North America News

US Stocks End Lower as Tech Leads the Pullback, Dow Flatlines

U.S. equities finished in the red on Wednesday, with the NASDAQ pacing losses amid renewed pressure in tech and travel names. The Dow Jones Industrial Average ended effectively flat, slipping just -1.1 points to 42,865.77, while the S&P 500 lost -16.57 points, or -0.27%, to close at 6,022.24. The NASDAQ Composite dropped -99.11 points, or -0.50%, settling at 19,615.88.

Declines were led by weakness in airlines, chipmakers, and select consumer names. Some of the biggest laggards included:

- Chewy (CHWY): $40.76, -11.00%

- American Airlines (AAL): $11.06, -6.59%

- Intel (INTC): $20.70, -6.27%

- United Airlines (UAL): $78.65, -5.47%

- GameStop (GME): $28.52, -5.41%

- Delta (DAL): $49.18, -4.84%

- Lockheed Martin (LMT): $456.66, -4.24%

- Target (TGT): $98.36, -2.65%

- Southwest (LUV): $33.49, -2.55%

- Amazon (AMZN): $213.07, -2.04%

- Home Depot (HD): $360.25, -2.02%

- Apple (AAPL): $198.61, -1.90%

- Trump Media (DJT): $21.06, -1.82%

Despite the broader dip, several names bucked the trend, posting solid gains:

- Papa John’s (PZZA): $51.78, +7.43%

- SoFi Technologies (SOFI): $15.06, +4.66%

- Shopify (SHOP): $114.23, +3.51%

- Broadcom (AVGO): $252.91, +3.38%

- Robinhood (HOOD): $74.88, +3.27%

- Palantir (PLTR): $136.29, +2.67%

- Roblox (RBLX): $96.17, +2.61%

- RTX (RTX): $141.13, +2.39%

- Chipotle (CMG): $51.81, +2.34%

- Occidental (OXY): $44.06, +2.16%

- First Solar (FSLR): $167.97, +2.04%

- CrowdStrike (CRWD): $476.98, +2.00%

Market participants appear to be shifting exposure after the CPI report, as expectations for Fed rate action evolve.

US 10‑Year Note Auction Draws Strong Foreign Demand at 4.421%

The U.S. Treasury sold $39 billion in 9‑year, 11‑month notes at a high yield of 4.421%, slightly undercutting the 4.428% when-issued (WI) yield—a 0.7 bps step-through. The auction attracted solid interest: a bid-to-cover of 2.52, above the 2.60 average, and indirect participants (mainly foreign buyers) took 70.56% of the issuance. Direct bids represented 20.48%, while primary dealers absorbed 8.96%. Following the release of this morning’s softer CPI release, the 10‑year yield dropped 5.6 bps to 4.418%, signaling robust demand especially from overseas investors.

