuan

Australia to Launch Full Monthly CPI in November

Australia will switch to a complete monthly Consumer Price Index report starting November 26. The Australian Bureau of Statistics (ABS) will begin covering all 87 expenditure classes every month, replacing the current partial update that includes only 43.

This move will offer the Reserve Bank of Australia better real-time data and reduce uncertainty in rate decisions. The quarterly CPI will continue for at least 18 months as the RBA transitions. RBA Governor Michele Bullock warned the current monthly data remains volatile and unreliable for policy.

RBA Holds Rates in July But Signals More Cuts Ahead

The Reserve Bank of Australia kept its cash rate at 3.85% during its July meeting, resisting market pressure for a 25bp cut. Meeting minutes show the board agreed further cuts are likely needed but opted to wait for clearer evidence that inflation is easing.

While some members argued a rate cut was justified based on inflation tracking toward the midpoint of the RBA’s target, most felt additional easing now would be premature. Labor market strength and slightly firmer inflation data led the majority to hold off. However, downside risks remain, particularly from U.S. tariffs and global uncertainty.

New Zealand’s Exports Fall Sharply in June

New Zealand posted weaker-than-expected trade figures for June. Exports came in at NZD 6.63 billion, down from NZD 7.50 billion in the prior month. Imports edged up slightly to NZD 6.49 billion from NZD 6.42 billion.

The 12-month trade deficit widened to NZD -4.366 billion, compared to NZD -3.931 billion previously.

Japan, U.S. Still Far Apart on Tariff Talks

Japan’s chief trade negotiator Ryosei Akazawa said talks with the U.S. remain stalled after a two-hour meeting with Commerce Secretary Lutnick. The sides continue searching for mutually beneficial ground on tariffs, but no breakthrough appears close. Details remain scarce.

Bank of Japan Expected to Hold Rates Steady

The Bank of Japan is widely expected to leave its benchmark rate unchanged in its upcoming meeting. Bloomberg reports that the BOJ sees little urgency to act following recent election results and will be watching trade talks closely. However, policymakers remain alert to upside risks if fiscal stimulus ramps up sharply.

Japan Finance Chief Rejects Sales Tax Cut Despite Political Blow

Japan’s Finance Minister Katsunobu Kato says there will be no rollback of the country’s consumption tax, despite the ruling coalition’s weak showing in the latest upper house elections. Speaking Monday, Kato acknowledged the political setback but stood firm against populist tax relief measures.

He stressed the need to preserve fiscal discipline, especially given Japan’s massive debt load. Calls for a tax cut have grown louder, but Kato insisted any government response will prioritize economic stability over political expediency.

