North America News

Tech Lifts US Markets Again as Risk Trade Rolls On

U.S. equities finished mixed but largely positive on Wednesday, led once again by megacap technology stocks. With no major economic headlines to drive direction, the quiet backdrop allowed momentum-driven buying to continue, especially in the chip and AI sectors.

Major index closes:

- Dow Jones: -89.37 pts (-0.21%) at 42,051.06

- S&P 500: +6.03 pts (+0.10%) at 5,892.58 (up 0.19% YTD)

- NASDAQ: +136.72 pts (+0.72%) at 19,146.81 (down -0.85% YTD)

Market dynamics:

The S&P 500 notched its second consecutive positive day for the year, while the Nasdaq extended gains, fueled by heavy buying in chipmakers and AI infrastructure names.

- AMD jumped 4.68%, now up 19.37% since May 6

- NVIDIA added 4.16%, bringing its gain to 34% since April 22

- Super Micro Computers (SMCI) rocketed 15.69% after securing a $20 billion partnership with Saudi-based DataVolt. The stock is up 40.64% since May 9, though still down significantly from its 2024 peak.

Macro backdrop:

Canada’s building permits unexpectedly dropped 4.1%, nearly wiping out last month’s surge. In the U.S., crude oil inventory data was released but had minimal market impact.

From the Sohn Conference, hedge fund veteran David Einhorn gave a candid interview to CNBC. He warned that the U.S. has no serious plan to address its fiscal deficit, dismissing recent claims of $2 trillion in savings, arguing the real figure is likely closer to $150 billion. Tariff revenue might add another $100 billion, he said, but it’s far from a solution.

Einhorn downplayed concerns over the trade deficit and voiced his hopes for gold prices to rise toward $3,500–$3,800, but not to levels like $30,000, which he suggested would signal economic collapse. He was critical of the administration’s global posture, saying the U.S. no longer looks like a reliable negotiating partner.

He also shared a tactical hedge: short leveraged MicroStrategy ETFs, while staying long MSTR stock. He explained that leveraged ETFs are inefficient and costly due to their reliance on options rather than swaps.

US Treasury yields ended higher:

- 2-year: 4.057% (+4.0 bps)

- 5-year: 4.170% (+4.9 bps)

- 10-year: 4.542% (+4.3 bps)

- 30-year: 4.975% (+3.3 bps)

Looking ahead:

Markets remain fixated on upcoming U.S. PPI and retail data. With tech still in the driver’s seat and fiscal risks looming, sentiment remains upbeat—but fragile. Tariffs may soon take a backseat as broader economic debates move to the forefront.

US Mortgage Applications Edge Higher as Purchase Activity Picks Up

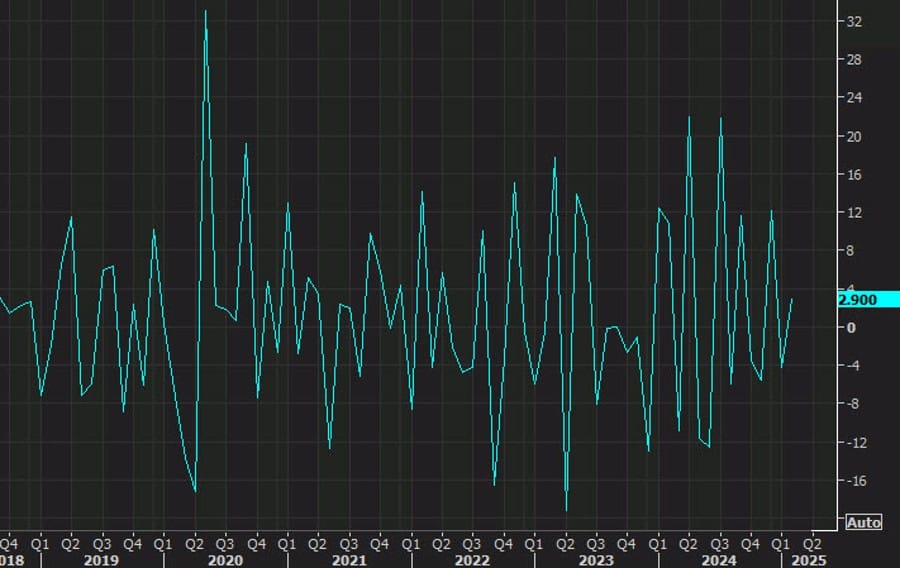

Data from the Mortgage Bankers Association shows mortgage applications rose 1.1% for the week ending May 9, 2025, a notable slowdown from the prior week’s 11.0% spike.

