North America News

US Stocks Close Just Shy of Record Highs

U.S. equity markets came tantalizingly close to all-time highs on Thursday, with both the S&P 500 and Nasdaq brushing record levels before easing modestly into the close.

- The S&P 500 hit a session high of 6,146.52, less than a point shy of its all-time record at 6,147.43, before settling at 6,141.02, up 0.80%.

- The Nasdaq rallied to 20,187.15, just below its record of 20,204.58, and closed at 20,167.91, gaining 0.97%.

- The Dow Jones Industrial Average rose 404.41 points, or 0.94%, ending the day at 43,386.84.

Top gainers:

- Super Micro Computer: +5.71%

- SoFi Technologies: +4.35%

- Airbnb: +3.12%

- DoorDash: +2.99%

- Caterpillar: +2.79%

- Worthington Industries: +2.70%

- Goldman Sachs: +2.62%

- Emerson: +2.59%

- Moderna: +2.53%

- Netflix: +2.48%

- Meta Platforms: +2.46%

- Uber Technologies: +2.42%

- Amazon: +2.42%

- Intuitive Surgical: +2.41%

Notable laggards:

- Chipotle: –1.58%

- Nio ADR: –1.30%

- Walmart: –1.18%

- Merck & Co: –1.05%

- Micron: –0.97%

- Palo Alto Networks: –0.96%

- Shopify: –0.72%

- Mastercard: –0.67%

- Adobe: –0.67%

- General Mills: –0.61%

- MicroStrategy: –0.57%

- Tesla: –0.54%

- Alibaba ADR: –0.53%

- Stryker: –0.47%

Nike Q4 2025 earnings:

- EPS: $0.14 (vs est. $0.13, YoY $0.99)

- Revenue: $11.10B (vs est. $10.72B)

- Inventory: $7.49B (vs est. $7.17B)

- Greater China EBIT: $304M (vs est. $328.5M)

- Gross margin: 40.3% (vs est. 40.2%)

Despite meeting expectations, investor sentiment toward Nike remains tepid, with the results seen as stable but uninspiring.

US Sells 7-Year Notes at 4.022% With Strong Demand

The U.S. Treasury’s 7-year note auction cleared at a high yield of 4.022%, slightly better than the 4.024% when-issued rate, resulting in a stop-through of 0.2 basis points.

Auction stats:

- Bid-to-cover ratio: 2.53

- Primary dealers: took 11.64%

- Direct bidders: 11.62%

- Indirect bidders (mostly foreign buyers): strong at 76.74%

The results point to solid demand, particularly from overseas, even as yields remain elevated.

US Initial Jobless Claims Fall to 236K, Beating Forecasts

Initial jobless claims dropped to 236,000 last week, better than the 245,000 consensus and down from the prior week’s 245,000 (unchanged in revision).

- 4-week average dipped slightly to 245,000 (from 245,750)

- Continuing claims rose to 1.974 million, up from 1.950 million

- 4-week average of continuing claims increased to 1.941 million, from 1.924 million

Labor market remains stable, but the uptick in continuing claims could hint at emerging friction in job retention.

US Pending Home Sales Jump 1.8% in May

Pending home sales surged 1.8% month-over-month in May, far exceeding expectations of +0.1%, and recovering from April’s -6.3% drop. The Pending Home Sales Index rose to 72.6 from 71.3.

Year-over-year, sales climbed 1.1%, reversing April’s -2.5% decline.

NAR Chief Economist Lawrence Yun commented:

“Consistent job gains and rising wages are modestly helping the housing market, but mortgage rate volatility continues to play a dominant role in affordability and buying behavior.”

US Q1 GDP Revised Down Sharply to -0.5%

The U.S. economy shrank by 0.5% in Q1 2025, according to the final GDP estimate—well below the -0.2% expected and a significant swing from the +2.4% growth recorded in Q4 2024.

- Final sales were revised up slightly to +3.3% (from 3.2%)

- Consumer spending growth was sharply downgraded to +0.5% (from 1.2%)

- Corporate profits improved marginally to -3.3% (from -3.6%)

GDP contribution breakdown:

- Consumption added just +0.31% (vs. +0.80% prior)

- Government spending detracted -0.10% (slightly better than -0.12%)

- Net trade knocked off -4.61%, a modest revision from -4.90%

- Inventories added +2.59%, down a tick from +2.64%

Inflation metrics:

- GDP deflator rose +3.8% (vs. 3.7% expected)

- Final Core PCE increased +3.5% (vs. 3.4% forecast)

- Services excluding energy/housing jumped +4.3% (up from 4.1%)

- Final price index came in at +3.7%, also slightly hotter than 3.6%

While the numbers suggest some pricing pressure, they’re increasingly viewed as backward-looking.

