North America News

NASDAQ Closes Higher Again, Marks Record Every Day This Week

The NASDAQ added a small gain on Friday, but it was enough to lock in a record close for the fifth straight session. The index edged up by 11.39 points, or 0.05%, to finish at 20,895.66. It now has 11 record closes in 2025.

Other major indexes didn’t keep pace:

- The S&P 500 slipped just 0.01%, coming off its ninth record of the year set on Thursday.

- The Dow Jones Industrial Average lost 142.30 points, or 0.32%, to end the day at 44,342.19.

- The Russell 2000, tracking small-cap stocks, also declined on the session.

Here’s how the indexes performed over the full week:

- NASDAQ: +1.51%

- S&P 500: +0.59%

- Russell 2000: +0.23%

- Dow Jones: -0.07%

The NASDAQ’s tech-heavy composition continues to lift it higher, while broader indexes saw more muted action heading into next week’s key data releases.

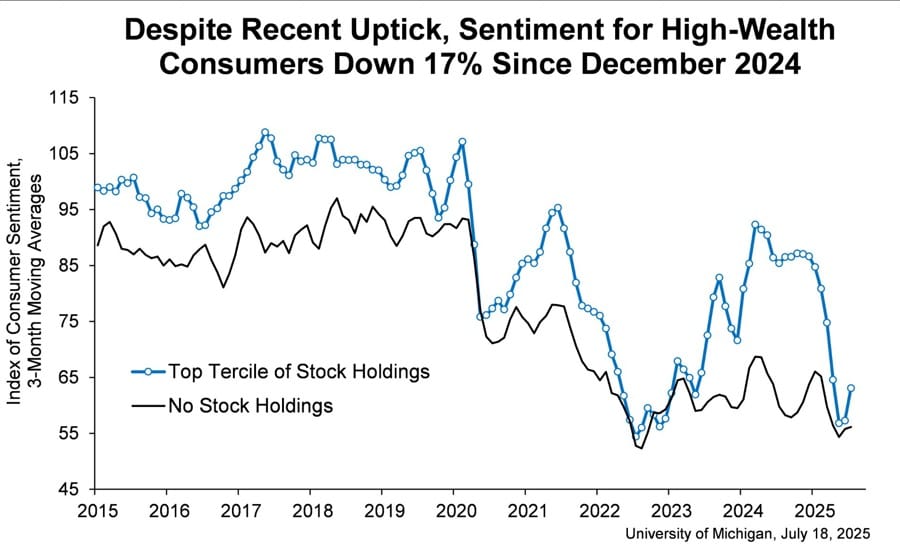

Michigan Consumer Sentiment Rises to 61.8 in July, Still Well Below Norm

The University of Michigan’s preliminary July sentiment index rose to 61.8, beating expectations of 61.5 and up from 60.7 in June. Components:

- Expectations: 58.6 (vs. 55.0 forecast; prior 58.1)

- Current conditions: 66.8 (vs. 63.9 forecast; prior 64.8)

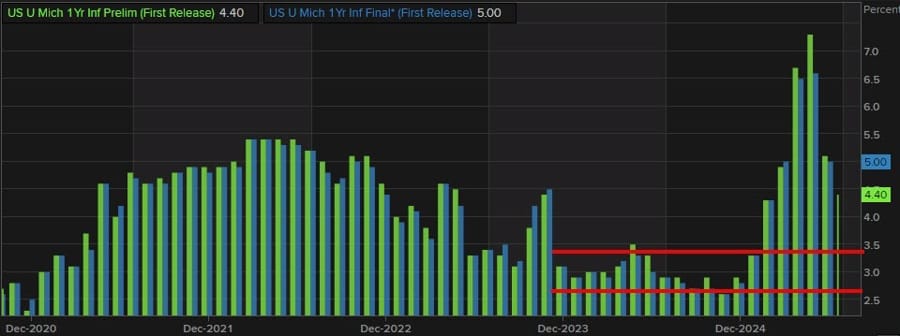

One-year inflation expectations fell to 4.4% (from 5.0%), and five-year expectations eased to 3.6% (from 4.0%). Director Joanne Hsu noted that sentiment remains low—still 16% under December 2024—and stressed that confidence recovery depends on easing inflation and clearer trade policy. Policy news had little direct effect.

Looking at the chart of inflation expectations, expectations are well off the high, but still above the 2024 levels as a result of the tariff fear .

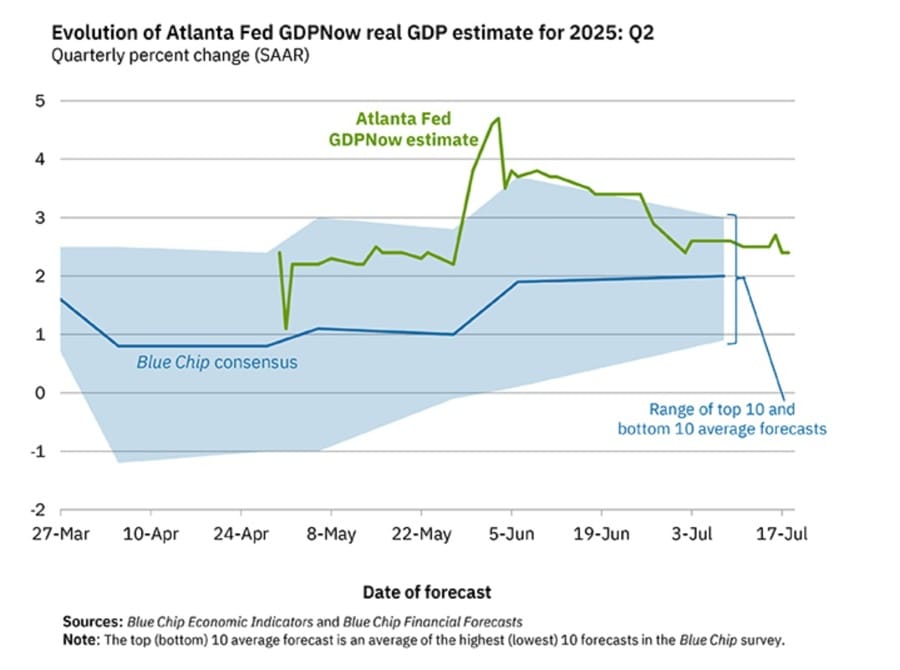

Atlanta Fed’s GDPNow Q2 Forecast Holds at 2.4%

The Atlanta Fed’s GDPNow model remains steady, estimating Q2 growth at 2.4%, unchanged from previous forecasts and a sign of moderate expansion.

