North America News

US Stocks End Mixed; Dow Inches Up While Broader Markets Slip

Major U.S. equity indices closed Friday on a mixed note, with the Dow Jones Industrial Average managing a modest gain, while the S&P 500 and Nasdaq Composite lost ground.

- Dow: +35.16 points (+0.08%) to 42,206.82

- S&P 500: -13.03 points (-0.22%) to 5,967.84

- Nasdaq: -98.86 points (-0.51%) to 19,447.41

Despite the slight day-to-day volatility, the trading week ended with very little movement across the major benchmarks:

- Dow: +0.02%

- S&P 500: -0.15%

- Nasdaq: +0.21%

The markets spent much of Friday in back-and-forth mode as investors hesitated to hold positions into the weekend, given lingering geopolitical risks and the uncertain trajectory of monetary policy. Traders gravitated toward safe havens early in the U.S. session, with gold rebounding modestly and the U.S. dollar firming.

The dollar gained traction despite Fed Governor Christopher Waller’s surprisingly dovish comments suggesting a possible rate cut in July. Those remarks, however, were overshadowed by other Fed voices, such as Richmond Fed President Thomas Barkin, who maintained a more cautious tone.

Looking ahead, next week’s U.S. economic calendar is relatively light. The spotlight will fall on the PCE inflation report, while traders also monitor developments in the Iran conflict, U.S. tariff policy, and fresh commentary from Federal Reserve officials, now out of their pre-meeting blackout.

Fed: Tariffs Are Hurting Confidence, But Impact Still Early

The Federal Reserve’s Monetary Policy Report flagged that recent tariffs have undermined both household and business confidence—even as the full economic impact is still developing.

Key points from the report:

- Market liquidity has stabilized but remains highly sensitive to trade headlines

- Treasury depth declined to early-2023 levels

- The weak start to 2025 reflects adjustment to new tariff structures

- Dollar has broadly declined

- Price pressures are building from tariffs, though not fully visible in data

- Financial stability remains “resilient”

Overall, the Fed characterized policy as “well-positioned,” while acknowledging inflation is still “somewhat elevated” and that the full effect of trade actions remains uncertain.

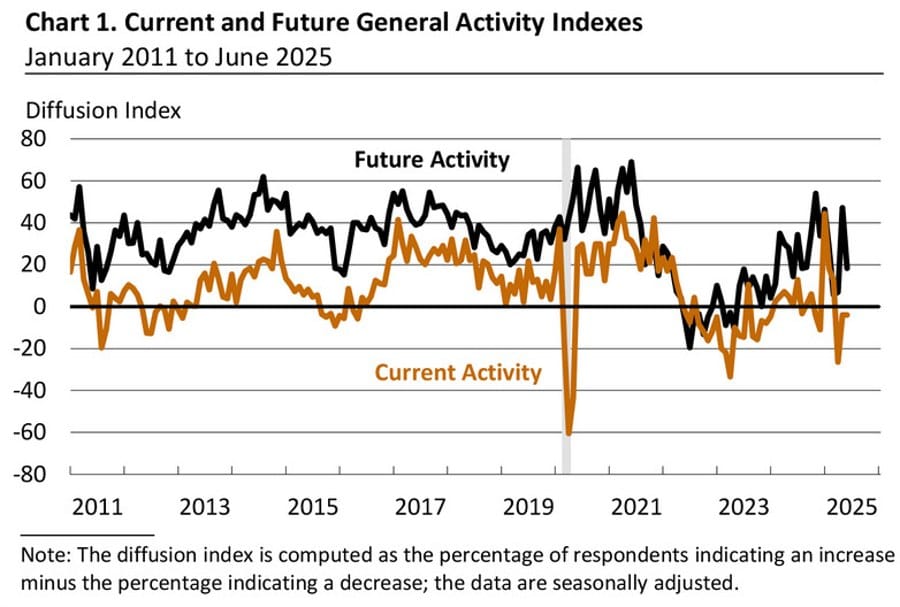

Philly Fed Business Index Holds at -4.0, Forward Outlook Dims Sharply

The Philadelphia Fed’s business activity index stayed at -4.0 in June, matching May’s level and missing the expected improvement to -1.0. The report showed a mixed picture under the surface.

- New Orders dropped to 2.3 (from 7.5)

- Shipments rebounded to 8.3 (from -13.0)

- Unfilled Orders rose to 9.3 (from 4.9)

- Delivery Times surged to 13.6 (from -9.2)

- Inventories softened to 3.6 (from 9.7)

- Prices Paid and Prices Received both declined, coming in at 41.4 and 29.5, respectively

- Employment dropped sharply to -9.8 (from 16.5)

- Future Activity expectations cratered, with the forward-looking index falling 29 points to 18.3

The report reflects growing caution in the region’s manufacturing outlook, with labor indicators deteriorating and inflation inputs easing somewhat.

