North America News

NASDAQ Closes at New Record High, Meta Headlines Tech Gains

U.S. equities finished higher on Monday, with the NASDAQ leading the charge to a fresh record close. The final numbers show:

- Dow Jones Industrial Average: +88.14 points, or +0.20%, finishing at 44,459.65.

- S&P 500: +8.81 points, or +0.14%, ending at 6,268.56.

- NASDAQ: +54.80 points, or +0.27%, closing at a record 20,640.33.

- Russell 2000: +14.90 points, or +0.67%, settling at 2,249.72.

Meta shares attracted attention after CEO Mark Zuckerberg announced a massive investment plan, pledging hundreds of billions of dollars into AI compute infrastructure for “superintelligence.” Meta stock surged to an intraday high of $728 before paring gains, closing up $3.41 or +0.48% at $720.92.

Notable outperformers included:

- Roblox (RBLX): +5.78%

- Block (XYZ): +5.42%

- Palantir (PLTR): +4.96%

- Shopify (SHOP): +4.13%

- Fortinet (FTNT): +3.97%

- MicroStrategy (MSTR): +3.79%

- PayPal (PYPL): +3.53%

- Tapestry (TPR): +3.17%

- Live Nation Entertainment (LYV): +3.17%

- Corning (GLW): +2.99%

- Delta Air Lines (DAL): +2.57%

- Airbnb (ABNB): +2.38%

- Gilead Sciences (GILD): +2.23%

Looking ahead, the second-quarter earnings season kicks off tomorrow, with J.P. Morgan set to report before the opening bell. Other big banks and major names lined up include Wells Fargo, BlackRock, Citi, Goldman Sachs, Bank of America, Morgan Stanley, Johnson & Johnson, and Netflix. By Friday, investors will also hear from American Express, 3M, and others.

Meta Bets Big on AI Superintelligence With $100B+ Investment

Meta CEO Mark Zuckerberg announced plans to invest hundreds of billions of dollars into computing infrastructure for “superintelligence.” Backed by strong cash flow from its core businesses, Meta aims to build a world-leading AI research powerhouse.

Projects include Hyperion — expected to scale to 5 gigawatts over several years — and the Prometheus cluster coming online in 2026. Meta also plans multiple “Titaned” clusters, setting a new benchmark for compute per researcher.

Zuckerberg’s strategy focuses on consolidating elite AI talent, potentially starving smaller labs and startups of top researchers. By providing unmatched compute resources, Meta hopes to accelerate breakthroughs in artificial general intelligence (AGI), signaling an arms race against rivals like OpenAI, Google DeepMind, and xAI.

This aggressive move positions Meta not just as a big player in generative AI, but as a serious contender for AGI leadership. It also hints at future regulatory and competitive clashes as other firms scramble to keep pace.

Fed’s Hammack: I see an economy that’s really healthy.

- Fed’s Hammack speaking on Fox Business:

- I see an economy that’s really healthy

- inflation has made progress to Feds target but is still too high

- we are not there yet on inflation, important to stay restrictive on monetary policy.

- Fed officials are having a great debate over the economy.

- Many business plans on pause amid uncertainty

- Uncertainty has been weighing on investment.

- We don’t know if economy will boom later this year

- we are pretty close to where the neutral rate is.

- Doesn’t see imminent need to cut rates.

- If Fed sees economy weakening of course Fed will respond.

Hassett: Deal Talks Continue, Tariffs Defended as Patriotic

White House economic advisor Kevin Hassett told CNBC that negotiations for new trade deals are ongoing, emphasizing the president’s commitment to “what’s best for the nation.” Hassett argued that declining import prices reflect American consumers choosing local products out of patriotic support, strengthening domestic communities.

He defended tariffs on Mexican goods, citing a “national emergency” over drug flows, and criticized Europe’s trade deficit with the U.S. Hassett also targeted Brazil for allegedly rerouting Chinese products, calling it another national emergency.

On monetary policy, he stressed that the Federal Reserve should remain independent but suggested it had misjudged the inflationary impact of tariffs. He argued that as U.S. production scales up, inflationary pressures will ease, adding that the historical link between European and U.S. rates is no longer reliable.

Powell Requests Inspector General Review of $2.5B Fed Renovation

Federal Reserve Chair Jerome Powell has formally asked the central bank’s Inspector General to examine the ongoing $2.5 billion renovation project. The review request comes amid rising criticism from the Trump administration, which has pressured Powell to cut interest rates and is now scrutinizing the budget overruns tied to the Fed’s headquarters upgrade.