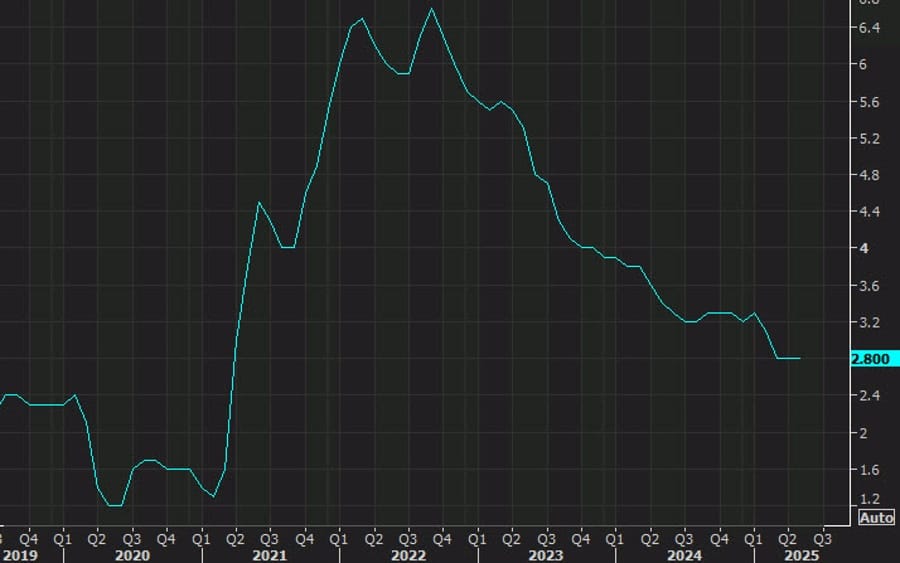

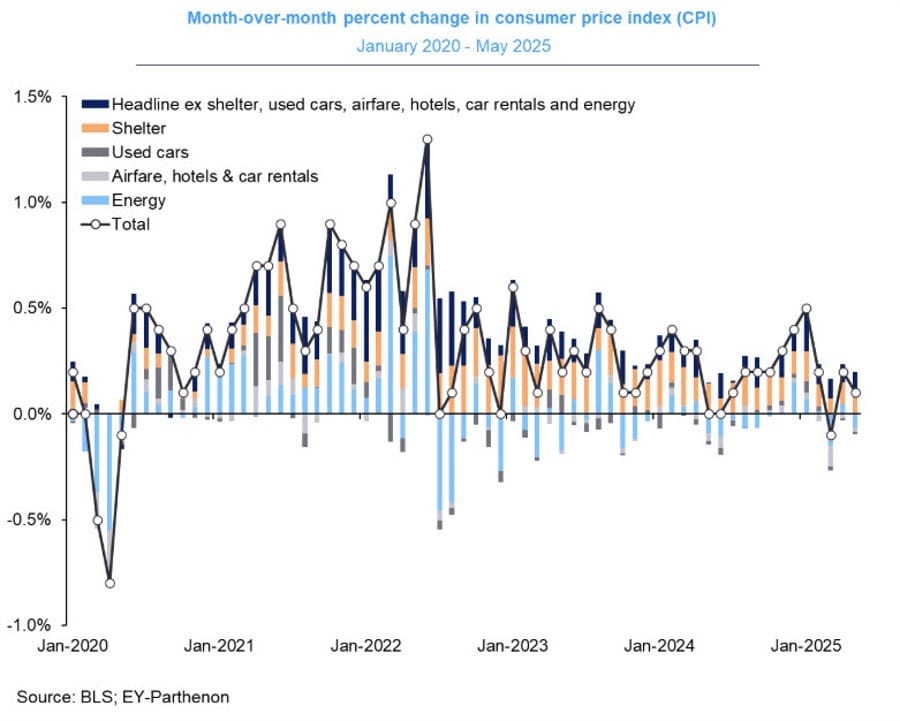

May Core CPI Softens to 2.8% Year-on-Year

May’s consumer inflation report reveals a slowdown in the core CPI to 2.8% year-over-year, below the 2.9% projection. Headline CPI was 2.4% (matching some forecasts), down from April’s 2.9%.

Monthly increases were modest—+0.08% core and +0.13% unrounded. However, real weekly earnings rose by 0.3%. Apparel, airfare, and hotel prices fell month-over-month, contributing to the slowdown. Markets now price in 77 bps of easing over the year, up from 67 bps prior.

U.S. Mortgage Demand Surges 12.5% as Rates Hover Near 7%

Applications for U.S. mortgages rebounded impressively for the week ending June 6. According to MBA data, the total application index leapt 12.5% to 254.6 from 226.4. Purchase applications rose to 170.9 (up from 155.0), and refinancing jumped to 707.4—up from 611.8.

Despite surging application volume—the biggest weekly purchase jump since early April—the average 30-year fixed mortgage rate held steady at 6.93%.

Trump Confirms 30% China Tariffs Will Stay; 55% Effective Rate

A Bloomberg report quoted a U.S. official confirming Trump’s intent to maintain a 30% tariff rate on Chinese imports. The effective rate includes a 10% baseline, 20% fentanyl-related tariff, plus roughly 25% from older 301, MFN, and other trade duties—bringing the total to about 55%, matching the current arrangement.

US Lutnick: China is going to approve all applications for magnets for US companies

- Speaking on CNBC

- China is going to approve all applications for magnets for US companies

- Trump-Xi has to approve final wording

- I am really excited about how this is going to work for America

- China is always trying to remove export controls.

- This is an American agreement only. Not for other countries

- We will take off counter measure

- You can say CHina tariff levels will not change from here

- Confirms 55% tariff on goods from China.

- China said fentanyl halt is not on the table

- We are competing with China on AI and chips.

- We are not going to give them our best chips.

- We stayed very positive for America, and I think it is positive for China as well.

- If an American company applies for magnates, they would approve it right away.

- So many trade deals coming. We will be focused on other deals starting today.

- We are in good shape, but being in good shape is not good enough

- Tariff deal after deal will start, and it will be starting next week, and the week after.

- Europe is more than thorny

US Treasury Secretary Bessent: Capital investments will increase once tax and spending bill is enacted

- Treasury Secretary is speaking on Capitol Hill

Treasury Secretary Bessent is back in Washington and made his scheduled testimony appointment on Capitol Hill. In addition to speaking about the China deal, he adds on the economy, that:

- Capital investments will increase once tax and spending bill is enacted.

- 24-hour wind is the incorrect way to view the bond market. Notes that the 10 year yields are down this year.

HSBC: Stocks May Climb Short-Term, But Q4 Risks Rising

HSBC says equities may push higher over the next three months, fueled by resilient macro data and minimal fallout from tariffs. However, the bank warns that risks build into Q4.

With markets near peak levels, the downside risks of recession, policy uncertainty, and high US valuations loom larger. HSBC notes signs that global capital may be rotating away from US stocks.

Goldman Sachs Warns Trump Tariffs Could Rekindle Inflation

Goldman Sachs forecasts that Trump’s tariffs could reaccelerate inflation, particularly in core goods. The bank expects the May CPI report to show a 0.05 percentage point uptick due to early tariff effects.

Core inflation is projected to climb to 3.5% by the end of 2025, up from 2.8% in April. Services inflation is expected to stay flat, with most of the upward pressure coming from goods like electronics and appliances.

Trump to Block California EV Mandates, Rolls Back EPA Waiver

Trump is set to sign three measures targeting California’s vehicle emissions regulations. The actions would cancel a Biden-era EPA waiver that allowed the state to enforce a 2035 ban on gas-only car sales and stricter standards for trucks and NOx emissions.

Automakers and dealer groups have lobbied for the rollback, calling the regulations unworkable. California’s Governor Gavin Newsom vowed legal retaliation, citing public health costs. This fits into a broader Republican strategy to unwind EV-related policies, including federal tax credits and subsidies.

Tesla to Deploy First Fully Self-Driving Delivery June 28

Elon Musk says Tesla will deliver its first vehicle without a human driver behind the wheel later this month. The car will autonomously travel from Tesla’s factory straight to the customer’s home on June 28.

Meanwhile, Musk says the rollout of Tesla’s public robotaxi rides is tentatively scheduled to begin on June 22.

Boeing Pushes for Airplane Tariff Exemptions in Any Trump Trade Pact

Boeing is asking the Trump administration to exempt aircraft and components from any future trade tariffs. The request comes as part of industry feedback to the Commerce Department, according to filings reported by the newswires.

The plea is supported by global partners—China, Mexico, the EU, and Japan—who also warn against national security tariffs being applied to aviation-related imports.

Appeals Court Lets Trump’s Tariffs Stand While Legal Fight Continues

A federal appeals court ruled that the controversial tariffs imposed by Donald Trump can remain in effect while legal challenges proceed. The decision suspends a lower court ruling that had questioned Trump’s authority under the IEEPA law.

