North America News

Dow and Small Caps Rally as Tech Names Get Hit

Market action on Tuesday saw a sharp rotation out of big tech and into Dow and small-cap names. Investors were rattled by stronger-than-expected JOLTs job openings data and started to factor in that a rate cut in July is unlikely.

Large-cap tech favorites were heavily sold:

- Nvidia: –2.69%

- Broadcom: –3.82%

- SuperMicro Computer: –3.14%

- AMD: –3.71%

- Meta: –2.42%

- Palantir: –4.27%

- Palo Alto Networks: –3.33%

Meanwhile, Dow components shined, with 15 stocks posting gains of at least 1.25%:

- UnitedHealth: +4.38%

- Amgen: +4.11%

- Sherwin-Williams: +3.73%

- Merck: +3.25%

- Nike: +3.19%

- Honeywell: +2.53%

- Johnson & Johnson: +2.02%

- McDonald’s: +1.97%

- Home Depot: +1.93%

- Chevron: +1.61%

- Coca-Cola: +1.38%

- 3M: +1.34%

- Apple: +1.39%

- American Express: +1.31%

- Procter & Gamble: +1.24%

Final index levels:

- Dow Jones: +400.29 points (+0.91%) at 44,495.06

- S&P 500: –6.90 points (–0.11%) at 6,198.05

- Nasdaq: –166.84 points (–0.82%) at 20,202.89

- Russell 2000: +20.43 points (+0.94%) at 2,195.46

The sharp move away from tech signaled profit-taking after recent record highs in the S&P and Nasdaq, while the shift into Dow and small caps suggested confidence in broader economic resilience.

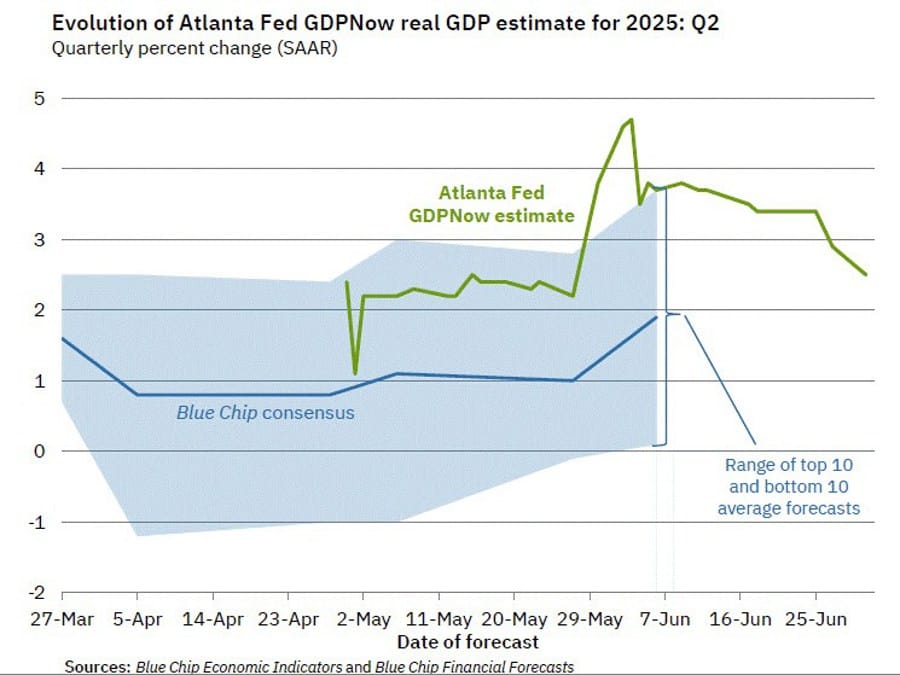

Atlanta Fed Lowers Q2 GDPNow Forecast to 2.5%

The Atlanta Fed’s GDPNow model cut its U.S. Q2 growth estimate to 2.5% as of July 1, down from 2.9% on June 27.

After new Census Bureau and ISM data, forecasts for personal consumption growth fell to 1.5% (from 1.7%), and private domestic investment dropped further to –11.9% (from –11.1%).

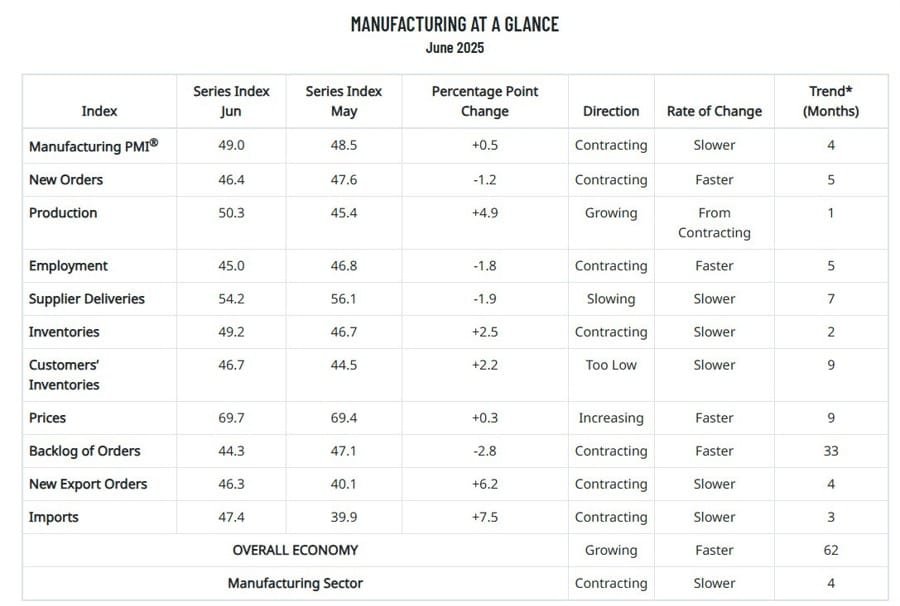

ISM Manufacturing PMI Rises to 49.0 in June

The ISM manufacturing PMI climbed to 49.0 in June, beating forecasts of 48.8 and improving from May’s 48.5.

Key breakdown:

- Prices paid: 69.7 (estimate: 69.0), prior: 69.4.

- Employment: 45.0 (estimate: 47.0).

- New orders: 46.4, down from 47.6 in May.

U.S. Job Openings Exceed Expectations at 7.77 Million

JOLTs data showed 7.769 million job openings in May, topping the 7.3 million forecast and up from April’s revised 7.391 million.

Other details:

- Quits rate: 2.1% (prior: 2.0%).

- Hires rate: 3.4% (prior: 3.5%).

- Layoffs rate: 1.0% (prior: 1.1%).

The report underscores a resilient labor market: fewer layoffs but more difficulty finding new hires. With tariff uncertainty easing and tax policy developments, the labor picture could strengthen further.

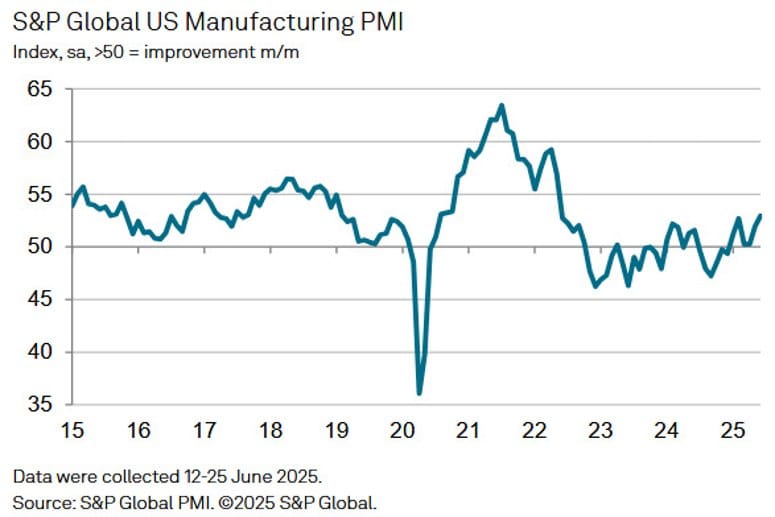

S&P Global Final Manufacturing PMI Jumps to 52.9

The final U.S. manufacturing PMI from S&P Global for June came in at 52.9, above the preliminary 52.0 and up from May’s 52.0.