The market index rose to 251.2 from 248.4. The purchase index climbed to 166.5 from 162.8, while the refinance index dipped slightly to 718.1 from 721.0. The average 30-year mortgage rate increased slightly to 6.86% from 6.84%.

The marginal growth was led by purchase activity, though rising interest rates may continue to pressure demand in the weeks ahead.

Goldman: April Retail Sales Likely Show Pre-Tariff Consumer Rush

Goldman Sachs is forecasting that April’s core U.S. retail sales rose 0.4% month-over-month, driven largely by consumers rushing to make purchases ahead of anticipated tariff hikes. Meanwhile, headline retail sales are expected to remain flat, with weaker auto sales and cheaper gasoline offsetting broader strength.

Key insights:

- Core sales forecast: +0.4% m/m

- Headline sales: 0.0% m/m

- Consumer behavior: Evidence of “frontloading” purchases due to tariff fears

- Sector pressure: Autos and energy weighing on top-line figures

Goldman believes the report will highlight shifting consumer dynamics in response to trade policy changes. While core strength is expected to remain resilient, the flat headline figure may mask the underlying consumer momentum.

The report is due Thursday at 8:30 a.m. ET and will be closely watched as a signal of whether tariffs are beginning to distort household spending patterns.

Fed’s Jefferson: Current policy is a good place to respond to economic developments

- Comments from Jefferson

- Current moderately restrictive policy rate in a good place to respond to economic developments

- Watching closely for signs in hard data of weaker activity

- Recent inflation data consistent with further progress toward 2% goal, but future path uncertainty due to tariffs

- Tariffs could lead to higher inflation

- Labor market still solid

- Q1 GDP data overstated deceleration in activity

- Whether tariffs create persistent inflation depends on implementation, response of supply chains and other factors

Fed’s Goolsbee: It will take time for current inflation trends to show up in the data

- Goolsbee reacts to the US CPI report yesterday

- Some part of April inflation represents lagged nature of data

- Fed is still very much holding its breath

- Right now is a time for the Fed to wait for more information, try to get past the noise in the data

- Cannot jump to conclusions about long-term trends given all the short-term volatility present

- Fed’s task is to be a steady hand and not to respond to daily gyrations of stock market, policy pronouncements

UBS Cuts US Equity View to Neutral, Sees More Gains Over 12 Months

UBS has lowered its short-term stance on U.S. equities to Neutral from Attractive, citing the market’s swift rebound since early April. The S&P 500 has jumped 11% since April 10, more than recovering from its dip following the “Liberation Day” tariff news on April 2.

UBS isn’t bearish, though. The bank maintains a full strategic allocation to U.S. stocks and expects further gains over the next year. It warns that volatility may return as the temporary truce between the U.S. and China evolves into potentially deeper negotiations.

Trump Still Watching Markets as Personal Performance Gauge

BMO Capital notes that President Trump continues to view equity market trends as a real-time indicator of his political performance—a mindset fueling the so-called “Trump Put.”

The S&P 500’s return to positive territory for 2025 has reduced the perceived risk of an economic slowdown triggered by market-related cutbacks in hiring or consumer spending. Recent shifts in tone from the administration reinforce the idea that Trump is closely monitoring financial market sentiment as a personal scoreboard.

Goldman Sachs Eyes S&P 500 Hitting 6,500 Within a Year

Goldman Sachs has raised its 12-month S&P 500 forecast to 6,500, up from a previous target of 6,200. Short-term, the bank sees the index stalling around 5,900, citing stretched valuations and cautious investor sentiment.

Back in March, Goldman lowered its forecast twice, flagging concerns over tariffs and a potential recession. Now, with trade tensions easing and Big Tech showing strong momentum, the firm sees renewed upside—though warns that profit margins may face pressure in 2025 as tariffs remain elevated.