The tariffs—targeting imports from China, Canada, Mexico, and others—were justified by the Trump team on grounds of national emergency. Plaintiffs, including 12 states and various importers, argue the move was unconstitutional. The Federal Circuit will decide whether the executive branch overstepped its legal powers.

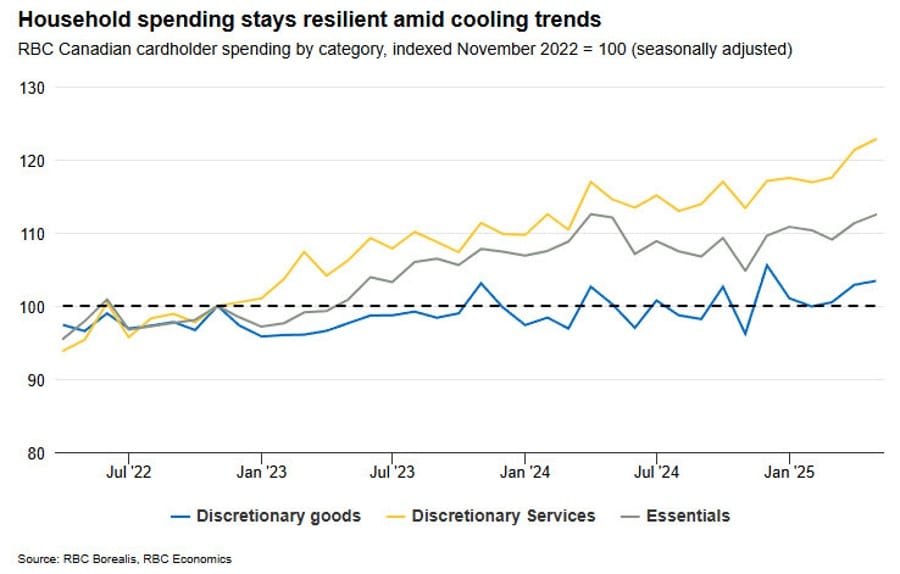

Canadian Consumer Spending Remains Firm, Card Data Shows

RBC’s proprietary cardholder data indicates retail spending in Canada rose 0.7% in May, extended from a 0.5% April gain. Excluding autos, spending grew 1.1%, while core sales increased 1.2%. Essential services showed a 1.2% uptick, essentials rose 1.1%, and discretionary goods increased by 0.5%. Despite global trade uncertainties, household demand remains resilient, though with signs of slow moderation.

Canada & U.S. Exchanging Drafts on Prospective Trade Pact

A CBC report reveals Washington and Ottawa have started exchanging working papers outlining potential provisions for a U.S.–Canada trade agreement ahead of the June 15 G7 summit. Although documents—fewer than five pages—have been exchanged, they are not finalized. Provisions under discussion include steel, aluminum, and potential military commitments. Sources caution that significant work remains before any deal is reached.

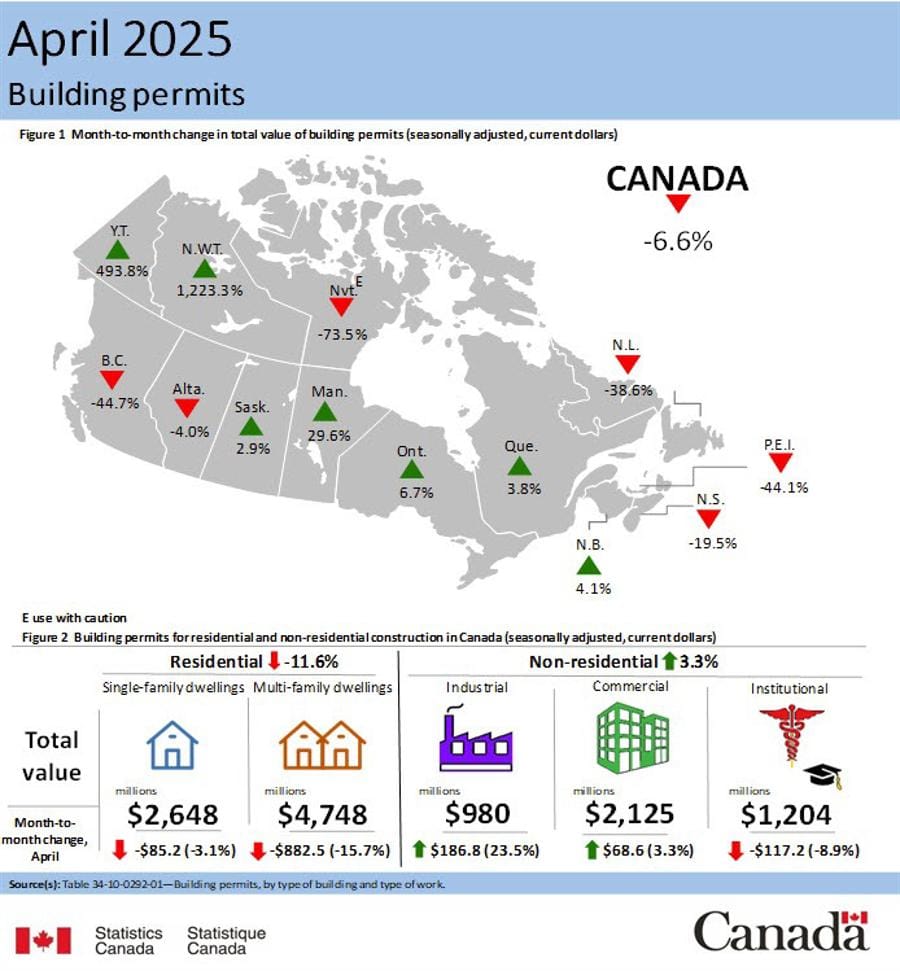

Canadian Building Permits Plunge 6.6% in April

April’s Canadian building permit volume dropped a steep 6.6%, compared to a flat 2.0% forecast. This decline follows March’s revised drop of 5.3% (initially -4.1%), reflecting ongoing weakness in the housing market.