Highlights:

- Strong output growth driven by sustained order book expansion.

- Tariffs pushed input and output costs higher.

- Business sentiment improved; employment growth hit its highest level since September 2022.

Chris Williamson, Chief Business Economist at S&P Global Market Intelligence

“June saw a welcome return to growth for US manufacturing production after three months of decline, with higher workloads driven by rising orders from both domestic and export customers. Reviving demand has also encouraged factories to take on additional staff at a rate not seen since September 2022.

“However, at least some of this improvement has been driven by inventory building, as factories and their customers in retail and wholesale markets have sought to safeguard against tariff-related price rises and possible supply issues. It therefore seems likely that we will get pay-back in the form of slower growth as we head into the second half of the year.

“These price pressures are already building, with factories reporting steep cost increases again in June, linked to tariffs, which they are passing through to customers. The big question of course is whether this merely results in a short-term change in the price level rather than a more worrying return of stubborn inflation.

“More encouragingly, business confidence has continued to improve from the low-point seen in April, with US manufacturers becoming more optimistic in the face of fewer trade and tariff worries compared to the heightened uncertainty seen in April, That said, many firms remain cautious as they await news of trade deals as the deadline for paused tariffs draws closer.”

U.S. Construction Spending Drops More Than Expected in May

U.S. construction spending fell by 0.3% in May, slightly worse than the expected 0.2% decline.

The prior month’s figure was revised up to a 0.2% drop from the initially reported 0.4% decrease.

Trump: He is not thinking about extending the July 9 deadline

- Doubt they will have a deal with Japan

Trump on the July 9th trade deal deadline:

- Not thinking about extending the deadline date

- Doubts that Japan will have a deal by that time.

- Tariffs in Japan could reach 30-35%]

- On the Fed Chair, they have 2-3 top choices for Fed Chair.

- They will probably have a deal with India

U.S. Senate Passes Major Tax Cuts and Spending Bill

The Senate approved a sweeping tax and spending package, with Vice President Vance casting the tie-breaking vote.

The bill now returns to the House of Representatives, where Republican lawmakers must reconcile differences to push it through. President Trump aims to have it on his desk by July 4.

White House CEA Chief Confident on EU Trade Deal

White House Council of Economic Advisers Chair Stephen Miran told CNBC he’s “optimistic” about finalizing a trade deal with the EU, calling this period “crunch time” for talks.

Miran also dismissed CBO deficit projections, arguing that stronger growth and increased tariff revenue would help offset fiscal concerns.

Trump Escalates Feud With Musk Over EV Policy

Trump fired back at Elon Musk, suggesting that “DOGE should take a good, hard look” at the billionaire and the massive subsidies his businesses receive.

Trump argued Musk has benefited from more subsidies than any other individual in history. Without them, Trump claimed, Musk would have to shut down operations, halt rocket launches and car production, and possibly “head back home to South Africa.”

He criticized the EV mandate again, emphasizing he never supported forcing consumers to buy electric vehicles. Meanwhile, Musk has continued attacking Trump’s “big, beautiful bill” and vowed to unseat lawmakers who support it, saying he would do so “if it is the last thing I do on this Earth.”

U.S. Eyes Smaller Trade Pacts Before July 9 Deadline

According to the Financial Times, citing insiders, Trump’s trade team has shifted strategy and is now chasing narrower, “agreements in principle” on select disputes with certain countries, hoping to finalize them by July 9.

This marks a sharp pivot away from the earlier bold goal of “90 deals in 90 days.” So far, the only concrete outcome is a partial agreement with the UK — and even that faces complications, with new sectoral tariffs from the U.S. stalling talks.

Countries managing to secure these streamlined deals could avoid immediate retaliatory tariffs. However, a blanket 10% tariff still looms as a floor.

Looking forward, Trump reportedly plans further tariffs targeting critical sectors such as aerospace parts, pharmaceuticals, semiconductors, lumber, copper, and vital minerals. The Commerce Department has already begun investigations, signaling these moves will shape future trade negotiations.

The full report here (may be gated).

US Treasury Secretary Bessent: We are moving toward a vote today on big beautiful bill

- US Treasury Secretary Bessent in a Fox News interview

- We are moving toward a vote today on big beautiful bill.

- This is a deal for working people.

- We want sequencing here, bill this week, talk about trade deals next week.

- We are very close with India.

- The tax bill ‘more than pays for itself’.

- We could be in surplus with the tax bill.

- Don’t agree with Musk on deficit.

- Admire Musk on rockets, I’ll take care of finances.

- Trade deals are next week’s agenda.

- I think we’ll get Senate approval of bill this afternoon.

BlackRock Sees Investors Shifting Away from U.S. Assets

BlackRock observed a gradual move by global investors to diversify out of U.S. assets, despite seeing the U.S. as a long-term innovation leader.

Earlier this year, foreign holdings of U.S. investments were at record highs, but recent data shows a shift underway.

Rick Rieder, the firm’s CIO for global fixed income, described this as a steady reallocation driven by global macro trends and policies such as tariff measures introduced during Trump’s term.

This trend is particularly visible in wealth and asset management sectors.

Commodities News

Gold Advances as Traders React to Mixed U.S. Signals

Gold prices climbed over 1% on Tuesday, hitting a four-day high around $3,340, as the dollar rebounded after touching a three-year low.

While the U.S. Senate passed a $4.5 trillion tax cut package (51–50 vote, with VP JD Vance breaking the tie), bullion traders largely ignored the fiscal headlines.

Stronger-than-expected JOLTs data (7.769 million openings) and a better ISM manufacturing reading (49.0 vs. 48.8 expected) supported Fed Chair Jerome Powell’s cautious approach.

Powell reiterated that monetary policy is “modestly restrictive,” and hinted that rate cuts are not imminent — especially due to Trump’s tariffs.

Looking ahead:

- ADP jobs data expected to rise to 85,000 from 37,000.

- June nonfarm payrolls forecast at 110,000 (down from May’s 139,000).

Citi expects gold prices to eventually move into the $2,500–$2,700 range by the second half of 2026.

Traders are currently pricing in around 62 basis points of rate cuts by year-end, reflecting ongoing caution.

Private Oil Inventory Survey Shows Surprise Build in Crude

A private survey ahead of official U.S. inventory data showed an unexpected crude build, contrasting with expectations for a draw.

Key figures (API survey):

- Crude oil: +680,000 barrels (expected: –2.26 million)

- Gasoline: +1.92 million barrels

- Distillates: –3.458 million barrels

- Cushing: –1.417 million barrels

- Strategic Petroleum Reserve (SPR): +300,000 barrels

The unexpected rise in crude stocks could weigh on near-term oil price sentiment, especially given recent concerns about oversupply.

Crude Oil Futures End Higher at $65.45

U.S. crude oil futures settled at $65.45 on Tuesday, up $0.34 or 0.52%.