Trump says the relationship with China is excellent

- Trump speaking with Fox:

- Attempting to initiate access to China

- China relationship is excellent

- I could see myself dealing with China’s Xi on deal

- Says he is a supporter of Iran

- Will not allow Iran to become a nuclear power

Canada’s March Building Permits Slide Sharply

Canadian building permits dropped 4.1% in March 2025, well below the -0.5% consensus forecast. February’s number was revised upward to +4.9% from an initial +2.9%.

A steep decline in non-residential permits (down 14.5% month-over-month) weighed heavily on the headline figure. However, residential permits rose by 2.0%.

Looking at the full first quarter, overall permits increased by 2.9%, suggesting some underlying resilience in housing even as commercial activity weakens.

Commodities News

Gold Breaks Below $3,200 as Risk Appetite Rebounds

Gold prices plunged below the $3,200 mark for the first time since April 11, as improving global sentiment—especially on trade—reduced the appeal of safe-haven assets. The move comes despite a softer U.S. dollar, typically a supportive factor for bullion.

At last check, spot gold was trading at $3,182, down over 2% on the day. A temporary thaw in U.S.-China trade tensions, along with President Trump’s tour through the Middle East, has boosted market confidence. Reports of pending trade deals with Japan and South Korea further undercut gold’s defensive narrative.

Even a muted U.S. inflation print hasn’t moved the needle for the Fed, which remains cautious, prompting investors to dial back expectations for aggressive rate cuts this year. As Treasury yields rise, gold loses its appeal as a non-yielding asset.

Technical outlook:

Gold has broken below its 200-bar moving average on the 4-hour chart, confirming a bearish momentum shift. Sellers are now targeting:

- $3,167.74 (April 3 swing high)

- $3,139 (trendline support)

- $3,129.26 (38.2% Fib retracement of the rally from November lows)

A sustained move below these levels could trigger a deeper pullback. On the flip side, reclaiming the $3,249 resistance (200-bar MA) would be needed to neutralize this bearish bias.

Crude Oil Settles at $63.15 After Inventory Surprise and Trade Hopes

Crude oil futures settled at $63.15, gaining $0.52, or 0.82%, on the day. Prices traded between a low of $62.78 and a high of $63.64, staying below the key 50% retracement level of the 2020–present range at $64.71.

That level remains a major pivot for bulls. Back on April 23, the market briefly broke above it—hitting $64.83—before reversing, underscoring its importance.

Oil drew support from easing concerns about a global recession and upbeat demand signals, including a larger-than-expected drop in gasoline inventories. The latest U.S. crude inventory data showed a build of 3.454 million barrels, a surprise versus the forecast draw of 1.078 million.

Gasoline stockpiles dropped by 1.022 million barrels, signaling continued demand strength.

Geopolitics is also in play: Trump has hinted at attending Ukraine-Russia talks on Thursday and reiterated conditional interest in a new deal with Iran—only if Tehran agrees to give up nuclear weapons. These developments may further impact oil sentiment in the coming days.

US Oil Inventories Jump as Gasoline and Distillates Decline

The Energy Information Administration reported a 3.45 million barrel increase in U.S. crude oil inventories for the week ending May 9, 2025—against expectations for a 1.08 million barrel decline.

Gasoline stocks fell by 1.02 million barrels, more than the forecast 561K drop. Distillate supplies tumbled by 3.15 million barrels, in contrast to an expected 129K build.

Refinery utilization rose by 1.2%, above the 0.8% forecast, indicating stronger throughput.

Private API data released the day before had flagged similar movements, including a 4.29 million barrel crude build, 1.37 million decline in gasoline stocks, and 3.67 million draw in distillates.

OPEC Keeps Oil Demand Outlook Steady Despite US-China Deal

In its latest monthly report, OPEC kept its projections for global oil demand growth unchanged for both 2025 and 2026. The organization acknowledged the recent 90-day trade agreement between the U.S. and China as a positive sign for stabilizing trade flows, but did not revise its outlook.

The report forecasts non-OPEC+ oil supply to increase by 800,000 barrels per day this year—slightly lower than last month’s 900,000 bpd estimate. Meanwhile, investment in oil exploration and production among non-OPEC+ producers is expected to decline by 5% in 2025.