Deutsche Bank: Markets Underestimate Risk of Trump Firing Powell

Deutsche Bank’s George Saravelos warns that markets are brushing off the risk of Trump removing Fed Chair Jerome Powell. If Powell is ousted, DB estimates a 3–4% fall in the dollar and a 30–40 basis point surge in Treasury yields. The move would raise serious concerns over Fed independence and could amplify market volatility due to the U.S.’s fragile external funding position.

Central Banks, Wealth Funds Eye China as Dollar Remains Dominant

A new Invesco report shows nearly 60% of sovereign wealth funds plan to increase China exposure, especially in tech, rising to 73% among North American funds. While 78% of central banks see no serious rival to the dollar for at least 20 years, reserve diversification is rising amid U.S. debt concerns. Private credit and digital assets also continue to gain traction.

Musk to Put Tesla Investment in xAI to Shareholder Vote

Elon Musk said Tesla shareholders will decide whether the company invests in his AI startup xAI. His comments followed speculation after reports of a possible $2 billion commitment from SpaceX. Musk noted, “It’s not up to me,” confirming the issue will go to a vote.

Canada’s Wholesale Trade Marginally Positive in May

Canadian wholesale trade ticked up by 0.1% in May, beating expectations for a 0.4% decline. April’s drop was revised slightly to -2.2% from -2.3%.

A 3.5% surge in personal and household goods sales to $12.4 billion led the gains, driven by strong performances in textiles, clothing, and footwear (+14.4%), as well as home entertainment and appliances (+15.5%).

Motor vehicles and parts also rose 2.2%, thanks to a 2.9% boost in motor vehicle sales. However, machinery, equipment, and supplies sales fell 3.3%, weighed down by sharp declines in farm, lawn, and garden machinery (-17.1%) and construction and industrial equipment (-3.9%).

Wholesale inventories rose 0.8% to $130.3 billion, with increases in building materials (+2.1%) and personal and household goods (+2.2%). The inventory-to-sales ratio inched up to 1.55 in May from 1.54, indicating slightly more inventory on hand relative to sales.

Mexican Pres Sheinbaum: We have done our part in fight against fentanyl

- …US has to do it’s part .

Mexican Pres. Sheinbaum on the new 30% tariffs effective August 1 says:

- We have done our part in the fight against Sentinel, US has to do its part.

- Will inform little by little, Monday she is meeting with team that went to Washington and our Minister of foreign affairs

- We hope to reach an agreement between now and August 1

- Mexico also has a plan for tariffs.

- There has been very important progress with the US on security issues, an agreement has almost been finalized.

Commodities News

Gold Slips as Traders Eye U.S. Inflation and Tariff Moves

Gold prices edged lower Monday, trading in a tight range between $3,340 and $3,370, as the U.S. dollar rebounded ahead of key economic data releases. At last check, gold hovered around $3,350, with bulls unable to sustain a breakout above $3,370 resistance.

Geopolitical tensions provided initial support after President Trump threatened to impose 30% tariffs on imports from the EU and Mexico starting August 1. Letters confirming the planned tariffs were sent to EU Commission President Ursula von der Leyen and Mexican President Claudia Sheinbaum over the weekend. Trump also hinted at tariffs for other nations, warning that retaliatory measures would be matched and added to the U.S. rate.

The European Commission responded Sunday, stating it remains open to negotiations but stands ready to implement proportional countermeasures if needed.

Traders are also focused on upcoming U.S. Consumer Price Index (CPI) data for June, due Tuesday. This report could shape expectations for Federal Reserve policy, especially as the central bank evaluates the inflation impact of new tariffs.

Meanwhile, markets are watching China’s economic releases — including Q2 GDP, industrial output, and retail sales — which could influence risk sentiment and further impact gold’s trajectory.

On the technical side, gold remains supported above recent breakout levels but stays vulnerable to dollar moves and global risk shifts. The Relative Strength Index indicates overbought conditions, hinting at possible near-term pullbacks unless fresh bullish catalysts emerge.

Oil Drops Below Key Averages, Closes at $66.98

Crude oil futures slid on Monday, settling at $66.98 per barrel, a decline of $1.47 or -2.15% on the day.

The session started strong, with prices reaching a peak of $69.61 — the highest since June 24 — but momentum turned sharply lower after prices failed to hold above key technical levels.

After losing ground below the 200-day moving average at $68.33, selling intensified. The breach also pulled prices below the 100-hour and 200-hour moving averages, adding further downward pressure and flipping control back to sellers.

Last week, oil traded around the 200-day moving average throughout most sessions, ultimately closing above it on Friday. Today’s decisive move back below these levels suggests a shift in short-term sentiment, putting buyers on the defensive once again.