Prices stayed within the range of $64 to $66.33 that has held since June 24.

The 100-hour moving average, currently around $65.25, was slightly surpassed, suggesting a mild bullish tilt in the near term.

Brent Crude Under Pressure After Failing 200-DMA Test

Brent crude’s inability to hold above its 200-day moving average has strengthened bearish signals, Société Générale analysts said.

Prices briefly rallied last month, peaking around $81.40, but quickly lost momentum after breaking below the key moving average at $72.

The next downside levels to watch: June lows near $63.30–$63.00, and a further drop to $58.40 remains on the radar.

Short-term resistance now sits at $69 and $72, which Brent needs to clear decisively to regain upward traction.

U.S. Oil Reserve Refill Postponed, Leaving Shale Without Support

Trump’s push to rapidly restock the U.S. Strategic Petroleum Reserve (SPR) has hit a snag, according to Commerzbank’s Carsten Fritsch.

Maintenance at storage sites has delayed deliveries, and only 8.8 million barrels out of the 15.8 million barrels purchased from January to May have arrived so far.

The Department of Energy stated that deliveries already secured will be rescheduled through the end of the year.

Fritsch noted that this setback deprives the U.S. shale industry of critical demand support. Combined with subdued oil prices, this makes an immediate rebound in drilling activity unlikely.

Weak Oil Prices Stall U.S. Shale Drilling

U.S. crude production reached a record 13.47 million barrels per day in April, according to the EIA, but momentum may be fading, says Commerzbank’s Fritsch.

The active U.S. oil rig count dropped by six last week to 432, the lowest level since October 2021. Since April, the count has fallen by over 9%, or more than 40 rigs.

Lower prices have played a major role. A Dallas Fed survey in March indicated shale producers need WTI at about $65 per barrel to break even on new wells. Prices hovered below this level for much of April to mid-June.

WTI briefly surged above $75 during the Israel-Iran conflict but fell back to around $65, supporting OPEC+’s strategy to squeeze U.S. shale. Trump’s “Drill, baby, drill!” mantra seems to be facing tough market realities.

China’s Gold Market Expands as Imports Surge

China imported 48.1 tons of gold from Hong Kong in May, up from 43.4 tons in April, according to Hong Kong trade data.

China had been a net exporter (36 tons) to Hong Kong in early 2025, highlighting the shift to strong domestic demand — largely driven by safe-haven buying amid tariff fears.

China plans to grow exploitable gold resources by 5–10% by 2027 and raise production by over 5% within two years.

Two new yuan-denominated gold contracts began trading on the Shanghai Gold Exchange in Hong Kong last week, with options for physical delivery and vault storage. These moves aim to attract more global investors and support rising ETF demand.

Gold Prices Climb Again Ahead of U.S. Jobs Data

Gold prices have resumed rising, according to Commerzbank’s Thu Lan Nguyen.

Drivers include:

- Rising bets on U.S. interest rate cuts.

- Fiscal concerns tied to the massive tax and spending package moving through Congress.

Analysts warn the Senate version could push U.S. debt even higher than initially projected.

Upcoming U.S. labor market data on Friday will be crucial. A strong jobs report could temper rate cut expectations and act as a headwind for gold.

OPEC+ Expected to Boost Output Again in August

Eight OPEC+ countries that had implemented voluntary cuts are set to lift production by 411,000 barrels per day starting in August, per Commerzbank’s Fritsch citing Bloomberg and Reuters sources.

Kazakhstan reportedly exceeded its June quota, and Russia, initially hesitant, appears supportive this time.

President Putin emphasized stronger seasonal demand, and Deputy PM Novak confirmed additional supply discussions at the July 6 meeting.

This would mark the fourth incremental increase since April, totaling about 1.8 million barrels per day. However, once summer demand fades, the added barrels could flood the market, putting downward pressure on prices.

TDS: Gold’s Move Driven by Trust, Not Just Demand

TD Securities’ Daniel Ghali said gold’s recent price swings aren’t just about demand but rather “trust.”

Highlights from his analysis:

- Fast-money shorts set the stage for a possible surge.

- Western investors may be underestimating coming catalysts: potential Treasury QE, trade friction, further rate cuts, stagflation risks, and doubts about central banks.

- Shanghai premiums suggest dip-buying has already resumed in Asia.

Ghali argued we’re witnessing a structural monetary shift similar to the 1970s, with gold’s behavior reflecting broader trust dynamics rather than immediate consumption needs.

Trump: U.S. SPR Refill Depends on Oil Price

President Trump signaled the U.S. would refill the Strategic Petroleum Reserve (SPR) “when the price is right.”

On Tuesday, crude oil rose $0.56 (0.86%) to $65.67 per barrel, trading between $64 and $66.33. The 100-hour moving average currently stands at $65.24.

Morgan Stanley Predicts Brent Oil to Drop to $60

Morgan Stanley expects Brent crude to slide to $60 per barrel by early 2026.

The forecast reflects easing geopolitical tensions, especially between Israel and Iran, and an ample supply outlook.

The bank sees non-OPEC supply expanding by around 1 million barrels per day in both 2025 and 2026, keeping up with demand.

Additionally, Morgan Stanley anticipates a global oil surplus of about 1.3 million barrels per day in 2026.

Europe News

European Markets End Mostly Lower; FTSE 100 Gains

European stock indices largely finished in the red on Tuesday, with the UK FTSE 100 bucking the trend.

Closing snapshot:

- Germany’s DAX: –0.80% (worst performer).

- France’s CAC 40: –0.04%.

- UK FTSE 100: +0.28% (only gainer).

- Spain’s Ibex: –0.03%.

- Italy’s FTSE MIB: –0.58%.

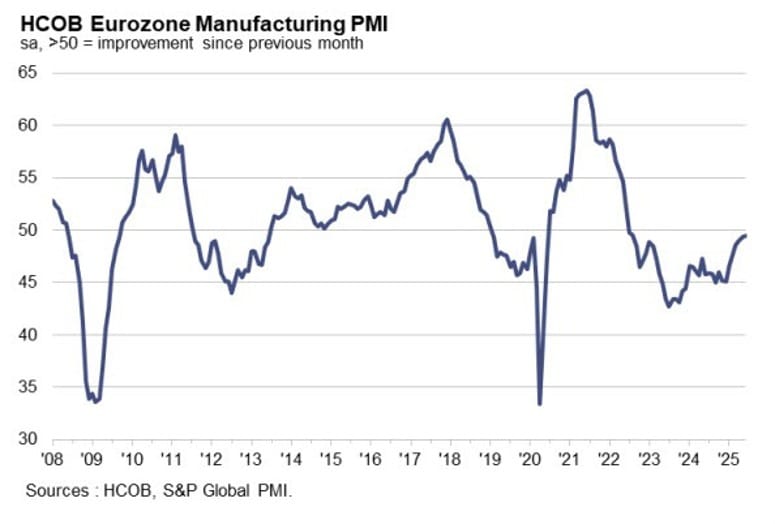

Eurozone June Manufacturing PMI Final at 49.5

The eurozone’s final June manufacturing PMI came in at 49.5, slightly above the 49.4 preliminary estimate and up from May.

Although still below the 50 threshold, the data suggest some stabilization in the sector. Germany’s rising business sentiment was a standout, though the durability of this momentum remains uncertain for the second half of the year.