Fed’s Daly: Things are in balance

- Comments from the SF Fed President

- So far the economy is in a good place and so is policy

- Concerns about tariff impact on inflation aren’t as large as they were when they were first announced

- Many possibilities on how much of tariffs pass through to customers

- Fundamentals of economy are moving to where an interest rate cut may be necessary

- CEOs have cautious optimism on tariffs

- I look more to the autumn rather than July for a rate cut

- Unless we see a faltering labor market, autumn looks more appropriate

Fed’s Barkin: No Rush to Cut, Tariff-Driven Inflation Still a Risk

Richmond Fed President Thomas Barkin signaled patience on rate cuts, saying the central bank is in no hurry to ease policy. Speaking Friday, Barkin warned that inflation risks tied to trade policy remain elevated.

He noted that:

- Price indexes are still above target

- Firms anticipate passing higher import costs onto consumers later in the year

- Trade uncertainty is driving caution in hiring and capital investment

- Even businesses not directly hit by tariffs are viewing the moment as pricing leverage

Barkin added that while the labor market and consumer spending are holding firm, there’s no urgency in the data to warrant a rate cut.

Fed’s Waller: I’m all in favor of saying ‘maybe we should think about cutting’ in July

- Waller gets dovish

- I’m all in favor of saying ‘maybe we should think about cutting at the next meeting’

- Tariffs ‘are not going to cause persistent inflation’

- Tariffs will be a one-time factor

- The Fed should not wait for the job market to crash in order to cut rates

- The job market is solid but starting to see things like high unemployment for recent grads

- The Fed has been on pause for six months waiting for an inflation shock that has not arrived

- The Fed has room to bring rates down and then can see what happens with inflation

- The Fed is in a position as early as July for cuts

Audi May Build New U.S. Plant to Navigate Tariffs—Report

According to Der Spiegel, Audi is exploring plans to build a new production plant in the United States to avoid the burden of Trump’s tariffs on EU auto imports. While no final decision has been made, sources say a firm announcement is likely by the end of 2025.

The German automaker, part of Volkswagen Group, is reportedly leaning toward a greenfield site in the southern U.S., potentially creating 3,000 to 4,000 jobs. Though VW has an existing facility in Tennessee, Audi is hesitant to use it due to recent union negotiations that granted workers over 25% in wage increases over five years—a cost Audi may prefer to avoid initially.

The final decision will depend heavily on the trajectory of EU-U.S. trade negotiations in the coming months.

JP Morgan Sees Weakening Dollar Amid Diverging Global Outlook

JP Morgan reiterated its bearish outlook on the U.S. dollar, citing slowing domestic growth, global policy divergence, and reduced international demand for U.S. assets.

In a client note, the bank pointed to sluggish indicators—ranging from jobless claims to soft PMIs and weaker construction and auto data—as evidence that U.S. economic momentum is losing steam. Meanwhile, global demand is being supported by stimulus elsewhere and lower energy prices.

Analysts say the dollar faces structural downside risks and may start trading at a “discount” over the longer term. They highlighted recent shifts in rate expectations: while the Fed’s terminal rate projections have slipped, bond term premiums have risen—creating what they call a “negative cocktail” for the dollar.

For 2025, JP Morgan expects stronger currency performance from Australia, New Zealand, the euro area, and Japan in the developed space, along with robust gains in select EMEA markets.

Canada’s Producer Prices Slide Again in May, Raw Materials Weak

Canada’s Producer Price Index (PPI) fell 0.5% in May, steeper than the expected -0.1% decline, though an improvement from April’s -0.8% reading. On a year-over-year basis, producer prices rose 1.2%, down from 1.9% the prior month.

The Raw Materials Price Index (RMPI) dropped 0.4% on the month, a significant easing compared to April’s -3.3% fall. The year-over-year RMPI now stands at -2.8%, a slight recovery from -3.9% previously. Weak energy input costs continue to weigh on upstream pricing momentum.

Canada April Retail Sales Miss, Advance May Estimate Shows Bigger Drop

Retail sales in Canada edged up just 0.3% in April, missing expectations for a 0.5% increase. The prior month’s figure was revised slightly higher to +0.8%. However, sales excluding autos came in at -0.3%, a clear miss versus the forecast of +0.2%.

The advance estimate for May points to a notable decline of -1.1%, indicating that consumer activity may have cooled significantly heading into Q2’s midpoint.

Commodities News

Gold Slips on Trump’s Iran Delay, Ends Week With Nearly 2% Loss

Gold prices drifted lower Friday and are on track for a weekly decline of around 1.90%, as risk appetite improved after President Trump signaled a pause on immediate military action against Iran.

At last check, spot gold traded at $3,369, down 0.11% on the day.

The shift in tone from the White House softened demand for safe havens. Although hostilities between Israel and Iran persist, the lack of immediate U.S. military escalation calmed investor nerves. News that Iran is willing to discuss limits on uranium enrichment, though firmly rejecting a “zero enrichment” policy, added to a sense of guarded optimism.

The easing in gold also came amid a broader risk-on move, following reports that the U.S. may pull back on semiconductor waivers for allies with facilities in China, which shook markets earlier in the day.

Fed Split Clouds Outlook for Gold

Diverging signals from Fed policymakers added complexity. While Governor Waller flagged a potential rate cut in July, others, like Barkin, emphasized the need for patience. Meanwhile, the Fed’s latest Monetary Policy Report reiterated that current policy is “well-positioned,” even as the full effects of tariffs on inflation and growth have yet to materialize.