Crypto Market Pulse

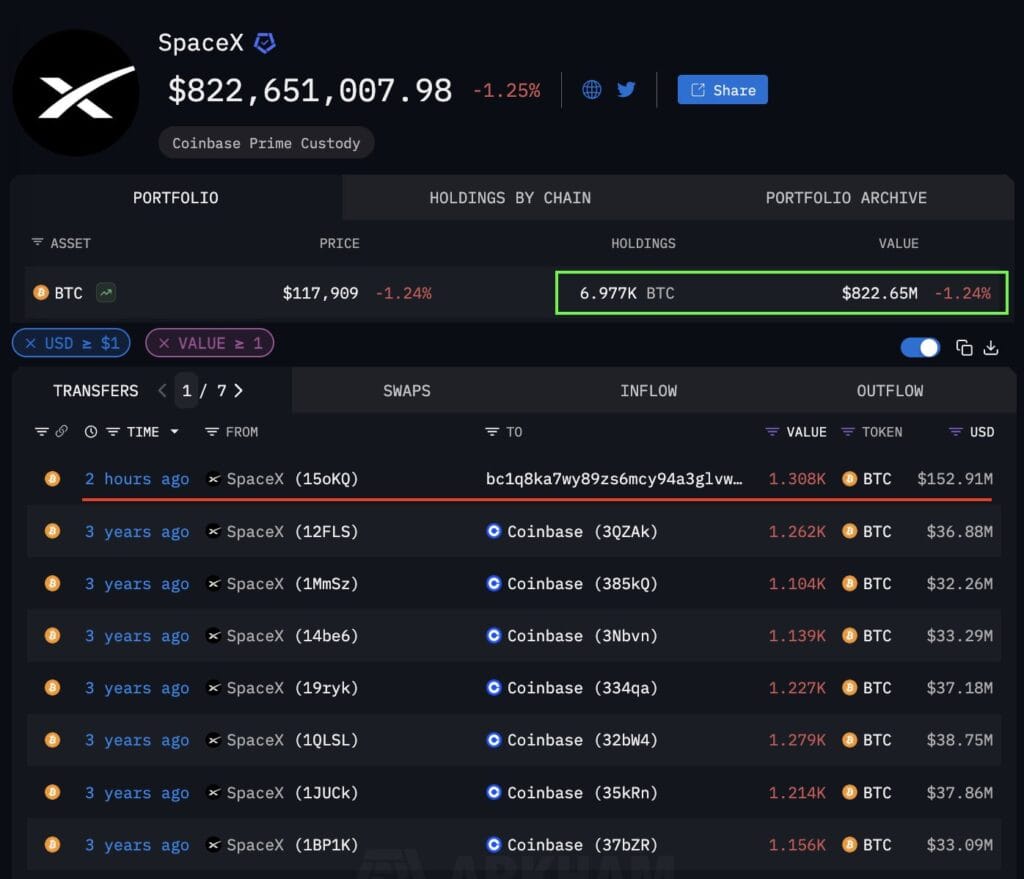

Bitcoin Holds Ground as SpaceX Moves $150M BTC; ETH, XRP Ease

Bitcoin held steady above $118,000 on Tuesday even as Ethereum and XRP pulled back. The market digested news that SpaceX transferred over $150 million in dormant BTC holdings.

Key Highlights:

- BTC: Consolidating above $118,000

- ETH: Down 2% to $3,662, with RSI cooling from 79

- XRP: Retreated to $3.48 after failing to break resistance at $3.66

SpaceX Activity:

For the first time since June 2022, Elon Musk’s SpaceX moved 1,308 BTC (~$153 million) to a new wallet, signaling renewed interest. The company still holds nearly 7,000 BTC worth ~$823 million.

