North America News

U.S. Stock Indices Finish Higher; S&P and Nasdaq Set New Records

Major U.S. stock benchmarks ended Thursday on a positive note, with both the S&P 500 and Nasdaq Composite closing at all-time highs.

The Dow Jones Industrial Average and small-cap Russell 2000 led gains throughout the session.

Final closing numbers:

- Dow Jones Industrial Average rose 192.40 points (0.43%) to 44,650.70.

- S&P 500 gained 17.14 points (0.27%) to end at 6,280.40, surpassing its previous record close from July 3.

- Nasdaq Composite climbed 19.33 points (0.09%) to 20,630.66, marking another record finish after also setting a new high on Wednesday.

- Russell 2000 advanced 10.92 points (0.48%) to 2,263.41.

Among standout movers, Nvidia’s shares closed at $164.10, pushing its market cap beyond $4 trillion.

The rally came despite new 50% tariffs announced on imports from Brazil, copper, and other goods starting August 1.

Airline stocks soared, led by United Airlines (+14.37%), American Airlines (+12.80%), and Delta (+12.01%).

Other notable gainers included Tesla (+4.73%) following new robotaxi approvals in Phoenix, Moderna (+4.57%), Robinhood (+4.43%), AMD (+4.16%), SoFi Technologies (+3.76%), Dollar Tree (+3.46%), Synopsys (+2.77%), Alibaba ADR (+2.67%), and American Express (+2.53%).

U.S. Treasury Sells $22 Billion in 30-Year Bonds at 4.889% Yield

The U.S. Treasury auctioned $22 billion of 30-year bonds on Thursday at a high yield of 4.889%, virtually matching the when-issued level of 4.890%.

Demand was robust: direct bidders took 27.4% (above the six-month average of 23.1%), while indirect bidders grabbed 59.78% (below the average 63%). Dealers were left with 12.82%, slightly less than their typical share.

The auction’s strong participation suggests ongoing appetite for long-dated U.S. debt even as yields remain elevated.

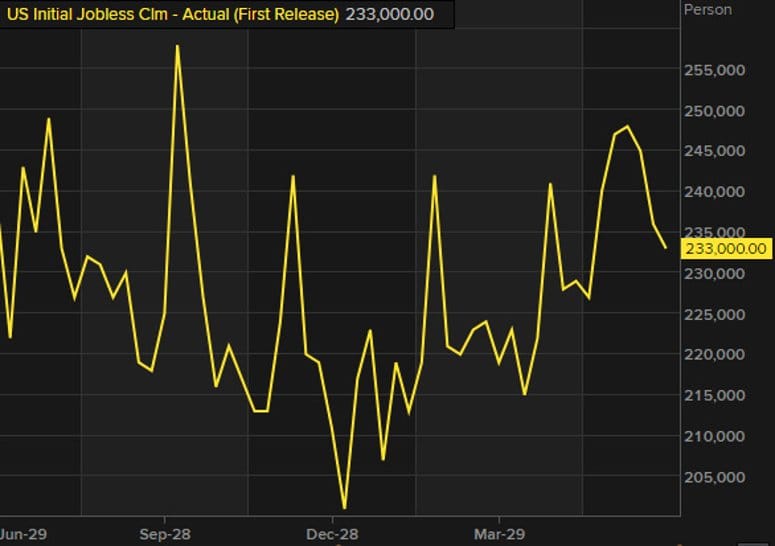

U.S. Weekly Jobless Claims Edge Lower to 227,000

New U.S. jobless claims fell to 227,000 for the week ending July 5, slightly better than the expected 235,000.

The previous week’s figure was revised down to 232,000.

The four-week moving average decreased to 235,500 from 241,500.

Continuing claims totaled 1.965 million, slightly below the expected 1.974 million, signaling resilience in the labor market despite broader economic headwinds.

Fed’s Daly: It’s time to think about adjusting the interest rate

- Comments from the SF Fed President

- The economy is in a good place

- Jobs and growth solid

- Inflation is easing

- Mon pol is still restrictive

- It’s time to think about adjusting the interest rate

- I see two cuts as likely outcome for the Fed this year

- There is a large amount of uncertainty around the outlook

- The economy is in a good place, monetary policy is still restrictive

- Waiting for inflation to rise could leave Fed behind on cutting rates

- Thinking about rate cuts during the fall

- She added the part about hiking in autumn, which stretches the timeline beyond September

Jamie Dimon Warns of Higher Rates, Flags Inflationary Pressures

JPMorgan CEO Jamie Dimon said he sees a 40–50% chance that U.S. interest rates will move higher in coming months.

Dimon pointed to several inflationary forces, including new tariffs, restrictive immigration policies, and a growing budget deficit.

“These drivers won’t create immediate price spikes, but they do set the stage for structurally higher inflation over time,” Dimon said, adding that these risks should be closely monitored by markets.

Fed’s Waller: Fed has long way to go to shrinking size of Balance Sheet

Fed’s Waller is speaking on the Fed Balance sheet and the plans for that:

- U.S. central bank likely has some ways to go in shrinking the size of its holdings

- A hypothetical $5.8 trillion balance sheet might be right level to aim for vs current $6.7 trillion

- $2.7 trillion in reserves might be right level to aim for vs current $3.3 trillion

- Fed’s balance sheet may not need to shrink as much as some expect

- Should consider shifting holdings more toward Treasury bills over time

- Any shift to Treasury bills should be gradual and predictable

- A shift toward greater bill holdings likely lies down the road

- Fed losses are function of asset-buying actions, not policy regime

- Fed holds too many long-maturity assets right now

- Tariffs increase prices one time, central banks can look through that.