A look at the details of the release shows:

- Total value of Canadian building permits in April: $11.7 billion, down $829.6 million (-6.6%) from March.

- British Columbia led the decline: -$1.2 billion, partially offset by Ontario: +$299.3 million.

- On a constant dollar basis (2023=100):

- Month-over-month: -6.6%

- Year-over-year: -16.4% (following a strong April 2024)

Residential Construction:

- Total residential permit value: $7.4 billion, down $967.7 million (-11.6%)

- Multi-family component: -$882.5 million, largely from British Columbia (-$837.4 million)

- Vancouver CMA accounted for -$1.0 billion

- Single-family component: -$85.2 million

- Largest drop in Alberta (-$37.4 million), partly offset by Quebec (+$26.6 million)

Housing Units Authorized:

- Multi-family dwellings: 21,400

- Single-family dwellings: 4,200

- Total units: 25,600, down 6.5% from March

Commodities News

Gold Firms Near $3,327 After Soft CPI, Fed Rate Cut Bets Rise

Gold prices edged higher Wednesday, with futures briefly spiking to $3,360 before retracing to trade around $3,327, as weaker-than-expected inflation figures stoked anticipation for a Federal Reserve rate cut by September. The metal closed up 0.22% on the day, finding support as investor focus turned toward the latest CPI print and ongoing U.S.–China trade dialogue.

The May Consumer Price Index rose 2.4% year-over-year, slightly below the 2.5% consensus, while core CPI held steady at 2.8%, also under expectations. Month-on-month, both headline and core numbers printed at +0.1%, missing the +0.2% forecast.

That was enough for markets to push U.S. rate cut odds higher: futures now imply 47.5 basis points of easing by year-end, with many traders eyeing a 25-bp cut in September as the most likely starting point.

Meanwhile, talks between the U.S. and China continued to underpin geopolitical tension and risk hedging. Commerce Secretary Howard Lutnick confirmed a framework has been reached to implement the Geneva Consensus, though it still awaits approval from both President Trump and President Xi Jinping.

From Beijing, Vice Commerce Minister Li Chenggang said negotiations were “rational and candid,” expressing hope that recent progress would “inject positive energy” into global economic ties. His comments followed Trump’s warning about Iran, which added another layer of geopolitical uncertainty. In an interview, Trump said he was “much less confident” a nuclear deal with Tehran could be reached, noting the possibility of “serious consequences” if talks collapse.

Gold’s gains were also amplified by a weaker U.S. Dollar, as the DXY index fell 0.44% to 98.61, a four-day low. The combination of fading inflation, dovish rate expectations, and geopolitical uncertainty created an ideal backdrop for bullion to remain firm above $3,300.

Looking ahead, traders will be watching the upcoming Producer Price Index (PPI) and jobless claims data for further clues on the Fed’s path.

Crude Futures Surge Near $68 on Middle East Tensions

U.S. crude oil futures rose $3.17 (4.88%) to settle at $68.15, trading as high as $68.33 after rumors of heightened naval alertness in Bahrain tied to Iranian tensions. The jump cleared the 100-day moving average at $66.08 and the midpoint of the 2025 trading range at $67.94. The price fell just short of the 200-day moving average at $68.48; a breach above that level would mark the first since February 4.

EIA Inventory Data Shows Crude Draw Exceeds Expectations

US Energy Information Administration data for the week ending June 6 showed a significant crude oil draw of 3.644 million barrels—more than double the expected 1.960 million. Gasoline and distillate inventories rose by 1.504 million and 1.246 million barrels, respectively. The prior week’s crude draw was 4.304 million barrels.

Chinese Crude Imports Fall to Four-Month Low in May

Chinese customs data show May crude oil imports dropped to 46.6 million tonnes (≈11 mbpd), down from 11.7 mbpd in April—the lowest since January. This follows refinery maintenance that sidelined 2.6 mbpd of processing capacity. Commerzbank’s Fritsch adds that Saudi Arabia lowered May official selling prices, while exports from Chinese refineries also fell to 4.41 millions tonnes—down from 5.0 mt in April—indicating regional demand softness and weaker margins.

EIA: U.S. Oil Production Set for Annual Decline in 2026

The EIA’s Short-Term Energy Outlook forecasts a 13.37 mbpd average in U.S. crude output in 2026—a 50 kbd drop from 2025 and the first decline since 2021. 2025’s output growth remains steady at 13.42 mbpd. ING analysts attribute the downturn to a recent slump in drilling activity. They note the move coincides with EU proposals to curb refined product imports tied to Russian crude, complicating global energy flows. Meanwhile, the latest API report shows a smaller crude draw of 0.4 mb but significant builds in gasoline (3 mb) and distillates (3.7 mb).

TDS: Gold Faces Short-Term Selling by Algorithms

Daniel Ghali, TDS’s Senior Commodity Strategist, notes algorithmic traders may take up to 4% off their gold positions—about 7% of current levels—in the near term. But he argues that trend-following CTAs and other macro funds will likely reaccumulate soon, especially given historically low broader participation in gold. In Ghali’s analysis: “Structural support intact amid low participation … could end up with even larger positions on a continued uptape.”

Platinum Surges to Four-Year High Above $1,270

Commerzbank analyst Carsten Fritsch reports platinum prices have climbed to roughly $1,270 per ounce—marking a four-year high and a 40% gain year-to-date. The uptick accelerated from $1,200 as the market absorbed supply tightness. This breakout contrasts sharply with April’s dip to $900 following reciprocal tariff announcements, underscoring how physical shortages are now fueling a sustained rally.

