North America News

U.S. Stocks End Strong as Nvidia Hits Historic $4 Trillion Valuation

U.S. equities closed higher on Wednesday, led by robust gains in tech shares, with Nvidia becoming the first company ever to reach a $4 trillion market cap.

Closing numbers:

- S&P 500: +0.6%

- Nasdaq Composite: +0.9%

- Russell 2000: +1.0%

- Dow Jones Industrial Average: +0.5%

Stocks opened strong but briefly pared gains mid-session before buyers stepped in to drive a solid finish.

Beyond Nvidia, homebuilders, Boeing, and Caterpillar all showed notable strength. Google and Amazon rebounded sharply, shaking off earlier negative headlines — a sign of underlying market resilience that may support further upside momentum.

Looking ahead, traders are watching Bitcoin closely to see if it can break into new highs in the coming days.

In post-market action, Kellog (KLG) shares soared 50% after a Wall Street Journal report revealed a planned $3 billion acquisition deal.

U.S. Treasury Sells $39 Billion of 10-Year Notes at 4.362% High Yield

The U.S. Treasury auctioned $39 billion in 10-year notes on Wednesday at a high yield of 4.362%, slightly below the when-issued (WI) level of 4.365%.

- Bid-to-cover ratio: 2.61x (above six-month average of 2.56x)

- Tail: –0.3 basis points (compared to six-month average of –0.7 bps)

- Direct (domestic) bidders took 23.7% (vs. 16.3% average)

- Indirect (foreign) bidders took 65.4% (vs. 71.7% average)

- Dealers ended up with 10.87% (vs. 12.0% average)

The auction saw stronger-than-usual participation from domestic buyers but softer interest from international investors. Dealers were left with a smaller-than-average allocation.

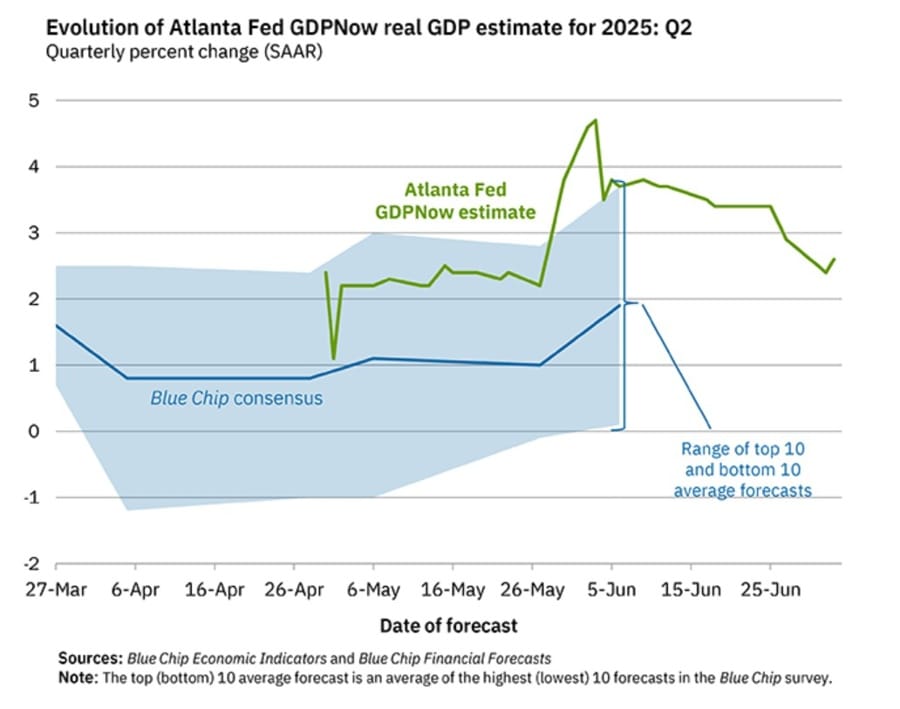

Atlanta Fed GDPNow Keeps Q2 Growth Estimate at 2.6%

The Atlanta Fed’s GDPNow model held its forecast for second-quarter U.S. economic growth steady at 2.6%.

There were no changes from the prior projection, reinforcing expectations for moderate expansion in Q2 2025.

This stable outlook comes amid mixed economic signals, including steady consumer activity and evolving inflation trends that the Fed will closely monitor in upcoming policy discussions.

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the second quarter of 2025 is 2.6 percent on July 9, unchanged from July 3 after rounding. After this morning’s wholesale trade report from the US Census Bureau, the nowcast of second-quarter real residential fixed investment growth decreased from -6.4 percent to -6.5 percent, while the nowcast of the contribution of inventory investment to annualized second-quarter real GDP growth decreased from -2.13 percentage points to -2.15 percentage points.