Despite this week’s dip, gold remains anchored by its role as a geopolitical hedge. However, expectations for persistent rate holding—and a stronger U.S. dollar—are capping upside momentum.

- The U.S. Dollar Index (DXY) is up 0.50% for the week, ending at 98.65

- The Philadelphia Fed Manufacturing Index for June remained weak at -4.0, matching May’s level and falling short of the expected -1.0

Market Outlook

The Fed’s cautious stance, ongoing Middle East tensions, and tariff-related uncertainty will keep gold in focus next week. Money markets are now pricing in 46 basis points of rate cuts by year-end, leaving room for further moves in the metal depending on data and headlines.

Key economic reports next week include GDP, housing data, flash PMIs, and fresh Fed speeches that could help clarify the policy path through Q3.

Platinum Hits 11-Year High, But ETF Outflows Raise Red Flags

Platinum reached a peak of $1,350 per troy ounce, its highest since 2013, before pulling back below the $1,300 level. Analyst Carsten Fritsch at Commerzbank noted that the metal’s rally has narrowed the price gap with gold to under $2,050, a three-month low.

However, recent fund flows suggest caution. Platinum ETFs tracked by Bloomberg saw outflows of 190,000 ounces in just one week—erasing nearly all inflows seen since the start of the year.

Fritsch warns that while fundamentals remain supportive, waning investor interest through ETFs could cap near-term upside, especially if speculative appetite begins to cool across commodities more broadly.

Crude Oil Trapped in Range as Market Waits on Iran-U.S. Signals

Oil markets remained locked in a sideways pattern Thursday, with WTI prices unable to break above key resistance levels amid simmering tensions in the Middle East. Traders appear to be betting on eventual de-escalation, despite threats of U.S. involvement in the Iran-Israel conflict.

On the charts, crude has held just above the $72.00 support zone, repeatedly failing to push higher. A clear break below that level could open the door to a pullback toward $65.00. On the upside, buyers continue to defend the range lows but lack a catalyst for follow-through.

News that Iran is open to discussing limits on uranium enrichment sent oil lower intraday. Tehran has reportedly shifted focus to engaging with European powers, given current hostilities with Israel and diplomatic silence from Washington. Iran says it will not accept a total enrichment freeze under current conditions.

Central Banks Plan More Gold Buying Over the Next Year

A new survey from the World Gold Council shows a growing appetite for gold among global central banks. The findings, cited by Commerzbank’s Carsten Fritsch, revealed:

- 95% of surveyed banks expect global gold reserves to increase in the next 12 months

- Over 40% plan to buy gold themselves (up from 29% last year)

- 72% believe the share of gold in reserves will rise slightly; 4% see a significant increase

Emerging market banks were more likely to cite crisis protection and inflation hedging as primary reasons, while developed markets leaned more on gold’s historical role.

IEA Confirms Global Oil Demand to Peak by 2030

The International Energy Agency (IEA) reiterated in its medium-term outlook that global oil demand will reach its peak around the end of this decade. Commerzbank analyst Barbara Lambrecht provided additional insights:

- EV adoption alone will displace around 5.4 million bpd by 2030

- Saudi Arabia is scaling back oil use in power generation through renewables and gas

- Petrochemical demand remains the main growth driver

- India is expected to post the strongest growth, despite still using far less than China

While demand growth is tapering, capacity expansion from the U.S. and Saudi Arabia is expected to outpace it, keeping the market balanced unless major disruptions occur.

Gold May Rise Further If Middle East Escalates – Commerzbank

Gold prices briefly topped $3,400 before easing slightly, but the potential for renewed upward momentum remains if the Middle East conflict worsens, says Thu Lan Nguyen, Head of FX and Commodity Research at Commerzbank.

While investor appetite has cooled due to recent gains, geopolitical tensions continue to lend support. The upcoming data on gold flows between Hong Kong and China could offer clues on physical demand. A major escalation—such as direct U.S. strikes on Iran—would likely reignite gold’s rally.

U.S. Crude Inventories Plunge in Biggest Weekly Draw in a Year

U.S. crude oil stockpiles fell by 11.5 million barrels last week—the steepest drop in nearly 12 months—Commerzbank’s Carsten Fritsch reported. The draw was fueled by:

- A sharp reduction in net imports: -1.8 million bpd

- Rising exports despite a narrowing spread between WTI and Brent (now just $2.50/bbl)

Inventories at Cushing, Oklahoma are now 40% below their 5-year average, signaling tight U.S. supply. With WTI catching up to Brent in price, Fritsch warned that export volumes may not remain elevated for long.

Brent Surges to $79 as Middle East Tensions Keep Oil on Edge

Crude prices surged to a five-month high, with Brent trading near $79 per barrel, driven by growing fears of supply disruption from the Israel–Iran conflict, according to Commerzbank.

Analyst Carsten Fritsch warned that:

- Further escalation, particularly U.S. involvement, could significantly lift prices

- A blockade of the Strait of Hormuz—through which 20% of global oil flows—would severely tighten global supply

- Iran risks isolating itself and angering key customers like China if it triggers such a scenario

Despite the low likelihood of full closure, geopolitical risk premiums remain firmly priced into the market.