US May Wholesale Inventories Fall More Than Expected

Advance wholesale inventories for May slipped -0.3%, defying expectations for a +0.1% increase. April’s data was revised downward to +0.1% from the initially reported +0.2%.

Retail inventories excluding autos were up +0.2%, a slower pace than April’s +0.3% gain. The numbers point to cautious inventory management amid mixed demand signals.

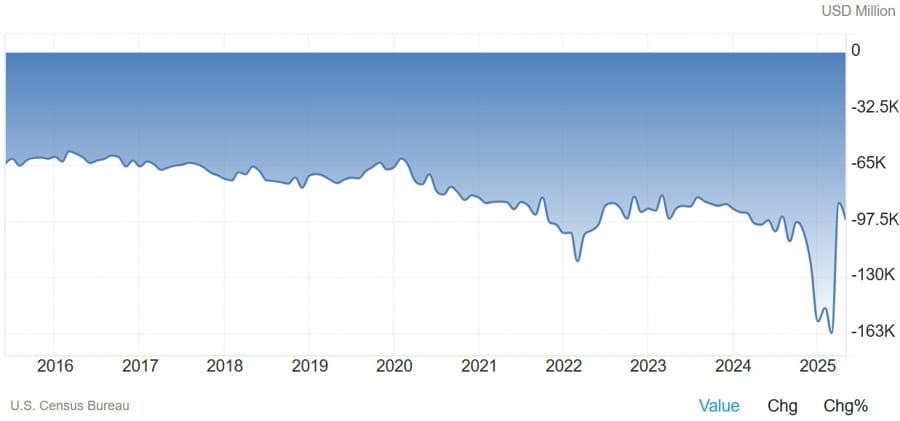

US Trade Deficit Widens Sharply to -$96.59B in May

The U.S. international trade balance worsened more than expected in May, posting a deficit of $96.59 billion, missing forecasts for -88.50 billion. The prior month’s shortfall was also revised higher to -87.62 billion.

The wider gap reflects increased import activity and could weigh on GDP calculations, depending on how the final Q2 data comes in.

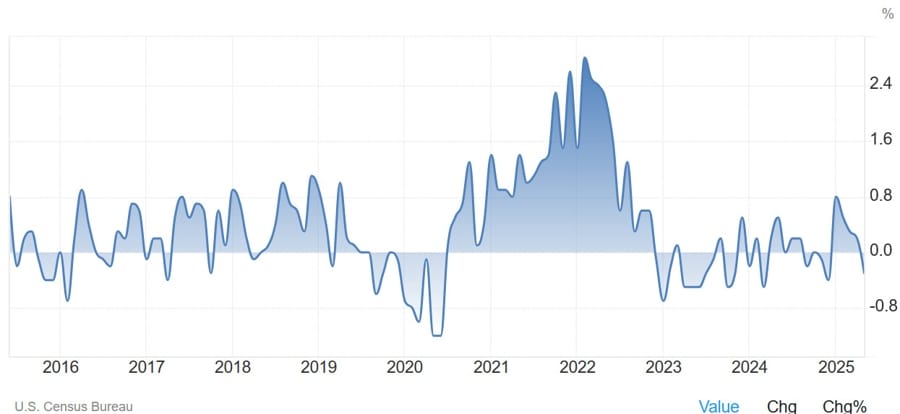

US Durable Goods Orders Surge in May, Well Above Expectations

Orders for long-lasting goods in the U.S. soared by 16.4% in May, nearly doubling the consensus estimate of +8.5%. The prior figure was revised lower to -6.6%.

- Nondefense capital goods orders ex-aircraft (a key business investment proxy) rose 1.7%, topping the expected 0.1%.

- Ex-transportation orders increased 0.5% (vs. 0.0% expected).

- Ex-defense orders spiked 15.5%, compared to a prior drop of -7.7%.

The report signals strong momentum in U.S. manufacturing and capital investment heading into the summer.

Fed’s Barr: Monetary policy well positioned to wait and see how conditions unfold

- Comments from Barr

- So important to bring inflation back to target as low-income households can ill-afford price increases

- Tariffs to put upward pressure on inflation

- Tariffs may at same time slow economy, cause unemployment to rise

- Low-income workers often hardest hit when job market weakens

- Still considerable uncertainty around tariff effects

Fed’s Collins says July probably too early for rate cut

- Fed has time to carefully assess incoming information

- Baseline outlook is to resume cutting later this year

Fed’s Barkin: Fed policy is well positioned for where economy might go

- Comments from Barkin

- Fed has time to take in data

- Inflation will be pressured higher by tariffs

- Doesn’t expect replay of pandemic era inflation

- Fed faces risks on both jobs and inflation mandates

- Outlook for the economy remains cloudy

- Businesses still in pause mode among uncertainty

- Recent inflation data encouraging, job market is healthy

- Businesses still in pause mode amid uncertainty

- Doesn’t think tariffs will be as inflationary as some fear

- Inflation expectations matter a great deal

- It’s hard for businesses to know where tariffs stand

- Recent inflation experience makes it harder to know what tariffs will do to prices