OPEC also trimmed its estimate for U.S. oil production growth next year to 300,000 bpd, down from 400,000 bpd. In April 2025, OPEC+ output averaged 40.92 million bpd, a drop of 106,000 bpd from March.

Oil Prices Rally on US Sanctions Threats Against Iran

Brent crude surged nearly 2.6%, reaching its highest price since late April, as geopolitical risks surrounding Iran flared up. A softer U.S. dollar added some lift, but the main driver was new U.S. Treasury sanctions targeting entities that ship Iranian crude to China.

President Trump warned of even harsher measures if a nuclear agreement isn’t reached, reviving fears of supply disruption. Iran currently exports roughly 1.6 million barrels per day (b/d), but that could fall sharply—potentially back to 2019 levels near 600k b/d.

OPEC+ members may benefit from tighter Iranian supply, giving them cover to ramp up production. However, Trump faces a balancing act: lower prices may hurt the U.S. oil sector by discouraging drilling. Meanwhile, API data showed U.S. crude inventories rose by 4.29 million barrels last week, while Cushing storage dropped by 850,000 barrels. Gasoline and distillates fell by 1.37 million and 3.68 million barrels, respectively.

Palladium and Platinum Diverge as Metals Trade Mixed

Palladium opened Wednesday at $953.80 per ounce, slipping from the prior close of $957.25. Platinum, in contrast, gained ground, trading at $997.58, up from its previous close of $993.35.

The mixed start to the day reflects uncertainty across the precious metals space, with platinum group metals (PGMs) responding to shifting macro and market dynamics.

Crude Oil Nears Breakout Point as Global Demand Optimism Returns

Crude oil prices are rebounding as expectations for improved global growth buoy demand outlooks. After slumping in April due to poor supply-demand dynamics, the market now eyes a technical breakout.

The price is testing a resistance zone near $64.00. Bulls are betting on a push toward $67.00 if that level is breached. On the flip side, bears are targeting a return to $55.00 should the resistance hold. Trendlines on the 1-hour and 4-hour charts show bullish momentum building, and any pullbacks may see buyers re-enter around trendline support levels.

This developing pattern hints at a possible double bottom, but confirmation depends on a decisive move above the resistance.

Iran Demands Solid Assurances Ahead of US Talks

Iran has stated it will not agree to any new deal with the United States unless clear and enforceable guarantees are put in place. A spokesman from Iran’s Foreign Ministry made the comment ahead of a Friday meeting in Istanbul with E3 nations—Germany, France, and the UK—designed to set the stage for resumed U.S.-Iran negotiations.

The broader geopolitical context includes the U.S. urging Iran to curb its nuclear ambitions. Oil markets are watching closely, since any breakthrough could bring more Iranian crude back to market.

Europe News

European Stocks Slip into the Close, But Spain Hits 16-Year Peak

European markets ended lower on the day, with late-session selling dragging key indexes into the red. Despite the broader dip, Spain’s IBEX outperformed, notching its highest close since 2008.

Here’s how major indexes closed on the day:

- Stoxx 600: -0.4%

- German DAX: -0.6%

- France CAC 40: -0.6%

- UK FTSE 100: -0.3%

- Spain IBEX: +0.3% (best since 2008)

- Italy FTSE MIB: +0.5%

The broader softness reflects some caution ahead of major U.S. inflation and retail data, even as Spain continues to ride a wave of domestic strength.

Germany’s Final April CPI Confirms 2.1% YoY Inflation

Germany’s final consumer price index (CPI) for April 2025 came in at 2.1% year-on-year, matching the preliminary reading and down slightly from March’s 2.2%. The harmonized index (HICP) also held steady at 2.2% year-on-year, as expected.

However, the concerning detail for the European Central Bank is that core inflation ticked up to 2.9%, from 2.6% in March. That rise in underlying price pressure complicates the ECB’s push toward rate cuts, especially as macro conditions begin to settle globally.

Spain’s April CPI Holds at 2.2% But Core Inflation Rises

Spain’s April 2025 final CPI reading stood at 2.2% year-on-year, identical to the preliminary figure and slightly below the prior month’s 2.3%. The HICP also matched expectations at 2.2%.

However, like in Germany, core inflation crept higher—to 2.4%, up from 2.0% in March. This marks another bump in the road for the ECB, which now faces a consistent uptick in underlying inflation from two of the eurozone’s largest economies.