Oil Rallies on Venezuela Comments, Iran Deal Doubts

WTI crude surged $1.18 to $66.16 after Trump said he is less confident in the Iran nuclear deal, calling its renewal unclear. Markets reacted sharply, pricing in renewed dislocation risk for Middle East oil supply.

Trump Says His Confidence in Iran Deal Is Waning

In a New York Post podcast, former President Trump confessed he’s “much less confident” about the Iran nuclear deal’s viability. His remarks triggered an immediate jump in crude prices: WTI spiked $1.25 to reach $66.23.

He elaborated, “If they don’t make a deal, they’re not going to have a nuclear weapon,” while also noting a deal wouldn’t lead to a new weapon. The sharp price reaction highlights how sensitive oil markets remain to geopolitical risk.

OPEC Chief: Oil Demand to Surge Through 2050, No Peak in Sight

OPEC Secretary General Haitham Al Ghais said Tuesday that oil consumption is set to climb beyond 120 million barrels per day by 2050. Speaking in Calgary, he cited OPEC’s forecast for a 24% rise in global energy demand over the same period.

Al Ghais warned that without $17.4 trillion in oil and gas investment, energy security would be at risk. He praised Canada’s Trans Mountain pipeline and noted Alberta’s goal to double production. He also dismissed net-zero deadlines as unrealistic without significant technological support like carbon capture.

Europe News

European Markets End Mostly Flat, London Leads Gains

Most major European indices closed slightly lower, while London’s FTSE 100 bucked the trend with a 0.23% gain.

- FTSE 100 (UK): +0.23%

- DAX (Germany): -0.06%

- CAC 40 (France): -0.34%

- Ibex (Spain): -0.59%

- FTSE MIB (Italy): -0.09%

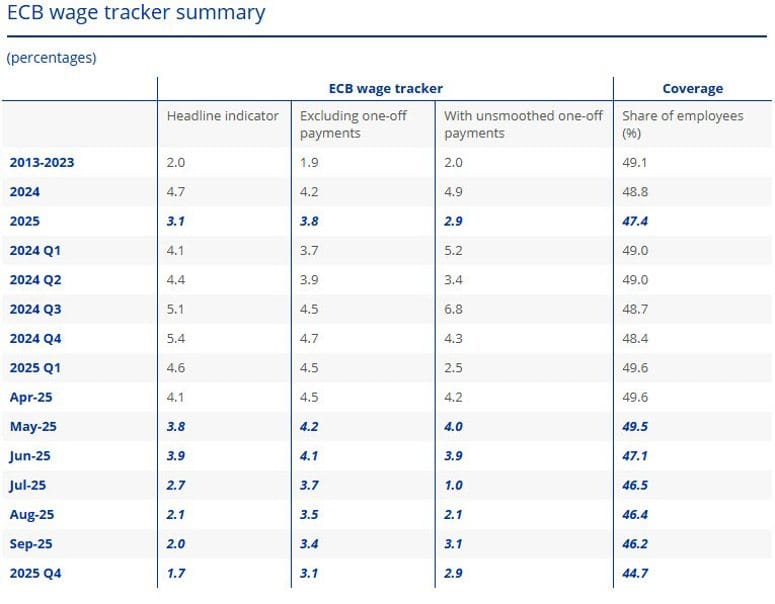

ECB Wage Tracker Reveals Sharp Cooling in Wage Growth

The European Central Bank’s latest wage tracker shows average negotiated pay increasing just 3.1% in 2025, down sharply from 4.7% last year. Even in Q1 of this year, wage growth eased to 4.6% from Q4’s 5.4%.

This slowdown in wage gains is welcome news for ECB policymakers aiming to quell inflation pressures. It reinforces the central bank’s current cautious stance, suggesting inflation trends are softening. Here’s the latest summary from the ECB:

Nvidia CEO: Europe Ramps Up ‘AI Data Factories’ Ambitions

In remarks that underscore Europe’s expanding AI role, Nvidia CEO Jensen Huang highlighted the continent’s awakening to “AI data factories.” He revealed Nvidia is establishing AI centers in seven European nations.

Europe is planning 20 more so-called “giga-factories.” Huang predicts Europe’s AI computing capacity will increase tenfold within two years, marking a major shift in digital infrastructure.

EU Pushes US Talks Beyond July Deadline Despite Tariff Truce

A Bloomberg report suggests that EU officials support extending U.S.–China trade discussions past former President Trump’s self-imposed July deadline. Despite Trump’s claim that a steep 50% tariff threat accelerated negotiations, the reality has been slower progress. The recent U.S.–China framework remains just that—a framework rather than a deal.

Tariffs have been dialed back to the 10% range, prompting businesses to operate assuming 10–20% trade costs. That baseline stability may prompt additional 90-day pauses rather than full resolution, ensuring that tariffs remain around 10% moving forward.

ECB’s Kazaks: Keeping 2% inflation will require some further cuts for fine tuning

- Comments from the ECB policymaker to Econostream

- Quite likely keeping 2% inflation will require some further cuts for fine tuning.

- Market pricing of one more cut or so not out of the realm of the baseline.

- Fine-tuning cuts will very much depend on how the economy develops.

- May at some point, not yet by any means, go into accommodative territory.

- Must be cautious about potential persistence of undershooting.

- We need to take care of those risks of a too persistent or large deviation from target.

- So far, seems deflationary effect of trade tensions could dominate, but final outcome open.

- June cut to ensure that inflation in 2026 eventually turns the corner and starts returning towards 2%.

Blackstone to Pour $500 Billion Into Europe Over Next 10 Years

Blackstone plans to invest half a trillion dollars in Europe across the next decade, CEO Steve Schwarzman told Bloomberg. The private equity giant is targeting data centers, logistics, and other infrastructure sectors.

