North America News

U.S. Stocks End Lower, Posting Weekly Losses Across Major Indices

U.S. equity markets closed in the red on Friday, pushing all major benchmarks into negative territory for the week.

Daily performance:

- Dow Jones Industrial Average dropped 279.13 points (-0.63%) to 44,371.51.

- S&P 500 lost 20.71 points (-0.33%) to end at 6,259.75.

- Nasdaq Composite fell 45.14 points (-0.22%) to 20,585.53.

- Russell 2000 slid the most, down 28.58 points (-1.26%) at 2,234.82.

Weekly changes:

- Dow Jones: -1.02%

- S&P 500: -0.31%

- Nasdaq: -0.08%

- Russell 2000: -0.63%

Weekly Winners

- Ethereum (ETH/USD): +19.73% — Best performer, surging on renewed crypto optimism.

- SoFi Technologies: +14.22% — Continued investor enthusiasm for fintech growth.

- Nio A ADR: +11.40% — Strong rebound in Chinese electric vehicle stocks.

- Delta Air Lines: +11.38% — Boosted by robust travel demand and earnings momentum.

- Moderna: +10.33% — Biotech sector strength supported gains.

- Bitcoin Futures: +9.57% — Crypto rally pushed futures higher.

- Tapestry: +9.12% — Fashion sector outperformed on solid sales trends.

- Southwest Airlines: +8.95% — Broad airline recovery lifted shares.

- Bitcoin (BTC/USD): +8.92% — Broader risk-on move in crypto.

- Grayscale Bitcoin Trust: +8.09% — Benefited from Bitcoin’s new highs.

- MicroStrategy: +7.57% — Rose in tandem with BTC’s rally.

- Dollar Tree: +7.27% — Strong discount retail performance.

- United Airlines: +6.44% — Weekly gain despite daily weakness.

- AMD: +6.18% — Continued AI chip momentum.

- Palantir: +5.76% — Tech sector strength carried shares higher.

- Occidental Petroleum: +5.73% — Oil prices supported energy stocks.

- Boeing: +5.03% — Strength in aerospace lifted the stock.

Weekly Losers

- Raytheon: -17.17% — Largest drop of the week.

- First Solar: -12.21% — Sharp pullback in solar energy names.

- Chewy: -7.99% — Weakness in online pet retail.

- Palo Alto Networks: -7.14% — Cybersecurity names under pressure.

- CrowdStrike: -6.94% — Tech correction weighed on sentiment.

- PayPal: -6.83% — Fintech weakness dragged shares lower.

- Zoom Video: -6.59% — Further losses amid post-pandemic decline.

- Fortinet: -6.26% — Security sector retreat continued.

- Intuitive Surgical: -6.00% — Pullback from recent health tech highs.

- Block (Square): -5.95% — Crypto-related weakness hurt shares.

- Arm: -5.90% — AI and chip sector cooled after recent runs.

- Salesforce: -5.17% — Enterprise software stocks lagged.

- Nike: -4.92% — Retail pressures weighed on performance.

- Snowflake: -4.86% — High-growth tech sold off broadly.

- Bank of America: -4.54% — Financials slumped as yields fell.

- Adobe: -4.21% — Software stocks underperformed.

- Intuit: -4.20% — Down despite flat Friday.

- Papa John’s: -4.04% — Mild pullback in consumer staples.

- Walmart: -4.03% — Defensive retail sector saw profit-taking.

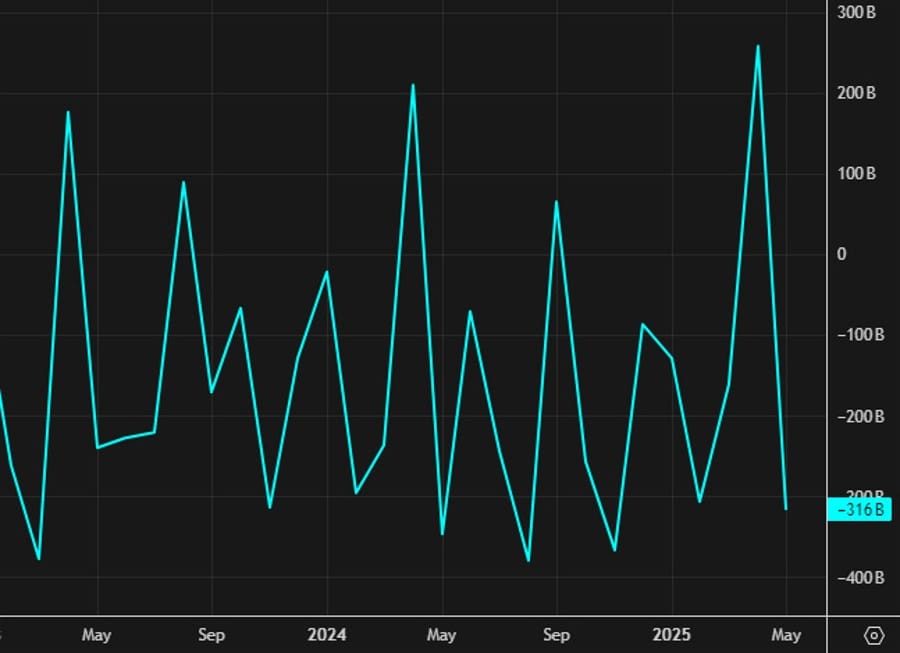

U.S. Federal Budget Posts Surprising $27 Billion Surplus in June

The U.S. federal government recorded a $27 billion budget surplus in June, far surpassing expectations for an $11 billion deficit, according to data released Friday.

This positive surprise followed a massive $316 billion deficit in May and last June’s $69 billion shortfall.

- Outlays totaled $499 billion.

- Receipts came in at $526 billion.

- Customs duties contributed $27 billion to revenue.