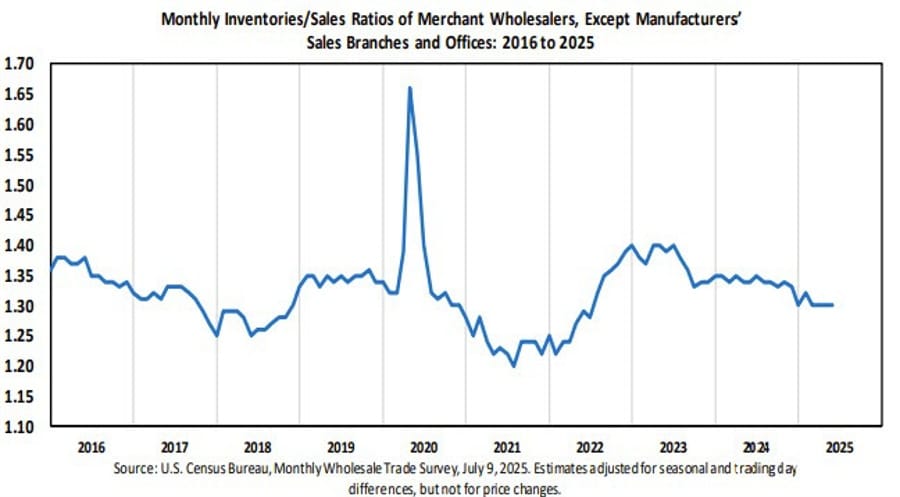

U.S. Wholesale Inventories Slip 0.3% in May, Sales Also Decline

U.S. wholesale inventories dropped by 0.3% in May, matching earlier estimates and preliminary figures, according to the latest Census Bureau report.

- Inventories totaled $905.5 billion in May, down from April’s level but 1.4% higher than May 2024.

- Wholesale sales fell 0.3% month-over-month to $697.2 billion. Sales were still up 4.8% compared to a year ago.

- April sales were revised from +0.1% to nearly flat.

The inventories-to-sales ratio held steady at 1.30 in May, unchanged from April and down from 1.34 in May 2024. This ratio remains at its lowest levels since 2022, signaling leaner stock levels relative to sales.

U.S. Mortgage Applications Jump 9.4% as Rates Ease Slightly

Mortgage Bankers Association data for the week ending July 4, 2025, showed U.S. mortgage applications surged 9.4%, up sharply from a 2.7% increase the prior week.

- Market index: 281.6 (prior: 257.5)

- Purchase index: 180.9 (prior: 165.3)

- Refinance index: 829.3 (prior: 759.7)

- 30-year fixed mortgage rate: 6.77% (prior: 6.79%)

The drop in rates, albeit slight, contributed to stronger application activity across both purchase and refinance segments.

FOMC Minutes: Some Open to July Rate Cut, Inflation Risks Linger

Minutes from the June Federal Open Market Committee meeting show that “a couple” participants would consider a rate cut as early as July, depending on economic and labor market conditions.

While most members anticipate some reduction in the Fed funds rate this year, “some” participants argued that no cuts may be needed in 2025, citing sticky inflation, high inflation expectations, and continued economic resilience.

A few members noted that tariffs could result in a temporary rise in prices without impacting long-term inflation expectations. However, most participants saw a risk that tariffs could have more sustained inflationary effects.

Fed staff revised their forecast to show higher real GDP growth and lower inflation for 2025 versus previous estimates.

The minutes emphasize that if the labor market weakens significantly or inflation continues to fall with stable expectations, a less restrictive monetary policy stance would be appropriate.

Markets will now turn their attention to upcoming inflation reports — June CPI due July 15 and PPI on July 16 — for clues on the Fed’s next move.

Trump Pressures Fed, Says Rates Are “At Least 3 Points Too High”

President Trump renewed his criticism of Federal Reserve policy on Wednesday, declaring that interest rates are “at least 3 points too high.”

Trump’s comments were primarily aimed at Fed Chair Jerome Powell, though other committee members are also likely paying attention.

Powell has indicated he expects inflation to edge higher in June, July, and August. June inflation data will begin to roll out later this month, with July CPI scheduled for release on July 15 and PPI on July 16.

While Trump’s remarks may not dictate policy alone, they could influence market sentiment and shape discussions among Fed officials as they weigh future rate adjustments.

Navarro: The markets understands that the letters are part of negotiations

White House trade advisor Navarro is speaking on Fox news and says:

- The markets view trade letters as part of negotiations

- Apple thinks it is too big to tariff.

- Fed should have cut rates in July.

U.S. Tariff Revenues May Hit $300 Billion by Year-End: Bessent

Treasury Secretary Scott Bessent projects that U.S. tariff revenue could soar to $300 billion in 2025, fueled by Trump’s expanded trade measures.