- Tariff effects not zero, but are not large either.

- Has been arguing a pretty restrictive policy rate can come down.

- Unemployment is around long run level.

- Reiterate case for why July rate cut could happen, says an easing would not be political.

- Thinks that rates are 150 basis points above the long run steady state neutral

- Says the Fed is “just too tight”

- Admits that he is in the minority on this

- Stablecoins are just a new method for making a payment

- Will introduce more competition in payment systems

Fed’s Musalem: The outlook is for inflation to increase going forward due to tariffs

- Comments from Musalem

- There have been some positive trends on inflation in recent months but outlook is for a tariff-driven increase

- There is some upside risk to inflation

- The economy is in a good place, with labor market at or near full employment

- It’s critical for the Fed to keep long-term inflation expectations anchored

- Could be late this year or early next year for impact of tariffs to be fully felt

- Hiring trends have been softer than usual

- Labor supply seems ot be declining, which may be due to slowed immigration or other factors

Tesla’s Robotaxi Trial Grows, Adds Coverage in Austin

Tesla CEO Elon Musk confirmed that the company’s robotaxi test program will expand to more areas of Austin this weekend.

Each driverless vehicle still has a Tesla employee in the front passenger seat for safety. Musk added that Tesla is awaiting regulatory clearance to launch a similar pilot in the Bay Area, which could come within one or two months.

Trump’s Tariff Moves Stir Fed Debate Over When to Cut Rates

Trump’s tariff hikes are triggering internal disputes at the Federal Reserve about how soon to lower interest rates.

Nick Timiraos of the Wall Street Journal reports that the central bank is weighing the inflationary risks of new tariffs against signs of slowing economic growth.

Fed Chair Jerome Powell has adopted a more flexible stance lately, saying rate cuts could happen sooner if inflation drops or the job market weakens.

April’s unexpected tariff announcements disrupted earlier plans to resume rate cuts, raising fears of stagflation. For the Fed to move ahead with cuts, officials say they need clearer signals that inflation will ease without a deep downturn.

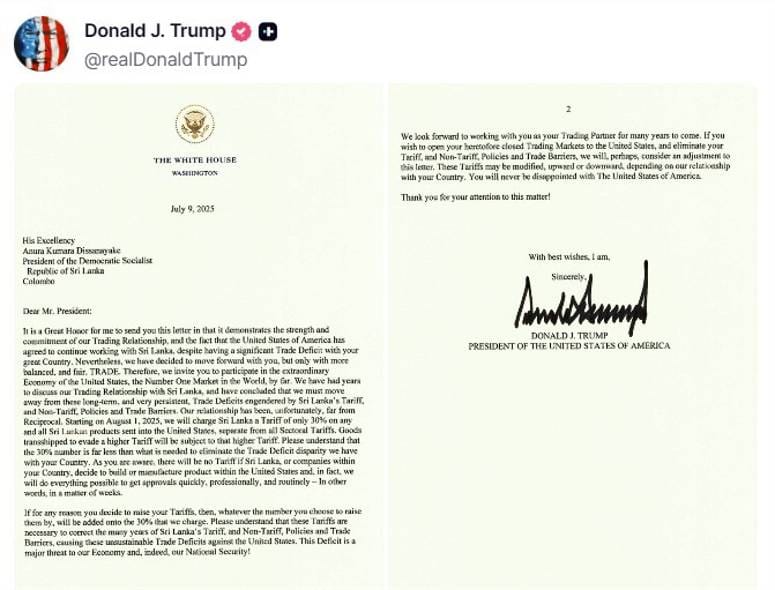

Its Trump vs. Sri Lanka now. Trump hits Sri Lanka with a 30% tariff.

- Trump still sending letters

Trump hits Sri Lanka with a 30% tariff.

The United States and Sri Lanka maintain a significant trade relationship, with total bilateral trade reaching approximately $3.4 billion in 2024. The U.S. imported about $3.0 billion worth of goods from Sri Lanka, while exporting $368.2 million to the island nation, resulting in a trade deficit of $2.6 billion in favor of Sri Lanka .

Brazil Leans Toward China as Trade Tensions With U.S. Mount

Brazil is deepening its ties with China while keeping a cool-headed stance in response to global trade friction.

In late 2024, President Lula da Silva signed 37 new agreements with Chinese President Xi Jinping across energy, agriculture, and tech sectors. Bilateral trade between the two countries hit $160 billion last year.

While Brazil favors diplomacy over retaliation, it’s clearly moving toward a diversified global strategy, distancing itself from U.S. volatility and aligning more with China’s trade model.

Commodities News

Gold Holds Steady Above $3,300 Despite Strong U.S. Jobs Data

Gold prices remained stable on Thursday, hovering above $3,300, as stronger-than-expected U.S. jobless claims data tempered expectations of a near-term rate cut.

Robust labor market figures, along with a firm U.S. dollar and elevated Treasury yields, kept gold trading in a narrow range.

Initial jobless claims for the week ending July 5 came in at 227,000, below forecasts of 235,000 and down from the prior week’s revised 232,000, signaling underlying economic strength.

Despite some Fed officials supporting a potential July rate cut, the majority remain cautious amid inflation concerns, particularly as new tariffs could stoke price pressures.

President Trump’s decision to slap Brazil with 50% tariffs further fueled trade tensions. He said, “Brazil has not been good to us, not good at all,” echoing his protectionist stance.

Meanwhile, gold ETFs saw their biggest inflows since August 2022, adding $38 billion in the first half of 2025, which helped steady bullion prices.