With $100 billion already deployed in the UK, Blackstone is bullish on Europe’s growth potential. The firm is also eyeing opportunities in the Middle East, particularly in fast-growing cities like Riyadh and Dubai.

Asia-Pacific & World News

China Limits Rare-Earth Export Licenses to Six Months

The Wall Street Journal reports China will cap rare-earth export licenses for U.S. firms at six months. The move follows two days of London negotiations after the Geneva framework deal.

In return, the U.S. agreed to ease restrictions on jet engines and ethane. The deal, awaiting final approval from Trump and Xi, would enable swift licensing—expected within a week of sign-off. However, both nations have since accused each other of backtracking on commitments.

China’s Vice Premier: Trade Stance Clear and Principled

China’s Vice Premier He Lifeng emphasized in London that Beijing’s position on U.S. trade disputes remains steady. He said both sides must build consensus, communicate openly, and avoid missteps.

He stated, “There are no winners in a trade war,” affirming China’s desire for dialogue while also signaling readiness to defend its interests. He urged the U.S. to honor its commitments and work cooperatively—stating firmly that China will remain principled and engaged in the trade process.

China Reconsiders 4.5-Day Workweek to Spark Domestic Spending

The idea of shortening China’s workweek to 4.5 days is back in discussion, with the city of Mianyang in Sichuan province reportedly testing a 2.5-day weekend pilot.

Businesses would close early on Fridays to give workers more leisure time and boost consumption. Mianyang, Sichuan’s second-largest city by GDP, has a population just under 5 million.

China’s Li Chenggang: US Talks Were Rational, In-Depth, Productive

Chinese Vice Commerce Minister Li Chenggang described the latest US-China trade discussions as “professional, rational, and candid.” Speaking after the London meetings, he said both sides agreed on a shared framework and would report to leadership on next steps.

Li expressed hope that progress made will boost global trust and stimulate economic cooperation. He emphasized the value of maintaining open and thorough exchanges.

US, China Reach Framework Deal to Implement Geneva Accord

US Commerce Secretary Howard Lutnick said Washington and Beijing have agreed on a framework that could implement the Geneva Consensus—pending Trump’s approval.

Lutnick emphasized that the leaders’ call on June 5 was a game-changer. US Trade Representative Jamieson Greer added that communication would continue and that both sides expect near-term movement on issues like fentanyl and rare earths. Treasury Secretary Bessent is returning to DC, with Greer and Lutnick continuing the negotiations.

China’s Steel Output Set to Shrink 4% in 2025, Says CISA

The China Iron and Steel Association expects steel production to contract by 4% in 2025, as Beijing’s push to curb emissions continues reshaping the country’s industrial policy.

The projected drop aligns with the long-running shift away from infrastructure-heavy development and tighter regulatory caps introduced in 2021 to limit annual production growth.

PBOC sets USD/ CNY central rate at 7.1815 (vs. estimate at 7.1801)

- PBOC CNY reference rate setting for the trading session ahead.

PBOC injected 164bn yuan via 7-day reverse repos at 1.40%

- 211.9bn yuan mature today

- net drain is 50.9bn yuan

RBNZ’s Adrian Orr Resigned Over Sharp Budget Cuts, Documents Reveal

Adrian Orr abruptly resigned as Reserve Bank of New Zealand Governor in March after internal disagreements over government-imposed budget cuts. Newly revealed documents confirm he stepped down after determining the bank could not meet its mandate under the new NZ$750 million cap.

Orr reportedly agreed to a 16.5% cut but opposed the steeper reduction finalized by the board and Finance Minister Nicola Willis. His resignation followed direct talks with government officials. Deputy Governor Christian Hawkesby has since taken over as interim head.

BOJ Survey: No Rate Changes Through Year-End, Hike Expected by March

A Reuters poll published June 11 reveals that economists overwhelmingly expect the Bank of Japan to maintain its benchmark rate through 2025. Of the 58 respondents, 30 (52%) anticipate no change until year-end—up from 48% previously—while 40 out of 51 (78%) foresee at least one rate hike by March 2026.

Regarding bond purchase tapering, 17 of 31 (55%) think the BOJ will begin reducing its ¥400 billion quarterly bond purchases to a range of ¥200–¥370 billion starting April 2026. Moreover, 21 of 28 (75%) expect the government to cut the issuance of super-long JGBs.

Forecasts indicate market anxiety over U.S. tariffs and Japan’s fiscal outlook have delayed rate hikes. Wall Street is pricing in only about 15 bps of BOJ rate increases by year-end, consistent with economist expectations.

Japan prime minister Ishiba says government is taking issue of rising prices seriously

- Remarks by Japan prime minister Ishiba and economy minister Akazawa

- Government making utmost efforts to overcome rising prices

- Cannot agree on call to reduce consumption tax rate

- It will take a long time to adjust system for lower consumption tax rate on food

- It is not true that government is mulling providing cash handouts

- Will protect auto industry, no plans to sacrifice agriculture in exchange

Economy Minister Akazawa:

- Sharp rises in JGB yields have undesirable impact on economy, fiscal situation (Akazawa)

- Government’s stance is to promote increase in domestic investors for JGBs (Akazawa)

- If interest rates rise sharply, that could increase Japan’s debt financing costs (Akazawa)