Speaking at a cabinet meeting, Bessent revealed that the government has already collected about $100 billion this year, with May alone bringing in $22.8 billion — nearly quadruple last year’s monthly figure.

From October through May, fiscal 2025 collections totaled $86.1 billion, with $63.4 billion in the first five months of the calendar year.

The Congressional Budget Office has forecast $2.8 trillion in tariff income over the next decade, but Bessent believes that projection may be too conservative.

Goldman Sachs Raises S&P 500 Target to 6,600

Goldman Sachs has lifted its year-end forecast for the S&P 500 to 6,600, up from 6,100.

The bank attributes this upgrade to a more resilient earnings outlook for 2026, the prospect of resumed Fed rate cuts, and lower bond yields than previously expected.

Goldman’s updated valuation framework puts the forward P/E ratio at 22x (up from 20.4x), supported by strong fundamentals among the largest U.S. stocks and an expectation that investors will look past near-term earnings softness.

Recent inflation trends and corporate surveys suggest that tariff-related price pass-through is proving milder than feared, allowing large-cap companies to lean on existing inventories to manage upcoming tariff increases gradually.

Deutsche Bank: Trump’s New Threats Could Push Tariffs Near 20%

Deutsche Bank analysis, reported by the Wall Street Journal, suggests President Trump’s latest tariff threats could raise the average U.S. tariff rate to around 18.7%, up from roughly 17% last week.

The estimate factors in a 10% base tariff plus extra duties on key sectors such as autos, steel, and aluminum. While this is a jump, it still sits below the potential peak of over 22% that Trump’s earlier “Liberation Day” plan in April might have caused.

Nissan Suspends Three Canadian-Bound Models at U.S. Plants

Nissan has halted production of three vehicle models bound for Canada due to reciprocal tariffs between the U.S. and Canada, Nikkei reported Wednesday.

The pause, which began in May, affects the Pathfinder and Murano SUVs built in Tennessee and the Frontier pickup trucks assembled in Mississippi.

The suspension underscores growing trade frictions impacting cross-border automotive supply chains.

J.P. Morgan Scales Back EMFX Overweight as Peso Looks Overbought

J.P. Morgan is dialing down its bullish stance on emerging market currencies, warning that recent rallies have left them looking stretched.

The bank is especially cautious on the Mexican peso (MXN), which it has downgraded from an overweight position after a strong run.

While J.P. Morgan maintains a broadly supportive long-term view for EMFX, they warn that short-term performance may falter as recent gains have outpaced fundamentals. The move reflects a tactical shift rather than a structural reversal.

Commodities News

Gold Pushes Back Above $3,300 as Trump Announces New Tariffs

Gold prices rose on Wednesday, breaking back above the $3,300 mark after President Trump announced a fresh wave of tariffs set to take effect August 1.

Spot gold recovered from recent lows, currently trading around $3,305. The 50-day simple moving average (SMA) at $3,321 is acting as immediate resistance, while price found support at the lower boundary of a recent triangle pattern.

Trump unveiled plans for 30% tariffs on imports from Iraq, Libya, and Algeria, along with a 20% duty on goods from the Philippines. He reiterated there will be no further delay in the August 1 implementation date, stating, “TARIFFS WILL START BEING PAID ON AUGUST 1, 2025. There has been no change to this date, and there will be no change.”

In addition, Trump has hinted at potential future levies, including a 50% tariff on copper imports and a possible 200% rate on pharmaceutical products.

So far this week, 14 new tariff letters have been sent to countries including Japan and South Korea, with Commerce Secretary Howard Lutnick confirming another 15–20 letters would be dispatched by Wednesday.

Trump also threatened BRICS nations with an extra 10% tariff, further fueling global trade tensions. BRICS — a bloc that includes Brazil, Russia, India, China, and South Africa — aims to strengthen cooperation on economic and political fronts.

Meanwhile, investors await the release of June’s FOMC minutes for clues on future interest rate policy. While the Fed held its benchmark rate steady at 4.25%–4.50% in June, the labor market’s continued strength and persistent inflation pressures have kept policy hawkish.

Last week’s Nonfarm Payrolls report confirmed strong job growth, tempering near-term rate cut bets.

According to the CME FedWatch Tool, markets are pricing in a 62.9% chance of a 25-basis-point rate cut in September. Trump has ramped up his criticism of Fed Chair Jerome Powell, calling for his “immediate resignation” and accusing him of obstructing Trump’s reelection by not lowering rates sooner.

Gold typically moves inversely to U.S. Treasury yields and the dollar. With rates and yields still elevated, upside for gold remains cautious, but geopolitical and policy risks continue to support safe-haven demand.

WTI Rises as Red Sea Attacks Overshadow U.S. Inventory Build

WTI Crude Oil prices climbed above $67 on Wednesday as geopolitical tensions in the Red Sea offset a surprisingly large build in U.S. inventories.