- The exact timing of a Fed move doesn’t matter that much

- The jobs market breakeven is now back to 80-100k per month in non-farm payrolls

Fed’s Daly: US labor market is solid. Not signaling weakness but suggests slowing

- San Francisco Pres. Mary Daly is speaking on Bloomberg

- US labor market is solid. Not signaling weakness suggests slowing.

- Inflation could be a one off and not materialize, or a small impact.

- Could look to begin adjust rates in autumn, and has been her view for some time

- The fall looks promising for a rate cut.

- Tariffs will boost inflation but it should dissipate

- Businesses are cautiously optimistic

- Very focused on getting inflation back down to 2%

Fed’s Goolsbee: Prior to Liberation Day tariffs, it seemed the Fed was on solid ground

- Goolsbee on CNBC

- We gotta get a few months of clarity before I’m ready to say tariffs didn’t have an impact

- Hope is that there will not be much inflation from tariffs, but there needs to be a few months of clarity

- Economists are unanimous that monetary policy needs to be free of political interference

- If inflation stays in the range of 2% and the uncertainty is resolved the Fed is on a path to lowering rates

J.P. Morgan Expects Fed to Cut Rates in December, Sees Four Cuts by 2026

J.P. Morgan is forecasting that the Federal Reserve will begin cutting rates in December, with as many as four total reductions stretching into early 2026.

The bank now sees 2025 U.S. GDP growth at just 1.3%, down from 2%, citing the drag from tariffs and a slower economic outlook. However, strong earnings and tech-sector resilience—especially from AI-driven demand—should keep equity markets supported.

The firm expects the Fed’s target range to settle at 3.25%–3.50% by early 2026 and believes that the rally in risk assets can continue, especially as AI investment becomes more institutional and less speculative.

India-US Trade Talks Hit Snags Ahead of Tariff Deadline

Trade negotiations between India and the U.S. have reportedly stalled, with Indian officials citing disagreements over duties on auto parts, farm goods, and steel.

India had been considered a frontrunner for a quick resolution, but talks have broken down just weeks ahead of the July 9 tariff deadline. India is pushing for the U.S. to scrap its proposed 26% reciprocal tariff, which is currently set at 10%. Additional sticking points include demands for steel tariff relief and broader concessions in auto component trade.

Click here for the full article

Trump May Announce Fed Chair Pick Early to Undercut Powell

The Wall Street Journal reports that Donald Trump is weighing an early announcement for the next Federal Reserve Chair—potentially before the end of summer.

Although Jerome Powell’s term doesn’t expire for another 11 months, Trump is reportedly considering names such as Kevin Warsh, Kevin Hassett, and Scott Bessent. Also under discussion are David Malpass and Christopher Waller. The move is widely seen as an effort to weaken Powell’s influence in his final months.

J.P. Morgan Predicts 5.7% Drop in US Dollar Index Over Next Year

J.P. Morgan expects the US Dollar Index (DXY) to slide 5.7% in the next 12 months. The bank argues that U.S. growth is losing steam and will lag behind both other developed and emerging economies.

Global fiscal policy is becoming more supportive, especially outside the U.S., which J.P. Morgan says could exert additional pressure on the greenback as capital shifts abroad.

Nomura Sees Treasury Rally on Rising Slowdown Fears

Nomura forecasts U.S. Treasuries will strengthen in the months ahead as recession concerns mount. In a note to clients, the bank said that while a firm labor market could temper yield declines, any signs of softening job data would likely accelerate the bond rally.

The firm’s call reflects a shift in market focus away from inflation and toward weaker growth as the primary concern driving yields.

Canadian Average Weekly Earnings Climb 4.43% in April

Canadian workers earned more in April, with average weekly earnings rising 4.43% year-over-year, up from March’s 4.06% (revised from 4.31%).

- Monthly earnings growth: +0.8%, reaching $1,297/week

- Average weekly hours: steady at 33.5, with little change

Payroll job changes:

- Manufacturing: -7,300 (-0.5%)

- Accommodation & food services: -5,800 (-0.4%)

- Retail trade: -5,000 (-0.3%)

- Admin/support & waste services: -4,700 (-0.6%)

Job gains were seen in:

- Health care & social assistance: +10,800 (+0.4%)

- Public administration: +6,200 (+0.5%)

- Educational services: +5,200 (+0.4%)

Job vacancies fell by 16,800 (-3.2%) to 501,300, marking a 15.4% drop year-over-year. The biggest declines came from sectors like building materials and apparel retailers. Health care hiring rebounded from the prior month’s dip.

