North America News

Dow and Russell Bounce Back, Nasdaq Extends Record-Setting Streak

U.S. stocks ended Wednesday on a positive note, with the Dow Jones Industrial Average and Russell 2000 leading the charge after lagging in the previous session.

The Dow recovered sharply, rising 231.49 points (+0.53%) to finish at 44,254.75, while the small-cap Russell 2000 gained 21.93 points (+0.99%) to close at 2,226.98, clawing back almost all of Tuesday’s 2% drop.

The S&P 500 also advanced, adding 19.94 points (+0.32%) to settle at 6,263.70, just shy of its July 10 high close of 6,280.46.

The Nasdaq Composite climbed 52.59 points (+0.25%) to a new record close of 20,730.49, though it stayed below yesterday’s intraday peak of 20,836.04. Today’s high came in at 20,751.05.

While the Dow remains short of its 2025 high of 44,882.13 (set January 30) and its record close from December 4, 2024 at 45,014.04, today’s rally helped narrow the gap.

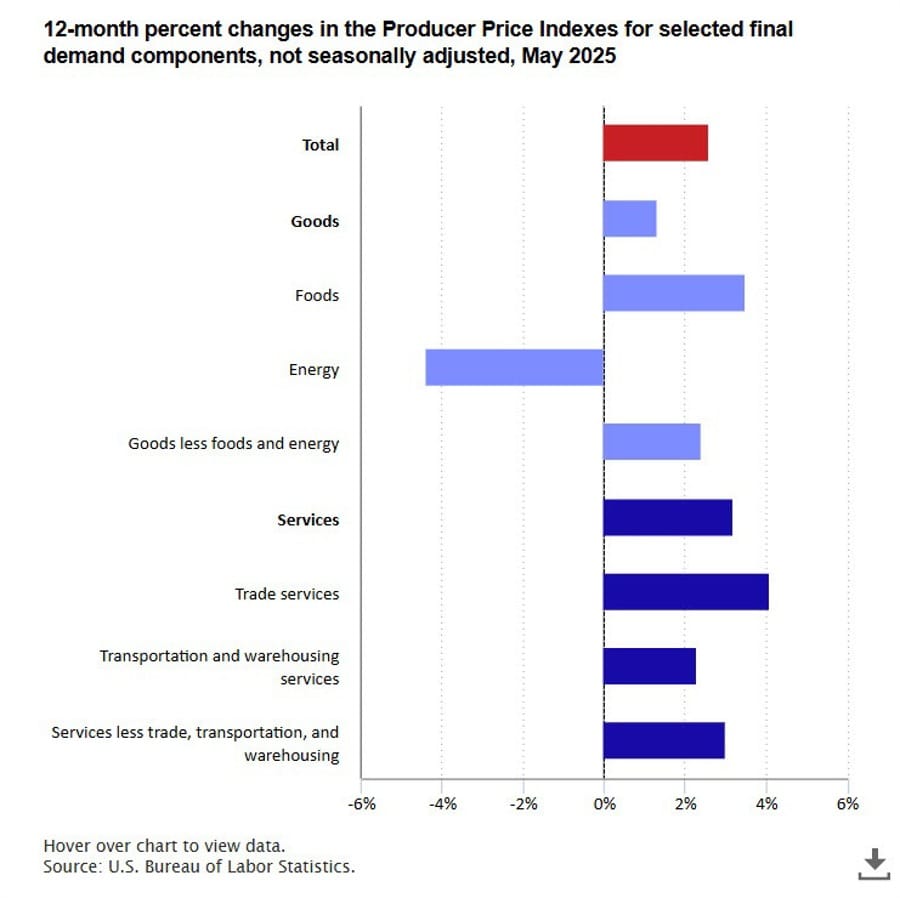

US Producer Prices Flat in June, Missing Estimates

The US producer price index (PPI) for final demand was flat on the month in June, below the 0.2% estimate.

Excluding food and energy, PPI also printed at 0.0%, missing expectations for a 0.2% increase.

On an annual basis, final demand PPI rose 2.3%, under the 2.5% consensus and down from May’s 2.7% (revised from 2.6%).

The core PPI (excluding food and energy) rose 2.6% year-on-year, slightly below the 2.7% forecast and lower than May’s 3.2% (revised up from 3.0%).

Detailed breakdown:

- Goods prices rose 0.3%, led by a 0.6% increase in energy and a 0.2% gain in food. Communication equipment prices jumped 0.8%, while chicken eggs plunged 21.8%.

- Services prices fell 0.1%, driven by a 4.1% slide in traveler accommodation. Transportation services fell 0.9%, and trade margins were unchanged.

Analysts note that early core PCE estimates for June still suggest monthly gains around 0.3–0.4%, though leaning to the lower end.

US Industrial Production Outpaces Estimates

US industrial production rose by 0.3% in June, topping the 0.1% estimate, according to the Federal Reserve’s latest data.

May’s figure was revised up to unchanged from an initial -0.2%.

Capacity utilization in June hit 77.6%, ahead of the 77.4% forecast, while May’s reading was revised up to 77.5%.

Manufacturing output advanced 0.1%, slightly above flat expectations, with May revised up to 0.3% from 0.1%.

These solid numbers suggest some underlying momentum in the industrial sector despite other macro headwinds.