The latest EIA report showed a crude stockpile increase of 7.07 million barrels last week, against expectations for a 2 million barrel draw. Gasoline inventories fell by 2.66 million barrels, and distillates declined by 825,000 barrels.

Despite the bearish inventory data, supply risks have kept oil supported. Over the weekend, OPEC+ announced an additional production increase of 548,000 barrels per day for August. Between April and July, OPEC+ has already ramped output by 1.37 million bpd.

Meanwhile, escalating attacks in the Red Sea are adding to the market’s risk premium. Houthi rebels targeted and sank two ships, the Greek-owned Magic Seas and the Liberian-flagged Eternity C, resulting in casualties and missing crew members.

These events have reinforced price support around $65, while the 200-day moving average above $68 remains the next major technical hurdle.

U.S. Weekly Crude Stocks Surge by 7 Million Barrels, Confounding Drawdown Forecasts

U.S. crude oil inventories rose by 7.070 million barrels for the week ending July 4, sharply contrasting with expectations for a 2.071 million barrel draw, according to EIA data.

Other details:

- Gasoline inventories fell by 2.658 million barrels (expected: –1.486 million)

- Distillate stocks declined by 825,000 barrels (expected: –1.486 million)

Crude prices were little changed at $67.86 following the report. Technical charts show prices remain below the 200-day moving average ($68.37). While oil has recently fluctuated above and below this key level, it closed below it in the prior session.

A consistent close above the 200-day average would be needed to confirm a stronger bullish reversal; for now, upside momentum remains limited.

Trump’s 50% Copper Tariff Sparks Record U.S. Price Surge

President Trump confirmed plans to impose a 50% tariff on copper imports, sending U.S. copper futures to record highs on Tuesday.

Commerce Secretary Howard Lutnick said the tariffs are likely to be implemented by the end of July. This marks the first time the U.S. has targeted copper with import duties.

ING analysts Ewa Manthey and Warren Patterson noted that the market expected a tariff closer to 25%, making the 50% rate a shock.

In February, Trump initiated a Section 232 probe on copper imports, which could have extended into November, but this move accelerated the timeline.

The U.S. depends heavily on imported copper—about 850,000 tonnes in 2024, accounting for 50% of domestic use. Chile is the top supplier at 40%, followed by Canada and Mexico.

The immediate price surge benefits Comex copper, but long-term, the tariffs could crush demand and lead to a pile-up of domestic inventories. Meanwhile, London Metal Exchange (LME) prices may fall as global flows adjust. Currently, the Comex-LME price gap has blown out to over $2,000 per tonne.

Brent Crude Pushes Back Above $70 as Supply Risks Linger

Brent crude oil settled above $70 per barrel on Tuesday, despite global trade tensions and recent OPEC+ supply announcements.

ING analysts highlighted Middle East tensions, notably Houthi attacks on ships in the Red Sea, as supportive for oil prices. Near-term market tightness continues, especially during peak summer demand.

API data showed U.S. crude inventories rose by 7.1 million barrels, with Cushing stocks up 100k barrels. Gasoline inventories fell by 2.2 million barrels, and distillates dropped by 800k barrels, keeping middle distillate concerns in focus.

The EIA’s latest Short Term Energy Outlook revised U.S. crude output growth down to 160,000 barrels per day in 2025 (previously 210,000 b/d). For 2026, growth is expected to be flat, pressured by slower drilling activity.

The oil market may remain tight through summer, with a potential easing only from Q4 onward.

Trump’s 50% Copper Tariff Expected to Hit Within 30 Days

Citi analysts expect the newly announced 50% U.S. tariff on copper imports to be formally confirmed and rolled out within 30 days.

Trump announced the plan on Tuesday, and Citi’s revised base case now assumes the COMEX-LME arbitrage will price at 25–35% of London Metal Exchange levels (about $2,300–$3,300 per tonne), up from a prior forecast of 15–20%.

Citi also forecasts that ex-U.S. copper prices will retreat to around $8,800/ton over a 0–3 month horizon, driven by expected shifts in global trade flows and market recalibration.

Gold ETFs Record Biggest Inflows Since 2020 Amid Trade Fears

Physically backed gold ETFs pulled in $38 billion in the first half of 2025 — the largest semi-annual inflow since early 2020, per the World Gold Council.

Holdings jumped by 397.1 metric tons, pushing global ETF gold reserves to 3,615.9 tons at June’s end. This is the highest since August 2022 but still below the record of 3,915 tons set in October 2020.

U.S.-listed funds led the way, adding 206.8 tons. Asian ETFs saw record demand, contributing 28% of net global inflows despite holding just 9% of global assets under management.