Banxico Cuts Rates by 50bps, One Member Dissents

The Bank of Mexico (Banxico) cut its benchmark interest rate by 50 basis points, as expected, though the decision wasn’t unanimous—one policymaker voted to leave rates unchanged.

The tone of the post-decision statement was notably more cautious than previous guidance. While the door remains open to further cuts, the bank signaled a slower pace of easing going forward as it monitors inflation and global risks.

Commodities News

Gold Stalls Near $3,331 Despite Weak Dollar and Lower Yields

Gold prices stalled on Thursday, despite favorable tailwinds from a falling U.S. Dollar and declining Treasury yields. Spot gold was last seen trading at $3,331, posting a slight 0.05% loss for the session.

While the U.S. Dollar Index (DXY) slipped 0.59% to 97.13—testing levels last seen in February 2022—and Treasury yields declined, strong U.S. data took the steam out of gold’s rally.

Economic backdrop:

- Initial Jobless Claims: 236K vs. 245K prior

- Durable Goods Orders (May): +16.4% MoM vs. +8.5% expected

- Q1 GDP (Final): –0.5% QoQ vs. –0.2% prior estimate

Political risk factor:

A Wall Street Journal report suggested President Trump may nominate Fed Chair Jerome Powell’s successor by September or October, introducing further uncertainty around the Fed’s policy path as markets already price in 63.5 basis points in rate cuts by year-end.

Fed commentary:

- Boston Fed’s Collins: Not enough evidence yet to justify a July rate cut.

- Richmond Fed’s Barkin: Tariffs likely to push inflation higher but not dramatically so.

Despite gold’s failure to move higher Thursday, the broader trend remains supported by inflation concerns, central bank policy divergence, and growing skepticism around the dollar’s long-term stability.

Crude Oil Rebounds Modestly, Faces Resistance at Key Technical Level

Crude oil recovered slightly on Thursday, but gains were capped near a crucial Fibonacci retracement level. WTI crude settled at $65.24, up $0.32 on the day, after bouncing between $64.70 and $66.39.

The session high briefly breached the 50% midpoint of the April-to-June rally, located at $66.33, but failed to hold above it, reinforcing that level as immediate resistance.

Outlook:

- As long as crude remains below $66.33, technical bias leans bearish.

- On the downside, attention turns to the $63.67–$64.63 zone—a support band reinforced by multiple swing lows and the 61.8% retracement level from the same rally, anchored at $63.67.

With prices consolidating between well-defined technical levels, a breakout on either side could dictate the next leg in oil’s direction.

Silver Holds Above 21‑Day EMA as Momentum Eases

Silver pulled back from an intraday high of $36.84 and is currently around $36.40. It remains perched above the 21-day EMA within a rising wedge pattern; a breakdown under the wedge could lead to declines toward $35.00–$34.80.

This consolidation follows mixed US economic data: Q1 GDP contraction of –0.5%, a surprising 16.4% jump in factory orders for May, and a widening trade deficit of $96.6 billion. ETF holdings remain robust, speculative longs on COMEX are still heavy, and industrial demand in solar and EV sectors is resilient. Together, these factors support the price, reducing downside risk despite slower momentum.

Gold Gradually Repositions as Dollar Weakens – TDS

Daniel Ghali argues the dollar is losing its traditional role as a store of value, and gold is quietly stepping into the breach. He observes central banks are accumulating bullion, while gold prices diverge from typical drivers like the dollar, US rates, and equity sentiment.

The Shanghai Gold Exchange’s Hong Kong expansion underscores this trend, aiming to boost yuan-based gold trading and challenge dollar dominance. Although easing trade tensions have dampened immediate demand, low market participation suggests gold isn’t headed much lower. Ghali anticipates the next buying wave driven by key catalysts on the horizon.

Crude Oil Price Floor Erodes Despite Ceasefire – TDS

TDS Senior Commodity Strategist Daniel Ghali points out that oil’s support level has weakened amid ongoing geopolitical tensions. Despite the ceasefire, downward pressure on crude continues as risks grow under current dynamics.

Technical funds have heavily sold futures recently, cutting their WTI exposure by roughly 50% in a single session. They’re poised to sell an additional 5% if prices dip below $64.45/bbl. Discretionary money managers remain vulnerable, having entered the conflict with long positions. With summer supply-demand imbalances ahead, further outflows are possible even as automated funds hold some support.