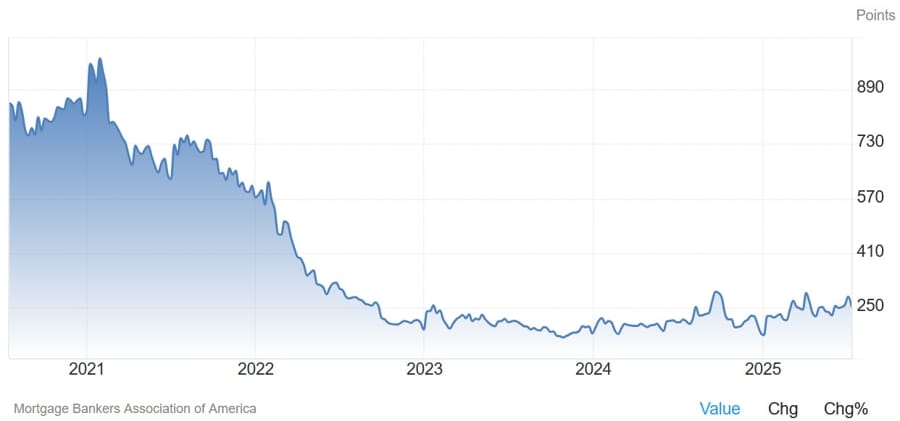

US Mortgage Applications Plunge as Rates Edge Higher

Mortgage activity in the US tumbled last week, with total applications down 10.0% for the week ending July 11, following a 9.4% rise the previous week, per Mortgage Bankers Association data.

The market index dropped to 253.5 from 281.6.

Purchase applications fell sharply to 159.6 from 180.9, while refinance applications declined to 767.6 from 829.3.

The average 30-year mortgage rate rose to 6.82% from 6.77%, contributing to the slump in demand as affordability challenges persist.

Fed’s Beige Book: Slight Growth, But Caution Still Reigns

The latest Federal Reserve Beige Book, released ahead of the July FOMC meeting, describes marginal improvement in the U.S. economy from late May to early July, though sentiment remains cautious.

Of the 12 Fed districts:

- 5 reported slight or modest growth

- 5 saw flat activity

- 2 experienced modest declines

That’s a step up from the prior report, where half the districts reported declines.

Business sentiment was mostly neutral, with only two districts forecasting future growth. High uncertainty continues to shape decision-making across industries.

Key highlights by category:

Employment

- Overall job growth was slight

- 6 districts saw small employment gains

- 3 remained unchanged, and 2 reported slight declines

- Skilled labor shortages persist, especially in trades

- Hiring plans are on hold for many firms amid policy uncertainty

- More employers are investing in automation and AI

- Wage gains ranged from flat to modest

- Layoffs stayed limited, mostly in manufacturing

Prices

- All districts reported rising prices

- 7 characterized price increases as moderate, 5 called them modest

- Tariffs are intensifying input costs, especially in construction and manufacturing

- Insurance premiums were frequently cited as rising

- While some firms passed higher costs onto consumers, many couldn’t, squeezing profit margins

- Cost pressures are expected to persist into late summer

Sector Trends

- Retail and auto sales weakened, especially post-tariff bump

- Tourism was mixed, manufacturing slightly lower

- Nonfinancial services held steady with regional variance

- Construction activity slowed due to rising material costs

- Agriculture remained weak, and energy production dipped

- Loan volumes were up slightly, particularly in Dallas and Kansas City

District Snapshots

- Boston: Retail and tourism fell; home sales edged up

- New York: Slight job growth; rising input costs

- Philadelphia: Slight employment dip; nonfinancial services dragged overall activity down

- Cleveland: Modest inflation; improvement expected despite weak transport demand

- Richmond: Manufacturing down; services stronger

- Atlanta: Real estate and retail soft; tourism and labor steady

- Chicago: Modest job and price gains; farm income flat

- St. Louis: No growth; tariffs pressuring nonlabor costs

- Minneapolis: Employment ticked higher; construction and energy fell

- Kansas City: Flat growth; wage pressure easing

- Dallas: Services up; manufacturing steady; retail down

- San Francisco: Stable overall; residential real estate continued to weaken

Trump: Fed Chair Powell is too late, but he does not planning on doing anything

- Fed chair Powell is too late

- He does not plan on doing anything

- He is concerned about renovation

- His board is not doing its job

- We get a chance to change in 8 months

- We are not talking about firing.

- Kevin Hasset is someone we consider for the Fed job

- It is not a tough job being the Fed Chair.

- We should be saving a trillion dollars a year with lower rates

- Powell is a knucklehead.

- Firing Powell would be highly unlikely, unless there is fraud

- There is a possibility unless there is fraud with the renovations

- China has been helping on fentanyl

- another deal with India coming up

- we have some pretty good deals will announce

- We live by “the letter”with Japan.

NEC Hassett: The US inflation data has been fine. The Fed needs to get back on the curve

- NEC Director Hassett speaking

- The US inflation data has been fine

- The Fed has to get back on the curve.

USTR Greer: US is losing advanced manufacturing along with basic manufacturing

- USTR speaking on trade

- US is losing advanced manufacturing along with basic manufacturing

- China’s cumulative tariff rate is 55%

- Trump’s expanded tariff program is bearing fruit in terms of industrial investment in the US.