The surge is driven by rising demand for safe-haven assets amid escalating geopolitical and economic uncertainty tied to Trump’s aggressive tariff policy.

Spot gold is up 26% year-to-date, peaking at $3,500 per ounce in April.

Europe News

European Stocks Close Higher on U.S.-EU Trade Deal Hopes

European equities finished Wednesday firmly in positive territory, buoyed by optimism over a potential U.S.-EU trade agreement.

Closing levels:

- German DAX: +1.30% (new all-time high, driven by defense stocks)

- France’s CAC 40: +1.44%

- UK’s FTSE 100: +0.14%

- Spain’s Ibex 35: +1.24%

- Italy’s FTSE MIB: +1.59% (four-week high)

Traders were encouraged by European Commission statements reaffirming efforts to secure a foundational trade deal with the U.S., expected to be finalized by week’s end.

EU Nears Temporary Trade “Framework” Deal With U.S.

The Financial Times reports that the European Union is close to finalizing a temporary “framework” trade agreement with the United States.

The structure resembles the UK’s earlier arrangement, maintaining the 10% baseline tariff level. However, unlike the UK deal, the U.S. is pushing for a 17% tariff on EU agrifood products. One EU official remarked, “The UK agreement was better than this. It’s surprising given how long we have negotiated.”

Negotiations are ongoing, but this provisional agreement could be wrapped up by the end of this week. Some EU insiders view the maintenance of 10% tariffs as a relative win, underscoring how Trump has managed to normalize tariffs globally.

EU Aims to Finalize U.S. Trade Deal Before August Deadline

The European Commission says it is working to clinch a trade agreement with the U.S. before the August 1 tariff deadline.

Trump extended the tariff start date to August 1 via executive order on Monday. EU officials told Reuters that they expect to avoid being included in the upcoming batch of tariff letters, signaling positive momentum toward an agreement.

These developments have helped sustain gains in European equity markets in recent sessions as investors anticipate a resolution.

EU trade negotiator Sefcovic: Trade talks continue remotely every day with US

- EU and US trade negotiations continue

EU trade negotiator Sefcovic is testifying to EU parliament and says:

- Trade talks continue remotely every day with the US

- Our priority is a negotiated solution with the US

- We made good progress on text of agreement in principle.

- Hope to reach satisfactory results in coming days

- While we remain committed to reaching satisfactory deal, a degree of rebalancing will remain.

- Our regulatory framework remains nonnegotiable

- Our diversification agenda remains priority.

- Commission is working to protect EU from trade diversion from other countries.

- EU unity remains absolutely crucial.

ECB’s Lane: Data dependence also extends to incoming data outside the monetary domain

- Remarks by ECB chief economist, Philip Lane

- That considering shifts in international, domestic policy regimes are highly relevant for future inflation dynamics

- Orientation for monetary policy stance now is to make sure that current, prospective shocks to the economy do not lead to medium-term deviations of inflation from the target

- There has been a marked drop in energy prices and a substantial appreciation of the euro

- Currently, there is high uncertainty about the future of the international trade system

- Amid high uncertainty, it is vital to remain data dependent and take a meeting-by-meeting approach

- ECB is basing monetary policy decisions on an integrated assessment of all relevant factors

- It not only incorporates inflation path and the economy but also surrounding risks and uncertainty

BoE’s Bailey: Steepening in yield curves for bonds is not particularly UK-focused

- Remarks from the BoE Governor

- QT is an open decision.

- Global steepening of bond curves will have to be looked at carefully in annual QT decision.

- We are seeing firms tell us that higher uncertainty is delaying investment decisions, including capital raising.

- Caution on business investment will have some effect on employment.

German Chancellor Merz: Cautiously optimistic on EU trade deal with the US

- Comments in a speech to Parliament

- Cautiously optimistic on EU trade deal with the US.

- I am optimistic we can agree deal with USA by the end of this month.

- I am in intensive contact with US government as well as EU Comission on tariffs.

EU will be firm, working closely with US to reach an agreement – von der Leyen

- Remark by European Commission president, Ursula von der Leyen

- EU is getting ready for all scenarios

Asia-Pacific & World News

China Vice Premier He Lifeng: China economy has demonstrated strong resilience

China vice premier He Lifeng says:

- China economy has demonstrated strong resilience and growth potential despite constantly changing external environment.

- Met with BASF chairman on Wednesday. Welcoming the company and similar enterprises to expand investment and cooperation within China.

China calls out EU to readjust its attitude on trade relations

- Remarks by the China foreign ministry

- EU need to readjust its attitude, not China

- Hopes EU can uphold more positive, practical policy towards China

- Hopes for positive bilateral economic and trade relations

- EU’s public procurement market is far from being fair and open as they claim it to be

UBS: Emerging Market Stocks Underestimate Tariff Risks

UBS analysts caution that emerging market (EM) equities may not be fully accounting for tariff risks.

