North America News

Major U.S. Stock Indices End at Record Highs; Dow Leads Gains

U.S. stocks closed out Monday’s session at new record highs, with the major indices posting solid gains across the board.

The S&P 500 and Nasdaq Composite each advanced by around 0.50%, while the Dow Jones Industrial Average outperformed, climbing 0.63% and adding 275.50 points to finish at 44,094.77.

The S&P 500 rose 31.88 points to close at 6,204.95, and the Nasdaq gained 96.27 points to end at 20,369.73.

Dow leaders included:

- Goldman Sachs: $707.69 (+$16.88, +2.44%)

- Verizon: $43.27 (+$0.96, +2.27%)

- Apple: $205.09 (+$4.01, +1.99%)

- Visa: $354.88 (+$6.27, +1.80%)

- Honeywell: $232.88 (+$4.03, +1.76%)

- IBM: $294.72 (+$5.02, +1.73%)

Among large-cap standouts:

- Robinhood Markets: $93.63 (+$10.60, +12.77%)

- First Solar: $165.47 (+$13.33, +8.76%)

- Whirlpool: $101.44 (+$5.27, +5.48%)

- MicroStrategy: $404.34 (+$20.46, +5.33%)

- Palantir: $136.22 (+$5.58, +4.27%)

- Trump Media & Technology Group: $18.04 (+$0.64, +3.68%)

- GameStop: $24.37 (+$0.78, +3.31%)

- Super Micro Computer: $49.00 (+$1.42, +2.98%)

- General Mills: $51.80 (+$1.28, +2.53%)

- Fortinet: $105.72 (+$2.61, +2.53%)

- Broadcom: $275.57 (+$6.22, +2.31%)

- Mastercard: $561.69 (+$11.37, +2.07%)

- Palo Alto Networks: $204.66 (+$4.07, +2.03%)

- Chipotle: $56.16 (+$1.11, +2.01%)

Strong performances from tech and financial names powered the day, with momentum supported by optimism around upcoming economic data and easing policy expectations.

Goldman Sachs Moves Fed Rate Cut Call Up to September

Goldman Sachs has brought forward its forecast for the Federal Reserve’s next rate cut to September from December.

The move follows comments from Fed’s Bostic suggesting only one cut in 2024 and patience on policy adjustments. Other officials, including Bowman and Waller, have hinted that if June inflation data is subdued, a rate cut as early as July remains possible.

Goldman’s revised call signals a growing consensus that the Fed may act sooner than previously expected, especially if inflation trends show further moderation.

Feds Bostic: Advance warning on tabs have allowed firms to manage process

- Atlanta Fed Pres. Bostic is speaking

- Advanced warning on tariffs have allowed firms to manage process.

- It will take time before full clarity arrives on trade policy.

- Tariff impacts will play out over time.

- Risk tariff -related inflation will affect expectations, it’s an open question.

- Much of tariffs pricing hasn’t worked its self into economy yet.

- Needs more information to know what’s next for monetary policy.

- Uncertainty over outlook is more than just trade policy driven.

- People don’t like one monetary policy is volatile.

- Fed has luxury to be patient, job market is solid.

- Expects one rate cut this year and three next year

- There is more tariff related price increases to come

- Data suggests firms will pass on tariff related price increases

- Firms trying to avoid steady price rises when adjusting for tariffs

- Wage gains have returned to pre-pandemic levels.

- Big debate on whether firms can fully pass on tariffs and what consumers will accept

- Does not believe that there is a need to raise rates to combat inflation

NEC Director Hassett: Expects the one big beautiful bill to pass by midnight tonight

- Expectes the one big beautiful bill to pass by midnight tonight

- This is a very fiscally responsible bill

- Does not believe these CBO projections

- Denies to comment on whether he would consider becoming the next Fed Chair.

- US will restart negotiations with Canada immediately.

Treasury Secretary Bessent: Confident that fiscal policy bill will progress in coming hours

- Speaking on Bloomberg TV

- Confident that fiscal policy bill will progress in coming hours.

- This is a start of controlling US debt.

- Republican budget bill will help grow the economy while controlling and bringing down expenses.

- Questions why the US would borrow longer term at these rates?

- He is focusing on the 10 year.

- The whole curve could parallel shift down

- We could see a lowering of rates. Inflation is very low.