Copper Stocks Plunge Close to Critical Levels – TDS

According to Daniel Ghali, copper inventories are approaching crisis thresholds with dockside supply dwindling. He notes that while markets expected a post-holiday drop in demand, proprietary indicators show steady consumption. Additionally, Section 232 tariff threats and Chinese hoarding have drained global supplies.

As LME warehouses near empty, time spreads have widened, incentivizing inflows—though actual metal delivery to these facilities has lagged. If inventories don’t rebound swiftly, the market could echo the 2021 crunch. Although CTA buying has stabilized prices, algorithms remain exposed to downward shocks. Expect stronger CTA demand in zinc and lead markets soon.

China Launches First Offshore Gold Contracts, Opens Vault in Hong Kong

The Shanghai Gold Exchange has taken its first step outside mainland China, rolling out two new gold contracts and launching a bullion vault in Hong Kong. This marks a major effort to expand China’s influence in both global commodity trading and yuan usage.

Trading for the contracts—covering different purities—will be settled in Chinese yuan, either via cash or physical delivery. The vault, operated by Bank of China’s Hong Kong unit, will support those deliveries. To boost participation, the Exchange is waiving vault fees through year-end. Trading begins Thursday.

Europe News

German DAX Leads European Equities With 0.56% Gain

The German DAX outperformed its European peers with a 0.56% increase, while most other regional indices hovered near flat for the day.

- France CAC 40: -0.01%

- UK FTSE 100: +0.19%

- Spain’s IBEX: +0.03%

- Italy’s FTSE MIB: +0.08%

Investor focus remained on macroeconomic data and central bank commentary, with little new to shake markets broadly.

Far-Right MEPs Push No Confidence Vote Against EU’s von der Leyen

Far-right members of the European Parliament are attempting to remove European Commission President Ursula von der Leyen over her role in the controversial Pfizer COVID-19 vaccine deal—a saga now dubbed Pfizergate.

Romanian MEP Gheorghe Piperea is leading the charge, having secured more than the required 72 signatures to submit the no confidence motion. The scandal centers around von der Leyen’s direct negotiations with Pfizer for €35 billion worth of vaccines without following the public procurement process.

Despite the move, the math appears against her opponents. Von der Leyen won re-election with 401 out of 720 votes, meaning her position looks secure unless a significant number of supporters defect.

Germany’s Consumer Mood Slips as Savings Rise

The latest GfK survey shows German consumer sentiment dipping further going into July, with the reading at -20.3, slightly below the expected -19.3 and down from -19.9 in June.

GfK analysts noted a rising inclination to save among households—even as income expectations have improved—which they interpret as a sign of ongoing caution and uncertainty among German consumers.

ECB’s de Guindos: Markets are surprisingly calm in recent days given geopolitical events

- Comments from the ECB Vice President

- Markets are surprisingly calm in recent days given geopolitical events.

- Role of the euro can expand if EU progresses with reforms.

BOE’s Bailey: A gradual and careful approach on rate cuts remains appropriate

- Remarks by BOE governor, Andrew Bailey

- Monetary policy needs to continue to remain restrictive for sufficiently long until the risks to inflation returning sustainably to 2% has dissipated further

- Monetary policy is not on a pre-set path

- Interest rates remain on a gradual downwards path

- In recent months, evidence that slack is opening up has strengthened; especially in the labour market

- Should recognise that short-term pick up in inflation introduces some further uncertainty

- Moves in FX have not been moving based on interest rates speculation.

- Investors are reconsidering positions.

- Uncertainties about structural changes in world economy have impacted FX.

BoE Breeden: UK’s robust standards and resilient system boosts competition

- Remarks from the BoE policymaker

- UK’s robust standards and resilient system boosts competition.

- The UK needs to ensure private markets are sustainable.

UK to Appoint Oversight Official to Fix ONS Data Woes

The British government is reportedly preparing to appoint a senior civil servant to help overhaul the Office for National Statistics (ONS), following extended criticism over unreliable data.

The planned move comes after a review commission recommended splitting the top role at the agency to allow one official to focus specifically on internal operations. The ONS has struggled for over a year to consistently deliver accurate figures on labour, inflation, and trade, complicating the Bank of England’s policymaking.

The government is expected to adopt the commission’s recommendations, but the timeline for reforms remains unclear.

Asia-Pacific & World News

Citigroup Raises China 2025 GDP Forecast to 5%

Citigroup has upgraded its growth projection for China’s economy in 2025, revising its forecast from 4.7% to 5%. The latest bump marks the third adjustment in as many months, after Citi initially slashed expectations to 4.2% in April, before lifting them back to 4.7% in May.

This ongoing revision cycle reflects how closely China’s economic outlook remains tethered to trade developments and policy responses, especially as the global landscape shifts.