In their own words:

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the second quarter of 2025 is 2.4 percent on July 18, unchanged from July 17 after rounding. After this morning’s housing starts release from the US Census Bureau, the nowcast of second-quarter real residential investment growth decreased from -6.4 percent to -7.0 percent.

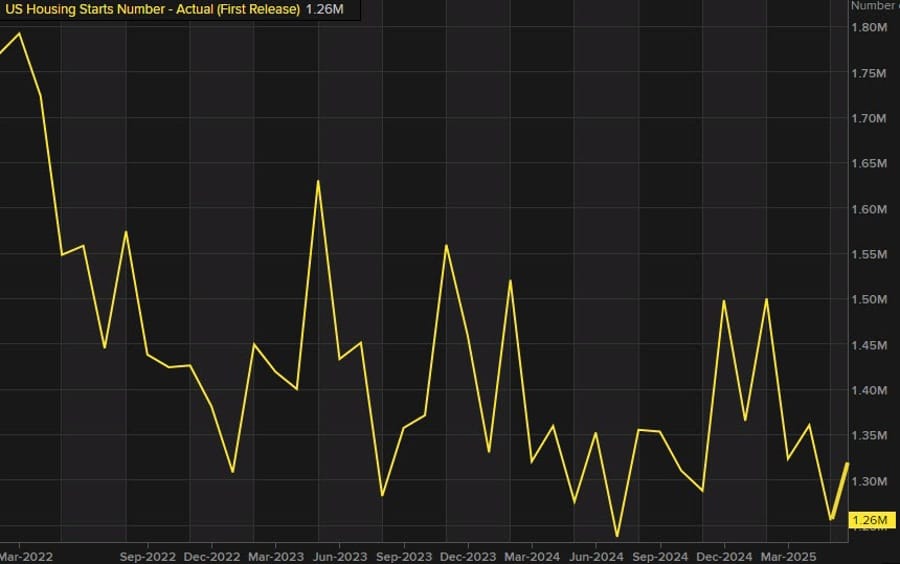

US Housing Starts Beat Estimate at 1.321M; Completions Slide 24%

In June, U.S. housing starts came in at 1.321 million, topping the 1.300 million estimate and up 4.6% from May. However, completions plunged 14.7% MoM and 24.1% YoY to 1.314 million—a worrying sign.

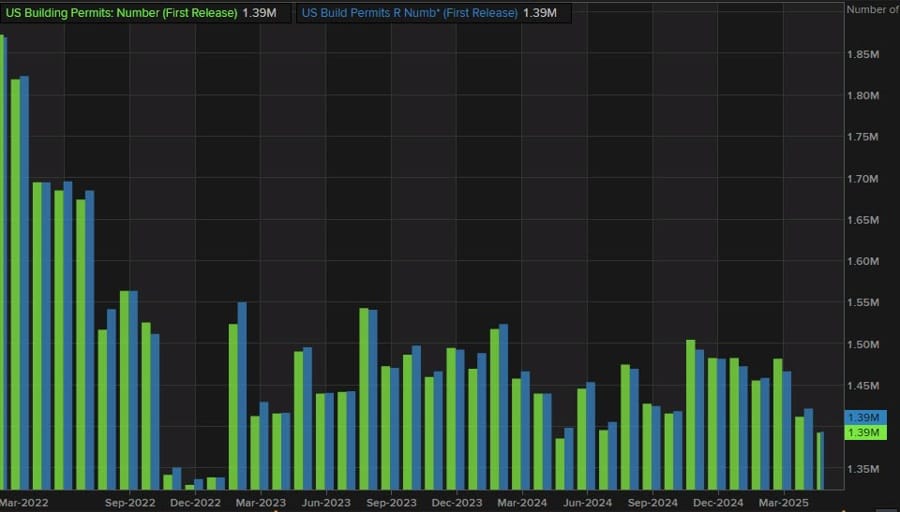

Permit data showed stability, with 1.397 million permits issued, a 0.2% monthly gain and 4.4% below last year. Single-family permits dropped 3.7% to 866,000, and multi-family permits were at 478,000. Single-family starts also dipped 4.6% MoM, while multi-family starts reached 414,000. Chart trends show starts remain near historic lows despite the uptick.

Looking at Building permits, the data is also still near lows too.

FT Reports Trump Seeking Minimum 15–20% EU Tariffs

According to the Financial Times, President Trump is pressing for a 15–20% minimum tariff on all EU goods, rejecting the idea of zero tariffs in exchange for reciprocal trade deals. He also opposes rolling back the current 25%-levied auto tariffs, instead favoring a 10%–20% “access fee” on EU exports to the U.S. EU Trade Commissioner relayed a sobering update to EU ambassadors after talks in Washington. Trump is intent on holding firm, saying the U.S. won’t grant tariff relief without hitting back.

Fed Goolsbee: A little wary as latest CPI shows tariffs pushing up goods inflation

- Fed Goolsbee getting his last words in before quiet period begins

- A little wary as latest CPI data shows tariffs pushing up goods inflation.

- Pains me to see arguments about central bank independence.

- Rates can go down a fair bit over the next year

Fed’s Waller: Private sector is not doing as well as it seems

- Comments from the Fed Governor

- Headline labor market numbers are ‘ok’.

- It wouldn’t take much to tip the labor market.

- Business executives say they are not hiring or firing.

- Will not commit to a dissent on interest rate vote ahead of the July meeting.

- Disagreement over monetary policy shows healthy debate.

- The debate is not about politics but about making an economic argument.

- It’s important that dissents are made carefully.

- It’s probably not critical if the Fed waits six more weeks to cut, but also no real reason to hold off.

- Tariffs are a tax. Like any tax, tariffs will be shared by different groups.