ECB Intensifies Oversight on Dollar Funding Over Trump Risk

According to Reuters, the European Central Bank is quietly urging banks to evaluate their U.S. dollar funding strategies amid fears that former President Trump may pressure the Federal Reserve to deny access to emergency dollar liquidity.

Three sources familiar with the matter said ECB supervisors have asked institutions to prepare for the possibility of losing access to key Fed backstops during financial stress. These swap lines and lending arrangements are traditionally available during market turmoil, but Trump’s unpredictable approach has sparked concern in the eurozone.

While the Federal Reserve hasn’t hinted at cutting off support, euro area regulators aren’t taking any chances and want banks to plan for the worst-case scenario.

German Chancellor: EU Wants Trade Peace, Less Reliance on China

Germany’s Chancellor Friedrich Merz said the country remains committed to avoiding an extended trade standoff with the United States. He emphasized Berlin’s support for securing as many EU trade agreements as possible to strengthen the bloc’s economic position.

Merz also stated that Germany is moving to reduce one-sided dependencies on China as part of a broader “strategic de-risking” agenda, aligning with EU efforts to safeguard supply chains and mitigate geopolitical vulnerabilities.

Goldman Sachs Ups Targets for European and UK Equities

Goldman Sachs has revised its 12-month targets for both European and UK stock markets following more stable trade conditions. The firm now sees the Stoxx 600 hitting 570, up from a previous forecast of 520.

For the UK’s FTSE 100, Goldman has raised its target to 8,800, up from 8,500. The improved outlook is tied to reduced tariff uncertainty and a shift in investor sentiment towards European equities.

ECB’s Nagel: There is a good probability we will get to 2% inflation target

- Remarks by ECB policymaker, Joachim Nagel

- Current uncertainty will be the new “normal”

- Central banks have to get used to managing it

- Expect there to be new staff projections in June

- But we don’t know the exact impact from tariffs on inflation and the economy

- June rate decision depends on incoming data

- Dollar is very important for the world financial system

- But the role of the euro will become stronger as a reserve currency over the next few years

German Economy Ministry: A renewed weakening of the economy cannot be ruled out

- Remarks by the German economy ministry

- Business expectations remain gloomy, particularly in export-oriented manufacturing sector

- Inflation likely to remain in the region of 2% for the remainder of the year

- Trade and economic policy uncertainty remains significantly elevated

BOE’s Mann: UK labour market has been more resilient than expected

- Remarks by BOE policymaker, Catherine Mann

- Worried that household inflation expectations have increased

- Need to see loss of pricing power by firms

- But goods price inflation is going up

Asia-Pacific & World News

China, EU Hold Financial Talks Amid Global Uncertainty

The People’s Bank of China has confirmed that China and the European Union have had substantial discussions on navigating global economic instability. The dialogue comes as the two sides mark 50 years of diplomatic relations in 2025.

Talks included market access reforms, collaboration on sustainable finance, handling of cross-border data transfers, and the development of modernized payment systems. These discussions took place during a financial working group meeting in Brussels.

Despite current tensions with the U.S., both China and the EU continue to maintain diplomatic and economic engagement with one another, emphasizing cooperation during a time of broader geopolitical strain.

China Issues Rare Earth Export Permits – US Not on the List

According to Reuters, China has granted its first rare earth export licenses since tightening restrictions last month—but none of them are destined for the United States. Sources familiar with the matter said permits were instead approved for customers in Europe and Vietnam.

At least four licenses were issued, with one going to Baotou Tianhe Magnetics, which supplies magnetic components for Volkswagen’s electric and hybrid vehicle motors. Volkswagen reportedly lobbied Beijing directly to secure the export clearance, which was granted in late April.

China’s new restrictions, implemented last month, added seven additional minerals to its export control list. Typically, the review process for these permits can take two to three months. This initial batch appears to signal a green light for friendly trade partners—but not for U.S. companies. Unless there’s major progress during the current 90-day negotiation window between the U.S. and China, expectations are low for American buyers receiving approval any time soon. De facto, a ban seems in place.

China’s April Money Supply and Lending Data Miss Expectations

Fresh credit data from China reveals the M2 money supply rose 8.0% year-on-year in April, ahead of the 7.3% forecast and higher than March’s 7.0%. However, the story on new bank lending was much weaker.