- Will be working on Fed Chair successor over the next week’s and months

- Asked about speculation over Fed chair, says I will do whatever the president wants but I have a stop in Washington

- We have give consideration to the January Fed Board nominee. Could eventually become the Fed Chair

- Fed made gigantic mistake in 2022 rates

- We have seen no inflation from tariffs, there could be one time price adjustment.

- There will be a flurry of trade deals going into the July 9 expiration of tariff relief, and pressure increases.

- Countries should be aware that we could spring back to April 2 levels on tariffs.

- Any tariff negotiation extensions will be up to Trump

- Any action on Fannie Mae Freddie Mac will be focused on making sure mortgage rate do not move higher

Canada Drops Digital Services Tax to Reignite U.S. Trade Talks

Canada has officially scrapped its planned Digital Services Tax, paving the way to resume broader trade negotiations with the United States.

In a statement released Sunday by Canada’s finance ministry, officials confirmed the tax reversal following talks between former President Trump and Finance Minister Mark Carney. Both sides agreed to restart trade discussions immediately, aiming to finalize a deal by July 21.

Commodities News

Gold Edges Higher as Dollar Slips, Traders Eye Packed Data Week

Gold prices rose on Monday as the U.S. Dollar fell to its lowest levels since February 2022, driven by uncertainty around the Federal Reserve’s leadership and policy trajectory.

Spot gold climbed 0.58% to $3,292 after rebounding from an intraday low of $3,246, positioning to finish June with a modest monthly gain of 0.18%.

The dollar’s weakness follows speculation that President Trump could announce a new Fed Chair nomination as soon as September or October. This speculation, combined with lower yields, has pushed the Greenback sharply lower.

Citi expects gold to trade within a $3,100–$3,500 range during Q3, citing contained safe-haven flows as Middle East tensions ease and global trade optimism improves.

Key upcoming U.S. data this week includes:

- ISM Manufacturing PMI (forecast: 48.8, prior: 48.5)

- ADP Employment Change (expected: 85K vs. May’s 37K)

- Initial Jobless Claims

- June Nonfarm Payrolls (forecast: 110K, prior: 139K)

Traders are also watching for updates on Trump’s “One Big Beautiful Bill,” which recently passed the Senate and aims to overhaul tax policy while potentially raising the deficit by $3.8 trillion.

Market drivers supporting gold:

- Expectations for over 60 basis points of Fed rate cuts by year-end

- U.S.-China progress on rare earth deals

- Canada’s decision to withdraw its digital services tax on U.S. tech firms

Citi further projects that gold prices could retreat to the $2,500–$2,700 range by H2 2026.

Investor focus remains on economic signals this holiday-shortened week, with many anticipating signs of a cooling labor market and possible Fed policy pivots to keep gold supported.

Crude Oil Ends Lower at $65.11, Stays in Range

Crude oil futures settled at $65.11 on Monday, down $0.41 or 0.63% on the session.

The price has been stuck in a consolidation range since June 24, hovering below the 50% retracement level of the May rebound at $66.33.

Oil found support near $64 and closed just below its 100-hour moving average of $65.24. Traders continue to watch technical levels for a breakout as momentum remains limited.

Metals Market Redrawn as Strategic Hoarding Emerges — TDS

Global metals markets are undergoing a major shift as strategic stockpiling intensifies, according to TDS strategist Daniel Ghali.

Silver, platinum, and copper have all shown signals of supply stress, pointing to fragmenting global inventories.

Ghali notes that the trade war has accelerated metal inflows into the U.S. while China’s large-scale hoarding further depletes global availability.

He warns these inventories are unlikely to return to open markets anytime soon, as U.S. financialization and Chinese strategic reserves lock them in. This tug-of-war for raw materials between the world’s two biggest economies is fundamentally bullish for metals prices.

Silver Stuck Around $36, Market Lacks Clear Direction

Silver is consolidating near the $36 mark on Monday, trading sideways as global risk appetite dampens safe-haven demand.

The metal remains supported above $35.40, with intraday lows around $35.41 cushioning downside moves.

Technically, silver is forming a potential Doji candle on the daily chart, signaling market indecision. The 20-day moving average at $36.11 is acting as resistance, while a solid floor exists at $35.12 (23.6% Fibonacci retracement of the April-June rally).

With RSI hovering around 55, price action suggests ongoing consolidation in the near term.

Copper Breaks Out, Targets Multi-Month Highs

Copper prices on the London Metal Exchange (LME) have regained bullish momentum, breaking above the 50-day moving average and setting the stage for potential new peaks, according to Société Générale analysts.