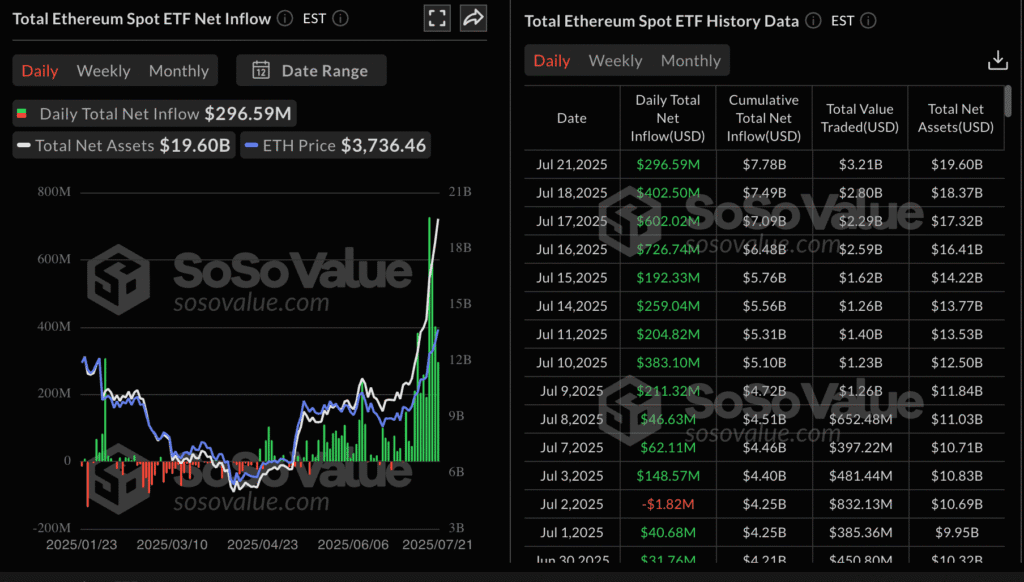

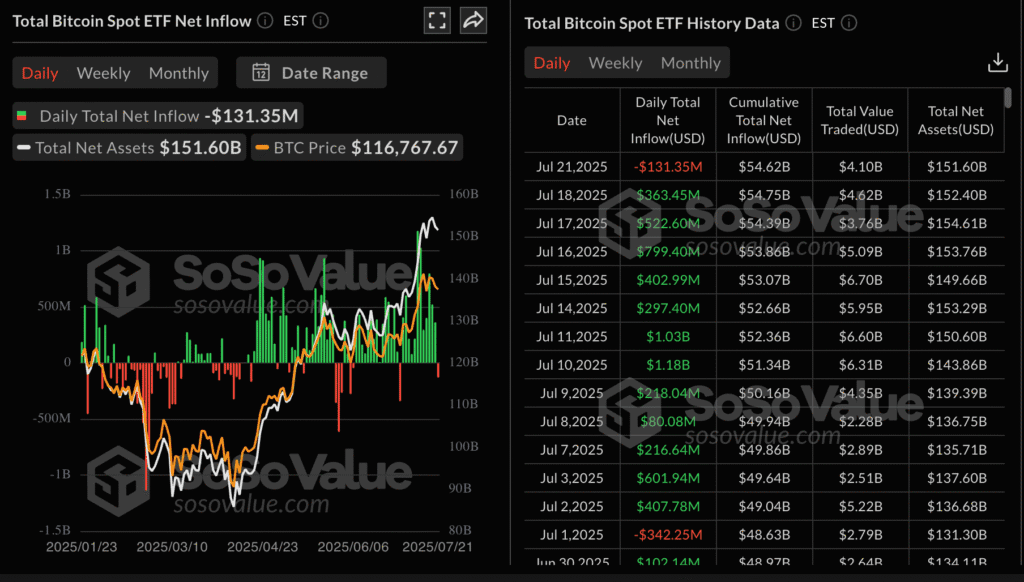

ETF Flows:

- Ethereum spot ETFs saw $297 million in inflows Monday, their 12th consecutive day

- Total ETH ETF assets: $19.60 billion

- Bitcoin ETFs recorded $131 million in outflows, breaking their 12-day streak

Technical Picture:

ETH’s recent run-up hit $3,860 before easing. Short-term support lies at $3,600 and $3,500. The asset remains technically strong with two confirmed golden crosses (50/200 EMA and 100/200 EMA).

XRP is losing steam after multiple rejections near $3.66. The RSI cooled from 88 to 80, hinting at more selling pressure. A move below $3.42 could trigger further downside as profit-taking accelerates.

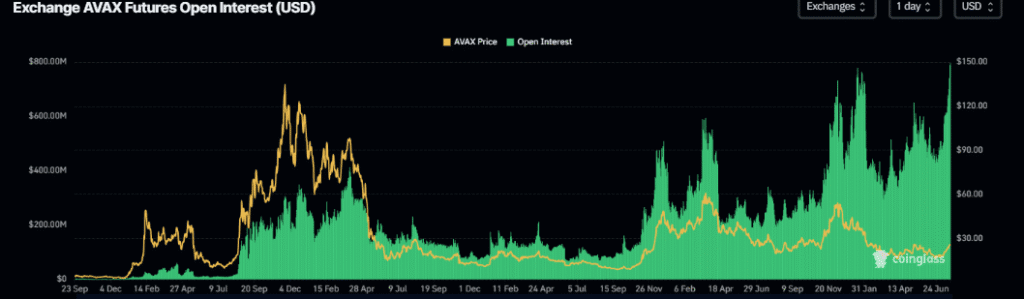

Avalanche Hits Record Open Interest as Bulls Eye $30+

Avalanche (AVAX) is riding high after an 18% rally last week, supported by bullish derivatives data and rising ecosystem activity.