New yuan loans came in at just ¥280.0 billion—well below the expected ¥700.0 billion and far off the ¥3.64 trillion reported in March. The drop follows a Q1 surge, when Beijing ramped up credit stimulus ahead of escalating tensions with Washington. Despite April’s slowdown in lending, outstanding yuan loans still grew 7.2% year-over-year.

Baidu to Trial Autonomous Taxis in Europe

Baidu is laying groundwork to begin testing its Apollo Go self-driving ride-hailing service in Europe, with Switzerland set to host the initial pilot program. The Chinese tech heavyweight is working on establishing a local subsidiary there within the next few months, aiming to start trials by year-end, according to sources cited by the Wall Street Journal.

Talks are reportedly ongoing between Baidu and Swiss transit operator PostAuto. Baidu also has expansion ambitions in Turkey, as it contends with intensifying domestic competition in China. Globally, autonomous mobility firms are pushing to commercialize their technology, but launching in Europe may involve regulatory hurdles.

Lula: Brazil Deepening Ties with China, Unfazed by US

Brazilian President Luiz Inácio Lula da Silva says Brazil is pushing to deepen cooperation with China, undeterred by any backlash from the United States. He highlighted Beijing’s potential role in driving Brazil’s technological development and dismissed concerns that the U.S.-China trade agreement might undermine Brazil’s export access to the Chinese market.

Lula also reiterated support for creating a new international currency system that reduces dependency on a single dominant currency, echoing past calls for de-dollarization.

PBOC sets USD/ CNY mid-point today at 7.1956 (vs. estimate at 7.1813)

- PBOC CNY reference rate setting for the trading session ahead.

PBOC injected 92bn yuan via 7-day reverse repos at 1.40%

- 195.5bn yuan mature today

- net drains 103.5bn yuan

Australian Wages Beat Forecasts, RBA Still on Track for Rate Cut

Australia’s wage price index rose by 0.9% in the first quarter of 2025, surpassing expectations of 0.8%. On an annual basis, wages climbed 3.4%, again above the 3.2% forecast. This persistent wage growth has been a key factor in the Reserve Bank of Australia’s concern that inflation may still be lurking.

Despite the strong wage data, the RBA is still expected to proceed with a 25 basis point cut to the cash rate at its May 19–20 meeting.

Additional data showed home loan values dropped 1.6% quarter-on-quarter, against a flat forecast. Investment housing finance dipped 0.3%, and owner-occupier lending fell by a sharper 2.5%.

Fitch: Australian Banks Holding Steady Despite Challenges

Fitch Ratings says the financial performance of Australia’s major banks reflects strong resilience, reinforcing their current credit ratings. However, the outlook for 2025 includes ongoing pressure on earnings. Profit levels are expected to remain largely unchanged, but banks will face narrower net interest margins (NIM) due to anticipated rate cuts in 2025 and 2026. Fitch suggests this margin squeeze will be manageable, though rising competition adds further strain.

Signs of stabilisation in asset quality emerged during the first half of FY25. The big four banks also maintained robust capital reserves, a strategic buffer amid global volatility. Funding conditions stayed consistent, and liquidity remained high, providing extra protection against international economic shifts.

NZ Retail Sales Data Flat in April, Down 0.3% Y/Y

New Zealand’s card spending data, covering around 68% of all core retail purchases, showed flat monthly movement in April, while year-on-year sales fell 0.3%. That’s an improvement from March, which posted a 0.8% monthly drop and a 1.6% annual decline.

The retail card data remains a key metric for tracking consumer activity in New Zealand.

Japan’s April PPI Matches Forecasts: +0.2% m/m, +4.0% y/y

Japan’s Producer Price Index (PPI) rose 0.2% month-on-month in April and 4.0% year-on-year, aligning with market expectations. This data, published by the Bank of Japan, confirms a cooling trend from March’s figures, where PPI stood at 0.4% m/m and 4.2% y/y.

The PPI, also known as the Corporate Goods Price Index, serves as an early inflation signal, reflecting input cost changes for Japanese firms.