- I want to look at 3-month & 6-month inflation for tariffs.

- Some of the cost of tariffs will be passed along to consumers, but not in a way that causes persistent inflation.

- If there is a sequence of higher and higher tariffs there could be a rolling impact on prices.

- I want to make sure we don’t have a hard landing.

- I’m not seeing longer-term inflation expectations go up.

- Without credibility, inflation expectations will spike.

- So far, the president has not been in touch.

US House Approves $9 Billion Spending Cut Package, Awaits Trump’s Signature

The House of Representatives has passed a $9 billion rescissions bill, just one day after the Senate gave its approval. The measure—backed by President Trump—targets reductions in public broadcasting and foreign aid programs.

If signed into law, this will mark a rare instance where a sitting U.S. president successfully pushes through a formal rescission request, clawing back previously approved federal funds. According to administration officials, this may be the first of multiple such efforts this term.

Fed Reserve Chair Powell says Fed board believes transparency is of the utmost importance

- Powell addressing politically inspired the witch hunt

Fed’s Powell sends response to questions from OMB Director Vought

- Fed board believes transparency is of the utmost importance, cites ongoing reviews including Inspector General of project since it began in 2017

- Says collaboration with National Capital Planning Commission has been constructive and robust, but was voluntary on the part of the Fed

- Says changes since NCPC approval were to scale back and simplify construction and added no new elements, with no further review warranted

Reuters: Judge rules Trump’s firing of FTC commissioner was illegal

- Eyes on such rulings in so far as they pertain to Trump’s efforts to fire Federal Reserve Chair Powell

A U.S. federal judge ruled on Thursday that President Donald Trump’s dismissal of Federal Trade Commission member Rebecca Slaughter earlier this year was unlawful.

District Judge Loren AliKhan stated that the Trump administration’s effort to remove Slaughter violated legal protections that limit the president’s ability to dismiss FTC commissioners.

Fed’s Waller says the FOMC should cut interest rates by 25bp at the July meeting

- This has been Waller’s opinion for some time

Headlines via Reuters:

- The Fed should cut interest rates 25 basis points at July meeting

- Rising risks to economy favour easing policy rate

- If underlying inflation remains in check and growth tepid, more cuts needed

- The Fed should not wait until labour market hits trouble before cutting rates

- Delaying cuts runs risk of need for more aggressive action later

- Evidence mounting that labour market is growing weaker

- Tariffs likely to have one-time impact the Fed can look through

- July rate cut could give the Fed space to hold rates for a few meetings

- Absent tariff impact, inflation is close to the Fed’s 2% target

- Tariffs will boost inflation in the near term

- Risks include an economic slowdown with GDP around 1%

- Economy calls for monetary policy closer to neutral setting

- Expects tariff impact to fade next year

- Data suggests job market ‘on the edge’

- Upside risks to inflation are limited

- Sustained 10% tariff likely to increase inflation 0.75%–1% this year

- Private sector hiring ‘near stall speed’

Federal Reserve Governor Christopher Waller Q&A

- Lots of uncertainty around long-term Fed funds rate; 3% seems right

- Long-term bond yields don’t suggest loose financial conditions

- No one from the Trump administration has talked to him about taking the Fed chair

- Cut rates in July and then adjust policy meeting by meeting

- Stablecoins introduce competition into the payment system; does not see them as a threat

- It’s going to be a slow process unloading Fed-owned mortgage bonds

- Doesn’t see huge appetite to sell Fed-owned mortgage bonds

- Data should determine pace of Fed rate cuts

- Market price signals will determine how far the Fed shrinks the balance sheet

- It is not uncommon for renovations to see cost overruns

- There is nothing wrong with Fed officials disagreeing with each other

- All Fed officials value central bank independence

Canada Pushes to Resume Trade Talks with China, Reengage with India

Canada’s International Trade Minister said officials are working to reestablish high-level talks with China to resolve ongoing trade challenges. She also welcomed the move to restore India’s high commissioner, calling it key to reviving economic dialogue.

The minister added that Mercosur and ASEAN countries show momentum for accelerating trade agreements and that Ottawa sees fresh appetite for cooperation across those regions.

Commodities News

Gold Pushes Past $3,350 as Waller Supports July Rate Cut, Dollar Weakens

Gold prices moved higher on Friday as Federal Reserve Governor Christopher Waller struck a more dovish tone, endorsing a rate cut at the upcoming July FOMC meeting. The metal traded around $3,353, up 0.43%, bolstered by falling Treasury yields and a weaker dollar.

Waller’s comments came alongside improving consumer sentiment data and softening long-term inflation expectations, all of which fed into gold’s bullish momentum.

The US Dollar Index (DXY) fell 0.13% to 98.48, giving gold a tailwind by making it cheaper for foreign buyers. Traders also increased bets on rate cuts, now pricing in 45 bps of easing by year-end, up from 42 bps just one day earlier.

Additional market drivers included:

- University of Michigan sentiment for July rose to 61.8, a five-month high.

- 1-year inflation expectations dropped to 4.4% (from 5.0%).

- 5-year expectations fell to 3.6% (from 4.0%).

Despite not retesting its midweek highs, gold maintained strength amid ongoing political noise—particularly rumors (later denied) that President Trump was eyeing Fed Chair Jerome Powell’s removal.

Economic data remains mixed, with CPI edging closer to 3%, PPI trending down, and retail sales surprising to the upside—largely due to tariff-driven price increases.

Fed funds futures now show a 94% chance that the Fed holds rates at its July 30 meeting, with only a 6% probability of a quarter-point cut.

Looking ahead, the economic calendar brings housing numbers, PMIs, jobless claims, and durable goods orders—all of which could sway rate expectations and gold’s next move.

Baker Hughes Report Shows U.S. Rig Count at 544, Canada at 172

This week’s Baker Hughes figures:

- U.S. rigs: +7 to 544, with oil rigs down 2 to 422, gas rigs up 9 to 117. Offshore rigs are unchanged at 13.

- Canada rigs: +10 to 172, including 120 oil rigs and 52 gas rigs.

Compared to last year, U.S. total rigs are down 42 from 586, while Canada’s count is 25 rigs lower than last year’s 197.