- I want to reverse the trend of the US trade deficit, keep it decreasing over time.

- We have to be clear eyed about challenge before US in re-industrializing the US.

Senator Tillis Warns Against Politicizing Fed Leadership

U.S. Senator Thom Tillis criticized calls to fire Fed Chair Jerome Powell, warning that such a move would damage U.S. credibility and provoke immediate market turmoil.

Speaking on Wednesday, Tillis said, “Ending Fed independence would be a grave mistake.”

Meanwhile, House Speaker Mike Johnson suggested he supports a leadership change at the Fed and reiterated his stance that interest rates should be adjusted, aligning with President Trump’s push to influence monetary policy.

Trump Floats Bessent as Fed Chair Candidate, Confirms More Tariffs

President Trump suggested that Treasury Secretary Bessent is a potential candidate to replace Fed Chair Powell, though he’s satisfied with Bessent’s current Treasury role for now.

He confirmed that pharmaceutical tariffs will likely begin at the end of July, starting at lower rates but expected to rise. Letters detailing tariffs on smaller economies will be released soon, with a possible uniform rate above 10%.

Trump also stated that tariff payments would begin August 1.

On trade negotiations, he mentioned near-final agreements with Vietnam and hinted that two to three new deals could be finalized by August 1.

Separately, Trump noted that weapons shipments to Ukraine have begun and emphasized that NATO will reimburse the U.S. for those expenses. He reiterated no plans for U.S. boots on the ground and indicated no urgency in diplomatic talks with Iran.

Apple Locks In $500 Million U.S. Rare Earth Supply Deal

Apple has inked a $500 million deal with MP Materials to secure a domestic supply of rare earth magnets, Reuters reported. The tech giant plans to pre-pay $200 million upfront, with actual deliveries starting in 2027.

This move is a direct response to China’s recent export restrictions on rare earths, ensuring Apple has a reliable U.S.-based source for these critical components. The agreement also underscores Apple’s commitment to strengthening its standing with U.S. regulators, as lawmakers continue scrutinizing global supply chains.

Under the deal, some of the magnets will be sourced from recycled materials, supporting Apple’s environmental targets. MP Materials, bolstered by major backing from the U.S. Department of Defense, is set to become majority owned by the Pentagon, reflecting Washington’s interest in reducing reliance on China for strategic minerals.

The magnets are vital in smartphones, electric vehicles, and defense systems. Apple’s agreement is part of a broader $500 billion commitment to U.S. investment over the next four years.

Tesla Faces Deep Cuts to Earnings Forecasts, Stock Sinks

Evercore analysts slashed Tesla’s long-term earnings outlook, estimating 2026 EPS will be about 85% lower than projections made in 2022.

Several factors contributed to the downgrade, including slower-than-expected deployment of autonomous driving technology, Elon Musk’s politically charged public statements, and technical signals suggesting a possible downward price trend.

Tesla’s stock is down over 21% year to date and now trades with increasing skepticism from institutional investors.

Second-quarter earnings are expected to come in at $0.38–$0.40 per share, missing Wall Street’s average estimate of $0.44.

Analysts cautioned that even a potential auto tariff deal from the Trump administration is unlikely to give Tesla a significant boost, as underlying operational and strategic concerns weigh more heavily on investor sentiment.

U.S. Opens Section 301 Investigation Into Brazil

The U.S. has launched a Section 301 investigation into Brazil’s trade practices, focusing on what officials describe as persistent attacks on American digital trade interests.

This probe comes just a week after President Trump announced a hefty 50% tariff on Brazilian imports.

The Section 301 mechanism allows the U.S. to examine and potentially retaliate against unfair trade practices, setting the stage for further escalations between Washington and Brasília.

Fed’s Logan says there is a lot of uncertainty about tariff pass-through to consumers

- Dallas Fed President Lorie Logan

- A lot of uncertainty about tariff pass-through to consumers

- Many companies want to wait and see how tariffs are settled before they pass on higher prices to consumers

- We’ll be looking at the data in summer, into fall before we have a good read

- Fed builds its credibility by explaining to the public its view of the economy and its thinking on policy

- Economic models show tariffs have one-time price effect, but models assume much smaller tariffs

- Watching the data very carefully into the fall

- Must make sure inflation expectations don’t rise

- Base case is that monetary policy needs to hold tight for a while longer to bring inflation down

- Want to see low inflation continue longer to be convinced

- June CPI data suggests PCE inflation, which the Fed targets at 2%, will rise

- Also possible that softer inflation, weakening labor market will call for lower rates ‘fairly soon’

- Labor market remains solid, fiscal policy set to be a tailwind for growth

- Under base case can sustain maximum employment even with modestly restrictive policy

- If Fed misjudges and doesn’t cut soon enough, it could cut rates further to get employment back on track

- Tariff increases appear likely to create additional inflationary pressure for some time

- If Fed cuts rates too soon, risks deeper economic scars on longer road to price stability

Canada Tightens Steel Import Quotas and Tariffs to Cut Dependence on U.S.

Canada announced it will cut tariff-rate quota levels for steel products from non-free trade agreement (non-FTA) countries to 50% of 2024 volumes, slashing them from the previous 100%.