Despite this month’s surplus, analysts caution against drawing broader conclusions from single-month figures, as timing quirks—like holidays and shifting payroll schedules—can heavily influence results.

Fed’s Goolsbee: Latest tariff threat could delay rate cuts

- Comments from the Fed’s Goolsbee

- If we get a few more months of excellent inflation reports, that would persuade me we’re still on golden path

- Want to wait until the anxiety dies down before comfortable that US is back on track to a soft landing

- If we’re going to an environment where prices start rising again, I’ll be nervous

- New round of tariffs makes it messy to truly say how the economy is doing

- Latest tariff threat could delay rate cuts

Tesla Applies to Operate Robotaxis in Arizona

Tesla has formally applied to the Arizona Department of Transportation to test and deploy its autonomous vehicles in the state.

The application covers both robotaxis operated without safety drivers and those with human supervisors onboard.

If approved, the program would further Tesla’s push into fully autonomous transport and expand its footprint in Phoenix, already a hub for self-driving trials.

US secretary of state Rubio: The odds are ‘high’ for a Trump-Xi meeting

- Remarks by US secretary of state, Marco Rubio

- Had a very constructive meeting with China foreign minister Wang Yi

- US and China have to have relations, communication

Fed’s Goolsbee says mandate is inflation, jobs. Its not cutting rates to make govt debt cheaper

- Federal Reserve Bank of Chicago President Austan Goolsbee

- Before April 2 Liberation Day tariffs the hard data on the economy was looking solid

- Since then there has been potential disruption, ambiguity, that the Fed needs to resolve

- Says does not understand arguments the Fed should cut rates to make government debt cheaper, mandate is on jobs and prices

- The Fed building is not a luxury building

- The buildings need to be renovated and done so with a high level of security

- Not a lot of indication that tariffs have yet pushed up inflation

- Businesses in the Midwest are still uncertain about what is to come

Trump plans to sell weapons to several NATO allies, to be then passed on to Ukraine

- Putin will not welcoming this news

According to Axios, U.S. President Trump is working on a major plan to sell offensive and defensive weapons to several NATO allies, under the condition that the equipment be passed on to Ukraine.

- The proposal was reportedly discussed with Ukrainian President Zelensky, French President Macron, U.K. Prime Minister Starmer, and other European leaders during the NATO Summit in May.

- The move comes as Trump grows increasingly frustrated and disillusioned with Russian President Vladimir Putin.

Trump Slaps 35% Tariff on Canadian Imports

In a new escalation, Trump has imposed a hefty 35% tariff on goods coming from Canada.

This dramatic move, announced in an official letter, marks one of the most severe trade actions against a key U.S. partner to date.

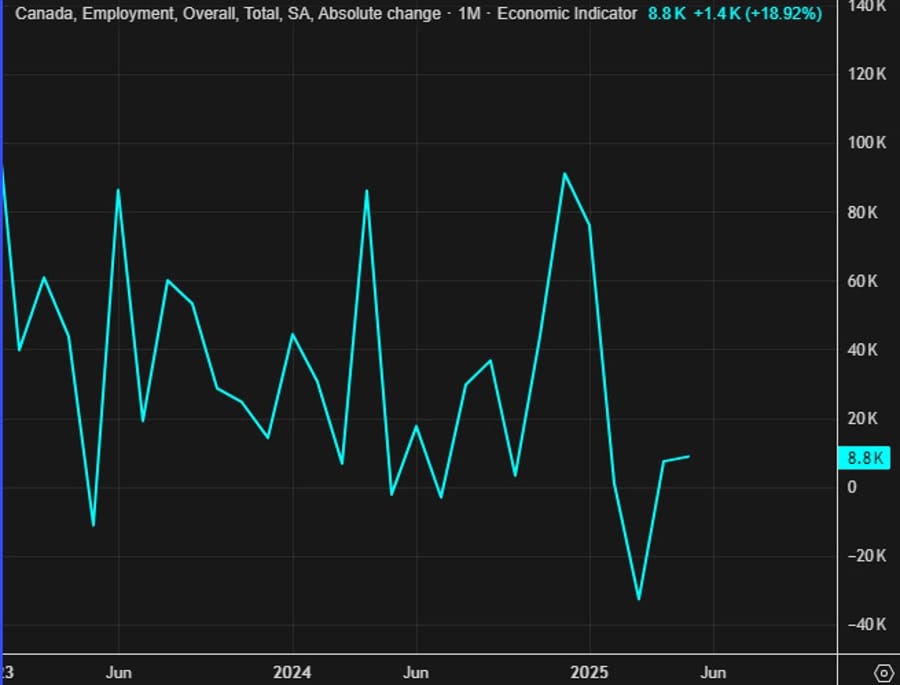

Canada Adds 83,100 Jobs in May, Unemployment Dips

Canada saw employment jump by 83,100 in May, well above expectations for no change, according to the latest figures released for June 2025.

Breakdown:

- Unemployment rate fell to 6.9% (expected: 7.1%), down from 7.0% prior.

- Full-time jobs increased by 13,500, compared to +57,700 in April.

- Part-time positions rose sharply by 69,500, reversing a -48,800 decline previously.

- Participation rate edged up to 65.4% from 65.3%.

- Average hourly wages climbed 3.2% annually, slightly below the prior 3.5%.

Despite higher participation, the lower jobless rate signals renewed strength in the labor market, even as it remains above pre-pandemic levels.