Middle Distillate Market Tightens Further as Diesel Pulls from Asia

ING analysts report continued tightness in the middle distillate market:

- ICE gasOil crack climbed above $26/bbl

- ARA region inventories dropped to 1.76 mt, lowest since Jan 2024

Drone strikes on Kurdish oil fields temporarily knocked out 200k bpd, but a new deal will resume 230k bpd in exports to Iraq’s SOMO. With refinery margins rising and OPEC+ supply ramping up, more relief is expected later in the year.

China’s Copper Output Hits Record 1.3M Tons in June

China’s refined copper production surged to a new high of 1.3 million tons in June, up 14.2% YoY, according to the National Bureau of Statistics.

Analysts at Commerzbank note that high global copper prices offset weaker processing margins, keeping production profitable. Some of this output spike may reflect front-loaded demand ahead of U.S. tariff changes set for August 1.

Asian Physical Gold Demand Slumps as European ETF Interest Climbs

Commerzbank analysts highlight a drop in physical gold demand across Asia in June:

- India imported just 21 tons, the lowest since April 2023.

- Swiss exports to China fell 39%, to 16.7 tons.

- Exports to India fell 71%, to just under 3 tons.

Meanwhile, UK-bound exports rose sharply, signaling rising European ETF demand. European ETFs logged 23 tons of inflows in June, per World Gold Council data.

US Natural Gas Steady; EU Prices Ease as Norwegian Supply Recovers

U.S. natural gas prices held firm after EIA data showed a 46 bcf storage build, close to the 45 bcf expected. U.S. storage now stands at 3.05 tcf, up 6.2% from the 5-year average.

In Europe, gas prices at the TTF dropped 1.15%, with pipeline flows from Norway stabilizing after earlier disruptions at the Nyhamna and Kollsnes plants.

OPEC Maintains Demand Forecast, Offers Saudi Supply Clarification

In its latest monthly update, OPEC held its demand growth forecast at +1.3 million bpd for 2025, remaining significantly more optimistic than the IEA, which expects only half that increase.

The report clarified that Saudi Arabia’s reported 9.75 million bpd figure included inventory additions, while actual market supply was closer to 9.35 million bpd. Analysts expect no near-term compensatory cuts, but say production may taper as a one-off surge subsides.

Gold Momentum Fades as Price Hovers Below $3,400

Gold appears to be losing steam after a nearly 30% rally in four months. Despite the U.S. dollar hitting a 4-year low vs. the euro, gold prices have stalled near $3,400/oz.

Commerzbank’s Thu Lan Nguyen noted that investor interest may be rotating to other metals like silver and palladium. Although favorable conditions (rate cut prospects, weak USD) persist, momentum is cooling. The bank still forecasts gold to reach $3,600 in 2026, but sees no need to upgrade expectations further.

Oil Prices Hold as Market Waits on Policy Shifts, US Inventories Mixed

Crude oil markets stayed flat this week. The latest U.S. EIA inventory report showed a sharp drop in crude stocks but an increase in gasoline and distillates, creating a neutral impact overall.

Traders are watching for shifts in U.S. sanctions and tariffs, particularly as India’s oil minister noted contingency plans to offset supply shocks from Russian sanctions. Russia still exports over 7.2 million bpd, and any broad restrictions could trigger a global reshuffle.

Europe News

European Stocks End Week Mixed Ahead of Aug 1 Tariffs

Major European indices closed the week with a mix of gains and losses as markets eye the looming August 1 tariff deadline (EU rate at 30%). Weekly and daily moves were modest:

- German DAX: -0.35% (week: +0.14%)

- France’s CAC: +0.01% (week: -0.08%)

- UK FTSE 100: +0.22% (week: +0.57%)

- Spain’s Ibex: -0.04% (week: -0.14%)

- Italy’s FTSE MIB: +0.46% (week: +0.58%)

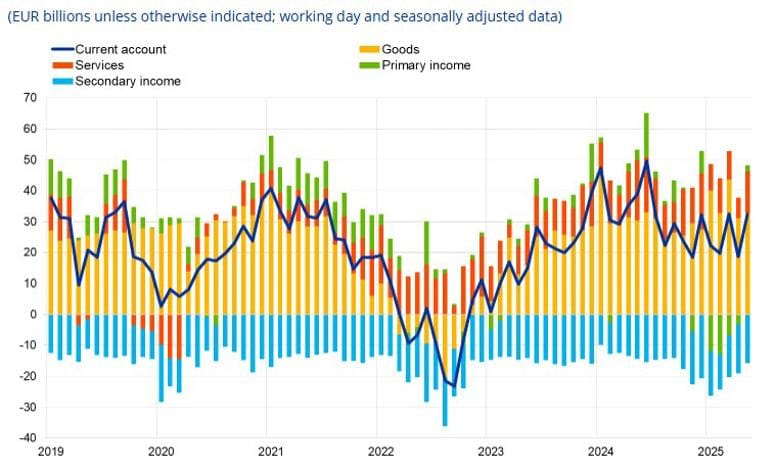

Eurozone Current Account Surplus Widens to €32.3 Billion in May

The euro area posted a €32.3 billion current account surplus in May, up from €19.3 billion in April, according to the ECB.

The surplus was led by:

- Goods: +€33 billion

- Services: +€13 billion

- Primary Income: +€2 billion

These inflows were partly offset by a €16 billion deficit in secondary income.

Eurozone Construction Output Falls 1.7% in May After Sharp April Jump

Construction output in the Eurozone contracted by 1.7% MoM in May, reversing the sharp upwardly revised +4.3% gain from April. Year-on-year, output was up 2.9%, a touch lower than April’s +4.7% YoY.

Breakdown:

- Building construction: -1.3%

- Civil engineering: -0.7%

- Specialized work: -1.7%

The data from Eurostat reflects a pullback after April’s spike and remains broadly considered a lagging indicator.

Germany’s Producer Prices Edge Up 0.1% in June, Energy Still Drives Annual Decline

Germany’s June PPI increased by 0.1% month-over-month, slightly above the flat reading expected. This follows a -0.2% decline in May.