HKMA: More Interventions Possible Depending on Capital Flows

The Hong Kong Monetary Authority (HKMA) said it will continue to monitor external risks and capital flow dynamics to maintain orderly HKD market operations, following its recent intervention.

In a brief statement, the central bank said the weak-side convertibility undertaking for the HKD may be tested again if market imbalances resurface. Officials emphasized they’re prepared to step in again if volatility returns.

Goldman Sachs Targets 4,600 on CSI 300, Reaffirms Bullish View

Goldman Sachs is sticking with its bullish outlook on Chinese equities, predicting the CSI 300 Index will climb to 4,600 by year-end—representing a double-digit upside from current levels.

Despite a shaky start to the year, Goldman expects the second half of 2025 to benefit from policy support, better corporate earnings, and stabilizing macro conditions. The bank remains “overweight” on both A-shares and Chinese ADRs, pointing to favorable valuations and potential capital inflows as investor confidence improves.

China’s NDRC Signals Confidence in Managing External Risks

China’s National Development and Reform Commission (NDRC) says it is confident in minimizing the economic fallout from global uncertainties.

Officials acknowledged the external environment has grown more complex and unpredictable, but they emphasized that the domestic economy remains stable. Summer electricity supply is expected to outperform last year. The NDRC confirmed a third wave of trade-in subsidies for consumer goods is set for rollout in July.

Premier Li Reaffirms China’s Pledge to Stimulate Consumption

Chinese Premier Li repeated that China will take “strong and effective” action to boost consumer demand. In his latest remarks, Li described the country’s economy as resilient, with second-quarter data showing continued stability.

He also reiterated that China’s recovery will create opportunities for global partners and maintains that China is still a primary engine of global growth.

PBOC sets USD/ CNY reference rate for today at 7.1620 (vs. estimate at 7.1561)

- PBOC CNY reference rate setting for the trading session ahead.

PBOC injected 509.3bn yuan via 7-day reverse repos at 1.40%

- 203.5bn yuan mature today

- net injection is 305.8bn yuan

Deutsche Bank Moves RBA Rate Cut Call to July

Deutsche Bank now sees the Reserve Bank of Australia (RBA) delivering a 25 basis point rate cut at its July 8 meeting, moving its forecast forward from August.

The change follows weaker-than-expected inflation data, with Deutsche now predicting further cuts in August and November as well. The bank sees mounting evidence that inflation is cooling fast enough to justify earlier policy easing.

Japan Rejects 25% Auto Tariff Threat, Vows Continued Talks with US

Japan’s State Minister of Economy, Trade and Industry, Akazawa, pushed back firmly against the U.S. proposal for a 25% tariff on Japanese auto exports.

Speaking ahead of expected reciprocal tariffs scheduled for July 9, Akazawa said Japan “cannot accept” the proposed measures and emphasized Tokyo’s intention to continue negotiations with Washington.

Japan’s 2-Year Bond Auction Sees Best Demand Since January

Demand for Japanese 2-year government bonds jumped to its highest level in six months. The latest auction produced a bid-to-cover ratio of 3.90, a rise from May’s 3.77.

The average yield came in at 0.729%, with the lowest accepted yield at 0.735%. The auction tail widened slightly to 0.012 yen, up from 0.009 yen in the previous sale. The results suggest steady interest in short-term JGBs amid ongoing market uncertainty over the Bank of Japan’s next moves and broader global rate trends.

Foreign Investors Exit Japanese Equities After 11-Week Buying Streak

For the first time since March, foreign investors turned net sellers of Japanese equities, according to Ministry of Finance data for the week ending June 20.

Over the week, they sold a net ¥524.3 billion in Japanese stocks, ending an 11-week run of buying that had totaled ¥7.24 trillion. The pullback reflects concerns about rich valuations and underwhelming earnings growth.

Crypto Market Pulse

Crypto Outlook: Bitcoin, Ethereum, XRP Tick Higher as Dollar Weakens

Crypto markets are gaining on recent dollar weakness: Bitcoin briefly climbed above $108K before settling near $107,356. President Trump’s renewed criticism of Fed Chair Powell has triggered debates around Fed independence, fueling flow into digital assets via spot ETFs.

BTC spot ETFs attracted over $547 million in inflows, marking 12 consecutive days of net inflows; total inflows now exceed $48 billion, with about $134 billion in assets under management. Ethereum spot ETFs added ~ $60 million, bringing cumulative inflows to $4.1 billion, with $10 billion in assets.

Ethereum is firm around $2,451, held above key EMAs with a MACD buy signal; resistance sits at $2,481. A breakout could target $2,570 and $2,882. XRP trades near $2.17 amid forming wedge patterns. A MACD buy signal supports a move higher, with key levels to watch between $2.00 and $2.18.