Four Oil Price Forecasts: High-End Scenarios Point to $130

A Reuters roundup of analyst views from Citi, JP Morgan, Goldman Sachs, and Barclays highlights a wide range of oil price outcomes, depending on how the Iran-Israel conflict plays out.

Citi estimates that if 3 million bpd of Iranian supply is disrupted, Brent could rise to $90. In a more extreme case, prices could spike to $130. However, Citi also notes:

- Iranian exports are already falling

- China has reduced imports

- OPEC has spare capacity

- Any Hormuz disruption is likely short-lived

Overall, while geopolitical risk is high, analysts believe the worst-case price outcomes remain unlikely—at least for now.

Russia Backs OPEC+ Output Boost Despite Previous Hesitations

Russia’s Deputy Prime Minister Alexander Novak said Thursday that OPEC+ should move forward with scheduled oil production increases this summer, citing seasonal demand growth.

The bloc is phasing out 2.2 million barrels per day in voluntary cuts from April through July. While Moscow had previously proposed pausing the July hike, it’s now backing a 411,000 bpd output boost.

Novak and Saudi Energy Minister Abdulaziz bin Salman both stressed that OPEC+ should respond only to actual disruptions—not speculative threats—particularly in light of current Middle East tensions.

Europe News

European Stocks Mixed Into Week’s End, FTSE Lags on Retail Miss

European equity markets finished Friday with small gains, although the week ended in the red for most regional indices.

Closing snapshot:

- DAX: +299.01 pts (+1.30%) to 23,350.56

- CAC 40: +36.22 pts (+0.48%) to 7,589.67

- FTSE 100: -17.15 pts (-0.20%) to 8,774.66

- Ibex 35: +105.40 pts (+0.77%) to 13,850.29

- FTSE MIB: +289.14 pts (+0.74%) to 39,231.34

Weekly changes:

- DAX: -0.70%

- CAC 40: -1.24%

- FTSE 100: -0.86%

- Ibex: -0.43%

- FTSE MIB: -0.53%

London lagged as disappointing retail figures weighed on sentiment, while modest rebounds in continental Europe helped offset earlier declines.

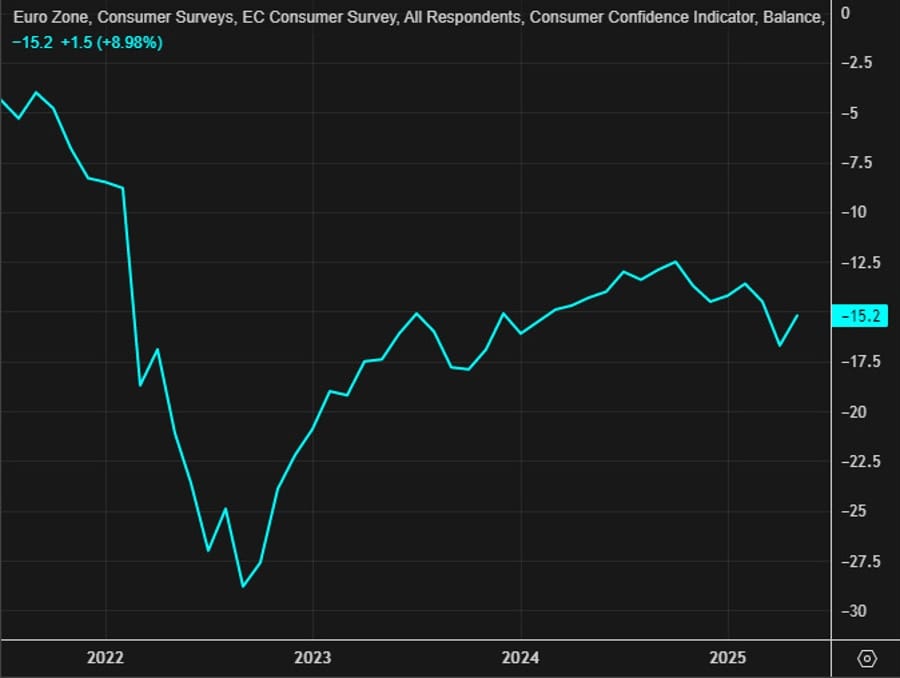

Eurozone Consumer Confidence Weakens Slightly in June

Consumer sentiment across the Eurozone softened in June, with the European Commission’s confidence index dropping to -15.3, from -15.2 last month and below the expected -14.5.

Though still above last year’s lows, the data signals persistent caution among households. Rising energy costs and geopolitical uncertainty continue to weigh on European consumers heading into the second half of 2025.

German Producer Prices Flat in May When Energy Is Stripped Out

Germany’s Producer Price Index (PPI) fell 0.2% month-on-month in May, slightly better than the expected -0.3% decline. The headline drop was largely driven by a 0.9% fall in energy prices, according to the Destatis release.

Excluding energy, producer prices were unchanged on the month, highlighting stability in core industrial pricing pressures despite broader disinflationary trends. The prior month’s figure stood at -0.6%.

French Business Confidence Holds Steady in June, Services Improve

Business sentiment in France remained unchanged in June, with INSEE’s business climate index holding at 96, in line with May’s level. Manufacturing sentiment dipped slightly to 96 from 97, while services confidence saw a modest uptick from 95 to 96.