Silver Hits 14-Year Peak Amid Trade Tensions

Silver surged to $39.13 on Monday — its highest price since 2011 — before easing to around $38.60 during U.S. trading hours. This marks the third straight session of gains as investors pile into precious metals amid escalating trade war fears.

President Trump’s threats to impose 30% tariffs on EU and Mexican imports starting August 1 have intensified market anxiety, driving safe-haven demand.

Technically, silver remains strong above its recent breakout from the $37.00–$37.30 resistance zone. The metal trades above its 9-day EMA at $37.36, supporting the bullish outlook.

The RSI at 73 signals overbought conditions but also confirms strong upward momentum. The ADX at 15.65 suggests the trend is still gaining strength.

Traders are watching for a potential push to the psychological $40 level. Immediate support lies around $37.30, with deeper support near $35.25 if a corrective pullback occurs.

All eyes now turn to Tuesday’s U.S. CPI data, which could influence Fed policy expectations and silver’s short-term trajectory.

Speculators Flood into Brent and Gasoil Long Positions

ING analysts report that speculators ramped up their net long positions in ICE Brent by 55,630 lots last week, bringing the total to 222,347 lots as of Tuesday. Fresh buying dominated the move as traders focused on short-term supply tightness rather than long-term balances.

Net long positions in ICE gasoil futures also rose by 12,064 lots to 83,784 lots. Tight middle distillate inventories have underpinned bullish sentiment, though analysts warn of a potential supply surplus emerging in Q4.

Oil Prices Hold Steady Ahead of Trump’s Russia Statement

Brent crude closed Friday up 2.51%, and prices remain firm this morning, according to ING’s latest analysis. Despite tariff tensions resurfacing — with the U.S. threatening 30% tariffs on imports from the EU and Mexico — supply-side dynamics continue to support oil.

President Trump’s planned “major statement” on Russia today is a key risk factor. Possible new sanctions on Russian energy could sharply alter the market balance.

Meanwhile, the International Energy Agency trimmed its 2025 oil demand growth forecast to 700,000 b/d, the lowest since 2009 outside the pandemic years. For 2026, demand is expected to rise by 720,000 b/d. The IEA simultaneously increased its supply growth projections, forecasting a 2.1 million b/d gain this year and a further 1.3 million b/d in 2026, driven largely by returning OPEC+ volumes.

EU Moves Toward Lower Russian Oil Price Cap in Latest Sanctions Round

The EU is close to finalizing its 18th sanctions package against Russia, including a proposed oil price cap around $47 per barrel—15% below the 22-week global average. The review period will shift to every six months. Additional measures include bans on Nord Stream pipeline transactions, blacklisting of a Russian refinery in India, and sanctions on Chinese banks aiding Russian evasion efforts.

ANZ Flags Oil Supply Risks as Trump Tensions with Putin Mount

Oil prices opened higher in Asia amid worries over potential U.S. sanctions on Russia. ANZ Research notes that President Trump’s renewed criticism of Putin and lack of Ukraine peace progress may lead to a major announcement soon, according to the Wall Street Journal.

Europe News

European Markets End Mixed as FTSE 100 Hits New Record

European stocks had a mixed finish on Monday. The UK’s FTSE 100 closed at a record 8,998.07, up 0.64%, after touching an intraday peak of 8,999.22.

Germany’s DAX fell 0.36%, while France’s CAC dropped 0.27%. Spain’s Ibex gained 0.19%, and Italy’s FTSE MIB rose 0.27%.

In bond markets, 10-year yields moved unevenly:

- Spain: +0.003 to 3.338%

- Germany: +0.039 to 2.725%

- France: +0.006 to 3.427%

- UK: -0.035 to 4.595%

- Italy: +0.012 to 3.617%

FTSE 100 Hits Fresh Intraday High

The UK’s FTSE 100 index climbed to a new intraday record of 8,984.98 on Monday, surpassing Friday’s high of 8,918.49. The benchmark rose about 40 points or 0.42% during the session.

Back in March, the index peaked at 8,908.82 before falling to a yearly low at 7,544.83. Since then, the index has rebounded sharply by about 19%, marking a 9.91% gain so far this year.

Meanwhile, Germany’s DAX pulled back, down 163 points or 0.67%, after recently hitting record highs, and France’s CAC also slid.