On a yearly basis, producer prices were 1.3% lower—but only because of a continued drop in energy costs. Strip out energy, and producer prices were actually up 1.3% year-on-year. The data was released by Destatis.

Goldman Sachs Withdraws September BOE Cut Forecast, Now Sees Easing From November

Goldman Sachs no longer expects the Bank of England to cut interest rates in September. The firm had previously projected a 25-basis-point reduction for the end of Q3 but has now pushed its expectations back.

Goldman’s new forecast sees the BOE beginning a sequence of rate cuts from November through March, eventually bringing the bank rate down to 3%. The firm still expects an initial rate cut in August.

Citi Follows Goldman in Scrapping BOE September Rate Cut Forecast

Citi has revised its expectations for UK monetary policy, dropping its call for a September rate cut by the Bank of England.

Now aligned with Goldman Sachs, Citi forecasts the BOE will begin cutting in November, continuing into early 2026. The adjustment reflects changes in inflation data and a reassessment of the BOE’s near-term guidance.

BofA Joins Goldman and Citi in Dropping BOE September Cut Forecast

Bank of America is now the third major institution to retract its call for a BOE rate cut in September. Previously expecting cuts in August, September, and November, the bank now sees just two more cuts this cycle.

The revised projection includes a reduction next month, followed by a second cut in November. BofA does not foresee a sequential rate cut pattern, instead expecting the final cut to occur in February 2026, leaving the terminal rate at 3.5%.

ECB’s Nagel: Financial markets show how Fed attacks affect them

- Comments from the ECB policymaker

- Financial markets speak their own language and are showing how Fed attacks affect them.

- Avoid interfering with central bank independence.

Germany’s Chancellor Merz: We can assume that there will be an asymmetrical agreement

- Comment from the German Chancellor

- We can assume that there will be an asymmetrical agreement.

Asia-Pacific & World News

IMF: Global Economy Faces Trade-Tension-Driven Headwinds Since April

The IMF reports that, since April, economic data paints a tangled picture shaped by rising trade tensions. There’s strong evidence of frontloading activity ahead of tariff hikes and some diverted trade flows. Cooling demand and falling energy costs have helped ease inflation, though the impact varies country to country. Meanwhile, global financial conditions improved slightly after several trade agreements lowered average tariffs. Despite updates to forecasts expected later this month, the IMF says downside risks remain dominant and uncertainty is still high.

China Confirms US Has Begun Process to Approve Nvidia H20 GPU Sales

China’s Ministry of Commerce confirmed on Friday that the United States has initiated steps to authorize Nvidia’s H20 GPU sales to Chinese firms. Beijing welcomed the move, emphasizing the importance of cooperation over conflict.

A spokesperson said the U.S. should continue working toward mutual understanding and roll back trade restrictions deemed unreasonable by China, calling “win-win” outcomes the right path forward.

China’s Commerce Minister: US Trade Ties Survive Friction, But Pressure Remains

China’s Commerce Minister said Thursday that despite years of friction, China-US trade relations remain essential. He criticized the U.S. for relying on unilateral protectionist policies since 2018 but insisted that mutual economic benefit continues to define the relationship.

He highlighted the Geneva agreement and London framework as recent turning points, helping reduce commercial tensions. The minister argued that any attempt at economic decoupling is bound to fail, as some interdependencies are simply irreplaceable in the near term.

China Threatens to Block $23B Global Port Deal Without Cosco Stake

China is applying pressure to be included in the $23 billion sale of over 40 seaports currently owned by CK Hutchison, warning that it may block the transaction unless Cosco Shipping is given a stake.

The proposed deal would see BlackRock and MSC acquire strategic assets—including two key ports near the Panama Canal. Beijing wants Cosco to be a co-investor. The escalation highlights China’s intent to maintain influence over global maritime infrastructure, especially as Western capital moves in.

China Expects Retail Sales to Top 50 Trillion Yuan in 2025

China’s Minister of Commerce, Wang Wentao, said this year’s retail sales are projected to exceed 50 trillion yuan, maintaining the country’s status as the world’s second-largest consumer market. He noted a 5.5% average annual growth in retail sales over the past four years.

He also pointed to resilience in foreign trade, with China’s goods trade market share staying above 14% for exports and 10% for imports. Foreign investment under the 14th Five-Year Plan has now surpassed $700 billion, topping projections.

PBOC Injects 1.3 Trillion Yuan to Ease Funding Strain

China’s central bank injected 1.3 trillion yuan into the financial system this week—the most in six months. The peak came Wednesday, when the People’s Bank of China added 444.6 billion yuan, followed by a smaller 102.8 billion yuan injection on Friday.

The move aims to reduce liquidity stress caused by upcoming tax deadlines and an uptick in government bond supply. Interbank repo rates dropped for three straight sessions, signaling that the liquidity boost is stabilizing funding markets. Economists expect the injections to decline after the July 15 tax date.

PBOC sets USD/ CNY reference rate for today at 7.1498 (vs. estimate at 7.1736)

- PBOC CNY reference rate setting for the trading session ahead.

PBOC injected 187.5bn yuan via 7-day reverse repos at 1.40%

- net 102.8bn yuan injection with 84.7bn maturing today

New Zealand Credit Card Spending Slows Sharply in June

New Zealand’s credit card spending rose 0.9% year-over-year in June, a steep deceleration from +2.0% the month before. The data was published by the Reserve Bank of New Zealand, offering a snapshot of weaker consumer activity amid persistent inflation and higher borrowing costs.

BoJ may offer a less gloomy view of US tariff hit in quarterly report – Reuters

- Reuters reporting on the matter citing three sources

- BoJ to warn of uncertainty over the impact of US tariffs but may offer a less gloomy view.

- BoJ to keep interest rates unchanged at the July 30-31 meeting.

- BoJ likely to maintain view that inflation will durably hit its 2% target in the latter half of its three-year projection period.

- BoJ will consider revising up its inflation forecast for the current fiscal year.