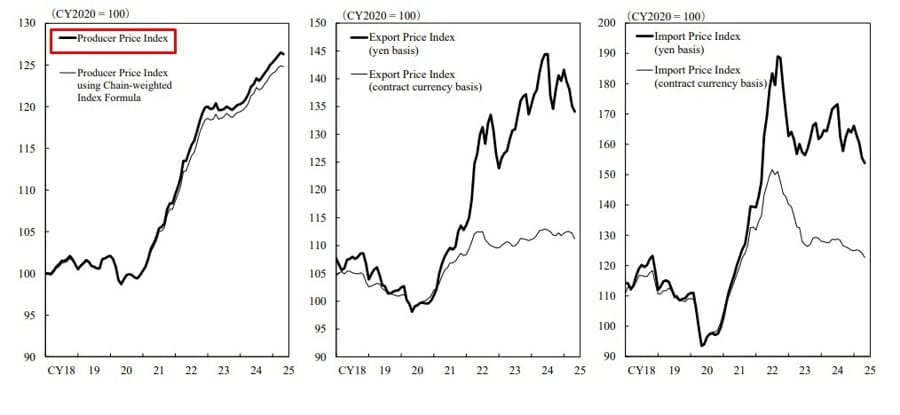

Japan’s Producer Prices Disappoint, May PPI Drops Unexpectedly

Japan’s Producer Price Index dropped 0.2% month-over-month in May, falling short of the 0.2% rise forecast. Year-over-year, prices rose 3.2%, also missing estimates of 3.5%.

The data, published by the Bank of Japan, may challenge expectations for inflation momentum. The PPI often influences future consumer prices, and this drop may delay any BOJ policy shift Ueda had in mind.

Foreign Buyers Snap Up Long-Dated Japanese Bonds as Yields Spike

Morgan Stanley reports that international investors are increasingly purchasing Japan’s 30- and 40-year bonds, attracted by surging yields and limited domestic demand amid reduced BOJ buying.

Buyers from North America, Europe, and Asia are taking advantage of the higher returns, and while Japan is no longer the global anchor for rates, Morgan Stanley expects global central bank trends to maintain downward pressure on yields over time.

BOJ Seen Holding Rates, Slowing Bond Pullback as Market Stays Fragile

The Bank of Japan is expected to leave its policy rate unchanged at 0.5% during its June 16–17 meeting, according to a Bloomberg economist survey. Market attention is fixed on the pace of the BOJ’s bond tapering, with expectations pointing to a deceleration in the pace of government bond purchase cuts due to persistent bond market instability.

Since August, the BOJ has been trimming bond purchases by ¥400 billion quarterly. That may soon slow to ¥200–¥300 billion, starting next fiscal year. Economists warn an overly cautious shift could undermine confidence in the market’s ability to absorb new issuance. Meanwhile, rate hike expectations have shifted to January 2026, overtaking earlier forecasts for mid-to-late 2025. Goldman Sachs says global risks—especially US tariffs and auto trade issues—are central to that outlook. The possibility of a US-Japan trade deal remains in question ahead of the G7.

Crypto Market Pulse

Bitcoin and Crypto Remain Resilient Post CPI and Trade News

Following a softer-than-expected U.S. May CPI print of 2.4% (below the anticipated 2.5%), BTC traded near $109,000. President Trump’s announcement of a U.S.–China trade framework stabilized markets; CPI rose 0.1% monthly (below forecasts), helping calm inflation fears. Bitcoin funding rates remain cautious at 1.3% annualized—a typically bullish signal—while ETH, SOL, and DOGE posted daily gains of 2.5%, 3%, and 2%, respectively. DeFi, AI, and meme coins also saw notable inflows.

XRP Flirts with $3 on On‑Ledger Treasury Token Launch

XRP rose to $2.31 after U.S. CPI came in softer. Momentum was driven by Ondo Finance’s launch of tokenized U.S. Treasury exposure on the XRP Ledger. With Core CPI unchanged at 2.8% and the Fed expected to hold rates at 4.25–4.50% in June, XRP faces a breakout opportunity. That momentum shift positions XRP as a playable token amid treasuries-focused innovation.

Stripe Bolsters Crypto Toolkit with Privy Wallet Purchase

Stripe has acquired crypto wallet provider Privy—valued at over $230 million—following its purchase of Bridge. Privy enables seamless wallet integration, used by platforms like OpenSea to improve onboarding. Stripe is now expanding its stablecoin financial accounts and AI-powered payments infrastructure globally, starting with USDC and USDB. The move aligns with the late-stage passage of the GENIUS Act in the Senate, which establishes a regulatory framework for stablecoins in the U.S.

Presale Funding Shifts Toward Utility over Meme Coins

Outset PR’s May report, tracking $134.7 million in crypto presales, shows utility and infrastructure projects eclipsing meme coins. While meme tokens still garnered attention, true capital flows went to wallet/infrastructure, DeFi, AI, and GameFi projects. AI-themed presales notably outpaced meme financing mid-month, even as GameFi fundraising lagged in sustained investor commitment.

Hyperliquid (HYPE) Hits Record High, Futures Open Interest Surges 34%

Hyperliquid (HYPE) reached a fresh all-time high near $43 before pulling back to approximately $41.33. Its futures open interest has spiked to $1.89 billion—a 34% rise this month—while volume climbed to $2.16 billion. The advancing Money Flow Index surpassing 50 suggests strong institutional interest, and a long-to-short futures ratio of 1.0367 confirms a bullish bias in the derivatives market.

Michael Saylor Declares Bitcoin’s Ascent to $1 Million is Inevitable

Michael Saylor, chairman of Bitcoin-holding giant Strategy, told Bloomberg that Bitcoin is on track to hit $1 million. Dismissing bearish narratives, he declared, “Winter is not coming back… If it’s not going to zero, it’s going to a million.”

Saylor claims that publicly listed firms are aggressively buying up the supply of Bitcoin. Strategy itself has acquired 582,000 BTC since 2020, solidifying its position as one of the largest corporate holders of the asset.

The Day’s Takeaway

United States

- Stocks Close Lower: The NASDAQ led declines with a -0.50% drop, while the S&P 500 fell -0.27%. The Dow ended flat. Key losers included Intel (-6.27%), American Airlines (-6.59%), and Apple (-1.90%). On the flip side, Papa John’s (+7.43%) and SoFi (+4.66%) posted strong gains.