Technical Outlook:

Trading above $25 on Tuesday, AVAX is targeting a breakout above $30. CoinGlass data shows Open Interest hit a new all-time high at $796.35 million, up from $667.08 million just days earlier.

Ecosystem Growth:

DefiLlama data shows TVL on the AVAX chain has surged from $1.49B on July 1 to $1.93B—the highest since September 2022. This suggests rising user engagement and capital inflows into Avalanche’s DeFi ecosystem.

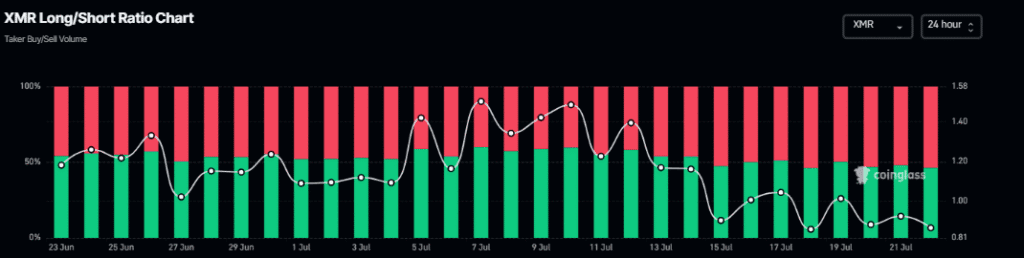

Monero Bears Tighten Grip as Momentum Shifts

Monero (XMR) is flashing warning signs after breaking below an ascending trendline, with increasing short interest confirming bearish sentiment.

Bearish Shift:

XMR currently trades around $320. Coinglass reports the long-to-short ratio has dropped to 0.82—the lowest in over a month—showing a growing number of traders betting on further downside.

Technical indicators support this shift, pointing toward a likely correction in the near term.

JPMorgan Plans Crypto-Collateral Loans by 2026

JPMorgan is preparing to let clients borrow using cryptocurrencies like Bitcoin and Ethereum as collateral—a major step toward mainstreaming digital assets in traditional finance.

Current Setup:

While JPMorgan already allows loans against crypto ETFs, the bank is now working toward accepting direct token collateral. The move comes amid clearer regulatory signals and rising institutional interest.

Custody and Risk:

To manage risk, JPMorgan will likely use third-party custodians like Coinbase to hold collateral. This limits direct exposure while giving clients access to liquidity.

Bitcoin Holds Key Support as Buyers Defend $116K

Bitcoin remains in a holding pattern above a crucial support zone, with traders eyeing a potential breakout to define the next major trend.

Macro Setup:

Despite strong U.S. economic figures and easing inflation, Bitcoin’s rally has paused. Since the April 9 low, growth expectations and liquidity trends have improved—both supportive for crypto. The upcoming August 1 tariff deadline adds some caution, but given Trump’s history of delays, market sentiment still leans toward positive resolution.

Unless markets are hit with another macro shock—like hawkish rate expectations or new growth concerns—the bullish momentum should remain intact.

4-Hour Chart:

On the 4-hour timeframe, Bitcoin continues to bounce from the $116,000 support level. Buyers are stepping in aggressively with clearly defined stop-losses under the ascending trendline. A break below this area could open the door to deeper downside, targeting support near $110,000.

1-Hour Chart:

Price action has formed a descending triangle, which typically precedes a decisive breakout. Whether it’s up or down, the next move should set the tone for short-term momentum.