For steel imports from FTA partners (excluding the U.S.), the quota will remain at 100% of 2024 levels. Any volumes above those thresholds will face a 50% tariff.

Additionally, an extra 25% duty will be slapped on steel imports from all countries—except the U.S.—that contain steel melted and poured in China.

Prime Minister Carney emphasized the move is designed to reduce Canada’s reliance on the U.S. and push for a stronger domestic supply chain, ensuring more Canadian steel goes into Canadian projects.

Canada June Housing Starts Beat Expectations

Canada’s housing starts in June totaled 283,700 units on a seasonally adjusted annual rate, beating the 259,000 forecast, as reported by CMHC.

The May figure was revised slightly higher to 282,700 from an initial 279,500.

Despite the stronger headline number, this data isn’t expected to sway Bank of Canada policy decisions. Following Tuesday’s CPI figures, market bets on another rate cut before year-end have slipped below a 50% probability.

Commodities News

Gold Rebounds as Powell’s Future Raises Market Jitters

Gold prices rose on Wednesday, regaining traction above $3,350 per ounce, as soft inflation data and speculation about Fed Chair Jerome Powell’s job security shook investor confidence in U.S. monetary policy independence.

At last check, gold was trading around $3,355, bouncing back from the prior day’s pressure following a stronger-than-expected CPI report.

Market Drivers:

- June Producer Price Index (PPI):

- Headline PPI MoM: 0.0% (vs. 0.2% est.)

- Headline PPI YoY: +2.3% (vs. 2.5% est., down from May’s 2.6%)

- Core PPI MoM: 0.0%

- Core PPI YoY: 2.6% (vs. 3.0% prior)

- Industrial Production came in stronger, up 0.3%, versus a 0.1% forecast, indicating some strength in factory activity despite inflation softening.

Gold initially dropped after Tuesday’s CPI data showed headline inflation rising 2.7% YoY in June, with core CPI climbing to 2.9%, higher than both May and consensus expectations—cutting odds of a near-term Fed rate cut.

But Wednesday’s softer PPI numbers revived hopes for policy easing, pushing the U.S. dollar lower and lifting bullion prices.

Fed Chair Uncertainty Adds Volatility

Political chatter picked up after reports emerged that President Trump may replace Fed Chair Jerome Powell. Trump later said Treasury Secretary Scott Bessent was “an option,” though not his leading candidate.

Bessent clarified that Powell’s dismissal isn’t imminent, but admitted the administration has begun searching for potential successors.

The increased scrutiny of Powell’s position—and concern over Fed independence—prompted safe-haven demand for gold, even as markets digest conflicting inflation and production data.

The CME FedWatch Tool currently shows:

- 56.1% chance of a rate cut in September

- 42.5% chance of no change

Investors now turn their attention to Friday’s University of Michigan consumer sentiment data, retail sales, and final inflation clues before the Fed’s next move.

WTI Crude Oil Settles Slightly Lower as Technical Levels Eyed

WTI crude futures closed at $66.38 Wednesday, down $0.14 or 0.21% on the day.

Prices briefly touched a session high near $67 before slipping as low as $65.45.

At the day’s lows, prices approached the 100-day moving average at $65.08, a critical support zone. Below that, further downside could target a swing area between $63.97 and $64.63.

On the upside, reclaiming the 200-day moving average at $68.26 would be required to regain bullish momentum.

Last week, WTI managed to close above the 200-day level but struggled to sustain gains after posting a new July high of $69.61 on Monday.

US Crude Oil Stocks Post Large Draw, Prices Dip

US crude inventories fell by 3.859 million barrels for the week ending July 12, a significantly larger draw than the 552,000-barrel decline forecast, according to EIA data.

Distillate stocks rose by 4.173 million barrels, far above the expected 199,000-barrel build. Gasoline inventories increased by 3.399 million barrels, beating the 952,000-barrel estimate.

Cushing storage edged up by 213,000 barrels.

Despite the hefty crude draw, oil prices slipped slightly post-release, with WTI crude falling to $65.54 from $65.78 pre-data, reflecting market caution amid broader economic concerns.

Silver Firm Above $37.80 as Soft U.S. PPI Supports Bulls

Silver prices stabilized near $37.90 on Wednesday, recovering from early-week pullbacks after the latest U.S. PPI numbers landed below forecasts.

Headline PPI was flat month-over-month in June, missing the expected 0.2% rise and slowing from May’s 0.3%. Year-on-year, headline PPI eased to 2.3%, under the 2.5% consensus.

Core PPI (excluding food and energy) also showed no monthly growth (0.0% vs. 0.2% expected) and decelerated annually to 2.6%, down from 3.0% in May.

Earlier this week, silver touched a 14-year high at $39.13 before profit-taking set in. Despite temporary weakness, the metal maintains a bullish technical outlook, helped by lingering safe-haven demand and a weaker dollar.

Iron Ore Slides as China’s Steel Output Plummets

Iron ore prices retreated sharply after China reported its steepest monthly decline in crude steel production in a decade. June steel output sank 9.2% year-over-year to 83.2 million tonnes—the weakest first-half total since 2020, according to ING’s Francesco Pesole.

The slowdown is closely linked to China’s property market slump, which accounts for around 40% of steel demand.