HCOB notes that:

“There are signs of some stabilization in the manufacturing sector. Companies have now expanded production slightly for the fourth month in a row, order intake has ceased to fall, and slightly longer delivery times also indicate that demand is picking up a bit. Against the backdrop of numerous uncertainties – US tariffs, the crisis in the Middle East, and Russia’s ongoing war against Ukraine – this can certainly be seen as a sign of resilience. However, it also has to do with the fact that, after years of recession, the economic cycle usually turns at some point because old machines need to be replaced, cars can no longer be repaired, and the necessary modernization of factory buildings can’t be postponed any further.

“Encouragingly, four of the eight eurozone countries where the PMI survey is conducted are now in expansion territory. Germany is not one of them, but the situation here has nevertheless improved somewhat. However, France, Italy, and Austria are putting the brakes on the eurozone’s growth, as their downturn has recently deepened. If Germany enters the growth zone, which we believe is likely given the new government’s growth package, among other things, these countries could receive a positive boost, as Germany is their most important export destination.

“A relatively high degree of optimism can be observed among manufacturers. In June, this indicator rose to its highest level since February 2022. This improved sentiment is partly due to Germany, where expectations of producing more in one year than today have risen to a 40-month high. The mood has also improved in Spain, while confidence has declined somewhat in France and Italy. This is in line with the general environment, as there is growth in Spain, while the manufacturing sector is shrinking in France and Italy.”

Eurozone Inflation Holds at 2.0% in June

Eurozone headline inflation was steady at 2.0% year-on-year in June, matching expectations and up slightly from May’s 1.9%.

Core inflation remained at 2.4%, unchanged and in line with forecasts.

These figures are unlikely to alter the ECB’s current stance, with policymakers expected to keep rates steady through the summer.

Germany’s June Manufacturing PMI at 49.0

Germany’s final June manufacturing PMI came in at 49.0, matching the preliminary reading and improving from May’s 48.3.

A notable point: business expectations hit their highest level since February 2022, hinting at potential stabilization ahead despite current challenges.

Commenting on the PMI data, Dr. Cyrus de la Rubia, Chief Economist at Hamburg Commercial Bank, said:

“Signs of a recovery, albeit a somewhat sluggish one, are increasing. Production rose for the fourth month in a row, especially in the capital goods sector in June, and order intakes have also picked up recently. The strength of the recovery is somewhat called into question by the accelerated pace of job cuts and the steeper reduction in inventories of raw materials and intermediate goods. The latter, however, may be the result of companies underestimating demand and therefore having to draw more than usual on existing stocks of inputs for production. Overall, the headline PMI is pointing upward and is on the verge of crossing into expansion territory.

“It is encouraging that new orders have risen three times in the past four months. In June, impulses came from both abroad and domestically. It is therefore not only the pull-forward effects of US importers seeking to pre-empt higher tariffs that are providing some tailwinds for German industry, but also domestic demand, which is gradually showing signs of life again.

“Purchasing prices have been falling month after month for around two-and-a-half years. However, competition has ensured that customers of German manufacturers have also been benefiting from lower prices for most of the past two years. The discounting appears to be somewhat less pronounced in sales prices, however, which suggests that profit margins in industry have risen.

“The manufacturing sector is looking to the future with a great deal of confidence. While the mood in autumn last year was very subdued, a large number of companies now consider it likely that production will increase over the next twelve months. There is clearly some hope here that the new government will soon deliver on its promises to stimulate the economy.”

German Unemployment Up by 11,000 in June

Germany recorded an increase of 11,000 unemployed persons in June, below the expected 15,000 rise.

The jobless rate held steady at 6.3%, matching May’s level and beating the 6.4% forecast.

In seasonally adjusted terms, total unemployed stood at 2.97 million, inching closer to 3 million — a milestone not reached in nearly a decade.

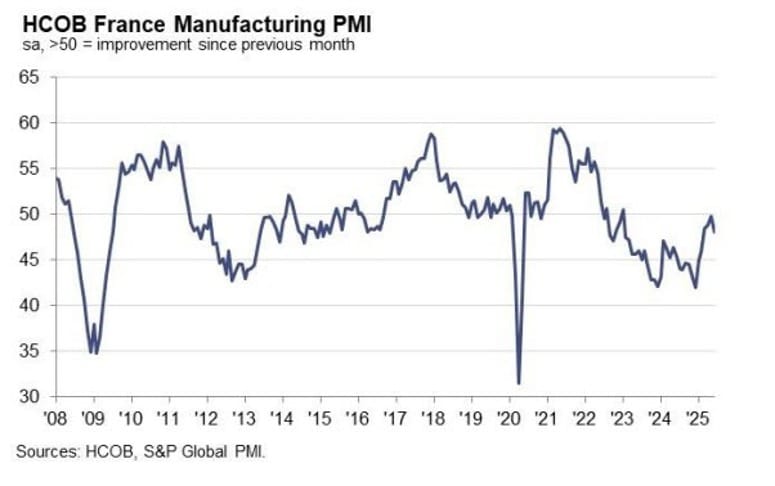

France’s Manufacturing PMI Revised Up to 48.1

France’s final June manufacturing PMI was adjusted slightly higher to 48.1, above the initial 47.8 estimate but below May’s 49.8.

The reading still points to a renewed contraction in the sector at the end of Q2. Weaker demand and persistent declines in new orders remain the core issues.

HCOB notes that:

“Over the course of 2025, the headline HCOB PMI for France’s manufacturing sector had shown a marked improvement, edging closer to the expansion threshold by May. However, this positive momentum came to a halt in June, with the headline manufacturing index declining for the first time this year. The deterioration can largely be attributed to two key subcomponents. First, output contracted again after two consecutive months of modest growth, with several panellists citing persistent weakness in the automotive sector as a contributing factor. Second, domestic demand—which had exhibited a clear recovery trend since the beginning of the year—saw a notable loss of momentum in June. As a result, the fragile recovery path of French manufacturing has suffered a significant setback. The key question now is whether this represents a temporary correction or the premature end of a hard-won rebound.

“Looking ahead, there are still reasons for cautious optimism. Despite the decline in the headline index, future output expectations continued to improve in June, extending their upward trajectory. This optimism likely reflects a combination of factors: the European Central Bank’s recent monetary easing, planned increases in defence-related investment, and EUlevel initiatives aimed at reducing regulatory burdens. Labour market dynamics, however, remain subdued. The employment subindex has hovered around the neutral 50 mark for the fourth consecutive month, suggesting stagnation in industrial hiring activity.

“Price developments present a mixed picture. Output prices declined marginally for the fourth month in a row, likely reflecting ongoing competitive pressures. At the same time, input prices remained above the growth threshold, indicating continued cost increases. This divergence is placing further pressure on firms’ profit margins.”

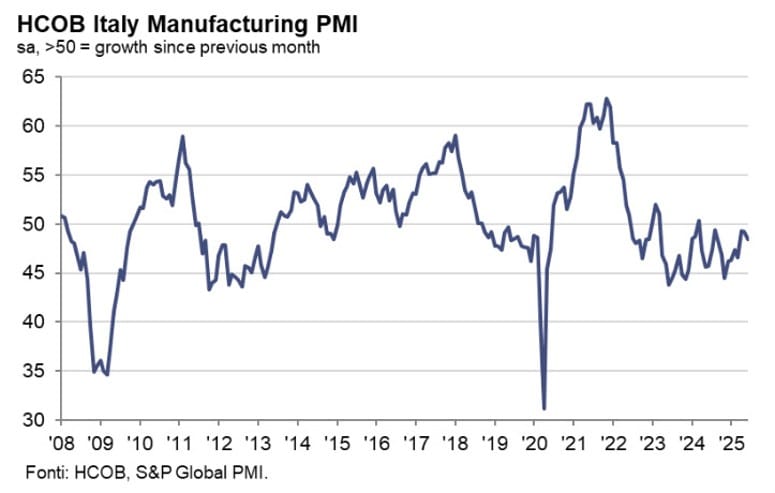

Italy’s Manufacturing PMI Falls to 48.4

Italy’s June manufacturing PMI fell to 48.4, missing the expected 49.5 and slipping from May’s 49.2.