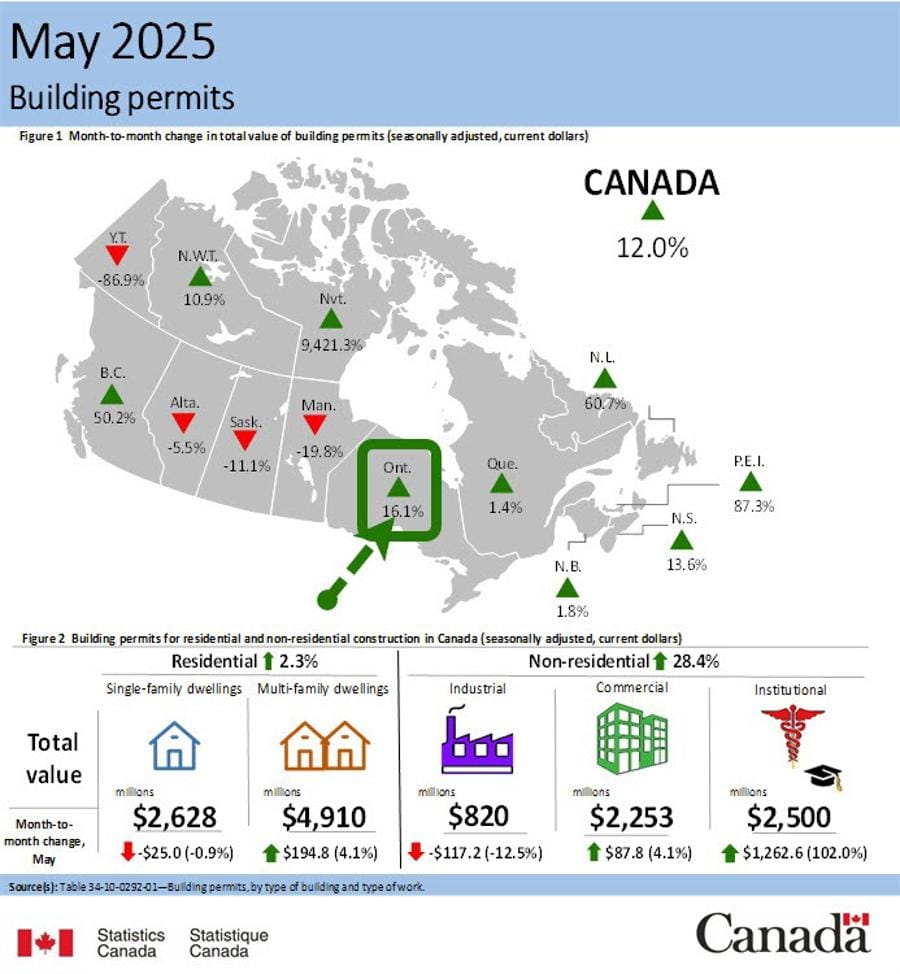

Canada Building Permits Surge 12% in May, Led by Major Hospital Project

Canadian building permits rose 12.0% in May, sharply beating the forecast of a -0.8% decline, per data for May 2025.

Key highlights:

- Non-residential permits surged by $1.2 billion to $5.6 billion, driven mainly by Ontario’s institutional sector.

- A massive new hospital project in Niagara valued at nearly seven times the average major permit propelled institutional permits to a record $2.5 billion.

- In constant dollar terms, this also marked an all-time high.

- Residential permits increased by $169.8 million to $7.5 billion, buoyed by British Columbia’s multi-family segment, which jumped $687.7 million to $1.5 billion.

While the big headline increase was largely driven by the Niagara hospital project, underlying residential activity also showed positive momentum.

Canadian Prime Minister Carney Reaffirms Close Cooperation with U.S.

Prime Minister Carney emphasized Canada’s commitment to working closely with the United States despite recent tariff tensions.

Responding to Trump’s new tariff threats, Carney said Canada will continue defending its workers and businesses as trade negotiations advance toward the August 1 deadline.

At the same time, Carney underlined that Canada remains committed to strengthening bilateral ties on security and community welfare, while also preparing major national initiatives to bolster domestic economic resilience. The statement hints at a strategy that balances cooperation with firm protection of Canada’s economic interests.

Brazil’s Lula: If US tariffs take effect, we will reciprocate

- Comments from the Brazilian President

- We will fight for US tariffs not to take effect

- Trump is misinformed, the US does not run a trade deficit with Brazil

Commodities News

Gold Jumps Above $3,350 on Fresh Trade Tensions

Gold prices surged Friday, breaking above $3,350 as investors sought safety amid new tariff threats from U.S. President Donald Trump.

The metal rebounded sharply from an intraday low of $3,322 to trade at $3,354 late in the session, marking a nearly 1% daily gain.

On Thursday, Trump unveiled a 35% tariff on Canadian goods, though some items remain exempt under the USMCA framework. He also signaled plans to impose 15–20% duties on additional trade partners and announced 50% tariffs on copper imports and Brazilian products.

Market Backdrop and Upcoming Data

The U.S. economic calendar is light heading into next week, but traders are closely watching upcoming data:

- CPI for June: Expected to rise 2.6% YoY (up from 2.4% in May), and 0.3% MoM (up from 0.1%).

- Core CPI: Forecast to hold steady at 2.8% YoY, with a 0.3% MoM increase (previously 0.1%).

- Retail Sales for June: Anticipated flat after May’s -0.9% drop.

- Jobless Claims for July 12: Expected to tick down to 225K from 227K.

Chicago Fed President Austan Goolsbee reiterated on Friday that the Fed’s focus is jobs and price stability, dismissing arguments for rate cuts to reduce government borrowing costs.

Meanwhile, the U.S. dollar remained firm, with the Dollar Index (DXY) on track for a 0.87% weekly gain — its strongest week since February.

Crude Oil Finishes Strong, Closes Above $68

Crude oil futures settled at $68.45 on Friday, gaining $1.88 (2.82%) on the day and $2.13 (3.2%) for the week.

The weekly advance came despite an unexpected 548,000-barrel rise in OPEC+ production heading into the week.

Additional support came midweek as OPEC+ hinted at pausing further output hikes and as former President Trump teased a “major” statement on Russia for next Monday, stirring geopolitical tensions.