XRP Poised for a Fall Below $2 as Pair Hits Lows

Ripple’s XRP has lost upward momentum, slipping from weekend lows of $1.90 to around $2.10 now. Its XRP/BTC ratio has dropped roughly 42% from a January peak, trading near 0.00001982 BTC—a seven-month low. The daily chart forms a falling wedge, which often precedes a breakout.

The decline in the pair reflects macro uncertainty and criticism of Fed Chair Powell by Trump, which has shaken markets. With XRP’s RSI around 37, it’s nearing oversold territory. A clear breakout could lift XRP above $2 again; failure might drag it below long-term support.

Meme-Coins Fartcoin, PEPE, WIF Signal Weakness

Despite Bitcoin’s steady rally to around $108K, meme coins are slipping. Fartcoin and Dogwifhat both declined ~10%, while PEPE dropped 7.5%.

Fartcoin is trading around $0.96, struggling to reclaim its 200‑period EMA. A “death cross” between EMAs suggests potential moves down to $0.80. PEPE is stuck near $0.00000930 with fundamentals bearish—futures open interest has collapsed, and a death cross looms. Dogwifhat, at $0.75, lost more than 5% today and saw its derivatives open interest fall 8.4%. MACD is still bearish. All signs point to further pressure in these speculative tokens amid a flight toward larger cryptos.

PEPE Falls 4.7% as Meme‑Coin Frenzy Subsides

Despite Elon Musk’s April social nod, PEPE has dropped nearly 5% in 24 hours to $0.000009499, according to CoinDesk. Once a viral favorite, it’s lost steam as focus returns to Bitcoin’s rise; BTC dominance now exceeds 65%, the highest in over two years.

A push above $0.00001013 failed, reinforcing resistance. Unless broader risk sentiment shifts back toward lesser-known tokens, recovery remains unlikely.

MOVE, XCN, KAS Continue Positive Streak

Several U.S.-based altcoins are riding strong upward trends: Movement (MOVE) has surged almost 60% this week, trading near $0.20 and eyeing resistance at $0.2540. The MACD and RSI support continued upside.

Onyxcoin (XCN) is close to breaching long-term resistance around $0.01699. With MACD bullish and RSI near 57, a breakout could drive it toward its 50% Fibonacci at $0.01943.

Kaspa (KAS) rose about 1.3% intraday and has seen gains of ~22% for the week. A wedge breakout is underway, bolstered by a MACD buy signal, targeting previous highs near $0.083 and $0.091.

Fannie, Freddie Directed to Prepare for Crypto in Mortgage Applications

In a significant shift, the Federal Housing Finance Agency has instructed Fannie Mae and Freddie Mac to begin treating cryptocurrency holdings as mortgage-eligible assets, according to agency director William Pulte.

Pulte said on X that the move aligns with former President Trump’s push to modernize the mortgage market. While no formal rule changes are yet in place, the directive signals a major potential change in underwriting standards that could make it easier for crypto holders to qualify for home loans.

The Day’s Takeaway

United States

- Q1 2025 GDP Final: Revised down to –0.5% (vs. –0.2% est), confirming contraction. Final Q4 2024 GDP was +2.4%.

- Consumer spending revised lower to +0.5% (from +1.2%)

- Corporate profits: –3.3% (improved from –3.6%)

- Net trade dragged –4.61%, inventories added +2.59%

- GDP deflator: +3.8% (vs. 3.7% est), Core PCE: +3.5%, Services ex-energy/housing: +4.3%

- Durable Goods (May): Surged +16.4% MoM, doubling the forecast (+8.5%)

- Initial Jobless Claims: Fell to 236K (vs. 245K prior), 4-week avg at 245K

- Pending Home Sales (May): Up +1.8% MoM (vs. +0.1% est), reversing April’s –6.3%

- Advance Wholesale Inventories (May): Fell –0.3% (vs. +0.1% est)

- May Trade Balance: Widened to –$96.59B (vs. –$88.5B est)

- Markets:

- S&P 500 closed at 6141.02, just shy of all-time high at 6147.43

- Nasdaq hit 20187.15 intraday, close to its 20204.58 record, settled at 20167.91

- Dow Jones: +404.41 points to 43386.84

- Nike Q4 earnings: EPS 14c (vs. est. 13c), revenue $11.10B, but down YoY on EPS. Inventories $7.49B (vs. $7.17B est)

- 7-Year Note Auction:

- High yield: 4.022% (stop-through of 0.2 bps)