Swiss Sight Deposits Climb to Highest in 2025

The Swiss National Bank reported that total sight deposits rose to CHF 464.1 billion in the week ending 11 July, up from CHF 459.8 billion previously. Domestic sight deposits increased to CHF 434.9 billion from CHF 424.4 billion. This marks the highest level since October last year. After June’s rate cut, the Swiss Average Rate Overnight (SARON) hovered around -0.03% to -0.04%, prompting foreign banks to shift funds into SNB accounts to avoid negative rates. Banks without minimum reserve obligations can deposit up to CHF 10 million interest-free.

Swiss Producer and Import Prices Ease Slightly in June

Data from Switzerland’s Federal Statistics Office, released on 14 July 2025, show producer and import prices dipped 0.1% in June compared to a 0.5% fall previously. Producer prices held flat on the month, while import prices slipped 0.2%, accounting for most of the overall decline. Over the past 12 months, combined producer and import prices are down 0.7%.

BOEs Bailey: Uncertainty continues to weigh on growth expectations

- BOE Bailey in a letter to g20 finance ministers and central bank governors

- Since April, market conditions have improved and asset prices have recovered

- We have seen further economic and geopolitical risks crystallize and global debt vulnerabilities remain high.

- Uncertainty continues to weigh on growth expectations.

- We need to remain vigilant to the rest of disruptive market moves.

Reuters source: ECB to discuss more negative scenario next week

- Given the Trump tariff threat, ECB bias is shifting

- ECB to discuss a more negative scenario next week then previously envisioned in June after latest Trump tariff threat

- Still seen holding rates at July 24 meeting on eight threat alone.

- Any ECB rate cut discussion remains pushed back to September.

EU’s Sefcovic on trade talks: It takes two hands to clap

EU’s trade chief Sefcovic on the trade talks with the US does not sound all that optimistic saying:

- It takes two hands to clap.

- Plan to confer with US counterparts later on Monday on state of play

- Believes there is still potential to continue US trade negotiations

UBS Delays ECB Rate Cut Forecast to September

UBS has pushed its projection for an ECB rate cut to September, scrapping its earlier July forecast. The revision comes as U.S.-EU trade discussions continue, and markets increasingly expect no policy move next week. Current market pricing shows roughly 97% probability of no change at the upcoming meeting, with only around 20 basis points of total easing anticipated by year-end.

Italy Warns of €21 Billion in Tariffs If No Deal with U.S.

Italy’s Foreign Minister Antonio Tajani told Il Messaggero that the European Union has drawn up a list of retaliatory tariffs totaling €21 billion. If ongoing negotiations with the U.S. collapse, these tariffs would be put in place immediately. Tajani underscored that Europe is ready to defend its economic interests if no agreement is reached.

Asia-Pacific & World News

China’s June Credit Data Shows Lending Surge

China’s M2 money supply increased 8.3% in June, beating the expected 8.1% and higher than May’s 7.9%. New yuan loans soared to ¥2.24 trillion, far above the ¥1.80 trillion forecast and sharply higher than May’s ¥620 billion. This brought total new loans to ¥12.92 trillion for the first half of 2025, reflecting authorities’ determination to sustain economic stimulus, especially in anticipation of trade tensions with the U.S.

Xi Targets Deflation with Anti-Involution Campaign

President Xi Jinping’s new push against “involution”—wasteful and excessive competition—is taking center stage. Sectors like solar, steel, and EVs are under pressure as Beijing aims to end destructive price wars. Stocks are responding favorably, with the CSI 300 outperforming and Morgan Stanley turning bullish on A-shares. But reforms may be tougher than in the past, as the overcapacity issue is now largely in the private sector.

PBOC deputy governor says will continue to implement appropriately loose monetary policy

- Remarks by PBOC deputy governor, Zou Lan

- Will support efforts to help achieve full-year economic growth target

- To better use various structural tools to support key sectors

- Will improve market-based interest rate regime

- To keep liquidity conditions ample

China’s Q2 GDP Likely Exceeded 5% as Exports and Policy Boost Growth

China’s economy likely grew 5.1% in Q2, outpacing the government’s annual target, based on a Bloomberg survey. Strong exports and domestic support policies have bolstered growth. However, Citi and Nomura foresee more stimulus ahead, including potential rate and reserve ratio cuts, as earlier measures lose steam.

China’s Yuan-Denominated Trade Surplus Holds Steady in June

In June, China’s yuan-based exports rose 7.2% year-on-year, up from 6.3% the month prior. Imports also grew by 2.9%, reversing a previous decline. The monthly trade surplus came in at 743.5 billion yuan, unchanged from May’s figure.

China H1 Exports Up 7.2% in Yuan Terms, Trade Hits Record High

Between January and June, China’s yuan-denominated exports climbed 7.2% year-on-year, while imports dropped 2.7%. Total trade volume exceeded 20 trillion yuan, rising 2.9% from the first half of 2024, according to the General Administration of Customs.