- CPI Inflation Cools: May’s headline CPI came in at +2.4% YoY, under the +2.5% forecast. Core CPI was +2.8%, slightly below the +2.9% estimate. This reinforced market expectations for a Fed rate cut in September, with 47.5 basis points of easing now priced in.

- Mortgage Applications Rebound: MBA data showed a +12.5% surge in applications for the week ending June 6, rebounding strongly after weeks of declines. Purchase and refinance activity both picked up.

- 10-Year Auction Sees Strong Demand: The U.S. Treasury sold $39B in 10-year notes at 4.421%, below the 4.428% WI level. Indirect bidders—mostly foreign—took 70.56%, signaling robust global demand.

- Trump Trade Framework Advances: U.S. Commerce Secretary Lutnick said a framework has been reached with China to implement the Geneva Consensus. Final approval now depends on Presidents Trump and Xi.

- Fed Cut Bets Rise Post-CPI: With inflation slowing, odds of a September cut are rising. Trump repeated his call for a 100 bps rate cut, adding political pressure on the Fed.

Canada

- Trade Deal Draft with U.S.: Ottawa and Washington exchanged preliminary documents outlining a potential bilateral trade agreement. No deal is expected before the G7.

- Building Permits Slump: April permits fell -6.6%, badly missing the +2.0% estimate. March was also revised lower to -5.3%, adding to the downbeat tone in Canadian construction activity.

- Consumer Spending Holds Up: RBC cardholder data showed May retail sales rose 0.7%, with core categories up 1.2%. Despite trade tension, household demand appears resilient.

Commodities

- Oil Surges on Geopolitical Tension: WTI crude futures closed at $68.15, up 4.88% on military alert reports tied to Iran and stronger demand signals from U.S.–China trade talks. Prices cleared the 100-DMA and 50% retracement of the 2025 range.

- Gold Rallies on CPI Miss: Gold rose to $3,360 before settling around $3,327 as inflation cooled and rate cut hopes surged. The softer dollar and unresolved U.S.–China talks supported bullish momentum.

- Platinum Breaks Out: Platinum prices surged past $1,200/oz, now trading near $1,270, the highest in 4 years. The metal is up 40% YTD, far outpacing gold.

- Chinese Oil Imports Drop: May imports hit a 4-month low at 11M bpd, down from 11.7M prior, due to refinery maintenance and price pressures. Exports of refined products also declined.

- EIA Sees U.S. Output Dip in 2026: Forecasts now show U.S. production dropping to 13.37M bpd next year, the first decline since 2021. The revision reflects weaker rig counts and lower prices.

- EIA Inventory Report: U.S. crude inventories fell -3.644M barrels last week. Gasoline and distillates both posted larger-than-expected builds.

Europe

- Markets Mostly Down: Major indices finished lower with the DAX -0.06%, CAC -0.34%, Ibex -0.59%, and FTSE MIB -0.09%. Only the UK FTSE 100 posted a gain (+0.23%).

- ECB Wage Tracker Falls: Negotiated wage growth slowed to 3.1% in 2025, down from 4.7% in 2024. This supports the ECB’s easing narrative.

- Goldman: Tariffs to Reignite Inflation: Goldman Sachs warned that Trump’s tariff strategy could push core inflation up to 3.5% by year-end, even as other pressures fade.

- Blackstone Eyes Europe: CEO Steve Schwarzman said the firm plans to invest up to $500B in Europe over the next decade, citing solid returns and new geopolitical tailwinds.

Asia

- BOJ Seen Holding Rates All Year: Reuters’ latest survey showed 52% of economists expect no rate hike in 2025. The earliest hike is now seen in Q1 2026, with a slower bond taper expected next year.

- Japan April PPI Misses: Producer prices fell -0.2% MoM, while YoY growth slowed to +3.2% (vs +3.5% expected). This could push back inflation targets for the BOJ.

- China Vice Premier on Trade: He Lifeng reaffirmed Beijing’s “clear and consistent” position, urging the U.S. to act in good faith while reiterating China’s willingness to cooperate—but not at any cost.

- China Limits Rare Earth Licenses: Beijing will now issue rare earth export licenses to U.S. firms on a 6-month basis, increasing leverage while finalizing the broader trade deal.

Rest of World

- Iran Deal in Doubt: Trump stated he’s “much less confident” a deal will materialize, adding fuel to oil price spikes. Talks resume this weekend amid rising tension.

- EU Eyes Longer Trade Talks: Brussels hopes to extend U.S. trade discussions past Trump’s July deadline. With tariff threats eased to 10–20%, momentum is steady but not urgent.

- Stripe Acquires Privy: The payments giant is pushing further into stablecoins and crypto wallet integration, following its $1.1B Bridge acquisition. New tools aim to fuse AI and financial tech across 101 countries.

Crypto

- Market Holds Firm Post-CPI & Trade Deal: Bitcoin stayed near $109,000 after inflation data undershot and Trump confirmed a framework deal with China. Altcoins like Ethereum and Solana rose up to 3%.

- XRP Nearing $3.00 Breakout: XRP hit $2.31 as Ondo Finance launched tokenized Treasuries on XRPL. Core CPI stability and fresh use cases for XRP helped lift sentiment.

- HYPE Hits All-Time High: Hyperliquid surged near $43, with Open Interest up 34% to $1.89B. Traders are favoring upside exposure as the altcoin extends price discovery mode.

- Privy Deal Advances Stripe’s Crypto Push: Stripe’s acquisition of Privy accelerates wallet integration and builds out global stablecoin rails. Stablecoin Financial Accounts and AI-enhanced payment tools were unveiled to accompany the expansion.

- Meme Coins Fading in Fundraising: Only 9% of May’s $134M in presale crypto funding went to meme tokens. Infrastructure, DeFi, and AI projects drew the bulk of investor attention, according to Outset PR.