More than 35% of MSCI EM revenues depend on exports, with 13% directly linked to the U.S., making these markets vulnerable as new U.S. tariffs kick in.

UBS expects the U.S. average tariff rate could climb to 21% — up from 16% currently and sharply higher than the 2.4% rate in 2024 if full reinstatements proceed.

Stress tests suggest EM earnings could decline by 6–9%, yet consensus estimates have only been cut by 3% so far. UBS expects further downgrades to weigh on EM stock performance.

China June CPI Inches Up, PPI Falls Sharply

China’s consumer price index rose by 0.1% year-over-year in June, beating the expected flat reading and marking the first increase in five months.

On a monthly basis, CPI fell 0.1%. Meanwhile, producer prices dropped 3.6% year-over-year, a deeper decline than the anticipated 3.2%, and the worst since July 2023.

The National Bureau of Statistics cited policy support for domestic demand, stabilization in industrial goods prices, and easing oil-related price drags as key CPI drivers.

For PPI, falling seasonal raw material costs and declines in green energy-driven power prices weighed heavily. Export-focused sectors such as electronics and textiles faced pricing pressure amid weak global trade, while declines narrowed slightly in autos and new energy products.

PBOC sets USD/ CNY central rate at 7.1541 (vs. estimate at 7.1806)

- PBOC CNY reference rate setting for the trading session ahead.

PBOC injected 75.5bn yuan via 7-day reverse repos at 1.40%

- 98.5bn yuan mature today

- net drain 23bn yuan

RBA Deputy Governor Andrew Hauser: Enormous amount of uncertainty in global economy

- Hauser says the market response is very surprising

Reserve Bank of Australia Deputy Governor Andrew Hauser:

- Enormous amount of uncertainty in global economy

- Very surprising how markets are shrugging and moving on

- Effects of tariffs on global economy are profound, to drag on growth

- First round impacts of tariffs on Australia look minor

- Its still in the early days, but the worst trade fears have not materialized

Economists See RBA Cutting Rates in August: Reuters Poll

A Reuters survey shows unanimous expectations for a 25 bp rate cut by the Reserve Bank of Australia in August, lowering the cash rate to 3.60%.

All 30 economists polled forecast the move, including Australia’s big four banks (ANZ, CBA, NAB, and Westpac).

The RBA has already delivered two cuts this year but paused in April and July to assess inflation trends.

The median projection now sees the cash rate at 3.35% by year-end, a revision from last week’s forecast of 3.10%.

Upcoming inflation data will be pivotal in confirming the RBA’s trajectory, with most economists anticipating at least one further cut after August to support the disinflation process.

RBNZ Holds Rate at 3.25%, Signals Possible Cuts Ahead

The Reserve Bank of New Zealand kept its official cash rate at 3.25% at this week’s meeting, as expected.

Policymakers emphasized that if medium-term inflation pressures continue to recede as projected, the committee anticipates further rate reductions.

Headline inflation is expected to approach the top of the 1–3% target band mid-2025 and return to around 2% by early 2026.

Members considered a 25 bp cut but opted to hold amid elevated global uncertainty and near-term inflation risks, deferring potential easing decisions to August.

The minutes noted that tariffs and trade tensions could slow global growth, dampening New Zealand’s recovery and easing domestic price pressures.

BoJ Official Flags Stronger-Than-Expected Food and Rice Inflation

Bank of Japan board member Koeda commented that Japan’s recent spikes in food and rice prices have exceeded what policymakers had anticipated during their May meeting. Speaking via Bloomberg, Koeda stressed that the central bank is monitoring these developments closely.

He highlighted that Japan’s weighted median inflation is still below the 2% target, and policymakers must carefully examine whether momentum toward stable price growth is taking hold.

Koeda added that it is too early to discuss a specific timeline for the next rate hike, citing high uncertainty around Japan’s economic outlook. He noted concerns over potential second-round effects on broader inflation expectations driven by rising rice and food prices.

Current inflation trends remain largely cost-push, rather than demand-driven. On balance sheet strategy, Koeda mentioned the BOJ needs to deliberate on eventually reducing its expanded holdings of JGBs but has no immediate plans to offload ETFs.

Crypto Market Pulse

Roswell Launches First U.S. Bitcoin Strategic Reserve — Could More Cities Join In?

Roswell, New Mexico, has become the first U.S. city to establish a Bitcoin strategic reserve, kicking off with an initial $3,000 donation and setting a goal of $1 million.

Located in southeastern New Mexico and famous for the 1947 UFO incident, Roswell formally launched its reserve in April 2025.

Currently, 17 U.S. states are considering similar reserve initiatives, while New Hampshire, Arizona, and Texas have already passed Bitcoin reserve legislation. Texas signed its bill into law most recently on June 20.