The employment outlook improved notably, with the hiring conditions indicator rising from 94 to 97—a sign that the labor market is still providing support even as headline growth remains soft.

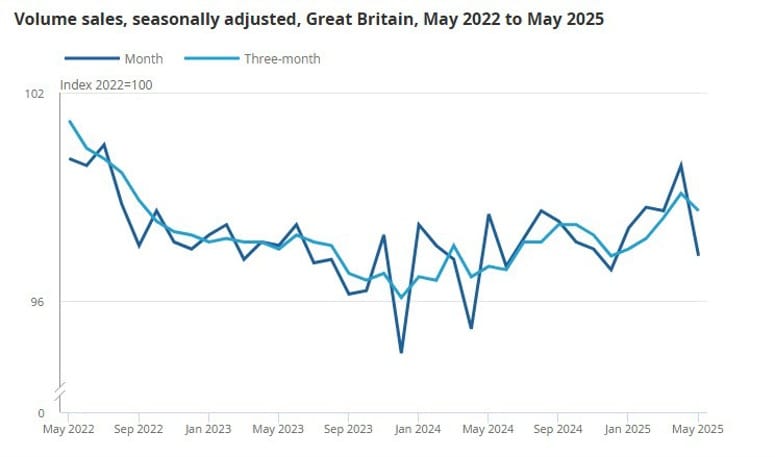

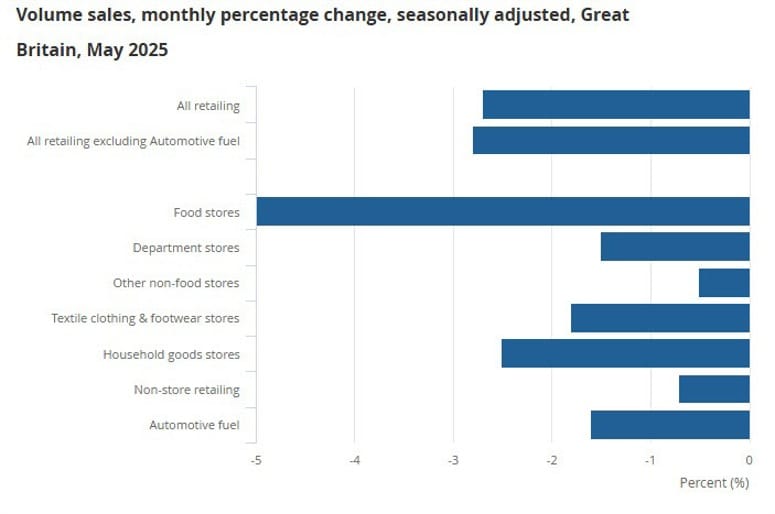

UK Retail Sales Collapse in May With Steepest Food Decline Since 2021

Retail activity in the UK slumped hard in May, with headline sales dropping 2.7% month-on-month, far worse than the -0.5% economists had expected. April’s figure was revised up slightly from +1.2% to +1.3%, making the May reversal even more striking.

Year-on-year, retail volumes fell 1.3%, missing the +1.7% forecast. When excluding automotive fuel, sales dropped 2.8% m/m (vs -0.5% expected) and fell 1.3% y/y (vs +1.8% consensus).

Food store sales plunged 5.0% on the month, erasing the strong 4.7% bounce seen in April and marking the sharpest monthly decline since May 2021. Other sectors weren’t spared: department store sales dropped 1.5%, and non-food retailers fell 0.5%. The data adds pressure on the Bank of England as consumer demand stumbles sharply heading into summer. Here’s the full breakdown:

UK Consumer Sentiment Improves Slightly, Still Negative

UK consumer confidence ticked up in June, with GfK’s index rising to -18 from -20, beating expectations for no change. This is the highest reading so far in 2025.

While the improvement is modest, analysts caution that rising fuel prices due to Middle East unrest and lingering tariff uncertainty could still dent household sentiment in the months ahead.

BOE Dovish Tilt Leaves Pound With Little to Work With, TD Says

TD Securities said the Bank of England’s latest rate decision offers little for the British pound. The central bank kept rates unchanged at 4.25% in a 6–3 split vote, with three members pushing for cuts—more dovish than expected.

In its note, TD emphasized that global risks, particularly the prospect of a U.S. strike on Iran, are dominating FX markets. “In this environment, the dollar becomes the rising or falling tide. The BOE doesn’t move the needle much.”

UK’s Lammy and US’ Rubio Aligned on Iran: No Nuclear Weapons

UK Foreign Secretary David Lammy and U.S. Secretary of State Marco Rubio met to discuss the escalating Iran-Israel conflict. Both officials stressed their nations are united in preventing Iran from obtaining a nuclear weapon.

Lammy described the Middle East security situation as “dangerous,” while Rubio reinforced Washington’s position that nuclear proliferation in the region remains a red line.

Asia-Pacific & World News

China and EU Hold “In-Depth” Trade Dialogue, No Breakthroughs Yet

China’s Ministry of Commerce said it held “in-depth” trade talks with the EU this week, touching on electric vehicle policy and broader trade friction. The virtual meeting involved Chinese Commerce Minister Wang Wentao and EU Trade Commissioner Maroš Šefčovič.