The metal is now aiming for 9,940/9,975, with an extended target around 10,160 — levels last seen in September 2024 and March 2025.

Support is seen near the 50-day moving average at 9,560, which could limit any short-term pullbacks.

Japan’s PM Ishiba Mulls U.S. Proposal to Purchase American Oil

Prime Minister Ishiba of Japan is considering President Trump’s suggestion that Japan start buying U.S. crude oil. According to the Nikkei, Ishiba commented that this is “a possibility that requires further and detailed examination.”

Meanwhile, crude oil prices edged lower to start the U.S. session, down $0.17 to $65.35. The price has been moving in a consolidation band between $63.97 and $67 since June 24. At the moment, it is trading slightly above the 100-hour moving average of $65.31 but continues to hover around that level as traders look for direction.

Trump’s Trade Tactics Threaten Australia’s Export Revenues

Australia’s mining and energy export earnings are projected to decline further over the next two years, according to the government’s latest resources and energy report.

Export revenues are expected to fall from A$415 billion in 2023–24 to A$385 billion this year, and to A$352 billion by 2026–27. Iron ore earnings could drop from A$116 billion to A$97 billion during that period, while LNG is also set for a price-driven decline.

Trade tensions driven by Trump’s unpredictable policies are adding to global uncertainty, delaying investments and dampening commodity demand.

Meanwhile, gold is forecast to rise to A$56 billion next year, becoming Australia’s third-largest export. Lithium is also expected to bounce back, with earnings forecast to rise to A$6.6 billion by 2026–27.

Europe News

European Stock Markets Close Mixed; Germany, France, UK Slip

European equity markets ended Monday’s session with a mixed performance.

Germany’s DAX closed down by 0.47%, while France’s CAC 40 fell 0.18%. The UK’s FTSE 100 also slipped, losing 0.31%.

In contrast, Spain’s Ibex 35 managed to edge higher by 0.16%, as did Italy’s FTSE MIB, which also gained 0.16%.

The divergence highlights varying investor sentiment across the continent, with southern European indices showing modest resilience.

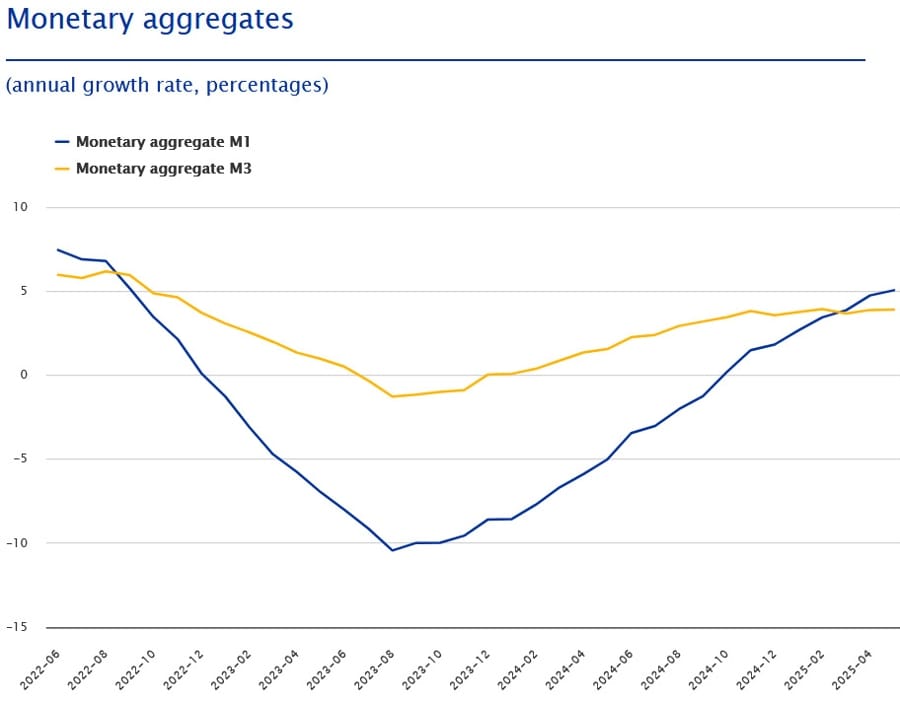

Eurozone Money Supply Holds Steady in May

The Eurozone’s M3 money supply expanded by 3.9% year-on-year in May, just below the 4.0% consensus.