President Trump’s pro-crypto stance has played a major role in encouraging state and local adoption. His administration has promoted crypto-friendly regulatory changes, resolved long-standing legal battles with firms like Coinbase and Ripple, and advanced new legislation such as the GENIUS Act for stablecoin oversight — which passed the Senate on June 17 and awaits a House vote.

Trump’s high-profile crypto dinner events, NFT drops, and family-backed DeFi ventures like World Liberty Financial highlight his aggressive push to mainstream digital assets.

With this backdrop, Roswell’s move could be a preview of what’s to come across many U.S. cities.

Solana Climbs on Strong Institutional Flows as Staking ETF Inflows Top $40 Million

Solana (SOL) pushed above $154 on Wednesday, gaining more than 2% as it rebounded from its June low of $125. The move follows a 22% jump from that support level.

Institutional interest continues to grow, driven by the rise of tokenized real-world assets and the debut of new exchange-traded products.

The new Solana staking ETF, trading under the ticker SSK, saw inflows exceed $40 million on its second day of trading. Launched Tuesday, SSK offers exposure to SOL as a spot asset along with staking yield, all within a traditional ETF wrapper.

Designed by REX Shares and Osprey Funds, SSK bridges on-chain staking rewards with off-chain ETF accessibility.

Bloomberg analyst Eric Balchunas reported that SSK attracted $20 million on day one and surpassed $80 million in total inflow by Wednesday. While smaller than initial flows into Bitcoin and Ethereum ETFs, SSK’s performance has exceeded expectations and reflects strong green-light metrics for institutional investors.

The SEC has also hinted at fast-tracking approvals for spot Solana ETFs under a new framework in development, signaling potential for further expansion in institutional Solana products.

Shiba Inu Futures OI Surpasses 7M SHIB as Price Rises and Whales Sell

Shiba Inu (SHIB) futures open interest crossed the 7 million SHIB mark on Binance for the first time since late May, signaling renewed speculative appetite.

The token, the second-largest meme coin by market cap, is trading above the 23.6% Fibonacci retracement level from its May-June downturn, up over 1% in the last 24 hours, per CoinDesk data.

Over the past week, SHIB has gained more than 5%, supported by a bullish 14-day relative strength index (RSI), which moved above 50 for the first time since May 23.

Daily volume has also outpaced the average of 307.5 billion tokens, indicating strong buying momentum.

Despite whale selling, the rise in perpetual futures OI and positive funding rates suggest that traders remain confident in a potential continued price climb.

SPX6900 Eyes Ascending Triangle Breakout as Hype Grows

Meme coin SPX6900 (SPX) rose over 3% on Wednesday, extending an 8.44% gain from Tuesday as bullish momentum builds.

SPX is hovering near the upper edge of an ascending triangle pattern, hinting at a possible breakout. Technical signals point to a bullish bias, fueled by rising social chatter.

Santiment data shows SPX’s “social dominance” at 0.913%, its highest in three months. This surge in mentions raises the probability of a hype-driven rally but also warns of potential exit strategies by early investors.

On the derivatives side, CoinGlass reports a 23.53% increase in Open Interest (OI) over 24 hours, pushing it to $148.84 million. The funding rate flipped positive at 0.0056%, indicating an influx of leveraged bullish bets.

AAVE Climbs as DeFi TVL Hits New High

Aave (AAVE) ticked up nearly 1% on Wednesday, building on a 3.45% gain from the day before. The token is inching toward the $300 psychological barrier, underpinned by robust activity in DeFi.

Aave’s total value locked (TVL) has climbed to a record $26.49 billion, according to DeFiLlama. Overall DeFi TVL stands at $116.79 billion, signaling widespread growth in the sector.

Despite the bullish price action and TVL spike, derivatives sentiment remains mixed. Technical trends lean bullish, with gradual momentum buildup suggesting a potential push past $300 in the near term.

Polygon (POL) Surges Ahead of Heimdall v2 Upgrade

Polygon’s native token POL rose by nearly 4% on Wednesday, trading close to $0.20, and has gained almost 9% so far this week.

The rally comes as anticipation builds for the Heimdall v2 upgrade scheduled for Thursday. This upgrade aims to reduce finality time, eliminate technical debt from earlier builds, and enhance security and user experience.

Polygon co-founder Sandeep Nailwal described Heimdall v2 as the most complex hard fork since the chain’s launch in 2020. The upgrade is expected to cut finality time to around five seconds and improve bridging safety, which could pave the way for further innovations.

Technical signals suggest that bullish momentum could continue post-upgrade, potentially attracting more investor interest.

The Day’s Takeaway

United States

- Stock market closed strong, led by tech, with Nvidia hitting a record-breaking $4 trillion valuation — the first company to ever reach that level.