On the flip side, primary aluminum output rose 3.4% year-over-year in June, reaching 3.8 million tonnes. Over the first half of 2025, cumulative production edged up 3.3% to 22.4 million tonnes, driven by better margins that encouraged smelters to lift capacity.

OPEC Output Climbs, Adding Pressure to Oil Prices

Oil prices edged lower on Tuesday, weighed down by a firmer U.S. dollar and no immediate punitive action from the U.S. against Russia after President Trump’s recent threats.

According to the American Petroleum Institute (API), U.S. crude inventories climbed by roughly 800,000 barrels last week, while gasoline and distillate stocks rose by 1.9 million and 800,000 barrels respectively.

OPEC’s monthly market report showed no revision to its global demand growth forecasts: 1.29 million barrels per day (bpd) for 2025 and 1.28 million bpd for 2026.

OPEC’s total output increased by 220,000 bpd in June to 27.24 million bpd, as the group continued easing cuts. Notably, Saudi Arabia shifted its reporting method, using supply-to-market rather than pure production figures. Without this change, Saudi production would have exceeded its June target by 385,000 bpd.

Kazakhstan also overproduced by 347,000 bpd but confirmed it will remain in OPEC+, citing the group’s stabilizing role.

Europe News

Eurozone Trade Surplus Expands in May

The euro area’s trade surplus rose to €16.2 billion in May, improving from €15.1 billion in April (revised up from €14.0 billion), Eurostat reported Tuesday.

This jump underscores ongoing strength in exports relative to imports despite a murky global demand backdrop.

The stronger trade balance adds another layer of resilience to the bloc’s external sector, even as internal inflation dynamics continue to grab headlines.

Italy Final June Inflation Holds Steady, Core Ticks Up

Italy’s final June CPI landed right in line with preliminary figures, coming in at 1.7% year-on-year, unchanged from the flash reading and slightly above May’s 1.6%, according to Istat.

The harmonized index of consumer prices (HICP) was slightly stronger, finalizing at 1.8% against the preliminary 1.7% and matching last month’s reading.

Core inflation moved modestly higher to 2.0% from 1.9% in May.

These relatively mild inflation figures suggest Italy remains in a more stable price environment compared to higher readings from peers like Germany, supporting the European Central Bank’s cautious summer stance.

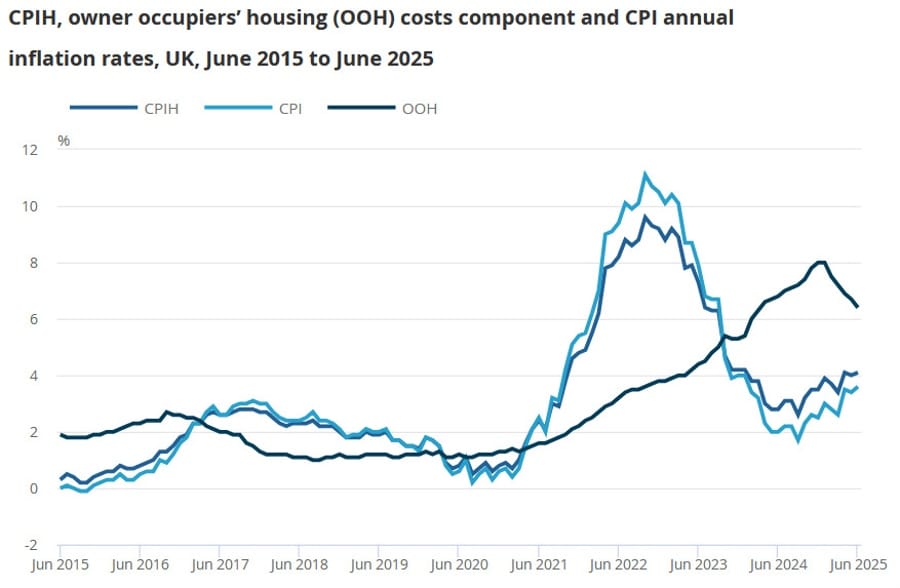

UK June Inflation Overshoots Forecasts

The UK consumer price index rose by 3.6% year-on-year in June, outpacing the 3.4% forecast and climbing from May’s 3.4%, according to the latest release from the Office for National Statistics (ONS).

Core inflation also pushed higher, hitting 3.7% versus the 3.5% expected and up from 3.5% previously.

Meanwhile, services inflation matched expectations at 4.7%, identical to May’s figure.

These numbers highlight the persistent price pressures, especially in core and services components, potentially complicating the Bank of England’s path toward rate cuts in the coming months.

BOE’s Mann: My view is it’s going to take some effort to get inflation down

BOE Mann from business news Wales says:

- My view is is going to take some effort to get inflation down.

- Without supplies side growth, demand is a sugar high, and it does not end well.

- Views differ on MPC about where demand conditions really are, and how that’s playing out in labor market.

German Finance Minister: Expects economic growth in the second half of the year

- German finance minister Klingbeil speaking

- Trump tariff threatens the American economy at least as much as the companies here in Europe

- EU fiscal rules give flexibility and I have received positive signals of support from the commission on Germans plans

- Expects economic growth in the second half of the year with approved government measures.

- Coalition has no time for battles amid all the global challenges on which we should focus.