The statement was broad and short on specifics but emphasized a shared commitment to stabilizing economic and trade ties. No policy breakthroughs were announced.

China Keeps Lending Benchmarks Unchanged as Expected

The People’s Bank of China left its loan prime rates unchanged at this month’s fix. The 1-year LPR held at 3.0% and the 5-year rate stayed at 3.5%—matching both consensus expectations and last month’s levels.

While the central bank reduced LPRs in May for the first time since October—lowering the 1-year by 10bps and the 5-year by 10bps—it has since shifted its primary policy lever to the 7-day reverse repo rate, which sits at 1.4%. This structural change aligns China’s policy setup more closely with global norms, like those used by the U.S. Fed and ECB.

PBOC sets USD/ CNY reference rate for today at 7.1695 (vs. estimate at 7.1801)

- PBOC CNY reference rate setting for the trading session ahead.

PBOC injected 161.2bn yuan via 7-day reverse repos at 1.40%

- 202.5bn yuan mature today

- net drain is 41.3bn yuan

New Zealand PM Luxon to Meet Xi Jinping for Trade, Security Talks

New Zealand Prime Minister Christopher Luxon is scheduled to meet Chinese President Xi Jinping in Beijing this Friday to discuss strengthening trade relations and regional geopolitical tensions. This marks Luxon’s first visit to China since assuming office in November 2023.

During his initial two days in Shanghai, Luxon promoted New Zealand as a prime destination for Chinese tourists and students and witnessed the signing of NZ$871 million (about $520 million USD) in commercial agreements.

China currently accounts for 20% of New Zealand’s exports—roughly NZ$21.5 billion in the year to March—making it Wellington’s top trading partner. The upcoming meeting underscores the government’s push to expand economic ties while navigating regional security concerns, particularly in the South Pacific.

Japan Confirms 2025 Bond Supply Cuts in Super-Long End

Japan’s Ministry of Finance confirmed plans to scale back issuance of super-long government bonds in 2025. The reductions, already anticipated in earlier updates, include:

- 20-year JGBs: ¥200 billion cut per auction

- 30-year JGBs: ¥100 billion cut per auction

- 40-year JGBs: ¥100 billion cut per auction

The cuts will be partially offset by increased issuance in shorter-dated paper, such as 2-year and 5-year notes, as well as Treasury bills, in an effort to balance investor demand and reduce pressure on long-end yields.

BOJ governor Ueda: Japan’s economy recovering moderately albeit with some weakness

- Remarks by BOJ governor, Kazuo Ueda, in Tokyo

- Expect underlying inflation to gradually heighten after a pause

- Underlying inflation likely to converge towards levels consistent with price target

- That should happen in latter half of 3-year projection period

- Expect to keep raising interest rates if economy, prices follow projections

- Japan’s real rate remains significantly low

Japan Not Locked Into July 9 Deadline on U.S. Trade Talks

Japan’s chief trade negotiator Ryosei Akazawa clarified Thursday that the July 9 date cited in U.S.-Japan trade talks is not a hard deadline. Speaking to reporters, Akazawa emphasized that Tokyo will not compromise its negotiating stance under artificial time pressure.

When asked if talks could be extended, he declined to confirm. The broader expectation is that the issue will be deferred, as has happened in similar negotiations with other countries. This leaves room for continued brinkmanship from the U.S., including the potential revival of steep tariffs.

BoJ Minutes Warn on Global Trade Risks, Keep Dovish Lean

Minutes from the Bank of Japan’s April 30–May 1 meeting revealed concerns over global trade tensions and their impact on domestic growth and inflation.

Several members called for continued caution, arguing that very low real interest rates are necessary to support the economy. While a few favored gradual hikes if inflation forecasts hold, most agreed rate moves must remain contingent on external conditions—particularly U.S. trade policy.

Some warned that recent tariffs could pressure Japanese firms to cut costs, slow wage growth, and reduce investment. Inflation momentum appears intact, but members noted it may take a year longer to hit the 2% target.

Japan’s Inflation Persists Above Target, Led by Services and Oil

Japan’s consumer inflation in May remained elevated:

- Headline CPI: 3.5% y/y (vs 3.5% expected, 3.6% prior)

- Core CPI (ex-fresh food): 3.7% y/y – highest since Jan 2023

- Core-core CPI (ex-fresh food & energy): 3.3% y/y – fastest since Jan 2024

Rising services costs and oil prices were the primary drivers. Even stripping out energy, price pressures remain high, challenging the Bank of Japan’s dovish bias and rate-hold stance.

South Korea Gets Thumbs-Up From MSCI on Short-Selling Rules

MSCI has upgraded South Korea’s accessibility rating for short selling after the country fully lifted its five-year ban in March. The country is under review for a possible reclassification from “emerging” to “developed” status.

The improved rating—from “–” to “+”—comes just ahead of MSCI’s market classification update. Foreign investors have long flagged short-selling restrictions as a barrier to upgrading Korea’s status. With that concern addressed, the focus now turns to whether MSCI will add Korea to its official watch list for future elevation.