- S&P 500: +0.6%

- Nasdaq: +0.9%

- Russell 2000: +1.0%

- Dow Jones: +0.5%

Homebuilders, Boeing, and Caterpillar were also top performers. Google and Amazon rebounded sharply, showing market resilience. After hours, Kellog (KLG) shares surged 50% on news of a $3 billion acquisition.

- Wholesale inventories fell 0.3% in May, matching estimates. Sales also dropped 0.3% month-over-month but were up 4.8% from May 2024. The inventory-to-sales ratio stayed at 1.30, the lowest since 2022.

- Atlanta Fed GDPNow held Q2 growth projection at 2.6%, signaling a steady but moderate expansion.

- Mortgage applications jumped 9.4% for the week ending July 4, aided by a slight dip in the 30-year fixed mortgage rate to 6.77%.

- U.S. Treasury sold $39 billion of 10-year notes at 4.362%, seeing strong domestic participation but weaker foreign demand.

- President Trump sharply criticized Fed policy, saying rates are “at least 3 points too high” and demanding Chair Powell’s “immediate resignation.” Upcoming inflation reports (CPI on July 15, PPI on July 16) will shape the Fed’s next moves.

- FOMC minutes showed some openness to a July rate cut, though most members expect a reduction later this year. Tariffs were cited as a potential inflation risk.

Canada

- Nissan suspended production of three models bound for Canada, citing new cross-border auto tariffs. The pause affects Pathfinder and Murano SUVs from Tennessee and Frontier pickups from Mississippi.

Commodities

- Gold rebounded above $3,300, supported by Trump’s announcement of new tariffs set to start August 1. Spot gold traded around $3,305, with resistance near the 50-day SMA ($3,321). Trump also hinted at possible 50% tariffs on copper and up to 200% on pharmaceuticals.

- U.S. crude oil inventories surged by 7.07 million barrels, against expectations for a 2 million barrel draw. Gasoline and distillate stocks fell, keeping middle distillate markets tight. WTI held above $67, supported by Red Sea attacks despite supply increases.

- Brent crude rose back above $70, buoyed by Middle East tensions and strong summer demand, despite bearish inventory data and new OPEC+ supply.

- Copper futures hit record highs, closing at $5.645/lb after Trump confirmed a 50% import tariff. The move shocked markets expecting 25%, widening the COMEX-LME price gap to over $2,000/ton.

- Gold ETFs recorded $38 billion in H1 inflows, the biggest since 2020, as investors piled into safe havens amid tariff and geopolitical uncertainty.

Europe

- European stocks rallied strongly, fueled by optimism over a potential U.S.-EU trade deal by week’s end.

- German DAX: +1.30% (new all-time high)

- France CAC: +1.44%

- UK FTSE 100: +0.14%

- Spain Ibex: +1.24%

- Italy FTSE MIB: +1.59% (four-week high)

EU officials aim to finalize a “framework” agreement maintaining 10% baseline tariffs, but including 17% on agrifood. The deadline for avoiding new tariffs is August 1.

Asia

- China’s June CPI rose 0.1% YoY, marking the first rise in five months. PPI fell 3.6%, the steepest drop since July 2023, highlighting persistent deflation pressures in manufacturing.

- RBNZ held rates at 3.25%, signaling possible cuts ahead if inflation continues easing. Members cited tariff-related risks to global growth.

- Japan’s BoJ official Koeda flagged unexpectedly strong food and rice inflation, but emphasized no rush for rate hikes due to overall price momentum still lacking.

- Economists expect the RBA to cut rates in August, lowering the cash rate to 3.60%, with additional easing likely by year-end.

Rest of World

- UBS warned that emerging market stocks are underpricing tariff risks, with stress tests suggesting EM earnings could fall 6–9% while current cuts to estimates remain limited.

Crypto

- Roswell, New Mexico, established the first U.S. city Bitcoin strategic reserve, targeting $1 million after an initial $3,000 donation. This follows Trump’s broader pro-crypto push, which has encouraged similar moves in multiple states.

- Solana rose above $154, boosted by institutional demand and strong flows into the new staking ETF (SSK), which recorded over $80 million in cumulative inflows by its second day.

- Shiba Inu futures open interest climbed above 7 million SHIB, signaling renewed speculative appetite, despite whale selling. SHIB gained over 5% this week, with bullish RSI readings and strong volumes.

- Aave’s TVL hit a record $26.49 billion, supporting price moves toward $300. Overall DeFi TVL reached $116.79 billion.

- Polygon (POL) gained nearly 4%, trading near $0.20 ahead of its Heimdall v2 upgrade aimed at improving network efficiency and security.

- SPX6900 meme coin climbed over 3%, approaching a potential ascending triangle breakout, with social dominance peaking at 0.913% and open interest up 23.5% to $148.8 million.