South Korea’s April Jobless Rate Falls to 2.7%

Unemployment in South Korea fell to 2.7% in April, beating forecasts of 3.0% and down from March’s 2.9%. The economy added 194,000 jobs in April, slightly more than the 193,000 gained the previous month.

This labor market resilience may strengthen the government’s argument for continued economic stimulus amid external trade risks.

South Korea Unveils $3.25B Relief Package for Tariff-Exposed SMEs

The South Korean government announced a 4.6 trillion won (about US$3.25 billion) support plan targeting small and medium-sized enterprises (SMEs) vulnerable to U.S. tariffs. The package includes funding aid, logistics subsidies, and export market programs.

Although SMEs contributed 17% of South Korea’s Q1 exports, over 80% of them see potential U.S. tariffs—currently suspended at 25%—as a serious threat. This new aid is part of a broader 13.8 trillion won supplementary budget designed to counter weak domestic demand and cushion against global trade shocks.

Crypto Market Pulse

XRP Eyes $3.00 as Futures Interest Surges by $1 Billion

XRP remains on a bullish path, hovering around $2.60 on Wednesday, supported by a surge in futures open interest (OI) exceeding $1 billion over the past week. Traders are eyeing a breakout above the $3.00 mark.

Data from Glassnode shows XRP futures OI spiked more than 41.6% in a week, now hitting $3.42 billion—the highest in three months. Whale investors are also accumulating: wallets with 10M–100M XRP now hold 12.22% of supply, up from 10.76% in March. Mega-whales (with 1B+ XRP) have raised their stake from 37.53% to 39.13% since early May.

Technically, XRP is trading well above its 50-, 100-, and 200-day exponential moving averages. The daily MACD is bullish, and the RSI stands at 69.71, approaching overbought territory. While strong momentum supports a continued rally, traders should watch for possible profit-taking or pullbacks toward support levels at $2.50 or $2.26.

Bonk Meme Coin Breaks Out, Targets 60% Rally

Bonk (BONK), a popular meme coin, has broken out of a classic cup and handle formation, setting the stage for a potential 60% price rally to $0.000034.

After surging 73.4% in April, Bonk is up another 21.4% so far in May, positioning itself for two straight months of gains. The breakout above the $0.000021 neckline has turned that level into new support.

Key moving averages are trending bullish, with the 200-day EMA near $0.000020, the 100-day EMA around $0.000018, and the 50-day EMA just under $0.000017. These indicators support a strong uptrend, especially as the MACD remains above the signal line and centerline—confirming bullish momentum.

Bonk’s current price action is backed by sustained risk-on sentiment, high trading volume, and solid technical positioning. If momentum holds, the target of $0.000034 is well within reach.

UBS: Wealthy Asians Dumping USD for Crypto, Gold, and China

UBS reports that affluent investors across Asia are moving away from the U.S. dollar in favor of gold, cryptocurrencies, and Chinese assets. Amy Lo, UBS’s Asia wealth management co-head, said the pivot stems from geopolitical tension and sustained volatility.

Gold is seeing renewed interest as a haven, but crypto and Chinese equities are gaining traction too. Clients previously cautious about China are now asking about exposure, especially after Hong Kong’s stock index outperformed globally in 2024.

A May 11 U.S.-China tariff truce has also boosted optimism. Tariffs were cut significantly: U.S. levies on Chinese goods dropped from 145% to 30%, while China lowered its tariffs on U.S. imports from 125% to 10%.

Galaxy Digital analysts say Bitcoin is emerging as a credible store of value. BlackRock’s Jay Jacobs added that countries are beginning to diversify reserves away from USD, increasingly adding Bitcoin to the mix.

Trump: I’m a big crypto fan

- Comments from Trump:

- I’m a big crypto fan.

- I’m a believer in AI.

- We lead China in cryptocurrency.

Tether Buys 4,812 Bitcoin at Average Price Over $95K

Tether has added another 4,812 Bitcoin to Twenty One Capital’s crypto holdings, spending roughly $458 million on the acquisition. According to a May 13 filing with the SEC, the transfer to an escrow wallet occurred on May 9. The purchase price averaged out to about US$95,319 per Bitcoin.

This adds to Tether’s continued strategy of strengthening reserves through digital asset investments.