Daniel Pavilonis of RJO Futures noted that he doesn’t expect gold to break above $3,400 unless there’s a major geopolitical shock.

Chicago Board of Trade data shows traders are pricing in 50 basis points of easing in 2025, though the Fed remains divided on the timeline for cuts.

On balance, gold stayed firm as traders weighed solid economic data against ongoing tariff uncertainty and mixed Fed signals.

Silver Stabilizes Above $36.50 After Sharp Sell-Off

Silver prices bounced back on Thursday, holding firm above $36.50 after a three-day losing streak.

The rebound was supported by renewed safe-haven demand amid escalating trade tensions and a slight drop in U.S. Treasury yields.

At last check, silver was trading around $36.63, slightly below its session high of $36.85.

Prices found support earlier in Asia near $36.30 as President Trump announced fresh tariffs on eight additional countries — including Algeria, Moldova, and the Philippines — with rates ranging from 20% to 50%, effective August 1.

From a technical standpoint, silver remains inside an ascending channel in place since early April, though recent price action has been confined between $35.50 and $37.00 for about a month.

Bulls have struggled to break through the $37.00 psychological barrier, while $37.30 remains a critical resistance level that hasn’t been tested since 2011.

Silver holds above its 21-day exponential moving average (EMA) at $36.22, keeping the short-term trend tilted bullish.

Momentum indicators show the Relative Strength Index (RSI) around 58, suggesting steady strength without an overbought signal. The Rate of Change (ROC) sits at about 1.76, indicating mild upside pressure.

A decisive move above $37.00 could pave the way toward the $38.00–$38.50 region. On the downside, a close below $35.50 would challenge the channel support and shift bias toward a deeper pullback, with next support near $34.50.

Tight Inventories Poised to Trigger More Metal Squeezes, Says TDS

Tightening global inventories are setting the stage for further price squeezes across critical metals, according to Daniel Ghali, Senior Commodity Strategist at TD Securities.

Ghali noted that Section 232 tariffs are intensifying distortions in copper markets, with the CME-LME arbitrage ratio dropping below 30%. Only about 3% of LME copper stocks are eligible for delivery to CME warehouses, highlighting limited mobility of physical supply.

He argued that rising geopolitical tensions and national security strategies are pushing countries to hoard strategic materials, creating what he described as a “silent bull market” in critical minerals.

Metals like platinum, palladium, nickel, and cobalt face heightened vulnerability as global inventories dwindle, forcing prices higher and complicating industrial supply chains.

EU Plans Floating Price Cap on Russian Oil

The European Commission is preparing a proposal to introduce a floating price ceiling on Russian oil exports, according to Reuters sources.

Previous price cap attempts have largely fallen short of expectations. The floating approach would aim to adjust in line with market dynamics rather than remain fixed.

Despite this potentially bullish shift for oil, markets remained calm. WTI crude slipped $1.54 to settle at $66.85, suggesting traders had largely priced in this possibility already.

OPEC+ Considers Pausing Production Increases Starting October

OPEC+ is reportedly debating whether to halt planned production increases starting in October, according to Bloomberg sources.

The possibility of a pause was generally anticipated, so while prices initially swung on the headline, they quickly returned to prior levels.

A potential pause could tighten supply and support prices, but markets appear to have already priced in the scenario.

WTI Drops Below $67 Despite Talk of OPEC+ Production Pause

WTI crude fell below $67 on Thursday, shrugging off news that OPEC+ may halt further supply increases after September’s final rollback of voluntary cuts.

Bloomberg reported that while OPEC+ is considering pausing additions to production, many traders believe the group lacks meaningful spare capacity.

Markets interpreted the news as mostly in line with expectations, resulting in a muted price reaction.

OPEC Cuts Oil Demand Forecasts Despite Denying Peak Demand

OPEC has sharply reduced its global oil demand projections for the next several years in its latest outlook, though the group insists demand hasn’t peaked.

The organization now sees global oil demand averaging 106.3 million barrels per day (bpd) in 2026, down from last year’s estimate of 108 million bpd. By 2029, demand is expected to reach 111.6 million bpd—700,000 bpd lower than last year’s forecast.

Interestingly, OPEC left its 2030 forecast unchanged at 113.3 million bpd.

For context, the International Energy Agency (IEA) forecasts global oil demand peaking at 105.6 million bpd by 2029 before starting to decline.

Despite trimming forecasts, OPEC maintains a bullish long-term outlook, predicting demand to keep growing and eventually reach 122.9 million bpd by 2050—far above most industry estimates. The group attributes the near-term cuts largely to a slowdown in Chinese consumption.

OPEC Bars Top Media From Oil Summit, Raising Transparency Concerns

OPEC has blocked major global news outlets—The Wall Street Journal, Bloomberg, Reuters, Financial Times, and The New York Times—from attending its oil summit in Vienna.

The organization hasn’t offered a public explanation. Secretary General Haitham Al-Ghais defended the decision by stating, “This is our house,” emphasizing the group’s discretion over media access.

This latest move adds to ongoing concerns about OPEC’s openness as it tries to navigate oil production decisions in a shaky global economy.

Trump Sets 50% Tariff on Copper, Starting August 1

Donald Trump has announced a steep 50% tariff on imported copper, effective August 1, 2025.

The measure follows a national security review and aims to spur domestic copper production in the U.S., which the former president sees as strategically vital.

Europe News

European Markets Mixed; DAX Retreats After Hitting New High

European stock indices ended the day with mixed performances on Thursday.

Germany’s DAX climbed to a fresh record intraday high at 24,639.10 before pulling back and closing near session lows at 24,456.82, down 0.3% on the day.