China’s June Exports Outperform Expectations

China’s dollar-denominated exports rose 5.8% year-on-year in June, beating the 5.0% forecast and improving from May’s 4.8%. Imports gained 1.1%, slightly below the 1.3% forecast but sharply above the previous -3.4%. The trade surplus hit $114.77 billion, ahead of expectations and up from $103.22 billion in May.

First-Half China–US Trade in Yuan Sees Significant Decline

Chinese customs data shows a 9.9% year-on-year drop in yuan-denominated exports to the U.S. for the January–June period. Imports from the U.S. also fell 7.7%. Total two-way trade slid 9.3%. A government spokesperson emphasized signs of recent improvement in bilateral trade ties, calling for cooperation over confrontation.

Albanese: Stronger China Ties Key to Regional Peace

Australian Prime Minister Anthony Albanese, speaking in Shanghai, reaffirmed his commitment to strengthening Australia-China relations. He stressed that a stable and peaceful Indo-Pacific region depends on constructive engagement with key partners, including China, in pursuit of shared prosperity.

PBOC sets USD/ CNY reference rate for today at 7.1491 (vs. estimate at 7.1744)

- PBOC CNY reference rate setting for the trading session ahead.

PBOC injected 226.2bn yuan via 7-day reverse repos at 1.40%

- 106.5bn yuan mature today

- net 119.7bn injection yuan

NZ Services Sector Still Contracting, But Shows Slight Recovery

New Zealand’s Performance of Services Index for June came in at 47.3, up from May’s 44.1 but still below the neutral 50 mark. The sector has now contracted for five consecutive months, with only one month of slight expansion in the past 16. BusinessNZ noted improvement in most sub-indexes, suggesting some resilience.

BNZ’s Senior Economist Doug Steel:

- “while the headline PSI measure did lift from 44.1 to 47.3, every month it remains below 50 suggests service sector conditions are getting worse not better. The timeline for New Zealand’s long-awaited economic recovery just keeps getting pushed further and further out”.

New Zealand Retail Card Spending Recovers in June

Electronic card spending on retail in New Zealand rose 0.5% month-on-month in June 2025 after dipping 0.1% in May. Year-on-year, spending declined 0.4%, continuing the downward trend from -0.1% the previous month. Total card spending dipped 0.2% on the month.

BHP and CATL Explore Battery Tech Collaboration

BHP has entered into a memorandum of understanding with Chinese battery maker CATL. The agreement will explore joint efforts in battery tech for mining vehicles and trains, as well as solutions in energy storage and battery recycling for BHP’s operations.

Japan’s May Machinery Orders Show Mixed Results

Core machinery orders in Japan fell 0.6% month-on-month in May, performing better than the expected -1.5% decline. Year-on-year, orders rose 4.4%, exceeding the 3.4% estimate, though down from April’s 6.6% growth.

Bank of Japan Poised to Adjust Inflation Outlook

Reports suggest the Bank of Japan may raise its inflation forecast for the current fiscal year during its upcoming meeting at month’s end. However, projections for FY 2026 and 2027 are expected to remain steady. The reports, sourced anonymously via financial media, hint at a potential policy shift amid evolving economic pressures.

Singapore’s Q2 GDP Beats Forecasts, Avoids Recession

Singapore’s economy expanded 1.4% quarter-on-quarter and 4.3% year-on-year in Q2 2025, beating expectations of 0.7% and 3.5%, respectively. The growth rebound follows a revised -0.5% contraction in Q1, marking a turn away from recession.

Crypto Market Pulse

XRP Nears $3 as Crypto Rally Gathers Steam

Ripple’s XRP advanced to around $2.95 on Monday, its highest level in five months, as investor interest soared alongside Bitcoin’s new record high above $123,000.