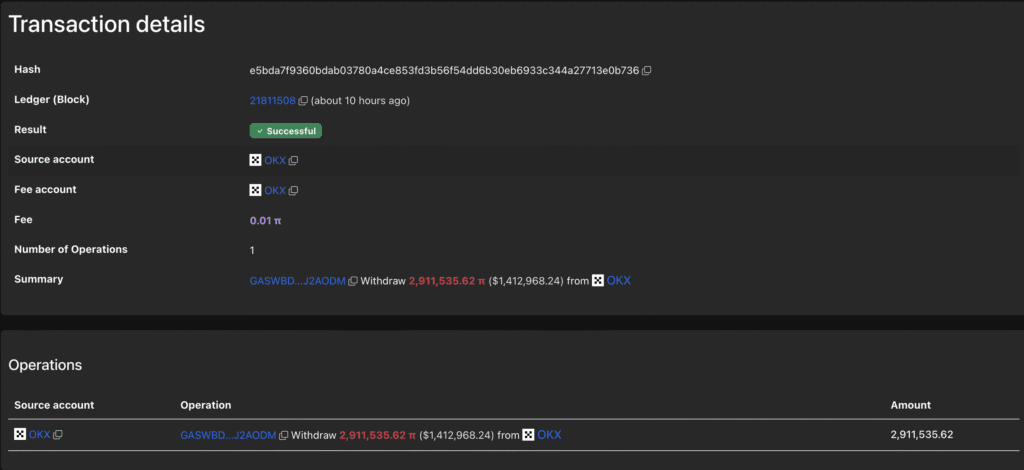

PI Token Struggles at $0.50 Despite Whale Activity

Pi Network (PI) saw a modest 4% gain Tuesday as it broke out of a consolidation range, but the rally lost momentum near the $0.50 mark.

Whale Activity:

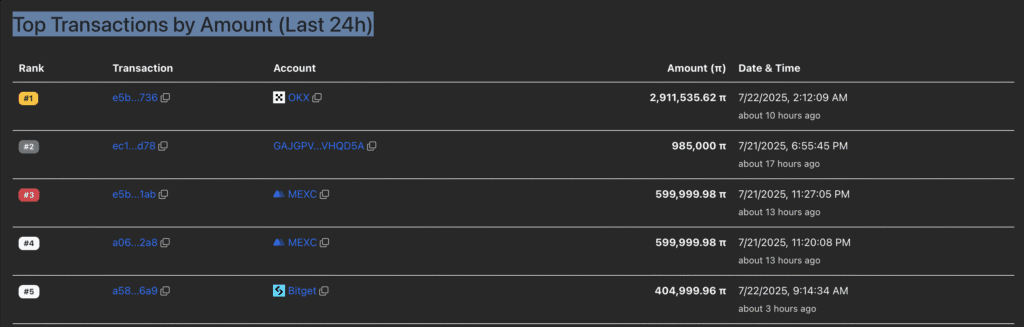

Blockchain tracker PiScan reported a single wallet withdrawing 2.91 million PI tokens (worth ~$1.41M) from OKX, signaling long-term confidence. However, major exchanges like Bitget and MEXC have been offloading PI onto other platforms—raising questions about overhead supply.

Exchange Movements:

MEXC moved nearly 600,000 PI tokens to Gate.io and OKX, while Bitget sent ~405,000 tokens to Gate.io. These transfers could signal a planned sell-off or internal reallocation strategies.

MicroStrategy Launches $500M Equity Offering to Fund More Bitcoin Buys

MicroStrategy is seeking to raise at least $500 million through a new preferred share issuance aimed at expanding its Bitcoin holdings. The company plans to sell 5 million Series A “Stretch” shares at $90 to $95 apiece. These shares carry a starting 9% dividend and are structured to offer cumulative, adjustable payouts that can rise monthly but decline only slightly over time.

Positioned above common equity but below earlier preferreds and convertibles, the offering is being pitched by major banks. The company’s Bitcoin stash now exceeds $71 billion. Following news of the issuance, MicroStrategy shares rose to $428 and climbed an additional 0.4% after the announcement. CEO Michael Saylor remains on the offensive, using creative financial tools to keep stacking Bitcoin.

The Day’s Takeaway

United States

- NASDAQ’s six-day winning streak ends, falling 0.39% to 20,892.69, breaking its streak of record closes.