In contrast, the U.K.’s FTSE 100 set a new record, finishing at 8,975.65 after peaking at 8,979.41 intraday — a gain of 1.23% or 108.64 points.

France’s CAC 40 added 0.30% to close at 7,902.26. Meanwhile, Spain’s Ibex slipped 0.79% to 14,141.60, and Italy’s FTSE MIB lost 0.72%, settling at 40,528.18.

Germany’s June Inflation Matches Preliminary Data at 2.0% Year-on-Year

Germany’s final consumer price index (CPI) for June confirmed a 2.0% annual rise, exactly in line with earlier estimates, according to Destatis on 10 July 2025.

This marks a slight drop from May’s 2.1% figure. The harmonized index of consumer prices (HICP) also stayed at 2.0% year-on-year, mirroring the preliminary read. Meanwhile, core inflation stood at 2.7% year-on-year.

Destatis noted that inflation eased to its lowest level in the first half of 2025, driven by falling energy costs and slower food price increases. However, service prices continued to climb faster than average, putting upward pressure on overall inflation.

The data doesn’t alter expectations for the European Central Bank, which is likely to keep watching summer data before making any policy moves.

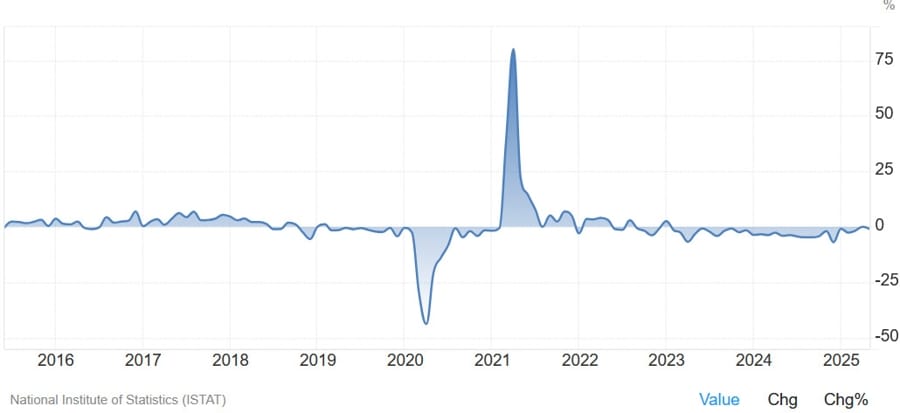

Italy’s Industrial Output Unexpectedly Contracts in June

Italy’s industrial production unexpectedly dropped in June, with the latest data from ISTAT showing a 0.9% fall versus expectations for a 0.2% increase.

On a monthly basis, output fell by 0.7%, missing forecasts of flat growth. This followed a 0.9% rise in May.

The disappointing numbers highlight continued weakness in Italy’s manufacturing sector, complicating the economic recovery efforts amid broader eurozone challenges.

U.K. Home Market Steadies as Buyer Interest Picks Up

The latest RICS survey shows that U.K. house prices in June posted a -7% reading, slightly better than the -9% forecast.

RICS also reported that buyer inquiries turned positive for the first time since December, and agreed sales rose as well.

Analysts attribute earlier disruptions to the April property tax hike, but note that the distortions are fading. Demand appears to be normalizing, pointing to a more stable housing market ahead.

EU is “working non-stop” to strike an agreement with the US – von der Leyen

- Remarks by European Commission president, Ursula von der Leyen

“We are working non-stop to find an initial agreement with the US to keep tariffs as low as possible and to provide the stability that businesses need.”

ECB’s Villeroy: Growth is slow, but positive in France

- Comments from the ECB policymaker

- Growth is slow, but positive in France.

- I still expect French GDP to grow 0.6% this year.

U.K. and France to Align Nuclear Responses for Europe’s Defense

In a strategic shift, the U.K. and France have agreed to jointly coordinate the use of their nuclear arsenals in response to serious threats to Europe.

The announcement came during French President Emmanuel Macron’s state visit to Britain and is expected to be formalized shortly.

Both nations are NATO members, but until now their nuclear forces operated independently of NATO’s defense framework. Together, they possess around 515 nuclear warheads—enough to serve as a strong regional deterrent, even if far fewer than those held by the U.S. or Russia.

Asia-Pacific & World News

China Criticizes Tariff Moves, Opposes Mixing Politics With Trade

China reiterated its opposition to using trade policy as a political weapon, responding to Trump’s newly announced 50% tariff on copper imports.

Although this specific tariff doesn’t directly target China, Beijing voiced concern that Trump’s ongoing push for sector-specific tariffs signals future restrictions aimed at China.

Chinese officials warned that such moves risk reigniting trade tensions and undermining global economic stability. They stressed the importance of handling economic issues separately from geopolitical disputes to avoid further conflict.

China Ramps Up Job Support With New Business Incentives

China has rolled out a new package of job-support policies aimed at stabilizing employment amid sluggish growth.

The State Council announced expanded access to targeted business loans and enhanced subsidies for social insurance payments to encourage hiring.

These efforts come as China battles weak consumer spending and a struggling property sector. Authorities say they’ll keep adjusting the policy mix as labor market conditions evolve, with a strong focus on helping key industries and vulnerable populations.

China Daily has much more here:

Chinese Companies Set to Roll Out 15,000 Nvidia Chips Across AI Facilities

Several Chinese firms plan to install around 15,000 high-end Nvidia chips in a network of new AI-focused data centers, according to a Bloomberg report.

Construction is already underway, and DeepSeek is actively pursuing partnerships to support the effort. However, how these companies plan to legally acquire U.S.-restricted hardware remains uncertain.