Crypto Market Pulse

TRON Overtakes Dogecoin as Stablecoin Regulation Boosts TRX

TRON’s native token TRX has officially overtaken Dogecoin (DOGE) to become the eighth-largest cryptocurrency by market cap, now valued at $25.75 billion, per CoinGecko data. Dogecoin trails behind at $24.1 billion.

The climb comes as momentum builds behind U.S. stablecoin legislation. The GENIUS bill, aimed at regulating stablecoin issuance, passed the Senate earlier this week in a 68–30 vote and now awaits a vote in the House. President Trump has urged lawmakers to bring the bill to his desk quickly.

TRON, the second-largest blockchain by stablecoin market cap after Ethereum, has benefitted significantly from the bill’s progress. According to DefiLlama, Ethereum holds a 50.1% share, while TRON is dominant in USDT payments. In May alone, TRON processed $694.5 billion in USDT transactions, with $411 billion attributed to whale activity, per CryptoQuant.

Binance was the primary driver of TRON’s USDT volume, moving $2–$3 billion daily, accounting for 65% of centralized exchange transfers via TRON.

Meanwhile, SRM Entertainment announced plans to rebrand as Tron Inc., adding a $100 million TRX treasury and naming founder Justin Sun as a strategic advisor. Sun also met with U.S. officials this week, including Bo Hines and Senator Bill Hagerty, to discuss TRON’s role in supporting digital asset infrastructure.

Despite a broader crypto pullback, TRX remained relatively stable, down just 0.9%, and held above its 50-day EMA.

Pump.fun Token Sale Delayed Again, DWF Warns of Insider Advantage

Solana-based meme coin platform Pump.fun has reportedly postponed its much-anticipated token auction once more, with the event now rumored to occur in mid-July. The sale, expected to raise $4 billion, has faced multiple delays since late 2024.

DWF Ventures, a Web3 venture firm, issued a cautionary note advising retail investors to stay on the sidelines until price stabilizes. Their analysis flags concerns that insiders and early participants may benefit disproportionately from early sales and liquidity cycles.

Pump.fun’s creator accounts remain suspended, including co-founder Alon Cohen, leaving the community without direct updates. Journalist Colin Wu cited anonymous sources confirming the latest delay, although there’s been no official statement from the platform itself.

SOL, which had previously surged alongside Pump.fun hype, fell 6% on Friday amid growing concerns over transparency and governance surrounding the launchpad.

XRP Stalls Under Resistance as Ripple Pushes Stablecoin Utility Narrative

XRP remains rangebound, trading around $2.17, caught between strong support at $2.09 and resistance at $2.24. Technical indicators, including a SuperTrend sell signal, suggest further consolidation unless volume improves.

Ripple CTO David Schwartz said in a panel this week that stablecoins like USDT, USDC, and Ripple’s own RLUSD will increasingly rely on XRP’s infrastructure as a liquidity bridge. He argued that XRP could serve as the connective layer across multiple stablecoins and markets, much like the U.S. dollar functions today in fiat.

The discussion coincided with U.S. Senate approval of the GENIUS stablecoin bill, now headed to the House. Schwartz emphasized that XRP is uniquely positioned to facilitate liquidity across a tokenized financial system—especially as institutional players demand compliance-ready infrastructure.

Sei Rallies 16% as Wyoming Chooses Network for State Stablecoin Pilot

Sei (SEI) surged above $0.21, posting over 10% daily gains and climbing 16% in 24 hours, after being named a finalist for the Wyoming Stable Token (WYST) pilot program. The protocol now trades independently of broader crypto market trends.

The Wyoming Stable Token Commission selected Sei and Aptos as finalists. Sei scored 30, just below Aptos’ 32, but ahead of rivals like Avalanche (27), Sui (26), Base (25), Algorand (21), and XRPL. Criteria included performance, infrastructure, uptime, user base, and security.

WYST, redeemable 1:1 with USD, is among the first state-issued fiat-backed stablecoins. Deployment will utilize LayerZero, enabling cross-chain communication.

Sei’s momentum aligns with the broader backdrop of the GENIUS Act, which is making its way through the U.S. legislative process. The combination of state-level adoption and national policy support has fueled optimism for more institutional and public-sector stablecoin integrations.

The Day’s Takeaway

United States

- Markets Close Mixed: The Dow edged up 0.08% to 42,206.82, while the S&P 500 fell 0.22% and the Nasdaq lost 0.51%. For the week, moves were modest: Dow +0.02%, S&P -0.15%, Nasdaq +0.21%. Despite global tensions, equity volatility remains subdued.

- Fed Split Widens: Fed Governor Christopher Waller floated a potential July rate cut, but others like Richmond Fed President Thomas Barkin pushed back. The Fed’s latest Monetary Policy Report calls policy “well-positioned,” while warning that tariffs are starting to pressure inflation.

- Philadelphia Fed Index Disappoints: The June manufacturing index remained at -4.0, weaker than the expected -1.0. New orders and employment softened, while shipment activity improved slightly.

- Stablecoin Legislation Gains Momentum: The Senate passed the GENIUS bill, which regulates stablecoin issuance. It now heads to the House. President Trump supports fast-tracking the bill, highlighting rising crypto-regulatory engagement.