Production declined again as new orders contracted further. Inflationary pressures eased, but businesses continued cutting jobs and confidence weakened.

Commenting on the PMI data, Nils Müller, Junior Economist at Hamburg Commercial Bank, said:

“Italy’s manufacturing sector lost ground in June, with the headline PMI falling to 48.4, marking the sharpest deterioration in operating conditions since March. After a brief recovery in May, output contracted once more, dragged down by a solid decline in new orders. Both domestic and foreign demand remained subdued, with firms citing persistent difficulties in securing new clients and waning appetite in key export markets.

“The downturn was broad-based across the PMI components. New orders fell at the fastest pace in three months, prompting firms to scale back production and purchasing activity. Employment continued to decline, though at a slower rate, largely due to non-replacement of voluntary leavers and reduced reliance on temporary staff. Stocks of purchases were drawn down at the quickest pace since March, while supplier delivery times lengthened amid logistical bottlenecks – an unwelcome development given softer input demand.

“Encouragingly, inflationary pressures continued to ease. Input costs fell for a second consecutive month, helped by lower raw material prices and supplier discounts. Output charges also declined fractionally, as firms sought to remain competitive in a weak demand environment. This disinflationary trend aligns with broader eurozone dynamics and may offer some relief to policymakers at the ECB.

“Yet, the outlook remains clouded. While firms remain broadly optimistic about future output – supported by hopes of stronger demand and planned investment – confidence slipped to its lowest since last November. This softening in sentiment reflects fragile customer demand and a challenging external environment as trade uncertainty stemming from U.S. policy shifts continues to weigh on the global outlook. However, the easing of geopolitical tensions, particularly in the Middle East, could raise the prospect for sustained lower energy prices. But for now, Italy’s manufacturers remain in a defensive posture, navigating a recovery that remains elusive.”

Spanish Manufacturing PMI Hits 51.4 in June

Spain’s manufacturing PMI climbed to 51.4 in June, outperforming the forecast of 50.5 and improving from May’s 50.5.

This is the highest reading so far this year, signaling moderate growth in output and a return of new orders — the first increase since January. HCOB notes that:

“June brought slight improvements in Spain’s manufacturing sector, as indicated by the HCOB headline PMI. Throughout the year, the sector has hovered around the 50-point threshold, suggesting a lack of clear direction following a strong performance in 2024. The recent uptick may mark the early stages of a potential recovery, though sustained momentum in the coming months will be crucial to confirm a more durable trend.

“Looking ahead, several factors could support the sector: interest rate cuts by the ECB, planned EU-level efforts to reduce regulatory burdens – particularly benefiting the automotive industry – and new NATO spending targets calling for defence budgets to rise to 5% of GDP by 2035. Spain, however, has secured an exemption: as long as it can meet the required military capabilities with fewer resources, it will not be held to the full spending target. Nonetheless, external risks remain. U.S. trade policy and its indirect effects could weigh on Spain’s export outlook. Nevertheless, sentiment among industrial firms has improved. The subindex for future output rose again in June and now exceeds its historical average.

“The nascent recovery in Spain’s manufacturing sector is currently being driven by a stronger order book and increased production activity. To meet rising production needs, firms have increasingly drawn on existing inventories. However, caution persists in the procurement of inputs, suggesting that the recovery has yet to gain sufficient breadth and depth to trigger a broader investment cycle.

“On the pricing side, the downward trend continues. Input prices have declined, largely due to the stronger euro, which has made imports more affordable and eased cost pressures. Should the Middle East conflict escalate further, rising oil prices could reverse this trend and exert upward pressure on input costs. For now, falling input prices are feeding through to output prices. Firms report declining sales prices, citing competitive pressures as a key driver.”

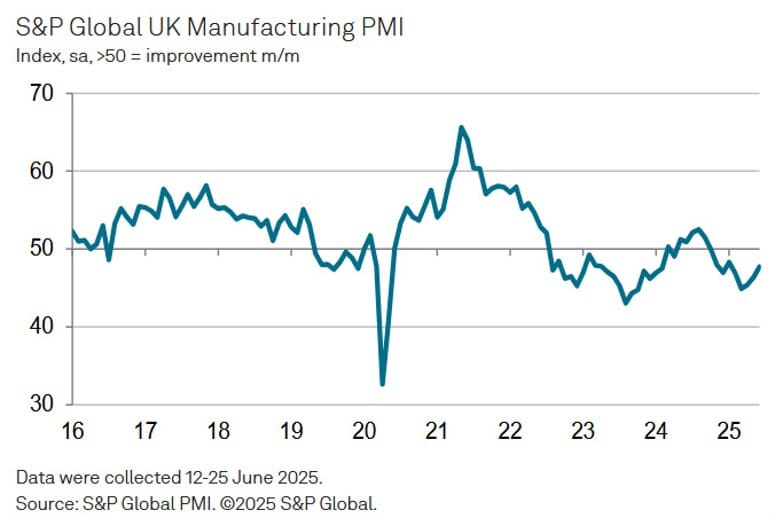

UK June Manufacturing PMI Steady at 47.7

The UK’s final manufacturing PMI for June was confirmed at 47.7, in line with the preliminary figure and an improvement from May’s 46.4.

Output, new orders, and employment all continued to decline, but at slower rates. Business optimism rose to its highest in four months, hinting at potential recovery hopes.

Rob Dobson, Director at S&P Global Market Intelligence

“Although the downturn in UK manufacturing continued in June, the latest PMI survey provides signs of conditions stabilising. Production, new orders and employment all fell at slower rates, while business optimism picked up to a four-month high. The orders-to-inventory ratio, a reliable bellwether of future production trends, also climbed sharply to its highest since August 2024. Inflation of both input costs and selling prices meanwhile nudged lower to hint at a softening inflation trend.

“That said, any hoped for stabilisation remains fragile and subject to potential headwinds that could severely impact demand, supply chain reliability and future growth prospects, as manufacturers continue to caution their optimism with concerns about heightened geopolitical tensions, weak global markets, tariff uncertainties and fears over the direction of future government policy.”

UK House Prices Drop 0.8% in June

Nationwide reported a 0.8% fall in UK house prices for June, against an expected 0.2% gain.

This follows a revised 0.4% increase in May (originally +0.5%). The decline reflects softer demand after the April stamp duty hike.

Nationwide remains cautiously positive on the outlook, anticipating some rebound as summer progresses, though economic uncertainty lingers.

UK Shop Prices Rise for First Time in Nearly a Year

The British Retail Consortium reported a 0.4% year-on-year increase in UK shop prices for June, reversing a slight decline in May.

Food prices surged 3.7% — the sharpest jump since March 2024 — driven by higher wholesale and labor costs, particularly for fresh meat and produce.

Analysts warn that further consumer spending slowdowns could complicate inflation dynamics moving into late 2025.