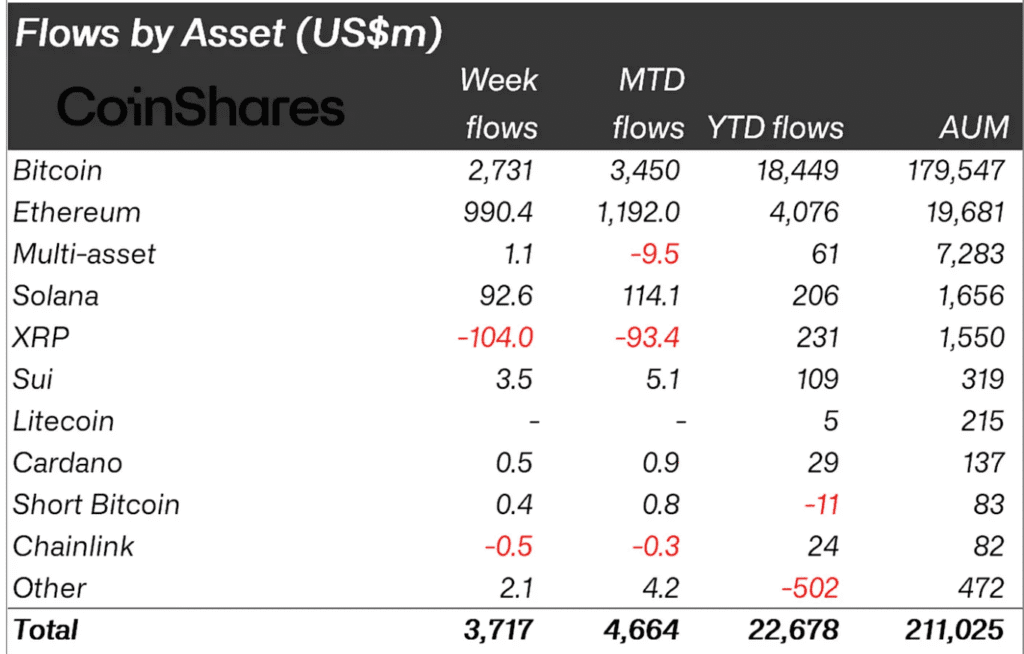

Despite $104 million in outflows from XRP-linked investment products last week, derivatives market data show a bullish backdrop. Open interest rose nearly 12% to $8.3 billion in the last 24 hours, and trading volume jumped 53% to about $23 billion.

CoinShares reported $3.7 billion in total weekly inflows across crypto investment products — the second-highest on record — with Bitcoin leading at $2.73 billion and Ethereum at $990 million.

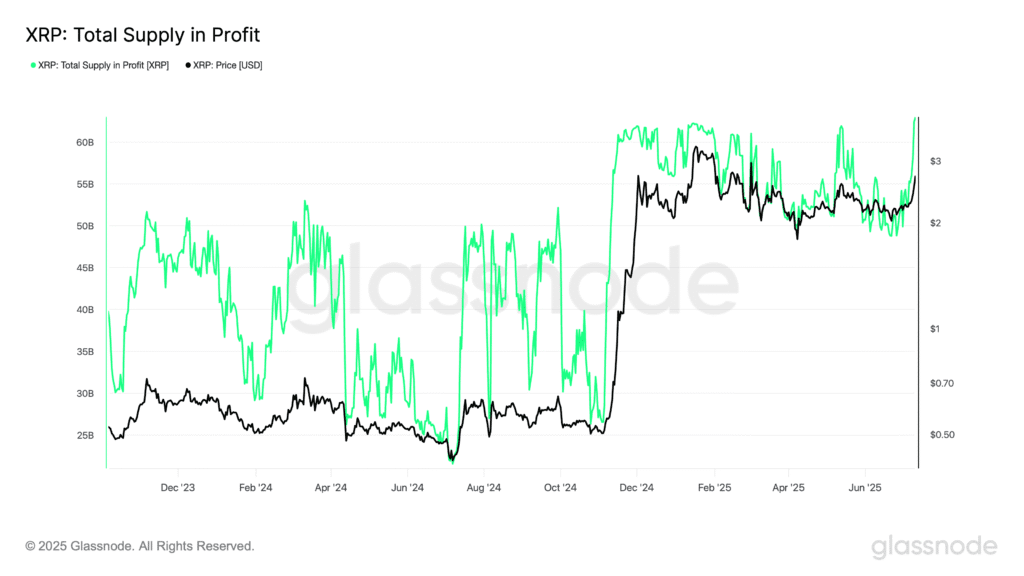

Technical momentum suggests a break above $3 could come soon, although elevated greed levels (Crypto Fear & Greed Index at 70) warn of potential volatility. Total supply in profit hit 58 billion XRP last week, raising the risk of profit-taking. Supply on exchanges also climbed, signaling possible selling pressure if traders rush to lock in gains.