Asia-Pacific & World News

China to Host SCO Summit With Over 20 Leaders

China confirmed it will host the Shanghai Cooperation Organization (SCO) Heads-of-State Summit in Tianjin from August 31 to September 1.

More than 20 heads of state and 10 international organization leaders are slated to attend. Participating nations include Belarus, India, Iran, Kazakhstan, Kyrgyzstan, Pakistan, Russia, Tajikistan, Uzbekistan, and China itself.

The summit aims to strengthen regional security cooperation, push forward economic integration, advance digital innovation, and highlight sustainable development.

Tianjin’s role as a model smart port city along the Belt and Road Initiative will also be showcased as part of broader urban and trade connectivity goals.

China GDP Forecasts Upgraded by Multiple Banks

Morgan Stanley has lifted its 2025 GDP forecast for China to 4.8% from 4.5%, citing stronger-than-expected growth momentum. UBS also raised its projection to 4.7%, while ANZ pushed its estimate even higher to 5.1% from 4.2%.

These upgrades follow fresh data showing China’s Q2 GDP growth at 5.2% year-on-year, slightly above the 5.1% consensus.

In nominal terms, GDP expanded by 3.9% in the first half, factoring in consumer price index deflation of 0.1% and a producer price index decline of 2.8%.

The adjustments suggest optimism that China’s recent policy support and industrial upgrades are beginning to gain traction.

China Tightens Grip on EV Battery Tech Exports

China is tightening export controls on its electric vehicle battery technology to maintain its lead over global competitors, especially the U.S., according to the Wall Street Journal.

On Tuesday, Beijing officially added technologies related to EV battery manufacturing — including cathode material production and specific metal-processing methods — to its restricted export list. This move means companies must now obtain government approval before transferring these technologies abroad.

While these aren’t outright bans, they significantly increase oversight, essentially tightening the noose on how automakers and battery firms share critical innovations overseas. China already dominates every segment of the EV battery value chain, from mining to final assembly, and these steps solidify that control further.

He Lifeng Says China Ramping Up Efforts to Drive Consumption

China’s Vice Premier He Lifeng confirmed on Tuesday that the country is stepping up efforts to boost domestic consumption, describing it as a cornerstone for long-term growth.

He highlighted the push toward building a modernized industrial framework, emphasizing new initiatives aimed at fostering openness, strengthening international collaboration, and promoting innovation.

China’s broader strategy includes reinforcing supply chains and supporting global industrial networks. He criticized the trend of “politicizing” and “over-securitizing” economic relations, stating that tariffs and protectionist measures ultimately harm global development and raise operational costs.

He argued that attempts to reshape supply chains through tariffs or reshoring campaigns would only backfire, adding unnecessary burdens on companies worldwide.

PBOC sets USD/ CNY mid-point today at 7.1526 (vs. estimate at 7.1914)

- PBOC CNY reference rate setting for the trading session ahead.

PBOC injected 520.1bn yuan via 7-day reverse repos at 1.40%

- 75.6bn yuan mature today

- net 444.6bn injection yuan

China and Australia to Reassess Free Trade Deal

China’s Ministry of Commerce announced that Beijing and Canberra have signed a memorandum to launch a joint review and implementation process for the China-Australia Free Trade Agreement (ChAFTA).

The review is set to evaluate the effectiveness of the deal since its inception, explore updates to address evolving trade landscapes, and strengthen economic ties between the two nations.

The move underscores a warming in bilateral relations after years of trade tensions and marks an effort to secure smoother market access for both sides.

Japanese Manufacturing Sentiment Improves Despite Tariff Worries

Japan’s manufacturers reported slightly better sentiment in July, with the Reuters Tankan Index climbing to +7 from June’s +6.

The service sector index remained flat at +30 for the third month straight. Manufacturers expect sentiment to inch up to +8 by October, although services anticipate a slight pullback to +27.

Electronics and chemical producers drove the optimism, buoyed by recovering semiconductor demand. Conversely, the transport machinery sector saw a sharp decline, dropping to +9 from +20, as worries over U.S. auto tariffs weighed heavily.

Service firms showed mixed results: wholesalers improved, but retail and IT sectors flagged, partly due to weaker tourism and a cautious consumer environment.

This uptick comes despite Japan’s Q1 economic contraction and falling exports in May, reflecting cautious optimism amid global trade and geopolitical tensions.

Crypto Market Pulse

Bitcoin, Ethereum, XRP Eye Continuation Rally as U.S. Crypto Bills Gain Momentum

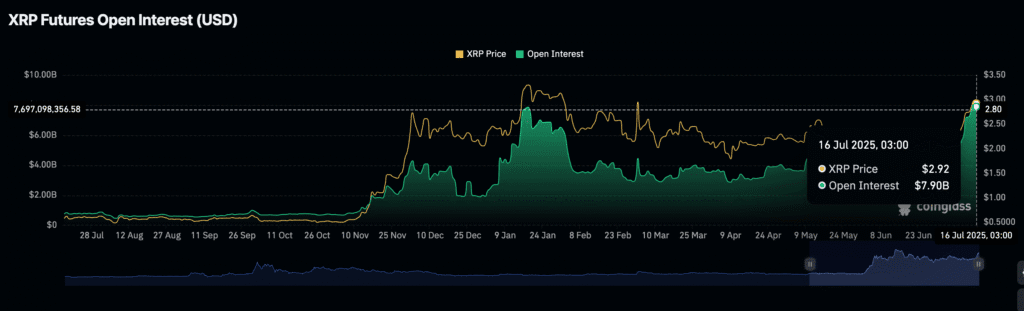

Bitcoin steadied above $119,000 Wednesday, rebounding from Tuesday’s drop to $115,736. Ethereum reclaimed the $3,100 level, while XRP aimed to break back above $3.00.