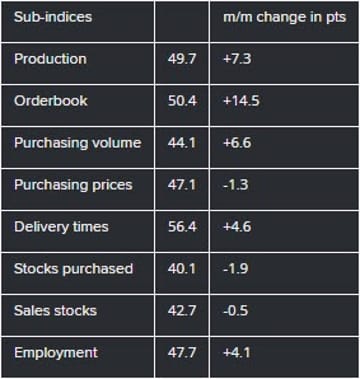

Swiss Manufacturing PMI Recovers to 49.6

Switzerland’s manufacturing PMI rose to 49.6 in June, beating expectations of 44.0 and jumping from May’s 42.1.

The rebound was driven by stronger output and new orders. However, optimism remains fragile, with 60% of surveyed firms expecting more protectionist policies in the coming year. Here’s the detailed breakdown of the report:

Swiss Retail Sales Flat in May

Switzerland’s retail sales were unchanged in May compared to a year earlier, according to data from the Federal Statistics Office.

This follows a revised 0.9% annual rise in April (initially reported as +1.3%). The trend aligns with the typical seasonal pattern and doesn’t signal any major shift in consumer spending.

BoE’s Bailey: Have to watch for inflation persistence

- Comments from the BoE Governor

- We have to watch very carefully for consequences of inflation.

- Labour market is softening.

- Path of interest rates will continue to be gradually downwards.

- A major change is needed for upturn in productivity.

- Next big tech change should help productivity.

- We’ve seen a steepening of the long term bond yield curve.

- I don’t think there’s anything unusual about the UK in terms of the yield curve.

- There will be no sustained growth without stable low inflation.

- I don’t believe that QT is causing steepening of the yield curve.

- Yield curve steepening partly as a responce to high level of uncertainty in global economy.

- I don’t think investors are concerned about viability of UK debt stock.

- Internationally there is an increase in uncertainty.

- Increase in uncertainty is coming through in terms of economic activity and growth.

- Businesses tell me they are putting off investment decisions.

ECB’s Muller: It makes sense for ECB interest rates to stay on hold for a while

- Comments from the ECB policymaker

- It makes sense for ECB interest rates to stay on hold for a while.

- No need to change rates in July; it’s not obvious that rates should be much lower even further out.

- Euro’s appreciation is quick but not particularly concerning for now.

ECB’s Vujcic: Face possibility of new inflation shocks

- Comments from the ECB policymaker to CNBC

- Face possibility of new inflation shocks.

- Higher defence spending will contribute somewhat to inflation pressures.

ECB’s Kazaks: Any further rate adjustments will be nothing big

- Comments from the ECB policymaker

- Any further rate adjustments will be nothing big.

- More big Euro gains could boost case for another cut.

- Any further rate cut would be small.

- 10% tariff and 10%+ euro appreciation large enough to hurt exports.

ECB’s Escriva: Symmetric 2% goal should remain ECB’s primary guide

- Comments from the ECB policymaker

- Symmetric 2% goal should remain ECB’s primary guide.

- New times call for vigorous policies at key moments.

- New times call for patience in temporary events.

ECB’s de Guindos: Possibility of undershooting 2% target is quite limited

- Remarks by ECB vice president, Luis de Guindos

- Growth in Q2, Q3 will be close to zero

- EUR/USD at 1.17 is perfectly acceptable

- Even 1.20 is something we can overlook, but anything more than that will be ‘complicated’

- An additional rate cut is not going to help the economy to improve

- We need certainty

ECB’s Lane: ECB must stand ready to counter any deviation in CPI

- Comments from the ECB policymaker

- This is going to be a lively 5 years.

- 10% tariffs are part of ECB baseline.

- Looks like inflation is around the target.

ECB’s Nagel: Policy is now in neutral zone

- Remarks by ECB hawk, Joachim Nagel

- Inflation is currently in a stable phase

- But ECB cannot relax too much about rising inflation

SNB’s Zanetti: Negative interest rates are an option

- Comments from the SNB policymaker

- Negative interest rates are an option.

- We have all the required instruments, even with zero interest rates.

Asia-Pacific & World News

Central Bank Chiefs Speak at ECB Forum in Portugal

At the Sintra forum:

ECB President Christine Lagarde confirmed euro area inflation at 2%, but stressed continued caution and a data-driven, meeting-by-meeting approach. She highlighted the slow evolution of the U.S. dollar’s global role and expressed alarm about truth distortion in the digital age due to AI.

Fed Chair Jerome Powell described the U.S. economy as solid, with tariffs expected to push summer inflation readings higher. He hinted that without tariff-related risks, rate cuts might already have happened and didn’t rule out a cut in July. Powell called the U.S. debt trajectory unsustainable and urged future Fed leaders to stay apolitical.

BoK Governor Rhee Chang-yong noted tariffs may have a deflationary effect in Korea.

BoE Governor Andrew Bailey warned of lingering inflation and possible second-round effects, while noting labor market softness. He sees rates staying restrictive but trending toward neutral over time.

BoJ Governor Kazuo Ueda said headline inflation remains above 2%, but underlying inflation is still below target. Future rate hikes will hinge on wage trends and inflation dynamics.

Tesla Raises Model 3 Long Range Price in China

Tesla has increased the price of its Model 3 long range variant in China to 285,000 yuan, reflecting ongoing adjustments to its pricing strategy in the region.

China’s Caixin June Manufacturing PMI Jumps to 50.4

China’s Caixin manufacturing PMI for June landed at 50.4, beating forecasts (49.0) and sharply up from May’s 48.3. The reading marks a return to expansion and indicates growth in eight of the last nine months.

Domestic production and new orders rebounded as firms pushed sales and adjusted to improved local trade conditions. However, external demand stayed weak, with export orders dropping for a third month, pressured by U.S. tariffs targeting consumer goods.

Employment contracted further, especially in consumer goods, as firms cut costs. Input and output prices dropped, with selling prices declining at their fastest rate in five months due to intense competition.

Supply chain delays persisted, and purchasing activity fell, particularly in consumer-focused sectors. Despite a slight drop in business confidence, firms remained cautiously optimistic about future output.

Overall, while domestic momentum improved, headwinds from global trade and pricing pressures remain significant.

Hong Kong Markets Closed for SAR Establishment Day

Today marks Hong Kong Special Administrative Region Establishment Day, commemorating the 1997 handover of sovereignty from Britain to China. Financial markets in Hong Kong are shut for the holiday.

PBOC sets USD/ CNY central rate at 7.1534 (vs. estimate at 7.1509)

- PBOC CNY reference rate setting for the trading session ahead.

PBOC injected 131bn yuan via 7-day reverse repos at 1.40%

- 406.5bn yuan mature today

- net drain is 275.5bn yuan

Australia’s June Manufacturing PMI Slips to 50.6

Australia’s final manufacturing PMI for June came in at 50.6, down from May’s 51.0 and below the flash estimate.

June marked the third consecutive month of slowing growth in the manufacturing sector. New orders dropped again, weighing on output at the month’s end. The Future Output Index also fell, suggesting softer expansion ahead.

New export orders showed continued weakness, with a significant drop in overseas demand.

On the pricing side, margin pressures were evident, but easing selling price inflation could help boost sales and support a potential rate cut later in 2025.

New Zealand Building Permits Jump 10.4% in May

Building permits in New Zealand rose 10.4% month-on-month in May, following a revised April drop of 14.6%.

Year-on-year, permits were down slightly at -0.8%, suggesting that while immediate activity picked up, broader trends remain mixed.

BNZ Withdraws Forecast for July RBNZ Rate Cut

Following the latest QSBO data, BNZ no longer expects the Reserve Bank of New Zealand to cut rates at its July 9 meeting.

Previously, BNZ had projected a 25 basis point cut but acknowledged that probability was falling. The shift in view aligns with market pricing, which now suggests about a 75% chance the central bank will keep rates steady.