Japan trade negotiator says Ishiba has requested Bessent to continue trade talks

- Remarks by Japan trade negotiator, Ryosei Akazawa

- Discussed various topics with US Treasury secretary Bessent

- Some of those topics are politically important

- Ishiba has asked Bessent to vigourously continue trade talks

Japan’s CPI Still Far Above BOJ’s Target in June

Japan’s inflation stayed elevated in June:

- Headline CPI: +3.3% YoY (vs. 3.3% forecast)

- Core CPI (ex-fresh food): +3.3% YoY (down from 3.7%)

- Core-core CPI (ex-fresh food and energy): +3.4% YoY (vs. 3.3% prior)

The dip in core CPI was linked to temporary utility discounts and the return of fuel subsidies. Still, all three measures remain well above the Bank of Japan’s 2% inflation target, reinforcing a cautious policy stance.

Japan’s Core Inflation Cools to 3.3% in June

Japan’s core CPI rose 3.3% year-over-year in June, down from 3.7% in May, matching expectations. Energy price moderation contributed to the slowdown, with energy inflation easing to +2.9%, while food costs excluding fresh food surged 8.2%.

Though inflation remains high, the Bank of Japan is unlikely to raise rates soon, especially amid trade uncertainty and the potential economic drag from new U.S. tariffs. Updated projections will be released at the next policy meeting.

Japan’s Upper House Election Could Shift Fiscal and Policy Outlook

Japan’s upcoming July 20 upper house elections will decide control of 124 out of 248 seats. PM Shigeru Ishiba’s LDP–Komeito coalition is at risk of losing its majority following recent losses and waning public support.

Rising costs, U.S. tariff fallout, and fiscal concerns are fueling support for opposition parties advocating for larger stimulus plans. A defeat could lead to more aggressive fiscal expansion and shake the JGB and yen markets. On the flip side, a clear LDP win may solidify policy direction but weigh on the yen due to prolonged stimulus expectations.

Crypto Market Pulse

Crypto Market Tops $4T, Bitcoin Consolidates, Ethereum and XRP Surge

The crypto market cap breached $4 trillion following Congressional action. Market dynamics:

- Bitcoin (BTC): Consolidating under $120,000 after recent highs.

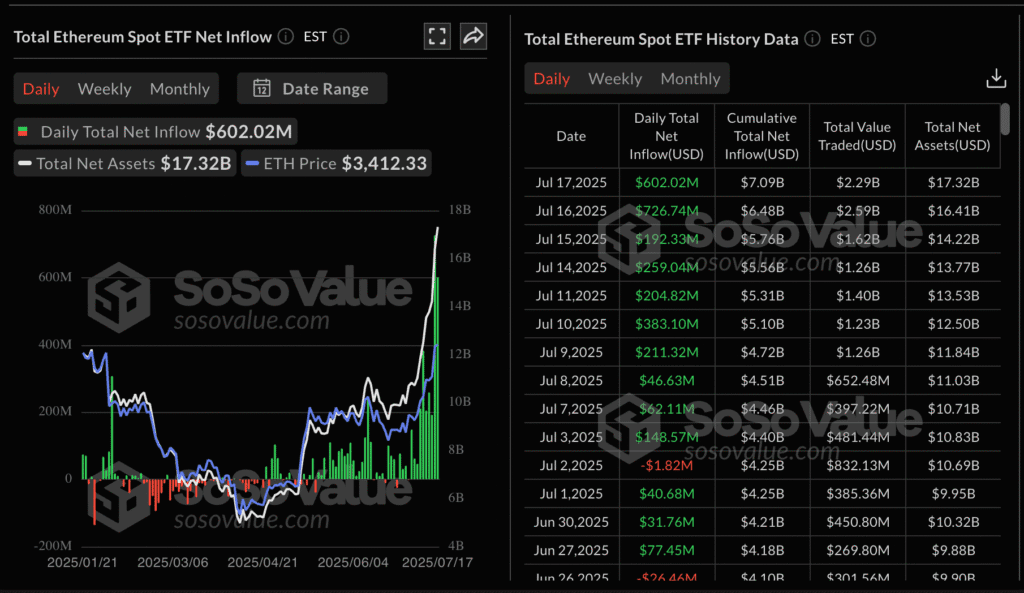

- Ethereum (ETH): Over $3,500, with strong institutional ETF inflows, eyeing $4,000.

- XRP: Surpassed its previous all-time high, setting new territory.

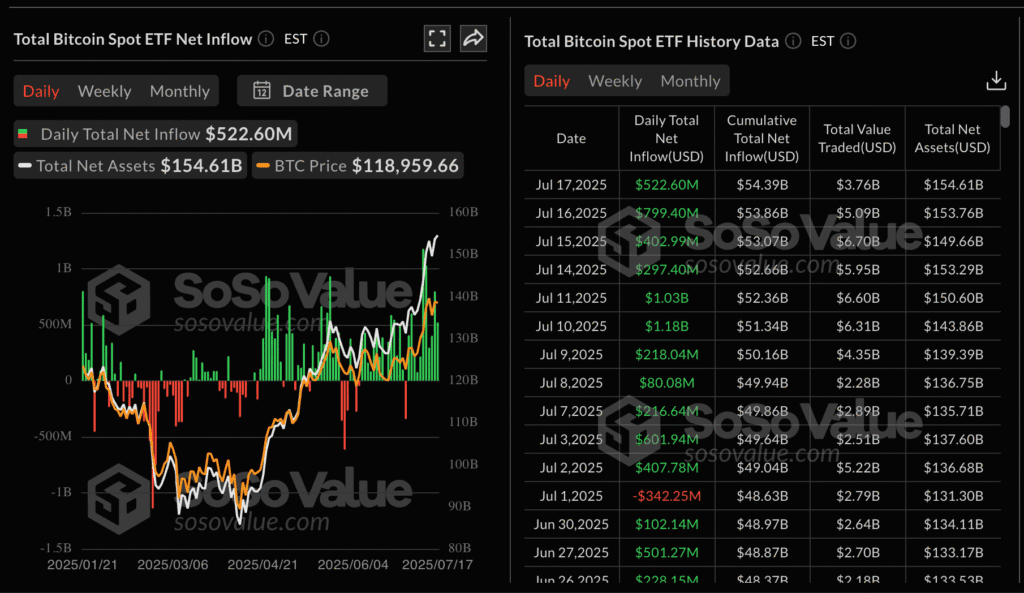

ETF data:

- BTC spot ETF inflows totaled $799 million on Wednesday.