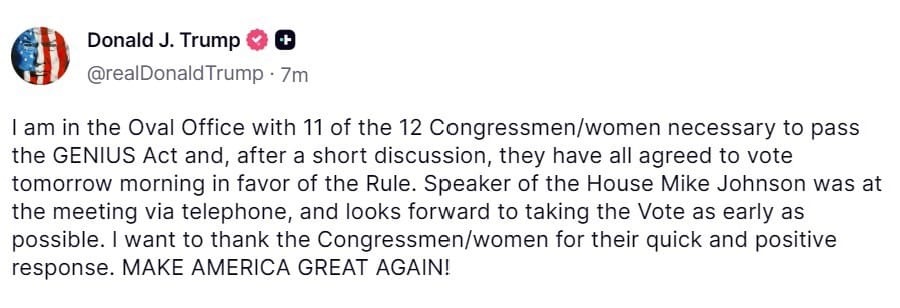

Market optimism is partly driven by the ongoing “Crypto Week” in the U.S. House, where lawmakers may pass landmark legislation such as the GENIUS Act.

President Trump announced Wednesday that he convinced 11 House members to support the bills after Tuesday’s 196–222 setback.

Bitcoin’s climb to a record $123,218 was powered by supportive macro factors: shifting global trade dynamics, institutional demand, and regulatory optimism. Deutsche Bank Research noted that this indicates crypto is maturing into a core portfolio asset.

Ethereum’s bullish structure is reinforced by a strong RSI at 77 and a continuing MACD buy signal since June 24. Targets beyond $3,500 and $4,000 are now on the radar if momentum persists.

XRP’s Micro Futures on CME also show growing institutional activity, with $250 million notional traded Friday and cumulative volume surpassing $1.6 billion.

A decisive move above $3.00 could shift attention to the all-time high near $3.40.

XRP Eyes Record Highs Amid On-Chain Strength and Crypto Bill Tailwinds

Ripple’s XRP is gaining traction again, up over 2% on Wednesday to around $2.99 after bouncing off $2.80 earlier in the week. The token looks poised to retest Monday’s highs above $3.00 and potentially challenge the January all-time high at $3.40.

The momentum is fueled partly by legislative progress in the U.S. House, where President Trump said he secured key votes to pass the GENIUS Act—a bill laying the foundation for stablecoin oversight and broader crypto regulation.

House Rep. French Hill confirmed on CNBC that there is now enough support to move forward on the GENIUS Act, the CLARITY Act, and the Anti-CBDC Surveillance State Act.

On-chain metrics are also robust. New XRP wallet addresses surged, and Open Interest climbed from $3.54 billion on June 23 to $7.9 billion Wednesday. However, derivatives volume slipped 45% to $13 billion, reflecting cautious trading after Monday’s profit-taking.

Ripple’s push to expand its RLUSD stablecoin and payments network positions it to benefit significantly if these regulatory frameworks pass.

Stellar’s XLM Pushes Higher as Network Activity Explodes

Stellar’s XLM token is up nearly 4% Wednesday, extending a massive July rally that now totals around 95%.

Data from The Block shows active addresses on Stellar’s network surged to 12.36K as of Monday, outpacing XRP Ledger’s 8.34K.

Transactions on Stellar hit a seven-day moving average of 5.20 million, dwarfing XRP’s 1.92 million.

XLM Open Interest hit a record $520 million Tuesday, highlighting an unprecedented level of trader engagement.

If Stellar maintains its growth in new addresses and transactions, it could strengthen its foothold as a leading cross-border payment solution, potentially challenging XRP’s dominance in this niche.

Bonk Meme Coin Rockets 55% in July, Maintains Strong Technical Momentum

Bonk (BONK) continued its explosive rally Wednesday, trading near $0.00003377 after posting intraday gains over 12%. The meme token has soared 110% over the last 30 days, lifting its market cap by 55% to $2.55 billion, per CoinGecko.

Technically, Bonk is supported by a confirmed Golden Cross, as the 50-day EMA crossed above the 100-day EMA.

CoinGlass data shows Open Interest (OI) on Bonk futures has surged to an average of $48 million this month. Trading volume in derivatives spiked from $39 million to $618 million, confirming deepening investor conviction.

If this trend holds, Bonk could target resistance around $0.00004000 in the near term.

Ethereum Surges to New 5-Month High Above $3,138

Ethereum has climbed to over $3,138, its highest level in more than five months, driven by a cocktail of institutional interest, technical milestones, and regulatory progress.

Ethereum’s core infrastructure now supports nearly half of all stablecoins in circulation. Confidence in the ecosystem has surged alongside U.S. legislative moves like the GENIUS Act, which is boosting investor appetite for crypto assets with stronger regulatory backing.

The rise of spot Ethereum ETFs — nine of which have launched since May 2024 — has funneled additional mainstream capital into ETH.