U.S. Energy Information Administration data showed a surprise build of 7 million barrels in crude stocks, offset by declines in gasoline and distillates.

From a technical standpoint, Friday’s close above the 200-day moving average at $68.35 is noteworthy. While crude had tested that level intraday over the past three sessions, this marked the first close above it—potentially signaling bullish momentum heading into next week.

U.S. Rig Count Falls by Two, Canada Adds Eleven

The latest Baker Hughes rig count showed a mixed picture for North America.

In the U.S., active rigs fell by two to 537. Oil rigs slipped by one to 424, gas rigs were unchanged at 108, and miscellaneous rigs fell by one to five. Compared to a year ago, the U.S. rig count is down by 47 rigs, with oil rigs down 54, gas rigs up eight, and miscellaneous rigs down one.

The U.S. offshore rig count held steady at 13, down 10 year-over-year.

Meanwhile, Canada saw an increase of 11 rigs, bringing the total to 162. Oil rigs rose by 10 to 112, and gas rigs ticked up by one to 50. Year-over-year, Canada’s rig count is down 27 rigs overall, with oil rigs down 14 and gas rigs down 13.

Silver Smashes Above $37, Reaches New 2025 Peak

Silver continued its strong rally on Friday, surging above $37.60 to hit a fresh year-to-date high as investors flocked to safe-haven assets amid escalating tariff tensions and a weaker U.S. dollar.

Bulls now set their sights on the next major psychological barrier at $38.00.

Silver has already gained over 30% this year, outperforming many commodities. The rise above February 2012’s high at $37.49 turned that level into a new support line.

The combination of a softening dollar, speculation about future Fed rate cuts, and safe-haven demand has reinforced silver’s dual appeal as both an investment asset and an industrial metal.

The latest surge pushed prices as high as $37.73 intraday. A sustained break above $38.00 could open the path toward higher milestones in the coming weeks.

Gold ETFs Record Strongest H1 Inflows Since 2020, Says Commerzbank

Gold-backed ETFs saw their highest first-half inflows since 2020, according to the World Gold Council’s June data, highlighted by Commerzbank commodity analyst Carsten Fritsch.

Investors added 75 tons in June alone, bringing second-quarter net purchases to 170 tons and total H1 inflows to 397 tons.

Back in 2020, COVID-related panic and massive global monetary easing fueled a similar surge. This time, uncertainty over U.S. President Trump’s aggressive tariff moves has driven demand for gold as a safe haven, particularly during February, March, and April.

Over half of these inflows came from U.S.-based ETFs.

While these strong ETF purchases initially helped push gold to a record high in April, the impact has recently faded. Despite a rally in early June, prices failed to reclaim those highs and ended June only slightly higher, signaling that ETF buying power is no longer as decisive as before.

U.S. Natural Gas Prices Spike After Smaller-than-Expected Storage Build

U.S. natural gas futures surged after the EIA reported a smaller storage build than anticipated.

- Storage rose by 53 billion cubic feet (bcf), compared to forecasts of a 62 bcf increase.

- Total U.S. gas inventories now stand just over 3 trillion cubic feet, 6.1% above the five-year average, but still down 5.8% from last year.

Front-month Henry Hub futures rallied 3.8% on the day, as highlighted by ING’s commodity analysts Ewa Manthey and Warren Patterson.

The year-on-year inventory gap continues to lend support to prices despite robust overall stock levels.

Oil Slips While Gas Rallies; Market Eyes Trump Russia Announcement

Oil prices fell sharply on Thursday, with ICE Brent settling over 2.2% lower, dipping below $70 per barrel.

Friday morning saw partial recovery after Trump hinted at a “major” announcement regarding Russia on Monday, raising fears of new sanctions.

Analysts from UOB Group noted that reports of OPEC+ nearing the end of supply increases also added pressure. The group might deliver one more hike in September before pausing.

Meanwhile, the IEA is set to release its latest monthly oil market report. Previous forecasts projected global oil demand to grow by 720,000 b/d in 2025 and by 740,000 b/d in 2026, with supply growth led mainly by non-OPEC+ producers.

However, challenges in U.S. drilling could limit non-OPEC contributions, tightening balances further down the line.

Copper Market Rattled by U.S. Tariff Shock, Prices Diverge Sharply

U.S. President Trump’s announcement of a 50% tariff on copper imports sent shockwaves through the market, pushing COMEX copper to nearly 590 cents per pound (around $13,000 per ton). Meanwhile, London Metal Exchange (LME) prices lagged, resulting in a premium of almost 30% for U.S. copper, noted Commerzbank’s head of FX and commodity research Thu Lan Nguyen.

The price gap stems from fears that U.S. supply will tighten dramatically, as the country imported 45% of its copper needs last year, with Chile accounting for 65% of those imports.

Domestic U.S. production would need to nearly double — an unrealistic short-term goal. Secondary production, which currently covers only 4% of U.S. supply, offers little relief.

These tariffs are expected to weaken U.S. demand and shift surplus copper to the global market, pressuring LME prices.

In the short term, U.S. buyers may accelerate shipments ahead of the August 1 tariff start date, briefly supporting LME prices. However, once tariffs kick in, LME copper could drop further, with Commerzbank forecasting a potential decline to $9,500 per ton.

Saudi Crude Shipments to China Set to Hit Highest Level Since 2023

Saudi Arabia plans to boost its crude oil deliveries to China to roughly 51 million barrels in August, the highest monthly volume since 2023, according to Reuters.

Saudi Aramco will increase shipments to about 1.65 million barrels per day — four million barrels higher than July’s allocations.

This sharp rise underscores strengthening energy ties between Riyadh and Beijing amid global supply shifts.

European Commission preparing floating oil price cap on Russia, starting at $45

- Info comes via Reuters reporting

The European Commission is preparing to propose a floating price cap on Russian oil as part of its 18th sanctions package, aiming to adjust the cap in line with global oil price changes.