PBOC sets USD/ CNY mid-point today at 7.1510 (vs. estimate at 7.1757)

- PBOC CNY reference rate setting for the trading session ahead.

PBOC injected 90bn yuan via 7-day reverse repos at 1.40%

- 57.1bn yuan mature today

- net injects 32.9n yuan

Malaysia Extends Summit Invitation to Trump Amid Tariff Tensions

Malaysia has formally invited Donald Trump to attend the ASEAN and East Asia summits scheduled for October.

U.S. Secretary of State Marco Rubio, visiting Malaysia for meetings, discussed regional tensions and tariffs with Prime Minister Anwar Ibrahim.

Trump recently threatened additional 10% tariffs on nations cooperating with BRICS, though it’s unclear which countries would be affected. Malaysia was recently hit with a 25% tariff, up from 24% in April, surprising local officials who say they don’t know what led to the new rate.

In 2024, Malaysia exported about $43.7 billion worth of goods to the U.S., making the U.S. a significant, though not dominant, trading partner.

While the invitation aims to improve ties, analysts doubt Trump will prioritize attending, leaving China space to deepen its influence in Southeast Asia. China’s Foreign Minister Wang Yi is also in Malaysia this week for ASEAN-related talks.

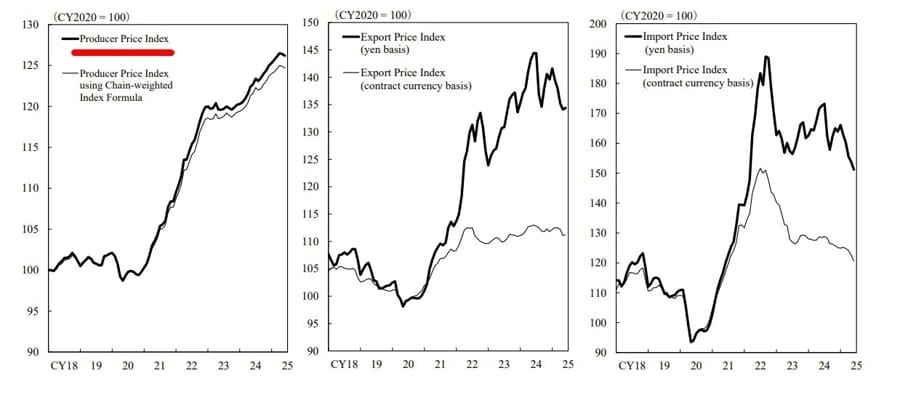

Japan’s Wholesale Prices in June Align With Forecasts

Japan’s Producer Price Index (PPI), also known as the Corporate Goods Price Index, rose 2.9% year-over-year in June—right on target with expectations.

On a monthly basis, prices declined 0.2%, matching projections and continuing a softening trend after May’s reading.

Japan eyes tariff talks with U.S. during Bessent’s World Expo visit next week

- And a call prior

Japan is seeking ministerial-level tariff talks with the U.S. ahead of the August 1 deadline for new 25% U.S. tariffs on Japanese imports.

- Tokyo hopes to arrange meetings between its chief negotiator Ryosei Akazawa and U.S. Treasury Secretary Scott Bessent during Bessent’s visit to Japan for the World Expo on July 19.

- Japan also aims to secure a call prior to the meeting, and possibly a meeting between Prime Minister Ishiba and Bessent.

The reports come from Japanese media, Yomiuri.

Trump’s 25% Tariff Plan Could Cut Japan’s GDP by Over 1%, Says Daiwa

Daiwa Securities warns that if former President Trump imposes a 25% reciprocal tariff on Japanese imports, Japan’s economy could take a notable hit—shrinking its real GDP by 1.1% over time.

The firm sees GDP growth slowing to just 0.1–0.2% in fiscal 2025, a major decline from the 0.8% expansion projected for FY2024.

Despite the potential drag from tariffs, persistent labor shortages in Japan may continue to push inflation higher. Daiwa expects the Bank of Japan to stay the course with gradual rate hikes, rather than reversing direction due to slower growth.

South Korea Keeps Rates at 2.5% Amid Debt and Trade Pressures

The Bank of Korea left its key interest rate unchanged at 2.5% in its latest policy decision, as widely expected.

Officials are keeping a close eye on rising household debt and the potential economic fallout from newly proposed U.S. tariffs.

The central bank’s seven-member policy board continues to prioritize financial stability.

Crypto Market Pulse

Bitcoin Eyes Higher After Breaking Record Highs

Bitcoin (BTC) powered past $113,000 on Thursday, hitting fresh all-time highs amid market volatility tied to U.S. trade policy and broader macro concerns.

Investors are turning to Bitcoin as a hedge, with the U.S. dollar struggling below 100 on the DXY index and uncertainty surrounding the Federal Reserve’s independence under President Trump’s public attacks on Jerome Powell.