Loans to households increased by 2.0% from 1.9% previously, while loans to companies edged down to 2.5% from 2.6%, reflecting stable credit conditions amid a complex macro backdrop.

German Inflation Eases Slightly in June

Germany’s June preliminary CPI rose 2.0% year-on-year, slightly below the 2.2% forecast and down from 2.1% in May.

The harmonized measure (HICP) also showed a 2.0% increase.

Core inflation moderated slightly to 2.7% from 2.8% the previous month, signaling that price pressures remain stubbornly high even as headline readings come down marginally.

German State CPI Data Points to Softer National Inflation

Preliminary CPI data from German states indicated softer inflation pressures in June.

Bavaria’s CPI came in at +1.8% y/y, down from 2.1%. North Rhine-Westphalia and Hesse both reported a 1.8% rate, while Baden-Württemberg saw a slight uptick to 2.3%, and Saxony landed at 2.2%.

Taken together, these figures suggest that Germany’s national CPI could settle around 1.9% to 2.0% for June, below the expected 2.2%, signaling a possible easing in headline inflation momentum.

Germany’s Import Prices Slide Again in May

Germany’s import price index fell 0.7% month-on-month in May, a sharper decline than the 0.4% drop expected.

This marks another month of relief driven mostly by lower energy costs. Stripping out energy, import prices slipped only 0.3%. Prices also dropped for intermediate goods (-0.5%) and capital goods (-0.2%), highlighting broad-based easing in input costs for German businesses.

German Retail Sales Disappoint in May, Extend Losing Streak

German retail sales contracted 1.6% in May, significantly underperforming expectations for a 0.5% increase.

The decline marks a third straight monthly fall and underscores persistent strains on consumer spending from elevated prices. While this outcome is unlikely to alter ECB policy immediately, it highlights ongoing challenges for Europe’s largest economy.

Italy’s Inflation Holds Steady in June

Italy’s preliminary CPI for June recorded a 1.7% annual rise, matching expectations and up slightly from 1.6% in May.

The harmonized index (HICP) came in slightly softer at 1.7%, versus the expected 1.8%.

While overall inflation remains under 2%, core inflation is estimated to tick higher from 1.9% to 2.1%, providing a mild caution signal for policymakers.

UK Economy Grows 0.7% in Q1, Final GDP Confirms

The UK’s final GDP figures for Q1 2025 confirmed solid economic momentum, with a quarter-on-quarter expansion of 0.7%, matching preliminary estimates.

On an annual basis, GDP grew 1.3%, down slightly from 1.5% in the previous quarter. The main growth driver was the services sector, which continues to underpin the UK’s economic resilience.

UK Mortgage Approvals Beat Expectations in May

UK mortgage approvals increased to 63,030 in May, above the forecasted 59,750.

The prior figure was revised up slightly to 60,660. Meanwhile, net mortgage borrowing by individuals rose sharply by £2.8 billion, reversing a prior net repayment trend.

Remortgage approvals also picked up strongly, rising by 6,200 to 41,500 — the biggest jump since February 2024. Net consumer credit slowed to £0.9 billion from a revised £1.9 billion.

Swiss Sight Deposits Rise Sharply in Late June

Total sight deposits at the Swiss National Bank (SNB) climbed to CHF 460.7 billion for the week ending June 27, up from CHF 442.5 billion the prior week.

Domestic deposits dipped slightly to CHF 425.8 billion from CHF 430.0 billion, suggesting some liquidity shifts within the Swiss banking system even as aggregate balances rose.

Swiss KOF Indicator Hits Lowest Since 2023

Switzerland’s KOF leading indicator dropped to 96.1 in June, falling short of the 99.3 forecast and marking its lowest reading since October 2023.

This renewed weakness points to a deteriorating economic outlook as European uncertainties linger, despite some easing in global trade tensions.

ECB’s Simkus: Does not know if the ECB will have all the information they need by Sept

- ECB Simkus speaking

- ECB would decide meeting by meeting and would avoid pre-commitment due to an unpredictable environment

ECB’s Rehn: Risk of inflation undershooting target should not be underestimated

- Remarks from the ECB policymaker to Econostream

- There is no reason for self-complacency in Europe.

- We must be vigilant now to both directions.

- We have to closely monitor geopolitical developments and price developments in energy markets.

- The trade war seems to dampen inflation in the Euro Area rather than increase it.