Dogecoin Rally Faces Profit-Taking Risk Above $0.20

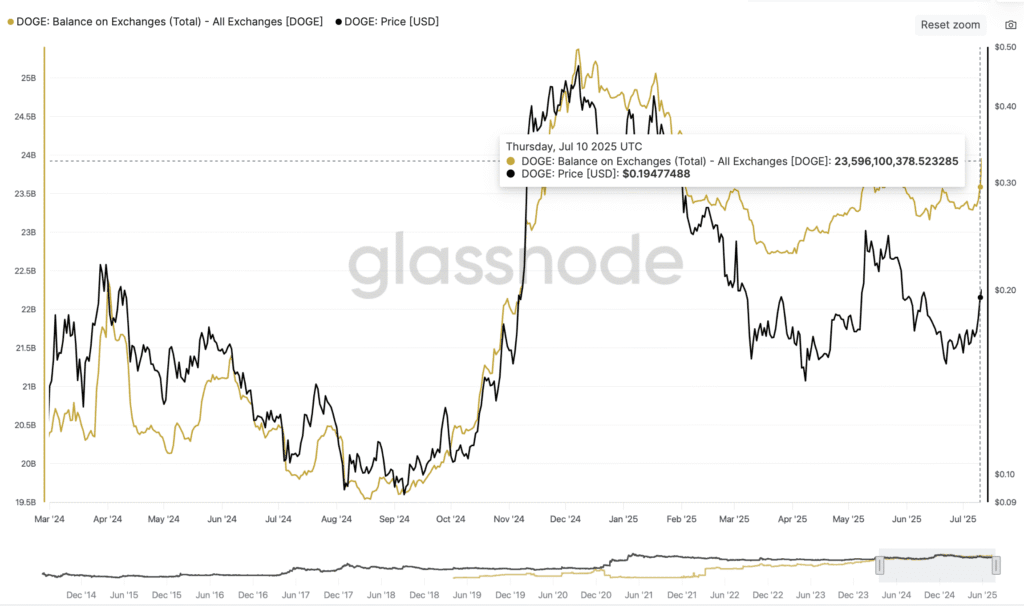

Dogecoin climbed past $0.2000 on Monday, trading near $0.2060, bolstered by strong retail enthusiasm and derivatives market activity. The meme coin has surged 44% from June lows, but the rising supply in profit could soon weigh on prices.

Currently, about 86 billion DOGE are in profit, up from 23.2 billion in mid-June. Past peaks in profitable supply often coincided with selling, such as the May high when supply in profit topped 121 billion DOGE.

Exchange balances have also increased to roughly 23.5 billion DOGE, signaling potential readiness to sell.

Despite the risks, technical indicators remain bullish, with support at the 200-day EMA and buyers firmly in control for now. Traders should watch for signs of reversals if selling accelerates.

SUI Eyes $4 Breakout After Sharp Rally

Sui (SUI) is surging toward the $4 mark after a nearly 12% gain on Monday. The rally coincides with its DeFi Total Value Locked (TVL) hitting a record $2.20 billion — an 8.74% jump in 24 hours, per DeFiLlama.

Open interest has also spiked by 19.1% to $1.73 billion, indicating heightened trader engagement. The funding rate of 0.01% signals sustained bullish sentiment, as traders pay premiums to maintain long positions.

Recent liquidations saw $8.02 million in shorts cleared out, significantly above $1.47 million in long liquidations. While the long/short ratio has only slightly tipped above 1, momentum remains firmly with the bulls, setting the stage for a potential breakout above $4 and a sustained move higher.

U.S. Crypto Firms Move Into Banking as Regulations Ease

Crypto companies like Ripple, Circle, and Kraken are expanding into traditional banking in the U.S., spurred by a friendlier regulatory climate under President Trump.

Ripple and Circle have applied for national trust bank charters from the OCC, allowing them to offer custodial and payment services nationwide without separate state licenses. Kraken plans to roll out both debit and credit cards by month-end, and Robinhood is preparing to launch banking services later this year.

Anchorage Digital currently holds the only trust bank charter, but more firms are racing to follow. Circle described its application as key to bringing crypto deeper into mainstream finance.

Meanwhile, proposed legislation such as the Genius Act would require stablecoin issuers to be OCC-approved and backed by Treasuries, further cementing the sector’s regulatory integration.

Meta, Klarna, and even Bank of America are exploring stablecoin services, though some — including Kraken — prefer partial services through partnerships rather than becoming full-fledged banks.

Bitcoin Hits New Peaks, Edges Toward $130,000

Bitcoin continues to rally, gaining more than 2% today to trade just under $122,000. After nearly dipping below $100,000 last month, Bitcoin has since powered through multiple resistance levels, echoing the explosive move that took it past $72,000 last year. During Monday’s Asian session, BTC briefly hit $119,999 — a new all-time high.

Technical momentum indicators remain bullish: the daily RSI stands at 76, and the MACD histogram is firmly above neutral. The next major target is $132,372, derived from the 127.20% Fibonacci extension of the move from April’s $74,508 low to the latest high.