Chinese-Linked Firm Buys $300M in Trump-Themed Cryptocurrency

A little-known tech firm, GD Culture Group, with ties to China and a TikTok-based business model, has made headlines after announcing plans to invest up to $300 million in the memecoin branded with Donald Trump’s name, $TRUMP. The New York Times reports that the company, listed in the U.S. but operating a Chinese subsidiary, disclosed the purchase despite having just eight employees and no recorded revenue last year.

The announcement raised eyebrows due to the size of the investment and the company’s minimal financial footprint. Its link to TikTok, a platform already under scrutiny, adds another layer to the story.

The Day’s Takeaway

United States

- Tech-led gains continue: Nasdaq jumped 0.72% with megacap tech—especially semiconductors—driving momentum. NVIDIA (+4.16%) and AMD (+4.68%) led the rally, while Super Micro surged nearly 16% after a major data center deal.

- Retail sales preview: Goldman Sachs expects a modest +0.4% core retail sales increase for April, driven by consumers frontloading purchases ahead of tariff hikes. Headline sales may be flat, hit by weak auto and fuel spending.

- Rate cut recalibration: Following a softer CPI report, traders pared back expectations for three Fed cuts in 2025. The Fed’s caution, backed by higher Treasury yields, keeps the “wait and see” narrative intact.

- Crude inventory surprise: EIA reported a +3.454M barrel crude build, defying forecasts for a draw. Gasoline stocks fell more than expected, suggesting resilient consumer fuel demand.

Canada

- Housing under pressure: March building permits plunged -4.1%, far below the expected -0.5%. The drop was led by a sharp -14.5% slide in non-residential permits, though residential permits rose 2%.

- Macro implications: The steep non-residential pullback may raise concerns about business investment softness in Q2. Q1 total permits still managed to grow +2.9%.

Commodities

- Gold breaks down: Gold slumped below $3,200, falling to $3,182, as risk appetite rebounded on improved trade outlook. Rising Treasury yields and a firmer economic tone dulled bullion’s appeal.

- Oil edges higher: Crude oil settled at $63.15 (+0.82%). While still under the key retracement ceiling of $64.71, the market shrugged off inventory builds on optimism that recession fears may be overblown.

- Key resistance in oil remains: Bulls need a clean break above $64.71 to reignite upward momentum. Talks involving Ukraine, Russia, and Trump may shift sentiment further.

Europe

- Late-day selloff: Most European indices closed in the red as caution crept in. Stoxx 600 fell -0.4%, Germany’s DAX dropped -0.6%, and France’s CAC slipped -0.6%.

- Spain shines: Spain’s IBEX rose +0.3%, hitting its highest level since 2008, driven by local strength in financials and industrials.

- ECB in focus: The ECB is quietly urging banks to assess USD funding risk in case Trump disrupts Fed swap lines. This preemptive supervision suggests growing wariness over geopolitical disruptions to liquidity.

Asia

- China’s trade signals shift: Gold dipped despite a weaker dollar as the Trump administration pursues trade deals in Asia. Reports of near-complete deals with Japan and South Korea added to market optimism.

- PBOC comments: China and the EU discussed cross-border data, payment systems, and green finance, showing continued efforts to deepen cooperation despite Western tensions.

- Tech sentiment cautious: Asian equities traded mixed overnight with investors watching U.S. inflation data and oil developments.

Rest of the World

- Germany’s Merz calls for trade calm: The German chancellor reaffirmed commitment to avoid long-term U.S. trade friction and reduce dependency on China—echoing EU’s strategic de-risking policy.

- OPEC steady on outlook: Global oil demand growth projections for 2025–2026 were unchanged, but the group trimmed its U.S. production growth forecast to +300K BPD and flagged a 5% decline in non-OPEC+ exploration.

Crypto

- Bonk breaks out: BONK meme coin surged after confirming a cup and handle breakout, eyeing a 60% rally toward $0.000034. April’s 73.4% gain is being followed by a solid +21.4% in May.

- Technical strength holds: BONK remains above all major EMAs. The MACD stays bullish, and volume confirms trader commitment. A return to $0.000034 looks viable if momentum persists.

- XRP cooling but stable: After a $1B+ rise in open interest, XRP held firm around $2.60, maintaining its uptrend. However, RSI near overbought levels raises short-term correction risks.