ECB’s de Guindos: Facing brutal uncertainty

- Comments from the ECB Vice President

- Facing brutal uncertainty.

- Q2, Q3 growth will be almost flat.

- Consumption as a driver hasn’t happened.

- Current interest rate position is correct.

- Seen remarkable services inflation deceleration.

- Inflation figure has been positive.

- Rate policy is compatible with convergence to 2% target.

- We must keep all rate options open because of uncertainty.

- Doubts regarding US are reflected in the dollar.

- The euro could be reserve currency if Europe does it right.

- I hope there is a US-EU trade agreement by July 9.

UK-US Trade Deal Comes Into Force, Says London

The UK government has officially announced that its partial trade agreement with the United States is now active, according to a press release issued Monday.

The agreement delivers tariff relief for key British industries. UK car manufacturers can now ship vehicles to the U.S. at a reduced 10% tariff, down sharply from the previous total of 27.5%. Meanwhile, UK aerospace exporters will benefit from the removal of 10% tariffs on engines and aircraft parts.

While not a comprehensive trade pact, this partial deal marks a meaningful step forward for British exporters and helps the UK avoid immediate scrutiny as the U.S. administration focuses on resolving other trade disputes.

UK Business Confidence Climbs to Nine-Year High

Business confidence in the UK soared in June, reaching its highest level since 2015. Lloyds Bank’s Business Barometer rose to 51%, up from 50% in May.

Economic optimism hit a 10-month high, and hiring expectations surged, with 60% of firms planning to add staff over the next year.

Lloyds economists noted that businesses are preparing for expansion and showing strong resilience despite ongoing economic challenges.

Asia-Pacific & World News

China Manufacturing Improves but Remains in Contraction

China’s manufacturing sector showed tentative recovery signs in June, despite staying below the growth threshold. The National Bureau of Statistics reported a second straight month of improvement, but the PMI remained below 50, indicating ongoing contraction.

Production activity accelerated, and market demand picked up slightly. However, domestic consumption remains sluggish even as overseas orders continue to play a crucial role, supporting around 40% of first-quarter GDP.

The data came after a 90-day trade truce with the U.S., underlining China’s heavy reliance on exports and its vulnerability to global trade swings.

China June PMI Data: Manufacturing Stuck in Contraction

The official manufacturing PMI for June came in at 49.7, matching expectations but still below 50, signaling a third month of contraction.

New orders rose to 50.2, the first move into expansion in months, while new export orders improved slightly to 47.7.

The non-manufacturing PMI, covering services and construction, rose to 50.5, just above forecasts. The composite index climbed to 50.7, helped by large enterprises (up to 51.2). Medium-sized firms saw a slight improvement to 48.6, but small businesses weakened further to 47.3.

PBOC sets USD/ CNY reference rate for today at 7.1586 (vs. estimate at 7.168)

- PBOC CNY reference rate setting for the trading session ahead.

PBOC injected 331.5bn yuan via 7-day reverse repos at 1.40%

- 220.5bn yuan mature today

- net injection is 111bn yuan

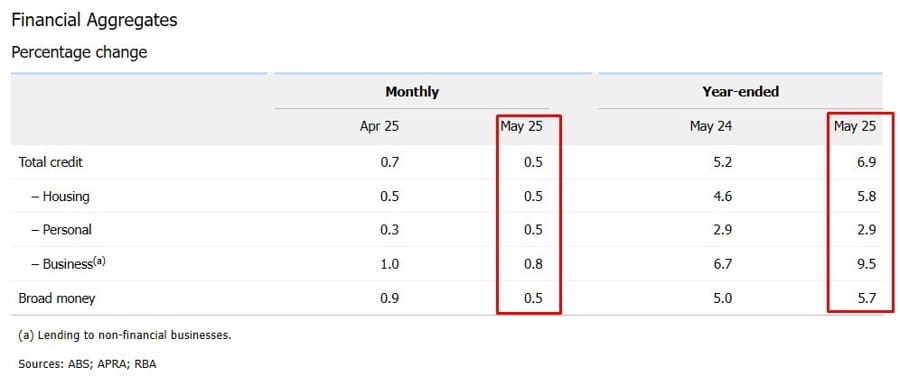

Australia’s Private Sector Credit Growth Slows in May

Australia’s private sector credit rose in May 2025 but at a slower pace compared to April, expanding by 0.7% month-on-month as expected.

Data from the Reserve Bank of Australia points to softer lending momentum, reflecting cautious household and business borrowing despite relatively stable economic conditions.