Ethereum has also joined the upswing, climbing back above $3,000. Traders are increasingly diversifying away from dollar-denominated assets, with gold also attracting inflows amid worries over U.S. fiscal stability.

The Day’s Takeaway

United States

The major U.S. indices wrapped up higher, led by the NASDAQ which closed at a new record of 20,640.33, gaining 0.27%. The Dow Jones rose 0.20% to 44,459.65, and the S&P 500 added 0.14% to 6,268.56. The small-cap Russell 2000 advanced 0.67%, ending at 2,249.72.

Meta shares edged up 0.48% after CEO Mark Zuckerberg unveiled plans to pour hundreds of billions of dollars into AI computing infrastructure, targeting superintelligence. Other top movers included Roblox (+5.78%), Block (+5.42%), Palantir (+4.96%), and Shopify (+4.13%).

Earnings season officially kicks off tomorrow with J.P. Morgan reporting before the open. Big names like Wells Fargo, Citi, Goldman Sachs, and Netflix are lined up through the week.

Separately, Federal Reserve Chair Jerome Powell requested an internal review of the $2.5 billion renovation project at the Fed, amid growing scrutiny from the Trump administration.

White House economic adviser Kevin Hassett emphasized ongoing trade deal talks, defending tariffs as patriotic and necessary to support domestic production. He criticized the Fed’s view on inflation and insisted that higher U.S. production would tame price pressures.

Canada

Wholesale trade in Canada rose 0.1% in May, defying expectations for a decline. Personal and household goods led gains with a 3.5% jump, supported by strong sales in clothing, footwear, and appliances. Motor vehicle parts added 2.2%, while machinery and equipment sales slipped 3.3%.

Wholesale inventories rose 0.8% to $130.3 billion, pushing the inventory-to-sales ratio up slightly to 1.55, signaling more stock on hand relative to sales.

Commodities

Crude oil futures fell 2.15%, settling at $66.98 after sellers regained control when prices dropped below the 200-day moving average. Earlier in the day, prices had touched $69.61 before reversing sharply.

Gold slipped to around $3,350 as traders shifted focus to Tuesday’s U.S. CPI data and new tariff threats. Despite initial support from geopolitical tensions, gold failed to hold above key resistance levels.

Silver extended its winning streak, reaching a 14-year high of $39.13 before easing slightly to $38.60. Demand surged as investors sought safe havens amid fears of a broadening trade war.

Europe

The UK’s FTSE 100 closed at a record 8,998.07, up 0.64% after touching an intraday high just shy of 9,000. Meanwhile, Germany’s DAX lost 0.36%, and France’s CAC dropped 0.27%.

In bond markets, 10-year yields moved mixed: Germany rose to 2.725%, France to 3.427%, Spain to 3.338%, Italy to 3.617%, while UK yields fell slightly to 4.595%.

Swiss producer and import prices slipped 0.1% in June, mainly due to a 0.2% decline in import prices. On an annual basis, prices are down 0.7%.

Swiss sight deposits climbed to CHF 464.1 billion, marking the highest level of the year as foreign banks shifted funds to avoid negative interest rates following recent rate adjustments.

Italy’s foreign minister confirmed the EU has prepared €21 billion worth of retaliatory tariffs against the U.S. if trade talks fail.

Asia

China’s M2 money supply grew 8.3% in June, surpassing expectations. New yuan loans surged to ¥2.24 trillion, signaling Beijing’s ongoing effort to stimulate the economy amid trade headwinds.

China’s trade data also showed solid performance in June, with exports in dollar terms rising 5.8% year-on-year and imports up 1.1%, lifting the trade surplus to $114.77 billion.

Crypto

Bitcoin maintained its momentum, hovering just below $122,000 after hitting a new all-time high at $119,999. Technical indicators suggest further upside, with a target around $132,372 based on Fibonacci levels.

Ethereum reclaimed levels above $3,000, riding the broader crypto rally.

XRP advanced toward $3.00, with open interest surging to $8.3 billion despite recent outflows from investment products. The derivatives market remains firmly bullish.

Dogecoin rose above $0.20, but analysts warn of potential selling pressure as supply in profit increases, hinting at possible pullbacks.

Sui (SUI) posted double-digit gains, nearing $4 as its DeFi total value locked hit a record $2.20 billion. Open interest also surged, pointing to strong speculative momentum.

Meanwhile, major U.S. crypto firms like Ripple, Circle, and Kraken are pushing deeper into traditional banking, spurred by friendlier regulatory signals under President Trump.