- ETH ETF inflow reached a record $726 million on Wednesday.

- BlackRock’s ETHA led with $546 million; NASDAQ filed to add staking to ETHA.

GameSquare raised $70 million to invest in ETH via its asset strategy.

XRP Hits New Record Above $3.60, Buoyed by GENIUS Bill

XRP rallied to $3.66, a fresh all-time high, before pulling back modestly on Friday. The token gained momentum following House passage of the GENIUS, CLARITY, and Anti-CBDC Surveillance Act bills. CEO Brad Garlinghouse hailed the legislation as a milestone for fintech innovation. Despite the rally, spot trading volumes remain moderate, suggesting room for further upside. Ripple’s new RLUSD stablecoin also crossed a $517 million market cap.

Coinbase Stock Soars to $444 as Crypto Legislation Nears Signing

Coinbase (COIN) surged to an all-time high of $444 on Friday, up over 70% year-to-date, following the House’s passage of key crypto bills. Anticipation is building ahead of President Trump’s imminent signing of the GENIUS Act, expanding 401(k) eligibility. Coinbase’s Base app, built on USDC integration, reinforced bullish sentiment. Bernstein recently raised price targets as COIN continues gaining momentum; shares were ~$410 at publication.

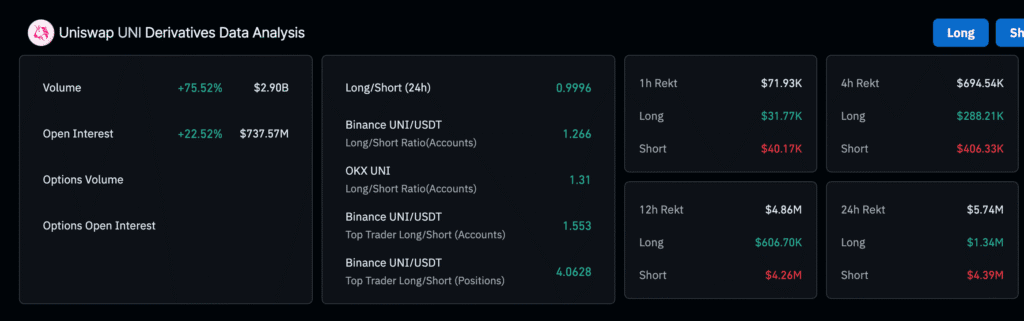

Uniswap (UNI) Jumps 20% as DeFi Activity and Derivatives Volume Accelerate

Uniswap’s UNI token surged nearly 20% on Friday, breaking above the $10.00 mark for the first time since February. The rally is backed by strong activity in both the DeFi ecosystem and derivatives markets.

Key metrics:

- UNI price: ~$10.62

- TVL: $5.75 billion (up from $3.28B in April)

- Open Interest: +23% to $738M

- Volume: +75% to $2.9B

Liquidations hit shorts hardest, wiping out $4.4M compared to just $1.34M in long positions. The long-to-short ratio on Binance rose to 1.266, reflecting bullish trader bias following the U.S. House’s passage of major crypto bills.

Crypto Market Cap Surges Past $4 Trillion After Stablecoin Regulation Clears Congress

The total crypto market capitalization crossed the $4 trillion threshold following the House passage of the GENIUS Act, legislation focused on stablecoin regulation.

Highlights:

- Bitcoin dominance fell to 61.67%, down 4.8 percentage points over the week

- TOTAL2 (market cap excluding BTC): +13.19%

- TOTAL3 (excluding BTC & ETH): +10.0%

Altcoins led the charge, with XRP surpassing a $200B market cap, and analysts forecasting it may top $250B by year’s end. Reports also emerged that 401(k) plans may soon include crypto options, amplifying institutional interest.

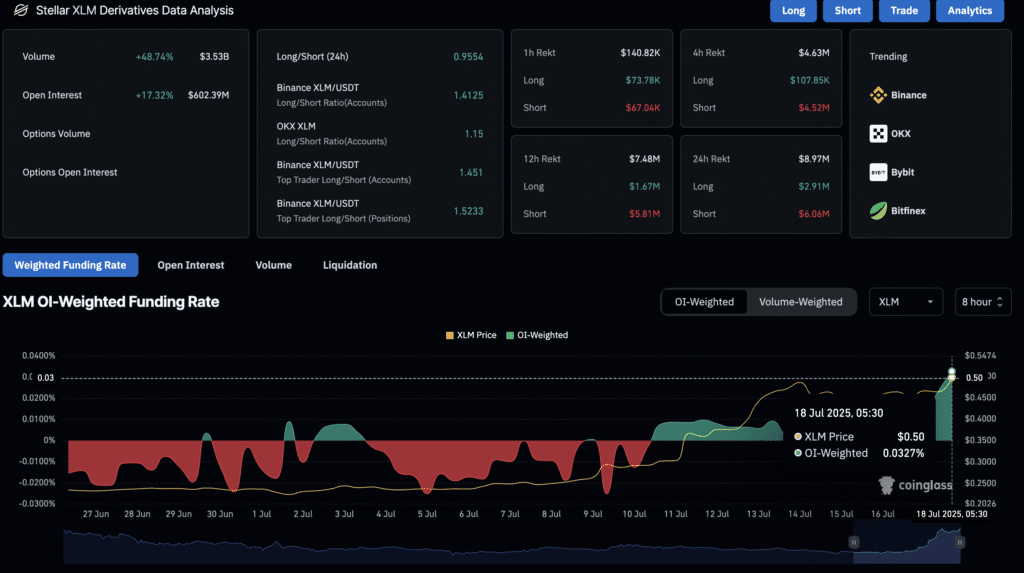

Stellar (XLM) Open Interest Hits Record $602M as Bulls Target $0.50

Stellar’s XLM is trading slightly higher on Friday, building on a 9.71% gain from the prior session. Open Interest has climbed to a record $602.39 million, indicating a surge in trader positioning.