Australia Inflation Gauge Creeps Higher in June

The Melbourne Institute’s monthly inflation gauge showed a slight rise in June, up 0.1% month-on-month, following a 0.4% drop in May.

On an annual basis, inflation was at 2.4%, down from 2.6% in May. The trimmed mean, a measure of core inflation, increased 0.1% m/m and rose 2.6% y/y, easing slightly from 2.8% the month prior.

The data suggests that inflation pressures remain contained but persistent, supporting a cautious approach from the Reserve Bank of Australia.

TCorp Economist Urges RBA to Drop 2.5% Inflation Midpoint Target

Brian Redican, chief economist at New South Wales Treasury Corporation (TCorp), has called on the Reserve Bank of Australia to abandon its focus on the 2.5% midpoint within its inflation target range.

Redican argues the midpoint sets unrealistic expectations, muddles communication, and fails to reflect global drivers like energy prices and U.S. trade policy.

His comments come ahead of a new monetary policy statement expected to formalize the RBA’s inflation target, potentially including recommendations from the recent policy review.

New Zealand Business Confidence Jumps in June

Business confidence in New Zealand surged in June, with the ANZ index rising to 46.3 from 36.6. The activity outlook improved to 40.9, reflecting optimism driven by easing tariffs.

However, indicators of actual recent performance stayed weak. Reported past activity dropped 3 points to 2%, while past employment remained at -10%.

Firms continue to face cost pressures, with 46% planning price increases and expected costs rising to 79%. Inflation expectations stayed anchored at 2.71%.

Japan’s trade negotiator Akazawa says still working with US to reach an agreement

- Remarks by Japan’s trade negotiator, Ryosei Akazawa

- Will continue working with US to reach an agreement while defending national interest

- Aware of Trump’s comment on autos, will decline to talk about it

- Believes that understanding deepens each time talks are held

BOJ Stays Cautious, Highlights “Underlying Inflation”

The Bank of Japan is increasingly leaning on alternative inflation measures to justify its gradual approach to tightening, even as headline and core inflation remain above 2%.

The BOJ emphasizes “underlying” price measures, like the weighted median and mode, which remain below target. Governor Ueda stressed that expectations have shifted away from zero but have yet to anchor at 2%, arguing for patience.

Services inflation in May was just 1.4%, and internal disagreements over policy pace appear to be deepening.

Japan’s Industrial Output Misses Forecasts in May

Japan’s preliminary industrial production data for May showed just a 0.5% monthly increase, far short of the expected 3.4% rebound after April’s 1.1% decline.

On an annual basis, output dropped 1.8%, reversing the prior month’s 0.5% gain. The Ministry of Economy, Trade and Industry forecasts slight increases of 0.3% in June, followed by a 0.7% decline in July.

Auto-related sectors face heightened risks from upcoming U.S. tariffs, including a 25% levy and a 24% “reciprocal” tariff scheduled to start July 9.

Japanese Households Brace for Surge in Food Prices

Consumers in Japan will face significant cost-of-living challenges starting July, with food prices set to jump sharply. A survey by Teikoku Databank shows price increases on more than 2,100 food items, five times higher than a year ago.

Average price hikes are expected to reach about 15%, driven by surging raw material and energy costs, as well as rising labor and transportation expenses.

Teikoku warned that if crude oil prices spike again — especially due to renewed Middle East tensions — inflation could spiral to levels seen in 2022 when nearly 26,000 products saw price hikes.

South Korea says will seek extension on trade talks with the US

- Remarks by a senior trade official from Seoul

- Trade talks are mainly about non-tariff barriers

- US trade talks will have to continue past 8 July

- Will seek extension to that

Crypto Market Pulse

BitMine Unveils ETH Treasury Strategy as Inflows Top $430 Million

Ethereum (ETH) hovered near $2,480 on Monday after BitMine revealed plans to create an ETH treasury strategy using proceeds from a $250 million private placement.

The private round, led by MOZAYYX and other major funds, includes heavyweights such as Founders Fund, Galaxy Digital, Kraken, Pantera Capital, and Fundstrat’s Thomas Lee, who is now BitMine’s chairman.

Lee described Ethereum as “the backbone of future banking infrastructure,” citing its dominance in the stablecoin space.

ETH investment products attracted nearly $430 million in inflows last week, with U.S. spot ETFs alone seeing $283 million, per CoinShares.