New Zealand Business Confidence Improves in Q2

The NZIER Quarterly Survey of Business Opinion showed business confidence at 22% in Q2 2025, up from 19% previously.

A seasonally adjusted net 27% of firms expect better economic conditions in coming months, up from 23% in Q1.

However, many firms reported weak current demand, with a net 23% noting a drop in trading activity. Yet, looking ahead, a net 18% expect demand to improve next quarter, highlighting a clear divide between current challenges and future optimism.

BoJ’s Masu: Don’t have any strong disagreement that underlying inflation still short of 2%

- He’s the new BoJ board member

- Want to scrutinise how prices move after recent spike in price of rice moderates.

- Want to hear from BoJ staff, see data for policy.

- We need to monitor government’s trade talks with US.

- Automobiles are mainstay of Japan’s export to US so should not have any pre-set idea on impact on Japan’s economy until trade talks with US are resolved.

- Recent economic conditions suggest we’re not in a state where BoJ can rush into raising interest rates and must move cautiously with close eye on various data.

- BoJ must unload its huge ETF holdings at some point.

- Given huge market impact on stock market, BoJ must move very cautiously in unwinding ETF holdings.

- When asked whether he would brand himself as hawkish or dovish on monetary policy “I probably stand right in the middle, have no strong view”.

Japan to Start Seabed Rare Earth Mining in 2025

Japan plans to kick off rare earth element extraction from the seabed near Minami-Torishima Island starting fiscal 2025, with actual operations set for January 2026.

The project was delayed from its original 2024 timeline due to a late equipment delivery.

This initiative aims to diversify Japan’s supply of critical minerals — including cobalt and nickel — and reduce reliance on China, which currently dominates the rare earth supply chain.

Japan’s BOJ Tankan Survey Shows Stronger Manufacturer Confidence

The Bank of Japan’s June Tankan survey showed the large manufacturer index at +13, ahead of the forecasted +10 — the best reading since December last year.

For September, the large manufacturer outlook sits at +12 (forecast +9).

Large non-manufacturers came in at +34 as expected but marked the lowest since December. The outlook for September dipped slightly to +27 (forecast +29).

Small manufacturers posted +1 (forecast -1), with a September outlook at -2. Small non-manufacturers recorded +15 (matching forecast), with a stable outlook of +9.

Currency assumptions for FY2025/26 are ¥145.72 for USD and ¥157.79 for the euro.

Other highlights:

- Employment index: -35.

- Financial conditions index: +11 (up from March’s +10).

- Production capacity index: +2 (vs March’s +3).

- Recurring profits expected to decline 8.4% for large manufacturers.

- Capex plans: +11.5% for large firms (forecast +10.0%), -5.6% for small firms (forecast -7.2%).

On inflation, firms expect consumer prices to rise 2.4% over one, three, and five years.

The survey reflects resilience among big manufacturers but softer sentiment in services, highlighting persistent worries over costs and future conditions.

Japan’s June Final Manufacturing PMI at 50.1

Japan’s final manufacturing PMI for June settled at 50.1, slightly below the preliminary 50.4 but up from May’s 49.4. This marks the first expansion in over a year.

New orders fell for the 25th straight month, with export orders still struggling amid uncertainty tied to U.S. tariffs, especially in the semiconductor and automotive sectors.

Despite this, manufacturers raised their expectations for future output to a five-month high and continued hiring for the seventh month running.

Cost pressures persisted, with both input and output prices rising on the back of higher raw materials, energy, and labor costs.

Japan Stands Firm on Protecting Agriculture in U.S. Trade Talks

Chief Cabinet Secretary Hayashi stressed Japan’s commitment to shielding its agricultural sector during negotiations with the U.S. Agriculture Minister Koizumi also reaffirmed this position, stating they will work with other ministries to secure Japan’s national interests. Economic Minister Akazawa declined to confirm whether rice is included in tariff discussions, emphasizing talks are still ongoing.

BOJ official: No clear voices from firms citing impact of U.S. trade policy on capex plans

- Bank of Japan official after the Tankan report

- Some automakers mentioned impact of U.S. trade policy, though others cited improvement in profits due to pass-through of costs

- No clear voices from firms citing impact of U.S. trade policy on capex plans

Crypto Market Pulse

Bitwise Sticks to $200K Bitcoin Target; Altcoins Show Weakness

Bitwise remains firm on its prediction that Bitcoin will hit $200,000 by the end of 2025, even as altcoins like Ethereum and Solana continue to lag.

Bitcoin touched an all-time high of $112,000 in May, fueling Bitwise’s optimism. Executives Matt Hougan and Ryan Rasmussen noted strong ETF inflows and growing institutional interest as key drivers.

U.S. spot Bitcoin ETFs attracted nearly $13 billion in the first half of the year, with expectations to surpass the $35 billion inflow record from 2024.

Ethereum and Solana, while showing subdued momentum, could still rally in the second half thanks to progress on crypto legislation and new treasury allocations focused on altcoins.

The stablecoin sector also expanded, with assets under management hitting $260 billion — up 30% since the start of 2025 — though still shy of the $400 billion target.

A potential catalyst: the GENIUS Act, a new stablecoin bill that passed the U.S. Senate and aims to clarify regulations. If signed, it could spur further institutional investment.

Strategy’s Preferred Shares Surge Ahead of S&P 500 Inclusion Hopes

Strategy (MSTR) perpetual preferred shares are rallying as speculation builds over its potential S&P 500 entry.

Bitcoin’s record June close at $107,750 boosted Strategy’s Q2 earnings to an estimated $11 billion, pushing EPS to roughly $39.50 — enough to clear the final earnings hurdle for S&P 500 eligibility.

On Monday, MSTR stock jumped 5% to over $400. The preferred shares outperformed: STRK rose 15%, STRF gained 7.5%, and STRD added 3%.

STRK now trades at $121 with a 6.6% yield, having returned 42% since launch in February. STRF offers an 8.8% yield, and STRD sits at 11.1%.

These gains suggest investors are positioning early, expecting index inclusion to attract fresh institutional demand.

Bittensor’s Dev Activity Soars 3,600% Despite Price Drop

Bittensor (TAO) saw its development activity skyrocket by over 3,600% in June, based on Santiment metrics, even as its price fell 22%.

TAO traded around $324 on Tuesday, slipping 3% intraday after failing to break above $352 on Sunday.

While the broader crypto AI sector struggled in June, Bittensor led in dev activity, followed by Celestia (+3,216%), Near Protocol (+3,100%), and Internet Computer (+2,779%).

Despite June’s price slump, TAO posted a strong Q2 overall, with a 50% gain after losing 49% in Q1.

Futures open interest remains steady at $249 million, signaling continued investor interest in the project’s technical roadmap.

XRP Eyes Breakout as ETF Approval Odds Rise

XRP remains under pressure, mirroring broader crypto market sluggishness.

However, Bloomberg analysts Eric Balchunas and James Seyffart now put XRP’s spot ETF approval chances at 95% by year-end.

Ripple’s launch of its XRPL EVM Sidechain on mainnet has also stirred developer interest, targeting cross-chain integration.

XRP traded at $2.19 on Tuesday, down 2%. A rebound from support at $2.18 could lead to a breakout towards $2.34 and $2.65.

Futures open interest dropped to $4.38 billion from January’s peak of $7.76 billion, signaling reduced speculative appetite.

Sui Faces More Selling as $120M Token Unlock Completes

Sui (SUI) fell further on Tuesday, capping a 15.5% loss over 30 days.