- The new mechanism is being drafted after earlier proposals to lower the G7-imposed $60 per barrel cap to $45 met resistance from some member states and failed to gain U.S. support.

- The floating cap would be reviewed more automatically and could start slightly above $45, though details are still under discussion.

- The move comes amid concerns that the fixed cap has become ineffective due to falling oil prices.

- Shipping-dependent countries like Greece, Cyprus, and Malta remain cautious, worried the measure could harm their maritime industries if businesses shift outside the EU.

Europe News

European Stocks End Friday Lower But Post Weekly Gains

Major European equity markets closed in the red on Friday, although most still booked solid gains over the week.

Final daily performances:

- German DAX: -0.82%

- France’s CAC 40: -0.92%

- UK’s FTSE 100: -0.38%

- Spain’s Ibex: -0.94%

- Italy’s FTSE MIB: -1.11%

Weekly changes, however, were positive across the board:

- DAX: +1.97%

- CAC 40: +1.73%

- FTSE 100: +1.34%

- Ibex: +0.26%

- FTSE MIB: +1.15%

The German DAX narrowly missed closing at a record weekly high; it finished at 24,255.32, just shy of its previous record close of 24,304.

Meanwhile, the UK FTSE 100 marked a milestone, ending the week at an all-time high of 8,941.13.

German Wholesale Prices Edge Up After Months of Decline

Germany’s wholesale price index rose 0.2% in June compared to May, ending a three-month streak of declines, according to Destatis data published on July 11.

On a yearly basis, prices were up 0.9%, hovering close to 2023’s average pace.

The uptick suggests a slight recovery in upstream price pressures, though overall wholesale price movements remain subdued relative to previous inflation peaks.

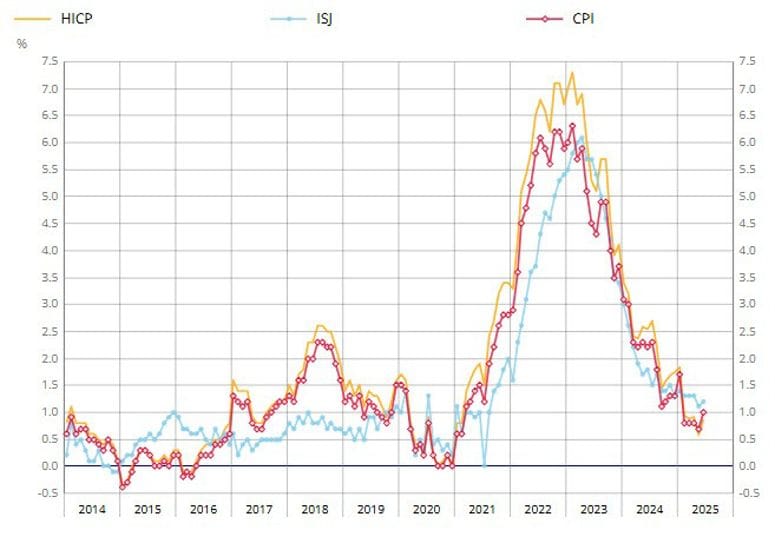

France June Inflation Revised Up Slightly to 1.0% Annually

France’s final consumer price index (CPI) for June showed a 1.0% annual increase, a tick higher than the preliminary estimate of 0.9%, as reported by INSEE on July 11.

The harmonized index (HICP) also came in slightly higher at 0.9% year-over-year, compared to the 0.8% prelim reading.

Core inflation edged up to 1.2% from 1.1% in May.

Despite this upward revision, France’s inflation pressures remain moderate, especially when contrasted with levels seen in Germany and other parts of Europe.

UK GDP Falls 0.1% in May, Industrial Sector Weighs on Growth

The UK economy contracted by 0.1% month-over-month in May, falling short of expectations for a 0.1% expansion, according to the latest figures from the Office for National Statistics released on July 11.

In detail:

- Services sector eked out a 0.1% gain, matching forecasts and recovering slightly from a revised -0.3% in April.

- Industrial production dropped 0.9%, well below the expected flat reading, after a 0.6% decline in April.

- Manufacturing output fell 1.0%, far worse than the anticipated -0.1%, following a revised -0.7% prior.

- Construction output fell 0.6% against an expected 0.2% increase, after being revised slightly higher to 0.8% in April.

The overall monthly downturn was primarily driven by weakness in the industrial sector, while services provided only a modest lift. The latest data could increase the likelihood of the Bank of England moving forward with rate cuts sooner to support the slowing economy.

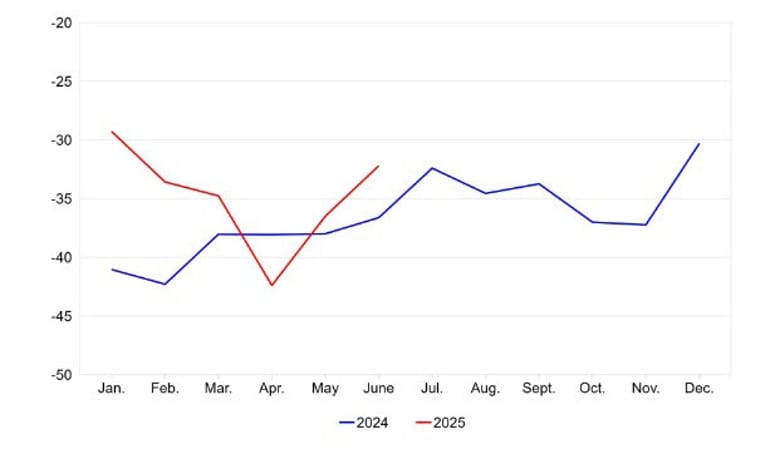

Swiss Consumer Sentiment Beats Forecasts in June

Switzerland’s consumer climate index improved to -32.2 in June, better than the -35.0 forecast, according to data from SECO on July 11.