- S&P 500 hits a new all-time high, closing up 0.06% at 6,309.62.

- Alphabet rose for the 10th consecutive session, up 0.65% to $191.34 ahead of earnings tomorrow.

- Tesla added 1.10%, closing at $332.11. It also reports earnings after the bell Wednesday.

- Netflix dropped 3.5%, hitting its lowest level since June 10 and now down over 11% from its June 30 high.

- Chip stocks struggled, with Broadcom down 3.34%, Nvidia down 2.54%, and AMD down 1.45%.

- Richmond Fed manufacturing index plunged to -20, with major declines in shipments, new orders, and employment.

- Fed Governor Michelle Bowman reaffirmed the importance of central bank independence, stating it is essential for maintaining inflation control and market credibility.

- President Trump suggested Jerome Powell will be “out soon”, while criticizing the Fed’s rate policy and floating plans to remove capital gains taxes on home sales.

Canada

- Prime Minister Mark Carney stated that any U.S. trade deal must serve Canadian interests, emphasizing the complexity of ongoing negotiations.

- Ottawa is preparing support packages for workers in steel and softwood lumber facing potential U.S. tariffs.

Commodities

Crude Oil

- Saudi Arabia boosted exports in May, shipping just under 6.2M bpd of crude, up 1.2% YoY. Oil product exports rose 12.2%, led by gasoline and aviation fuel.

- Crude refining activity dropped 7.6%, while electricity sector crude use rose 23% YoY (albeit from a low base).

- June data may show even higher crude exports, particularly to China.

Gold

- Gold surged to a five-week high, rising over 0.9% to $3,427 as U.S. Treasury yields fell for a fifth day and trade tensions spiked.

- Uncertainty over U.S.–EU trade talks and expectations that the Fed will hold rates (94% odds) are boosting safe-haven demand.

- The U.S. Dollar Index (DXY) dropped 0.44% to 97.43 amid falling yields and limited macro data this week.

Europe

- Major indices closed mixed:

- DAX: -1.09%

- CAC 40: -0.69%

- FTSE 100: +0.12%

- Ibex 35: +0.07%

- FTSE MIB: Unchanged

- Concerns over U.S. tariffs on the EU are weighing on investor sentiment.

- EU preparing countermeasures if no deal is reached before August 1.

Asia

- President Trump announced a sweeping trade deal with Indonesia, imposing a 19% flat tariff on all Indonesian imports to the U.S.

- Indonesia agreed to open markets for U.S. tech, industrial goods, agriculture, and energy.

- Indonesia to drop internet tariffs and accept U.S. auto safety standards.

- U.S. trade deficit with Indonesia stood at $17.9B last year ($28.1B in imports vs $10.2B in exports).

Rest of the World

- Trump confirmed a new trade agreement with the Philippines, with:

- 19% tariffs on all imports from the Philippines

- 0% tariffs on U.S. exports to the Philippines

- Military cooperation added to the deal framework

- The deal mirrors recent U.S.–Vietnam agreements, part of a broader push to shrink trade deficits and expand U.S. export access.

Crypto

- JPMorgan to launch crypto-backed loans in 2026, allowing clients to borrow against Bitcoin and Ethereum.

- The bank is expected to partner with custodians like Coinbase, given it won’t hold crypto directly on its balance sheet.

- Jamie Dimon’s stance on crypto softens, even as he remains skeptical of its utility versus fiat.

- Regulatory support rising with the GENIUS Act signed into law and the Crypto CLARITY bill moving to the Senate.

Market Moves

- Bitcoin consolidates above $118,000, despite SpaceX transferring $153M in BTC to new wallets—its first movement since June 2022.

- Ethereum drops over 2%, trading near $3,662. Despite outflows, ETF demand remains strong with $297M added Monday.

- XRP falls to $3.48 after rejection at $3.66. RSI suggests overbought conditions easing, raising the risk of deeper profit-taking.

- Altcoin ETFs show strong interest, while BTC ETF flows posted $131M in outflows Monday—breaking a 12-day inflow streak.