Recent protocol upgrades, including Pectra and Dencun, have cut transaction costs and improved scalability, making Ethereum more appealing for staking and decentralized finance (DeFi) use cases.

Institutions, including banks and asset managers, are increasingly using Ethereum for yield generation, viewing it as more than just a speculative play.

Trump: GENIUS Act Has the Votes to Pass

President Trump announced on his social media platform that he has secured enough votes to pass the GENIUS Act — formally known as the Guiding and Establishing National Innovation for U.S. Stablecoins Act.

The bipartisan bill aims to establish the first comprehensive federal framework for USD-backed stablecoins. It will require strict reserve backing, regular audits, and robust oversight to protect consumers and add stability to the digital asset sector.

The Act is expected to significantly shape the stablecoin market by providing regulatory clarity and promoting safer adoption.

The Day’s Takeaway

United States

Equities: Major U.S. stock indices closed mixed, but generally higher.

- Dow Jones gained 231.49 pts (+0.53%) to 44,254.75.

- Russell 2000 rebounded +0.99% after yesterday’s drop.

- S&P 500 rose +0.32% to 6,263.70.

- Nasdaq Composite edged up +0.25% to 20,730.49, hitting a fresh record close.

Strength in semiconductor stocks—such as NVIDIA (+4%), AMD (+6.4%), Microsoft, Apple, and Amazon—fuelled gains as markets digested signs of renewed U.S. chip-sales to China.

Central Bank & Monetary Policy: The Fed’s Beige Book showed a slight uptick in activity across districts from late May to early July, though sentiment remains cautiously neutral. Employment rose modestly, price growth continued, and tariff-related input costs were noted. The tone heading into July’s FOMC remains unchanged.

Inflation & Rates:

- June PPI came in flat MoM and softer YoY at +2.3%.

- Industrial production exceeded expectations (+0.3% vs +0.1%).

- Markets took this as a signal for potential dovish tilt, driving gold higher.

Mortgage & Real‑Estate Data:

- MBA mortgage applications dropped 10% week-over-week.

- 30-year rate climbed slightly to 6.82%.

Canada

- Announced it will halve its steel tariff-rate quota, cutting threshold to 50% of 2024 volumes from non‑FTA countries, and apply a 25% tariff on steel melted in China (excluding the U.S.). This aligns with PM Carney’s push to diversify and rely more on Canadian steel.

Commodities

Gold: Bounced back above $3,350/oz after weaker PPI and renewed concerns over Independence at the Fed, which slashed U.S. dollar demand.

Oil & Energy:

- Crude inventories dropped by 3.86 million barrels vs +0.55MM est.

- WTI futures settled around $66.52–$66.98 range.

Metals:

- Silver steadied near $37.90–$38.00/oz, supported by cooling inflation data and continued haven demand.

Base Metals:

- Iron ore prices dipped on data showing China’s steel output dropped 9.2% from a year ago—the largest decline in ten months.

- Aluminum production in China moderated after hitting record highs; smelters are slowing to avoid exceeding annual caps.

- Copper ore imports into China eased somewhat but remained elevated, up ~6% year-to-date, supporting ongoing output.

Europe

UK Inflation:

- June CPI rose 3.6% YoY (core: +3.7%, services: +4.7%), above expectations, reinforcing the BoE’s caution amid sticky price pressures.

Italy Inflation:

- June CPI held at +1.7%, core rose to 2.0%; ECB likely to maintain pause.

Eurozone Industry & Trade:

- May industrial production jumped +1.7% MoM (energy +3.7%, capital goods +2.7%, consumer non-durables +8.5%).

- May trade surplus widened to €16.2 bn.

Asia

Japan:

- July Reuters Tankan shows manufacturers at +7 (up from +6), non-manuf. stable at +30; recovery signs in semiconductors, though U.S. auto tariffs weigh on sentiment.

China:

- Vice Premier He Lifeng announced increased efforts to boost domestic consumption, strengthen economic openness, and resist protectionism.

Crypto

Broad Market Momentum:

- Bitcoin reclaimed levels around $119k–$120k, stabilized ahead of key U.S. legislative votes.

- Ethereum surpassed $3,100, buoyed by strong spot ETF inflows and technical upgrades.

XRP:

- Trading near $2.99, with the $3.00 psychological level in sight. Rising on-chain activity and expected U.S. legislative clarity (GENIUS & CLARITY Acts, Anti‑CBDC).

Stellar (XLM):

- Up 95% for July, hitting new highs near $0.50, with record **Open Interest ($520M)** and accelerating transaction volumes.

Bonk (BONK):

- Gained ~55% this month, trading around $0.0000338, supported by inflows and technical signals including a Golden Cross setup.

Summary:

- US: Equities rebound led by cyclical and tech catch-up; inflation data remains mixed, setting tone for Fed policy.

- Canada: Trade diversification moves reshape steel tariffs.

- Commodities: Metals and energy reflect a mixed picture—growth concerns support gold and silver, while base metals show Chinese policy impact.

- Europe: High inflation and strong industrial data strengthen the case for cautious monetary policy.

- Asia: Japan business sentiment improves modestly; China leans into domestic demand.

- Crypto: Momentum stays strong across major tokens, with legislative tailwinds and on-chain indicators in focus.