Compared to last year, the index for overall economic outlook was lower, but other measures showed notable improvements:

- Past financial situation and financial outlook both strengthened.

- Intentions for major purchases rose above 2024 levels.

The data points to cautious optimism among Swiss consumers, suggesting resilience in household sentiment even amid a softer macro backdrop.

HSBC: ECB Likely to Hold Off on Rate Cuts Despite Stronger Euro

HSBC economists believe the European Central Bank is unlikely to rush into further rate cuts even as the euro’s recent strength risks pushing inflation below the 2% target.

They argue that the delayed impact of monetary policy and moderate overall trade-weighted euro appreciation suggest the ECB might overlook short-term currency moves.

June meeting minutes revealed that eurozone firms are facing margin pressures; some may use a stronger euro to rebuild profits rather than lower consumer prices.

Moreover, looser fiscal policies across Europe could offset any deflationary pressures, further discouraging immediate rate reductions.

ECB’s Panetta: Monetary policy approach in coming months must remain flexible, pragmatic

- Remarks from the ECB policymaker

- ECB in a good position to carefully consider upcoming steps.

- If downside growth risks strengthen disinflationary process, ECB should keep easing monetary policy.

- Potential reduction in the global importance of US markets could create chances for others, including Europe.

- Europe can benefit from reallocation of global portfolios but it must act.

EU’s Kallas: No outcome yet in US talks on tariffs, we don’t want to retaliate

- Comments from the EU Foreign Policy Chief

- No outcome yet in US talks on tariffs, we don’t want to retaliate.

- We don’t want trade war.

ECB’s Schnabel: The threshold for another rate cut is very high

- Remarks by ECB executive board member, Isabel Schnabel

- No risk of sustained inflation undershoot

- Concern about impact of euro strength on prices is exaggerated

- Economy is resilient, growth outlook risks are balanced

- Policy is in a good place

- ECB is in a good place.

- Plan is to reduce monetary policy bond portfolios to zero.

- Euro strength concern to impact prices exaggerated.

- The economy is resilient.

- Growth outlook risks are balanced.

- ECB becoming more accommodating.

Asia-Pacific & World News

China Expected to Expand Fiscal Support in H2

China plans to ramp up fiscal support during the second half of 2025, according to a report by Shanghai Securities News citing policy insiders.

Authorities are expected to accelerate current stimulus measures and introduce new tools as needed. Possible steps include issuing more special bonds, providing support for unsold property inventory, and deploying targeted funds for property and trade stabilization.

Experts also see potential for raising the fiscal deficit target and expanding local or ultra-long special government bond programs.

The strategy aims to counter sluggish growth and cushion the economy against persistent external and domestic headwinds.

Chinese Policy Adviser Proposes $209 Billion Stimulus to Offset U.S. Tariffs

A senior adviser to the People’s Bank of China has recommended a sweeping $209 billion stimulus plan to mitigate the impact of escalating U.S. tariffs.

The proposal calls for cutting interest rates, encouraging banks to reduce lending rates, and keeping the yuan flexible to absorb external shocks.

Policymakers are also discussing tax reforms, including broader income tax coverage and simplified sales taxes, to stabilize domestic demand.

Particular concern has focused on small business loans, which now account for over 60% of China’s GDP and pose a larger risk than local government debt.

The stimulus recommendation underscores urgent efforts to combat deflation, a fragile property sector, and weakening exports caused by 20–30% tariffs from the U.S.

Hong Kong Central Bank Steps In Again to Support Currency

The Hong Kong Monetary Authority (HKMA) intervened in the FX market, buying 13.8 billion HKD to support the local currency as it traded near the weaker end of its permitted band against the U.S. dollar.

HKMA continues to act whenever the Hong Kong dollar hits the top end of the USD/HKD trading band, maintaining stability under its decades-old peg system.

PBOC sets USD/ CNY reference rate for today at 7.1475 (vs. estimate at 7.1771)

- PBOC CNY reference rate setting for the trading session ahead.

PBOC injected 84.7bn yuan via 7-day reverse repos at 1.40%

- 34bn yuan mature today

- net 50.7bn injection yuan

New Zealand’s Manufacturing PMI Inches Up but Remains in Contraction

New Zealand’s manufacturing sector stayed in contraction territory in June, with the PMI rising slightly to 48.8 from May’s 47.4, according to BNZ–BusinessNZ.

The survey’s long-term average is 52.5, signaling that activity remains subdued.

BusinessNZ’s Catherine Beard noted that most manufacturers are still reporting declines across major sub-indices, struggling with weak demand, high living costs, and supply chain challenges.

BNZ Senior Economist Doug Steel remarked that while some recovery chatter exists, the underlying conditions remain “very tough,” with indicators still well below historical norms.

Japan’s GPIF Lifts U.S. Treasury Holdings to Decade-High

Japan’s $1.7 trillion Government Pension Investment Fund (GPIF) has increased its holdings of U.S. Treasuries to the highest level in a decade.

As of March, Treasuries made up 51.8% of GPIF’s foreign bond portfolio, the largest share since records began in 2015.

The move was driven by attractive U.S. yields and a weaker yen, which boosted returns on unhedged dollar assets.

Nomura’s Naokazu Koshimizu noted that the wide interest rate gap has made Treasuries especially appealing to Japanese investors.

GPIF’s purchases came ahead of the recent U.S. tariff escalations. While concerns initially surfaced, Treasury returns have since stabilized, and Koshimizu expects more buying as the Fed edges closer to potential rate cuts.

South Korea trade official: US has demanded South Korea to join efforts to curb China

- South Korea trade official:

- U.S. has demanded South Korea to join efforts to curb China

- U.S. is very reserved about including sectoral tariffs in trade deal

Crypto Market Pulse

Crypto Roundup: Bitcoin Blasts Past $118,000, Ethereum and XRP Follow

Bitcoin (BTC) extended its record-setting rally on Friday, hitting a new peak at $118,870 and sparking massive market excitement.