As ETH trades below resistance at $2,510, options traders are positioning for volatility during ETHCC in Cannes, where historically major announcements drive price swings.

XRP Faces Selling Pressure Despite Strong Fund Inflows

XRP pulled back to $2.17 on Monday after failing to break above resistance at $2.22, shedding more than 1% on the day.

The retreat comes even as inflows into XRP investment products reached $10.6 million last week, pushing the year-to-date total to $219 million. Assets under management now sit at $1.18 billion, per CoinShares.

Open Interest in XRP futures remains elevated, standing above $4 billion, a 15.5% increase from $3.54 billion on June 23.

While institutional demand remains robust, XRP’s price action reflects a cautious broader crypto market ahead of Fed Chair Jerome Powell’s appearance at the ECB Forum in Sintra on Tuesday.

Arbitrum Soars 17% on Speculation of Robinhood Partnership

Arbitrum (ARB), the Ethereum layer-2 scaling solution, jumped 17% Monday amid market chatter that it may partner with Robinhood.

The speculation grew after Robinhood teased a fireside chat with Ethereum co-founder Vitalik Buterin, Robinhood Crypto’s Johann Kerbrat, and Offchain Labs’ A.J. Warner in Cannes, France.

Rumors of Robinhood building a blockchain platform to enable European investors to trade U.S. stocks surfaced in May, with Arbitrum and Solana reportedly under consideration.

Crypto figures such as Eric Connor and Omar Kanji have suggested that Robinhood’s announcement could reveal an Arbitrum partnership, further fueling price momentum.

Dogwifhat Eyes Further Gains as Social Buzz Peaks

Dogwifhat (WIF) is consolidating gains after jumping 4.82% on Sunday, holding above both its 50-day and 100-day exponential moving averages. The token is trading at $0.85 as of Monday.

Santiment data shows WIF’s social dominance score climbing to 0.327%, the highest since mid-May, signaling a surge in online chatter. The sentiment score also improved to -0.176 on Sunday from a recent low of -0.305, hinting at diminishing bearish sentiment.

With increasing Open Interest and rising funding rates, technical signals suggest a bullish continuation, although a broadening wedge pattern implies that caution remains warranted.

Chainlink Struggles at Resistance Amid On-Chain Selling Pressure

Chainlink (LINK) dropped over 2% on Monday, giving up gains from the weekend rally. The token is encountering strong resistance in the $13.06–$14.06 range, where around 105 million LINK tokens were previously accumulated.

The immediate supply zone between $14.06 and $14.29, held by nearly 20 million LINK, is adding headwinds. On the downside, a support band exists from $12.74 to $13.06.

On the derivatives side, Open Interest rose by 3.84% to $559.76 million, and the funding rate climbed to 0.0086%, reflecting increased long positions.

Despite last week’s 17% gain, LINK now trades below its 200-period EMA on the 4-hour chart. If it falls below $13.12, a deeper slide to $12.63 could follow. The RSI at 52 signals fading buying momentum.

Saylor Teases Another Bitcoin Purchase, Extending Buying Spree

Michael Saylor hinted over the weekend at another Bitcoin acquisition, which would mark Strategy’s 11th consecutive week of buying since mid-April.

“Twenty-one years from now, you’ll wish you bought more,” Saylor posted to his 4.4 million followers on X.

The firm’s last purchase on June 23 added 245 BTC worth $26 million, lifting its holdings to 592,345 BTC. This cements Strategy’s position as the largest known corporate Bitcoin holder, owning more than twice as much as the next 20 largest public holders combined.

The Day’s Takeaway

United States

U.S. stocks ended Monday at new all-time highs. The S&P 500 rose 0.52% to close at 6,204.95, while the Nasdaq gained 0.47% to finish at 20,369.73. The Dow Jones led major indices, climbing 0.63% (275 points) to 44,094.77, boosted by strong performances from Goldman Sachs (+2.44%), Verizon (+2.27%), Apple (+1.99%), and Visa (+1.80%).

Among large caps, Robinhood surged nearly 13%, First Solar rose 8.8%, and Whirlpool gained 5.5%.

Goldman Sachs moved its forecast for the next Fed rate cut forward to September from December, signaling expectations for earlier policy easing if inflation continues to moderate.

Meanwhile, traders prepare for a packed economic calendar this week, including ISM Manufacturing PMI, ADP jobs data, jobless claims, and June’s Nonfarm Payrolls.