Three key factors suggest Bitcoin could keep pushing higher:

Weak Sell Pressure

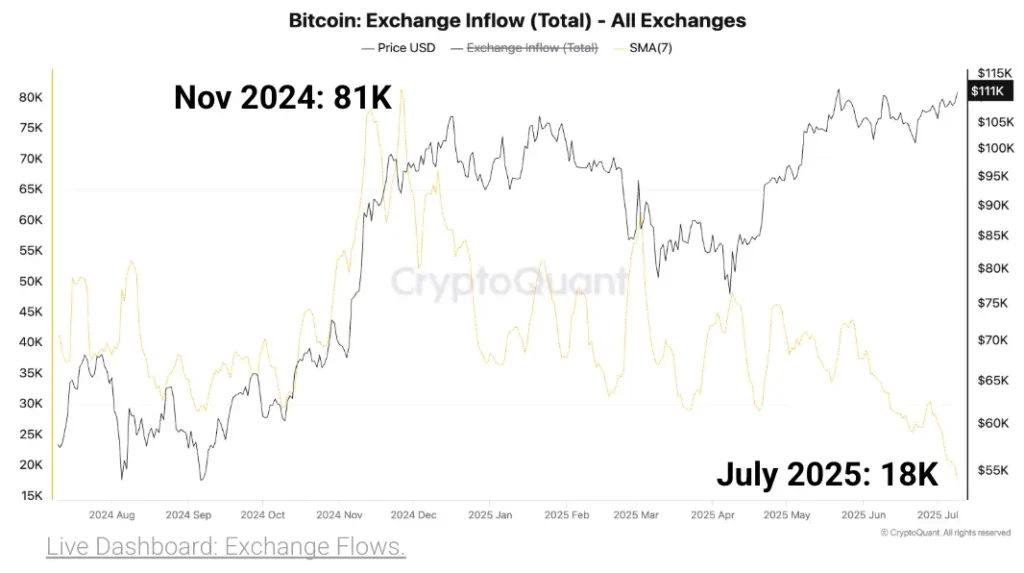

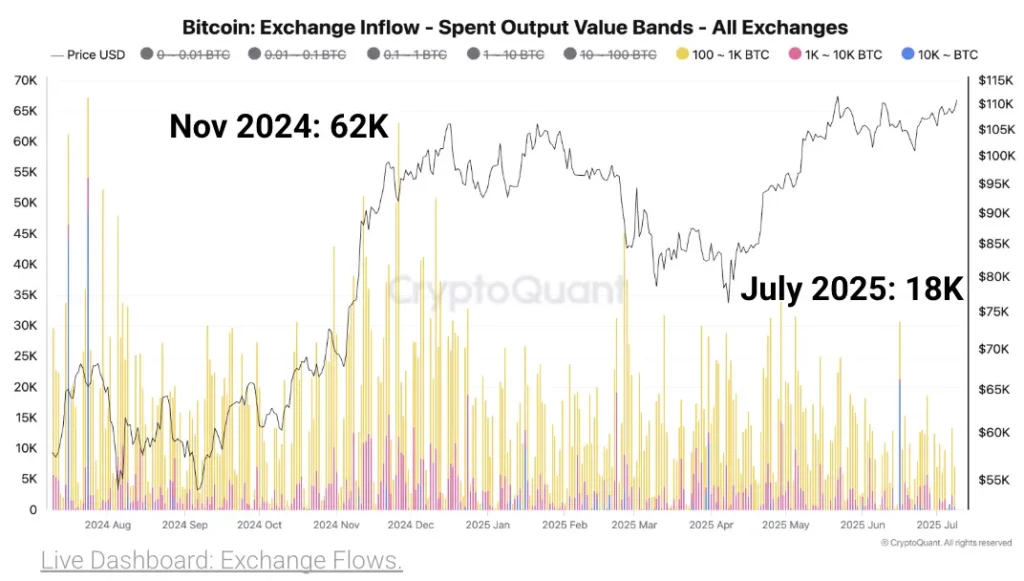

CryptoQuant data shows exchange inflows have plummeted to 18,000 BTC, the lowest since April 2015. This signals minimal selling pressure, supporting price stability at higher levels.

Reduced Whale Transfers

Large holders (wallets with 100+ BTC) sent only 7,000 BTC to exchanges recently, down sharply from 62,000 in late November 2024, further suggesting strong holding behavior.

Strong Institutional Demand

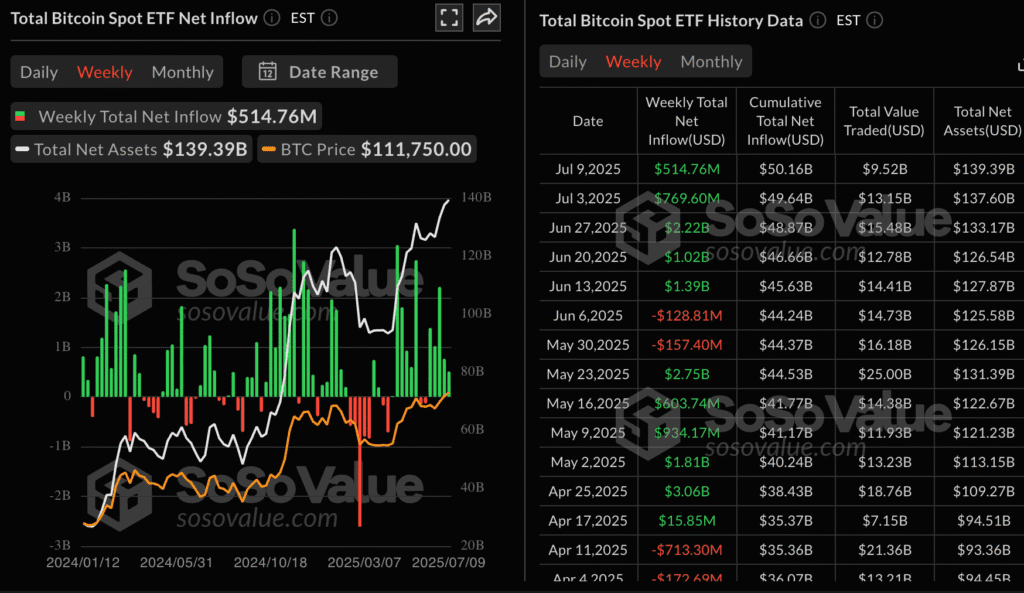

U.S.-approved Bitcoin spot ETFs recorded a $218 million inflow on Wednesday alone. Weekly inflows total around $515 million, with cumulative net inflows topping $50 billion and net assets reaching roughly $139.4 billion.