Highlights:

- Funding rate: +0.0327% (up from 0.0114%)

- Short liquidations: $6.06M

- Long liquidations: $2.91M

Veteran chartist Peter Brandt flagged XLM’s setup as potentially “one of the most bullish” in the market. He cited two conditions for a breakout:

- Hold above April’s low of $0.20

- Close decisively above $1.00

Brandt projected a long-term upside target of $7.23 if those milestones are met.

Trump Poised to Allow Crypto in Retirement Plans, FT Reports

The Financial Times reports that President Trump is preparing an executive order to allow 401(k) retirement plans to invest in alternative assets such as cryptocurrencies.

Sources familiar with the plan say the measure would broaden access to non-traditional investment vehicles, potentially bringing a wave of institutional inflows into the digital asset space.

ICYMI – US House passes three major crypto bills

- Lots of winning for crypto

The U.S. House of Representatives approved three major cryptocurrency bills on Thursday, signaling a significant step forward for the digital asset sector.

- The GENIUS Act, which sets rules for stablecoins, passed with a 308-122 vote and now goes to President Trump.

- The CLARITY Act, aimed at defining the broader structure of crypto markets, passed 294-134 and will move on to the Senate, backed by strong bipartisan support.

- A third bill, more politically divided, proposes a ban on central bank digital currencies. While some lawmakers, including Rep. Maxine Waters, opposed the measures, the overall outcome highlights increasing political momentum behind the crypto industry.

The Day’s Takeaway

United States

- NASDAQ hits new record close for 5th straight day: Gained 0.05% to finish at 20,895.66, marking 11 record closes in 2025.

- S&P 500 dipped by 0.01% after notching a record yesterday.

- Dow Jones fell 0.32%, closing at 44,342.19.

- Weekly performance: NASDAQ +1.51%, S&P +0.59%, Russell 2000 +0.23%, Dow -0.07%.

- Gold rises as Fed Governor Waller backs a July rate cut. Yields dropped, boosting bullion prices to $3,353.

- University of Michigan Sentiment rose to 61.8 in July (vs. 61.5 est.). Long-term inflation expectations eased to 3.6%, short-term down to 4.4%.

- Housing starts came in at 1.321M (above the 1.300M forecast), while building permits edged up to 1.397M. However, housing completions fell sharply, down 24.1% YoY.

- Atlanta Fed GDPNow held steady at 2.4% for Q2 growth.

- IMF notes economic complexity driven by trade tensions, frontloading, and diverging inflation trends.

- Trump pushes for a 15–20% minimum tariff on EU imports, rejecting calls for 0% trade deals.

- House passes $9B in spending cuts, targeting public broadcasting and foreign aid. Trump is expected to sign.

Canada

- International trade minister says efforts are underway to re-engage with China and India on trade.

- Also highlighted momentum to reach trade agreements with Mercosur and ASEAN.

- Baker Hughes Rig Count: Canada added 10 rigs, bringing the total to 172, though still down 25 YoY.

Commodities

- Gold climbs past $3,350, supported by dovish Fed tone and a softer US Dollar.

- Silver holds elevated levels near $37.57, pulling back from recent 14-year highs as the dollar firmed on strong retail data.

- Oil remains rangebound despite inventory drawdowns, Middle East production disruptions, and tariff-related uncertainty. Brent held near $66.23.

- Copper smelter output in China hit a record 1.3M tons in June, up 14.2% YoY, driven by high prices and frontloading ahead of tariffs.

- Natural Gas in the US stayed flat after an in-line storage build of +46 bcf. European gas prices softened as Norwegian flows normalized.

- Middle distillate markets remain tight in Europe. Inventories in ARA dropped to 1.76mt, the lowest since January.

- Gold demand diverges: Weak in Asia (India, China), stronger in Europe due to rising ETF interest.

- OPEC clarifies that Saudi Arabia’s recent high output was likely a temporary event, not a policy shift.

Europe

- Major indexes closed mixed: DAX -0.35%, CAC flat, FTSE 100 +0.22%.

- Weekly performance: FTSE MIB +0.58%, DAX +0.14%, CAC -0.08%, IBEX -0.14%.

- Germany’s June PPI rose 0.1% MoM, while YoY declined 1.3%—but energy was the main drag; core producer prices actually rose.

- Eurozone current account posted a surplus of €32.3B in May, led by strong goods and services balances.

- Eurozone construction output dropped 1.7% MoM in May.

Asia-Pacific

- People’s Bank of China injected ¥1.3T into the banking system this week—largest liquidity operation since January.

- China’s June copper output surged, suggesting frontloaded demand before US tariffs kick in August 1.

- China Commerce Minister says US-China trade ties have weathered storms but require mutual respect.

- China threatens to block $23B global ports deal unless Cosco is given a stake.

- China’s retail sales are projected to exceed ¥50T in 2025.

- New Zealand credit card spending slowed to +0.9% YoY in June (vs. prior +2.0%).

- Japan’s June CPI printed at 3.3%, still above BoJ’s 2% target.

- BOJ cautious on rate hikes amid inflation risks and political headwinds.

- Japan heads to upper house elections July 20, with markets watching for fiscal policy shifts.

- FT: Japan’s core inflation cooled slightly—offering relief to the BoJ, but not necessarily to the government.

Rest of the World

- IMF flags persistent downside risks in the global economy, driven by trade uncertainty, inflation divergence, and frontloaded shipments ahead of tariffs.

Crypto

- Total crypto market cap broke above $4 trillion after the House passed the GENIUS, CLARITY, and Anti-CBDC bills.

- Coinbase (COIN) hit a new all-time high at $444, up 70% YTD. Launch of Base App and bullish market helped drive gains.

- Bitcoin consolidates under $120,000, but ETF flows remain strong.

- Ethereum surged past $3,600, poised to test $4,000, supported by institutional inflows and potential ETF staking options.

- XRP rallied to a record $3.66 before pulling back. CEO Brad Garlinghouse called the GENIUS Act a “historic” step for US crypto regulation.

- UNI (Uniswap) gained nearly 20%, supported by growing DeFi TVL and rising open interest.

- XLM (Stellar) open interest hit an all-time high of $602M, with bulls aiming to break above the $0.50 psychological level.