The surge triggered roughly $635 million in short liquidations, further fueling upward momentum.

Ethereum (ETH) reclaimed and pushed beyond $3,000, driven by robust institutional flows into spot ETFs and sustained retail buying. ETH was last seen near $3,024.

XRP also advanced, trading above $2.60 and targeting the next resistance at $2.76.

Bitcoin: Institutional Demand Sets New Records

Data from CryptoQuant revealed record-low exchange inflows—just 18,000 BTC on average—indicating sellers are staying on the sidelines. Meanwhile, large holders (100+ BTC transactions) have sharply reduced exchange transfers, down to 7,000 BTC from 62,000 BTC last November.

Bitcoin spot ETFs in the U.S. saw $1.18 billion in net inflows on Thursday, marking the second-largest daily inflow ever. Total cumulative net inflows across 12 U.S.-approved ETFs now exceed $51.3 billion, with combined net assets around $144 billion.

Ethereum: Eyes on Higher Targets

Ethereum has flipped $3,000 into support, with momentum indicators—like the MACD—showing a sustained bullish signal since early July. Price targets include $3,229 (a November resistance level) and $3,530 (a key support area from December).

XRP: Watching for Potential Pullback

XRP’s Money Flow Index (MFI) is now in overbought territory, while the RSI has climbed to 83, suggesting some risk of a near-term reversal. A dip toward the 50-period EMA around $2.28 is possible before another push higher.

XRP Eyes $3 After 14% Monthly Jump, But On-Chain Metrics Flash Caution

XRP climbed above $2.80 on Friday, continuing its sharp recovery and aiming for the critical $3.00 level. The token has gained nearly 50% since its June low at $1.90.

However, on-chain data points to potential headwinds.

- Futures open interest rebounded strongly, hitting $5.9 billion from $3.5 billion on June 23, indicating strong risk appetite.

- Meanwhile, spot market volume is cooling, suggesting some traders are stepping back.

- Exchange balances climbed 2.9% to 3.5 billion XRP, hinting that investors are preparing to offload holdings.

Glassnode also noted a spike in XRP supply in profit, now close to May’s peak of around 62 billion coins.

If supply starts outpacing demand, XRP could face selling pressure or a consolidation phase before any sustained move beyond $3.00.

Dogecoin Rockets to $0.20 as Meme Coins Outperform

Dogecoin surged to $0.20 on Friday before easing slightly, reflecting a surge in retail investor enthusiasm that lifted meme coins across the board.

Meme coins as a group soared over 12% in the last 24 hours, outperforming smart contract platforms (+6.2%) and Layer-1 protocols (+6.1%).

DOGE’s futures open interest ballooned to $2.65 billion, with derivatives volume spiking to $7.20 billion. Since dropping to $1.7 billion on July 2, open interest has rebounded sharply.

CoinGlass data shows $13 million in liquidations over the past day, mostly from shorts ($10 million).

Dogecoin’s strong rally, supported by a long-to-short ratio above 1.0, suggests traders remain optimistic and could drive further gains, especially as capital rotates out of Bitcoin following its recent record high.

Ethena (ENA) Soars on Upbit Listing and Coinbase Partnership

Ethena (ENA) rose 20% on Friday, marking its fourth straight day of gains and reflecting renewed bullish momentum.

The rally was driven by Upbit’s announcement that it would list ENA against KRW, BTC, and USDT, opening the door to the Korean trading community. Trading began at 5 p.m. KST on Friday.

Trading volume jumped 300% in the last 24 hours to reach $1 billion, according to CoinMarketCap.

Additionally, Ethena Labs revealed that Coinbase International Exchange, via Copper Clearloop, will serve as a new hedging venue for assets backing its USDe stablecoin.

The dual boost from Korean market exposure and expanded hedging support has fueled speculation that ENA could maintain its upward trajectory.

Sei (SEI) Climbs Higher on USDC and CCTP Integration News

Sei (SEI) added nearly 8% on Friday, trading around $0.326, extending a nearly 25% weekly surge.

Circle announced Thursday that its native USDC stablecoin and the Cross-Chain Transfer Protocol (CCTP) V2 would soon integrate with Sei, sparking investor excitement.

On-chain data shows Sei’s total value locked (TVL) and open interest both reaching record highs, signaling deeper ecosystem engagement.

The anticipated arrival of USDC and cross-chain capabilities is expected to drive higher adoption and user activity across Sei’s network, supporting its rapid price appreciation.

Bitcoin Extends Record Run Amid Short Squeeze

Bitcoin surged over 9% in the past two days, breaking past its previous all-time high and accelerating into new territory.

The rapid move upward is widely seen as a short squeeze, triggered after the breakout above key resistance.

Technical analysis shows Bitcoin has emerged from a bullish flag pattern, with projections suggesting potential targets up to $135,000, though a more conservative $125,000 is considered more realistic.

On the four-hour chart, a fresh uptrend line supports the current rally. Short-term pullbacks might find support around $114,000, with further downside targets near $110,000 if sellers gain momentum.

Despite the parabolic price action, many see room for continued upside as expansionary monetary and fiscal policies remain supportive.

However, a hawkish turn in rate expectations or a hot CPI reading could temporarily stall the rally. For now, dip buyers are likely to remain active, leaning on technical levels to fuel further highs.

The Day’s Takeaway

United States

U.S. stocks closed lower on Friday, sealing weekly losses across all major indices.

- Dow Jones: fell 279 points (-0.63%) to 44,371.51; down -1.02% for the week.

- S&P 500: lost 20.71 points (-0.33%) at 6,259.75; down -0.31% weekly.