The network unlocked 44 million tokens (worth ~$120 million), raising its circulating supply to 3.45 billion, about 34.46% of the total.

SUI currently trades at $2.71, down from June’s peak of $4.29 — a 37% slide.

This week’s token unlock could drag prices another 15.5% lower to support around $2.30, last tested on June 23.

Despite recent pain, over 5.2 billion SUI tokens (52.17% of total supply) remain locked, hinting at more supply events ahead.

SRM Entertainment Stakes $100M in TRON, Bets on Long-Term Growth

TRON (TRX) traded around $0.279 on Tuesday, holding gains from a 5% rally last week.

SRM Entertainment finalized its $100 million TRON treasury initiative by staking 365 million TRX tokens on Monday.

This move boosts TRX staking yield up to 10% per year when combined with energy renting.

SRM recently brought in Weike Sun as board chairman and welcomed TRON founder Justin Sun as a strategic advisor.

Meanwhile, TRON’s stablecoin market cap surpassed $81 billion, setting an all-time high and hinting at robust on-chain growth driven by DeFi and payment use cases.

The Day’s Takeaway

United States

Markets saw sharp sector rotation, with big tech stocks under heavy selling pressure while Dow and small-cap names outperformed. Strong JOLTs job openings data (7.769 million vs. 7.3 million expected) and a stronger ISM manufacturing PMI (49.0 vs. 48.8 expected) dampened hopes for a July rate cut.

Mega-cap tech losers included Nvidia (–2.69%), Broadcom (–3.82%), AMD (–3.71%), and Meta (–2.42%). Meanwhile, Dow gainers featured UnitedHealth (+4.38%), Amgen (+4.11%), and Sherwin-Williams (+3.73%).

Index closes:

- Dow: +0.91% at 44,495.06

- S&P 500: –0.11% at 6,198.05

- Nasdaq: –0.82% at 20,202.89

- Russell 2000: +0.94% at 2,195.46

U.S. construction spending for May fell 0.3% (expected –0.2%), while April was revised to –0.2% (from –0.4%).

The S&P Global final manufacturing PMI for June climbed to 52.9 (prelim 52.0), marking strong output growth and rising employment.

Separately, White House CEA Chair Stephen Miran expressed optimism on securing a trade deal with the EU soon.

The U.S. Senate passed a $4.5 trillion tax cut and spending package (51–50 vote), sending it to the House. President Trump hopes to sign it by July 4.

Atlanta Fed’s GDPNow Q2 growth estimate fell to 2.5% (down from 2.9%), reflecting weaker consumption and investment projections.

President Trump stated the Strategic Petroleum Reserve would only be refilled when prices are favorable.

Europe

European indices mostly ended lower:

- Germany DAX: –0.80%

- France CAC 40: –0.04%

- UK FTSE 100: +0.28% (only gainer)

- Spain Ibex: –0.03%

- Italy FTSE MIB: –0.58%

At the ECB Sintra forum:

- ECB’s Lagarde stressed inflation at 2% and committed to a data-dependent approach.

- Fed’s Powell hinted that tariffs have delayed possible rate cuts; U.S. debt trajectory is “unsustainable.”

- BoE’s Bailey noted inflation risks but signaled a move toward neutral policy over time.

- BoJ’s Ueda said inflation above 2% headline but underlying pressures remain below target.

- BoK’s Rhee noted potential deflationary effects from tariffs.

UK house prices dropped 0.8% in June (expected +0.2%), after a revised 0.4% rise in May.

UK final manufacturing PMI for June held at 47.7, improving from May’s 46.4. Business optimism reached a four-month high despite ongoing output and order declines.

Eurozone final manufacturing PMI for June came in at 49.5 (prelim 49.4), slightly higher than May’s 49.4, suggesting tentative stabilization.

Eurozone June inflation held at 2.0% y/y, with core at 2.4%, reinforcing expectations for the ECB to hold rates steady this summer.

Germany’s final June manufacturing PMI was 49.0, up from May’s 48.3, with business expectations at their highest since February 2022.

Germany’s unemployment rose by 11,000 in June (expected +15,000), with jobless rate steady at 6.3%. Total unemployed now at 2.97 million, close to a 10-year high.

France’s final June manufacturing PMI revised to 48.1 (prelim 47.8), below May’s 49.8.

Italy’s PMI slipped to 48.4 (expected 49.5), reflecting production declines and job cuts.

Spain’s PMI rose to 51.4 (expected 50.5), marking the best reading this year with new orders returning to growth.

Swiss retail sales were flat in May (prior revised +0.9%).

Swiss manufacturing PMI jumped to 49.6 (expected 44.0), rebounding from May’s 42.1.

Asia

China’s Caixin June manufacturing PMI jumped to 50.4 (expected 49.0), sharply up from May’s 48.3. Domestic production and orders improved, while export demand weakened for a third month due to U.S. tariffs. Employment continued to decline, and prices fell further under competitive pressure.

Japan’s final June manufacturing PMI came in at 50.1 (prelim 50.4), up from May’s 49.4 — its first expansion in over a year. New orders fell for a 25th consecutive month, but firms raised output expectations and continued hiring despite ongoing cost pressures.

Australia’s final June manufacturing PMI slipped to 50.6 (flash 51.0), down from May’s 51.0. New orders declined again, export demand weakened, and future output expectations softened.

Commodities

Crude oil futures closed at $65.45 (+0.52%), staying within a tight range.

A private API survey showed an unexpected crude build (+680,000 barrels vs. expected –2.26 million), gasoline stocks rose (+1.92 million), distillates fell (–3.46 million), and Cushing inventories dropped (–1.42 million).

OPEC+ is set to raise output by 411,000 barrels per day in August, totaling nearly 1.8 million barrels of extra supply since April.

Brent crude failed to hold above its 200-day moving average, signaling possible declines toward $63 or even $58 if momentum remains weak.

U.S. shale drilling remains under pressure; active oil rigs fell to 432, the lowest since October 2021. Producers need WTI at ~$65 to break even, but recent prices mostly stayed below that level.

SPR replenishment delays further weaken support for the U.S. shale sector.

Gold prices surged over 1% to around $3,340 as traders weighed mixed U.S. data and the Fed’s cautious stance. Citi forecasts gold to reach $2,500–$2,700 by late 2026.

TD Securities emphasized that gold’s rally is driven by “trust” rather than pure demand, citing geopolitical and macro catalysts.

China’s gold imports from Hong Kong rose to 48.1 tons in May (from 43.4 tons in April), underlining rising domestic demand. China aims to expand gold resources by 5–10% by 2027.

Crypto

Bitwise reiterated its forecast for Bitcoin to reach $200,000 by the end of 2025, despite recent consolidation around $112,000. Strong ETF inflows and rising institutional interest remain key drivers.

Ethereum and Solana underperformed in H1 but may see renewed strength in H2 as crypto legislation advances and altcoin-focused treasuries grow.

Stablecoin AUM grew 30% in 2025 to $260 billion, still short of the $400 billion goal. The GENIUS Act, which recently passed the U.S. Senate, could provide needed regulatory clarity to accelerate further growth.

XRP traded around $2.19, with analysts eyeing a possible breakout if support at $2.18 holds.

Sui (SUI) extended losses after unlocking $120 million worth of tokens, risking a further 15.5% drop to $2.30.

SRM Entertainment staked 365 million TRX tokens as part of its $100 million TRON treasury strategy, supporting long-term growth expectations.

Bittensor’s (TAO) development activity jumped 3,600% in June, despite a 22% price decline, signaling sustained developer commitment.