- Bid-to-cover: 2.53

- Indirects: 76.74%, Directs: 11.62%, Dealers: 11.64%

- Gold price: Stalled near $3,331 despite dollar weakness and rate cut bets

- Political Risk: Trump may name a Powell successor as early as September or October, raising Fed independence concerns

Canada

- Average Weekly Earnings (April):

- +0.8% MoM to $1,297, up +4.43% YoY

- Payroll job losses: Manufacturing –7,300; Accommodation/Food –5,800; Retail –5,000

- Job gains: Health/Social Assistance +10,800; Public Administration +6,200

- Job Vacancies: Fell –16,800 MoM to 501,300, down 15.4% YoY

Commodities

Crude Oil

- WTI settled at $65.24, up $0.32

- Stalled at key resistance near $66.33, the 50% retracement from April–June move

- Support zone eyed between $63.67–$64.63

- TDS: Oil’s price floor may be deteriorating due to fading war premium and CTA flows; discretionary longs remain at risk

Copper

- Inventories approaching critically low levels at LME

- Timespreads blowing out, no Chinese exports have yet hit LME warehouses

- CTA flows supporting price but could reverse on market shock

- TDS warns of potential stock-out if metal doesn’t return to system soon

Gold

- Struggled to gain traction despite weak USD

- Economic strength, particularly Durable Goods and Jobs data, capped upside

- TDS: Gold is increasingly replacing USD as a store of value; SGE’s Hong Kong expansion signals currency re-alignment

Silver

- Pulled back to $36.40 from high of $36.84, holding above 21-day EMA

- Rising wedge remains intact; breakdown risks move toward $35.00–$34.80

- Investor flows remain strong; industrial demand from solar/EV keeps support firm

Europe

- Germany GfK Consumer Sentiment (July): Fell to –20.3 (vs. –19.3 est), prior –19.9

- DAX led gains in Europe: +0.56%

- France CAC: –0.01%

- UK FTSE 100: +0.19%

- Spain IBEX: +0.03%

- Italy FTSE MIB: +0.08%

- Far-right MEPs attempt no confidence vote against von der Leyen over Pfizergate; unlikely to pass

- UK Government to appoint new civil service role to fix ONS data credibility issues after persistent inflation/labor data failures

Asia

- Japan 2-Year JGB Auction:

- Strongest demand since January, bid-to-cover at 3.90 (vs. 3.77 prior)

- Average yield: 0.729%, tail widened slightly

- Foreigners Sell Japan Equities: Net sellers for first time since March, offloading ¥524.3B

- China GDP Outlook: Citi raises 2025 forecast to 5.0% (from 4.7%) after previous downgrades

- China’s NDRC: Confident in offsetting global shocks, third round of trade-in subsidies coming in July

- Premier Li: Says economy remains stable, will ramp up consumption stimulus

- Hong Kong: HKMA monitoring capital flows, weak-side USD/HKD trigger may be tested again

- Japan Tariff Pushback: Trade minister says Tokyo will not accept 25% U.S. auto tariffs

- India-US Trade Talks: Stalled over auto, steel, farm goods; India pushing for rollback before July 9 deadline

Rest of World

- Mexico: Banxico cut rates by 50bps, one member dissented. Guidance now less aggressive about future easing

- Australia: Deutsche Bank brings forward RBA rate cuts to July, sees second cut in August, third in November

- Nomura: Says U.S. Treasuries poised for rally if labor market softens

- J.P. Morgan: Expects Fed to cut in December, possibly four cuts total by early 2026

- Trump: Claims Iran war is over, says Israel and Iran are both “tired,” hints at potential deal with Iran

- Trump on Spain: Slams Spain’s trade behavior, threatens higher tariffs

Crypto

- Bitcoin: Briefly breached $108K, now near $107,356

- Ethereum: Trades at $2,451, eyes breakout above $2,481, support at $2,426

- XRP: Trading at $2.17, MACD buy signal intact, wedge breakout possible

- BTC Spot ETF Inflows: +$547M on Wednesday, 12-day streak, total inflows $48.14B

- ETH Spot ETFs: +$60M inflow, total ~$4.1B

- Dollar Weakness: DXY falls to 97.13, down 11.82% since January

- Altcoins:

- MOVE: +60% weekly, testing $0.20, targeting $0.254

- XCN: Approaching breakout at $0.01699, RSI rising

- KAS: +22% weekly, wedge breakout confirmed, eyes $0.08298

- Meme Coins:

- Fartcoin: Down 3%, testing $0.96; death cross on chart

- PEPE: Fell 4.7%, now at $0.00000930, open interest plunging

- Dogwifhat (WIF): Down 5%, now $0.75; OI down 8.4%, MACD still bearish

- Sector down 4.7% overall, underperforming as Bitcoin dominance tops 65%