Canada

Canada withdrew its Digital Services Tax, clearing the way to restart trade negotiations with the U.S. Talks between President Trump and Canadian Finance Minister Carney are now back on, with a goal of finalizing a deal by July 21.

Canada’s GDP data for April showed a 0.1% decline, with manufacturing weakness dragging down the goods sector, while services sectors managed slight growth.

Commodities

Gold advanced 0.58% to $3,292 on Monday, supported by a weaker U.S. dollar near its lowest level since February 2022. Speculation around Fed leadership changes and anticipated rate cuts kept the metal bid, even as geopolitical tensions in the Middle East eased. Citi expects gold to trade between $3,100 and $3,500 in Q3.

Italy’s export earnings outlook turned cautious as Trump’s trade tactics threaten global demand for Australian commodities. Australia expects mining and energy export revenues to drop from A$415 billion in 2023–24 to A$352 billion by 2026–27.

Gold is expected to become Australia’s third-largest export next year, while lithium earnings are forecast to rebound steadily.

Crude oil futures settled at $65.11, down $0.41 or 0.63%, remaining rangebound since June 24. Traders continue to watch support around $64 and resistance near $66.33.

Copper gained strength, clearing its 50-day moving average and setting sights on levels around $10,160, according to Société Générale. Meanwhile, silver consolidated near $36.00, holding above key support despite risk-on sentiment capping gains.

TDS highlighted ongoing strategic hoarding of metals like silver, platinum, and copper, driven by U.S.-China competition and fragmenting global inventories.

Europe

European markets closed mixed. Germany’s DAX fell 0.47%, France’s CAC dropped 0.18%, and the UK’s FTSE 100 declined 0.31%. Spain’s Ibex and Italy’s FTSE MIB both eked out modest 0.16% gains.

UK final Q1 GDP was confirmed at +0.7% q/q and +1.3% y/y, led by services growth. Mortgage approvals in the UK rose to 63,030 in May, above expectations.

Germany saw retail sales disappoint again in May, down 1.6%, and import prices fell 0.7% m/m on energy price declines. Preliminary June CPI in Germany eased to 2.0% y/y, and state data hinted at further moderation.

Italy’s preliminary June CPI held at 1.7%, while Eurozone M3 money supply grew 3.9% y/y, slightly below forecast.

Switzerland’s KOF indicator slid to 96.1, its lowest since October 2023, reflecting a weaker outlook despite receding tariff tensions. SNB sight deposits rose to CHF 460.7 billion.

Asia

In Japan, PM Ishiba indicated openness to President Trump’s suggestion that Japan purchase U.S. crude, calling it “a possibility requiring detailed review.”

Japan’s May industrial production disappointed, up only 0.5% m/m versus the expected 3.4%. Automakers and exporters remain cautious as new U.S. tariffs loom in July.

Japanese households face rising cost pressures, with food prices set to jump on over 2,100 items in July. Meanwhile, the BOJ emphasized “underlying inflation” to justify a slow pace of tightening, even as headline inflation holds above 2%.

China’s manufacturing PMI for June improved slightly to 49.7, though it remains in contraction territory for the third straight month. Non-manufacturing PMI ticked up to 50.5, and the composite index rose to 50.7.

Australia’s private sector credit grew 0.7% in May, while inflation gauges showed only a modest 0.1% monthly increase. Meanwhile, TCorp’s chief economist urged the RBA to abandon its strict 2.5% inflation midpoint target.

New Zealand business confidence surged in June, with the ANZ index rising to 46.3 as tariff-related optimism supported sentiment, despite weak recent activity indicators.

Crypto

Bitcoin hovered near record highs above $107,000, buoyed by steady ETF inflows and a strong technical foundation.

Ethereum traded around $2,480 after BitMine announced a new ETH treasury strategy funded by a $250 million private placement, alongside record institutional inflows totaling nearly $430 million last week.

XRP pulled back to $2.17 despite strong inflows and robust Open Interest above $4 billion, as sentiment turned cautious ahead of Powell’s remarks in Sintra.

Dogwifhat (WIF) maintained bullish momentum above $0.85, supported by record-high social dominance metrics.

Chainlink (LINK) fell over 2% on Monday amid heavy supply pressure, even as Open Interest and funding rates suggested strong speculative activity.

Arbitrum (ARB) surged 17% on rumors of a potential partnership announcement with Robinhood, stoked by a high-profile crypto panel in Cannes.