Analysts, including Bitget’s Ryan Lee, predict BTC could approach $120,000 soon if this trend holds.

XRP Pushes Toward $3.00 as Market Momentum Builds

XRP extended its rally on Thursday, touching around $2.49, as bullish sentiment swept across crypto markets. Investors are shifting into riskier assets like Bitcoin (BTC), Ethereum (ETH), and XRP, spurred by rising macroeconomic uncertainty and the latest U.S. tariff moves.

XRP’s next immediate target sits above $3.00, driven by a technical breakout from an inverse head-and-shoulders pattern and strong on-chain fundamentals.

The number of active addresses on the XRP Ledger has surged to an average of 7.3 million, a jump from 6.3 million at the start of 2025 and 5.7 million a year ago, signaling growing user participation and network activity.

Derivatives data supports the rally: XRP futures open interest has climbed to $5.56 billion, up from $3.54 billion in late June. Trading volume also soared by roughly 30% to about $9 billion.

Liquidations over the past 24 hours totaled $10 million, with $8 million coming from shorts, highlighting an increasingly bullish trader bias. The long-to-short ratio is hovering near 0.9904, reinforcing upward momentum.

Corporate Bitcoin Holdings Hit Record High in Q2 With 159,107 BTC Added

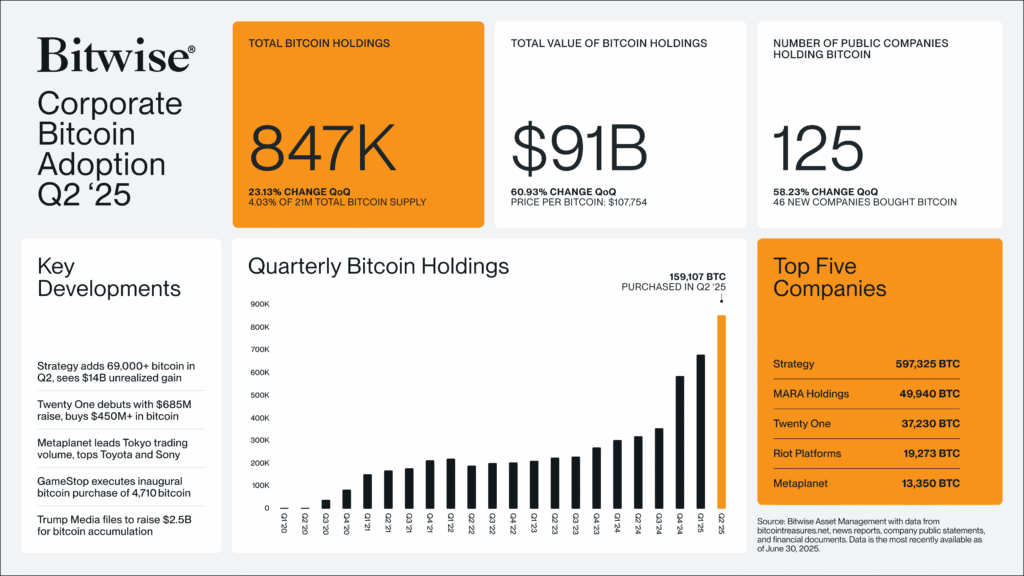

Companies added an unprecedented 159,107 BTC to their treasuries in Q2 2025, valued at over $17.6 billion at current prices.

This represented a 23.13% jump quarter-over-quarter, lifting total corporate holdings to 847,000 BTC—roughly 4% of Bitcoin’s 21 million supply cap.

Total corporate Bitcoin value reached $91 billion by the end of Q2, based on a closing price of $107,754—up 60.93% from the prior quarter.

Leading the corporate charge is Strategy, steered by Michael Saylor, which now owns 597,325 BTC. Strategy’s aggressive accumulation, funded by convertible notes and equity offerings, has propelled its stock price up 43% year-to-date.

The number of public companies holding Bitcoin rose sharply to 125, up 58.23% from the previous quarter, reflecting growing institutional confidence as BTC hit a new record above $112,000 this week.

Pi Network Bounces Back After New Node Version Release

Pi Network (PI) has been trading higher for the third straight day, rebounding from last week’s 12% slide.

The bounce coincides with the rollout of version 0.5.3 of the Pi Node, which aims to improve the robustness and efficiency of node initialization.

As of Thursday, PiScan data showed 99 active nodes, with South Korea leading at 23. Overall, Pi’s decentralization remains limited, featuring only 10 validators and 792 known peers.

Technically, PI is approaching a potential breakout from an Adam and Eve pattern on the 4-hour chart, adding to bullish momentum.

Sui Targets $4.00 After Breaking Key Resistance, TVL Nears $2 Billion

Sui (SUI) rallied more than 5% on Thursday, climbing to around $3.21 after clearing a key descending channel and reclaiming support at its 100-day EMA of $3.07.

The protocol’s total value locked (TVL) has surged to $1.95 billion, up from $1.54 billion in late May, signaling stronger investor confidence in Sui’s DeFi ecosystem.

Open interest in SUI futures jumped 14% to $1.45 billion in 24 hours, while trading volume soared 74% to $5.43 billion.

The long-to-short ratio stands at 1.0288, indicating a tilt toward bullish positioning. Recent liquidations totaled $4 billion, disproportionately hitting short positions ($3.88 million liquidated), reflecting aggressive bets on further price gains.