Canada

- Retail Sales Miss: April sales rose just 0.3% (vs 0.5% expected), while May’s advance reading showed a -1.1% drop, suggesting consumption may be cooling. Ex-auto sales in April were -0.3%, missing expectations.

- Producer Prices Slip: The May PPI fell 0.5%, steeper than the -0.1% forecast. Raw materials prices dipped 0.4%, bringing the year-over-year decline to -2.8%. Inflation pressures in Canada remain moderate upstream.

Commodities

- Gold Loses Altitude as Trump Pulls Back: Gold ended near $3,369, down 0.11% on the day and 1.90% for the week. As Trump opted for diplomacy with Iran, risk appetite increased. The U.S. Dollar Index rose 0.50% to 98.65, also weighing on gold.

- Oil Holds Steady on Geopolitical Risk: Brent traded near $79 as markets priced in the risk of U.S. involvement in the Middle East conflict. Analysts warn a Strait of Hormuz blockade remains unlikely but would cause a severe global supply disruption.

- Platinum Pulls Back From 11-Year High: After peaking at $1,350/oz, platinum slipped below $1,300. ETF holdings dropped by 190,000 ounces in a week, nearly erasing all YTD inflows.

- IEA Sees Demand Peak by 2030: The IEA reaffirmed that oil demand will peak by decade’s end, with EV adoption and renewables in Saudi Arabia key drivers. Capacity expansion, especially in the U.S. and Middle East, is expected to outpace demand.

- U.S. Oil Inventories Post Major Drop: Inventories fell by 11.5 million barrels, the largest weekly draw in a year. Falling imports and rising exports drove the drop. WTI’s discount to Brent narrowed to $2.50, possibly limiting future exports.

- Central Banks Plan More Gold Buying: A World Gold Council survey showed 95% of central banks expect global reserves to grow in the next year. Over 40% plan direct purchases, up from 29% last year, signaling continued diversification away from fiat.

Europe

- European Stocks Close Mixed:

- DAX +1.30%, CAC +0.48%, FTSE 100 -0.20%, Ibex +0.77%, FTSE MIB +0.74%

- Weekly change: Most indices slightly down; DAX -0.70%, FTSE 100 -0.86%

- UK Retail Collapses in May: Sales plunged 2.7% m/m, far worse than the expected -0.5%. Food sales fell 5.0%, the worst since May 2021. Y/Y sales dropped 1.3%.

- Germany PPI Edges Lower: May producer prices declined 0.2% m/m, mainly due to a 0.9% drop in energy. Core PPI was flat.

- France Business Sentiment Stable: INSEE’s June business confidence remained at 96, with services improving and manufacturing slipping slightly.

- Eurozone Consumer Confidence Falls: Confidence declined to -15.3 in June, slightly below the -14.5 expected, signaling ongoing caution among households.

Asia

- Japan CPI Still Elevated:

- Headline: 3.5% y/y

- Ex-fresh food: 3.7% (highest since Jan 2023)

- Ex-fresh food and energy: 3.3%

Inflation remains well above BoJ’s 2% target, with price pressure concentrated in services and energy.

- BoJ Minutes Caution on Global Risks: Members cited U.S. tariffs and Middle East volatility as downside risks. While some favored hikes if forecasts hold, others urged patience until U.S. policy stabilizes.

- Japan Cuts Super-Long JGB Issuance:

- 20-yr: down ¥200B/auction

- 30-yr: down ¥100B/auction

- 40-yr: down ¥100B/auction

Offset by boosts to 2- and 5-year notes and T-bills to manage yield curve risk.

- PBOC Holds Loan Prime Rates Steady:

- 1-yr at 3.0%

- 5-yr at 3.5%

These benchmarks were cut in May but left unchanged this month. The central bank is now steering policy via its 7-day reverse repo, aligning with global norms.

- South Korea Gains Praise from MSCI: After lifting its five-year short-selling ban in March, MSCI upgraded Korea’s rating to “+”, a key step toward a potential move from emerging to developed market status.

Rest of the World

- New Zealand’s PM Meets Xi in China: PM Christopher Luxon visited Beijing, where he’s expected to discuss trade and regional security with President Xi. NZ signed NZ$871 million in commercial deals during the visit. China accounts for 20% of NZ exports.

Crypto

- TRON Overtakes Dogecoin: TRX reached $25.75B market cap, passing DOGE to claim 8th place globally. The rally follows U.S. Senate progress on the GENIUS stablecoin bill and growing USDT activity on TRON.

- Pump.fun Token Sale Faces Delay Again: The Solana-based launchpad may push its token auction to mid-July. DWF Ventures cautioned retail traders, citing risks from insider allocations and price volatility. SOL fell 6%.

- XRP Stuck in Neutral as Ripple Pushes Stablecoin Role: XRP trades near $2.17, stuck between strong support ($2.09) and resistance ($2.24). Ripple CTO said XRP is key to stablecoin liquidity across fragmented markets.

- Sei Surges as Wyoming Selects it for State Stablecoin Pilot: SEI rose 16%, trading near $0.21, after being chosen by the Wyoming Stable Token Commission for the WYST pilot. This is the first fiat-backed stablecoin issued by a U.S. state.