- Nasdaq: dropped 45.14 points (-0.22%) to 20,585.53; off -0.08% this week.

- Russell 2000: fell hardest, down 1.26% on the day and -0.63% for the week.

Weekly winners included Ethereum (+19.73%), SoFi Technologies (+14.22%), and Delta Air Lines (+11.38%). Meanwhile, big losers featured Raytheon (-17.17%), First Solar (-12.21%), and Chewy (-7.99%).

On the fiscal side, the U.S. federal government posted a $27 billion budget surplus for June, far surpassing expectations for an $11 billion deficit. Receipts totaled $526 billion, with outlays at $499 billion, and customs duties contributing $27 billion.

Markets are watching next week’s U.S. data releases closely, including June CPI (expected 2.6% YoY), retail sales, and jobless claims. Chicago Fed President Goolsbee reiterated the Fed’s focus on inflation and employment, dismissing political arguments for rate cuts.

Canada

Canada’s employment data surprised with an 83,100 job gain in May, sharply beating expectations. The unemployment rate fell to 6.9% versus 7.1% expected. Full-time jobs increased by 13,500 while part-time roles surged by 69,500.

Building permits for May rose 12.0%, driven by a record-breaking $1.3 billion hospital project in Ontario and strong multi-family residential permits in British Columbia.

Prime Minister Carney emphasized Canada’s commitment to cooperation with the U.S., despite Trump’s new 35% tariffs on Canadian goods. Carney noted Canada remains focused on protecting domestic businesses and preparing major national projects.

Commodities

Gold rallied to $3,354 on Friday, up nearly 1% on the day. The rebound was driven by escalating U.S. tariff threats, including new 35% duties on Canadian imports and possible 15–20% tariffs on other partners.

Silver climbed above $37.60, hitting a fresh 2025 high, with bulls eyeing the $38.00 mark as risk aversion and a weaker dollar spurred demand.

Crude oil closed at $68.45, gaining $1.88 (2.82%) on the day and up 3.2% for the week. The advance came despite an unexpected 7 million barrel build in U.S. inventories and higher OPEC+ output. Technical momentum strengthened after finally closing above its 200-day moving average.

Copper saw turmoil after Trump announced 50% tariffs on imports. COMEX copper soared near $13,000 per ton, while LME prices lagged under pressure, with analysts expecting further divergence and potential declines to $9,500 per ton once tariffs take effect in August.

Natural gas jumped after a smaller-than-expected storage build of 53 bcf. U.S. inventories remain 6.1% above the five-year average but 5.8% below last year, providing price support.

Gold ETFs saw their strongest first-half inflows since 2020, totaling 397 tons as investors fled to safety during tariff volatility.

The latest Baker Hughes rig count showed U.S. rigs fell by 2 to 537, while Canada’s rig count rose by 11 to 162.

Europe

European stocks ended Friday lower but closed the week higher overall.

- German DAX: -0.82% Friday, +1.97% weekly.

- France’s CAC 40: -0.92% Friday, +1.73% weekly.

- UK’s FTSE 100: -0.38% Friday, +1.34% weekly (new record close at 8,941.13).

- Spain’s Ibex: -0.94% Friday, +0.26% weekly.

- Italy’s FTSE MIB: -1.11% Friday, +1.15% weekly.

Germany’s wholesale price index rose 0.2% in June after three months of declines, up 0.9% YoY.

France’s final June CPI was revised higher to 1.0% YoY, with core inflation ticking up to 1.2%.

UK GDP fell 0.1% in May, dragged down by industrial weakness, while services grew modestly at 0.1%.

Switzerland’s June consumer climate index improved to -32.2, above expectations and showing stronger sentiment across financial outlook and big-ticket purchases.

Asia

Japan’s GPIF raised its U.S. Treasury holdings to 51.8% of its foreign bond portfolio, the highest since records began in 2015, driven by strong yields and a weaker yen.

Japan’s June PPI came in at +2.9% YoY as expected, with monthly prices down 0.2%.

Daiwa Securities warned that Trump’s proposed 25% tariffs could cut Japan’s real GDP by 1.1%, but the Bank of Japan is expected to continue gradual rate hikes.

In China, policymakers recommended a $209 billion stimulus package to counter tariffs, focusing on rate cuts and tax reform. Separately, Beijing announced plans to expand fiscal support and accelerate special bond issuance in the second half of the year.

The Hong Kong Monetary Authority intervened, buying HKD 13.8 billion to stabilize the currency near the weak end of its trading band.

Rest of the World

Saudi Arabia plans to ramp up crude shipments to China in August to 51 million barrels, the highest since 2023.

Malaysia invited Trump to attend ASEAN and East Asia summits, while balancing relations with China.

OPEC cut its oil demand forecasts for 2026–2029 but maintained a bullish long-term view, seeing demand at 122.9 million b/d by 2050.

Brazil continues strengthening ties with China despite U.S. tensions, focusing on trade cooperation rather than retaliation.

Crypto

Bitcoin surged to a new record high at $118,870, triggering $635 million in short liquidations. Spot ETF inflows hit $1.18 billion Thursday — the second-highest daily inflow ever.

Ethereum reclaimed $3,000, with spot ETF inflows totaling $383 million. Technical targets include $3,229 and $3,530.

XRP traded above $2.60, aiming for $2.76 and possibly $3.00. On-chain data shows growing exchange balances, hinting at potential profit-taking.

Dogecoin rallied to $0.20 before slight cooling, as meme coins collectively gained 12% in 24 hours. Futures open interest rose to $2.65 billion, with $13 million in liquidations mostly hitting shorts.

Ethena (ENA) soared 20% after Upbit listing and Coinbase hedging partnership, with trading volume up 300% to $1 billion.

Sei (SEI) gained 8%, driven by Circle’s announcement to bring USDC and CCTP to its network, lifting TVL and open interest to record highs.