Australia Launches Massive Wholesale CBDC Pilot Program

The Reserve Bank of Australia is taking its wholesale central bank digital currency (CBDC) project to the next stage.

Dubbed “Project Acacia,” the initiative involves 19 pilot programs using real assets, alongside five additional simulations.

The trials will test settlement solutions across fixed income, trade finance, carbon credits, and more. Platforms involved include Hedera, R3 Corda, and Canvas Connect.

Assistant Governor Brad Jones says the project will evaluate how central bank money and private digital tokens could modernize financial infrastructure, reduce costs, and improve efficiency. The final report is due in early 2026.

The Day’s Takeaway

United States

U.S. stock indices closed higher across the board, with the S&P 500 and Nasdaq setting new record highs. The Dow led gains, rising 0.43% to 44,650.70, while the Russell 2000 climbed 0.48% to 2,263.41.

Investors shrugged off tariff worries, including fresh 50% duties on imports from Brazil and copper starting August 1.

Airline stocks exploded higher: United Airlines (+14.37%), American Airlines (+12.80%), and Delta (+12.01%) topped the leaderboard. Tesla rose 4.73% after a new robotaxi petition in Phoenix, while Nvidia closed above $4 trillion in market cap at $164.10.

Meanwhile, initial jobless claims came in at 227,000, beating forecasts and supporting confidence in the labor market. The four-week moving average fell to 235,500. Continuing claims held steady at 1.965 million.

In the bond market, the U.S. Treasury sold $22 billion of 30-year bonds at a high yield of 4.889%, drawing strong demand from direct bidders.

Commodities

Gold remained firm, holding above $3,300 after stronger-than-expected U.S. jobs data dampened hopes for a July Fed rate cut. Inflows into gold ETFs hit $38 billion in the first half of 2025, the largest since August 2022, helping support bullion despite high Treasury yields and a firm dollar.

Silver stabilized above $36.50 after rebounding from a three-day drop. The metal continues to trade in a tight range between $35.50 and $37.00 inside a broader rising channel. Fresh tariff threats on eight more countries, including Algeria and the Philippines, added to safe-haven demand.

Crude oil prices slipped, with WTI falling below $67 despite news that OPEC+ is considering pausing output increases from October. Traders viewed the pause as expected, and skepticism about spare capacity limited the upside.

Tightening global inventories continue to set the stage for possible squeezes in metals markets, according to TD Securities. New U.S. Section 232 tariffs are adding further friction, encouraging stockpiling of strategic raw materials such as copper, platinum, and nickel.

Europe

European indices closed mixed. Germany’s DAX hit a new intraday high at 24,639.10 but pulled back to finish down 0.3% at 24,456.82.

The UK’s FTSE 100 advanced 1.23% to a record 8,975.65. France’s CAC 40 closed up 0.30% at 7,902.26, while Spain’s Ibex fell 0.79% and Italy’s FTSE MIB dropped 0.72%.

The European Commission is reportedly planning to propose a floating price cap on Russian oil, a shift from earlier fixed levels. While potentially bullish for oil, markets remained calm.

Germany confirmed June CPI at 2.0% year-on-year, matching the preliminary figure. Core inflation came in at 2.7%, as easing energy and food costs offset rising service prices.

Italy’s industrial production fell 0.9% in June, sharply missing expectations for a 0.2% increase and highlighting ongoing manufacturing weakness.

Asia

In Japan, Daiwa Securities warned that Trump’s proposed 25% tariffs could reduce Japan’s real GDP by 1.1%, with projected growth dropping to just 0.1%–0.2% in FY2025. The Bank of Japan is still expected to maintain gradual rate hikes despite this threat.

Japan’s June Producer Price Index rose 2.9% year-on-year, in line with forecasts, while monthly prices fell 0.2%.

China reaffirmed its opposition to politicizing trade following Trump’s new tariff announcements. The country also pledged new employment support measures, including expanded loans and insurance subsidies to stabilize hiring.

Chinese firms plan to deploy around 15,000 Nvidia chips across new AI data centers, even as questions remain over how they’ll secure restricted U.S. technology.

South Korea held its policy rate steady at 2.5%, citing financial stability risks and rising household debt.

Rest of World

Brazil is moving closer to China, having signed 37 cooperation agreements last year, and continues to favor dialogue over retaliation in trade disputes.

Malaysia invited Trump to attend the ASEAN and East Asia summits in October. Meanwhile, U.S. Secretary of State Marco Rubio discussed tariff policy with Malaysian officials amid ongoing tensions.

OPEC cut its oil demand forecasts for 2026–2029 but insisted there’s no sign of global demand peaking. The group predicts demand could still reach 122.9 million barrels per day by 2050, well above other estimates.

Crypto

Bitcoin hit a fresh all-time high above $113,000, supported by subdued selling pressure, strong institutional flows, and weak dollar sentiment. Exchange inflows dropped to the lowest since 2015, while spot ETFs recorded $218 million in inflows on Wednesday alone. Analysts see potential for a move toward $120,000 if momentum holds.

XRP extended its rally to $2.49, eyeing $3.00 in the short term. The number of addresses on the XRP Ledger climbed to a record 7.3 million, and derivatives open interest surged to $5.56 billion.

Sui (SUI) gained over 5% to around $3.21, buoyed by a growing DeFi ecosystem. Total value locked approached $2 billion, and trading volume jumped 74% to $5.43 billion.

Pi Network edged higher for a third straight day following the launch of its new node version. The technical setup points to a potential breakout, though network decentralization remains limited.